Difference Between an Invoice and Receipt: Key Comparison

Learn the difference between an invoice and receipt. Discover their roles, legal importance, and how they impact your business transactions.

Let's clear this up once and for all. An invoice is a request for payment you send to a client before they pay you. A receipt, on the other hand, is the proof of payment you give them after the transaction is done.

Think of it like this: an invoice says, “Here’s what you owe me,” while a receipt says, “Thanks, you’ve paid me!”

Invoice vs. Receipt: A Clear Comparison

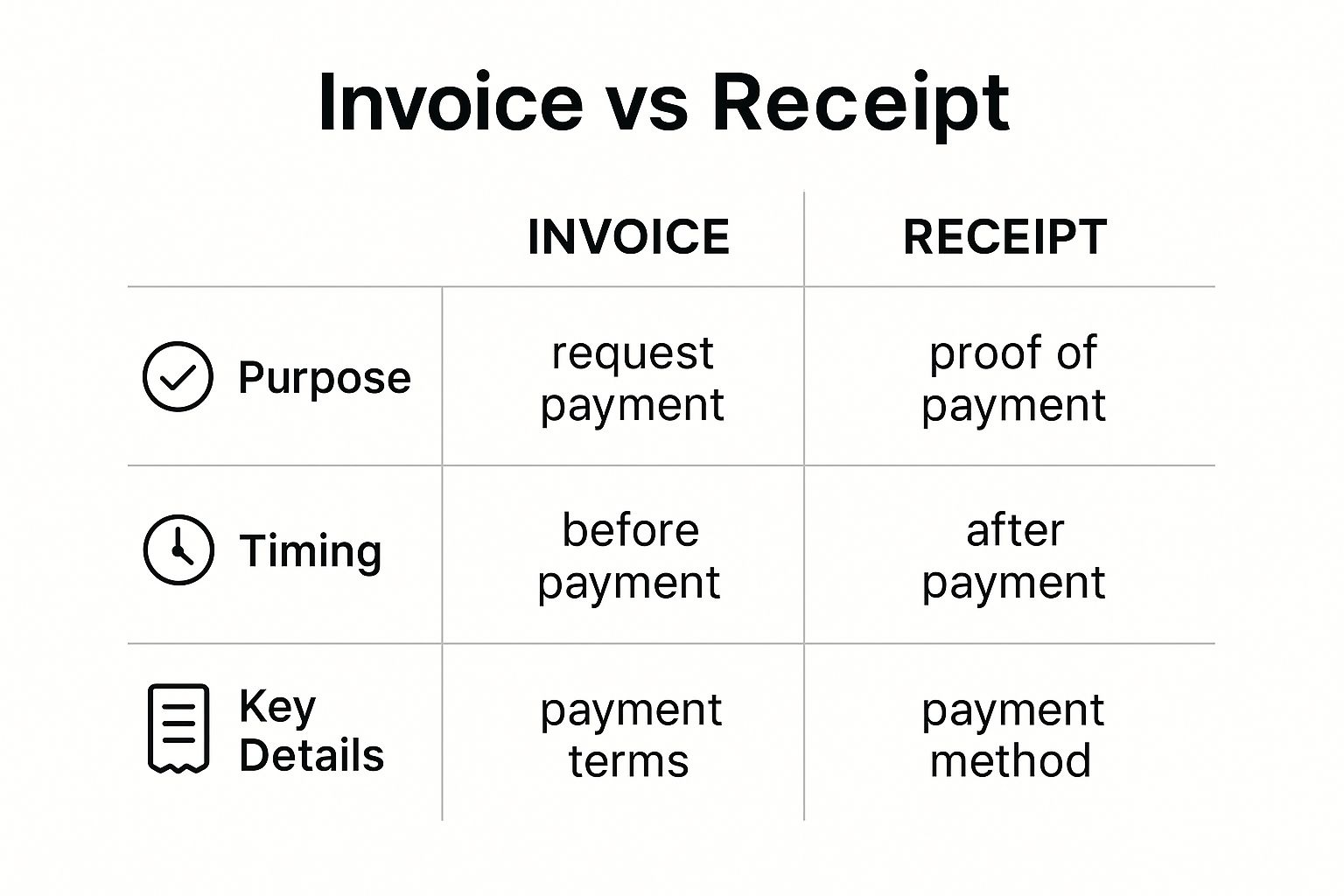

Getting the hang of the difference between an invoice and a receipt is fundamental for keeping your books in order. Even though they’re both part of the same transaction, they pop up at different times and do completely different jobs. An invoice gets the ball rolling on payment, and a receipt officially closes the loop.

This quick visual guide sums up their main functions and timing perfectly.

As you can see, an invoice is your tool for managing money coming in (accounts receivable), while a receipt is simply a record confirming a deal is done and dusted.

Invoice vs. Receipt At a Glance

To make it even simpler, here’s a table that lays out the core differences.

| Attribute | Invoice | Receipt |

|---|---|---|

| Purpose | To request payment for goods or services. | To confirm that payment has been received. |

| Timing | Issued before payment is made. | Issued after payment is made. |

| Role | Kicks off the payment process. | Concludes the payment process. |

This distinction isn't just semantics; it’s critical for managing your finances. In fact, over 90% of SMEs rely on invoices to formally request payment, often with terms stretching out to 30 or even 60 days, which has a direct impact on cash flow. You can find more insights on how businesses handle payments over on Hiveage.com.

This workflow really highlights the invoice's job as a forward-looking financial document, completely different from the receipt's role as a historical record of a payment that’s already happened.

Breaking Down the Invoice: What It Is and Why It Matters

An invoice isn't just a bill - it's a formal, professional request for payment that gets your accounts receivable moving. Think of it as the official starting gun for getting paid. It lays out a detailed agreement of the products sold or services you provided, essentially telling your client, "Here’s the great work I did, and here's what you owe me for it."

For instance, imagine a marketing consultant wrapping up a three-month social media campaign. They’d send an invoice that itemizes every part of the project - things like "Content Creation," "Ad Management," and "Performance Reporting" - each with its own agreed-upon rate. This level of detail eliminates any guesswork and establishes a professional tone right from the start.

The Anatomy of a Professional Invoice

To be effective (and legally sound), every invoice needs a few key ingredients. These components ensure both you and your client are on the same page, which is invaluable for good bookkeeping and heading off any potential disputes down the road.

A solid invoice always includes:

- •A unique invoice number for simple tracking.

- •A detailed itemization of every service or product and its cost.

- •Clear payment terms, including the due date (like Net 30).

- •The total amount due, with a clear breakdown of any taxes.

This structure does more than just ask for money; it's a critical tool for managing your business's cash flow. And by the way, understanding what is electronic invoicing can take this whole process to the next level, making tracking and payments feel almost effortless.

At its core, an invoice is a tool of commerce that communicates a debt. It turns a verbal agreement into a documented financial obligation that can be tracked, managed, and, if it comes to it, legally pursued.

The invoice as a formal payment request has been around for a long time. They really came into their own in the late Middle Ages in Europe when merchants needed a standardized way to demand payment for goods. If you look at Venetian trade records from the 1400s, you'll see early invoices being used to request payments that would be settled later, cementing their role as a formal demand for payment.

Understanding the Receipt: The Final Handshake

Once money has changed hands, the receipt enters the picture. Think of it as the final, official handshake confirming that a deal is done and the debt is settled. It’s the proof that says, “Payment received, thank you very much.”

This slip of paper is more than just a formality; it's a vital record for everyone involved. The core difference between an invoice and a receipt really comes down to timing - the invoice asks for money, while the receipt confirms it’s been paid.

Buying a coffee is the perfect example. You don’t get an invoice from the barista. You pay at the counter and immediately get a receipt. That little piece of paper is your proof of purchase, and you’ll need it if you ever have to return something or just want to track your daily spending.

Key Elements of a Valid Receipt

For a receipt to actually work as proof of purchase, it needs to contain a few specific details. This isn't just about being thorough; it's about making sure there’s no confusion about the transaction later on.

Here’s what every good receipt should have:

- •Payment Date: The exact date the money was received.

- •Amount Received: The total amount the customer paid.

- •Payment Method: How the payment was made (e.g., cash, credit card, bank transfer).

- •Itemized List: A simple description of the goods or services sold.

These details are absolutely critical for proper bookkeeping and tax season. For any business, this record is non-negotiable for proving revenue, keeping track of inventory, and staying on the right side of the law. Without it, your financial records are basically incomplete.

A receipt isn't just for the customer's peace of mind. For a business, it's the final entry in a transaction's story, closing the loop on accounts receivable and solidifying revenue in the books.

This proof of payment protects both parties. The customer can manage returns, claim warranties, and track their expenses. For the business, it's a critical piece of the puzzle for accurate accounting. Keeping these documents in order is everything, which is why a dedicated receipt organizer for business can be a true game-changer for any finance team. It makes sure every transaction is accounted for without all the manual grunt work.

How Invoices and Receipts Drive Your Financial Workflow

https://www.youtube.com/embed/Vw1CBF124Uw

Think of invoices and receipts as a perfect tag team that guides every transaction from start to finish. The whole process kicks off with an invoice. It's the official request for payment, which immediately gets logged in your accounts receivable as money you're owed.

Once the customer pays up, the receipt jumps in to finish the job. It’s the final handshake that confirms the deal is done and the debt is settled. That’s when the money officially moves out of your accounts receivable and into your revenue, giving you a crystal-clear picture of what you’ve earned.

From Request to Record

Getting this sequence right is key to understanding the real difference between the two. One document starts the cash flowing into your business, and the other confirms it has safely arrived.

- •Invoice Stage (The Ask): Imagine a freelance designer just finished a new logo. They send an invoice for $1,500. That amount now sits in their books as an outstanding payment, directly impacting their cash flow forecast.

- •Receipt Stage (The Confirmation): The client pays the bill. The designer then sends over a receipt, which closes out that invoice in their accounting software and officially records the $1,500 as revenue.

This simple two-step dance ensures every single transaction is tracked properly from request to resolution. It’s what keeps your financial records balanced and trustworthy.

An invoice looks forward, managing income you expect to receive. A receipt looks backward, confirming a transaction that has already happened. Nailing this workflow is the foundation of solid financial management.

This isn't just about paperwork; it’s about accountability. In large North American companies, a staggering 75% of accounts receivable teams rely on invoices to track what they’re owed, with some juggling more than 10,000 invoices every month. Receipts come in after the fact to finalize the books and sort out any issues.

For a deeper dive into these operational details, this guide on mastering invoices and payments is a great resource. When you manage this flow correctly, you avoid confusion, get paid on time, and build a solid audit trail for your business.

Why Tax Authorities Care About the Difference

When it comes to taxes and legal matters, mixing up an invoice and a receipt is more than a simple clerical error - it can be a seriously expensive mistake. Tax authorities like the IRS are notoriously strict about paperwork, and getting this distinction right is absolutely essential for keeping your business compliant.

Think of it this way: an invoice is a request for payment, not proof it was ever made. For tax purposes, that difference is everything. When you're claiming business expenses, a receipt is the non-negotiable proof that you actually spent the money. An invoice just shows an intention to pay or a request to be paid.

Receipts as Proof for Deductions

If you find yourself in an audit, handing over an invoice for that new software or a client lunch just won't cut it. The auditor needs to see a receipt to confirm the transaction actually happened. It’s your first and best line of defense to prove your spending was legitimate and your deductions are valid.

Tax agencies all over the world, from the IRS in the US to HMRC in the UK, require receipts as the official proof of payment. It's shocking, but studies show that a whopping 42% of audit failures are due to insufficient or missing receipts - not invoices. You can read more about this common tax pitfall on Hiveage.com. For a deeper dive, check out our guide on how to prepare for an audit.

An invoice is an IOU, but a receipt is a signed confession that a debt has been settled. For a tax auditor, only the confession matters.

Invoices in Legal Disputes

These documents play equally critical, but opposite, roles in legal situations. If a client doesn't pay you, that unpaid invoice is the cornerstone of your evidence. It proves you delivered the goods or services and formally requested payment based on the terms you both agreed to.

On the other hand, if a vendor ever claims you haven't paid them, your receipt is the knockout punch. It’s the undeniable proof that you settled the account, shutting down the argument right then and there.

Let’s Make Your Invoicing and Receipt Process Effortless

Let’s be honest: manually handling invoices and receipts is a huge time-drain. It pulls you away from the work that actually grows your business. Thankfully, modern tools can take this entire workflow off your plate, turning a tedious chore into a smooth, automated process and giving you back those precious hours.

Think about it. A project wraps up, and boom - a professional invoice is automatically created and sent. The system then follows up with polite payment reminders, which research shows can cut down on late payments by as much as 50%. Once the client pays, a receipt is instantly generated and delivered. Just like that, the loop is closed with zero manual effort, making the difference between an invoice and receipt a seamless part of your operations, not just a definition.

Why You Should Embrace Financial Automation

When you bring in the right tools, you’re not just saving time; you’re drastically reducing the chance of human error. Everything stays perfectly organized and ready for tax season. An automated system means every single transaction is documented accurately from start to finish.

Automation isn't just about speed. It's about building a reliable, error-free financial system. When your invoicing and receipt workflow runs itself, you can stop chasing paperwork and start focusing on growth.

To really get a handle on this, businesses and freelancers can explore effective invoicing tools for freelancers that make these tasks simple. Platforms like Tailride are built to manage this entire lifecycle, ensuring everything is accurate and freeing up your team to do more important work.

Got Questions? Let’s Talk Invoices vs. Receipts

Even seasoned pros can get tripped up by the details. Let's clear the air on a few common mix-ups when it comes to the difference between an invoice and receipt.

Is a 'Paid' Invoice the Same as a Receipt?

Not quite. Stamping an invoice with a big 'PAID' stamp feels good, but it doesn’t make it an official receipt. A proper receipt has specific details a paid invoice might miss, like how the payment was made (credit card, bank transfer, etc.) and the exact transaction date.

When it comes to official business - think tax returns, expense reports, or handling a refund - you need the real deal. A dedicated receipt is always the cleaner, more professional choice.

Relying on a 'paid' invoice instead of a proper receipt can create headaches during an audit. Tax authorities look for clear proof of payment, and a receipt provides that undeniable evidence.

What if a Customer Pays Upfront, No Invoice Needed?

This happens all the time, especially in retail or for on-the-spot services. The game plan is simple: issue a receipt right away. This gives the customer their proof of purchase and confirms you've received the money.

For your own books, you should still create an invoice for the sale and immediately mark it as paid. This keeps your accounting records straight and ensures every bit of income is tracked properly.

Do I Really Need to Keep Both?

Yes, you absolutely do. This isn't an either/or situation. Each document plays a unique and critical role in your financial workflow.

- •Invoices track what you're owed. They are the backbone of your accounts receivable and tell the story of your sales.

- •Receipts track what you've spent. They are the proof you need for tax deductions and managing your expenses.

Keeping both gives you a full, audit-proof financial picture. There's no getting around it.

Stop drowning in paperwork. With Tailride, you can automate your entire invoice and receipt management process in minutes, eliminating manual data entry for good. Get started for free at https://tailride.so.