Your Guide to a Receipt Organizer for Business

Find the right receipt organizer for business to end clutter. Learn how to digitize, automate, and integrate your expense tracking for ultimate efficiency.

If you're still using a shoebox as your receipt organizer for business, it's time for an intervention. Let's be real - that jumble of faded, crumpled paper isn't just a mess. It's a genuine liability.

Every lost receipt is a missed tax deduction. Every hour you waste manually punching numbers into a spreadsheet is an hour you could have spent growing your business. When your receipts are in chaos, you're flying blind, making it impossible to get a true read on your cash flow.

A modern receipt management system completely flips the script. This isn't just about finding a digital shoebox; it's about turning that mountain of messy data into something you can actually use.

The real cost of a bad receipt system isn't the paper. It's the lost opportunities - the missed deductions, the wasted time, and the bad financial decisions you make because you don't have the full picture. A good system pays for itself almost immediately by plugging those leaks.

Moving from paper chaos to digital clarity gives you an immediate boost, both to your bottom line and your sanity.

Why a Digital System Just Makes Sense

- •You're Always Ready for an Audit: Digital copies are perfectly legal for tax purposes. More importantly, when everything is organized, you can pull up any expense record in seconds if the tax man comes knocking. No more panic attacks.

- •You Actually Know Where Your Money Goes: When every single expense is captured and categorized properly, you get a crystal-clear view of your spending. A solid receipt organizer is the first step to track business expenses the right way.

- •Automation Buys You Time: Let's face it, nobody enjoys manual data entry. Modern tools can automatically scan receipts and pull out the important info (vendor, date, amount), saving you from a tedious, error-prone chore. This same principle saves massive amounts of time on a larger scale, which you can see in the benefits of automated invoice processing.

Honestly, a dedicated system for your receipts isn't a "nice-to-have" anymore. For any serious business, it’s the bedrock of good financial management and a prerequisite for growth.

Finding the Right Receipt Management System

Picking the right receipt organizer is your first real step toward getting a handle on your business finances. The options out there can feel overwhelming, from simple mobile apps perfect for a one-person show to full-blown expense management platforms built for teams. The best choice really boils down to what your day-to-day operations look like.

Think about it: a freelance writer probably just needs a simple app to snap photos of coffee and office supply receipts. For them, it’s all about ease and affordability. But a growing marketing agency with a team of account managers constantly expensing client dinners and software subscriptions? They need something more robust - a system with different user permissions, approval workflows, and maybe even corporate card integration.

It’s no surprise that the expense management software market, valued at USD 5.45 billion, is projected to more than double. These tools have become absolutely essential.

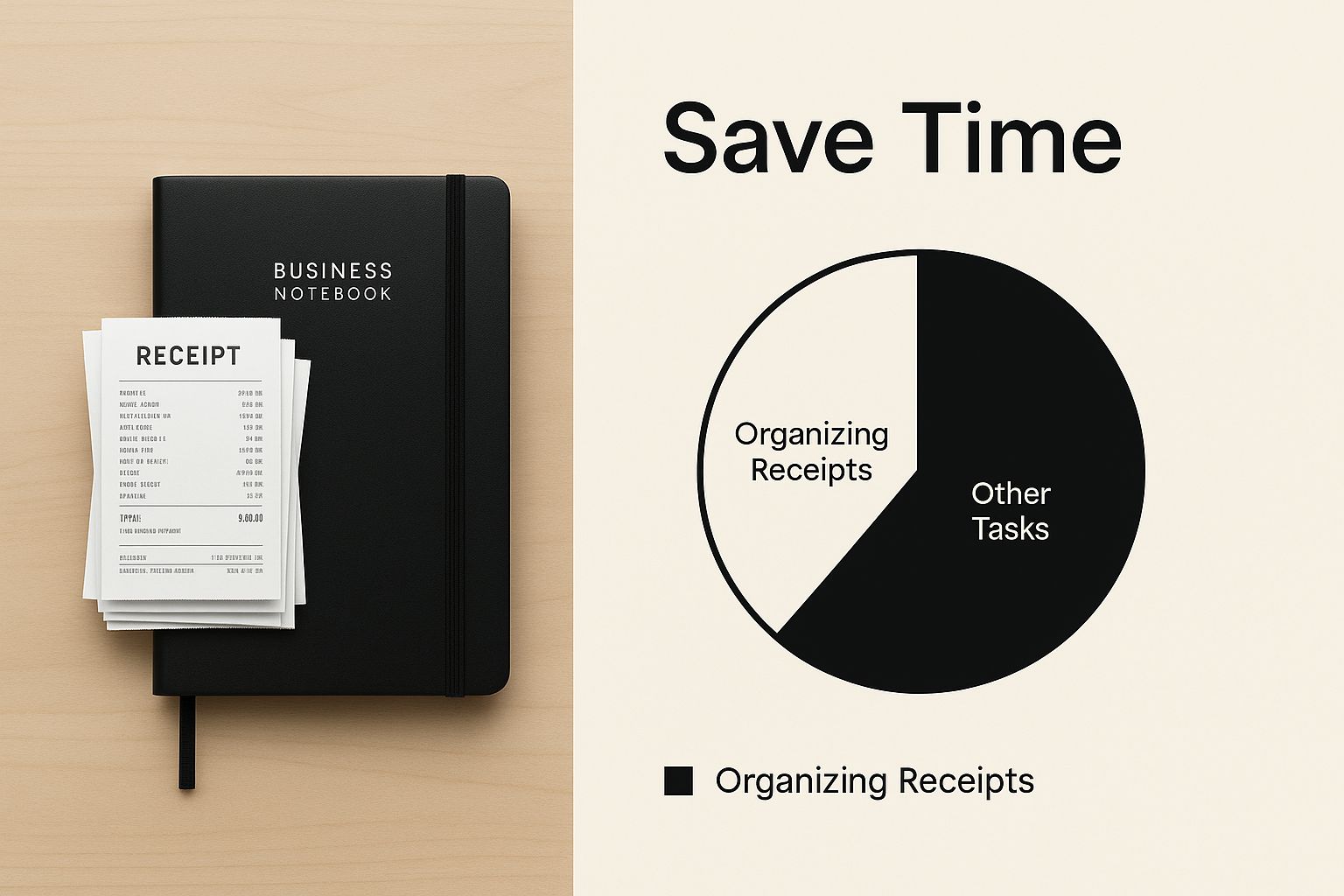

This image really drives home the biggest win you get from a modern receipt system: getting your time back.

Ultimately, the best return on your investment isn't just about the money you track; it's about the hours you're no longer wasting on paperwork.

What to Look For in a System

When you start comparing options, don't just look at the price. The features are what will make or break your new workflow.

Here’s what I always tell clients to focus on:

- •OCR Accuracy: How good is the tool at actually reading a receipt? A great system uses Optical Character Recognition (OCR) to pull the vendor, date, and amount automatically. Test it out with a couple of your own crumpled or faded receipts before committing.

- •Accounting Integrations: This one is non-negotiable. The whole point is to eliminate manual data entry, so make sure the system talks directly to your accounting software, whether that's QuickBooks, Xero, or something else.

- •Cloud Storage: You need to be able to pull up a receipt from anywhere, at any time. Secure and reliable cloud storage is a must-have, especially if you ever face an audit.

My biggest piece of advice? Pick a system that your team will actually use. The most powerful software in the world is useless if it's too complicated and everyone gives up after a week. Simplicity often wins.

Comparison of Receipt Organizer Types

To help you narrow down the choices, let's break down the main types of receipt organizers available. Each one serves a different purpose, so finding the right fit for your business size and complexity is key.

| Organizer Type | Best For | Key Features | Price Range |

|---|---|---|---|

| Mobile Scanning Apps | Freelancers, Solopreneurs, Micro-Businesses | OCR scanning, Basic categorization, Cloud storage | Free to $15/month |

| Receipt Management Software | Small to Medium Businesses (SMBs) | Accounting integration, Advanced reporting, User permissions | $10 to $50/user/month |

| Expense Management Platforms | Growing Teams, Mid-to-Large Companies | Corporate card integration, Approval workflows, Policy enforcement | $25+/user/month |

This table should give you a good starting point. Whether you're a freelancer who just needs to digitize receipts for your accountant or a company trying to manage team spending, there's a solution built for you. The key is matching the features to your real-world needs.

As you think about this, remember that receipt organization is just one piece of the puzzle. For a bigger picture on how to manage all your company spending, this comprehensive guide to business expense tracking is a fantastic resource. A good receipt organizer should slide right into your existing financial workflow and make everything a whole lot easier.

Going Paperless the Right Way

Let's be honest, just snapping a blurry photo of a receipt with your phone isn't a "system." The real goal here is to build a digital filing cabinet that's dependable, easy to search, and - most importantly - will hold up if you're ever audited. Nailing this process from the get-go saves you a world of pain later.

It all starts with getting a clean, readable scan. This sounds simple, but I've seen countless unreadable images that are just as useless as a lost receipt.

For the best results, always lay the receipt on a flat surface with a contrasting background, like a dark desk. Make sure you have good, even lighting to kill any shadows that might hide the date or final total.

Creating a System That Actually Works

Once you have a crisp image, the real organization begins. A folder full of randomly named JPEGs is nothing more than a digital junk drawer. This is where a smart naming convention and a logical folder system become your new best friends.

A simple, effective naming format I always recommend looks something like this:

- •YYYY-MM-DD_VendorName_Amount (e.g.,

2024-10-28_Staples_45.99)

With a filename like that, you can sort your files and find exactly what you need without even opening the image. From there, you can create folders by month, client, or project. For a much deeper dive, we have a complete guide on how to organize business receipts.

Just so you know, the IRS is totally on board with digital receipts. As long as your digital copy is a complete and accurate image of the original paper version, it's legally valid for tax purposes.

This move away from paper is part of a massive shift. The global market for digital receipts is already worth around USD 2.1 billion, and it's projected to more than double by 2033. Businesses everywhere are catching on. You can see more on the digital receipts market growth on market.us. Getting the right receipt organizer for business now just makes good sense.

Let Smart Categories Automate Your Workflow

Let’s be honest: nobody wants to spend their evenings hunched over a pile of receipts, manually typing in every line item. That’s a one-way ticket to burnout and a recipe for data entry errors. A modern receipt organizer for business can completely change the game, taking this soul-crushing task off your plate.

The secret sauce is a technology called Optical Character Recognition (OCR), paired with some clever AI. When you snap a picture of a receipt, the software doesn't just store a photo. It actively reads the text, pulling out the vendor's name, the date, and the total amount spent. This is where you start to win back your time.

How to Set Up Your Categories

The real efficiency kicks in when you set up categories that actually match your business's books. Don't just settle for a generic "Office Supplies" bucket. Get specific! Create categories that give you a crystal-clear picture of where your money is going.

Think about the expenses you have all the time:

- •Client Lunches: Perfect for tracking business development and entertainment costs.

- •Software & Subscriptions: A home for all your SaaS tools and recurring digital services.

- •Travel Expenses: Break this down further if needed - flights, hotels, and ride-shares.

- •Marketing Spend: Keep track of everything from Google Ads to trade show banners.

Setting these up from day one makes your expense reports far more consistent and keeps your financial data tidy. The best tools even let you create rules. For example, you could set a rule that automatically tags any receipt from "GoDaddy" as "Web Hosting."

Here’s a look at what this looks like in practice. The software scans the receipt, grabs the key details like the vendor and amount, and then suggests a category for you.

It’s this simple bit of automation that wipes out the most tedious and error-prone part of the entire process.

Want my best tip for getting started? Block out one hour on your calendar and set up rules for your top ten vendors - the places you buy from most often. I guarantee that initial time investment will pay for itself in the first month alone, probably by handling 80% of your recurring receipts automatically.

When you take this approach, your receipt organizer becomes more than just a digital shoebox. It becomes an active partner in your financial workflow, feeding clean, pre-sorted data directly into your accounting software.

Tying It All Together: Integrating Receipts with Your Accounting Software

Having an organized receipt system is great. But when that system talks directly to your accounting software? That’s when the magic really happens. This is the final piece of the puzzle, turning your receipt organizer from a neat little side project into a core part of your financial workflow. The whole point is to get information flowing seamlessly, killing off duplicate data entry for good.

Imagine your bank reconciliation process when every single transaction already has a receipt attached. No more hunting through folders or emails. It's right there. This direct link creates a bulletproof audit trail and takes all the guesswork out of your bookkeeping.

Creating a Smooth Financial Workflow

A good integration does more than just dump numbers from one system into another. It should attach the actual receipt image to the corresponding transaction in your accounting software, like QuickBooks or Xero. That means when you or your accountant are looking at an expense line, the proof is just a click away.

This simple connection can turn tax season from a mad dash into a straightforward review.

When your receipt data and accounting data live in the same place, you finally get a single source of truth for your finances. This gives you a real-time, accurate picture of your company's health, not a snapshot that's already weeks out of date.

This push for connected systems is even changing hardware. The receipt printer market, now worth a cool USD 4.21 billion, is shifting toward printers that can easily talk to digital platforms. It just goes to show that businesses need tools that can handle both paper and pixels. You can read more about the future of POS receipt printers on researchandmarkets.com.

If you want to dive deeper into how these connections work, check out our guide on accounting software integration.

Got Questions About Organizing Your Receipts? We’ve Got Answers.

Making the leap to a modern receipt system can feel like a big step, and it's totally normal to have a few questions before jumping in. We've heard just about everything from business owners, so let's clear up some of the most common things people wonder about.

One of the first questions that always comes up is about the legal side of things. Can you really just throw away the paper once you've scanned a receipt?

Are Digital Receipts Actually Legit for Taxes?

You bet they are. Tax authorities, including the IRS here in the U.S., are perfectly happy with digital or scanned copies of your receipts.

The big thing to remember is that the digital copy has to be a clear, legible, and complete version of the original. All the important details - who you paid, the date, what you bought, and the total amount - must be easy to read.

Using a good receipt organizer for your business is the easiest way to make sure your digital copies meet these official standards. That way, you can shred the paper clutter with confidence.

How Long Do I Really Need to Keep Business Receipts?

The general rule of thumb from the IRS is to hang onto your business records for at least three years after you file your taxes. That said, this can stretch to six years if you happen to significantly underreport your income, and in rare cases of fraud, you'd need them indefinitely.

This is where a digital system is a game-changer. Storing files for years is simple and secure, and it doesn't involve cramming another filing cabinet into your office. You can keep everything you need forever without the physical mess, making sure you're always ready for anything.

What’s the Best Receipt Organizer for a Freelancer?

If you're a freelancer or running a solo operation, you don't need some massive, complex platform. The best tool is usually something simple, affordable, and easy to use when you're out and about.

You’ll want to look for a mobile app that has:

- •A solid free plan or a low-cost option that covers all the basics.

- •Key features like unlimited receipt scanning and automatic data reading (OCR).

- •Simple categorization to make sorting expenses for tax time a breeze.

Many all-in-one accounting tools like QuickBooks Self-Employed or Wave already have receipt scanning built right in, which makes them a fantastic starting point for a business of one.

Ready to stop wrestling with receipts and put your financial workflow on autopilot? Tailride plugs into your email and online accounts to grab every invoice and receipt automatically. Get started in seconds and see how much time you can save.