Your Guide to Invoice Approval Automation

Discover how invoice approval automation streamlines your finance operations. Learn what it is, how it works, and how to implement it for maximum ROI.

Tags

Let’s talk about invoice approval automation. In simple terms, it's a system that takes over the grunt work of handling invoices. It uses technology to automatically grab invoice data, check it for accuracy, and send it to the right person for a thumbs-up. This means no more mind-numbing data entry, no more piles of paper, and no more chasing approvals through endless email threads. It's like having a super-efficient digital assistant for your accounts payable process.

Escape the Endless Paper Chase

Take a quick look at your finance team's workspace. Is it overflowing with paper invoices? Are people spending way too much time hunting down managers for a signature or painstakingly typing numbers into a spreadsheet? If that sounds familiar, you're not alone. For many companies, this is just another Tuesday. It’s a bit like a busy restaurant kitchen during a surprise dinner rush - things get lost, service slows to a crawl, and your vendors (the customers, in this case) start getting antsy.

This modern-day paper chase is really just a new version of a very old problem. For centuries, finance has been about verifying trust and keeping accurate records. It's fascinating when you look at the long history of accounting and its evolution and realize we're still trying to solve the same core challenges.

Now, imagine this instead: an invoice lands in your inbox, and a smart system immediately reads it. It pulls out all the important info, matches it against the purchase order, and knows exactly who needs to sign off on it. Maybe it’s a department head for marketing spend, or a senior manager for anything over $5,000. That person gets a quick notification on their phone, taps to approve, and bam - the invoice is ready for payment in your accounting system.

This isn't some far-off future. This is exactly what invoice approval automation does. It turns that chaotic kitchen into a well-oiled machine where every single step is efficient, transparent, and under control.

Shifting from Manual Drudgery to Strategic Control

At its heart, invoice approval automation is about changing what your finance team focuses on. Instead of getting buried in administrative tasks, they can step back and look at the bigger picture - analyzing spending trends, managing cash flow effectively, and building better relationships with suppliers.

This technology directly tackles the biggest headaches of manual AP:

- •Eliminates Human Error: Let's be honest, people make typos. Manual data entry is a breeding ground for mistakes that can lead to paying too much or even compliance problems. Automation pulls data straight from the source, so it's right every time.

- •Accelerates Approval Cycles: No more invoices sitting on a desk for a week or getting lost in a cluttered inbox. Automated workflows and friendly reminders can shrink approval times from weeks down to just a few hours.

- •Provides Real-Time Visibility: Wondering where that big invoice is? A central dashboard shows you the status of every single invoice in real time. The guesswork is gone, giving you total control over your company's spending.

By bringing in this kind of automation, you’re doing more than just speeding up a process. You're giving your entire financial operation a serious upgrade. This move lays the groundwork for lower costs, happier vendors, and a finance team that has the time and data to help the business grow.

How Invoice Approval Automation Actually Works

Ever wondered what goes on behind the scenes with invoice approval automation? It’s less about complex sorcery and more like having a super-efficient digital mail clerk and a meticulous accountant working together 24/7. It takes the journey from a newly arrived invoice to a fully paid one and makes it incredibly smooth.

It all starts the moment an invoice hits your system. It doesn't matter if it's a PDF in an email, a paper document someone scanned, or a file submitted through a vendor portal. The system's first job is to read it, no matter the format. This is where a cool piece of tech called Optical Character Recognition (OCR) steps in.

OCR technology scans the invoice and pulls out all the critical details - who the vendor is, the invoice number, the due date, what was purchased, and the total amount. Think about how much better that is than someone manually typing everything in, where a single slip of the finger can lead to payment headaches. These modern systems are remarkably good, often hitting 90% to 95% accuracy right out of the gate.

The Automated Validation Checkpoint

Once the data is captured, the system puts on its auditor hat. It doesn't just blindly accept the information; it checks it against your company's records and predefined rules. This is where you really start to see the power of automation shine.

The software performs a few critical checks on its own:

- •2-Way Matching: The system pulls up the original purchase order (PO) and compares it to the invoice. It checks if the prices, item quantities, and descriptions line up with what you agreed to buy.

- •3-Way Matching: For an even tighter layer of security, it performs a 3-way match. It compares the invoice to both the purchase order and the goods receipt note, confirming that you actually received what you’re being billed for.

If anything doesn't add up - maybe the invoice total is higher than the PO, or the items don't match - the system immediately flags it as an exception. This nips potential overpayments in the bud and sends the problem invoice directly to the right person to sort out. You can learn more about this in our guide to comprehensive invoice processing automation.

From Smart Routing to Final Sync

With all the data captured and validated, the system’s next move is to get the invoice approved. It intelligently routes the invoice to the right person based on rules you’ve already set. For example, an invoice for marketing software under $1,000 might go straight to the marketing manager, while a big-ticket purchase over $10,000 could require approval from a department head and then the CFO.

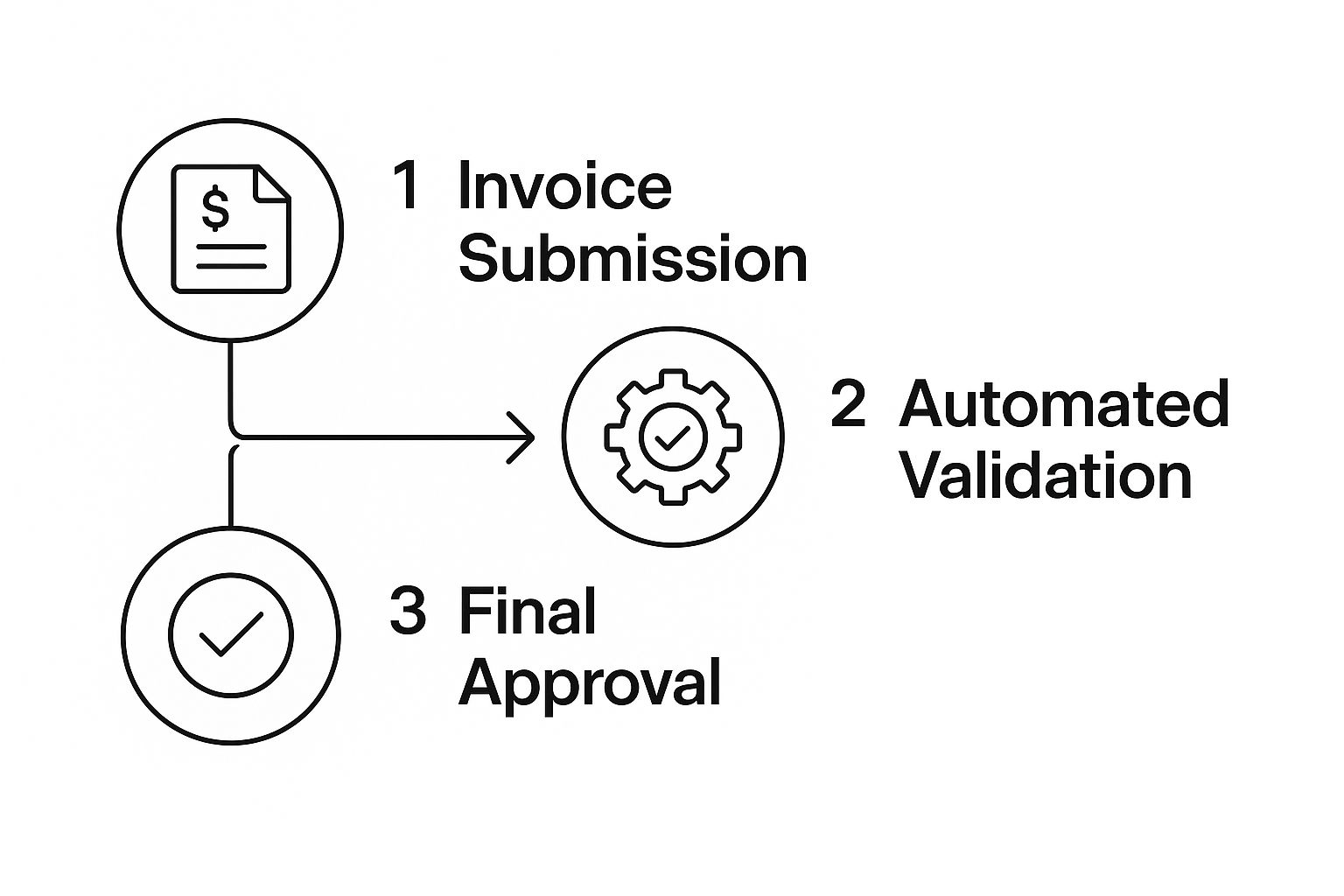

The infographic below shows just how clean and simple this process becomes.

As you can see, the system gets rid of the manual hand-offs and endless email chains that bog down traditional workflows. Approvers get a ping on their computer or phone, can quickly review the details, and approve it with a single click.

The best part? The entire process is tracked on a central dashboard. You get a bird's-eye view of everything, so at any moment, you can see exactly where an invoice is, who needs to review it, and how long it's been sitting there.

Once it's fully approved, the system's job still isn't done. It takes all that approved data - GL codes, payment details, and all - and syncs it directly with your accounting software. This final handshake closes the loop, ensuring your financial records are always accurate and up-to-date without anyone having to lift a finger for data entry.

Key Features of a Powerful Automation System

Not all invoice approval automation platforms are created equal. Once you start looking, you'll find a dizzying array of options, each with its own list of features. Choosing the right one isn’t just about ticking a box that says "automated." It's about finding the specific tools that will genuinely reshape your financial workflows and give you a real return on your investment.

Think of it like buying a new car. Sure, any car will get you from A to B. But some have GPS, state-of-the-art safety features, and a hybrid engine that saves you a ton on gas. Those are the features that make the drive smoother, safer, and cheaper. The same logic applies here.

To make a smart choice, you need to know what features are must-haves versus nice-to-haves. Let’s break down the core components that separate a basic tool from a system that can truly change your business.

Customizable Approval Workflows

This is the heart and soul of a great automation system. A rigid, one-size-fits-all approval chain is a recipe for frustration because no two businesses operate the same way. A powerful platform lets you build fully customizable approval workflows that mirror your company's actual rules and hierarchy.

This means you can set up smart, multi-step approval chains that kick in based on your own criteria. For example:

- •By Amount: Invoices under $500 could be auto-approved, while anything over $10,000 needs a sign-off from both the department head and the CFO.

- •By Department: A marketing invoice gets routed straight to the CMO, while an IT purchase lands on the tech lead’s desk. No more guesswork.

- •By Project Code: You can assign specific approvers to different projects, ensuring the right person is always reviewing project-related costs.

This kind of control gets invoices to the right people instantly, without your AP team having to manually chase anyone down.

Centralized Dashboard and Real-Time Visibility

Picture this: a single screen where you can see the live status of every single invoice in your company. That’s what a centralized dashboard gives you. It completely eliminates that dreaded "black hole" where invoices seem to vanish for days or even weeks.

With real-time visibility, anyone with permission can see if an invoice has been received, is waiting for approval, has been flagged with an issue, or is scheduled for payment. This transparency is a game-changer for forecasting cash flow and answering vendor questions on the spot.

Ironclad Audit Trails for Compliance

When the auditors show up, you need your ducks in a row. A top-tier automation system creates an unalterable digital audit trail for every invoice that passes through it. This log captures every touchpoint, from the moment the data is captured to the final approval stamp.

Each action is timestamped and tied to a specific user, creating a clean, chronological history. This isn't just great for audits; it’s a powerful tool for internal controls and preventing fraud. What used to be a stressful, paper-filled scramble becomes a simple matter of pulling a report. For a deeper dive, you can check out the top players in effective invoice automation software that really nail this feature.

Finally, here are two more essentials that tie everything together:

- •Seamless ERP and Accounting Integrations: The system has to play nice with your existing accounting software, whether that's QuickBooks, Xero, or NetSuite. This is non-negotiable. A smooth connection means approved invoice data syncs automatically, killing manual data entry and keeping your general ledger perfectly accurate.

- •Mobile Access and Approvals: Business doesn’t stop just because someone is out of the office. The ability for managers to review and approve invoices right from their phones is crucial. It keeps bottlenecks from forming and ensures the payment cycle keeps moving, no matter where your team is.

The Real-World Benefits of Automating Approvals

It’s one thing to talk about technical features, but what does invoice approval automation actually do for a business? The change isn't just a small improvement; for many, it’s a complete operational turnaround.

Think about a fast-growing e-commerce company, let's call them "Innovate Goods," that's getting swamped by its own success. Their finance team is drowning in paperwork, spending all their time chasing down approvals. This leads to late payment fees and some pretty tense phone calls from suppliers who are wondering where their money is.

Now, imagine Innovate Goods flips the switch on automation. Instead of paying penalties, they’re now snagging early payment discounts because they can approve and pay invoices so quickly. This single shift turns their accounts payable team from a cost center into a value generator. They can finally forecast their cash flow accurately and build strong, strategic partnerships with their vendors instead of just putting out fires.

This kind of success story is exactly why the market is exploding. The invoice automation software market was valued at USD 3.5 billion this year and is on track to hit a massive USD 10.2 billion by 2033. Businesses everywhere are catching on to the clear financial and operational wins these systems deliver. You can see more on this explosive growth in this market report.

Unlocking a Clear Return on Investment

The ROI here is about so much more than just paying bills on time. It shows up in several powerful ways that strengthen your company’s financial health from the inside out.

- •Dramatically Lower Processing Costs: Think about all the time your team spends printing, manually entering data, and physically storing paper invoices. Automation takes a hands-on process that can stretch for days and shrinks it down to just a few minutes, slashing those hidden labor costs.

- •Elimination of Human Error: Even the most meticulous person can make a typo. Automation removes the risk of manual data entry mistakes, preventing costly overpayments or duplicate payments that quietly drain your bank account.

- •Enhanced Security Against Fraud: Manual systems are a prime target for fake invoices. An automated system acts as a digital gatekeeper, immediately flagging suspicious details like a duplicate invoice number or a PO that doesn't match up.

Boosting Team Morale and Strategic Focus

Honestly, one of the most overlooked perks is how this changes things for your team. When you free skilled finance professionals from the soul-crushing grind of chasing paper and punching numbers, their jobs become infinitely more rewarding.

Instead of being data-entry clerks, they become financial analysts. Their time is reallocated to high-value activities like analyzing spending patterns, negotiating better terms with vendors, and contributing to the company's strategic financial planning.

This shift doesn't just make the department more efficient; it boosts morale and job satisfaction, which is key to keeping your best people around. Employees feel more engaged when their work actually matters. For a deeper look at empowering your finance team, check out our guide on the core benefits of accounts payable automation.

Ultimately, automation isn't about replacing people - it's about empowering them to work smarter, not harder.

Your Roadmap to a Successful Implementation

Bringing a new system into your business can feel like a huge undertaking, but rolling out invoice approval automation is completely doable when you have a solid plan. The trick is to see it not as a massive, disruptive overhaul, but as a series of clear, manageable steps.

This roadmap will walk you through the entire journey, taking you from your current manual setup to a smooth, fully automated workflow. By approaching it methodically instead of rushing, you’ll not only get the most out of your investment but also make the transition a breeze for your whole team.

Step 1: Map Your Current Process

Before you can build something better, you need to know exactly what you’re working with now. The first step is to sit down and trace your entire invoice approval process - from the moment an invoice hits your inbox to the second it gets paid.

Don't skip the small stuff. Document every person who touches it, every manual check, and every point where things tend to stall. This exercise is often an eye-opener. You’ll quickly spot the real bottlenecks. Are invoices piling up on a specific manager's desk? Is it the constant back-and-forth to fix coding mistakes? Pinpointing these pain points gives you a crystal-clear target for what your new automation needs to solve.

Step 2: Define Your Approval Rules

With a clear picture of your current process, it’s time to design your ideal one. This is where you get to translate your company’s internal policies into smart, automated rules that the software will follow. Get your key stakeholders in a room and hash out the logic that will power your invoice approval automation.

You'll want to answer questions like:

- •Who needs to approve invoices from which departments?

- •What's the dollar amount that triggers a second or even third level of approval?

- •Which invoices can be green-lit automatically if they perfectly match a purchase order?

Getting these rules right is absolutely critical. This is what ensures your system maintains compliance and follows your internal controls without anyone having to lift a finger.

Step 3: Choose the Right Software Partner

Now for the fun part: finding the right tool for the job. Not all platforms are created equal, so you’ll want to look for a partner whose features, integrations, and scalability match what you just mapped out. This is a big decision, especially since the market is evolving so quickly.

The global invoice automation software market is rocketing, projected to jump from $3.54 billion in 2025 to $8.6 billion by 2032. This isn't just random growth; it's fueled by the widespread adoption of AI and other powerful technologies. You can learn more about the expanding invoice automation market and where it's headed.

This explosion of options is great, but it also means you need to do your homework. Prioritize solutions that offer a seamless connection to your existing accounting software and have a great reputation for customer support.

Step 4: Run a Pilot Program

Whatever you do, don't try to switch everyone over at once. A pilot program is your best friend here. Pick a single department or a small group of trusted vendors to be your guinea pigs for the new system. This controlled test run lets you iron out any wrinkles in a low-risk, low-pressure environment.

This is where you’ll get invaluable, real-world feedback on your approval rules and spot any training gaps you might have missed. A successful pilot also builds momentum and creates internal champions who can sing the system's praises when you're ready for the company-wide launch.

Step 5: Train Your Team and Launch

The final step is all about your people. The best technology in the world is useless if your team doesn't know how to use it. Run clear, hands-on training sessions that focus on the "why" behind the change - how it will make their jobs easier, not just different.

Give them cheat sheets, guides, and plenty of support as they get used to the new way of doing things. Once your team feels confident and the pilot has proven the system works as it should, you’re ready to go live. With clear communication and a solid change management plan, your move to invoice approval automation will be a genuine success.

Frequently Asked Questions

Jumping into invoice approval automation is a big step, and it’s completely normal to have a few questions. Moving a core financial process to a new system can feel like a huge change, but getting clear on the common concerns around security, compatibility, and company size can make the path forward much clearer.

We get it. Many business owners and finance pros worry about trusting a new system with such a critical function. So, let’s walk through some of the most common questions we hear to help you feel confident about the decision.

How Secure Is Invoice Approval Automation Software?

This is usually the first question people ask, and for good reason. Any reputable automation platform builds its entire system on a foundation of security - it's not just an add-on. They use multiple layers of protection to keep your sensitive financial data locked down and safe from any unauthorized eyes.

Think of it like a bank vault. The security typically includes:

- •Data Encryption: Your information is scrambled and protected both while it's moving between systems (in transit) and while it's stored on servers (at rest). This is done using top-tier protocols like TLS and AES-256.

- •Access Controls: You can set specific user roles and permissions, meaning your team members can only see and approve the invoices that are relevant to their job. No one gets access to information they don't need.

- •Unalterable Audit Trails: Every single touchpoint is recorded. From the moment an invoice is received to the final payment approval, you have a permanent, timestamped log of who did what and when. This creates a transparent, tamper-proof record that’s perfect for audits.

Many of the best tools also have built-in AI that actively looks for red flags, like duplicate invoices or bills from sketchy vendors, adding another powerful layer of defense. When you're shopping around, always ask providers about their security credentials, like a SOC 2 certification.

Will This Software Integrate With My Accounting System?

Absolutely. In fact, this is one of the main selling points. Modern invoice approval automation tools aren't designed to rip out your existing accounting software. They’re built to work hand-in-hand with it, creating a single, connected system for your finances.

Leading platforms come with pre-built connectors or flexible APIs, allowing them to sync up smoothly with the most popular accounting and ERP systems out there. We're talking about systems like QuickBooks, Xero, NetSuite, and Sage.

The real magic happens once an invoice gets the green light. The system automatically sends all the verified data - the vendor name, GL codes, payment amounts, you name it - straight into your accounting software. This one step eliminates manual data entry, which is where so many costly mistakes happen.

Before you sign on the dotted line, just double-check that the provider has a solid, proven integration with the accounting software you rely on every day.

Is Automation Only for Large Corporations?

That’s a very common myth, but it’s one that keeps a lot of great businesses stuck in the past. While big companies were the first to jump on board, the game has completely changed. Thanks to cloud-based Software-as-a-Service (SaaS) models, powerful invoice approval automation is now totally accessible and affordable for businesses of all shapes and sizes.

For a small or medium-sized business (SMB), the time you get back from automating this work is priceless. It frees up your key people to focus on things that actually grow the business, instead of getting bogged down in administrative quicksand.

The benefits - like better cash flow, snagging early payment discounts, and building stronger relationships with your vendors - provide a massive return on investment, no matter how big your company is. Most providers offer pricing that scales with you, so you only pay for what you use. This makes it a smart, cost-effective move for any business.

Ready to stop chasing invoices and start optimizing your finances? See how Tailride can automate your entire AP process, from email capture to accounting sync, in just minutes. Discover the power of Tailride today!