Organizing Business Receipts Made Simple

Tired of receipt chaos? Learn how to build a simple, effective system for organizing business receipts. Get practical tips for digital tools and tax compliance.

That shoebox overflowing with faded receipts isn't just clutter. For most business owners I know, it's a major source of stress that gets in the way of real financial clarity. Honestly, creating a solid method for organizing business receipts is probably the single most important thing you can do for stress-free tax prep, smart budgeting, and making confident business decisions.

Let's treat this as a fresh start. It's time to ditch the chaos and build a system that actually works for you.

Finally Conquer Your Receipt Overload

That overflowing pile of paper isn't just an organizational headache; it’s a direct threat to your bottom line. Every lost receipt for a business lunch, a software subscription, or even a tank of gas is a missed tax deduction. That kind of financial leakage, added up over a year, can easily cost you hundreds or even thousands of dollars.

More than the money, it's the constant, low-grade anxiety that really gets you, especially when tax deadlines start looming.

The real challenge isn't that you're not trying. It's that you don't have a simple, repeatable system. To truly get a handle on this, you first need a clear picture of where your money is going. This is key to understanding your spending habits. Once you see the patterns, putting a system in place feels a lot more natural.

Find Your 'Receipt Home'

The very first thing to do is decide where every single receipt will live from now on. This "receipt home" has to be the one and only spot for all your proofs of purchase. No more frantic searching through your wallet, glove compartment, and a dozen different email inboxes.

You've got two main paths you can go down here. Before you commit, it helps to see them side-by-side.

Choosing Your Receipt Organization Approach

Here’s a quick comparison of the two main approaches for organizing business receipts to help you decide on the best starting point for your needs.

| Method | Best For | Key Benefit | Main Drawback |

|---|---|---|---|

| Physical System | Technophobes or those with very few monthly transactions. | Dead simple. No apps or software needed to get started. | Receipts get lost or fade, and it requires manual data entry later. |

| Digital System | Most businesses, especially those wanting to save time and integrate with accounting. | Durable, searchable, and automates data entry. A huge time-saver. | Requires a smartphone and a bit of setup with an app or cloud service. |

There's no single "right" answer, but choosing one and sticking with it is what truly matters.

The goal is consistency, not perfection. Choosing one method and sticking to it is far more effective than trying to create a complex system you won't actually maintain.

Commit today. From this moment on, every new receipt goes straight into its designated home - no exceptions.

This shift toward digital isn't just a trend; it's a massive movement in business finance. The global cloud-based receipt management market is projected to reach USD 11.36 billion by 2034. The receipt capture and scanning segment already holds the dominant market share, which tells you that businesses are overwhelmingly choosing automation to cut down on manual errors.

This isn't about chasing the latest tech. It's about embracing a proven method for getting your financial life in order.

Building Your Digital Receipt System

Let's be honest, the old shoebox full of crumpled receipts isn't just messy - it's a massive time suck and a serious liability. The single biggest upgrade you can make to your financial workflow is ditching the paper and creating a digital hub that actually works for you. Thankfully, setting one up is easier than you might think.

The heart of this new system is a dedicated tool. If you're a freelancer just starting out, a simple, well-organized folder system in Google Drive or Dropbox can get the job done. But for pretty much everyone else, a dedicated receipt scanning app or a feature built right into your accounting software is a game-changer.

Choosing the Right Digital Tool

The perfect tool for you really depends on your business. A solo consultant with maybe five expenses a month has completely different needs than a growing retail shop juggling hundreds of transactions. You don't need a sledgehammer to crack a nut, but you also don't want to bring a butter knife to a construction site.

When you're shopping around, here are the things I always tell people to look for:

- •OCR Capability: This is a non-negotiable. Optical Character Recognition (OCR) is the magic that automatically reads the key details - vendor name, date, total amount - from a photo of your receipt. It’s what saves you from mind-numbing manual data entry.

- •Accounting Integration: Can it talk to your accounting software? Whether you use QuickBooks, Xero, or Wave, a direct connection creates a seamless flow and saves you hours of painful reconciliation work later.

- •Ease of Use: If the app is clunky and a pain to use on the go, you just won't use it. Plain and simple. Always test out the mobile app experience before you commit.

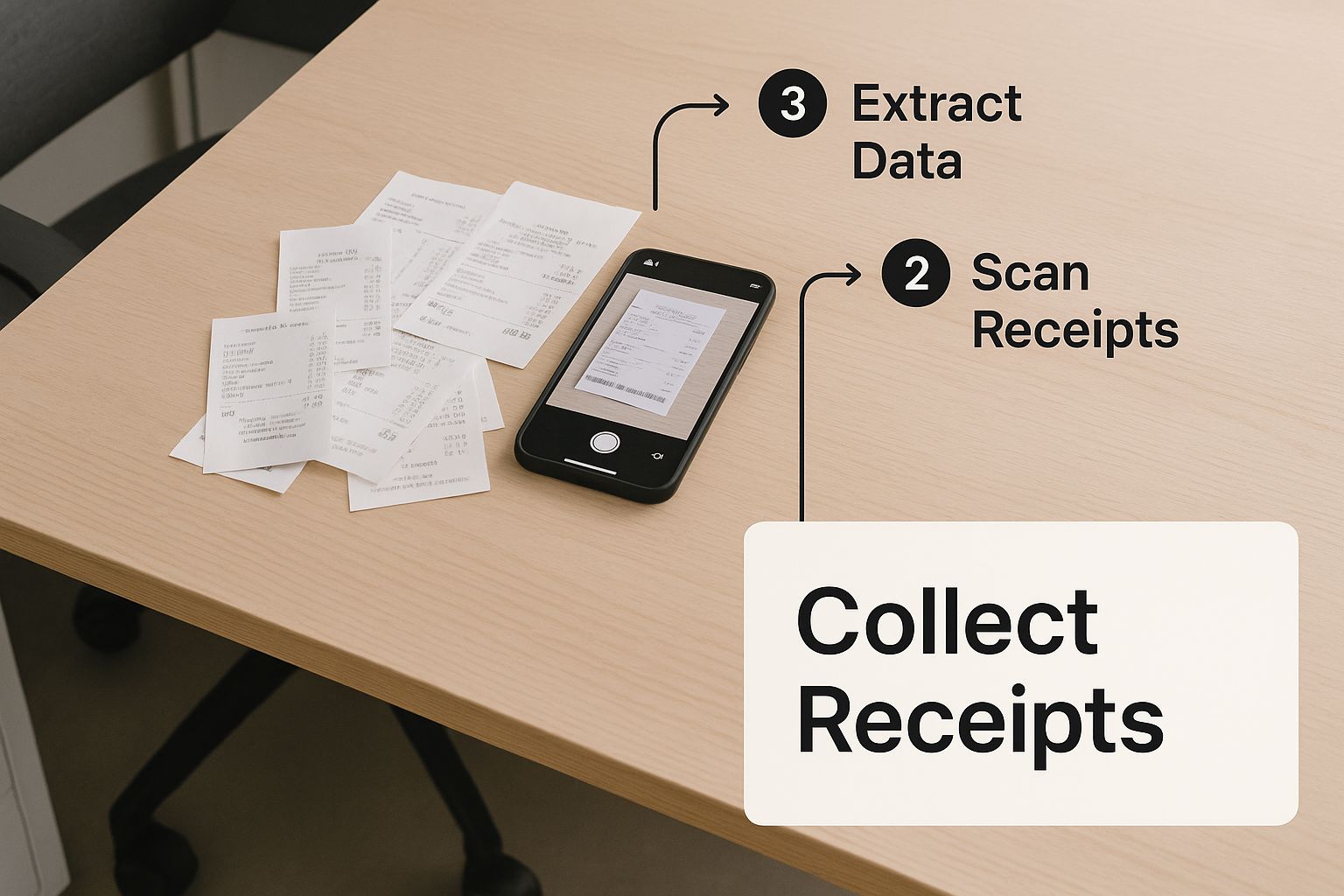

To give you a sense of what a modern app can do, check out this screenshot from Wave's receipt feature. It’s a great example of a clean, simple interface.

As you can see, you can snap a photo with your phone or upload a file from your computer, and the app instantly gets to work scanning the details and getting them ready for your books.

Establish a Foolproof Naming Convention

Even with a fantastic app, a consistent file naming system adds a powerful layer of organization. This is especially true if you’re starting with a cloud storage solution. I’ve found a simple, effective format is "YYYY-MM-DD_Vendor_Amount".

For instance, a receipt from a Staples run for $45.20 on October 26, 2024, becomes 2024-10-26_Staples_45.20.pdf. This simple trick makes your files instantly searchable and sortable by date, vendor, or even amount, no matter where they're stored.

The real power of a digital system isn't just about storing receipts; it's about finding them. When everything is captured and named the same way, you can pull up any proof of purchase in seconds. That's absolutely invaluable during tax time or, heaven forbid, an audit.

This entire process kicks off with one simple habit: capturing every single receipt. It doesn't matter if it's a paper slip from a coffee shop or a PDF that just landed in your inbox - grab it immediately before it disappears into the void.

Building this system is a fantastic first step. As you grow, you might want to explore the wider document management system benefits to streamline all of your record-keeping. And if your business handles a lot of billing, looking into invoice automation software is the logical next step for creating a truly efficient, hands-off financial workflow.

Categorizing Receipts for Effortless Tax Prep

Getting your receipts into a digital format is a great first step, but the real game-changer is how you categorize them. Honestly, this is what turns a digital mess into a genuinely useful financial tool that will save you a world of pain come tax season.

Getting your receipts into a digital format is a great first step, but the real game-changer is how you categorize them. Honestly, this is what turns a digital mess into a genuinely useful financial tool that will save you a world of pain come tax season.

Think of it this way: a good categorization system is your secret weapon for maximizing deductions and understanding where your money is really going. Without it, you’ve just got a digital shoebox. With it, every single expense has a home, making your financial reporting and budgeting so much easier.

Align Your Categories with Tax Forms

So, where do you start? My best advice is to stop trying to invent your own system and simply copy what the IRS and your accountant already use. Line up your categories with the expense fields on standard tax forms.

Here are some of the most common buckets you'll need:

- •Office Supplies: The basics, like pens, paper, printer ink, and planners.

- •Software & Subscriptions: Those recurring monthly fees for tools like Asana, Adobe Creative Cloud, or Dropbox.

- •Meals: Business lunches with clients or your meals when you're on the road for work.

- •Travel: This covers flights, hotels, and rental cars for any business-related trips.

- •Utilities: A percentage of your home internet or cell phone bill that you can attribute to your business.

Nearly every decent receipt scanning app will let you set up your own custom categories or tags. Do this right from the get-go. It makes filing each receipt as simple as a couple of taps, and that consistency is absolutely essential for clean financial reports. If you're building this habit from scratch, our guide on how to organize receipts is a fantastic resource to get you going.

Handling Mixed-Use Receipts

Ah, the dreaded mixed receipt. We've all been there - you run into Costco for a new office chair but also grab a rotisserie chicken and a giant bag of coffee for home. This is where people often get tripped up. The most important thing to remember is to never claim the full amount.

The golden rule for mixed receipts is to isolate the business expense. Before you even scan it, use a pen to circle the business-related items and write the subtotal next to it. When you digitize it, only enter the business portion into your system and add a note like "Business supplies only" for clarity.

This tiny bit of discipline keeps your books squeaky clean and ready for any audit. It proves you're serious about separating your personal and business finances, a crucial habit for accurately tracking your company's real profitability. When you get this right, you're not just organizing receipts - you're empowering yourself to make smarter financial decisions all year long.

Connecting Receipts to Your Accounting Workflow

Having an organized pile of receipts is one thing, but connecting them directly to your books is where the real magic happens. This is the move that takes you from simply storing records to building a truly efficient financial workflow. The goal is to create a seamless bridge between a purchase and its final destination in your accounting records.

Most modern receipt apps are designed specifically for this. They're built to talk to major accounting platforms like QuickBooks, Xero, and Wave. This connection is what finally automates a process that used to be a soul-crushing, manual chore.

How Automated Data Extraction Works Its Magic

Behind the scenes, this connection is powered by a clever bit of tech called Optical Character Recognition (OCR). When you snap a photo of a receipt, the OCR software isn’t just taking a picture - it’s actually reading it. The software intelligently hunts for and pulls out the key pieces of information: the vendor's name, the date, and, of course, the total amount.

That extracted data is then zapped over to your accounting software to create a draft expense transaction. The days of squinting at faded receipts and painstakingly typing every line item into a spreadsheet are finally behind us. This isn’t just a time-saver; it’s a massive win for accuracy by cutting down on human error.

The whole point is to touch each receipt just once. Capture it, and let the system handle the heavy lifting of data entry and categorization. Your books stay current with almost no extra effort on your part.

This shift isn't just a nice-to-have anymore. By 2025, an estimated 71% of finance leaders admit they struggle with expense compliance and fraud detection using manual systems. It’s no surprise that businesses are flocking to AI-powered tools for better real-time tracking. You can dive deeper into these emerging expense management trends on primesourcex.com.

A Real-World Integration Example

Let's walk through a common scenario to see how this plays out in the real world. Say you just bought coffee for a client meeting. Here's what the new process looks like:

- •

Capture It on the Spot: You pay and get the receipt. Right there at the counter, you pop open your receipt app, take a quick photo, and give it a once-over to make sure the OCR got the details right.

- •

Let the Sync Happen: Because your app is already hooked up to your accounting software, it automatically forwards the data. A new draft expense from "The Coffee Shop" for the correct amount and date is created without you lifting another finger.

- •

Review and Reconcile Later: When you're doing your books, you'll see that draft expense waiting for you. Once the actual charge hits your bank feed, your accounting software will likely suggest a match. One click, and the expense is officially reconciled.

A task that used to involve pocketing a paper receipt, trying to remember to enter it later, and then manually matching it to a bank statement now takes about 30 seconds. This is how organizing business receipts properly ensures nothing ever slips through the cracks, giving you a constantly accurate view of your company's finances.

Keeping Your Receipts Safe for the Long Haul

Alright, so you’ve scanned and sorted your receipts. The final piece of the puzzle is making sure they’re stored correctly for long-term compliance. A neat digital system is fantastic for day-to-day work, but its true power lies in keeping you on the right side of tax authorities like the IRS.

The great news? Digital receipts are not only allowed, but they're often better than paper. The IRS has given the green light to digital records for years, as long as they're clear, accurate, and complete. Think about it: a receipt saved in the cloud won't fade like thermal paper, get lost during an office move, or be ruined by an unfortunate coffee spill. That right there is a huge win over a clunky old filing cabinet.

So, How Long Do I Need to Keep Receipts?

This is the million-dollar question every business owner asks. While there can be some nuances, the IRS actually gives us some pretty clear timelines to follow.

- •

The 3-Year Rule: For most day-to-day business expenses, you’ll need to hang onto those records for three years from the date you filed your tax return. This is your baseline.

- •

The 6-Year Rule: The clock extends to six years if you happen to underreport your income by more than 25%. It’s an edge case, but it’s important to know.

- •

The 7-Year Safety Net: If you're claiming a loss from something like a bad debt or worthless securities, the requirement is seven years. Honestly, most accountants will just tell you to adopt the seven-year rule for everything. It’s the safest, simplest way to make sure you’re always covered.

Getting a handle on these long-term rules is a cornerstone of effective record-keeping for small businesses and will save you major headaches down the road.

Creating a Bulletproof Backup Plan

A digital archive is a fantastic first step, but what if the service you rely on has an outage or you accidentally delete a crucial folder? This is where a solid backup strategy becomes absolutely essential. You're aiming for redundancy.

Your primary cloud storage should never be your only digital storage. A simple "set it and forget it" backup plan protects you from data loss and ensures you can always produce records when needed.

Most dedicated receipt apps handle this for you with automatic cloud backups, which is a massive perk. Our guide on the best receipt scanning software dives into which tools have the strongest backup features.

But if you’re building your own system with something like Google Drive, you’ll want to create a secondary backup. It could be as simple as setting up an automated monthly sync from your main folder to another cloud service like Dropbox, or even to an external hard drive you keep offline.

This one small action transforms your digital files into a secure, long-term asset. It's the final step that ensures if you ever face an audit, you can pull up any document in seconds with total confidence.

Common Questions About Organizing Receipts

Even with a great system, you're bound to run into a few tricky situations when organizing your business receipts. Let's walk through some of the questions I hear all the time from business owners and freelancers. Getting these details right can save you a ton of headaches later.

Think of it this way: nailing these small points is what makes your financial system truly work for you, especially when the pressure of tax season hits.

How Long Should I Keep Business Receipts?

This is the big one, and for good reason. For U.S. tax purposes, the IRS officially suggests keeping receipts for at least three years after you've filed the related tax return. That’s the absolute minimum for most of your day-to-day expenses.

But here's where it gets a little more complicated. If you happen to underreport your income by more than 25%, that window suddenly jumps to six years. To avoid any "what if" scenarios, most accountants (myself included) will tell you to just stick to a simple seven-year rule for everything. It gives you a comfortable buffer and peace of mind. With a digital system, holding onto records for that long is easy - no dusty boxes or faded thermal paper to worry about.

Are Digital Copies of Receipts Valid for an IRS Audit?

Yes, they absolutely are. The IRS has been accepting digital copies for years, as long as they are clear, complete, and accurate. This is a massive win for anyone trying to escape the paper pile-up.

The key is making sure your digital copy has all the same info as the original: who you paid, when you paid them, what you bought, and how much it cost.

Honestly, digital copies are often safer than paper ones. A paper receipt can get lost, soaked in a coffee spill, or destroyed in a fire. The only catch is that you have to be diligent about making sure your digital files are reliably stored and - this is crucial - backed up.

How Do I Handle a Receipt with Both Business and Personal Items?

We’ve all been there. You do a big run at Costco and walk out with a new office printer and a week's worth of groceries on the same bill. It's a super common problem, but the fix is straightforward.

Your goal is to separate the costs before you log the expense.

- •On a Paper Receipt: Grab a pen, circle the business items, and jot down the business subtotal right on the receipt. Then scan it.

- •Inside Your App: If you forget to do it on paper, no problem. Just use the notes or annotation feature in your scanning app to mark which items were for the business.

When it's time to enter the expense into your books, you only record the total for the business items. Never, ever claim the full amount. I always recommend adding a quick memo like "Business supplies only" for extra clarity. It makes your records clean and audit-proof.

Should I Use a Dedicated Receipt App or Cloud Storage?

This really comes down to how many expenses you have and how complex your business is. If you're a freelancer with just a few receipts a month, a neatly organized folder in Google Drive or Dropbox can work just fine. The trick is to be disciplined with your file naming.

For most growing businesses, though, a dedicated receipt app is a game-changer. These tools don't just store images; they use technology to automatically read the data, categorize it for you, and send it straight to your accounting software. The time you save on manual data entry is huge, freeing you up to focus on what actually matters - running your business.

Ready to stop chasing down receipts and put your financial workflow on autopilot? Tailride connects to your inboxes and online accounts to grab every invoice and receipt automatically. It uses AI to pull out the key data and syncs it right into your accounting software. No more manual entry, just hours of your time back every week.