How to Automate Invoice Processing: Easy Step-by-Step Guide

Learn how to automate invoice processing efficiently. Discover expert tips and strategies to streamline your invoicing workflow today.

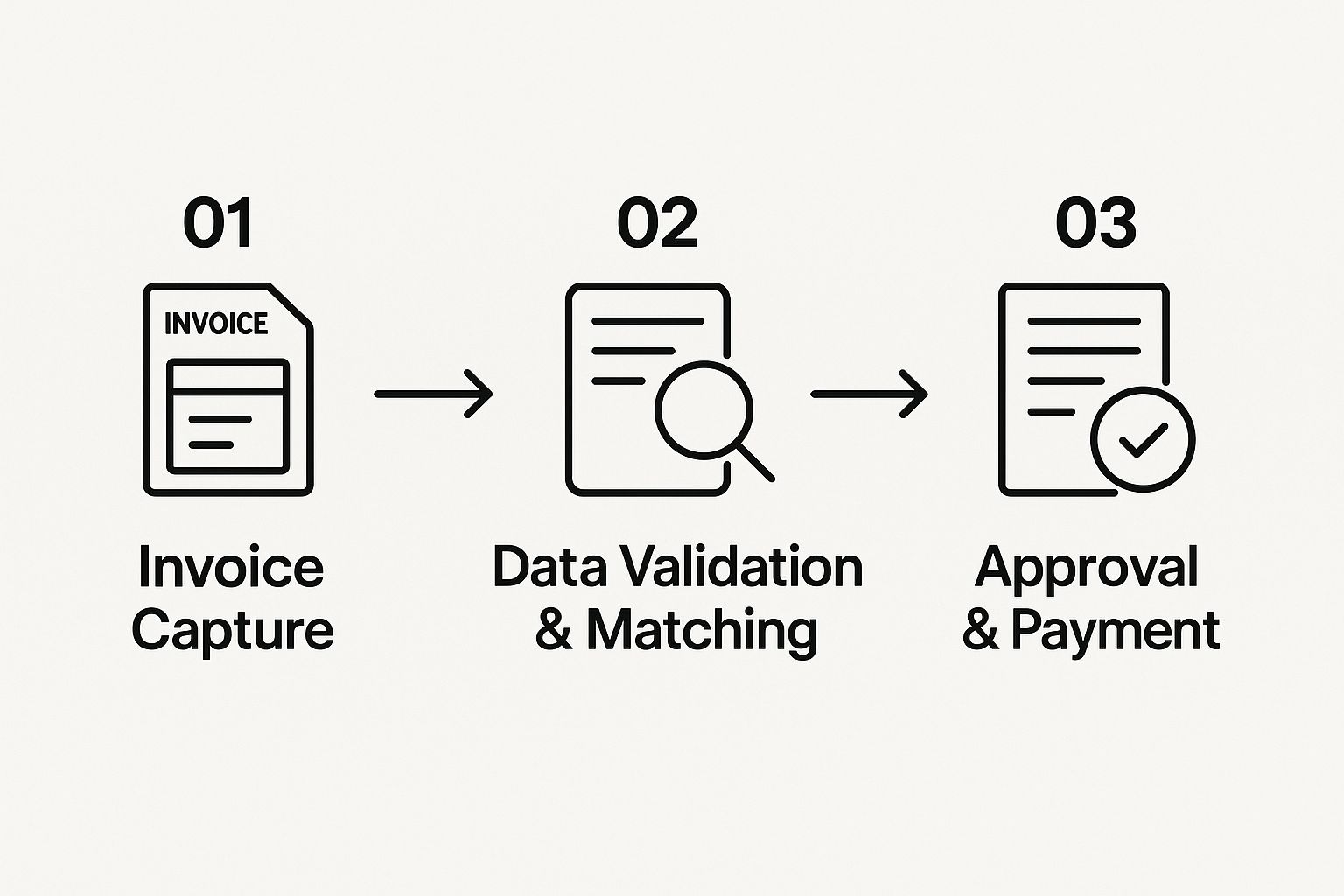

Automating how you handle invoices is actually pretty simple at its core. You use software to grab invoices as they come in, let AI pull out the important stuff like who the vendor is and what the total is, and then have the system automatically route it for approval and payment. It's a game-changer that gets rid of manual data entry, makes approvals happen way faster, and syncs everything up with your accounting system.

Why You Can't Afford to Ignore Invoice Automation

Let's be real for a second. Manually processing invoices isn't just a drag - it's a genuine bottleneck holding your business back. We've all been there: stacks of paper, inboxes bursting at the seams, and the endless follow-up game of tracking down managers for a simple signature.

Every minute someone on your finance team spends punching in numbers is a minute they aren't spending on high-value strategic work.

The True Price of Sticking to the Old Ways

The hidden costs of doing things "the way we've always done them" add up fast. It's not just about the time spent typing. It’s about the real, tangible impact on your company’s financial health and ability to move quickly.

Just think about these all-too-common headaches:

- •Paying Late: When you're manually tracking and approving invoices, it's almost inevitable that some will slip through the cracks. This leads to late fees and, worse, damages your relationship with great vendors. A good supplier is a partner, and paying them late is a surefire way to sour that partnership.

- •Expensive Mistakes: A single typo can cause you to overpay an invoice or, even worse, pay the same one twice. Hunting down these errors is a nightmare and a direct hit to your cash flow.

- •Zero Visibility: With invoices buried in email chains or sitting on someone's desk, you have no clear, up-to-the-minute picture of what you owe. This turns cash flow forecasting into a pure guessing game and makes closing the books at the end of the month a frantic scramble.

The real problem is that manual processing turns your sharpest financial minds into data entry clerks. Automation completely flips that script, freeing them up to be the strategic advisors you hired them to be.

Gaining a Real Competitive Edge

Ditching manual entry isn't just about being more efficient; it's about getting ahead of the competition. The market for invoice processing software tells the whole story. Valued at $33.59 billion in 2024, it's on track to hit an incredible $87.95 billion by 2029. That kind of growth shows just how essential automation has become. If you're curious, you can dig into more accounts payable trends and statistics to see the bigger picture.

Technologies like AI and smart Optical Character Recognition (OCR) aren't just for Fortune 500 companies anymore. These are accessible, affordable tools that deliver a clear and powerful return on your investment. By automating, you aren't just patching a broken workflow; you're building a smarter, more accurate, and more strategic finance department that’s ready for whatever comes next.

Setting Up Your Centralized Invoice Capture System

Alright, this is where the real work - and the real magic - begins. Before you can automate anything, you have to stop the chaos. Invoices have a bad habit of showing up everywhere: different email inboxes, random vendor portals, and even physical mail trays. Our first goal is to wrangle all of them into one place.

Think of it like building a single, digital front door for all your company’s bills. Instead of your team playing detective, every single invoice - whether it’s a PDF from an email, a download from a supplier portal, or a scanned paper copy - ends up in the exact same starting block. Getting this right is the non-negotiable foundation for a smooth, hands-off workflow.

Hooking Up Your Digital Inboxes

Let's start with the most common source: email. The easiest win here is to create a dedicated email address just for this purpose. Something simple like invoices@yourcompany.com or ap@yourcompany.com works perfectly. Tell all your vendors to send their invoices there from now on.

Modern automation platforms, like Tailride, are built to plug right into these inboxes. You can connect your Gmail or Outlook account, and the system will automatically grab new invoices and their attachments as soon as they land. Just like that, you've eliminated the soul-crushing task of manually downloading PDFs all day.

Putting Vendor Portals on Autopilot

Ugh, vendor portals. I think we can all agree they are one of the biggest time-sinks for any AP team. Keeping track of dozens of different logins, fumbling through clunky interfaces, and manually downloading invoices is a recipe for frustration. It's also the perfect kind of repetitive work to give to a machine.

Some of the better automation tools can securely log into these portals for you. You just set up the credentials one time, and the system will pop in on a regular schedule to check for new invoices and pull them directly into your workflow. It’s a classic "set it and forget it" solution that can genuinely save you hours every single month.

The real power here is in the consistency. When every single invoice - no matter where it came from - enters the exact same workflow, you build a predictable, reliable, and fully auditable process from start to finish.

The industry is definitely heading this way. By 2025, forecasts suggest that over 60% of finance pros expect to have their AP invoice processing fully automated. Yet, somehow, a staggering 68% of companies are still manually keying in data from invoices. When you consider that processing one invoice by hand can cost around $15, the gap between where we are and where we could be is huge. It's a massive opportunity to get more efficient, and you can read more about the future of invoice automation to see why so many are finally making the jump.

Dealing with the Last of the Paper Invoices

Even in 2024, paper invoices are still a thing. The trick is to get them into your digital system as painlessly as possible.

Here are a couple of practical ways to do it:

- •A good office scanner: If you still get a lot of mail, set up a high-speed scanner. Most modern ones can be configured to automatically email the scanned file right to your new

ap@yourcompany.cominbox. - •Mobile apps: This is my personal favorite. Many automation platforms come with a mobile app. Anyone on your team can just snap a quick photo of a paper invoice, and the app uploads it straight into the system. It's perfect for expenses from the field or invoices picked up on the go.

By creating these simple on-ramps for every type of invoice, you’ve officially built a seamless pipeline. No bill gets left behind, and your team is finally free from the grunt work of just collecting documents.

Putting AI to Work: Intelligent Data Extraction

Alright, you’ve successfully corralled all your invoices into one place. Now for the fun part - teaching a machine to read them. This is where the real magic happens, moving beyond simple scanning to a workflow that’s genuinely smart. We're not just turning paper into pixels; we're teaching the system to understand what it's looking at, just like a seasoned AP clerk would.

The whole point is to have the AI intelligently pinpoint and grab the essential data from any invoice, no matter how chaotic the layout. Think vendor names, invoice numbers, due dates, pesky line items, and the all-important grand total.

This image really drives home how central this step is. It's the engine of the whole operation.

As you can see, once the data is accurately pulled, everything downstream - like validation and approvals - can happen automatically, without anyone needing to lift a finger.

How Does the AI Actually Learn to Read Invoices?

Under the hood, this is a tag team of Optical Character Recognition (OCR) and artificial intelligence. OCR does the heavy lifting of converting the invoice image into raw text. But the AI provides the real brainpower.

Think of it this way: OCR might see a bunch of numbers, but the AI is what figures out that this string of digits is the invoice number and that one is just part of the P.O. Box in the address.

When an invoice from a new vendor comes in, you might have to give the system a little nudge the first time. You’ll essentially point to a field and say, "Hey, this is the invoice total." But here’s the cool part: the AI learns from that single correction. The next time that vendor sends an invoice, the system remembers the layout and snags the data on its own.

The true power here is the AI's ability to learn and adapt. Every little fix you make is a lesson that sharpens its accuracy, getting you closer and closer to a "touchless" process where human review is the rare exception, not the daily grind.

Fine-Tuning the System for Maximum Accuracy

Getting to near-perfect accuracy isn’t just about making a few initial corrections. It's about building a robust system that can handle the quirks and inconsistencies of all your different suppliers.

The difference between old-school data entry and a modern AI-powered approach is night and day. We're talking about systems that consistently hit accuracy rates in the high 90% range, often catching errors a human might miss.

Here’s a quick comparison of what that looks like in practice:

Manual vs. AI-Powered Invoice Data Extraction

| Metric | Manual Processing | AI-Automated Processing |

|---|---|---|

| Accuracy Rate | 80-90% (with human error) | 95-99%+ |

| Processing Time | 5-15 minutes per invoice | 30-60 seconds per invoice |

| Scalability | Low (requires more staff) | High (handles volume spikes) |

| Error Detection | Relies on manual checks | Automated validation rules |

The numbers speak for themselves. The time savings and accuracy gains from AI completely change the game for AP teams.

To get the absolute best results from your system, here are a few tips I've picked up over the years:

- •Tackle Your High-Volume Vendors First: Start by training the AI on invoices from the suppliers you hear from the most. Getting these right will give you the biggest and fastest return on your time.

- •Set a Review Threshold: You don't need to check every single invoice. Instead, create a rule. For example, any invoice with a confidence score below 95% gets flagged for a quick human glance. This is the perfect balance of speed and accuracy.

- •Go Deep with Line-Item Extraction: For more complex PO-based invoices, make sure your system is configured to capture individual line items, not just the final total. This is non-negotiable for accurate three-way matching.

By putting in a little bit of effort to train the AI upfront, you're essentially building an asset that works for you 24/7, getting smarter and more efficient over time. To see how this capability fits into a complete platform, check out our guide on finding the best automated invoice processing software.

Crafting Smart Validation and Approval Workflows

So, you’ve pulled all the data from your invoices with AI. That's a huge win, but the data is only as good as what you do with it. The next step is where the real magic happens: building the logic that validates every bill and gets it approved. This is how you ensure vendors get paid correctly and on time, without your team getting buried in email chains and manual cross-checking.

A solid workflow should take an invoice from initial capture to final approval with as few human touches as possible. Here, concepts like 2-way and 3-way matching are your secret weapons. Instead of someone manually digging up a purchase order (PO) to compare against an invoice, the system can do it in a fraction of a second.

With 2-way matching, for example, the software instantly confirms that the invoice details - like pricing and quantities - match the original purchase order. It’s a simple check, but it catches a ton of common errors.

Going Deeper with Your Validation Rules

For businesses dealing with physical goods, 3-way matching is essential. This adds another layer of security by looping in the goods receipt note. It’s not just about what you ordered; it’s about confirming you actually received what you're being billed for. This single step is a game-changer for preventing payments for phantom shipments.

The real power move, though, is setting up smart business rules to handle exceptions automatically. You can teach the system to flag invoices based on your own internal policies.

Think about rules like these:

- •A price on the invoice is more than 5% higher than what’s on the PO.

- •An invoice is tied to a PO that has already been fully paid.

- •The bill comes from a vendor who isn't on your approved list.

When a rule like this gets triggered, the invoice is automatically paused and routed to the right person for a quick look. This frees up your team to focus their brainpower on the exceptions, not the 90% of invoices that sail through without a problem.

The goal isn’t just to automate the easy stuff. It’s to build a system that intelligently manages the entire lifecycle of an invoice, only asking for human help when it’s genuinely needed. This is how you shift AP from a cost center to a well-oiled machine.

Building Approval Paths That Actually Work

The final piece of this puzzle is designing approval workflows that mirror how your company actually operates. No more sending every single invoice to the CFO for a sign-off. A modern system can route invoices dynamically based on the data it has already captured.

Let’s walk through a real-world scenario:

- •A $750 invoice from your marketing analytics tool comes in. The system sees the vendor is tagged as "Marketing" and the amount is under your $1,000 departmental threshold. It automatically routes it straight to the Head of Marketing for a one-click approval.

- •Next, a $15,000 invoice for new servers lands. The system flags the high value and routes it first to the IT Director. Once they approve it, it’s automatically forwarded to the CFO for the final green light.

These multi-step, conditional workflows crush bottlenecks and create clear accountability. If you want to dive deeper into structuring these flows, check out our guide on creating an effective invoice approval process. By setting up these smart pathways, you can finally put the "who needs to approve this?" question to rest for good.

Making Your Systems Talk: Creating a Truly Touchless Workflow

https://www.youtube.com/embed/MrsOZLNddfI

Getting invoices captured and approved automatically is a huge win, but the real magic happens when that information flows directly into your company's financial hub. This is where your automation system truly proves its worth. After all, what’s the point of automating the front half of the process if someone still has to manually key everything into your accounting software or ERP?

The ultimate goal here is to completely kill manual data entry. Once an invoice gets the final green light, it should instantly and automatically post as a bill in your general ledger. Think systems like QuickBooks, Xero, or NetSuite. This isn’t just about clawing back a few hours; it’s about ensuring your data is perfect and that you have a real-time, accurate picture of your company's finances.

How to Connect Your Systems

When it’s time to link everything up, you generally have a couple of paths to choose from. Your decision will really come down to the software you're already using and how much custom work you’re willing to do.

The Plug-and-Play Route: Native Connectors

Most modern invoice automation platforms, including Tailride, come with native connectors right out of the box. These are pre-built integrations for the big-name accounting systems.

They are designed to be incredibly straightforward. You basically:

- •Authorize the connection between the two platforms.

- •Map a few key fields (like your chart of accounts to your expense categories).

- •And that's it. You're ready to go.

For the vast majority of small and mid-sized businesses, this is the quickest and easiest way to get everything synced up.

The Custom-Built Path: Using an API

If you're a larger company running on a heavily customized ERP system like SAP or Oracle, a standard connector might not cut it. This is where an API (Application Programming Interface) comes in handy. It’s a more technical route, giving your developers a toolkit to build a custom bridge that moves data precisely the way your unique financial workflows demand.

What a Touchless Workflow Feels Like in Real Life

Let’s imagine a typical scenario. An invoice for your company's monthly software subscription lands in the designated AP inbox.

The automation platform immediately picks it up. The AI gets to work, extracting all the important data in seconds. Since it's from a trusted, recurring vendor and the amount is under the pre-set threshold, the system gives it an automatic approval.

Then, the final, most satisfying part happens:

- •The approved invoice data is instantly sent over to your accounting software.

- •A new bill is automatically created in QuickBooks, correctly coded to the "Software & Subscriptions" expense account.

- •The vendor name, due date, invoice amount, and even the original PDF are all neatly attached to the new bill record. No human hands required.

The biggest payoff? How smooth and fast your month-end close becomes. When your books are updated in real-time as invoices get approved, the mad dash to enter a huge pile of bills before closing the books completely disappears. Your liabilities are always up-to-date, meaning your financial reports are accurate whenever you pull them.

Connecting these systems transforms accounts payable from a reactive, paper-pushing chore into a proactive, strategic part of the business. It guarantees that the numbers you rely on for budgeting and forecasting are not just correct, but available the second you need them. This final connection is what truly closes the loop on a fully automated invoice workflow.

Fine-Tuning the Engine: How to Handle Exceptions and Keep Improving

Let’s be real - no automation system is perfect on day one. You're going to get an invoice that stumps it. Maybe it’s from a vendor you've never worked with before, or the PO number is nowhere to be found, or it just plain fails one of your validation rules.

When this happens, don't panic. This isn't a sign that your new system is broken. Far from it. These flagged invoices, or exceptions, are actually your secret weapon for making the whole workflow smarter. Think of them less as problems and more as opportunities to teach your system a new trick.

Setting Up a Smooth Review Process

First things first, you need a simple, clear plan for what happens when an invoice gets flagged. The last thing you want is a bottleneck where exceptions pile up. The goal is a fast, painless review.

When an invoice gets kicked out of the automated flow, it should land with a designated person or team, complete with all the context they need to make a quick decision.

This is where a modern platform like Tailride really shines. It gives your team a split-screen view - the original invoice on one side and the data the AI pulled out on the other. This makes it incredibly easy to spot the discrepancy, make the fix, and push the invoice through with a couple of clicks. No more hunting for information.

Turning One-Off Fixes into Lasting Intelligence

Here’s the brilliant part. When your team corrects a flagged invoice, they’re doing more than just getting that one bill paid. Every single correction feeds back into the AI model.

You're essentially training the system in real time. Fix a misread field, add a missing bit of info - you're teaching the AI what to look for next time. It learns from that human touch and is far less likely to stumble on a similar invoice again.

The real magic of a smart AP system isn't its initial accuracy. It's how it learns and adapts from every single human correction. You’re not just processing invoices; you’re building a smarter, more autonomous system with every click.

This is the continuous improvement loop that separates basic scripting from true intelligent automation. Over the first few months, you'll literally watch the number of exceptions plummet. Invoices that used to get stuck will start flying through the workflow without anyone needing to lift a finger.

This doesn't just save a few minutes here and there; it fundamentally boosts your team's capacity and makes the entire process more reliable. For more on this, check out our guide to improve accounts payable efficiency.

By treating exceptions as a training tool, you turn your automated system from a static piece of software into a living, learning asset that gets better and more valuable with every invoice it touches.

Your Top Questions About Invoice Automation Answered

Diving into automated invoice processing naturally brings up a few questions. I've heard these from countless teams making the switch, so let's walk through the most common ones to give you a clearer picture of what to expect.

So, What's the Real Cost of Invoice Automation?

This is usually the first question on everyone's mind, and the honest answer is: it depends. The price really hinges on your monthly invoice volume and the complexity of your setup.

For smaller businesses, you can find fantastic cloud-based tools that start at just a few hundred dollars a month. If you're a larger enterprise needing deep, custom integrations with an existing ERP system, you'll be looking at a more significant investment.

The real trick is to look beyond the subscription fee and focus on the ROI. Think about what you're gaining. You’re not just buying software; you're buying back countless hours of manual data entry, eliminating expensive human errors, and finally getting in a position to grab those early payment discounts. The payback period is often surprisingly fast.

How Long Until We're Actually Up and Running?

The implementation timeline is all about the tool you pick.

Some modern, cloud-first platforms like Tailride are designed for speed. You can genuinely have them connected and pulling in invoices in a few hours or days. For most small to mid-sized companies, a realistic goal for being fully operational with a standard cloud solution is about two to four weeks.

On the other hand, if you’re dealing with a more complex on-premise system that needs to shake hands with a legacy ERP, that can be a multi-month project. Thankfully, that's becoming less and less common these days.

Can the AI Really Read Handwritten Invoices?

Great question, and a very practical one. Let's be realistic: today's AI-powered OCR is incredibly powerful, but it's not magic. It can still get tripped up by particularly messy or inconsistent handwriting.

Where it truly shines is with printed invoices. It can read a staggering variety of layouts, tables, and line items with over 95% accuracy right out of the box.

Here's the crucial difference: basic OCR just scans for characters. True AI understands the context. It can tell an invoice number from a PO number, knows a due date from an issue date, and learns from every correction you make.

Besides, the best systems are built for reality. If the AI encounters an invoice it can't read confidently, it doesn't just guess. It smartly flags it for a quick human check. This "human-in-the-loop" approach gives you the perfect blend of automation's speed and human oversight's accuracy.

Ready to put an end to chasing down invoices and finally automate your AP workflow? Tailride plugs right into your inboxes and vendor portals to automatically capture, read, and process your bills.

Discover how much time you could get back. Visit https://tailride.so to get started.