Streamline Your Invoice Approval Process Today

Discover how to improve your invoice approval process for faster payments and reduced paperwork. Boost efficiency with our expert guide.

That stack of invoices piling up on someone's desk isn't just a to-do list - it's a real threat to your company's financial stability. When your invoice approval process is slow or broken, it's more than a simple headache. It becomes a quiet drain on your cash flow, puts a strain on your vendor relationships, and introduces a surprising amount of operational risk.

Tackling this isn't just about tidying up paperwork; it's a core financial strategy.

The Hidden Costs of a Broken Invoice Approval Process

It’s easy to underestimate what a clunky, manual invoice process is really costing you. The problem goes way beyond just paying a bill late. When invoices get lost in email chains or passed physically from desk to desk, the real damage is happening behind the scenes, chipping away at your profits and stability.

The most direct hit to your bottom line? Financial leakage. Many suppliers offer early payment discounts - often around 2% - if you pay within 10 days. A slow approval workflow makes it almost impossible to catch these deadlines. You're essentially choosing to pay more than you have to, invoice after invoice.

Why Your Vendor Relationships Suffer

Beyond the dollars and cents, a messy approval process can seriously damage the relationships you have with your partners. Your suppliers are essential to your success, but paying them late sends a clear message: you're disorganized, and you might not value their partnership.

This can snowball into bigger problems:

- •Worse Terms: A vendor might think twice about offering you competitive pricing or favorable credit terms next time.

- •Service Disruptions: Suppliers could put your account on hold until they get paid, which can halt your own operations.

- •A Bad Reputation: Word gets around. Being known as a company that pays late can make it tougher to attract top-tier partners in the future.

A reliable payment history is a form of business currency. When your approval process causes delays, you're not just paying late; you're devaluing your reputation with the very partners you depend on.

The High Price of Doing Things by Hand

Let's talk about manual data entry. It’s a huge weak spot. It’s surprising, but even with all the tech available, research shows that 60% of invoices are still keyed in by hand. And the cost of that manual work isn't trivial.

The numbers paint a pretty clear picture when you compare the old way with a more modern, automated approach.

Manual vs Automated Processing: The Real Cost

| Metric | Manual Process | Automated Process |

|---|---|---|

| Average Cost per Invoice | Around $15 | Typically $2 - $4 |

| Processing Time | Can exceed 3 weeks | A few hours to a day |

| Error Rate | High, prone to typos and duplicates | Significantly lower, near zero |

| Early Payment Discounts | Almost always missed | Consistently captured |

| Staff Focus | Administrative firefighting | Strategic financial analysis |

| Audit Trail | Inconsistent, hard to track | Clear, compliant, and instant |

This hands-on approach isn't just slow; it’s a recipe for expensive mistakes. You can learn more about these automation trends and their impact at Dokka.com.

Think about it: a single typo could lead to an overpayment, a duplicate payment, or incorrect coding that messes up your financial reports. Your team then has to spend even more time hunting down and fixing these errors - time they could be using for actual financial planning. Without a solid system, you're also leaving yourself open to compliance headaches and creating a major governance challenge with no clear audit trail.

How to Design Your Ideal Approval Workflow

Let's be honest: building a better invoice approval process isn't about grabbing some generic, one-size-fits-all template. It's about designing a blueprint that truly fits your company's unique DNA - its structure, its spending habits, and its tolerance for risk. Before you can even think about automating anything, you first have to map out this ideal workflow. You need a clear, logical path for every single invoice that comes through the door.

This design phase is where you finally bring order to the chaos. It's about being intentional. Instead of invoices landing in a random inbox and getting ping-ponged around until someone finally pays them, you’re creating a deliberate, efficient system. This forethought ensures everyone knows their exact role, which helps you snuff out bottlenecks before they even start.

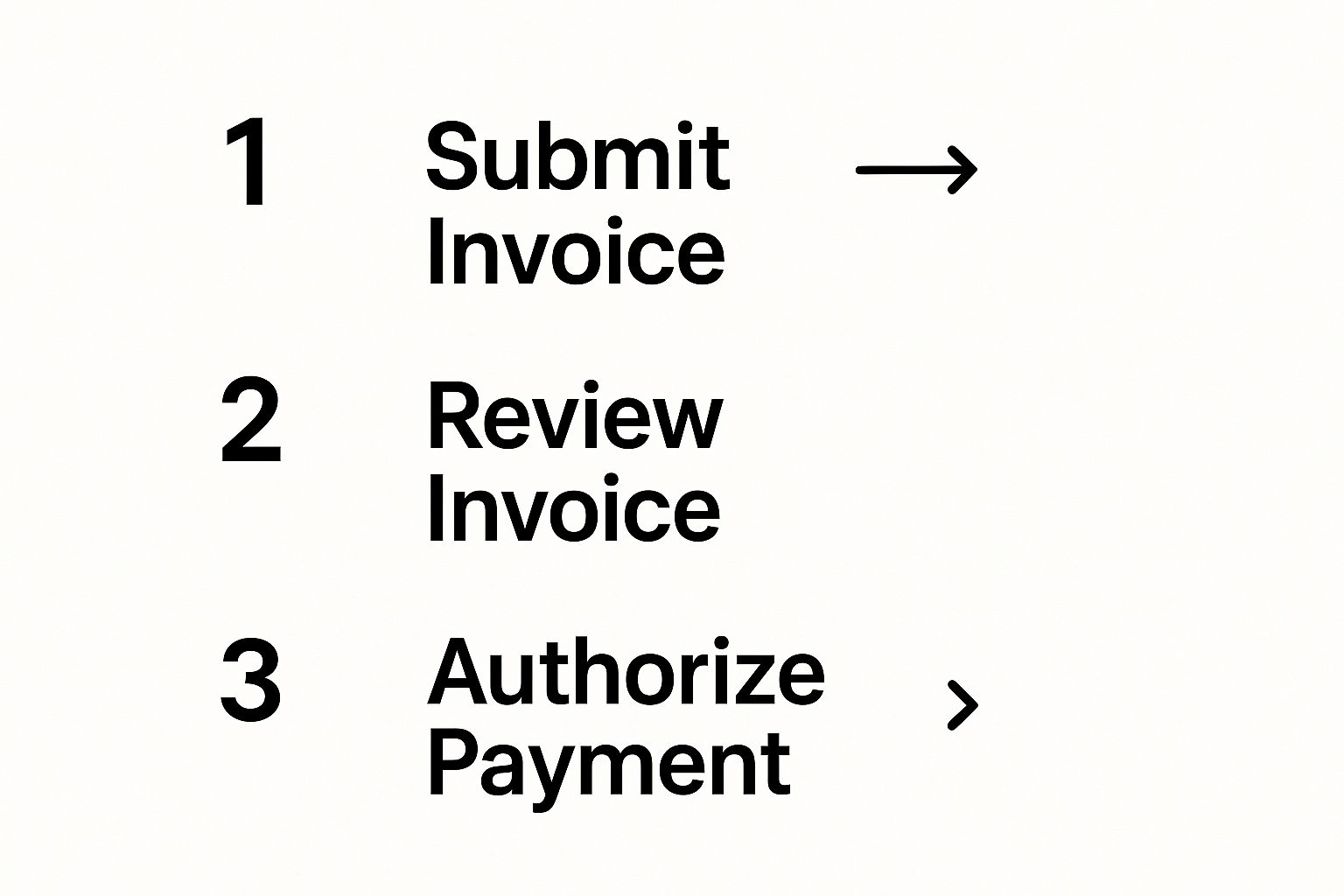

This visual gives you a great high-level view of what a clean, streamlined process looks like in practice.

As you can see, a strong workflow breaks the journey down into clear, distinct stages. This is how you eliminate confusion and create a consistent, reliable path to payment.

Define Crystal-Clear Roles and Responsibilities

First things first: you have to end the "who approves what?" guessing game. Ambiguity is the sworn enemy of an efficient invoice process. It’s absolutely crucial to define the roles and responsibilities for every person involved, from the person who first reviews the bill to the one who gives the final sign-off for payment.

Think about a small marketing agency, for example. The project manager who hired a freelance designer is the perfect person to verify the work was delivered as promised. But should they be authorizing a $15,000 payment? Probably not. That responsibility is better suited for the head of the marketing department or the company controller.

A simple roles chart can make this incredibly clear for everyone:

| Role | Responsibility | Example |

|---|---|---|

| Requestor | Kicks off the purchase and confirms goods/services were delivered. | A project manager ordering new design software. |

| AP Clerk | Gets the invoice, codes it, and matches it to a purchase order. | The finance team member who handles payables. |

| Department Head | Approves spending for their own department's budget. | The Director of Engineering signing off on a new server. |

| Finance Controller | Gives the final green light for high-value payments. | The CFO reviewing all invoices over a certain threshold. |

This kind of structure ensures that the people with the most relevant knowledge are involved at just the right time. It speeds things up without ever sacrificing proper oversight.

Establish Smart Approval Thresholds

Not every invoice is created equal. A $50 bill for office supplies shouldn't go through the same rigorous approval gauntlet as a $25,000 capital expenditure. This is where approval thresholds become your secret weapon for balancing speed with financial control.

By setting up tiered approval rules based on dollar amounts, you empower your team to handle routine purchases fast. At the same time, you guarantee that significant expenses get the executive oversight they absolutely need. This isn't just a good idea; it's a fundamental principle of smart financial governance.

Here’s a practical example of what a multi-level approval chain could look like:

- •Under $500: Automatically approved if it matches a valid purchase order. This wipes out bottlenecks for all those small, routine buys.

- •$501 - $5,000: Requires approval from the relevant department manager. This keeps budget owners in the loop and in control of their spending.

- •$5,001 - $20,000: Needs a thumbs-up from both the department manager and the division director. You're adding a second layer of review for more substantial costs.

- •Over $20,000: Must be approved by the department manager, the director, and the Chief Financial Officer (CFO). This ensures maximum scrutiny for major financial commitments.

This tiered approach is a real cornerstone of effective invoice management. To take it to the next level, it really helps to understand the bigger picture of business process optimization. That knowledge can help you spot and smooth out friction points not just in accounts payable, but across your whole operation. And when you're ready to dig into the tech side, our guide on https://tailride.so/blog/invoice-approval-automation offers more specific strategies.

By thoughtfully designing your roles and rules now, you create a solid framework. This blueprint makes your invoice approval process predictable, auditable, and a whole lot more efficient, perfectly setting the stage for successful implementation and automation.

A Modern Look at the Invoice Approval Journey

So, what does a truly optimized invoice approval process feel like on a day-to-day basis? Let's walk through the life of an invoice in a modern system, from the moment it lands on your digital doorstep to the final payment. This isn't just about speed; it's about creating a smarter, more transparent financial engine for your business.

The whole thing starts with a simple but powerful idea: a single, central place for all incoming invoices. No more paper copies mysteriously appearing on someone's desk. No more critical bills getting lost in a manager’s chaotic inbox.

This single entry point - whether it's a dedicated email address or a slick vendor portal - is your first line of defense against chaos. It guarantees every single invoice starts on the same standardized path.

This shift to a central, electronic hub is more than just a nice-to-have. The global e-invoicing market, valued at around EUR 4.3 billion, is expected to skyrocket to EUR 18 billion soon. Much of this growth is driven by governments mandating real-time clearance to tighten up tax collection, making a digital-first approach the new global standard. You can get a deeper look at this trend and its business implications over at GHX.com.

Automated Data Capture and Smart Coding

Once an invoice arrives, the manual work should effectively stop. This is where smart technology takes over. Modern systems use Optical Character Recognition (OCR) to instantly "read" the invoice, pulling out all the important bits with incredible accuracy.

It doesn't matter if it's a PDF, an image file, or even buried in an email body. The AI grabs the vendor name, invoice number, due date, and every line item.

But it gets even smarter. The system then intelligently codes the invoice, matching it against purchase orders (a crucial process called two-way or three-way matching) and assigning it to the right general ledger accounts based on history.

Imagine an invoice from your cloud provider comes in. The system instantly recognizes it, codes it to your "IT Infrastructure" expense account, and flags it for the IT department to review. All in a matter of seconds.

The Magic of Automated Routing

Here’s where all that planning you did with your approval rules really pays off. Instead of an AP clerk scratching their head trying to figure out who needs to approve a bill, the system handles it automatically.

An automated routing engine is the heart of a modern invoice approval workflow. It’s like a digital traffic controller, sending each invoice to the right person based on the rules you set. It completely eliminates guesswork and bottlenecks.

Let's look at a few common situations:

- •The Small Purchase: An invoice for $300 worth of new office chairs arrives. The system sees it matches an approved purchase order and is below the $500 auto-approval limit. Poof. It bypasses manual review and goes straight to the "approved for payment" list.

- •The Departmental Expense: A $4,500 marketing consultant invoice lands. The system automatically routes it directly to the Head of Marketing's dashboard, since the amount is within their approval authority.

- •The Major Investment: A $22,000 invoice for new equipment comes through. The workflow kicks in, sending it first to the plant manager for their sign-off, then to the VP of Operations, and finally to the CFO for the last look.

In every case, the invoice moves along without anyone having to manually forward an email. The system sends out notifications and nudges approvers along, making sure nothing falls through the cracks. If you're curious to learn more, our guide on invoice processing best practices is a great next step.

Seamless Sync and a Perfect Audit Trail

The final piece of this elegant puzzle is what happens after that last "approve" button is clicked. The approved invoice data doesn't just sit in a folder somewhere. It syncs directly with your accounting software, whether you use QuickBooks, Xero, or something else.

This sync creates a new bill that's ready to be paid, complete with all the correct coding, the full approval history, and a link to the original invoice document. What you get is a clean, transparent, and completely auditable trail for every transaction. This makes month-end closing a breeze and turns annual audits from a headache into a simple review.

Bringing Your Workflow to Life with AI and Automation

Okay, you’ve mapped out a brilliant invoice approval workflow. Now comes the fun part: making it work for you, automatically. Shifting from a manual process to an automated one isn’t just about speed. It’s about building a smarter, more accurate, and far more resilient financial operation.

This isn't some futuristic pipe dream, either. The tools are here, right now, ready to transform that painstaking process into a smooth, hands-off system.

The real win is letting technology take over the repetitive tasks that suck the life out of your team. No more manual data entry from PDFs. No more chasing down managers for a signature. Automation handles the grunt work, freeing up your finance experts to focus on what humans do best: strategic analysis, managing cash flow, and spotting opportunities for growth.

Smart Data Extraction: The First Big Leap

The most immediate game-changer is AI-powered Optical Character Recognition (OCR). Forget the clunky scanners of the past. Modern OCR is incredibly sophisticated. It can read and pull key information from practically any invoice format you throw at it - a crisp PDF, a blurry photo of a receipt, or even data buried in an email.

Think about a system like Tailride watching a dedicated inbox. As soon as a new invoice lands, the AI springs into action, instantly extracting the essentials:

- •Vendor Name

- •Invoice Number and Date

- •Total Amount and Due Date

- •Individual Line Items (yes, it can break down quantities, descriptions, and prices!)

This single step wipes out the mind-numbing task of manual data entry, which, let's be honest, is where most costly mistakes happen.

Let Machine Learning Catch Problems for You

Beyond just grabbing data, machine learning brings a whole new level of intelligence to the table. As the system handles more of your invoices, it learns your company's normal patterns. This predictive insight is a massive boost for your financial controls.

For example, the system knows what you typically pay a certain vendor. If an invoice suddenly arrives for 10 times the usual amount, the AI will immediately flag it for a human to review. It also becomes an expert at spotting potential duplicate payments by recognizing if an invoice with the same number and amount has already been paid. It’s like having a digital fraud detector and error-checker working for you 24/7.

Tying It All Together with Automated Workflows

This is where the real magic happens. Automated workflows take the data from OCR and the insights from machine learning and execute the approval rules you've designed - perfectly, every single time.

An automated workflow is the engine that drives your entire invoice approval process. It ensures the right information gets to the right person at precisely the right time, without anyone lifting a finger.

The results speak for themselves. Companies that have made this switch have seen processing costs drop by nearly 70%, cycle times shrink by 75%, and invoice errors practically disappear, with reductions as high as 90%. This isn't just wishful thinking; it's the direct result of AI, machine learning, and OCR working in concert.

And this thinking doesn't have to live in a silo. If your team lives in other platforms, like a project management tool, you can extend this logic. For instance, you can automate your approval workflow in Jira to keep your project budgets and financials in lockstep. By connecting your tools, you build a cohesive operational system that cuts down on delays and makes everyone's job easier.

Keeping Your Process Sharp for the Long Haul

Getting your new, streamlined invoice approval process up and running is a huge win. But here's the thing: it's not a one-and-done project. Think of it less like a finished painting and more like a high-performance engine. It needs regular tune-ups to keep running at its best.

If you just set it and forget it, you'll be surprised how quickly old problems start creeping back in. New roles get added, vendors update their banking info, and yesterday's perfect approval rule can become tomorrow's bottleneck. Let's make sure that doesn't happen.

Tweak Your Approval Rules as You Grow

Your business is alive. It's constantly changing and evolving. That $5,000 approval limit you set for department heads might have been perfect last year, but if you've doubled in size, it might now be slowing down crucial purchases. This is exactly why checking in on your approval rules and hierarchies is something you have to do regularly.

I always recommend teams schedule a review at least once or twice a year, and definitely any time there's a big shift in the company structure. During that review, ask the tough questions:

- •Is one manager always a bottleneck? Maybe their approval threshold is too low, or they desperately need a backup approver for when they're swamped.

- •Did we just spin up a new marketing division? They'll need to be plugged into the workflow with their own budget owner and approval limits.

- •Where can we be even faster? Perhaps those low-value, recurring invoices from trusted vendors can bypass a human touch altogether.

Your invoice approval process should be a flexible framework, not a rigid cage. Adapting your rules to the reality of your business today is what keeps your system an asset, not a frustrating hurdle.

Empower Your Team with Ongoing Know-How

Even with a system as intuitive as GetInvoice, you can't skip out on training. People move into new roles, you'll onboard new hires, and even your power users can use a refresher on a new feature that could save them a ton of time.

This isn't about death by PowerPoint. It's about empowerment. Show the AP team how a new AI tool can automatically code invoices, freeing them up for more strategic work. Remind managers how to delegate approvals before they go on vacation so the payment train keeps moving. The more comfortable your team feels, the more value you'll squeeze out of your system.

Keep Your Vendor Data Squeaky Clean

Your vendor master file is the absolute bedrock of your payables process. When it gets messy and outdated, it's not just a clerical headache - it's a massive operational and security risk. This is how payments end up in the wrong bank account, duplicate vendors cause chaos, and invoice fraud finds a way in.

Make vendor data cleanup a scheduled, recurring task. Have a rock-solid process for adding new vendors that includes verifying their details before they ever get into the system. Periodically archive vendors you no longer work with and update payment info the second you're notified of a change. Trust me, this simple digital hygiene pays for itself many times over in efficiency and security. To explore this and other powerful strategies, check out our guide on how to improve accounts payable efficiency.

What Gets Measured, Gets Managed: Track Your KPIs

You can’t improve what you don’t measure. The only way to know for sure if your process is really working is to track the right Key Performance Indicators (KPIs). These numbers give you the real story, backed by data, not just gut feelings.

Here are a few essential KPIs I always tell clients to watch:

- •Average Invoice Approval Time: How many days from receipt to final approval? This is your core speed metric.

- •Early Payment Discount Capture Rate: Are you snagging those discounts? This is pure ROI.

- •Invoice Exception Rate: How many invoices get kicked out for manual review? A high rate here tells you something is broken upstream.

- •Cost Per Invoice Processed: What’s your all-in cost, including staff time, to process one invoice? This is your key efficiency number.

By keeping an eye on these metrics, you can spot small problems before they become big ones and make smart, data-driven decisions to keep refining your process for years to come.

Got Questions About Your Invoice Process? We’ve Got Answers.

Switching to a better invoice approval process always kicks up a few questions. That's a good thing! It means your team is thinking critically about a big change. Let's walk through some of the most common questions we hear from folks just like you, so you can move forward with confidence.

These are the real-world, "how does this actually work for us?" concerns that come up. Tackling them head-on is the secret to a smooth transition.

Where Do We Even Start Improving Our Invoice Process?

Before you can fix anything, you have to see it clearly. The single best first step is to map out your current process, warts and all.

Seriously, grab a whiteboard, pull your team into a room, and trace the entire journey of an invoice, from the moment it lands in someone's inbox to the second it's paid. Document every single touchpoint, every person involved, and especially every delay.

You'll almost certainly uncover some surprising bottlenecks and redundant steps that have become "just the way we do things." This visual map gives you a factual baseline, showing you exactly where the biggest problems are so you can score the biggest wins first.

It’s a simple truth: you can't fix what you can't see. Mapping your existing workflow is the most important action you can take. It replaces guesswork with facts and gives you a clear, data-driven starting point for improvement.

How Can We Get Our Team on Board with a New Automated System?

Getting your team to embrace change is all about showing them what’s in it for them, personally. The best way to do that is to involve them from the very beginning. They’re the ones living with the current headaches, so their input on what needs fixing is pure gold.

When it's time for training, don't just focus on the clicks and buttons. Focus on the "why" that matters to their daily work:

- •"This means no more mind-numbing manual data entry for you."

- •"You'll never have to chase down a manager for a signature again."

- •"You can literally approve an invoice from your phone in 30 seconds while waiting for coffee."

And when the new system starts working, celebrate those wins! Announce when it catches a duplicate invoice or helps you snag an early payment discount. Once your team sees it as a tool that makes their jobs easier, not harder, they'll become its biggest fans.

What’s a Reasonable Number of Approvers for an Invoice?

The golden rule here is "as few as possible, but as many as necessary." For nearly every business, a tiered approach based on the invoice amount is the most effective strategy. It perfectly balances financial control with the need for speed.

For instance, a small business might set up its approval rules like this:

| Invoice Amount | Required Approvals | Why It Works |

|---|---|---|

| Under $1,000 | Department Manager Only | Empowers managers to quickly handle routine operational costs. |

| $1,001 - $10,000 | Manager + Director | Adds a second layer of oversight for more significant spending. |

| Over $10,000 | Manager + Director + CFO | Ensures maximum scrutiny for high-value financial commitments. |

This kind of structure lets small, everyday purchases fly through the system without friction, while making sure the big, strategic expenses get the executive oversight they deserve. It gets you away from the "one-size-fits-all" process that just slows everything down.

What's the Best Way to Handle a Rejected or Disputed Invoice?

Your process absolutely needs a clear, standardized path for when things go wrong. In a modern system, an approver shouldn’t just click a generic "reject" button. That’s a recipe for confusion and extra work.

Instead, the system should prompt them to choose a specific reason from a list (like "Incorrect Pricing," "Duplicate Charge," or "Goods Not Received") and add a quick comment. From there, the system should automatically send the invoice back to the right person - whether that's AP or the original requester - with all of that context attached.

This creates a clear, documented audit trail that nobody can miss. Problems get solved based on facts, not lost in messy email chains. It turns a potential fire drill into a structured, solvable problem.

Ready to answer all your invoice questions with a system that just works? GetInvoice eliminates manual data entry, automates your approval workflows, and gives you complete control over your accounts payable process. See how GetInvoice works and extract your first invoice in seconds.