What Is a Source Document? Essential Guide for Your Business

Wondering what is a source document? Learn how source documents like receipts and invoices impact your business and why proper management matters.

Tags

At its core, a source document is simply the original paper (or digital) trail that proves a business transaction actually happened. Think of things like invoices, receipts, and bank statements. These are the raw materials for your accounting records, capturing the essential details like the date, the dollar amount, and who was involved.

Your Business's Financial Story Starts Here

Think of your company's finances like a story you're telling. Every time you claim a sale or write off an expense, you need something to back it up. A source document is that proof. Without it, your financial story is just a collection of claims with no credibility, which won't hold up when you need to file taxes, talk to auditors, or apply for a loan.

These documents are like the evidence a detective gathers for a case file. Each one answers the critical questions: who, what, when, and for how much. That’s why they are the absolute, non-negotiable starting point for everything you do in accounting.

The Building Blocks of Financial Truth

Every single number on your financial reports, from the profit and loss statement to the balance sheet, has to trace back to a source document. It's this paper trail that keeps your books accurate, honest, and transparent.

A source document is the original record that gives you undeniable proof of a financial transaction. This isn't just a good idea; it's a requirement. Major accounting standards like GAAP and IFRS demand this level of documentation to ensure financial reporting is trustworthy.

A business without organized source documents is like a ship without a compass. It's moving, but it has no verifiable way to prove where it has been or confidently chart where it's going.

Why Every Document Matters

Even that tiny receipt for a coffee meeting plays a part. When you put them all together, these documents create a complete, detailed picture of your company's financial health. They become absolutely critical for a few key reasons:

- •Audits and Tax Compliance: When the auditors or the tax authorities ask for proof, this is what you give them.

- •Dispute Resolution: If a vendor or customer questions a charge, your source document is your legal evidence.

- •Strategic Decision-Making: You can't analyze cash flow or create a realistic budget without reliable data, and that data comes from these documents.

Keeping these records in order, especially the mountain of receipts every business collects, is fundamental. A solid system makes sure nothing slips through the cracks. If you're looking for a better way to handle this, you can check out our complete guide on finding the best receipt organizer for your business.

The Most Common Types of Source Documents

Not all financial paperwork is the same. Think of your business transactions like a story; each event needs its own specific piece of evidence to be told correctly. Getting a handle on the different types of source documents helps you keep that financial story straight and ensures every entry in your books has the proper backup.

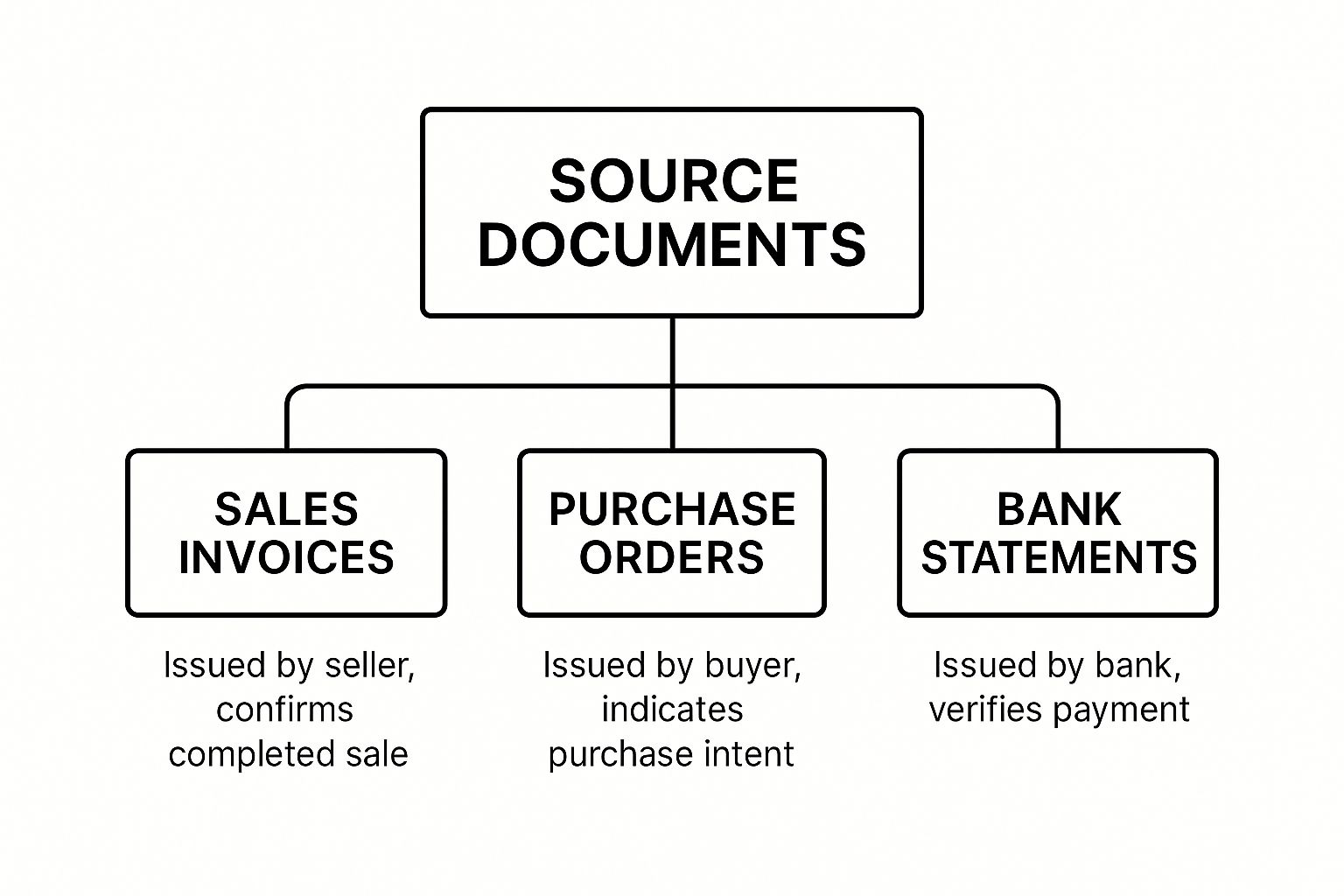

This is your go-to guide for spotting the most common source documents you’ll run into day-to-day. Each one captures a different moment in a transaction's journey, from the first "I want to buy this" to the final "payment confirmed." Let's break down the key players you'll see most often.

Documents That Initiate and Confirm Sales

A sale isn't just a single event; it's a process, often involving a few key pieces of paper (or their digital twins). Each document serves a distinct purpose, moving the transaction from a simple request to a done deal.

- •Purchase Orders (POs): This is where it all starts. A PO is a document sent from a buyer to a seller, officially requesting to order a product or service. Think of it as a statement of intent - it shows what the buyer wants, how many they want, and the price they've agreed to pay. It’s the starting gun for the transaction.

- •Sales Invoices: Once the seller has delivered the goods or services, they send a sales invoice to the buyer. This document confirms the order has been fulfilled and formally asks for payment. It breaks down what was sold, the total amount due, and the payment terms.

This infographic shows how these documents flow between the buyer, seller, and even the bank.

As you can see, there's a logical path here: from the intent to buy, to the confirmation of sale, and finally, to the verification of payment.

Documents That Verify Payment

After an invoice goes out, the next set of documents is all about proving that money has actually changed hands. These are absolutely critical for reconciling your accounts and making sure your cash flow records are spot on. While they're related, it's important to understand the key differences between an invoice and a receipt.

A common mistake is using "invoice" and "receipt" as if they're the same thing. An invoice requests payment for a sale, while a receipt confirms payment has been made. Both are vital source documents, but they represent two different stages of a transaction.

Here are the essential documents that confirm payment has been made:

- •Receipts: This is the buyer’s proof of payment. It can be a paper slip from a register or a digital confirmation email - either way, it’s the official nod that a bill has been paid.

- •Credit Card Slips: When a customer pays by card, that signed slip or digital authorization is the immediate proof of the transaction. It's a specific kind of receipt tied directly to a credit account.

- •Bank Statements: This document, issued by your bank, gives you the big picture. It’s a full summary of all deposits, withdrawals, and transfers over a set period. It’s the ultimate verifier, confirming that the payments recorded on your invoices and receipts have actually cleared the bank.

To make this even clearer, let's break down some common source documents and their specific jobs in the accounting cycle.

Common Source Documents and Their Roles

| Document Type | Primary Function | Who Issues It? | Example Scenario |

|---|---|---|---|

| Purchase Order | To initiate a purchase from a supplier. | The Buyer | Your company sends a PO to a vendor to order 50 new office chairs. |

| Sales Invoice | To request payment for goods or services sold. | The Seller | You send an invoice to a client after completing a web design project. |

| Receipt | To confirm that a payment has been received. | The Seller | A customer buys a coffee, and you give them a printed receipt. |

| Credit Card Slip | To provide proof of a credit card transaction. | The Seller | A diner pays for their meal with a credit card, and the restaurant provides a slip. |

| Bank Statement | To reconcile company books with actual cash flow. | The Bank | At month-end, you use your bank statement to verify all transactions. |

| Check / Cheque | To make a payment to a vendor or employee. | The Payer (Buyer) | You write a check to pay your monthly office rent. |

Each of these documents tells a small but crucial part of your company's financial story. Having the right one for every transaction is the key to accurate, audit-proof bookkeeping.

Why Accurate Records Are Your Financial Bedrock

Think of your business like a house. Your sales strategies and growth plans are the walls and the roof, but your source documents? That's the bedrock foundation everything is built on. If that foundation is shaky - littered with missing receipts or inaccurate invoices - the whole structure is at risk of crumbling. Good record-keeping isn't just a chore for your accountant; it's one of the most important things you can do for the long-term health of your business.

This is about so much more than just checking a compliance box. Solid records are the very heart of your company's integrity. They are the single source of truth for every number you report.

The Foundation for Accurate Financials

Every financial report you pull, whether it’s an income statement or a balance sheet, is really just a summary of all those individual source documents. Those original slips of paper (or digital files) are the backbone of your entire accounting system, and they're absolutely essential for understanding your financial health.

An error at this early stage - a miskeyed invoice or a lost receipt - can create a ripple effect that throws off all your financial reporting. This can distort your understanding of how the company is actually performing and lead you to make some really bad decisions. You can learn more about how these documents impact business accounting on Study.com.

Without a solid paper trail, you’re flying blind.

An organized set of source documents transforms a stressful tax audit from a potential crisis into a routine check-up. It's your ultimate defense, proving that every number you've reported is accurate and justifiable.

Creating an Indispensable Audit Trail

Let’s imagine a small business owner, Sarah, who runs a growing e-commerce store. One day, she gets that dreaded letter: a tax audit. Panic starts to creep in, but then she remembers she’s been diligent. She has a system for capturing every single supplier invoice, sales receipt, and bank confirmation.

So, when the auditor asks for proof of her expenses, Sarah isn't digging through shoeboxes. She just pulls up the organized digital files.

- •Cost of goods sold? She has the purchase orders and vendor invoices ready to go.

- •Marketing expenses? The invoices from her ad platforms are right there.

- •Shipping costs? Every courier receipt is neatly filed away.

What could have been a nightmare becomes a simple verification process. Sarah's story shows exactly why this matters: a clear audit trail built from source documents provides undeniable proof of your financial activities, protecting your business and giving you incredible peace of mind.

Providing Legal Proof and Building Trust

It's not just about taxes, either. Your source documents are your first line of defense in any financial dispute. If a customer claims they were never billed or a vendor says you didn't pay, the original document settles the matter quickly and decisively.

This level of organization also sends a powerful signal to everyone outside your company. When you're looking for a loan or trying to attract investors, showing them a complete and verifiable financial history speaks volumes. It proves you run a tight ship where every claim is backed by solid proof, making your business a far more attractive and trustworthy investment.

How to Capture and Manage Source Documents

Just having a pile of source documents isn't enough. You need a rock-solid system to capture, organize, and store them. Without a clear workflow, that shoebox of receipts and stack of invoices quickly becomes a massive headache, especially when it’s time to close the books or file taxes.

The real goal here is to create a simple, repeatable process that makes sure every single transaction is properly documented. A great system saves you time, slashes frustrating errors, and makes pulling financial reports feel almost effortless. Lucky for us, modern tools have taken us far beyond clunky filing cabinets and tedious manual data entry.

Creating Your Document Management Workflow

Building a workflow that actually works boils down to three core steps: capturing, recording, and storing. Think of it as a little assembly line for your financial data, where each step is just as vital as the one before it.

- •Capture Promptly: The golden rule is to grab every document the moment it lands in your hands (or inbox). Don't let receipts get crumpled in a wallet or invoices get buried. Use a scanner, your phone's camera, or an automated tool to create a digital copy on the spot.

- •Record Accurately: Once it's captured, the key information from the document - like the vendor's name, the date, and the total amount - needs to get into your accounting software. This is the crucial step that links the paper trail to your digital financial records.

- •Store Logically: Finally, file that digital copy somewhere you can actually find it later. A simple folder system organized by month or by vendor can work wonders.

This three-step process is the foundation of a totally stress-free system.

The key to successful document management is consistency. Capturing and filing every single source document as a routine habit prevents small oversights from becoming significant problems down the line.

Choosing Between Physical and Digital Storage

While paper records might feel old-school and reliable, digital storage has some serious advantages in speed, security, and accessibility. Cloud-based systems let you pull up your files from anywhere, protect them from disasters like a fire or flood, and make finding a specific document as easy as a quick search.

Traditionally, source documents are stored and archived right after being recorded because they’re so important for auditors. Many businesses keep documents from the last year on-site for easy access, while older records are often moved to off-site storage. But the whole world is going digital, and electronic copies are now widely accepted as valid proof for financial transactions.

For businesses still swimming in a sea of paperwork, looking into professional secure document storage solutions can be a smart way to manage and preserve those essential records.

For most modern businesses, though, a digital-first approach is the way to go. It turns document management from a dreaded chore into a simple, automated part of your day-to-day operations.

Automating Your Workflow with Modern Tools

Let's be honest, manual data entry is one of the biggest time-sucks in any business. Chasing down invoices, trying to decipher faded receipts, and punching every last detail into your accounting software is more than just slow - it’s a recipe for expensive mistakes. One misplaced decimal point can throw your entire financial picture out of whack.

This is where technology really steps up to change the game. Smart automation tools are built to handle this repetitive, error-prone work, freeing you up to focus on what actually matters. Instead of being buried in paperwork, you can make your documents work for you.

How Automation Changes Document Management

Think of a platform like Tailride as your tireless digital assistant. It plugs right into the places where your source documents show up - like your email inbox - and automatically grabs them for you. It then uses some pretty clever technology to read and understand what’s on each document, just like a person would, only much faster and without getting tired.

Here’s a quick look at what’s happening behind the scenes:

- •Automatic Capture: The software keeps an eye on your email for new invoices or receipts and pulls them into one central, organized place.

- •Intelligent Data Extraction: It scans the document and pulls out the important stuff, like the vendor’s name, the invoice number, the due date, and the total amount.

- •Seamless Syncing: That extracted data then gets zapped straight into your accounting system - think QuickBooks or Xero - without you having to do a thing.

For any business serious about boosting efficiency, adopting document workflow automation is a no-brainer. It transforms a chaotic, reactive chore into a smooth and predictable process.

The Power of AI and OCR in Action

The magic behind all this is a technology called Optical Character Recognition, or OCR. The best platforms today use AI-powered OCR, which means they don't just read the text; they understand its context. So, the system knows the difference between an invoice date and a due date and can pick out individual line items on a complicated receipt.

If you're curious and want to dive deeper into how it all works, our guide to invoice OCR software breaks down the technology in plain English.

Here’s a screenshot from Tailride that shows this in action. The platform has automatically snagged an invoice from an email attachment and pulled out all the key data points.

As you can see, the software nailed it - it correctly identified the vendor, invoice number, and total. From here, it's ready to be synced with just a single click.

The real win with automation isn’t just about saving a few hours on data entry. It’s about building a perfectly organized, easily searchable, and audit-ready digital archive of every financial transaction your business has ever made.

This shift means no more frantic searches for a missing receipt come tax time. Every single record is right there at your fingertips, neatly categorized and already reconciled. This kind of organization gives you a live, up-to-the-minute view of your finances, empowering you to make smarter decisions with total confidence.

Got Questions? We've Got Answers.

As you start to get a handle on source documents and why they're so important, a few practical questions almost always pop up. To wrap things up, let's go through some of the most common ones we hear from business owners. Getting these straight will help you manage your records like a pro and feel confident you’re ready for anything.

How Long Do I Need to Hang on to Source Documents?

This is the big one, and while the exact rules can change depending on where you live, a solid rule of thumb is to keep all your source documents for at least seven years.

Why seven years? That’s generally how long tax agencies, like the IRS in the U.S., can look back and audit your books. These documents are your concrete proof for every dollar of income you reported and every deduction you claimed. Just remember, that seven-year countdown starts from the end of the tax year the transaction happened in, not the date printed on the receipt.

It’s always smart to double-check with a local accountant, though. Some records, like those for big asset purchases (think buildings or heavy machinery) or certain employee files, often have their own, longer retention rules.

Are Digital Copies of Documents Actually Legit?

You bet they are. For pretty much any modern business, a digital or scanned copy of a source document is just as valid as the paper original for both your internal books and for the tax authorities.

The main thing is that the digital copy has to be a perfect, clear, and complete image of the original.

Tax authorities like the IRS are totally on board with digital records, as long as they're readable and stored in a way that proves they haven't been messed with. This just means you can't go back and change them, and you can pull them up easily if you're ever audited.

This is why using a secure, backed-up storage system is non-negotiable. It protects your digital files from disappearing and ensures you can produce any document when asked. Good software is built specifically to handle this, giving you one less thing to worry about.

What if I Lose a Source Document?

It happens to the best of us. Losing a document isn't great, but it’s rarely the end of the world. Your first move should always be to try and get a replacement. Just call or email the vendor, your bank, or whoever sent it in the first place and ask for a copy.

If a duplicate just isn't happening, your next best bet is to pull together other evidence that proves the transaction took place. This could be things like:

- •A bank or credit card statement that clearly shows the payment.

- •A canceled check matching the transaction.

- •Emails or other written notes that spell out the details.

It’s also a good idea to make a note of your attempts to find the original. While a single missing receipt isn't a disaster, having a bunch of gaps in your records can look really bad and cause major headaches down the road.

Can an Email Count as a Source Document?

Sometimes, yes! An email can absolutely work as a source document, but only if it has all the key information needed to verify what happened. To pass the test, it needs to clearly show the date, the amount, a description of what was bought or sold, and who was involved.

Think about it like this: an email from a consultant confirming a project is done and stating the final amount owed is acting like a simple invoice. A formal PDF invoice is always better and looks more professional, but a detailed email can be a lifesaver when a more official document was never created.

Trying to keep all this straight by hand is a massive time sink. Tailride puts the whole process on autopilot - from grabbing invoices right out of your email to pushing the data into your accounting software. You'll never have to chase down a missing document again. Get started for free at tailride.so and see just how easy it can be.