Invoice OCR Software: Your Ultimate Guide to Smarter Billing

Learn how invoice OCR software simplifies accounts payable. Discover key features and tips to choose the best solution for your business.

Invoice OCR software is a lifesaver for anyone buried in paperwork. Think of it as a smart assistant that automatically reads your invoices, grabs all the important details like vendor names and due dates, and zaps them straight into your accounting system. It takes the slow, error-filled chore of manual data entry and replaces it with instant, automated accuracy.

So, What Is Invoice OCR Software Anyway?

Let's cut through the tech talk. Picture your accounts payable team drowning in a sea of invoices - paper copies, PDFs, emails - and having to manually type every single line item, date, and dollar amount into a spreadsheet. It’s not just boring; it’s a bottleneck that’s practically guaranteed to create mistakes and delays.

Now, imagine a machine that does all that work in a flash. That's exactly what invoice OCR software is.

This tool automatically "reads" any invoice you throw at it, pulls out the critical info, and funnels it directly into your accounting or ERP system. No one has to lift a finger to type anything. This isn't just a small perk; it’s a complete game-changer for how finance departments work, turning a huge headache into a smooth, efficient process.

The Headaches of Manual Processing

It's no secret that handling invoices the old-fashioned way is a major drag. It's slow, full of potential human errors, and costs more than you think. Every minute someone spends typing in data is a minute they could have spent on something more valuable, like analyzing spending or building better relationships with suppliers.

Before we look at the solution, let's break down the all-too-common problems with the manual approach versus what automation can do.

Manual vs Automated Invoice Processing

| Challenge | Manual Processing | Invoice OCR Software Solution |

|---|---|---|

| Accuracy | Prone to typos, missed details, and duplicate payments. One wrong keystroke can be costly. | 99%+ accuracy captures data flawlessly, drastically reducing overpayments and errors. |

| Speed | Takes minutes to process a single invoice, with approval cycles dragging on for days or weeks. | Invoices are processed in seconds. Approval workflows are automated and instant. |

| Cost | High labor costs tied to repetitive data entry and error correction. | Dramatically reduces manual labor costs and eliminates late payment fees. |

| Visibility | Invoices get lost in email chains or on desks. It's nearly impossible to get a real-time view of liabilities. | Provides a centralized dashboard with a clear, real-time status for every single invoice. |

| Employee Morale | Mind-numbing, repetitive work leads to burnout and high employee turnover. | Frees up the team to focus on strategic, high-value tasks, boosting job satisfaction. |

As you can see, the difference is night and day. Automation doesn't just make the old process faster; it fundamentally changes it for the better.

How Automation Is the Answer

Invoice OCR software tackles these problems head-on by creating a "touchless" workflow. The incredible growth in this space shows just how powerful this shift is. The AI-powered invoice processing market is expected to skyrocket from USD 2.8 billion in 2024 to an incredible USD 47.1 billion by 2034.

By turning messy invoice data into clean, structured information, this software sets the stage for genuine financial automation. It’s not just about reading text; it's about understanding the entire context of a financial document.

Ultimately, this technology is a must-have for any modern finance team looking to operate more efficiently. Our complete guide offers a deeper look into how to choose the right invoice OCR software for your business.

How the Magic of Invoice OCR Actually Works

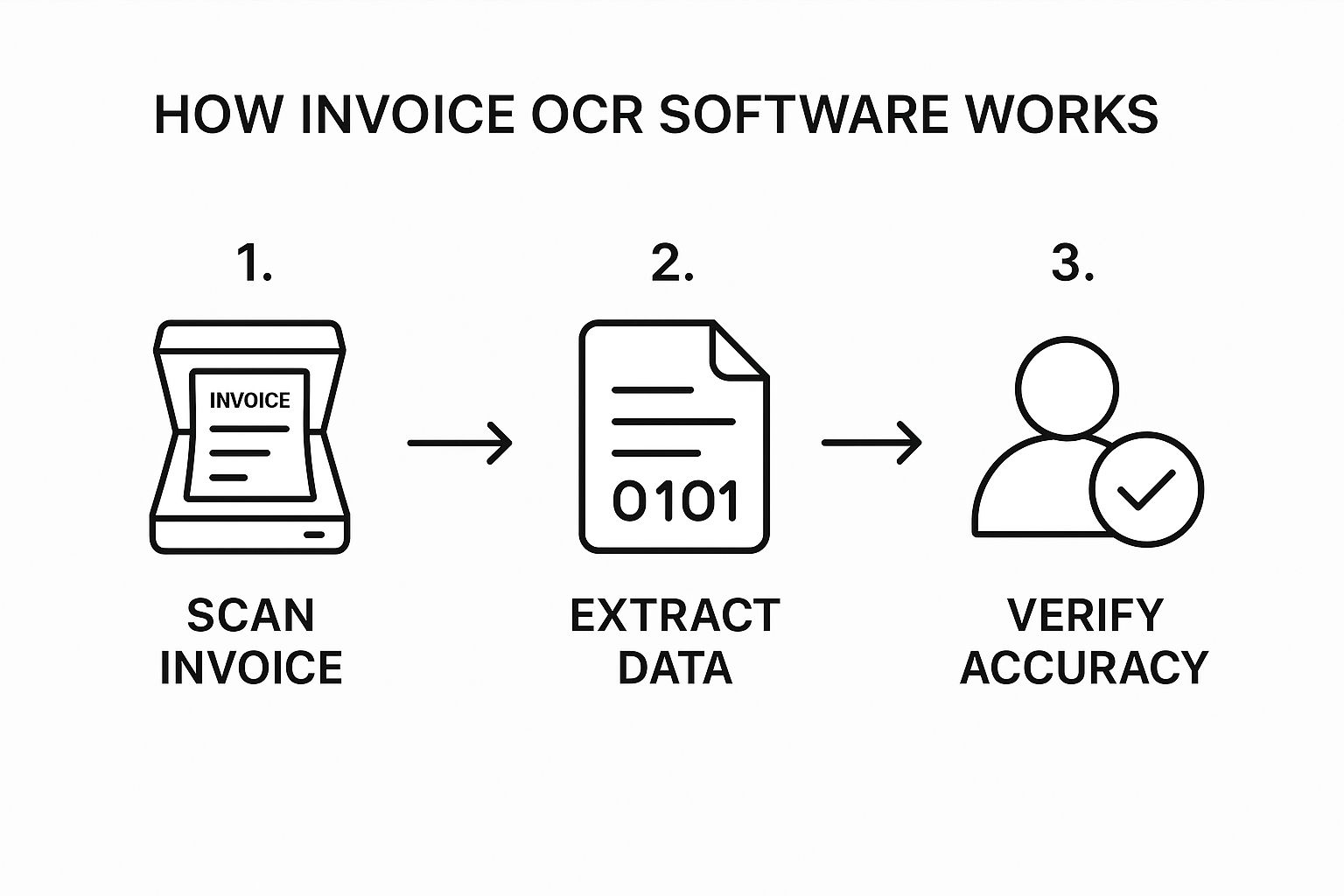

Ever wondered what happens behind the scenes when you upload an invoice? It might feel like magic, but it’s actually a brilliant, step-by-step process. Think of invoice OCR software as a super-efficient digital clerk, trained to turn a stack of random documents into neat, organized data for your accounting system.

The whole thing kicks off the second an invoice lands in your inbox as a PDF, gets scanned, or is even snapped as a photo. The software's first job is simply to grab this document, pulling the raw information into the system so it can get to work.

Preparing the Document for Reading

Before the software can "read" anything, the invoice image needs a little tidying up. This is the pre-processing stage. Imagine trying to decipher a faded, crooked, coffee-stained note - it’s tough, right? The software often deals with the digital equivalent, like skewed scans or grainy images.

The pre-processing phase is like a digital clean-up crew that preps the document for accurate reading. It typically involves a few key steps:

- •Deskewing: The software automatically straightens any crooked scans, making sure all the text is perfectly horizontal.

- •Noise Reduction: It gets rid of random spots, shadows, and other visual clutter that could confuse the system.

- •Binarization: The image is converted to a crisp black and white, creating a sharp contrast that makes the text pop.

This cleanup is vital. It ensures every character is as clear as possible, paving the way for the software to pull the data with pinpoint accuracy.

From Pixels to Text and Context

With a clean image ready, the core technology - Optical Character Recognition (OCR) - jumps into action. The software scans the document and recognizes each individual character, essentially turning the image's pixels back into actual letters and numbers. This is what allows the system to read the invoice in the first place. The OCR market was valued at USD 10.62 billion in 2022 and is expected to rocket to USD 32.90 billion by 2030, showing just how essential this tech has become.

But modern tools don't just stop there. They layer Artificial Intelligence (AI) on top for what's called intelligent data extraction.

This is where the real power lies. Basic OCR might just see a string of numbers, but an AI-powered system understands that the number "12345" appearing next to the words "Invoice #" is, in fact, the invoice number. It identifies totals, dates, and vendor names by understanding their context, even if every invoice has a completely different layout.

This entire workflow, from messy document to structured data, is a lot easier to visualize.

As you can see, it's a logical flow that systematically transforms a simple document into valuable, ready-to-use information.

Verification and Continuous Learning

Of course, no technology is 100% perfect, which is why the final step is all about validation. If the software is unsure about anything - maybe a blurry number or a date in a weird spot - it flags it for a quick human review. This means someone on your team only needs to check the exceptions, not every single line item.

This human-in-the-loop process does more than just catch the odd error. It creates a powerful feedback loop. Every time a correction is made, the AI learns from it, getting smarter and more accurate with each invoice it handles.

Over time, you'll find the system needs less and less hand-holding. This self-improving cycle is a core part of mastering document workflow automation and is what makes invoice OCR a game-changer for any finance team.

Essential Features Your Software Must Have

Alright, let's move from the "what is it" to the "what to look for." Think of this as your must-have checklist when you're shopping around. The truth is, not all invoice OCR tools are built the same. A great one does more than just read text; it weaves itself into your financial operations, taking tedious work off your plate and giving you a clearer picture of your spending.

When you start comparing options, you'll find some features are simply non-negotiable. These are the capabilities that separate a basic document scanner from a true business solution that actually pays for itself. Let’s break down what your software absolutely needs to make a real difference.

High-Accuracy and Template-Free Extraction

First and foremost, the software has to get the data right. High accuracy is the foundation of the whole operation. If you’re constantly fixing errors, you’ve just swapped manual data entry for manual data correction. It's a pointless trade. The best tools on the market consistently hit over 95% accuracy, which is a massive step up from the error rates we see with human keying.

Just as critical is template-free extraction. I remember the old days of OCR when you had to painstakingly create a "template" for every single vendor's invoice layout. If a supplier changed their invoice design even slightly, the whole thing would break. It was a nightmare, especially for businesses with hundreds of suppliers.

Modern, AI-driven software is different. It's smart enough to understand context, finding the "Invoice Number" or "Total Amount" no matter where it's located. That kind of flexibility is essential for handling the messy, real-world variety of invoices that land on your desk every day.

Detailed Line-Item Capture

Pulling the invoice total and due date is table stakes. Where a good system really proves its worth is by capturing line-item details. This means it extracts every single product or service listed on the invoice - the quantity, the price, the description, everything.

Why is this so important?

- •See Where the Money Really Goes: It gives you a granular view of your spending, helping you manage budgets with incredible precision.

- •Keep Inventory in Check: For any business selling products, matching line items from a supplier invoice to a purchase order is crucial for knowing what's actually on your shelves.

- •Nail Your Job Costing: If you’re a service-based business, you can assign specific costs to client projects, which helps you see what's profitable and quote more accurately next time.

Without line-item data, you’re flying blind. It's the difference between knowing you paid a vendor $5,000 and knowing you paid $3,000 for raw materials and $2,000 for shipping.

Automated Workflow and Approval Routing

Getting the data is just step one. The real magic happens with what the software does next. This is where workflow automation comes in and saves you from the endless back-and-forth of chasing down approvals.

Look for a system that lets you build your own rules. For example, you could set it up so invoices under $500 go straight to finance for payment, while anything over $5,000 automatically gets sent to the department head for a second look.

This takes a chaotic, email-driven mess and turns it into a clear, orderly process. Invoices get to the right people in the right sequence, which stops bottlenecks and late payment fees in their tracks.

This also creates a perfect digital paper trail. You can see exactly who approved what and when, which is a lifesaver during an audit.

Seamless Accounting System Integrations

Your invoice software can't be an island. To be truly effective, it has to talk to your main accounting or ERP (Enterprise Resource Planning) system. Otherwise, you're just creating another data silo and more work for your team.

A top-notch solution will have ready-made, direct integrations with the big players, like:

With these connections, once an invoice is captured and approved, all of its data - the vendor info, the amounts, the line items - gets posted to your general ledger automatically and accurately. This closes the loop, eliminating that final, error-prone step of manual entry and turning your accounts payable process into a well-oiled machine.

What This Actually Means for Your Business

Alright, we've talked about the tech. But let's get real about what invoice OCR software actually does for your business. This isn't just a fancy software upgrade; it's a strategic move that pays dividends in your bottom line, your team’s sanity, and your company's ability to handle whatever comes next. The ripple effect is huge.

Think about a small business juggling maybe 500 invoices a month. If each one takes just 10 minutes to handle manually - opening it, typing in the details, getting it approved - that's over 80 hours of work every single month. That's two full work weeks! Automation hands that time right back to you, so your team can focus on growing the business, not just processing paperwork.

Slash Costs and Unleash Your Team

The first thing you'll notice when you automate invoice processing is the direct hit to your operational costs. When you stop paying people for hours of mind-numbing data entry, you immediately cut labor expenses. In fact, studies show automated systems can slash the cost of processing a single invoice by as much as 80%.

But it's about more than just trimming the budget. It means your current team can handle way more work without getting overwhelmed. As your business grows, you won't need to hire more people just to keep up with the paperwork, which makes scaling up so much smoother.

The demand for this kind of efficiency is exploding. The Invoice OCR API market - the engine behind many of these tools - was valued at roughly USD 1.5 billion in 2024 and is on track to hit USD 5.8 billion by 2033. You can dig into the numbers and trends yourself over at Verified Market Reports.

Get Your Numbers Right and Tighten Financial Control

Let’s face it, humans make mistakes. And in accounting, a simple typo or a misplaced decimal can be a very expensive "oops." Invoice OCR software is your best defense against these costly slip-ups.

The system acts as a digital gatekeeper, catching common errors before they ever become a problem.

- •No More Double Payments: The software instantly flags invoices that look identical (same number, date, and amount), so you never accidentally pay the same bill twice.

- •Perfect PO Matching: It automatically checks invoice details against your purchase orders. You only pay for exactly what you ordered and received - no more, no less.

- •Lower Fraud Risk: A transparent, automated system with clear approval rules makes it incredibly difficult for fake or inflated invoices to sneak through.

This isn't just about avoiding errors; it's about gaining real-time, crystal-clear control over your company's finances. You always know exactly what you owe and when.

Improve Cash Flow and Make Your Suppliers Happy

Getting invoices processed faster isn't just an internal win; it directly impacts your company's cash flow. When you turn a weeks-long process into something that takes just a few hours, you unlock some serious financial advantages.

By speeding up the approval-to-payment cycle, you can finally take advantage of those early payment discounts your suppliers offer. Even a 2% discount for paying 10 days early adds up to thousands of dollars in real savings over a year.

And guess what? Your suppliers will love you for it. Paying them on time, every time, builds incredible trust and goodwill. A happy supplier is far more likely to give you better terms, prioritize your orders when things get busy, and be a genuine partner in your success. To see how this fits into the bigger picture, take a look at our guide on building a solid invoice processing workflow.

How Automation Moves the Needle on Key Metrics

When you introduce invoice OCR, you're not just buying software; you're investing in better business outcomes. The table below breaks down exactly how automation directly improves the numbers that matter most to your company's health.

Key Performance Indicators Impacted by Invoice OCR

| Business Metric (KPI) | Impact of Automation | Example Improvement |

|---|---|---|

| Cost Per Invoice | Drastically reduces manual labor and error correction costs. | From $15 per manual invoice down to $3 per automated invoice. |

| Invoice Processing Time | Cuts the cycle time from weeks or days to mere hours or minutes. | Average processing time drops from 14 days to less than 24 hours. |

| Early Payment Discount Capture Rate | Enables timely payments to capitalize on supplier discounts. | Increases discount capture from 20% to over 90%. |

| Data Entry Accuracy | Eliminates human error, leading to near-perfect data capture. | Accuracy rates climb from 95% (manual) to 99.5%+ (automated). |

| Supplier On-Time Payment Rate | Ensures vendors are paid promptly, improving relationships. | On-time payments increase to 99%, reducing late fees. |

| Audit & Compliance Readiness | Creates a digital, searchable record of all transactions. | Audit preparation time is reduced by 75% due to accessible data. |

As you can see, the benefits go far beyond simple convenience. Automating this one process creates a positive domino effect across your entire financial operation, leading to a more resilient, efficient, and profitable business.

Finally, the whole automated process creates a perfect, digital audit trail. Every single step - from the moment an invoice arrives to the second it's paid - is logged, time-stamped, and saved. When tax time or an audit rolls around, what used to be a frantic scramble for paper becomes a simple, stress-free search. That kind of peace of mind is priceless.

Choosing the Right Invoice OCR Software for Your Team

Picking the right invoice OCR software can feel overwhelming, but it really doesn’t have to be. With a solid game plan, you can cut through the noise and find a solution that feels like it was built just for your business. Think of it less like buying software and more like hiring a new, incredibly efficient member of your finance team.

The real goal here is to find a tool that does more than just scan invoices. You want something that genuinely simplifies your entire accounts payable world, saving you time, slashing errors, and freeing up your team to focus on work that actually moves the needle. Let's walk through what really matters so you can make a choice everyone will thank you for.

Start by Looking at Your Own Workflow and Volume

Before you even think about scheduling a demo, take a good, hard look in the mirror. Understanding your current process is the absolute most important first step. You can't figure out where you're going if you don't know where you're starting from.

Get your team together and ask some simple but crucial questions to paint a clear picture:

- •How many invoices are you actually processing each month? This is a huge factor for pricing, as most platforms charge based on volume.

- •How do invoices show up? Are they PDFs piling up in an inbox, paper scans, or a chaotic mix of everything?

- •What does your approval chain look like? Do invoices need a simple sign-off, or do they travel through multiple departments based on the dollar amount?

The answers to these questions will create a blueprint of your specific needs. A business wrestling with 5,000 invoices a month is in a completely different league than one managing 200. Knowing your numbers and your complexity helps you immediately weed out tools that are either too weak or way too overpowered for what you need.

Put Integrations and Usability at the Top of Your List

Here’s a non-negotiable: your invoice OCR tool can't live on an island. To be truly useful, it has to talk to the other systems you rely on every day, especially your accounting or ERP software.

Make sure any vendor you're considering has a solid, pre-built connection to your existing tech, whether that's QuickBooks, Xero, NetSuite, or something else. If it doesn't, you're just swapping one manual data-entry headache for another. A seamless integration means that once an invoice gets the green light, all that data flows right into your general ledger without anyone having to touch a keyboard.

Beyond the tech, think about the people.

The most powerful software in the world is completely worthless if your team hates using it. Look for a clean, intuitive design and a setup process that doesn't require a computer science degree. A great user experience is what turns a software purchase into a smart business investment.

Dig Into the Pricing Models and Support

Alright, let's talk about the practical side of things: money and help. Invoice OCR software comes in all sorts of pricing flavors, so you need to find one that makes sense for your budget and business rhythm.

You'll generally run into a few common models:

- •Pay-Per-Invoice: This is a fantastic, flexible option if your invoice volume goes up and down. You just pay for what you use.

- •Tiered Subscriptions: These plans give you a set number of invoices each month for a flat fee. Higher tiers usually unlock more advanced features.

- •Custom Enterprise Pricing: For the big players with massive invoice volumes or unique requirements, vendors will often build a custom-tailored plan.

When you're looking at the cost, don't just focus on the monthly fee. Think about the total return on investment. If a tool costs $200 a month but frees up 20 hours of your team's time, it’s already paying for itself several times over. When you automate your accounts payable process, you'll uncover all kinds of ways to save money.

Finally, don't overlook the support team. What happens when you get stuck or something isn't working right? Look for vendors with a reputation for responsive help, great onboarding, and clear, easy-to-find documentation. Good support is just as critical as the software itself - it means you have a real partner invested in your success.

Got Questions About Invoice OCR? Let's Clear Things Up.

Thinking about bringing in automation is smart, but it's natural to have a few questions pop up. You've seen what this tech can do, but what about the nitty-gritty details? Let's tackle the practical, "what if" questions that always come up before you make a move.

Think of this as a quick chat to smooth out any lingering uncertainties. My goal is to give you clear, straight-up answers so you can feel totally confident about what this means for your business.

How Accurate Is This Stuff, Really?

This is always the first question, and for good reason - the whole point is to have data you can trust. The good news is that modern invoice OCR software, especially the ones using AI, are incredibly reliable, consistently hitting accuracy rates above 95%. For invoices you see all the time from regular suppliers, that number can even push 99%.

Now, no technology is perfect 100% of the time. The best systems know this and are designed for it. They use a "human-in-the-loop" approach for validation. If the AI is ever less than certain about a piece of data - maybe a number is a bit blurry or the date is in a weird format - it flags it for a quick look by a person on your team. This mix of smart automation and human oversight catches far more mistakes than manual data entry ever could.

And here’s the cool part: the AI learns. Every time you confirm a flagged field, the system gets a little smarter, improving its accuracy for the next invoice that comes in from that vendor.

Can It Handle Invoices from Other Countries?

Absolutely. In a world where we work with people everywhere, this is a must-have. Top-tier invoice OCR tools are built for global business and come with solid support for multiple languages and currencies. They have no problem reading and pulling data from invoices in Spanish, French, German, or dozens of other languages.

They're also trained to spot all the different currency symbols and formats out there, from dollars ($) and euros (€) to pounds (£) and yen (¥).

If you work with international suppliers, this is a dealbreaker. Make sure you ask for a specific list of supported languages and currencies when looking at different options. You want to be sure the software is a perfect fit for your global operations, so things run smoothly no matter where your vendors are.

Is This Going to Be a Headache to Set Up?

The mere thought of a "software implementation" can bring on a cold sweat, conjuring images of long, complicated projects. Thankfully, that's not the reality with today's cloud-based invoice OCR platforms. Most are designed to be up and running in a matter of days, not months.

The most hands-on part is usually connecting it to your accounting or ERP system. To make that as painless as possible, the best providers offer pre-built integrations for platforms like QuickBooks, Xero, and NetSuite. This often means you can link everything up with just a few clicks.

Plus, you're not left to figure it out alone. Good vendors have dedicated support and onboarding teams to walk you through it all, ensuring a smooth start and helping you get value from day one.

Is This Affordable for a Small Business?

Yes, and that's one of the best things about where the technology is today. This kind of powerful automation is no longer just for giant corporations with bottomless budgets. Flexible pricing has made invoice OCR software a realistic option for businesses of all shapes and sizes.

You'll typically see a couple of pricing models:

- •Pay-Per-Invoice: Super flexible. You only pay for what you actually process. This is perfect if your invoice volume goes up and down.

- •Tiered Monthly Subscriptions: You get a certain number of invoices per month for a flat fee. This gives you predictable costs and often unlocks more features as you move up the tiers.

For nearly any small business, the return on investment (ROI) is a no-brainer. Just add up the hours your team spends typing in data, chasing down approvals, and fixing little errors. The money you'll save by ditching late fees, catching duplicate payments, and freeing up your people for more important work will almost always outweigh the cost of the software, making it a very smart financial decision.

Ready to stop the manual data entry grind and see what automation can do for your business? Tailride connects directly to your inboxes and online portals to capture and process every invoice automatically, saving you hours of work each week. Start automating your invoices in seconds with Tailride.