best ocr software for invoices - top options for 2025

best ocr software for invoices: automate AP, boost accuracy, and save time. Compare top options and pricing.

Tags

Welcome! If you're tired of chasing down invoices, squinting at PDFs, and manually typing line items into your accounting software, you're in the right place. Manual invoice processing isn't just tedious; it's a bottleneck that costs time, introduces errors, and slows down your entire financial operation. The solution is intelligent automation, powered by Optical Character Recognition (OCR).

But not all OCR tools are created equal. Some are basic text scrapers, while others are sophisticated AI platforms that can find, read, and understand invoices with minimal human intervention. Finding the right fit is crucial for unlocking true efficiency. Once implemented, the right tool is pivotal for realizing the future of approvals with an automated workflow system, drastically improving how your business operates.

This guide cuts through the marketing noise to help you find the best ocr software for invoices for your specific needs. We're diving deep into 12 leading solutions, analyzing their unique strengths, hidden limitations, and ideal use cases from the perspective of real-world finance teams. Each review includes screenshots and direct links to help you evaluate your options. Let's find the tool that finally lets you put invoice data entry on autopilot.

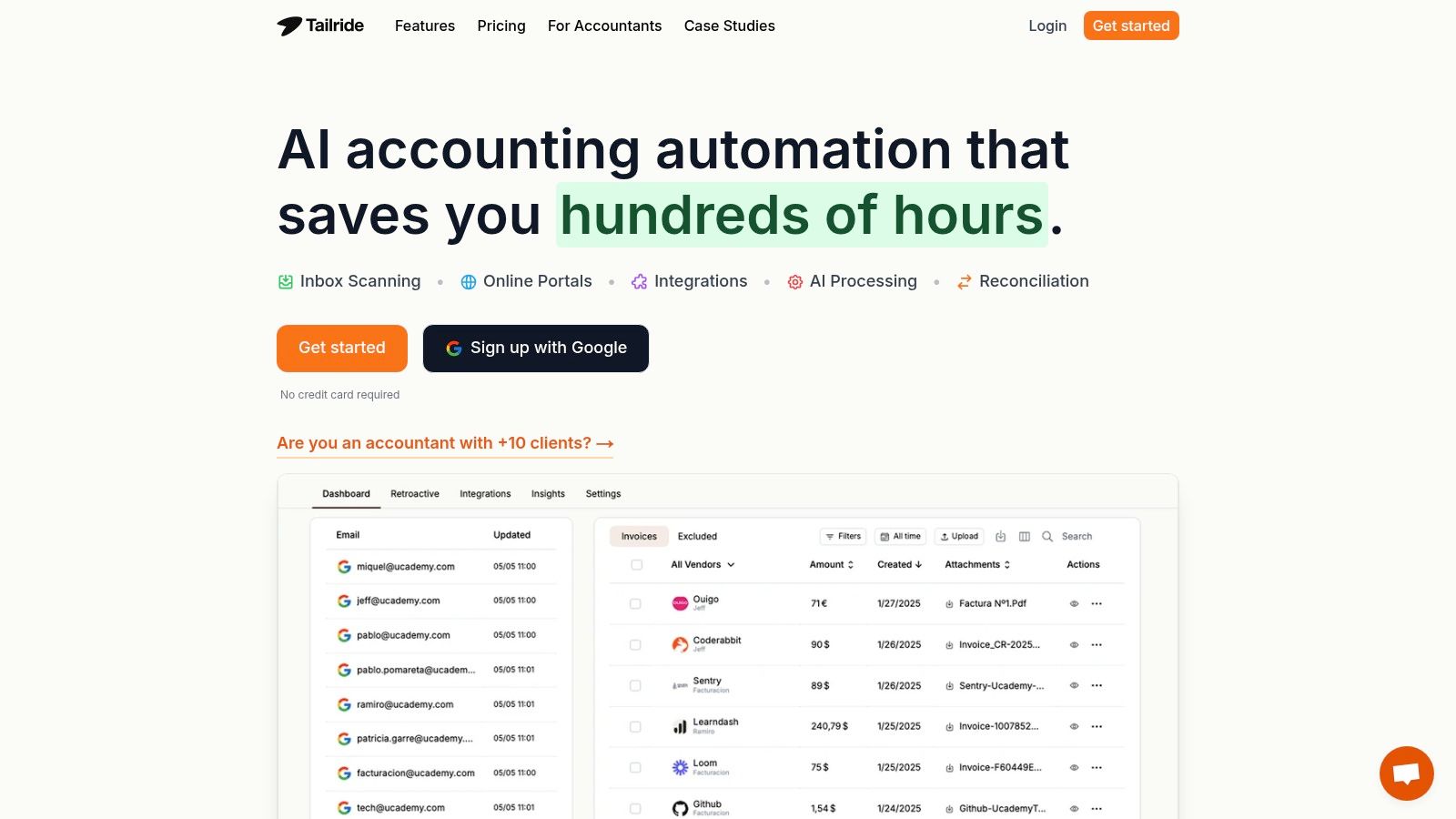

1. Tailride

Tailride positions itself as a powerhouse in invoice automation, making it a top contender for the best OCR software for invoices. It’s designed to eliminate manual data entry by creating a unified system that captures invoice data from virtually any source. The platform connects directly to email inboxes (like Gmail and Outlook), uses a clever Chrome extension to pull invoices from online portals without you handing over credentials, and processes documents in any format, from PDFs and images to email body text.

This isn't just basic data extraction. Tailride’s AI is highly configurable, allowing you to set up company-specific rules for tagging, tax rates, and due dates, ensuring the system handles your unique edge cases automatically. Its ability to retroactively scan inboxes for historical invoices is a huge plus for getting organized quickly.

Key Strengths & Use Cases

What truly sets Tailride apart is its end-to-end workflow automation. It doesn’t just capture data; it prepares it for your accounting system. The software can reconcile invoices against multi-currency bank statements, flag missing documents, and then seamlessly pipe the clean data into QuickBooks, Xero, or Google Sheets. This makes it ideal for finance teams aiming for near-total automation during month-end closing. You can find more details on how Tailride handles email invoice extraction on their blog.

The platform also emphasizes enterprise-grade security, with GDPR compliance, EU data residency, and a CASA Tier 2 validation, making it a secure choice for businesses of any size.

Best For: Accountants, SMBs, and enterprise finance departments needing a single tool to capture, process, and reconcile invoices from diverse sources with high accuracy and security.

Pricing:

- •Free Plan: Up to 10 invoices/month.

- •Paid Plans: Start at $19/month for 50 invoices. Credits can be purchased and do not expire. A 3-day full refund is also offered.

| Pros | Cons |

|---|---|

| Comprehensive Capture: Finds invoices across inboxes, portals, images, and even paper receipts via WhatsApp/Telegram bots. | Strict Plan Limits: You must upgrade or buy more credits if you exceed your monthly invoice limit; there is no overage allowance. |

| Advanced, Customizable AI: Applies company-specific rules for tags, taxes, and due dates, significantly reducing manual review. | Some Manual Input Required: Complex or unusual invoices might need initial rule configuration, and portal scraping relies on the user. |

| End-to-End Integration: Native connections to major accounting software and multi-currency bank reconciliation streamline the entire workflow. | |

| High Security & Compliance: GDPR compliant, EU data residency, and validated security assessments provide peace of mind. |

Website: https://tailride.so

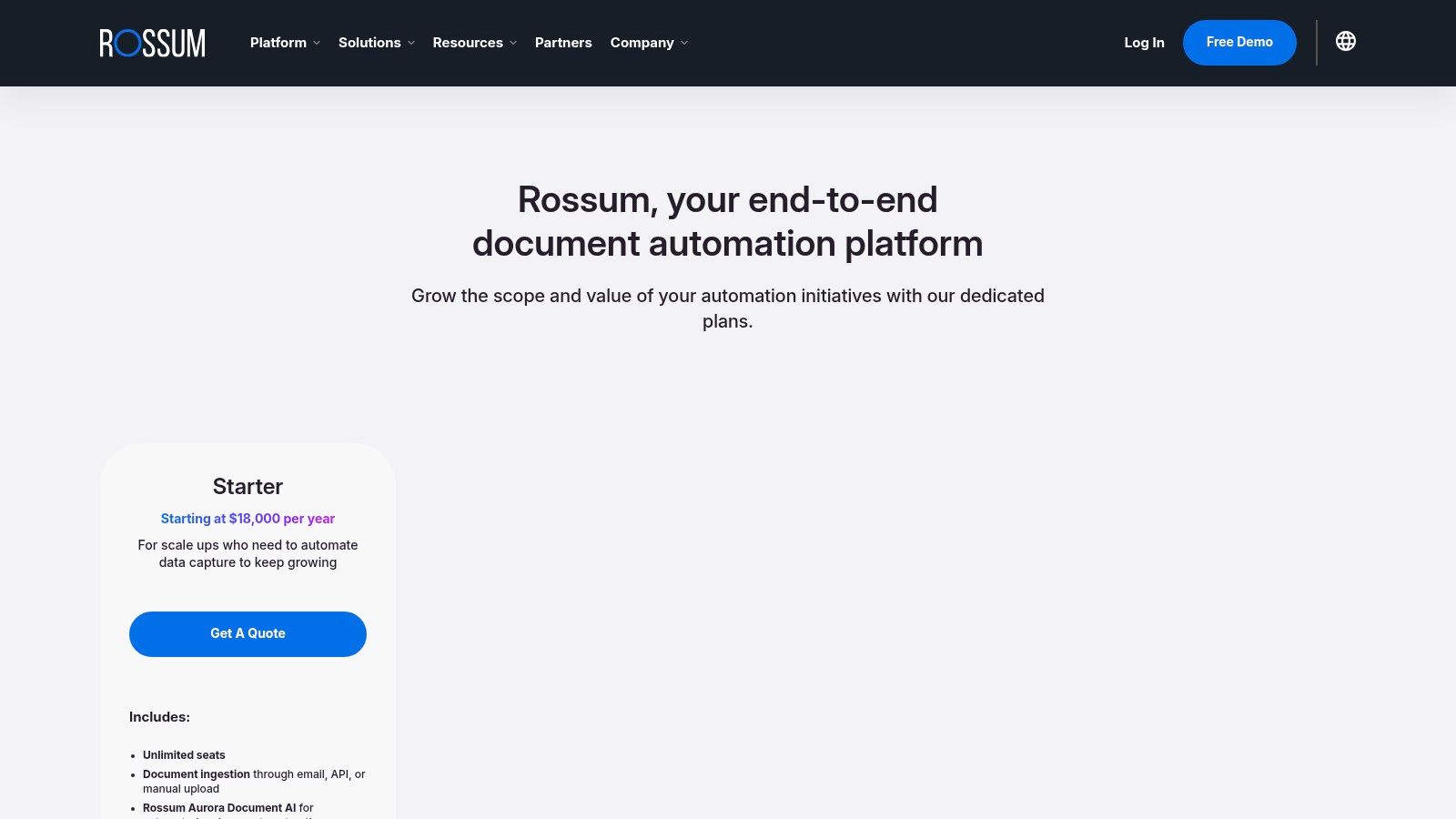

2. Rossum

Rossum is an AI-powered document processing platform designed specifically to tackle the complexities of invoice automation. It goes beyond basic data extraction by offering an end-to-end accounts payable workflow, from receiving invoices via email to validating data against your existing systems. The platform’s strength lies in its "human-in-the-loop" interface, which makes correcting AI-captured data a breeze and simultaneously trains the model to get smarter with every invoice you process.

This makes it one of the best OCR software for invoices if your team needs high accuracy on both header and line-item details. Rossum’s Aurora Document AI is pre-trained on millions of invoices, so it delivers strong results right out of the box with minimal setup.

Key Features & Considerations

Rossum truly shines for finance teams that want to automate duplicate detection, master-data matching, and exception handling without extensive IT involvement. It provides a clear audit trail for every document, which is a huge plus for compliance.

- •Best For: AP teams in mid-sized companies and enterprises needing a comprehensive, invoice-first automation platform with built-in validation and workflow rules.

- •Pricing: Starter plans begin around $18,000 per year, which includes unlimited user seats. This entry point might be steep for very small businesses.

- •Pros: Transparent starter pricing, powerful out-of-the-box invoice AI, and mature workflow features.

- •Cons: Advanced workflow customizations can require a more involved sales and implementation process.

Learn more at rossum.ai

3. ABBYY Vantage (Invoice Skills)

ABBYY Vantage is an enterprise-grade intelligent document processing platform that uses pre-trained "Skills" to handle specific document types. Its Invoice Skill is a powerful, ready-to-deploy solution that leverages ABBYY's decades of OCR leadership to capture complex invoice data, including multi-line items, taxes, and shipping details, with high precision. The platform is designed for scalability and governance, making it a strong contender for larger organizations.

This makes it one of the best OCR software for invoices when you need a robust, cloud-native tool with audit trails for regulated industries. The platform's marketplace allows you to add Skills for other documents like purchase orders or receipts, creating a centralized hub for automation beyond just AP. Continuous updates to the models mean the system improves over time without manual intervention.

Key Features & Considerations

ABBYY Vantage is ideal for enterprises that need a secure, manageable, and high-accuracy solution that can be extended easily. The subscription-based model with page counters provides predictable costs, while the administrative tools offer granular control over access and usage, a key benefit for compliance-focused teams.

- •Best For: Enterprises and regulated businesses needing a scalable, secure, and extensible platform with strong governance and pre-trained skills for multiple document types.

- •Pricing: Quote-based. Pricing is not publicly available and is tailored to usage volume and specific requirements.

- •Pros: Deep domain expertise in invoice processing, a marketplace of ready-to-use Skills, and strong governance features for enterprise environments.

- •Cons: The administrative model and quote-based pricing can introduce complexity and operational overhead for smaller teams.

Learn more at www.abbyy.com/vantage

4. Tungsten Automation – AP Essentials (formerly Kofax / ReadSoft Online)

Tungsten Automation, widely known by its former names Kofax and ReadSoft Online, offers AP Essentials as a mature, cloud-based invoice automation service. It is engineered for accounts payable teams that require robust, out-of-the-box functionality, including cognitive data extraction, purchase order matching, and duplicate invoice detection. The platform’s key differentiator is its ecosystem of certified, pre-built connectors for major ERP systems like SAP, NetSuite, and Microsoft Dynamics.

This makes it one of the best OCR software for invoices if your primary goal is rapid, reliable integration with an existing enterprise resource planning system. Its SaaS model ensures the service is continuously updated, providing multi-language and multi-country support for global AP operations without the burden of on-premise infrastructure.

Key Features & Considerations

AP Essentials is a powerful choice for finance departments that prioritize stability and proven ERP compatibility over extensive customization. The platform's long history in the market translates to refined AP-specific capabilities that handle complex invoice scenarios effectively, making it a dependable workhorse for established businesses.

- •Best For: Global enterprises and mid-market companies that need a proven, SaaS-based AP automation solution with certified, plug-and-play ERP integrations.

- •Pricing: Procurement is quote-based and handled through direct sales or a partner network. There is no public list pricing available.

- •Pros: Mature and reliable AP-specific features, strong and certified ERP connectors for quick deployment, and a continuously updated cloud service.

- •Cons: Pricing is not transparent. Achieving the ideal user experience and workflow customization often requires assistance from a partner.

Learn more at tungstenautomation.com

5. Google Cloud Document AI (Invoice Parser)

For teams with developer resources, Google Cloud's Document AI offers a powerful, no-frills engine for invoice data extraction. Its pre-trained Invoice Parser is built to recognize dozens of common invoice fields, from header details like invoice ID and due date to complex line-item data. This solution is less of a ready-made platform and more of a foundational building block for a custom accounts payable workflow.

This makes it one of the best OCR software for invoices if you prioritize flexibility and integration within the Google Cloud Platform (GCP) ecosystem. The technology behind it is robust, leveraging Google's massive AI infrastructure to deliver accurate results that can be piped directly into services like BigQuery for analysis or Cloud Storage for archiving. You can get a deeper understanding of the core functionality by learning more about what OCR technology is and how it works.

Key Features & Considerations

Document AI is ideal for businesses that want to embed best-in-class OCR into their existing applications without being tied to a specific vendor's user interface. Its extensive documentation, code samples, and clear API make it a favorite among engineering teams tasked with building automated financial systems.

- •Best For: Tech-savvy companies and developers looking to build a custom invoice processing solution on a scalable, pay-as-you-go infrastructure.

- •Pricing: Pay-per-page model, which is highly cost-effective for low volumes but can become expensive without architectural optimizations for high-volume processing.

- •Pros: Transparent and simple pricing, excellent documentation, and seamless integration with other GCP services.

- •Cons: Requires significant developer work to create a full AP workflow and user interface for exception handling.

Learn more at cloud.google.com/document-ai

6. Amazon Web Services – Textract (AnalyzeExpense)

For development teams already operating within the Amazon Web Services ecosystem, AWS Textract offers a powerful, API-driven approach to invoice processing. Its specialized AnalyzeExpense API is designed specifically to identify and extract key information like vendor names, invoice IDs, payment terms, and line items from invoices and receipts. This makes it a highly flexible tool for building custom automation workflows from the ground up.

Unlike all-in-one platforms, Textract provides the foundational OCR technology, allowing you to integrate it seamlessly with other AWS services like Lambda for processing, S3 for storage, and Step Functions for orchestration. This makes it one of the best OCR software for invoices if you need full control and have the technical resources to build a tailored solution.

Key Features & Considerations

Textract is fundamentally a developer's tool, not an out-of-the-box accounts payable platform. Its value comes from its raw extraction power and pay-as-you-go pricing, which avoids large upfront commitments and scales with your invoice volume.

- •Best For: Technically-savvy teams and companies with existing AWS infrastructure that need a flexible, usage-based OCR engine to power a custom invoice automation system.

- •Pricing: Purely pay-per-page, with rates around $0.01 per page for

AnalyzeExpense. A free tier includes 100 pages per month for the first three months. - •Pros: Low-friction pay-for-pages model, transparent pricing, and seamless integration with other AWS services. The free tier is great for pilot projects.

- •Cons: Requires significant developer effort and AWS setup to become a functional solution. Costs can become complex if using multiple APIs per page.

Learn more at aws.amazon.com/textract

7. Microsoft Power Automate + AI Builder (Copilot Credits transition)

Microsoft Power Automate offers a powerful low-code platform for automating workflows, with invoice processing handled by its AI Builder component. This solution is ideal for organizations deeply embedded in the Microsoft 365 ecosystem, allowing you to connect invoice data extraction directly to approvals in Teams, SharePoint lists, or your Dynamics ERP. The underlying technology is built on Azure Form Recognizer, providing robust data extraction capabilities.

This makes it one of the best OCR software for invoices if you prioritize custom automation over a pre-built AP solution. You can design intricate workflows that not only capture invoice data but also trigger subsequent business processes, like updating records in Dataverse or sending notifications, all within a familiar environment. The platform is also transitioning its licensing from dedicated AI Builder credits to more flexible Copilot Credits.

Key Features & Considerations

Power Automate is a strong choice for teams with IT support or a "citizen developer" mindset who want to build and own their invoice automation from the ground up. The extensive library of connectors means you can link your invoice OCR process to nearly any other business application you use, from accounting software to cloud storage.

- •Best For: Companies heavily invested in the Microsoft 365 and Dynamics ecosystem that need a highly customizable, integrated OCR and workflow automation tool.

- •Pricing: Requires a Power Automate license (starting around $15/user/month) plus AI credits (now Copilot Credits). Some plans include seeded credits.

- •Pros: Native integration with the full Microsoft stack, combines OCR with RPA and approvals, and some plans include initial AI credits.

- •Cons: The evolving licensing model can be complex, and estimating the exact per-page cost without using Microsoft's calculator is difficult.

Learn more at microsoft.com

8. UiPath Document Understanding (Cloud)

UiPath Document Understanding is a powerful component of the broader UiPath automation platform, designed to classify and extract data from invoices and other complex documents. It leverages pre-built AI models that can be fine-tuned with a human-in-the-loop validation process, ensuring high accuracy. Its main advantage is its seamless integration into the UiPath ecosystem, allowing you to build end-to-end automations that not only read invoices but also process them within your existing RPA workflows.

This makes it one of the best OCR software for invoices if your company is already invested in or planning to adopt robotic process automation (RPA). The platform offers both modern and generative AI extractors, providing flexibility for handling a wide variety of invoice formats, and supports both cloud and on-premise deployments.

Key Features & Considerations

UiPath is ideal for enterprises that need to embed intelligent document processing directly into larger, orchestrated automation strategies. The consumption-based pricing model using "Platform Units" allows you to pay for what you use, but understanding the licensing and estimating total costs requires some initial learning.

- •Best For: Companies with an existing RPA strategy looking to add intelligent invoice processing capabilities with robust governance and deployment flexibility.

- •Pricing: Consumption-based using Platform Units. The total cost depends on page volume, model complexity, and orchestration needs.

- •Pros: Tight integration with the leading RPA platform, flexible deployment options, and clear documentation on consumption metering.

- •Cons: The licensing terminology can be confusing initially, and the overall cost is more than just the OCR component.

Learn more at uipath.com

9. Veryfi

Veryfi provides a suite of developer-focused OCR tools, including a powerful invoice and receipt OCR API alongside a mobile business app. It stands out by offering production-ready data extraction with transparent, per-document pricing, making it a go-to for teams needing to embed invoice processing into their own software or workflows. The platform is engineered for speed and accuracy, turning unstructured document data into structured, actionable information in seconds.

This makes it one of the best OCR software for invoices if you prioritize API performance, clear pricing, and robust security compliance. With certifications like SOC 2 Type II and adherence to HIPAA, CCPA, and GDPR, Veryfi is a trusted choice for handling sensitive financial data, particularly within the US market.

Key Features & Considerations

Veryfi is ideal for SMBs and tech companies that want to bypass lengthy sales cycles and start building immediately. The extensive developer documentation and free tier for prototyping allow engineers to test and integrate the OCR capabilities without any upfront commitment, which is a significant advantage for agile teams.

- •Best For: Developers and businesses wanting to embed high-performance invoice OCR into their applications, and SMBs needing a reliable, compliant data extraction engine.

- •Pricing: A free developer tier offers 100 documents per month. Paid plans have a minimum commitment of $500 per month, with per-document pricing.

- •Pros: Transparent, published pricing with a free tier, developer-first focus with great documentation, and strong security compliance (SOC 2, HIPAA).

- •Cons: The minimum monthly spend on paid plans may be too high for very small businesses or solo entrepreneurs.

Learn more at veryfi.com

10. Nanonets

Nanonets offers a flexible, AI-powered platform for invoice processing that caters to both developers and business users. It stands out with its dual approach, providing powerful API access for custom integrations alongside a no-code workflow builder that allows non-technical teams to automate accounts payable processes. The platform uses pre-trained models for invoices, ensuring fast setup and accurate data extraction from the get-go.

Its credit-based, pay-as-you-go pricing model is particularly appealing for businesses that want to start small and scale without a large upfront commitment. This makes Nanonets one of the best OCR software for invoices for companies seeking both flexibility and advanced capabilities in their invoice data capture software.

Key Features & Considerations

Nanonets is designed for rapid deployment, allowing users to customize pre-built invoice models to capture specific fields or line items without needing extensive machine learning expertise. The platform’s ability to handle both API-first and workflow-based use cases makes it a versatile choice for a wide range of business needs.

- •Best For: Startups and SMBs looking for a scalable, pay-as-you-go solution, as well as larger companies wanting a powerful API for custom invoice automation projects.

- •Pricing: Nanonets uses a credit-based model and offers a free trial with $200 in credits. Paid plans are flexible and scale with invoice volume.

- •Pros: Low-friction trial with free credits, flexible pricing, and strong support for both no-code workflows and developer-focused APIs.

- •Cons: High-volume pricing may require a sales consultation for the best rates, and some advanced features are limited to paid tiers.

Learn more at nanonets.com

11. Klippa (SpendControl and DocHorizon)

Klippa offers a flexible, dual-path approach to invoice automation, serving both end-users and developers. Their SpendControl platform provides a complete invoice processing application with built-in OCR, approval workflows, and analytics. For those needing to build custom solutions, their DocHorizon API and SDKs deliver the powerful OCR engine as a standalone service, making it one of the most versatile options for invoice data extraction.

This makes Klippa a strong contender for the best OCR software for invoices, especially for European companies or businesses that value transparent, publicly listed pricing. The platform's commitment to compliance and security, including features like fraud and duplicate detection, provides peace of mind for finance teams handling sensitive documents.

Key Features & Considerations

Klippa’s unique offering caters to two distinct needs: a ready-to-use application for finance teams and a powerful API for tech teams. This flexibility, combined with its strong compliance posture, makes it an attractive choice for businesses operating globally. The ability to test the API for free is a great way for developers to validate its capabilities before committing.

- •Best For: Companies needing either a full, out-of-the-box invoice management solution (SpendControl) or a powerful OCR API/SDK (DocHorizon) for custom integrations.

- •Pricing: Tiered pricing is published publicly in EUR, starting from €1,250 per year for their Essential plan, which includes 1,200 documents.

- •Pros: Transparent tiered pricing, strong compliance features, and provides both an end-user app and developer APIs.

- •Cons: Pricing is published in EUR, which may be less convenient for US buyers, and certain integrations like SAP are billed as separate add-ons.

Learn more at klippa.com

12. Docsumo

Docsumo is an intelligent document processing platform designed for businesses that need to automate data extraction from invoices and purchase orders at scale. It uses AI to capture header and line-item details with high accuracy, aiming to reduce manual data entry and accelerate document workflows. The platform is particularly strong in its ability to handle unstructured documents and offers powerful validation rules to ensure data integrity before it enters your systems.

This makes it one of the best OCR software for invoices if your goal is achieving high straight-through processing rates. Docsumo's focus on enterprise-grade security, including SOC 2 and GDPR compliance, also provides peace of mind for organizations in highly regulated industries like financial services. Its API-first approach allows for seamless integration into existing ERPs and accounting software.

Key Features & Considerations

Docsumo is built to scale, offering plans that cater to growing businesses as well as large enterprises needing custom model training for unique document types. The platform's workflow automation tools and webhook integrations empower teams to build end-to-end document processing pipelines without heavy IT reliance.

- •Best For: Mid-sized to enterprise-level businesses in finance, logistics, and insurance that process a high volume of invoices and POs and require robust security and integration capabilities.

- •Pricing: Tiered plans are available (Growth, Business, Enterprise), but specific pricing is not public. A sales consultation is typically required to get a quote.

- •Pros: Strong security and compliance posture, scales from growth-stage to enterprise needs, and offers custom AI model training for higher accuracy.

- •Cons: Pricing isn't transparent, and setup fees may apply for more complex workflow implementations.

Learn more at docsumo.com

Top 12 Invoice OCR Software Comparison

| Product | Core features | AI & Accuracy ★ | Integrations & Workflow ✨ | Target audience & Pricing 👥💰 |

|---|---|---|---|---|

| Tailride 🏆 | Inbox + portal capture (Chrome ext), image/PDF/URL capture, receipt bots, bank reconciliation | ★★★★★ - configurable AI rules, ~99% automation goal | Native QuickBooks/Xero/Business Central, Google Drive/Sheets, real-time inbox & portal scraping ✨ | 👥 Accountants → Enterprise; 💰 Free (10/mo), $19/mo (50/mo) + credits |

| Rossum | Aurora AI extraction, email/API ingestion, validation UI | ★★★★☆ - strong invoice-first extraction | Master-data matching, workflows, audit trail ✨ | 👥 Mid-market & enterprise AP; 💰 Enterprise pricing (~$18k/yr entry) |

| ABBYY Vantage | Pre-trained Invoice Skill, skill marketplace, governance | ★★★★☆ - deep invoice domain coverage | Page-based subscription, admin monitoring, marketplace skills ✨ | 👥 Regulated enterprises; 💰 Quote-based, page counters |

| Tungsten Automation – AP Essentials | Cognitive capture, 2-/3-way matching, ERP connectors | ★★★★☆ - mature AP features | Certified connectors for SAP/NetSuite/Dynamics, multi-country support ✨ | 👥 Large AP teams/enterprises; 💰 Quote-based |

| Google Cloud Document AI | Pretrained Invoice Parser, per-page billing, dev SDKs | ★★★★☆ - robust entity extraction for devs | GCP-native (BigQuery, Storage), pay-as-you-go ✨ | 👥 Developers/engineering teams; 💰 Per-page PAYG |

| AWS Textract (AnalyzeExpense) | Invoice/receipt OCR API, AWS integrations, free trial tier | ★★★★☆ - serverless OCR for AWS stacks | Lambda/S3/Step Functions orchestration ✨ | 👥 AWS-native teams/devs; 💰 Per-page pricing, free tier (trial) |

| Microsoft Power Automate + AI Builder | Low-code flows, Form Recognizer-based document processing | ★★★☆☆ - accuracy depends on models & config | Native MS365/Dataverse connectors, approvals + RPA ✨ | 👥 Microsoft ecosystem customers; 💰 Licensing complex (Copilot credits) |

| UiPath Document Understanding | Prebuilt invoice models, human-in-the-loop validation, RPA | ★★★★☆ - strong with human validation | Tight UiPath RPA integration, cloud/on‑prem options ✨ | 👥 RPA-focused enterprises; 💰 Consumption (Platform Units) |

| Veryfi | Invoice/receipt OCR API, mobile SDK (Lens), published pricing | ★★★★☆ - fast, production-ready APIs | QuickBooks/Xero integrations, SDKs, compliance certs ✨ | 👥 SMBs & devs embedding OCR; 💰 Published pricing, free dev tier, $500/mo starter min |

| Nanonets | Prebuilt invoice models, no-code workflow + API, credit model | ★★★★☆ - flexible, credit-based scaling | No-code builder + API, onboarding docs ✨ | 👥 Startups & SMBs; 💰 Credit-based PAYG, free signup credits |

| Klippa (SpendControl & DocHorizon) | Invoice OCR app, approval workflows, SDK/API | ★★★★☆ - compliance & fraud detection focus | ERP integrations, API/SDK, tiered EUR pricing ✨ | 👥 EU/global businesses; 💰 Tiered EUR plans, free test credit |

| Docsumo | Invoice & PO extraction, validations, webhook/API automation | ★★★★☆ - built for high-volume straight-through processing | API/webhooks, enterprise security (SOC2/GDPR) ✨ | 👥 High-volume finance teams; 💰 Tiered plans, custom pricing & setup fees |

Making Your Final Choice: The Right Fit for Your Team

Choosing the best OCR software for invoices isn't about finding a one-size-fits-all champion. It’s about pinpointing the solution that slots perfectly into your unique operational puzzle. After diving deep into a dozen powerful tools, from the developer-centric APIs of AWS Textract to the end-to-end automation of Tailride, it’s clear that the "best" tool is the one that directly solves your biggest headaches.

The right choice hinges entirely on your specific circumstances. A high-volume e-commerce business drowning in thousands of supplier invoices has vastly different needs than a bookkeeping firm managing diverse client accounts. Your decision-making process should be a frank assessment of your team's reality.

Key Questions to Guide Your Decision

Before you commit, gather your team and ask these critical questions:

- •Who is the end-user? Will your accountants and bookkeepers be using the platform daily, or will your developers be integrating an API into a custom-built system? Platforms like Rossum and Nanonets offer user-friendly interfaces for finance pros, while Google Cloud Document AI requires technical expertise to implement.

- •What is our biggest bottleneck? Are you spending most of your time on manual data entry from PDFs? Or is the real challenge the initial step of even collecting invoices from dozens of different email inboxes and supplier portals? A tool focused solely on data extraction won't solve a collection problem.

- •How much customization do we need? Do you require complex, multi-stage approval workflows, custom validation rules, or specific integrations? Enterprise-grade solutions like ABBYY Vantage and Tungsten Automation offer deep customization, while others provide a more streamlined, out-of-the-box experience.

- •What does our budget look like? Pricing models vary dramatically. Some charge per document, others have tiered subscriptions, and some, like Microsoft Power Automate, are bundled into a larger ecosystem. Be sure to calculate the total cost of ownership, including any implementation or development resources required.

Your Actionable Next Steps

Armed with the insights from this guide, it's time to move from research to action. Don't get stuck in analysis paralysis. The most effective way to find your perfect match is to get hands-on experience with the software.

- •Shortlist Your Top 3: Based on your answers above, select two or three solutions that seem most promising.

- •Sign Up for Trials: Nearly every provider on our list offers a free trial or a demo. This is your opportunity to test the software with your actual invoices, not just sanitized examples.

- •Evaluate the User Experience: During the trial, pay close attention to the user interface, the accuracy of the data extraction, and how intuitive the workflow feels. Can your team realistically adopt this tool without extensive training?

- •Test Customer Support: Reach out with a question or two. The responsiveness and quality of the support team can be a crucial factor, especially during implementation.

Ultimately, the goal is simple: to transform your accounts payable process from a time-consuming cost center into a streamlined, efficient, and accurate operation. By carefully weighing your needs against the capabilities of these tools, you can reclaim countless hours, reduce costly errors, and empower your finance team to focus on more strategic work. The perfect solution is out there, waiting to make your job easier.

Ready to see how a fully automated, end-to-end solution can transform your invoice processing from start to finish? Tailride goes beyond simple OCR by automatically fetching invoices from emails and portals, applying your rules, and syncing everything to your accounting software. Start your free trial of Tailride today and experience true hands-off invoice management.