Gross Receipts Definition: What Are Gross Receipts? Explained

Learn the gross receipts definition what are gross receipts, how to calculate them, and why understanding this is vital for your business and taxes.

Think of gross receipts as the total, unadjusted income your business earns from all sources. It's the big, top-line number that captures every single dollar that comes through the door before you subtract any costs, returns, or other expenses.

What Are Gross Receipts? A Simple Explanation

Let's ditch the accounting jargon for a second. Imagine your business has a giant bucket. Every dollar a customer hands you for a product, every payment you receive for a service, and even other income - like interest from a business savings account or rent from a property you own - gets tossed into this bucket.

The total amount of money in that bucket, before you take a single penny out for things like inventory, rent, or payroll, is your gross receipts.

This figure gives you the purest, most unfiltered look at your company's ability to generate cash. It's a fundamental metric for everything from filing your taxes correctly to analyzing your financial health.

Essentially, gross receipts represent the total amount of money a business takes in from all sources, without any deductions. This concept is a cornerstone of tax and accounting because it provides a complete picture of revenue inflow.

Gross Receipts At A Glance

To help you get a quick handle on this, the table below breaks down what typically counts toward gross receipts and what doesn't. Remember, while an invoice is a request for payment, it’s the actual cash received that adds to your gross receipts total. To learn more, see our post on the difference between invoices and receipts.

This simple summary helps clarify the boundaries of what to include in your calculations.

| What's Included (Examples) | What's Excluded (Examples) |

|---|---|

| Revenue from all product and service sales | Cost of goods sold (COGS) |

| Interest and dividends from business investments | Employee salaries, wages, and benefits |

| Rental income from properties owned by the business | Rent, utilities, and other overhead costs |

| Royalties and licensing fees | Customer returns and sales allowances |

| Tips, commissions, and service fees | Sales taxes you collect for the government |

Seeing it laid out like this makes it clear that gross receipts are all about the "inflow" - what you bring in - not what you spend or have to give back.

Here’s the rewritten section, designed to sound more human, natural, and expert-driven.

What Really Counts as Gross Receipts? (It’s More Than You Think)

When someone mentions gross receipts, most people immediately think of the money coming in from their main gig - selling products or providing services. But that's only part of the story. The real definition is much wider, capturing every single dollar your business earns, from any source.

Think of it as the total cash flow into your business before you subtract a single expense. It's the big, top-line number that shows your company's total earning power.

Getting this number right is crucial. If you miss a few income streams, you’re not just getting your own books wrong; you could be setting yourself up for a headache with the IRS. So, let’s dig into the different kinds of income that make up your gross receipts.

It’s Not Just About Your Core Business

Your main revenue from sales is the obvious starting point, but the money trail doesn't stop there. Accurately calculating your gross receipts means you have to account for all the other ways your business makes money.

Here are a few common sources people sometimes forget:

- •Interest Income: That little bit of interest your business checking or savings account earns? Yep, that counts.

- •Dividends: If your business has investments in stocks, any dividends you receive need to be added to the pot.

- •Rental Income: Do you sublet a few desks in your office or rent out a spare room? That rent is part of your gross receipts.

- •Royalties: If you’ve licensed a patent, a book, or any other intellectual property, those royalty checks are included.

Let’s put this into perspective. Imagine a local coffee shop. Their gross receipts aren't just from flat whites and croissants. If they also rent out a small corner of their space to a pop-up flower stand on weekends, that rental income gets added right into their total gross receipts.

It’s this all-in approach that matters. Take a freelance graphic designer, for instance. Most of her income comes from client projects. But let's say she also earns $200 in interest from her business savings account and another $500 from an affiliate link on her blog. To get her true gross receipts, she has to add that $700 to her client fees. Every stream, big or small, comes together to form the complete financial picture that tax agencies start with.

Gross Receipts vs. Net Income: What's the Real Story?

If you're trying to get a grip on your business's financial health, you absolutely have to know the difference between gross receipts and net income. It’s a super common point of confusion, but a simple analogy clears it right up.

Picture your business as a bustling food truck that sells amazing tacos. Your gross receipts are all the money - every single dollar and coin - in your cash register at the end of the day. It's the grand total from selling every taco, side of guac, and soda.

Simply put, it’s the raw, unfiltered amount of cash that came in the door. But that big number doesn't actually tell you if you made any money.

That’s where net income comes in. This is what's left after you pay for everything it took to run the truck for the day. We’re talking about the cost of the tortillas, the meat, the fresh salsa, the gas for your generator, and even that pesky city permit. While gross receipts show your ability to generate sales, net income is what reveals your actual profitability.

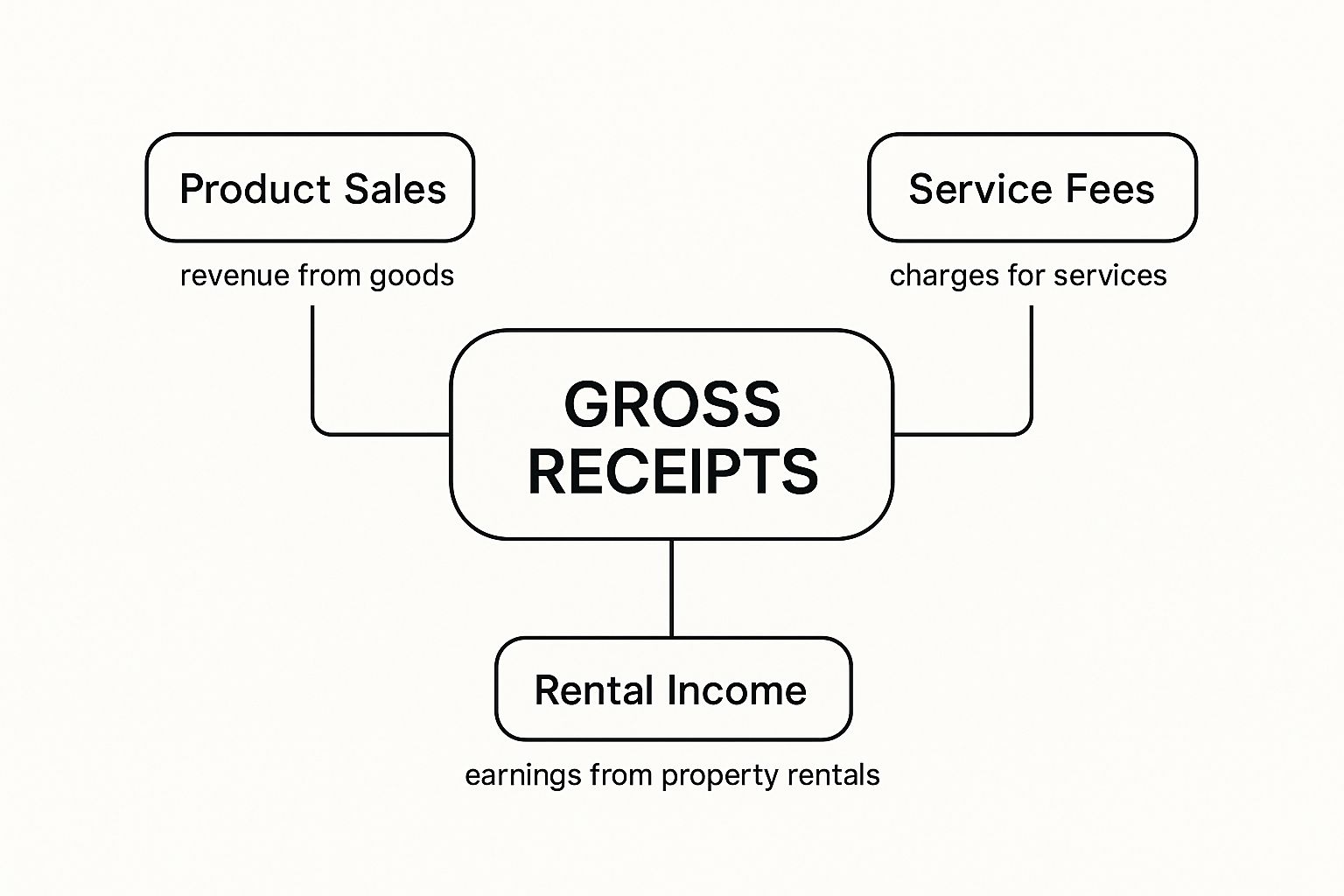

The image below gives you a nice visual of how different income sources all pour into that initial gross receipts bucket.

As you can see, whether it's from selling products, charging for services, or even rental income, it all starts as part of the same big revenue pool.

Unpacking the Financial Story

To really get the full picture, it helps to bring one more term into the mix: net receipts. This metric sits right between gross receipts and net income, and each one tells a different part of your financial story as you work your way from top-line revenue down to the bottom-line profit.

Gross receipts measure your total sales volume, while net income measures your actual profitability. One tells you how much money is coming in the door; the other tells you how much of that money you actually get to keep.

This isn't just about semantics; it has huge, real-world consequences for everything from how you file your taxes to how you analyze your business's performance.

Let's break down the key differences in a simple table to make it even clearer.

Gross Receipts vs Net Receipts vs Net Income

| Financial Term | What It Measures | Calculation Formula |

|---|---|---|

| Gross Receipts | Total revenue from all sources before any deductions. | Sales + Service Fees + Other Income |

| Net Receipts | Total revenue after returns and allowances. | Gross Receipts - Sales Returns - Allowances |

| Net Income | The final profit after all expenses are subtracted. | Net Receipts - Cost of Goods Sold - All Expenses |

So, think of it as a journey. You start with gross receipts, which is the biggest, broadest measure of your income. Then, you subtract any customer returns or discounts to get to your net receipts. Finally, you subtract all your other business expenses to arrive at your net income - the number that truly tells you whether your business is winning.

Why Tracking Gross Receipts Is Non-Negotiable

Getting a handle on your gross receipts isn't just some boring chore you hand off to your accountant. It's one of the most vital signs of your business's health, impacting everything from your tax bill to your ability to grow.

Think of it as the bedrock of your entire financial house. When tax season comes knocking, the IRS doesn't want to hear about your profit margins first. They start at the top, asking for your total gross receipts. That single number is the official starting line for figuring out what you owe.

Accurate gross receipts tracking is non-negotiable because it ensures tax compliance, unlocks financial opportunities like loans, and provides a clear, unfiltered view of your business's revenue-generating power.

A Foundation For Growth And Compliance

Beyond taxes, your gross receipts figure tells a powerful story about your business's scale and performance. Banks, lenders, and potential investors will zero in on this number to see if your company has real market traction and can handle its debts. A solid, well-documented history of growing receipts can be the key that unlocks a crucial business loan.

It’s also the first thing many people look at when trying to figure out what a business is worth. In fact, many a business valuation estimator uses this top-line figure as a primary input.

On a practical, day-to-day level, that number can even dictate how you run your business. For many small companies, gross receipts determine things like:

- •Your Accounting Method: Hitting a certain revenue level might mean you have to switch from the simple cash method of accounting to the more complex accrual method.

- •Filing Requirements: Some tax forms and reporting schedules only kick in after your business crosses a specific gross receipts threshold.

- •Tax Credits: Your eligibility for valuable small business tax credits is often tied directly to how much revenue you bring in.

At the end of the day, keeping a close eye on this figure gives you an honest, unfiltered look at your sales performance. It helps you spot trends, make smarter decisions, and build a truly solid financial strategy. Of course, tracking income is only half the battle; knowing https://tailride.so/blog/how-to-track-business-expenses is the other side of the coin.

How to Calculate Gross Receipts for Your Business

Alright, let's get down to the brass tacks. Figuring out your business's gross receipts is thankfully pretty simple. You’re essentially just adding up every single penny that came into the business from all its activities.

The basic formula looks like this: Total Sales + All Other Business Income = Gross Receipts. The real trick is making sure you don't forget any of those "other" income sources. It's surprisingly easy to overlook some of them.

To make this crystal clear, let's walk through a few real-world examples. Seeing it in action for different kinds of businesses is the best way to understand what you need to track.

Example Calculations by Business Type

Every business is a little different, with its own unique ways of making money. But the core idea of adding it all up stays exactly the same, whether you're selling code or cupcakes.

1. A Freelance Writer's Tally:

- •Client Invoices Paid: $55,000

- •Affiliate Commissions from a Blog: $1,500

- •Interest from Business Savings Account: $250

- •Total Gross Receipts: $56,750

2. An E-commerce Store's Numbers:

- •Product Sales Revenue: $250,000

- •Shipping Fees Collected from Customers: $15,000

- •Gift Card Sales: $5,000

- •Total Gross Receipts: $270,000

3. A Local Bakery's Bottom Line:

- •In-Store Sales (Cakes, Coffee, etc.): $120,000

- •Catering Service Fees: $25,000

- •Rental Income (from leasing out kitchen space): $3,600

- •Total Gross Receipts: $148,600

No matter what you sell or do, the principle is the same: you just add up every dollar that comes through the door before you subtract a single expense, return, or allowance. That top-line number is your gross receipts.

If you’re juggling a lot of data, modern tools can be a lifesaver. For example, learning how to use AI for financial analysis can give you a much clearer picture of where your money is coming from. And once you have your gross receipts nailed down, our guide on https://tailride.so/blog/margin-calculations-in-excel is a great place to go next to understand your profitability.

Common Mistakes to Avoid When Reporting Gross Receipts

https://www.youtube.com/embed/wihyUPTVwVg

Even seasoned business owners can get tripped up reporting gross receipts. It sounds simple, but a few common slip-ups can lead to some serious headaches, like skewed financial reports and even costly tax penalties. Nailing this number is ground zero for good bookkeeping.

Let's walk through the most common pitfalls so you can sidestep them completely.

Missing Minor Income Streams

One of the biggest mistakes is forgetting to include non-sales income. It's so easy to do. You're laser-focused on your main hustle - selling your products or services - and other trickles of cash get overlooked.

This could be things like:

- •Interest earned from your business bank account

- •Dividends from a company investment

- •Rent from a property your business owns

These might seem like small potatoes, but they absolutely count. Forgetting them means your gross receipts will be understated, which is a red flag for tax agencies. A good habit is to use accounting software that syncs with your bank or to keep a simple, separate log of all this "other" income.

Confusing Gross Receipts with Net Receipts

Another classic mix-up is subtracting returns, allowances, or discounts too early. Remember, "gross" means before anything comes out. You're trying to capture the grand total of all the money that flowed into your business from its regular operations.

Think of it like this: if a customer pays you $100 but later returns the item for a full refund, your gross receipt is still $100. The refund is an expense that gets accounted for later.

Misclassifying Cash Inflows

Not all cash that comes into your business is revenue. This is a crucial distinction that often trips people up.

For example, a $10,000 loan you take out from the bank isn't revenue; it’s a liability you have to pay back. Similarly, if you put $5,000 of your own money into the business as an owner's contribution, that’s an equity transaction, not income. Lumping these in with your sales will wildly inflate your gross receipts and throw your books completely out of whack.

The golden rule is to capture every penny earned before you factor in any expenses, refunds, or the cost of goods sold. Most reporting errors happen when these concepts get jumbled.

Overlooking Broader Economic Impacts

Finally, don't forget that outside forces can affect your numbers. For instance, in 2025, changes to tariffs and import duties in North American markets have shifted import tax revenues by around $6.5 billion each month, adding up to $21.5 billion. These kinds of border taxes can directly influence your cost of goods and pricing, making precise tracking of your gross receipts more important than ever. For a deeper dive into these trends, the economic reports from IATA are a great resource.

Got More Questions? We've Got Answers

Let's clear up a few more things about gross receipts. It's totally normal for some of these details to feel a bit tricky at first, so let's walk through a couple of common sticking points.

Do I Still Report Gross Receipts if My Business Lost Money?

Yes, you absolutely have to. Think of gross receipts as the very first number you put on the board before you start doing any other math. The IRS and other tax authorities need to see this total figure, regardless of whether you ended the year in the black or in the red.

This number is the starting line for calculating your taxable income. Leaving it out or getting it wrong can cause some serious headaches and potential penalties down the road, so it's a non-negotiable.

Are the Sales Taxes I Collect Included in Gross Receipts?

Great question, and the answer is usually no. When you collect sales tax from a customer, you're not actually earning that money. You're just holding onto it temporarily for the government.

Since you’re essentially a middleman for that specific cash, it doesn't count as your income. You'll pass it along to the state or local tax agency, so you leave it out of your gross receipts calculation.

How Do I Handle Customer Returns or Refunds?

This is a big one. Refunds and returns do not reduce your gross receipts figure. Remember, gross receipts are the grand total of all your sales before you subtract anything.

You’ll account for those returns and other allowances later on when you calculate different figures, like net sales. But for the initial gross receipts total? You report the full sale amount as if the return never happened.

Tired of manually tracking all this? Tailride can help you stop chasing down invoices and get your gross receipts right every time. It automatically captures receipts from your inbox and syncs everything with your accounting software. Start saving time and get audit-ready financials today.