Your Guide to Accounting AI

Discover how accounting AI can transform your finance workflow. Our guide explains the benefits, use cases, and how to implement AI in your business.

Tags

Picture this: you have a brilliant assistant who works around the clock, never fumbles a calculation, and tackles your most mind-numbing financial tasks in a flash. That, in a nutshell, is accounting AI. It's not here to replace accountants, but to give them a seriously powerful partner for navigating modern finance.

What Is Accounting AI?

At its heart, accounting AI is simply the use of artificial intelligence to automate and improve financial workflows. Don't think of a robot sitting at a desk. Instead, imagine smart software that learns, adapts, and handles tasks that used to eat up hours of your day.

Unlike older software that just followed a strict set of rules, accounting AI actually understands context. For instance, it can open a PDF invoice, figure out who the vendor is, pull the total amount, and categorize the expense correctly - all on its own. That kind of capability completely reshapes the day-to-day for finance pros.

It's More Than Just Basic Automation

The real magic of accounting AI isn't just about putting repetitive tasks on autopilot. It adds a layer of intelligence that we just didn't have before. By digging through huge amounts of financial data, these systems can spot trends, flag potential mistakes, and even create remarkably accurate forecasts.

By automating routine compliance tasks, such as data entry and tax preparation, accounting firms can reduce manual workload and increase accuracy. This allows accountants to shift their focus toward more profitable advisory services.

This change turns accounting from a backward-looking, historical function into one that's proactive and strategic. The technology takes care of the "what," which frees up human experts to dig into the "why" and figure out "what's next."

The Key Ingredients of Accounting AI

Modern accounting AI tools usually blend a few core technologies to get the job done. The technical stuff can get complicated, but what they do is pretty straightforward.

- •Machine Learning (ML): This is the "brain" of the operation. It learns from data. The more invoices it sees, the smarter it gets at recognizing different layouts and automatically sorting expenses.

- •Natural Language Processing (NLP): This is what lets the AI understand human language. It’s the reason a system can read an email, find the attached receipt, and pull out the important details.

- •Robotic Process Automation (RPA): Think of this as the "hands." It handles the boring, rule-based jobs like logging into a bank portal to download a statement or copying data from one spreadsheet to another.

When you put these pieces together, you get a seamless system that handles the grunt work. This leaves accountants free to concentrate on strategic analysis, advising clients, and high-level financial planning - the kind of work where human experience is truly essential.

How Does Accounting AI Actually Work?

So, how does this AI stuff actually function in the accounting world? Let’s pop the hood and take a look, minus all the confusing tech-speak.

At its heart, accounting AI learns from data, a lot like you'd train a new hire. Imagine you're showing a junior accountant how to process invoices from a specific supplier. After they've seen a few thousand examples - all with different layouts, line items, and dates - they start to recognize the patterns. They intuitively know what an invoice number looks like, where to find the total, and how to code it to the right expense account.

That's exactly what AI does. It's not just following a rigid, pre-programmed script; it's genuinely learning to understand financial documents.

The Engines Driving the AI

This learning is powered by a few key technologies working in concert. Think of them as the specialized experts on your AI team, each with a unique skill.

- •

Machine Learning (ML): This is your team's pattern-spotter. It’s the same magic that lets your music app learn your tastes and recommend new songs. In accounting, ML algorithms sift through years of financial data to learn what's "normal" for your business. This makes them incredibly good at flagging weird transactions that might point to fraud or a simple mistake.

- •

Natural Language Processing (NLP): This is the translator. NLP is what gives the AI the power to read and understand human language. It’s the tech that lets software scan a PDF receipt, pull out the vendor's name, identify the purchase date, and grab the total amount, just like a person would.

- •

Robotic Process Automation (RPA): Meet your diligent assistant. RPA takes over the boring, repetitive digital tasks. This could be anything from logging into a supplier's website to download the latest statements to moving data from a spreadsheet into your accounting platform. It's the ultimate cure for tedious copy-paste work.

When you bring these technologies together, you get a powerful system that doesn’t just automate tasks - it does them with a layer of real intelligence.

From Recognizing Data to Creating Insights

The real game-changer is when accounting AI moves beyond just entering data. By constantly analyzing your financial information, these systems can start making predictions. For example, an AI tool can look at your accounts receivable and historical payment trends to build a scarily accurate cash flow forecast.

Accounting AI doesn't just look in the rearview mirror. It uses the past to intelligently predict what’s coming, giving businesses a vital look into their future financial health.

This predictive power changes everything. Instead of just reacting to last month’s numbers, you can start making proactive decisions based on where your finances are likely to be next week or next quarter.

This demand for smarter financial tools is fueling incredible growth. The AI in accounting market was valued at USD 5.48 billion in 2024 and is projected to skyrocket to USD 53.41 billion by 2034. That’s a compound annual growth rate of 25.6%, driven by the universal need to automate tasks and slash operational costs. You can explore more about the factors driving this growth and see what it means for the future of finance.

A Real-World Example: An Invoice's Journey

Let's walk through how a single invoice gets processed in an AI-powered system to see how this all comes together.

- •

Capture: An invoice lands as a PDF in your company's main inbox. The AI, which is connected to that inbox, immediately spots it and snags the file.

- •

Extraction: Using NLP, the AI reads the document. It pulls out the key info - vendor, invoice number, due date, and line-item details - even if it's a completely new invoice format.

- •

Categorization: Machine learning kicks in. Based on thousands of past invoices, the AI correctly codes the expense as "Software Subscriptions" and assigns it to the Marketing department's budget.

- •

Verification: The system then cross-checks the invoice against the original purchase order in your system, making sure the amounts line up. If there’s a mismatch, it flags it for a human to review.

This whole sequence, which might take a person a few minutes of focused work, happens in seconds with near-perfect accuracy. It's this blend of speed, smarts, and reliability that truly defines how accounting AI works.

The Real-World Payoffs of Bringing AI into Your Accounting

So, why should your business actually care about accounting AI? It’s about more than just trimming a few hours from your workweek. When you weave smart technology into your financial workflows, you set off a chain reaction of benefits that completely reshape how you operate, plan, and grow.

I like to think of it this way: traditional accounting is like driving while only looking in the rearview mirror. You're just recording things that have already happened. Accounting AI, on the other hand, gives you a live dashboard for the present and a GPS for the road ahead.

Let's break down the tangible benefits you'll see.

A Whole New Level of Efficiency

The first thing you'll notice is a massive leap in efficiency. AI is a powerhouse when it comes to automating the tedious, repetitive tasks that drain your team's energy - think invoice processing, data entry, and sorting through thousands of transactions.

Take a small e-commerce business, for example. The owner used to spend two full days every month manually downloading, printing, and keying in hundreds of supplier invoices and payment receipts. Now, her AI-powered accounting system automatically fetches every invoice from her email and vendor portals, pulls out the key details, and lines it all up for a quick review.

A huge plus of bringing AI into accounting is its power to reshape how businesses manage paperwork. This leads to big gains in efficiency and accuracy through advanced AI document processing.

What once ate up days of mind-numbing work now takes just a couple of hours of oversight. This isn't just about saving time; it's about fundamentally changing how your business operates. Many companies find they can eliminate manual data entry entirely, freeing up their people for work that actually requires a human brain. If you're ready to get started, you can learn how to automate bookkeeping and see these results for yourself.

Near-Perfect Accuracy and Rock-Solid Compliance

Let's be honest, people make mistakes. But in accounting, a simple typo or a misplaced decimal can snowball into incorrect financial statements, compliance headaches, and bad business decisions. AI is your safeguard against this.

By taking over data entry and reconciliation, AI systems deliver a degree of accuracy that even the most careful person can't match. An AI can instantly check an invoice against its purchase order and flag any mismatch - a task that's nearly impossible to do manually when you're dealing with hundreds of documents.

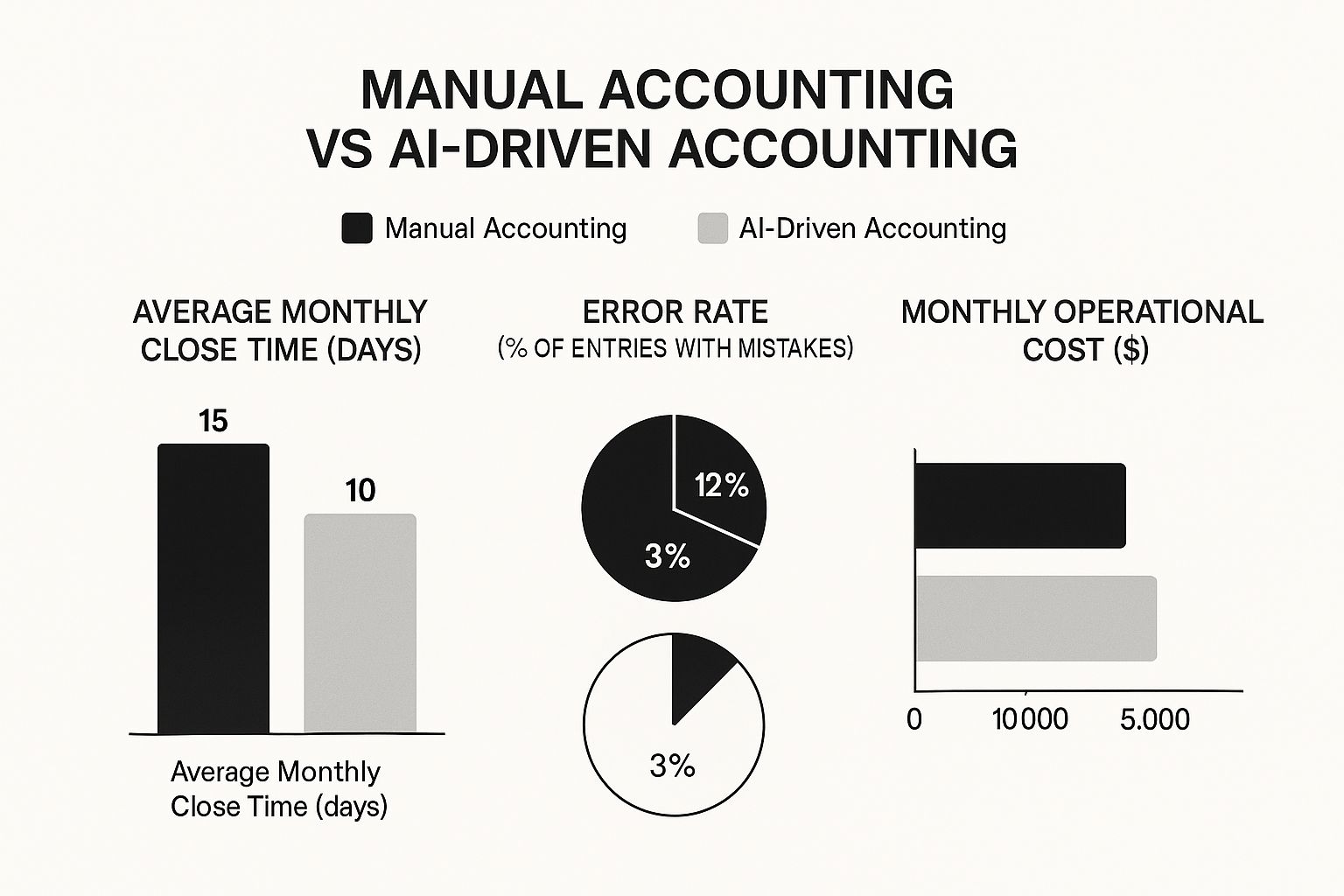

To see just how different the two approaches are, take a look at this comparison.

Manual Accounting vs AI-Powered Accounting

| Feature | Manual Accounting | AI-Powered Accounting |

|---|---|---|

| Data Entry | Time-consuming, prone to human error. | Automated, fast, and highly accurate. |

| Reconciliation | A manual, often monthly chore. | Continuous and happens in real-time. |

| Error Rate | Higher due to typos, miscategorization. | Drastically lower, with built-in checks. |

| Strategic Focus | Focused on historical record-keeping. | Focused on future analysis and strategy. |

| Fraud Detection | Relies on periodic audits; often delayed. | Proactive, real-time anomaly detection. |

The takeaway is clear: AI doesn't just speed things up; it makes your financial data more reliable, which is the foundation of a healthy business.

From Number Crunching to Strategic Insights

This might be the most valuable benefit of all. Accounting AI elevates your finance team from a back-office cost center to a strategic partner in the business. When your team isn't buried in spreadsheets, they can focus on high-impact analysis.

- •Live Cash Flow Visibility: Forget waiting for a month-end report. You get an up-to-the-minute look at your cash position, empowering you to make smart, timely decisions.

- •Smarter Forecasting: AI can analyze past data and market trends to build much more accurate financial forecasts, helping you prepare for a growth spurt or a potential dip.

- •Deep Performance Analysis: Accountants can finally spend their time digging into spending patterns, spotting opportunities to save money, and offering solid advice on business strategy.

This shift means you can start asking forward-looking questions like, "Can we afford to hire two new developers next quarter?" or "What's the real financial impact if we expand into a new market?" You get answers backed by data, not guesswork.

Your 24/7 Fraud Watchdog

Finally, AI acts as a vigilant guard for your finances. It quickly learns what "normal" looks like for your company's transactions. The moment something deviates from that pattern - like an unusually large payment to a brand-new vendor or a duplicate invoice - the system flags it for a human to review.

This proactive monitoring is worlds more effective than traditional methods, which often only uncover fraud months later during a manual audit. For a business owner, this delivers incredible peace of mind, knowing an intelligent system is protecting the company's assets around the clock.

Accounting AI Use Cases in the Real World

All the theory behind accounting AI sounds great, but where the rubber really meets the road is in how it solves everyday business problems. Companies of all sizes are putting these smart systems to work, not just to speed things up, but to gain a real competitive edge. The results are so compelling that the market is exploding.

Recent analysis shows just how fast this is happening. The global AI in accounting market was valued at USD 4.87 billion in 2024. By 2033, it's expected to skyrocket to nearly USD 96.69 billion. That’s a compound annual growth rate (CAGR) of 39.6%, fueled by businesses adopting AI for everything from paying bills to spotting fraud. If you're interested in the details, you can read the full research about these market dynamics and see just how quickly this technology is reshaping finance.

This isn't just a trend for giant corporations, either. It’s about practical tools making a difference right now. Let’s dive into some of the most common ways AI is being used in accounting today.

Intelligent Invoice and Receipt Processing

One of the first and most tangible wins with accounting AI is taking over the tedious task of handling invoices and receipts. What was once a mountain of manual, error-prone work becomes a smooth, automated flow.

Picture this: your inbox is a mix of PDF invoices, photos of receipts, and even payment details buried in email chains. An AI-powered system like Tail-spend management platform can plug right into your email, automatically sniffing out and grabbing these documents without anyone having to lift a finger.

- •Data Extraction: The AI uses Natural Language Processing (NLP) to "read" each document. It pulls out key details like the vendor’s name, invoice number, due date, and even specific line items with impressive accuracy.

- •Smart Categorization: Then, machine learning kicks in. The AI looks at the data, compares it to past transactions, and intelligently sorts the expense. For example, it knows a bill from Amazon Web Services should be categorized under "Cloud Hosting Costs."

- •Workflow Integration: Finally, all this neatly structured data is sent straight into your accounting software, whether it's QuickBooks or Xero, ready for you to approve and pay.

This completely eliminates manual data entry, freeing up countless hours and dramatically cutting down on human error.

Proactive Anomaly and Fraud Detection

AI systems are masters at spotting patterns, which makes them incredible watchdogs for your company’s finances. They quickly learn what "normal" looks like for your business and can instantly flag anything that seems out of place.

Instead of waiting for a monthly or quarterly audit to hopefully catch a problem, accounting AI acts like a 24/7 fraud analyst, providing continuous, real-time monitoring.

For instance, an AI might raise a red flag for:

- •A sudden, unusually large payment to a new vendor you've never worked with before.

- •Two invoices that have the same number but slightly different payment amounts.

- •An employee submitting an expense claim that is way higher than their typical spending habits.

This gives your finance team a chance to investigate potential issues the moment they happen, before they snowball into major losses. It’s a layer of security that manual checks just can't replicate.

Dynamic Financial Forecasting and Planning

Traditional accounting is all about looking in the rearview mirror. AI-powered accounting, on the other hand, helps you look ahead with much more confidence and clarity. By crunching massive amounts of historical data and factoring in real-time market trends, AI can build remarkably detailed and dynamic financial forecasts.

Forget about the static spreadsheet you update once a quarter. Imagine having a live, breathing financial model. This model can run different "what-if" scenarios on the fly, answering questions like, "What happens to our cash flow if our biggest client pays 30 days late?" or "How will a 5% jump in material costs impact our profit margins over the next six months?"

This capability changes the role of the finance department from a historical scorekeeper to a strategic partner. Business leaders can make critical decisions based on data-driven predictions, not just gut feelings, leading to smarter, more agile planning for both growth and risk.

How to Implement Accounting AI in Your Business

So, you're ready to bring accounting AI into your business? It might sound like a massive undertaking, but I promise it's more manageable than it seems. A great rollout isn't about flipping some master switch and changing everything overnight.

Instead, it's about being strategic. You start small, focus on your biggest headaches first, and build from there. When you take a thoughtful, step-by-step approach, bringing AI on board can be a genuinely smooth - and even exciting - process for everyone.

Start by Identifying Your Biggest Pains

Before you even think about shopping for software, take a hard look at your current processes. Where does your team get bogged down? What repetitive tasks are most likely to have errors or just make everyone groan?

Nailing down these specific pain points is the single most important first step. It gives you a crystal-clear target for what you want the AI to fix.

Common trouble spots usually include things like:

- •Manual Invoice Processing: Are you buried under a mountain of PDF invoices that someone has to key in by hand?

- •Expense Report Chaos: Is the end-of-month scramble to chase receipts and categorize expenses driving you crazy?

- •Slow Bank Reconciliations: Does it take days - or even weeks - to get your bank statements to match your books?

- •Delayed Financial Reporting: Do you struggle to pull up-to-date numbers when you need to make a quick decision?

By zeroing in on your top one or two problems, you can find a tool designed to solve exactly that, guaranteeing you see a real impact right away.

Choose the Right Accounting AI Software

Once you know what you're trying to fix, it's time to find the right tool. The market is packed with options, from all-in-one platforms to highly specialized apps.

As you look at different software, here’s what I’d focus on:

- •Specific Functionality: Does the tool do the one thing you need it to do exceptionally well? If invoice processing is your nightmare, you want a tool known for its dead-on data extraction.

- •Ease of Use: A tool is only powerful if your team actually uses it. Look for a clean interface and a straightforward setup.

- •Integration Capabilities: This one is non-negotiable. The AI tool absolutely must play nicely with your existing systems, especially your core accounting software like QuickBooks or Xero. Strong accounting software integration is what makes an automated workflow truly seamless.

Prepare Your Data for a Clean Start

Think of it like moving into a new house - you wouldn't want to bring all your old junk with you, right? Before you flip the "on" switch, spend a little time tidying up your financial data.

This means making sure your chart of accounts is logical, your vendor lists are current, and your historical data is clean and consistent. Giving the AI a clean dataset to learn from is like giving it a head start, leading to much more accurate results from day one. A bit of digital spring cleaning now will save you from major headaches down the road.

A common misconception is that AI is a "set it and forget it" solution. In reality, the most successful implementations involve a partnership, where the AI handles the bulk of the work and humans provide oversight, training, and strategic direction.

This approach ensures you get all the amazing benefits of automation while still keeping your hands on the wheel.

Train Your Team for Collaboration, Not Replacement

Let's be honest: introducing AI can make people nervous. It's crucial to frame this new technology as a helper - a powerful assistant that's here to make their jobs better, not take them away. Getting your team on board is everything.

And this isn't just a hunch; it's a feeling shared across the industry. Roughly 61% of accountants see AI as a positive force that helps them improve their work through automation and deeper analysis. If you're curious, you can dig into the latest industry reports to see how professionals are embracing these tools.

Focus your training on how the AI will free them from the boring, repetitive stuff. This frees them up to do more interesting, high-impact work, like analyzing trends and solving complex problems. They're not data-entry clerks anymore; they're managers of an intelligent system.

A great way to ease into it is with a small pilot program. Pick one workflow - maybe automating expense reports for just one department. This "start small, then scale" method lets you iron out the wrinkles, build your team's confidence, and prove the tool's value before you roll it out to the whole company.

Busting Common Myths and Overcoming Hurdles

Jumping into any new technology comes with a healthy dose of skepticism. When it's something as significant as accounting AI, it's easy for myths to get tangled up with reality. So, let’s clear the air and tackle the biggest concerns head-on. You'll find that these hurdles are a lot smaller than they seem.

A lot of business owners see the letters "A.I." and immediately think "expensive." There's a lingering idea that this kind of tech is only for massive corporations with bottomless budgets. A few years ago, that might have been true, but not anymore.

Thanks to the cloud, powerful AI tools are now incredibly accessible and affordable. Many operate on a simple subscription basis, so you can get started without a huge upfront investment and scale up as your business grows.

"But Is My Financial Data Really Secure with AI?"

This is a big one, and it's a completely valid question. Handing over sensitive financial information is a serious decision, and data security has to be the top priority. Good news: reputable AI providers get this. They build their platforms with bank-level security from the ground up - it’s not just an add-on, it’s the foundation.

Think of it like the security you trust for your online banking. These platforms typically use:

- •End-to-end encryption, which scrambles your data as it travels and when it's stored.

- •Secure cloud infrastructure from trusted giants like Amazon Web Services (AWS) or Microsoft Azure.

- •Strict access controls to ensure only you and your authorized team members can touch the data.

When you're vetting a tool, look for a company that's open and proud of its security practices. A partner you can trust will have no problem showing you exactly how they keep your information safe.

"Will AI Make My Accountant Obsolete?"

This might be the most common myth of them all - the idea that smart machines are coming for accountants' jobs. The reality couldn't be more different. AI isn't a replacement for your accountant; it’s their new best collaborator.

Here’s a better way to think about it: AI excels at the repetitive, high-volume tasks that consume an accountant's day. We're talking about mind-numbing data entry, categorizing hundreds of transactions, and tedious reconciliations. Automating that work doesn't make the accountant disappear. It frees them up to do what people do best.

AI handles the "what" so human experts can focus on the "why" and "what's next." It turns an accountant from a number-cruncher into a genuine strategic advisor.

When the grunt work is off their plate, accountants can finally dedicate their expertise to what really matters: analyzing financial health, providing strategic advice, and solving complex business problems. It's a shift toward more engaging and valuable work. To see this in action, explore these accounts payable automation best practices and see how it elevates the entire function.

Got Questions? We've Got Answers

It’s completely normal to have questions as you think about bringing new technology into your accounting workflow. Let's walk through some of the most common ones we hear about accounting AI.

Is AI Going to Replace My Accountant?

Short answer? No. Think of accounting AI as a powerful assistant, not a replacement. Its real strength lies in handling the tedious, repetitive work that eats up so much of an accountant's day - things like manual data entry or coding endless transactions.

This is actually great news for human accountants. By offloading that grunt work to AI, they get to spend more time on what they do best: strategic analysis, advising clients, and solving complex financial puzzles. Those are things that require critical thinking, creativity, and a human touch - skills a machine can't replicate.

Is This Tech Just for Big Companies?

Not at all. That might have been true years ago when AI was clunky and incredibly expensive, but things have changed dramatically. Today, there are tons of affordable, cloud-based AI tools designed specifically for small and medium-sized businesses (SMBs).

It's like the playing field has been completely leveled. Smaller businesses can now tap into the same kind of powerful automation and efficiency that used to be reserved for massive corporations.

This means you can streamline your finances, get more accurate books, and gain a real advantage - all without needing a huge budget or an in-house IT team.

How Safe Is My Financial Data in an AI System?

This is a big one, and rightly so. Reputable AI providers take data security incredibly seriously. For them, security isn't just a feature; it's the foundation of their entire platform. They use the same kind of security measures your bank does to protect your sensitive financial information.

Look for providers who offer:

- •End-to-end data encryption, which scrambles your information so it's unreadable while it's being sent and while it's stored.

- •Secure cloud infrastructure, typically hosted on ultra-reliable platforms like Amazon Web Services (AWS) or Microsoft Azure.

- •Rigid access controls, ensuring only people you authorize can ever see or touch your data.

Bottom line: Always ask a potential provider about their security practices. A trustworthy partner will be open and proud to show you how they keep your data safe.

Ready to stop wrestling with manual data entry and get hours back in your week? Tailride handles your entire invoice and receipt workflow, from capturing the data to getting it categorized perfectly. Start automating your finances in seconds.