Automated Invoice Processing Software Explained

Discover how automated invoice processing software streamlines finance operations. Learn how to choose, implement, and measure the ROI of your new system.

Let's be honest - nobody gets excited about sifting through stacks of invoices. It's a classic back-office chore that’s slow, tedious, and frustratingly prone to human error. But what if you could teach a machine to do it for you?

That’s essentially what automated invoice processing software is. Think of it as a smart, digital assistant for your accounts payable team. It takes over the entire invoice lifecycle, from the moment an invoice lands in your inbox to the final approval for payment. This means eliminating tedious manual data entry and giving your finance experts time back to focus on work that actually drives the business forward.

What Is Automated Invoice Processing Software

Picture your AP team's daily reality. Is it buried under paper, manually punching numbers, dates, and vendor details into a spreadsheet? Now, imagine a different scene: an invoice arrives via email, and a smart system instantly reads it, pulls out all the key information, verifies it against your records, and routes it to the right person for approval. This all happens in minutes, not days.

That's the magic of automated invoice processing software.

At its core, this software is built to bring order and efficiency to your financial operations and help you automate data entry. It acts like a super-efficient mailroom clerk, bookkeeper, and auditor all rolled into one. It uses powerful tech like Optical Character Recognition (OCR) to read text from PDFs or scanned documents and Artificial Intelligence (AI) to actually understand what it's reading - like telling the difference between an invoice date and a due date.

Shifting From Manual Chaos To Automated Clarity

The difference between the old manual way and the new automated approach is night and day. Manual processing isn't just slow; it's a minefield of potential problems, from typos and duplicate payments to lost documents and damaged vendor relationships over late payments.

Automation turns that chaotic, unpredictable process into a smooth, transparent, and reliable workflow. The best way to see the difference is to compare them side-by-side.

Manual vs Automated Invoice Processing at a Glance

Take a look at how the day-to-day tasks change when you move from a paper-based system to a modern, automated one. The improvements in speed, accuracy, and overall sanity are pretty clear.

| Process Step | Manual Processing (The Old Way) | Automated Processing (The New Way) |

|---|---|---|

| Invoice Arrival | Invoices arrive by mail or email, get printed, and are manually sorted into piles. | Software automatically captures invoices from emails, vendor portals, or scans. |

| Data Entry | An employee manually types all the data (vendor, amount, PO number) into the system. | OCR and AI extract all data instantly and accurately. No more typing. |

| Verification | Someone has to manually find the matching purchase order and delivery receipt. | The system performs a 3-way match automatically, flagging any issues for review. |

| Approval | The physical invoice is passed from desk to desk or gets lost in an email chain. | Invoices are digitally routed to the right person based on preset rules, with reminders. |

| Payment & Filing | Checks are cut, stuffed into envelopes, and paid invoices are shoved into filing cabinets. | Approved invoices are pushed to your accounting system for on-time payment and archived digitally. |

As you can see, automation doesn't just speed things up - it builds a smarter, more resilient process from the ground up.

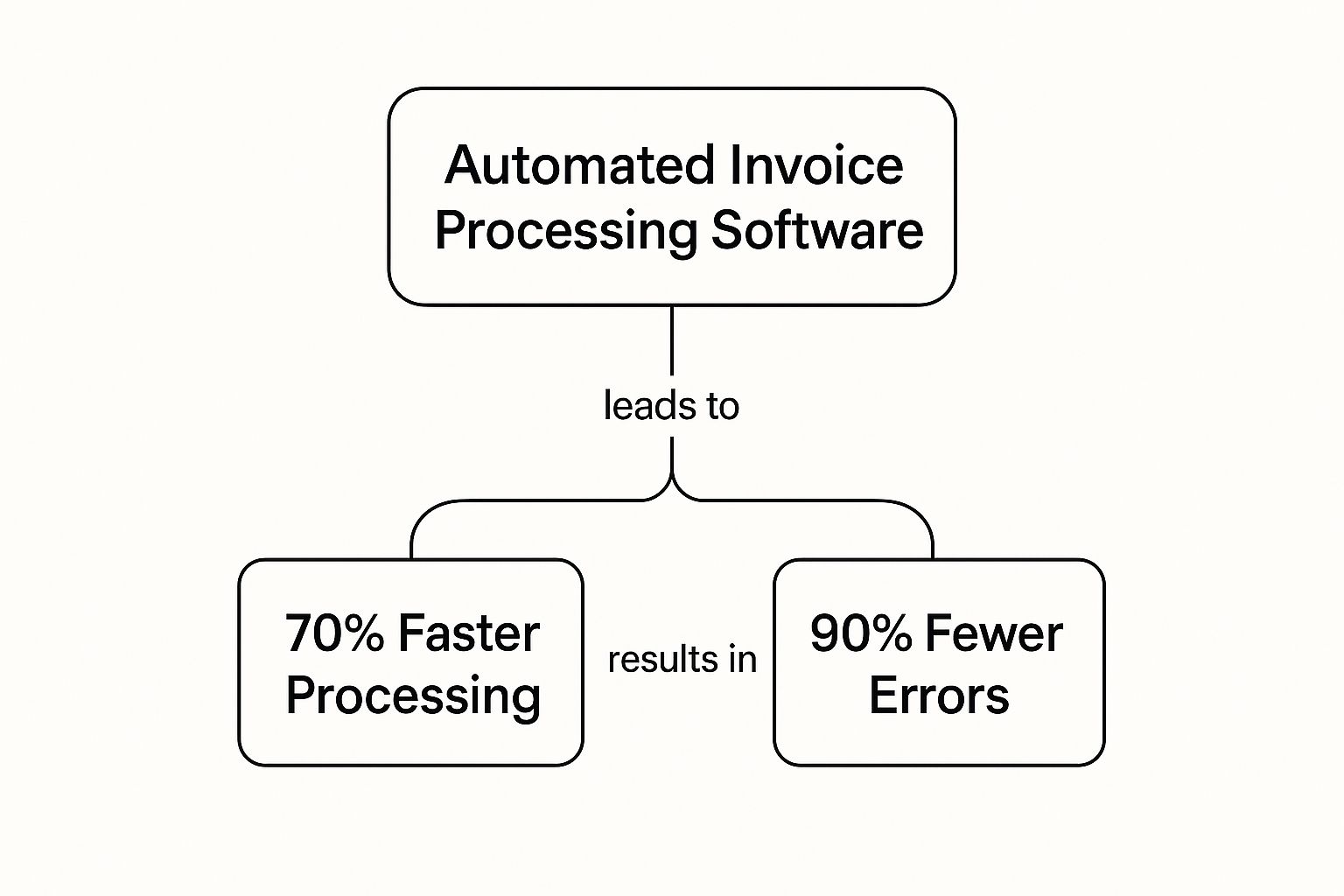

This visual gives you a great sense of how this all comes together, dramatically cutting down processing times while boosting accuracy.

The connection is simple: putting this technology to work directly translates into real, measurable improvements for your finance department.

This move away from paper is also why the market is growing so quickly. The invoice processing software market is expected to jump from $33.59 billion in 2024 to $40.82 billion in 2025 alone, a clear sign that businesses everywhere are tired of the old way of doing things.

The Real-World Benefits of Invoice Automation

It’s one thing to talk about features and specs, but what does invoice automation actually do for your business? The real magic isn't just about processing invoices faster - it’s about fundamentally changing how your company operates, saves money, and finds new ways to grow.

Let's imagine a typical growing business, we'll call them Apex Innovations. Before they switched to an automated system, their finance team was stuck in a familiar cycle of frustration. They spent hours keying in data by hand, chasing approvals through endless email chains, and digging through dusty filing cabinets. Late payment fees were chipping away at their budget, and their vendors were getting tired of the delays.

This story probably sounds familiar. Now, let’s look at what changed.

Slashing Costs and Wiping Out Errors

The first and most immediate win for Apex was a huge drop in their operational costs. You might not realize it, but processing an invoice manually is surprisingly expensive. Studies have shown that making the switch to automation can cut those costs by an incredible 67%, mostly by getting rid of the manual work needed for every single invoice.

At the same time, those small but costly human errors that used to cause so much trouble simply disappeared. A single typo could mean an overpayment or a rejected invoice, creating a cascade of problems. With automation, data capture accuracy can shoot up to 99%. The right info gets in the system, every time.

This boost in accuracy creates a positive ripple effect through the entire financial workflow, which you can read more about in our detailed guide on automated invoice processing.

Giving Your Team Their Time Back

Maybe the biggest transformation for Apex was seeing their team's productivity skyrocket. All those hours their skilled finance pros used to burn on mind-numbing data entry were suddenly freed up for work that actually matters. This isn't just a minor improvement; it's a total shift in the team's purpose.

"Within the first month, we got back over 20 hours of team productivity every single week. Our people are now focused on financial forecasting and analyzing spending trends instead of just pushing paper. It's been a complete game-changer for our department's morale and impact."

This reclaimed time lets your experts do what you hired them for: analyzing the company's financial health, spotting opportunities to save money, and helping shape long-term strategy. The finance department stops being a cost center and starts being a source of powerful business intelligence.

Gaining a Crystal-Clear Financial Picture

Before automation, Apex’s leadership was flying blind. Getting a clear, up-to-the-minute snapshot of their cash flow or upcoming bills was practically impossible. Automated invoice software gave them a live dashboard with a complete view of their accounts payable.

- •Real-Time Cash Flow: They could instantly see every single outstanding invoice, its due date, and its total value. This made managing cash flow a science, not a guessing game.

- •Audit-Ready Records: Every invoice, approval, and payment was logged digitally, creating a transparent, searchable trail. Stressful audit prep turned into a simple matter of pulling a report.

- •Stronger Vendor Relationships: Paying vendors on time, every time - and even snagging early payment discounts - strengthened their business relationships and gave them more leverage in negotiations.

It's no surprise the global market for this software is growing so fast, with projections to hit around $832.7 million by 2025. Companies just like our fictional Apex are discovering these game-changing benefits. And this is just the beginning; the same principles can apply to other financial tasks. For example, adding automated payout capabilities can further streamline how your business sends money out.

What Features Should My Automation Software Have?

Shopping for automated invoice processing software can feel overwhelming, with every vendor throwing a different list of technical specs at you. To simplify things, let's cut through the noise. You just need to focus on a few core features that really move the needle.

Think of this as your non-negotiable checklist. These aren't just shiny bells and whistles; they're the foundational components that drive real efficiency, boost accuracy, and save you money. Without them, you're only getting a pale imitation of what a modern accounts payable process should be.

Let's dive into exactly what to look for and why each one is a game-changer for your finance team.

Intelligent Data Extraction with OCR

The magic of any good automation tool starts with its ability to read and understand invoices on its own. The technology behind this is Optical Character Recognition (OCR). Picture OCR as a super-fast digital assistant that can instantly read any invoice you hand it, whether it's a PDF from an email, a scanned paper document, or even a photo of a receipt snapped on a phone.

But the best systems take it a step further. They combine OCR with artificial intelligence, which means the software doesn't just see the words and numbers - it understands them. It can tell the difference between an invoice number and a PO number and accurately pluck out the key data like vendor names, line items, and payment due dates, no matter how weirdly formatted the invoice is.

Why is this so important? Because it all but kills manual data entry. With modern tools reaching data capture accuracy up to 99%, you're wiping out the biggest source of errors and delays in your entire AP workflow. Your team gets to ditch the drudgery and focus on more valuable work.

This single feature is the bedrock for everything else. It ensures the data flowing into your system is clean from the get-go, a core idea we explore in our full guide to invoice automation software.

Automated 3-Way Matching

Okay, the data is in the system - but how do you know it’s right before you pay? This is where 3-way matching acts as your financial guardian angel. This feature automatically checks three crucial documents against each other to confirm an invoice is legitimate:

- •The Vendor Invoice: This is what your supplier claims you owe.

- •The Purchase Order (PO): This is what your company agreed to buy in the first place.

- •The Receiving Report: This is proof of what your team confirmed was actually delivered.

If the numbers on all three documents match up - quantities, prices, totals, everything - the system greenlights the invoice for payment without anyone having to lift a finger. But if there’s a mismatch, like a price is wrong or you were short-shipped, it instantly flags the invoice and sends it to a human for review. This simple cross-check is your best defense against overpayments, paying the same bill twice, or paying for stuff you never even got.

Customizable Approval Workflows

Your business has its own way of doing things, and your approval process is no different. That’s why you need a tool with flexible, rules-based approval workflows. This feature lets you build your company's internal approval hierarchy directly into the software.

For example, you could easily set up rules like:

- •Any invoice under $500 from the marketing team gets approved automatically.

- •Invoices from $501 to $5,000 need a sign-off from the department manager.

- •Anything over $5,000 requires approvals from both the department manager and the CFO.

The software takes care of all the routing, pinging the right people for their approval and even nudging them if an invoice sits idle for too long. This completely solves the age-old "where did that invoice go?" mystery, speeds up approvals, and helps you snag those valuable early payment discounts.

Seamless Accounting System Integration

Finally, your invoice automation tool can't be a silo. To get the full benefit, it absolutely must talk to the other software you already use. Look for a solution that offers seamless integration with your existing accounting platform or Enterprise Resource Planning (ERP) system, whether that's QuickBooks, Xero, NetSuite, or SAP.

A proper integration means data flows both ways effortlessly. Once an invoice is fully approved, all the critical information - vendor details, GL codes, payment amounts - is automatically synced to your accounting software. No more exporting spreadsheets or manually re-keying data. This ensures your financial records are always perfectly up-to-date, which makes things like month-end closing and reporting infinitely faster and less painful.

How AI Is Making Invoice Processing Smarter

If standard automation is the engine that drives modern invoicing, think of artificial intelligence as the expert driver behind the wheel. AI and machine learning are what turn automated invoice processing software from a simple data-entry tool into a smart, adaptive partner for your finance team. It's the difference between a system that just follows rules and one that learns, adapts, and even starts to anticipate your needs.

This isn’t about some far-off, futuristic concept. We're talking about practical tools that are already changing how businesses manage their money. AI gives the software the ability to think and reason, getting better over time just like a new hire gains experience. This intelligence shows up in a few powerful ways, making your accounts payable process faster, safer, and more strategic.

Going Beyond Basic Data Capture

Traditional automation, which often relies on Optical Character Recognition (OCR), is good at one thing: pulling text from a document. But AI adds a crucial layer of understanding on top of that. It can interpret context. This means it doesn't just see a date; it understands if it's an invoice date, a due date, or a shipping date. This contextual awareness is a game-changer when you’re dealing with all the different invoice formats that land on your desk.

For instance, when an invoice with a completely new layout comes in, an AI-powered system doesn't get stuck. It analyzes the document, figures out where the key information is, and remembers that layout for next time. It continuously refines its own accuracy, which means fewer manual fixes for your team and more confidence that data is being categorized correctly from the get-go.

The AI Fraud Detective On Your Team

One of the most valuable jobs AI performs is that of a vigilant fraud detective, tirelessly scanning every single invoice for signs of trouble. While a busy human might overlook subtle red flags, an AI algorithm can spot anomalies in a flash.

Think of it this way: AI has a perfect memory of every invoice your company has ever handled. It uses this vast knowledge to flag things that just don't look right, such as:

- •Duplicate Invoices: It instantly catches if the same invoice number has been submitted before, even if small details have been changed.

- •Suspicious Vendor Details: The system can raise an alert if a vendor’s bank account details suddenly change without any official notice.

- •Unusual Amounts: AI can pinpoint when an invoice amount is way out of line for a particular vendor or service.

By catching these issues before a payment goes out the door, AI adds a critical layer of security that directly protects your company's cash flow.

A Smart GPS For Payments And Approvals

AI also acts like a smart GPS for your internal workflows, always finding the fastest, most efficient route for every invoice. By analyzing the invoice content, it can automatically apply the correct general ledger (GL) codes and send it to the right person for approval - whether it's based on the department, project, or dollar amount. This intelligent routing gets rid of bottlenecks and makes sure everyone is following your company’s internal approval policies.

This intelligent workflow is a core component of what makes modern systems so effective. It's not just about speed; it's about building a process that is consistently accurate and reliable, which we explore further in our overview of https://tailride.so/blog/invoice-processing-automation.

The impact of this technology is fueling some serious market growth. The invoice automation software market is on track to grow from $3.54 billion in 2025 to $8.6 billion by 2032, largely driven by the power of AI. If you want to dive deeper into the business side of things, a comprehensive AI workflow automation guide can offer some fantastic insights for optimizing all sorts of processes.

A Simple Roadmap for Implementation Success

Bringing new technology into your business can feel like a huge undertaking, but it doesn't have to be a headache. A successful launch of automated invoice processing software isn't about flipping a switch and hoping for the best. It’s a thoughtful, step-by-step process that builds confidence and gets everyone on board for a much smoother way of working.

Think of it like building with LEGOs. You wouldn't just dump all the pieces on the floor and expect a masterpiece. You follow clear instructions, putting each piece in its place to create something solid. This five-stage roadmap is your instruction manual for getting it right.

Stage 1: Understand Your Current Process

Before you can build a better workflow, you have to know exactly what you’re working with now. The first move is to map out your existing invoice process from the moment an invoice lands in an inbox to the final confirmation that it's paid and filed.

Get into the nitty-gritty. Where are the hold-ups? How long does an average approval really take? What are the most common (and frustrating) errors your team has to fix? Answering these questions honestly is the only way to pinpoint the exact problems you need the new software to solve.

Stage 2: Find the Right Vendor Partner

Picking your software provider is one of the most critical decisions you'll make. This is about more than just a slick demo or a long list of features; it's about finding a true partner who gets your business and will be there for you down the road.

When you're talking to vendors, ask the tough questions to see if they're a good fit:

- •Integration Power: How well does their system play with your current accounting software, like QuickBooks or Xero? Do they offer simple, pre-built connectors, or are you looking at a complex custom job?

- •Support When You Need It: What does their customer support actually look like? Are you stuck with just email, or can you get a real person on the phone when something goes wrong?

- •Onboarding and Training: How will they help your team get comfortable with the new system? Look for clear video guides, live training options, and easy-to-understand documentation.

A Levvel Research report found that 62% of companies see integration as a top priority when choosing automation tools. It's the secret sauce for a truly connected and seamless workflow.

Stage 3: Prepare Your Team and Your Data

With a vendor chosen, it's time to get your house in order. This stage is all about prepping your two most important assets: your people and your information. Start by talking to your team about the "why" behind this change. Frame it as a tool that gets rid of the boring, repetitive tasks so they can focus on more important work.

This is also the perfect time for a "spring cleaning" of your data. Tidy up your vendor lists, get rid of outdated contact info, and make sure your purchase order records are accurate. Clean data going in means reliable results coming out.

Stage 4: Run a Controlled Pilot Program

Resist the urge to roll this out to the entire company at once. Instead, start small with a controlled pilot program. Pick a single department or a handful of your most common vendors to test the waters.

This trial run lets you work out the kinks in a low-stakes environment. Your pilot group will spot any quirks in the system, offer ideas for improvement, and become your internal champions - the go-to experts who can help train everyone else when it’s time for the full rollout.

Stage 5: Go Live and Keep Improving

After a successful pilot, you're ready to go live! Launch with confidence, knowing you’ve already tested the system and prepared your team. But don't think of this as the finish line. Implementation is the beginning of an ongoing journey of improvement.

Once the software is up and running, schedule regular check-ins to hear what your team thinks. Keep an eye on key numbers like invoice processing time and error rates to see just how much you've improved. A great software partner will keep releasing updates and new features, so stay curious and keep looking for ways to get even more value from your investment.

How to Measure the ROI of Your New Software

So, you're considering new software. It's a big step, and you'll need to show everyone it was the right call. When you’re looking at automated invoice processing software, calculating the return on investment (ROI) isn't just about comparing the price tag to your old costs. The real win comes from the operational savings, massive efficiency gains, and strategic edge it gives your business.

Think of it this way: it’s like upgrading an old, gas-guzzling sedan to a new electric car. You wouldn't just look at the sticker price. You'd factor in all the money saved on fuel, the lower maintenance bills, and the sheer joy of better performance. The ROI for your new software works the same way - it’s a mix of hard cash savings and those "softer" (but just as valuable) boosts in team productivity.

To build a rock-solid business case, you need to track the right things. This simple framework will help you put a number on the benefits and prove the software’s long-term worth to anyone who asks.

Key Metrics for Your ROI Calculation

First things first: you need a "before" picture. Gather data on your current manual process to create a baseline. Without it, you can't show just how much things have improved.

Focus on these four key areas to capture the full story.

- •Cost-Per-Invoice: This is your most direct financial metric. Tally up the total cost of your manual process - think employee salaries for all that time spent on data entry, chasing approvals, and filing paper. Then, you can compare it to the dramatically lower cost once a machine is doing the heavy lifting.

- •Invoice Cycle Time: How long does it currently take for an invoice to get from your inbox to paid? Manual processes can drag this out for weeks, which ties up your cash and can frustrate your vendors. Automation can slash this time, often cutting it in half from an average of over eight days down to just four.

- •Early Payment Discounts Captured: Many suppliers offer a nice discount for paying early, but slow, manual workflows make these nearly impossible to grab. Start tracking how many of these discounts you can secure with faster processing. It’s pure profit that drops straight to your bottom line.

- •Employee Productivity Gains: This is a huge one. Freeing your finance team from mind-numbing data entry is a game-changer. Calculate the hours saved each week and put a dollar value on them. This isn't just about cost savings; it's about giving your sharpest people time back for high-value work like financial planning and finding more ways to save money.

The goal here is to shift the perception of accounts payable from a simple cost center to a strategic hub. With the right data, you can show how AP becomes a source of savings, efficiency, and critical business insights.

A Sample ROI Calculation

Let's look at how these numbers play out in a real-world scenario. To make this tangible, here’s a simplified table showing how a company might quantify the benefits over one year after bringing in new software.

This example gives you a clear, side-by-side comparison of the costs and gains.

Sample ROI Calculation for Invoice Automation

| Metric | Before Automation (Annual Cost/Value) | After Automation (Annual Cost/Value) | Annual Savings/Gain |

|---|---|---|---|

| Labor Costs (2 FTEs) | $80,000 | $20,000 (reallocated time) | $60,000 |

| Late Payment Fees | $5,000 | $0 | $5,000 |

| Early Payment Discounts | $1,000 | $12,000 | $11,000 |

| Annual Software Cost | $0 | ($15,000) | ($15,000) |

| Total Net Annual ROI | $61,000 |

As you can see, the math is pretty compelling. By tracking just a few key metrics, you can easily build a powerful case that proves the immense value of your investment in automated invoice processing.

Have a Few Questions? We've Got Answers

Stepping into the world of automated invoice processing often brings up a few practical questions. It’s smart to wonder about the nitty-gritty details - like how your data is protected, if the software can handle your specific business needs, and how it plays with the tools you already use.

Let's walk through some of the most common things people ask.

How Secure Is My Financial Data, Really?

This is usually the first question people ask, and for good reason. Reputable software providers treat your security as their number one job. They use heavy-duty tools like end-to-end data encryption, multi-factor authentication, and undergo constant security audits to keep your information locked down.

Honestly, your financial data is often far safer in their highly protected cloud environment than on a server sitting in your office closet. Always ask a potential vendor about their security certifications, like SOC 2 or GDPR compliance, to be sure.

Can This Software Handle Invoices From Other Countries?

Yes, and this is a huge plus for businesses with a global footprint. Most modern platforms are designed from the ground up to manage international business. Their AI and OCR technology is smart enough to read and understand invoices in different languages, currencies, and formats.

Whether you're getting a PDF from Germany, a scanned paper invoice from Japan, or an XML file from down the street, a good system will process it all the same. This is a must-have feature if you work with suppliers from around the world.

The real magic of modern automated invoice processing software is how it adapts. The system actually learns from every invoice you run through it, becoming more accurate over time, no matter where it came from.

What if We Have Really Complicated Approval Rules?

This is where automation truly flexes its muscles. The best systems come with incredibly flexible workflow builders that let you map out approval routes for just about any situation you can think of.

You can create rules that automatically send invoices to the right person based on:

- •The total invoice amount

- •A specific department or project code

- •Who the vendor is

- •Certain keywords found on the document itself

This means even your most complex, multi-person approval chains run smoothly and correctly every single time. It just works, completely getting rid of those frustrating bottlenecks.

Will This Software Work With My Current Accounting System?

Absolutely. In fact, if it doesn't, you should walk away. Smooth integration is a non-negotiable feature. Most platforms offer ready-to-go connections for popular accounting software like QuickBooks, Xero, NetSuite, and SAP.

And for any custom-built or older systems you might have? They almost always provide an API that allows your tech team to build a bridge for two-way data sharing. This keeps your books perfectly in sync without anyone having to type a single number.

Ready to eliminate manual data entry and get your first invoices processed in seconds? See how Tailride can transform your accounts payable workflow. Get started with Tailride today