How to Integrate with Xero & Automate Your Finances

Learn how to integrate with Xero and automate your invoicing effortlessly. Follow our guide to streamline your financial workflow today!

Tags

Connecting your tools with Xero is about more than just shaving a few minutes off your day. It’s about completely overhauling your financial workflow, turning tedious, error-prone tasks into a smooth, automated process that gives you back your most valuable asset: time.

Why Hooking Up Your Apps to Xero Is a Total Game-Changer

Before we jump into the how-to, let's talk about the why. Seriously, understanding the strategic advantage here is key.

Picture this: you create an invoice in one app, and it instantly shows up, perfectly coded, in your accounting software. No copying and pasting. No double-checking numbers. That's the magic of a smart integration. By killing off the dreaded double-entry task, you’re not just sidestepping human error - you’re getting a live, accurate pulse on your business’s financial health. That kind of clarity is priceless when you need to make smart decisions on the fly.

From Mind-Numbing Admin to Big-Picture Strategy

Let’s be honest, the goal is to spend less time buried in admin and more time on the things that actually grow your business. Instead of spending hours matching invoices to bank statements, you could be analyzing sales trends, checking in with your best clients, or brainstorming new services.

This shift from manual to automated brings some huge wins:

- •See Your Cash Flow in Real-Time: Know exactly where you stand financially at any given moment. No more waiting for data to be manually entered.

- •Make Tax Time a Breeze: With income and expenses automatically categorized as they happen, tax season becomes way less of a headache.

- •Keep Your Books Spotless: Automated syncing eliminates the typos and missed entries that throw your financial reports out of whack.

The real power of an integration is creating a single source of truth for your financial data. When your invoicing and accounting software are speaking the same language, you can actually trust the numbers you're looking at.

The Real-World Impact of Xero Integrations

This isn't just theory; the numbers tell the same story. A recent study of accounting and bookkeeping firms showed just how vital Xero integration has become. It found that a massive 73% of practices saw their profits climb, a boost they tied directly to tech-driven efficiencies.

Even better, 56% of these firms started attracting new clients simply because they could operate faster and offer better service. It's a clear win-win.

Getting a handle on the best small business cloud accounting software is the first step. When you connect a powerful tool like GetInvoice, you really start to unlock what your accounting system can do. To see exactly how this works, you can check out the specifics on the https://tailride.so/integrations/xero page.

How to Prepare Your Accounts for a Smooth Connection

Connecting two powerful pieces of software is a bit like painting a room. Sure, you can just start slapping paint on the walls, but you’ll get a much cleaner, more professional result if you take a few minutes to tape the edges and lay down a drop cloth first. The same principle applies here.

Taking a little time to get your GetInvoice and Xero accounts in order before you connect them is the single best thing you can do to avoid headaches down the line. When you integrate with Xero, this upfront effort ensures your financial data flows exactly where it needs to go, right from the start.

This prep work tells Xero precisely how to handle the invoices GetInvoice sends over. Skip it, and you risk creating duplicate contacts or having sales dump into uncategorized accounts, which pretty much defeats the whole point of automating your workflow.

The Xero dashboard gives you a fantastic, at-a-glance view of your company's financial health. Keeping this data reliable starts with making sure the information flowing into it from your other apps is clean and consistent.

Fine-Tune Your Chart of Accounts

Think of your Chart of Accounts as the central nervous system of your bookkeeping. It’s the complete list of all the financial accounts in your general ledger - things like "Sales - Services," "Sales - Products," or "Office Expenses." Before you link anything, pop into Xero and give this list a once-over.

Ask yourself a simple question: Do I have specific accounts ready for all the different things I sell via GetInvoice? For example, if you bill for both consulting hours and a monthly software subscription, creating separate sales accounts for each will give you much richer, more detailed reporting. It’s a small change that delivers huge clarity.

Align Customer and Tax Information

I’ve seen it a hundred times: inconsistent data is the number one cause of integration glitches. A seemingly tiny difference, like having "John Smith Inc." in GetInvoice but "John Smith Incorporated" in Xero, is enough to create a messy duplicate contact.

- •Audit Your Contacts: Take five minutes and scan your most active customers in both systems. Make sure the names and other key details match up. This simple check prevents a lot of future confusion.

- •Check Tax Rates: Double-check that every tax rate you use in GetInvoice (like GST, VAT, or a specific state's sales tax) has an identical counterpart set up in Xero. This alignment is absolutely critical for accurate financial statements and a stress-free tax season.

Here’s a pro tip from years of doing this: Just pull up your last 10 invoices from GetInvoice and compare them one-by-one against your Xero setup. This quick, real-world audit almost always uncovers small inconsistencies you can fix in minutes. Trust me, it’s worth it.

Finally, make sure your bank feeds in Xero are reconciled and completely up-to-date. Starting the integration with a clean slate is just good financial hygiene. If you want to brush up on the fundamentals, there's some excellent information on general e-commerce accounting practices that applies well to almost any small business.

Alright, let's get your GetInvoice account talking to Xero. This is the part where we connect the dots and automate your invoicing workflow. Don't worry, this is much easier than it sounds - no complex technical know-how required.

Our goal here is simple: link the two systems so your invoices and payments flow seamlessly from GetInvoice right into your Xero books. Think of it less like a complicated setup and more like flipping a switch.

Let's dive in.

Starting the Connection in GetInvoice

First up, you’ll need to be logged into your GetInvoice account. From your main dashboard, find the 'Integrations' or 'Connections' tab in the navigation menu. This little area is the hub for connecting all your favorite tools.

Once you click in, you'll see a gallery of apps you can connect with. Spot the Xero logo and hit the ‘Connect’ button. This single click kicks off the process, telling GetInvoice you want to start the handshake with Xero.

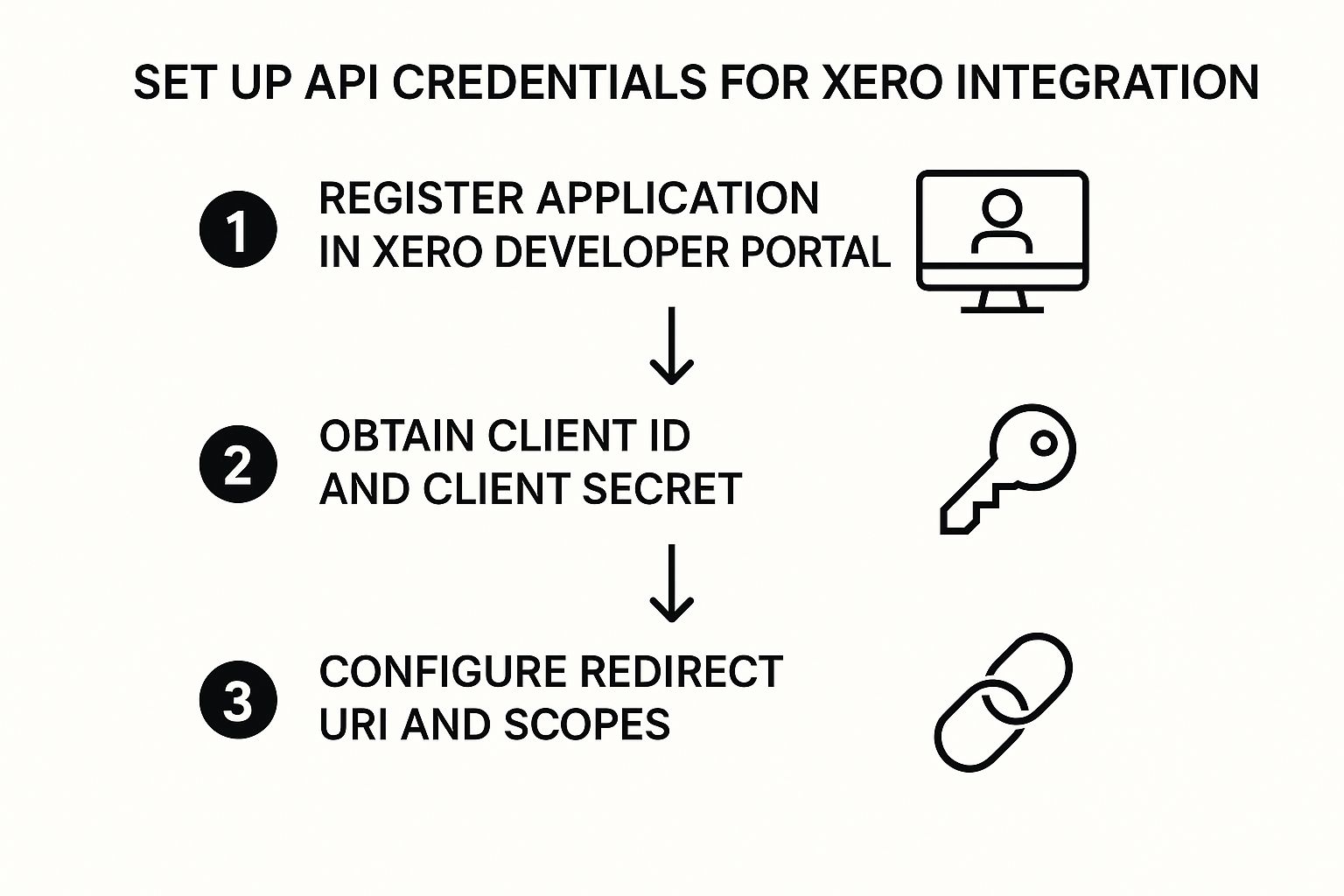

Behind the scenes, this initiates a secure process to generate the credentials needed for the two platforms to communicate safely.

This secure token exchange is what ensures your financial data is protected every step of the way.

Authorizing and Fine-Tuning the Setup

After you click connect, you'll be whisked away to a Xero login page. This is a good thing! It's a secure page hosted directly by Xero, so you can enter your credentials with confidence. Pop in your Xero login details, and you'll land on an authorization screen.

This screen is essentially Xero asking for your permission: "Is it okay if GetInvoice does this and that in your account?" It's not giving away the keys to the kingdom. You're granting specific permissions, usually to create invoices and view your Chart of Accounts.

Expert Tip: Take a moment to actually read these permissions. This authorization step is a critical security measure. It puts you in complete control, ensuring GetInvoice can only perform the actions you explicitly approve.

Once you grant permission, Xero will send you right back to GetInvoice to finalize the configuration. This is where you get to be the director and tell the integration exactly how to behave.

Mapping Your Settings

Now for the fun part - telling GetInvoice where to put everything in Xero. This ensures your data lands in the right place, keeping your accountant happy and your books tidy.

Here’s a quick-reference table that breaks down the most important settings you'll encounter. I’ve found that getting these right from the start saves a ton of headaches down the road.

GetInvoice to Xero Configuration Settings Explained

A quick reference guide to the key settings you'll configure during the integration setup and what they mean for your accounting.

| Setting Name | What It Does | Recommended Choice |

|---|---|---|

| Default Sales Account | Determines the default revenue account for new invoices sent to Xero. | For a service business, 'Sales' or a more specific 'Sales - Services' account is perfect. This keeps your Profit & Loss report clean. |

| Payment Account Mapping | Assigns payments received in GetInvoice to a specific account in Xero. | Map this to the bank account where you actually receive the funds. Some people prefer a 'Clearing Account' for reconciliation. |

| Invoice Status Syncing | Ensures that the status of an invoice (e.g., 'Draft', 'Awaiting Payment') is consistent across both systems. | Enable this! It’s key for knowing exactly where an invoice is in its lifecycle, whether you’re looking in GetInvoice or Xero. |

Getting these settings dialed in correctly is the final piece of the puzzle.

This kind of direct integration is a massive productivity booster. We see a similar dynamic in the partnership between Xero and the practice management tool Karbon, which helps accounting firms automate their own workflows. By syncing client and billing info, they free up professionals from tedious data entry. You can see how these powerful partnerships work on Xero's official announcement page.

Once you've saved your configuration, you’re all set! You've successfully built a bridge between GetInvoice and Xero. Every invoice you create from now on will flow directly into your accounting system, exactly where it needs to be.

Getting into the Groove with Your Automated Invoice Workflow

Alright, with the connection live, you're about to see a real change in how you handle your day-to-day finances. This isn't just about hooking up two pieces of software; it’s about creating a much smarter, smoother habit for managing your money. Let's walk through what this actually looks like in practice.

The real "aha!" moment comes the next time you create an invoice in GetInvoice. That task used to be the start of a whole chain of events, right? Now, it's pretty much the only thing you have to do. The second you send that invoice, GetInvoice zips over to Xero and creates the matching accounts receivable entry, all coded perfectly to the customer and revenue account you set up earlier.

From Invoice to Xero Entry - Instantly

Let's say you just billed a client for "Graphic Design." Since you mapped that item to your "Sales - Creative" account during setup, the invoice details pop up in Xero automatically. No more double-entry, no late-night data entry sessions, and zero chance of a typo throwing off your books. This immediate sync means your financial reports in Xero are always current, giving you a true picture of your business performance in near real-time.

And it works just as beautifully when the money comes in.

Watching Payments Sync Seamlessly

When your client pays up and you mark that invoice as paid in GetInvoice, the integration springs into action again. It instantly finds the corresponding invoice in Xero and marks it as paid, too. This closes the loop completely, shifting the amount from your accounts receivable and getting it ready for your bank reconciliation. Your cash flow statement in Xero is no longer a guess - it's an accurate, up-to-the-minute snapshot of your financial health.

This two-way flow of information is really the heart of it all. It builds a system you can count on, where what you do in your invoicing tool (GetInvoice) is perfectly reflected in your system of record (Xero). You finally get that single source of truth every business owner dreams of.

To really make this sing, a few good habits go a long way.

Best Practices for Your New Workflow

Any good automation needs a little human oversight to keep it humming along. Here are a few tips I've picked up that will ensure your GetInvoice and Xero integration stays a massive asset for your business.

- •Do a Quick Weekly Check-In: Block out just 10 minutes every Friday. Seriously, that's all it takes. Skim your latest invoices in GetInvoice and just double-check that they’ve landed correctly in Xero. This tiny habit helps you catch any mapping quirks early before they can turn into a headache.

- •Lean on Xero's Reporting: Now that all your rich invoice data is flowing directly into Xero, its reporting features are supercharged. Use them! Analyze sales trends by customer, look at which services are your top performers, or track revenue by month. You can trust the insights because you know the data behind them is solid.

- •Stay Curious and Adapt: The worlds of accounting and business tech are always evolving. For instance, Xero regularly updates its platform to handle new regulations, like the e-Invoicing mandates in Malaysia, making compliance much less painful. Keeping an eye on these changes helps you stay ahead.

By folding these simple practices into your routine, you’re not just using a feature - you’re building a smarter, more resilient financial operation. If you want to dive deeper into this topic, our guide on invoice automation software is a great next read.

Troubleshooting Common Integration Issues

Even with a perfect setup, technology can be a little quirky sometimes. Let's be honest, integrations occasionally throw a curveball. The good news? Most of these issues are surprisingly common and have simple fixes you can handle yourself in minutes.

So, let's walk through a couple of real-world scenarios you might run into. Maybe you just created an invoice in GetInvoice, but it's completely MIA in Xero. Or you log in to find a duplicate customer record, creating a mini-mess in your contacts. These are the exact kinds of hiccups we're going to squash.

Why Is My Invoice Not Syncing?

This is probably the #1 issue we hear about: an invoice just won't show up in Xero. Before you start pulling your hair out, take a deep breath and check the invoice details inside GetInvoice.

Nine times out of ten, the culprit is a brand-new product or service you just added. If that new item hasn't been mapped to an account in your Xero Chart of Accounts, the system simply doesn't know where to file it. Think of it like a lost package without a shipping label. The fix is easy - just pop into your integration settings, map that new item to the correct sales account in Xero, and resync. Problem solved.

Handling Unwanted Duplicate Contacts

Seeing double in your customer list? That’s another classic integration headache. This almost always boils down to a tiny, easy-to-miss difference in how a customer's name is entered in each system.

For example, to a computer, these are two completely separate clients:

- •In GetInvoice: My Company Inc

- •In Xero: My Company Incorporated

The integration doesn't realize they're the same and, trying to be helpful, creates a new contact. The solution is to pick one naming convention and stick with it across both platforms. Update the name, and then you can easily merge the duplicate contacts right inside Xero to keep your data clean.

Being proactive with your data is a cornerstone of solid financial automation. For a deeper dive, check out our guide on accounts payable automation best practices for more tips on keeping your records tidy.

Here's a pro tip: your best friend in these situations is the error log. Integrations like the GetInvoice and Xero connection keep a running log of sync activity. If something fails, the log will usually give you a clear, simple reason like "Item code not found" or "Customer name does not match." It's like a built-in instruction manual for fixing the problem.

Getting familiar with these common snags means you can solve most issues on your own, without waiting on a support ticket. When you integrate with Xero, knowing how to quickly spot and solve these little problems is what keeps your automation running smoothly and your financial data looking sharp.

Got Questions About the Xero Integration? We've Got Answers.

It’s totally normal to have a few questions before flipping the switch on a new integration. We've been there! To help you feel completely comfortable, we've gathered the most common questions we hear and answered them in plain English.

How Often Does My Data Sync?

This is probably the most popular question we get. You need your numbers to be up-to-the-minute, and we built our integration with that in mind.

The connection between GetInvoice and Xero is designed to work in near real-time. Whenever you create, update, or send an invoice in GetInvoice, that information is pushed over to Xero almost instantly. No waiting for a nightly batch process - your Xero dashboard is always a live reflection of what's happening.

What About Deleted Invoices?

So, what happens if you sync an invoice and then realize you need to delete it from GetInvoice? This is an important one.

Deleting an invoice in our system does not automatically remove it from Xero. This is a deliberate feature designed to protect your accounting records. Think of it as a safety net.

For accurate bookkeeping and a clean audit trail, the correct procedure is to head into Xero and void the invoice there. Voiding keeps a record of the transaction but cancels out its financial value, which is exactly what accountants need to see for a clear financial story.

Voiding an invoice in Xero, rather than deleting it, creates a transparent paper trail. It essentially says, "This invoice existed but is no longer active." This is a cornerstone of good bookkeeping and will save you a world of headaches during any financial review.

Can I Connect to More Than One Xero Organization?

This question comes up a lot, especially from agencies, bookkeepers, and entrepreneurs managing multiple businesses. The short answer is that the integration is built for a one-to-one relationship.

Your GetInvoice account connects to a single Xero organization. We set it up this way to guarantee that your financial data stays clean and never accidentally gets mixed up between different companies. Trust us, sorting that out is a mess you don't want.

If you do manage multiple entities, the best and safest path is to have a dedicated GetInvoice account for each Xero organization. This keeps everything neatly separated and ensures your automation works perfectly for each business.

Ready to stop chasing down invoices and let automation take over? With Tailride, you can connect directly to email inboxes and online portals, capturing every invoice automatically and syncing it seamlessly with Xero. See how it works at tailride.so.