Improve Accounts Payable Efficiency with Automation

Learn how to improve accounts payable efficiency with automation. This guide offers proven strategies and real-world tips to streamline your AP process.

Tags

To really boost your accounts payable efficiency, it’s not just about buying new software. The magic happens when you pair powerful automation with smarter internal workflows. This combination is what truly frees up your skilled finance team from the grind of repetitive tasks, letting them focus on high-impact analysis that moves the needle.

Why AP Efficiency Is No Longer Optional

Let’s be real for a second - manual accounts payable is a massive headache for most finance departments. That endless loop of chasing down invoice approvals, painstakingly keying in data from PDFs, and fixing inevitable human errors isn't just inefficient. It's a genuine strategic liability.

All that administrative weight keeps your team from doing the work that actually matters. Instead of analyzing spending trends or finding ways to optimize cash flow, they're stuck in a cycle of low-value, repetitive tasks. This is a direct path to team burnout, sluggish month-end closes, and a much higher risk of costly mistakes like duplicate payments or missed early-payment discounts.

The Hidden Costs of Sticking with the Status Quo

Clinging to outdated AP methods has consequences that stretch far beyond the finance department. The time lost to manual data entry is just the tip of the iceberg. The real damage is often hidden in the strategic opportunities you're missing.

- •Financial Reporting That’s Always Late: When your AP process moves at a snail's pace, your financial data is perpetually out of date. This makes it impossible for leadership to make quick, smart decisions based on what's happening right now.

- •Damaged Vendor Relationships: Nothing sours a relationship with a supplier faster than late or incorrect payments. A smooth, predictable payment cycle is fundamental to keeping those crucial partnerships strong.

- •A Revolving Door of Talent: Top-tier finance professionals didn't get into the field to do clerical work. An inefficient AP department makes it incredibly difficult to attract and keep the skilled people you need to grow the business.

We’ve all seen the difference between a clunky, paper-based system and a smooth, automated one. To put it in perspective, here's a quick comparison of the two worlds.

Manual AP vs. Automated AP: A Quick Comparison

This table shows the clear differences between a traditional, manual-heavy accounts payable process and a modern, automated one, highlighting the core benefits of making the switch.

| Process Area | Manual Approach (The Problem) | Automated Approach (The Solution) |

|---|---|---|

| Invoice Intake | Physical mail, multiple email inboxes, disorganized. | A single, centralized digital inbox for all invoices. |

| Data Entry | Manual keying from PDFs or paper; error-prone and slow. | AI-powered data extraction captures key info automatically. |

| Approval Routing | Chasing signatures via email or internal mail; no visibility. | Digital, pre-set approval workflows with reminders. |

| Payment Processing | Printing and mailing paper checks; high fraud risk. | Secure, automated digital payments (ACH, virtual cards). |

| Record Keeping | Filing cabinets, shared drives; difficult to search. | A searchable, cloud-based archive for instant access. |

The contrast is pretty stark. Moving to an automated system isn't just a minor upgrade; it fundamentally changes how the entire process works, for the better.

The accounts payable world is changing fast. By 2025, over half of all companies are expected to have AI integrated into their AP functions. Businesses that don't adapt are taking a serious risk, especially when 72% of finance workers say they've thought about leaving the industry because of burnout from outdated processes. You can dig deeper into these global AP trends to see just how urgent this is.

Bottom line: this conversation is no longer about just saving a bit of time. Improving accounts payable efficiency has become a cornerstone of business resilience, a key competitive advantage, and the foundation for building a finance team that can actually support long-term growth. It's about giving your people the tools to work smarter, not just harder.

Automating Invoice Capture and Data Entry

Alright, let's get down to business. The single biggest time-suck in any traditional accounts payable department is the soul-crushing manual data entry. If you want to see real improvement, this is where you have to start. It's all about getting invoices into your system without someone having to key in every single detail.

For years, Optical Character Recognition (OCR) was the go-to solution, but honestly, today's tech makes it look like a relic. We're in the era of AI-powered data extraction now, and it's a completely different ballgame.

Think about it: a complex, multi-page PDF invoice lands from a brand-new supplier. Instead of just trying to read the characters on the page, the AI actually understands the document's structure. It knows what an invoice number looks like, where to find the due date, and how to identify the vendor's name. It can even go a step further and pull out individual line-item details - like quantity and unit price - from a messy table.

The best part? It handles a blurry photo of a receipt from a smartphone just as easily as a pristine PDF, which dramatically slashes the 8-10% error rates that are so common with manual entry.

Moving Beyond Basic OCR to Intelligent Extraction

Look, older OCR was a decent first attempt. But it was notorious for tripping over different invoice layouts, grainy scans, or anything that wasn't perfectly formatted. It was like a digital scanner that could read text but had zero comprehension. This meant your team was still stuck doing a ton of manual review and cleanup, which kind of defeats the whole purpose of automation, right?

Intelligent data extraction is different. It uses machine learning to not just read, but comprehend.

- •It Learns on the Job: The more invoices it processes, the smarter it gets. It quickly learns Vendor A's unique layout, so every subsequent invoice from them is processed with near-perfect accuracy.

- •It Thrives on Variety: It doesn't get flustered by different formats. Whether the invoice arrives as a PDF, a JPEG, or even buried in the body of an email, the system can pinpoint and pull out the crucial information.

- •It Frees Up Your Team: Because the AI gets it right the first time, your people spend less time fixing typos and more time on high-value work, like investigating exceptions or analyzing spending patterns.

Here's the key takeaway: Modern AI learns from your historical data and adapts in real-time. This is what allows for automation that feels truly custom-built for your business, constantly getting smarter and more efficient on its own.

How to Set Up Your Digital Mailroom

So, how do you put this into practice? The first, most critical step is to create a single, central hub for all incoming invoices. The easiest and most effective way to do this is by setting up a dedicated email address - think invoices@yourcompany.com.

Once that's set up, you simply instruct all your vendors to send their invoices to this one address. No more invoices lost in random employee inboxes or sitting on someone's desk. This simple change creates a predictable, manageable flow. From there, an automation platform like Tailride can monitor that inbox 24/7, automatically fetching every new invoice the second it arrives.

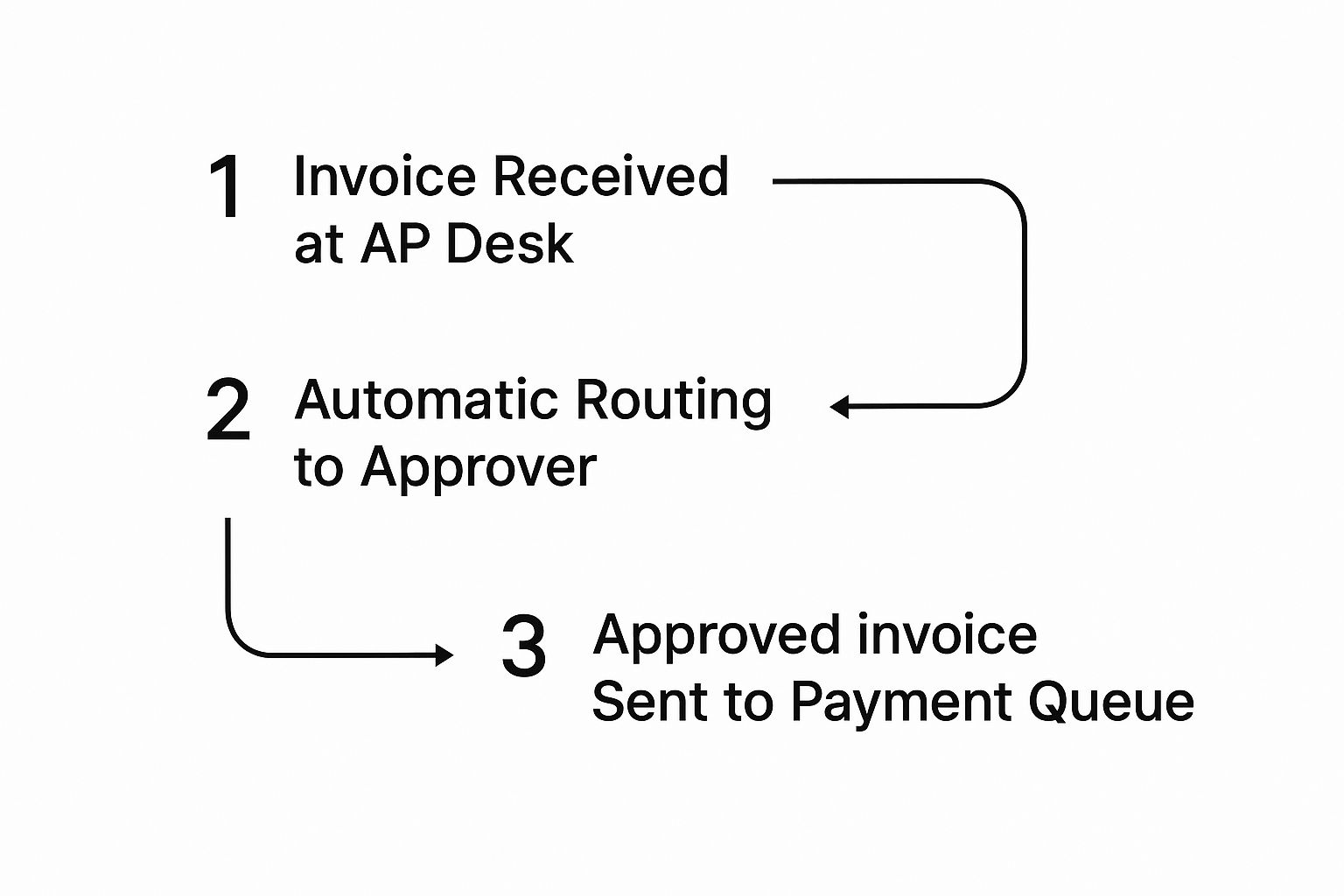

This little diagram shows you exactly how the workload shifts from your AP team's desk and flows directly into the system for approval and payment.

As you can see, once an invoice hits that dedicated inbox, it's on a fully automated path. No one needs to manually sort it or key in the data just to get it to the right person. By automating the capture and initial routing, you've just eliminated the two biggest bottlenecks at the very start of the AP cycle. This sets the stage for everything that follows: faster approvals, on-time payments, and a much happier team.

Building Smarter Invoice Approval Workflows

So, you’ve successfully captured an invoice and pulled out all the key data. Fantastic. But now it hits the next big AP sinkhole: the approval process. This is where things so often grind to a halt. We've all seen it - invoices lost in endless email threads or collecting dust on a manager's desk for weeks.

The solution isn't just to "automate it." The real secret lies in designing intelligent workflows.

A truly effective approval process isn't a one-size-fits-all conveyor belt. It’s a smart, multi-level system that routes invoices based on business rules you define. This strategic routing is what separates a truly efficient AP department from one that’s just shuffling paper digitally.

Think about it this way: an invoice for office supplies under $500 for the marketing team probably just needs a quick sign-off from the Marketing Manager. But what about a $10,000 software investment for that same department? That’s a different story. It should automatically trigger a more serious workflow, needing approval from both the Department Head and the CFO.

Designing Rules-Based Approval Chains

When you set up these kinds of smart workflows, you completely remove the need for someone to manually forward emails and chase down approvals. The system handles it all, making sure the right people see the right invoices at the right time. This doesn't just speed everything up; it also gives you a new level of financial control and a clear view of where every invoice stands.

You can build these rules around almost any variable. For instance:

- •By Invoice Amount: Low-value invoices can be set for a simple, single-step approval, while high-value ones automatically trigger a multi-layered sign-off process.

- •By Department or GL Code: Invoices get sent straight to the correct budget holder based on the department or project code assigned to them. No more guessing games.

- •By Specific Vendor: You could create a special rule where all invoices from a brand-new supplier are reviewed by a senior manager for the first few months, just to keep a closer eye on things.

This rules-based approach takes the guesswork out of the equation and creates a solid, auditable trail for every payment you make. It's a cornerstone of modernizing your AP operations. We dive deeper into this in our guide on invoice processing automation.

The Power of Mobile Approvals

Let's be realistic - your executives and managers aren't always sitting at their desks. Making them wait until they're back in the office to sign off on a pile of invoices is just asking for late payment fees and frustrated vendors. This is where mobile approvals completely change the game.

An AP automation platform with a solid mobile app allows busy leaders to review, comment on, and approve invoices right from their phones. Whether they're between meetings, waiting at an airport, or working from home, they can keep the approvals moving. This simple capability is what keeps your financial engine running without a hitch, no matter where your key people are.

This kind of flexibility is a massive efficiency booster. In fact, a major reason for the rapid growth in the accounts payable automation market is the demand for these digital tools. Good automation can slash the time your team spends on manual AP tasks by a staggering 70-80%, freeing them up for more valuable work like managing cash flow. Mobile AP apps are a huge part of that, enabling real-time processing from anywhere. You can read more about accounts payable trends on Ramp.com to see how this is shaping the industry.

Integrating AP Automation with Your ERP

An AP automation tool is great on its own, but its real magic happens when it talks directly to your Enterprise Resource Planning (ERP) system. This connection is the secret sauce to truly improving accounts payable efficiency. It creates a single, reliable source for all your financial data.

Think of it like this: your AP platform is the specialist that handles the messy front-end work - grabbing invoices, pulling out the data, and chasing down approvals. Your ERP, on the other hand, is your financial system of record where everything needs to end up, perfectly organized.

If there's no bridge between the two, you’re left with a huge bottleneck. You're still manually typing approved invoice data into the ERP, which is not only a time-suck but also a recipe for costly mistakes.

The Power of a Two-Way Sync

A proper integration isn’t a one-way street. It’s a dynamic, two-way conversation between your systems.

When an invoice gets the green light in your AP tool, all the critical data - the vendor name, amount, GL codes, you name it - should post automatically and accurately to your ERP. This completely wipes out the risk of manual entry errors that can wreak havoc on your general ledger.

Even better, it helps you dodge one of the most painful AP blunders: paying the same invoice twice. Because the systems are in constant communication, your AP tool knows instantly if an invoice number already exists in the ERP and flags it before a duplicate payment ever goes out.

A seamless two-way sync is non-negotiable. It’s what ensures data updated in one system is immediately reflected in the other, keeping your entire financial world in harmony. This connection is what turns a good AP tool into an indispensable one.

What to Look for in an ERP Integration

Not all integrations are built the same. When you're shopping for an AP automation solution, you have to dig into how well it will play with your existing financial stack.

Here's what I’ve learned really matters:

- •Pre-Built Connectors: Frankly, life is too short for custom-coded integrations if you can avoid them. The best platforms offer ready-to-go, out-of-the-box connectors for popular ERPs. This can turn a complicated IT headache into a simple plug-and-play setup.

- •Support for Custom Fields: Your business is unique, and your chart of accounts probably is too. Maybe you track costs by department, project, or location. A solid integration needs to handle these custom fields, ensuring data flows in a way that actually supports how you run your business.

- •Real-Time Data Flow: You want a sync that happens in real time, or very close to it. This gives you a constantly updated picture of your liabilities and cash flow, which is crucial for making smart financial decisions and forecasts.

For instance, a tight integration makes the entire payment process feel effortless. You can get a better sense of how this works by checking out our guide on Xero integration. This seamless journey - from invoice approval straight through to final reconciliation in your ERP - is what a truly hands-off, efficient AP process looks like.

Leading a Successful AP Transformation

I've seen it happen time and time again: a company invests in powerful automation tools, only to watch them collect dust. Why? Because implementing new AP technology is never just about flipping a switch. It’s fundamentally a human challenge. You have to lead your team through the change, and that requires a thoughtful, people-first plan.

Your first move is to build a rock-solid business case for the leadership team. Don’t just mumble about "saving time." You need to speak their language. Frame the investment in terms that get their attention: a clear ROI, a significant reduction in financial risk, and a real competitive advantage. Show them exactly how automated AP hits the bottom line by wiping out late fees, capturing every possible early payment discount, and making financial forecasts far more accurate.

Even with the green light from the top, the rollout itself needs a delicate touch. You’re trying to improve accounts payable efficiency, not throw daily operations into chaos. Jamming a new system down everyone's throats at once is a surefire way to breed resentment and resistance.

Start with a Pilot Program

Instead of a big-bang, company-wide launch, start small. Hand-pick one department - preferably one that’s a bit more tech-savvy - and run a pilot program. This gives you a controlled space to work out the kinks, fine-tune your new workflows, and get honest feedback from a manageable group of people.

Think of it as a dress rehearsal for the main event. You’ll spot the friction points and develop fixes before they become massive headaches. Better yet, this approach creates your first set of internal champions. When they start talking about how much easier their jobs have become, you’ll build natural momentum for the bigger rollout.

Despite the obvious wins, old manual habits die hard. A recent survey found that a staggering 63% of AP professionals still sink over 10 hours a week into manual invoice work. This just proves that having the tech isn't the whole story. Real change comes from smart leadership and a solid plan to shift ingrained behaviors. You can explore the full global research on AP priorities to dig deeper into these trends.

Master Your Vendor Communication

Your suppliers are your partners in this, not obstacles. You absolutely have to bring them along for the ride, and that means clear, proactive communication is non-negotiable. Please, don't just spring the change on them with a surprise email.

Take a few minutes to create a simple communication plan. It doesn't have to be complicated. Just make sure it covers:

- •The "Why": A quick, friendly note explaining you're upgrading your system to pay them faster and more reliably.

- •The New Process: Tell them exactly where invoices go now (e.g., a dedicated email like

invoices@yourcompany.com). - •The Timeline: Give them a firm "go-live" date so they know when to switch over.

- •A Point of Contact: Make sure they have an email or a phone number for someone who can answer their questions.

A little outreach shows you respect their business and their time. When you manage the people side of this transition with as much care as the technical side, you’ll find your new system isn't just adopted - it's embraced. That’s when you’ll finally see the powerful efficiency gains you were after all along.

Common Questions About AP Automation

When you start getting serious about fixing your accounts payable process, a lot of practical questions pop up. It’s one thing to read about the high-level benefits, but it's another to picture how it will actually work for your team on a Tuesday afternoon. Let's get into the nitty-gritty and answer the questions we hear all the time.

How Much Does AP Automation Software Cost?

This is always the first question, and the honest-to-goodness answer is: it depends. The price tag for an AP automation platform is directly tied to what you need it to do. The cost hinges on a few key things, like your monthly invoice volume, how many people need to use the system, and the specific features you can't live without.

Generally, you'll see a couple of common pricing structures:

- •Per-Invoice Pricing: Some platforms charge a small fee for each invoice they process, often somewhere between $0.50 and $2.00.

- •Subscription Tiers: More often, you'll find monthly or annual plans bundled by invoice volume or feature sets.

But looking at the initial cost is only half the picture. The real story is the return on your investment. You have to factor in the huge savings from slashing manual labor, completely wiping out late payment fees, and finally being able to grab those early payment discounts. From what I've seen, most companies find the software pays for itself well within the first year.

Will Automation Replace My Accounts Payable Team?

This is a big one, and a totally understandable fear. But it comes from a misunderstanding of what this technology is designed to do. The point of AP automation isn’t to replace your people; it’s to free them from the soul-crushing, repetitive tasks that bog them down.

Think about it. All those hours spent keying in invoice data, hunting down managers for approvals, or stuffing envelopes - that's what the software takes over. This frees up your AP pros to do the strategic work that actually requires their expertise and critical thinking.

Instead of being data entry clerks, your team becomes a group of financial detectives. They can dig into spending patterns, work with suppliers to get better payment terms, and actively manage cash flow. It transforms AP from a simple cost center into a strategic part of your finance department.

Ultimately, automation makes their jobs more engaging and helps you keep your best people. For a closer look, you can explore the many accounts payable automation benefits that go far beyond just saving time.

How Do We Get Our Vendors to Adopt a New System?

This is a critical piece of the puzzle. Getting your suppliers on board is all about good communication and showing them what's in it for them. Simply blasting out a generic email and hoping for the best is a recipe for a messy transition.

Instead, map out a clear communication plan. Let them know what's changing, when it's happening, and what the new, easier process looks like. Most importantly, frame it around how it makes their life better. The key selling points for them are usually:

- •Their invoices get processed much faster.

- •There's zero chance of an invoice getting lost in the mail or buried in an inbox.

- •They get paid sooner and more predictably.

Make it incredibly easy for them to send you invoices, whether that's through a dedicated email address (like invoices@yourcompany.com) or a simple online portal. For your biggest, most important vendors, a personal phone call goes a long way. A little support and clear guidance will get everyone on board with minimal friction.

Ready to stop chasing invoices and start improving your accounts payable efficiency? Tailride uses AI to automate invoice capture, approvals, and data entry, connecting directly to your inbox and accounting software. Get started in seconds and see the difference.