Inclusive vs Exclusive Tax: Key Differences Explained

Learn the essentials of inclusive vs exclusive tax with clear examples. Understand which to apply for your business and simplify your calculations.

The real difference between inclusive and exclusive tax boils down to one simple question: is the tax already baked into the price, or is it added on at the end? With inclusive tax, what you see is what you pay. With exclusive tax, the price tag is just the starting point, and taxes get tacked on at the checkout.

Deciding which to use isn't just a matter of preference; it's about balancing customer transparency with your own operational needs.

Understanding the Core Concepts

Getting a handle on these two tax models is crucial for any business. The choice you make ripples through everything from customer psychology to how you handle your financial reporting. Let's dig into what each one really means.

Defining Inclusive Tax

Inclusive tax is exactly what it sounds like - the tax is included in the advertised price. Think of it as "what you see is what you get" pricing. The price on the shelf is the final amount the customer pays, with no extra fees popping up at the register.

This isn't just a friendly gesture; in many parts of the world, it's the law. In the UK and most of Europe, for instance, Value-Added Tax (VAT) has to be part of the displayed price. It’s all about total transparency, making sure customers know the full cost upfront without any last-minute surprises. If you're curious about how different regions manage this, Webtoffee.com has some great insights.

Defining Exclusive Tax

On the flip side, exclusive tax shows the base price of an item before any taxes are added. The sales tax is calculated and tacked on to the subtotal when it's time to pay.

This is the standard approach in the United States, and for a good reason. Sales tax rates can be a patchwork quilt, varying from state to state, county to county, and even city to city. Showing a pre-tax price gives businesses the flexibility to advertise one consistent price across many different tax jurisdictions. The catch, of course, is that the customer only sees the true total at the very end.

Key Takeaway: The main distinction is when the customer learns about the tax. Inclusive pricing puts it all out in the open from the start. Exclusive pricing saves it for the checkout. This decision impacts more than just the price tag; it also changes how you account for revenue and manage your gross receipts - your total income before any deductions.

Here’s a quick rundown of the key differences:

| Feature | Inclusive Tax | Exclusive Tax |

|---|---|---|

| Price Display | Final price is shown upfront | Base price is shown; tax is added at checkout |

| Customer Experience | Very transparent, no surprise costs | Can lead to "sticker shock" at the register |

| Common Regions | Europe, Australia, UK | United States, Canada |

| Reporting Impact | You have to back the tax out of your revenue | Revenue and tax are already separate line items |

Alright, let's get into the nitty-gritty of how these tax calculations actually work. Moving from theory to practice is key, because getting these formulas right is crucial for accurate books, transparent pricing, and protecting your profit margins. Each method needs a slightly different approach.

It’s also important to remember that taxes aren't the only add-on to consider. Understanding how other charges are structured, like various payment gateway fee structures, can give you a clearer picture of your total costs.

Calculating Exclusive Tax

Let's start with the easy one. Calculating exclusive tax is pretty straightforward because you're just adding the tax on top of the base price you've already set. The process is a simple multiplication and addition, making it a clean, step-by-step calculation.

Here’s the formula:

Final Price = Base Price + (Base Price × Tax Rate)

Let's walk through a real-world example. Say you're selling a product with a base price of $100 and the local tax rate is 10% (or 0.10).

- •First, figure out the tax amount: $100 × 0.10 = $10

- •Then, add that tax to your base price: $100 + $10 = $110

- •The final price the customer sees and pays at checkout is $110.

Calculating Inclusive Tax

Now, this is where it gets a little trickier. With inclusive tax, you have to work backward to pull the tax amount out of a final price that already has it baked in. A common mistake is just multiplying the final price by the tax rate - that won't give you the right number.

Here’s the correct formula to use:

Tax Amount = Final Price - (Final Price / (1 + Tax Rate))

Let's use the same numbers but from an inclusive perspective. The customer sees a final, advertised price of $110, and you know this includes a 10% tax.

- •First, find the original base price: $110 / (1 + 0.10) = $110 / 1.10 = $100

- •Now, calculate the tax amount: $110 (Final Price) - $100 (Base Price) = $10

- •So, the tax portion of that $110 sale is $10.

Let's break that down side-by-side to make it even clearer.

Tax Calculation at a Glance

This table shows how you arrive at the final numbers for a $100 item with a 10% tax rate using both methods.

| Calculation Step | Exclusive Tax Example | Inclusive Tax Example |

|---|---|---|

| Start with... | A $100 base price. | A final, all-in price. Let's use $110. |

| Calculate Tax | $100 x 10% = $10 | $110 / 1.1 = $100 (base). $110 - $100 = $10 (tax). |

| Determine Final Price | $100 + $10 = $110 | The final price was our starting point: $110. |

| Customer Pays | $110 | $110 |

As you can see, the final price the customer pays is the same, but how you get there - and how you report it - is completely different.

This distinction is critical not just for individual sales but for international policy. For instance, a 50% tax-exclusive rate is equivalent to a 33% tax-inclusive rate. This difference significantly impacts how tax burdens are perceived and compared globally, a key consideration in initiatives like the OECD's global minimum corporate tax. Discover more about how these tax structures influence policy at Brookings.edu.

Getting comfortable with both formulas means your finance team can confidently handle any pricing model, stay compliant, and report revenue and tax liabilities with total precision.

Comparing the Business Impact of Each Method

Choosing between inclusive and exclusive tax isn't just a numbers game - it's a core strategic decision. This choice ripples through your business, shaping how customers see your brand, how complex your operations become, and ultimately, how healthy your bottom line is. There’s no single “best” answer; the right approach hinges entirely on your market, your customers, and your business model.

Instead of a dry list of pros and cons, let's dig into the real-world trade-offs. We'll look at how each method impacts the parts of your business that truly matter.

The Power of Price Transparency

The biggest win for inclusive tax is transparency, plain and simple. When a customer sees a price tag, they know that's exactly what they'll pay at the register. No surprises. This builds immediate trust and can slash cart abandonment rates, which often spike when unexpected fees pop up at checkout.

For B2C companies, especially those in regions like the EU or UK where this is standard practice, inclusive pricing is more than a nice-to-have - it’s a customer expectation. Meeting that expectation creates a seamless, trustworthy buying journey, which is a powerful driver of customer satisfaction and loyalty.

The main drawback? Your products might look more expensive on the shelf. If you're competing in a tax-exclusive market, your all-in price could seem high next to a competitor's lower base price, potentially turning away shoppers before they even consider the final total.

Strategic Differentiator: Inclusive pricing isn’t just about the price; it’s about the experience. By getting rid of last-minute surprises, you're building a path to purchase based on trust, not just the initial sticker price.

The Advantage of Operational Flexibility

On the flip side, exclusive tax gives you a ton of operational flexibility. This is especially true if you sell across different states or countries with a dizzying array of tax rates, like in the United States. It allows you to market one clean, consistent base price for a product, which massively simplifies your advertising and pricing strategy.

From an accounting perspective, this method keeps your product revenue and tax liability completely separate on every transaction. The tax is always its own line item, which makes financial reporting and reconciliation feel much more direct. Getting this right is critical for understanding your real profitability, which you can explore further by mastering your margin calculations in Excel.

Of course, the glaring downside is the risk of "sticker shock." A customer can go from excited to frustrated in seconds when they see the total jump at checkout. This friction can kill sales and erode trust if you aren't upfront about the coming taxes.

Here's a quick breakdown of how these two approaches stack up in key business areas:

| Business Area | Inclusive Tax Impact | Exclusive Tax Impact |

|---|---|---|

| Customer Perception | Seen as honest and transparent. Builds high trust. | Lower initial price seems attractive. Risk of "sticker shock." |

| Pricing Strategy | Easier in single-tax regions. Can appear higher at first glance. | Great for multi-tax regions. Maintains a consistent base price. |

| Financial Reporting | Requires calculating and separating tax from total revenue. | Revenue and tax are neatly separated from the start. |

| Cart Abandonment | Tends to be lower because there are no surprise costs. | Can be higher if taxes aren't communicated clearly and early. |

Choosing the Right Tax Method for Your Scenario

Picking between inclusive and exclusive tax isn't about finding a one-size-fits-all "winner." It's about aligning your pricing strategy with your business, your customers, and the law. Get it right, and the checkout process feels seamless and trustworthy. Get it wrong, and you risk confusing customers or even creating compliance headaches.

What works for a local coffee shop is entirely different from what a global software company needs. Let's break down where each approach shines.

When to Use Inclusive Tax

Inclusive tax is all about transparency. It’s the "what you see is what you pay" approach, and it’s a fantastic way to build trust right from the product page. When customers see the final price upfront, there are no nasty surprises waiting for them at checkout, which can go a long way in reducing cart abandonment.

This is probably the right move for you if:

- •You sell directly to consumers (B2C), especially in the EU or UK. In these markets, showing tax-inclusive prices isn't just a courtesy - it's often a legal requirement. Customers expect it, and regulators demand it.

- •You want the simplest, most predictable checkout experience possible. Think subscription services or stores with a high-trust, repeat customer base. A single, all-in price reinforces that sense of reliability.

The preference for inclusive vs. exclusive tax often mirrors a region's broader economic structure. For instance, you'll see inclusive tax more often in European countries where total tax revenues are a high share of GDP. Other countries might lean on different tax types; corporate income tax (CIT) in Malaysia makes up over 25% of its total tax revenue, while in Greece, it's under 5%. It’s a fascinating look at how local economies shape something as simple as a price tag. You can dive deeper into this in the OECD's Corporate Tax Statistics 2024 report.

When to Use Exclusive Tax

Exclusive tax is built for flexibility. It gives businesses the power to show a consistent base price to everyone, everywhere, and then add the appropriate tax at the very end. This is a lifesaver for companies dealing with complex, shifting tax rules.

This approach is likely your best bet if:

- •You operate somewhere with wildly different sales tax rates, like the United States. With taxes changing from state to state, county to county, and even city to city, advertising a single, tax-inclusive price is nearly impossible. Exclusive tax is the standard for a reason.

- •Your main customers are other businesses (B2B). B2B buyers are used to seeing prices before tax. They need that base price for their own accounting and want to see the tax as a separate line item for their records. It's just how business procurement works.

Setting Up Tax Rates in Your Financial System

Knowing the theory behind inclusive and exclusive tax is great, but putting it into practice correctly is where it really counts. Your financial system - be it a big ERP or specialized accounting software - is what makes or breaks your tax process. Getting the setup right from the start is absolutely essential.

While every platform has its quirks, the core steps are pretty much the same. You'll need to define your tax rates, assign them to the right jurisdictions, and tell the system how to apply them. A little bit of planning here saves a world of compliance headaches later on.

Creating and Naming Your Tax Rates

First things first, you need to head over to the tax settings or financial configuration area of your software. This is where you'll create the individual tax rates your business needs. The real secret to success here is a smart naming convention.

- •Be Specific: Don't just call a rate "Sales Tax." That's not helpful. A name like "CA-Alameda-9.75%" tells you the state, county, and exact rate in a single glance.

- •Indicate the Type: When you're dealing with inclusive rates, make it obvious. Adding a suffix like "VAT-UK-20%-Inc" clearly separates it from any exclusive rates you might have.

This isn't just about being tidy. This simple habit makes life infinitely easier when you're pulling reports, troubleshooting an invoice, or staring down an audit.

The screenshot below shows a pretty standard interface. You can see the fields for the tax name and rate, but the most important part is that little dropdown to select the tax type.

That simple choice - inclusive or exclusive - is the lynchpin. It tells the system whether to add tax on top of the price or to calculate it from the total you’ve entered.

Before you start clicking around, it helps to have a clear plan. This checklist breaks down the key steps for a smooth setup.

System Configuration Checklist

| Configuration Step | Key Action | Pro Tip |

|---|---|---|

| Review Local Regulations | Identify all jurisdictions where you have tax obligations. | Don't assume. Tax laws change. Check state, provincial, and national requirements regularly. |

| Establish Naming Conventions | Create a clear, consistent format for naming tax rates. | Include location, rate, and type (e.g., "NY-NYC-8.875%-Ex"). |

| Define Tax Rates | Enter each rate into your system, specifying the percentage. | Double-check your numbers. A typo here can be a costly mistake. |

| Select Tax Type | For each rate, choose whether it is inclusive or exclusive. | This is the most critical step. Get this wrong, and all your reports will be off. |

| Set Default Rules | Assign default tax rates to customers or product lines. | Automate where possible to reduce manual errors on every single transaction. |

| Test Transactions | Run a few test invoices to confirm calculations are correct. | Create a fake invoice for each tax type to verify the math before going live. |

Following these steps methodically will ensure your system is a reliable tool, not a source of frustration.

Applying Tax Rates to Transactions

With your rates defined, the next step is to put them to work. Most modern systems let you set default tax rates at different levels, which is a massive help. You can often apply a default rate to a specific customer, a product line, or a service category.

For example, you could configure your system to automatically apply an exclusive sales tax to all your U.S. customers while assigning an inclusive VAT rate to everyone in the UK. This kind of automation is a lifesaver, dramatically cutting down on manual data entry and the inevitable human errors that come with it.

For companies that handle a lot of invoices, connecting your tools is the next logical step. Platforms like Tailride can link directly to your accounting software to make this even smoother. If you want to see how that works, you can find great information on how to integrate with Xero and other systems.

Key Insight: The most important configuration is the choice between "inclusive" and "exclusive." This setting dictates how your software calculates and displays taxes on invoices and financial reports, directly impacting your revenue recognition and tax liability accounting.

Making the right selection here ensures that your financial statements are clean and accurate. It separates the revenue that belongs to you from the tax money you're simply collecting for the government - a crucial distinction for smart financial planning and staying compliant.

Making the Right Choice for Your Global Operations

When it comes to inclusive vs. exclusive tax, there’s no single right answer. It’s all about picking the strategy that fits your business like a glove. The best choice really comes down to your specific operations, where you have to juggle customer expectations, legal requirements, and what’s standard in your industry.

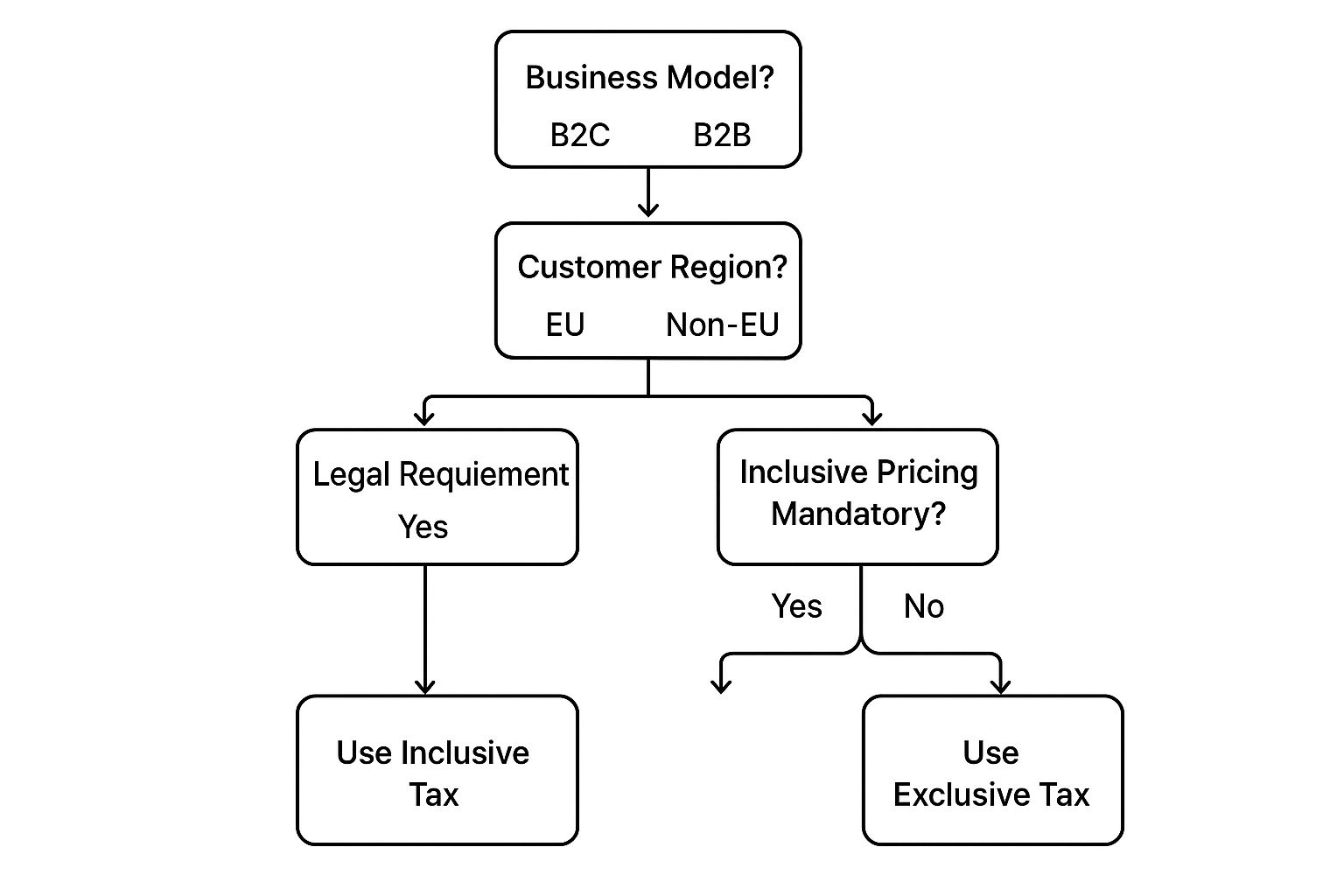

Think about your business model - are you B2C or B2B? Where are most of your customers located? Answering these two questions is the best place to start. A B2B software company based in the U.S. will have completely different needs than a B2C e-commerce shop selling to customers across Europe.

This decision tree gives you a straightforward way to see which approach makes the most sense for you.

As you can see, if you’re a B2C business selling in a place where inclusive pricing is the law, your choice is pretty much made for you. On the other hand, B2B companies or those outside the EU often find that exclusive tax pricing gives them the flexibility they need.

Ultimately, how you handle taxes is a fundamental piece of your company’s financial puzzle. As you expand, it’s a good idea to dig into broader strategies for tax efficiency and overcoming double taxation, especially when you’re dealing with sales in multiple countries.

By taking a moment to weigh these factors, you can land on the method that builds customer trust, keeps you compliant, and helps your business grow.

Got Questions? We've Got Answers

When you're dealing with inclusive and exclusive tax, a few common questions always pop up, especially for finance teams working across different regions. Let's clear up some of the most frequent ones.

Can We Really Use Both Tax Methods?

Not only can you, but you probably have to if you operate internationally. It's incredibly common. A business might show tax-inclusive prices for its customers in Europe to meet VAT rules, while at the same time, use tax-exclusive pricing in the U.S. where sales tax is a whole different ballgame.

Juggling both systems is just part of being a global business. The real trick is having a finance system that can handle this hybrid approach without giving your accounting team a headache.

How Does This Actually Change Our Financial Reports?

Your choice here directly hits two of the most important parts of your books: revenue recognition and tax liability. With exclusive tax, things are pretty clean. Revenue and tax are separate from the get-go, so reporting is a breeze. The price you listed is your revenue, and the tax you added is what you owe.

Inclusive pricing, on the other hand, adds a small but crucial step. You have to work backward and pull the tax amount out of the total price to figure out your actual revenue.

Think about it like this: on a $120 sale that includes a 20% VAT, your revenue isn't $120. It's $100. That extra $20 is the tax you've collected and need to set aside. If you don't separate these, you'll end up overstating your revenue and messing up your financial statements.

Which One Is Smarter for an Online Store?

For e-commerce businesses, the best method really comes down to who you're selling to. If your main customers are in places like the UK or Australia where people expect to see the final price, inclusive tax is the clear winner. It creates a much smoother experience and helps prevent that sticker shock at checkout that leads to abandoned carts.

But if you're selling mostly in the U.S. or to other businesses (B2B), exclusive tax is usually the more practical choice. It lets you advertise one clear price while still being able to handle the thousands of different local sales tax rates you might run into.

Trying to manage complex tax scenarios by hand is a recipe for errors. The smartest way forward is to automate your invoice and receipt management. Tailride plugs into your inboxes and portals, using AI to pull out and sort all your invoice data. This ensures your tax reporting is spot-on, no matter if it's inclusive or exclusive. You can get started in seconds at tailride.so.