Automated Outlook Invoice Extraction Made Simple

Tired of manual data entry? This guide shows you how to set up automated Outlook invoice extraction to save time, reduce errors, and streamline your workflow.

Let's be honest, digging through your Outlook inbox for invoices is a soul-crushing chore. That endless cycle of searching, downloading, and manually keying in data isn't just tedious - it's a real drag on your resources, causing delays and errors that mess up your entire financial workflow. It’s time to break that cycle.

Why Manual Invoice Processing Is Costing You Time and Money

If you’re still wrestling with invoices from Outlook by hand, you know the drill all too well. An invoice email lands, you download the PDF, pop open your accounting software, and painstakingly type in every single detail. This isn't just slow; it's a major bottleneck loaded with hidden costs.

Every minute you or your team spends on data entry is a minute you're not spending on smart financial planning. Just think about all the headaches that come standard with this old-school method.

The Real Cost of Human Error

We’re all human, and mistakes happen. But a single typo in an invoice number or amount can snowball into payment delays, skewed financial reports, and hours of frustrating detective work trying to pinpoint the mistake. These aren't just little oopsies; they can damage vendor relationships and even create compliance risks.

And let's not forget the chaos of inconsistent invoice formats. One supplier sends a perfect, text-based PDF, but the next sends a blurry, scanned image that’s barely readable. Each one demands a different approach, slowing you down and cranking up the odds of a costly error.

The biggest problem with manual invoice processing? It just doesn't scale. As your business grows, so does the invoice volume, and your team quickly gets buried under the administrative avalanche.

To put it in perspective, let's compare the two approaches side-by-side. The difference is pretty stark.

Manual vs Automated Outlook Invoice Extraction

| Metric | Manual Processing | Automated Extraction |

|---|---|---|

| Time per Invoice | 5–15 minutes | Under 60 seconds |

| Accuracy Rate | ~96% (with errors) | 99.5%+ |

| Labor Cost | High (ongoing salary/hourly) | Low (fixed subscription fee) |

| Scalability | Poor (requires more staff) | Excellent (handles volume spikes) |

As you can see, automation doesn't just save a few minutes here and there - it fundamentally changes the game in terms of efficiency and reliability.

An Industry-Wide Shift Toward Automation

This challenge isn't unique to your business; it's a universal pain point, which is why so many companies are finally moving on from manual methods. The proof is in the numbers. The global invoice processing software market is expected to jump from USD 33.59 billion in 2024 to USD 40.82 billion in 2025, all because businesses are hungry for better AP efficiency. You can read more about this industry trend and how it’s shaping modern finance.

Automating your Outlook invoice extraction isn’t about replacing your team. It's about empowering them. By taking the repetitive, low-value work off their plates, you free them up to focus on the strategic tasks that actually drive the business forward.

Getting Your Automated Invoice Workflow Off the Ground

Jumping from manual data entry to an automated system all starts with a solid foundation. The very first thing you need to do is create a secure, reliable connection between your Outlook inbox and your automation tool, in this case, Tailride. This initial handshake is what gets the whole process rolling for all future Outlook invoice extraction, making sure every important document is grabbed the second it lands in your inbox.

Think of it like setting up a digital mailroom. You're telling the system exactly which digital "pile" of mail to watch. For instance, you could point it to a dedicated inbox like invoices@yourcompany.com, or maybe you have a specific folder where you drag and drop all incoming bills. This keeps the system from sifting through personal emails and focuses its efforts only where it counts.

Setting Up Your "Watchdogs"

Once you've made the connection, you can start getting specific by setting up some rules. You could tell the system to only pay attention to emails with subject lines that include words like "Invoice," "Bill," or even a specific supplier's name. It's a simple filter, but it's incredibly effective at doing a first pass on your documents before the AI even gets involved.

From my experience, most businesses find that pointing the system to a specific folder and adding a few subject line rules catches over 99% of their invoices right off the bat. Getting this right is what builds the trust you need to let the system run on its own.

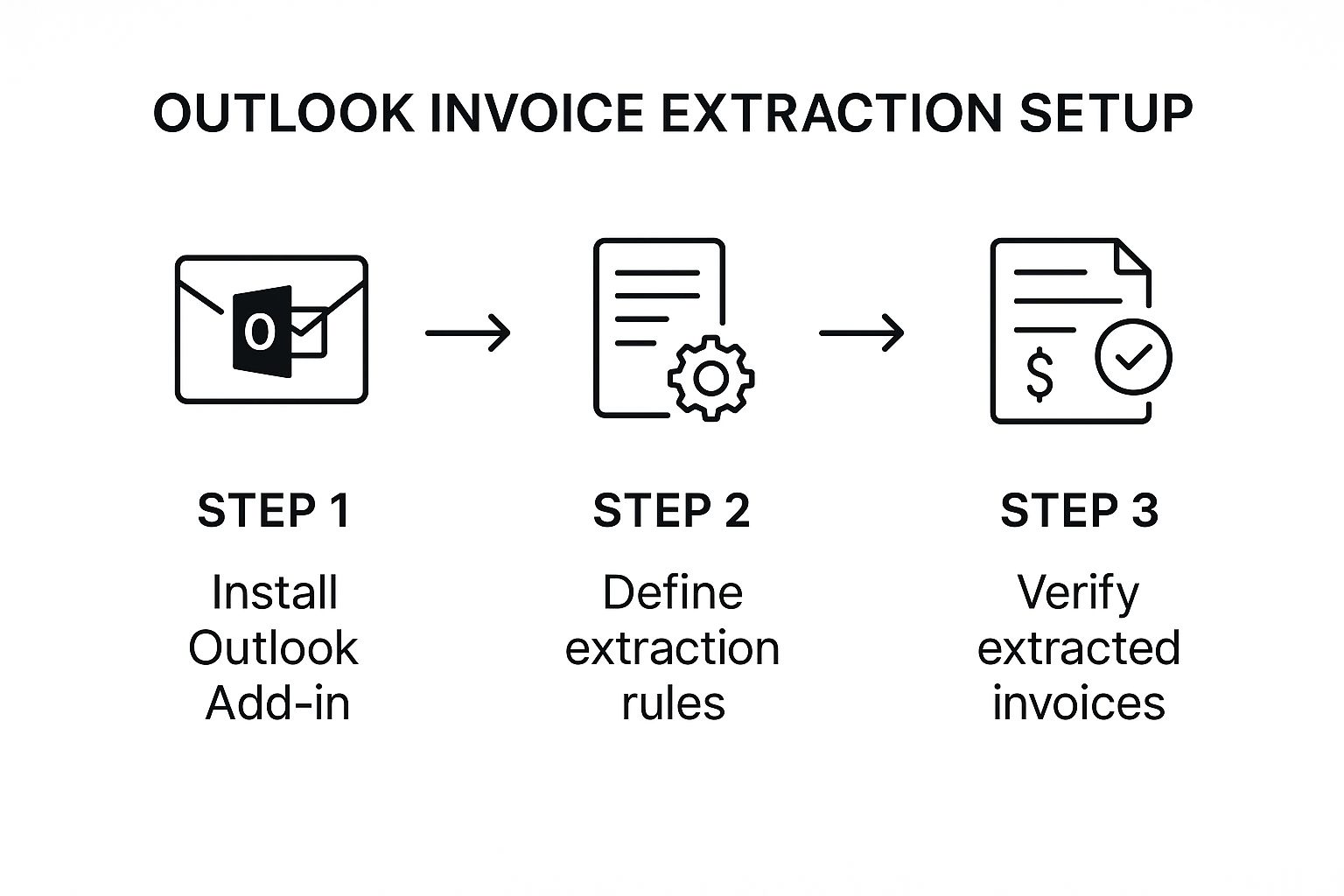

This graphic gives you a bird's-eye view of how the setup flows, from getting started to final checks.

As you can see, each part builds on the one before it, creating a straightforward and powerful way to automate your accounts payable process.

The point of this initial setup isn't just about connecting two apps. It's about creating a predictable, clean funnel. You're essentially training the system to ignore all the noise and zoom in exclusively on what matters: your invoices.

To get this configuration just right, it helps to know a little about what's happening under the hood. It’s always a good idea to understand some efficient PDF data extraction methods, as this knowledge will help you build smarter, more resilient rules.

For a complete, step-by-step guide on building out your entire AP system, don't miss our deep dive on how to https://tailride.so/blog/how-to-automate-invoice-processing. Once you have these basics in place, you’ll be ready for the fun part: teaching the AI how to read and understand your documents.

How to Train the AI to Read Your Invoices

Alright, this is where the real magic happens. You’ve set up your workflow to automatically pull invoices from Outlook, but now we need to tell the AI what to actually do with them. Don't worry, this isn't about writing code or diving into complex algorithms. It’s much more intuitive.

Think of it like training a new team member. You wouldn't just drop a pile of invoices on their desk and walk away. You’d show them an example and say, "See this number? That's the invoice ID. Here's the due date, and that's the total we owe." That’s precisely what you’ll be doing inside a tool like Tailride, creating simple, clear instructions for your Outlook invoice extraction process.

Defining Your Key Data Fields

First things first, you need to decide what information is non-negotiable. What data do you absolutely have to pull from every single invoice? I find that for most businesses, the list is pretty consistent and straightforward.

You can get started with the essentials:

- •Invoice Number (for obvious tracking reasons)

- •Due Date (so you never miss a payment)

- •Total Amount (for accurate bookkeeping)

- •Vendor Name (to know who gets paid)

The process is all about "mapping" these fields. You literally just highlight a piece of data on a sample invoice - say, "INV-12345" - and tell the system, "This is the Invoice Number." The AI takes it from there, learning to spot similar patterns on all future invoices, even if the layout is completely different.

The goal here isn't just to scrape text. It's to turn a jumble of unstructured data from a PDF into clean, organized information that your other business systems can actually understand and use.

This is all powered by a technology called Optical Character Recognition (OCR), which basically gives the system "eyes" to read text from PDFs and images. It's the engine behind the entire accounts payable automation market, which is expected to jump from USD 3.04 billion in 2024 to USD 8.11 billion by 2034. Why? Because it kills manual data entry. You can discover more about the future of invoice processing and see just how smart this tech has become.

Handling All Those Different Vendor Invoices

Let's be honest, one of the biggest pains of manual processing is that no two vendor invoices look the same. One company puts the invoice number in the top right corner, another hides it in a table at the bottom. This is where a smart AI really proves its worth.

Once you show the model a few examples from your main suppliers, it starts to get the hang of things. It learns that "Invoice #" or "Bill No." almost always comes before the actual invoice number, no matter where it is on the page.

The more invoices you feed it, the smarter it gets. You aren't building a rigid, one-size-fits-all template. You’re building an intelligent system that learns from experience and adapts on the fly.

Right, so you've pulled all the important details from an invoice. Now what? Getting the data out is only half the battle. The real magic happens when that information flows directly into the tools you rely on every day. A proper Outlook invoice extraction setup doesn't just dump data into a spreadsheet; it kicks off a chain reaction across your entire financial workflow.

Think of it as building a bridge between your inbox and your accounting software. Instead of manually keying in a new bill in QuickBooks, you can have a connection do the heavy lifting for you. As soon as Tailride grabs the vendor name, amount, and due date, it can pop them into a new bill, just waiting for you to give it the final nod.

Making Your Tools Talk to Each Other

But it doesn't have to stop with your accounting platform. You can create all sorts of clever, automated handoffs that solve your specific business headaches.

Here are a few ideas I've seen work wonders:

- •Keep a live budget tracker: Automatically add a new row to a shared Google Sheet the moment an invoice is processed.

- •Get timely alerts: Send a notification to your finance channel in Slack when a big invoice - say, over $5,000 - lands and needs a look.

- •Visualize your payables: Instantly create a new card on a "Payments Due" board in Trello to keep track of what's coming up.

Setting this up is mostly about mapping. You’re just telling the system, "Hey, see this 'Total Amount' field I extracted? I need you to put that into the 'Amount Due' field over in Xero."

This is the part that turns a simple data-pulling tool into a true automation engine. You’re not just gathering information anymore; you're putting it to work the second it arrives. This completely eliminates the tedious manual handoffs that slow down your accounts payable cycle.

This move toward connected systems is a massive trend. The market for AI in invoice management is expected to rocket to USD 47.1 billion by 2034, and it all starts with solid data extraction. This explosion shows just how crucial it is to link extraction with the rest of your financial tools to really get things moving efficiently. You can dig deeper into the growth of AI invoice management market trends if you're curious.

Advanced Tips for a Flawless Workflow

Getting your basic Outlook invoice extraction running is a great start. But let's be honest, "functional" isn't the same as "flawless." Now it’s time to dial things in with a few smart tweaks that will make your whole system ridiculously reliable. We're not talking about a complete overhaul, just some practical adjustments I've seen make all the difference.

First things first, let's tidy up your inbox. A little organization in Outlook goes a long way. I always recommend creating specific folders and setting up rules to automatically sort invoices as they arrive. For example, you could create a rule that sends any email from your top vendors with "invoice" in the subject line straight to a dedicated "To Process" folder. This keeps your main inbox clean and points the automation tool exactly where to look.

Implement Smart Validation Rules

Next up, let's get proactive with validation rules. Think of these as your personal quality control inspectors, catching problems before they spiral into bigger headaches.

You can easily set up rules to:

- •Flag invoices that are missing a Purchase Order (PO) number. This simple check can prevent so many payment delays down the road.

- •Trigger an alert for unusually high invoice amounts. It’s an easy way to add a layer of security against fraud or major errors.

- •Check for duplicate invoice numbers. This one is a no-brainer for avoiding accidental double payments.

Putting these checks in place will save you from so much manual cleanup later.

A truly effective system doesn’t mean zero human involvement. The goal isn't 100% hands-off automation right away, but 100% accuracy. It's much smarter to set up your workflow to flag any invoice the AI has low confidence in for a quick manual review.

This "human-in-the-loop" approach ensures nothing falls through the cracks while the system gets smarter over time. The quality of the data you extract is everything, and this helpful guide on how to improve data quality has some fantastic insights on that front.

Perfecting your workflow is a marathon, not a sprint. For more ideas on building a truly robust process, check out our deep dive into choosing the right https://tailride.so/blog/automated-invoice-processing-software.

Common Questions About Outlook Invoice Extraction

When you're first looking to automate your invoice workflow, it's completely normal to have a few questions. Handing over a critical financial task to a new system is a big step! Let's walk through some of the most common things people ask about Outlook invoice extraction.

What Kind of Files Can It Handle?

One of the first things people wonder about is file compatibility. Are you stuck with just one format? Thankfully, no. Modern tools are built for the real world, where invoices come in all shapes and sizes.

You can expect solid support for:

- •Digital PDFs (the most common kind, with selectable text)

- •Scanned PDFs where the invoice is essentially an image

- •Image files like a quick JPG or PNG photo of a receipt

- •Even Word documents or other office files

The underlying technology, Optical Character Recognition (OCR), has gotten incredibly good at pulling text from images. So, don't worry about those pesky scanned documents - they're no longer the roadblock they used to be.

How Accurate Is the AI, Really?

This is the big one, isn't it? Can you actually trust an AI with your numbers?

The short answer is a resounding yes. Right out of the box, you'll see accuracy rates for key data points like totals and dates pushing past 95%. But the real magic is that the system learns. Every time you process an invoice from a new vendor or fix a rare error, the AI gets smarter and fine-tunes itself to your specific needs.

My advice? Always look for a "human-in-the-loop" feature. This just means the system flags any data it's not 100% sure about for a quick human check. It takes two seconds and gets you to virtually perfect accuracy while you build confidence in the automation.

If you want to dig deeper into keeping your data clean and improving your workflow, we've put together a guide on invoice processing best practices that's full of practical tips.

What About International Invoices?

In a global market, dealing with different languages and currencies is just part of the job. Most top-tier platforms are built for this. They can easily recognize and pull data from invoices written in other languages and correctly identify currency symbols like $, €, and £. You can typically set a primary currency for your own books while still letting the system process those international payments without a hitch.

And what about those vendors who just paste the invoice right into the email body instead of attaching a file? Good tools can handle that, too. They can be set up to parse the text within the email itself, making sure no bill ever gets missed, no matter how it arrives.

Ready to stop chasing invoices and start automating? Tailride connects directly to your Outlook inbox to capture and process every bill automatically, saving you hours of manual work. Get started in seconds with Tailride.