How to Track Business Expenses A Practical Guide

Learn how to track business expenses with our practical guide. Discover proven methods and tools to streamline your finances and boost your bottom line.

Tags

Let's get one thing straight: the simplest way to get a handle on your business expenses is to keep your business and personal money separate, pick a tracking method that works for you (whether that's software or a simple spreadsheet), and then religiously log every single transaction. Nail this foundation, and you'll have a clear financial picture and be ready for tax time without the usual panic.

Why Smart Expense Tracking Is a Business Superpower

Before we get into the nitty-gritty of how to track expenses, let’s talk about why it’s so critical. This isn't just some tedious chore your accountant nags you about; it's a genuine strategic advantage. Think of it as the difference between navigating your business with a clear map versus driving blindfolded in the dark.

When you track your expenses properly, you get a real-time pulse on your company's financial health. This empowers you to make smarter, data-backed decisions that are the bedrock of growth and stability.

Gain Financial Clarity and Control

Good expense management shines a bright light on exactly where your money is going. This clarity is absolutely vital for a few key reasons:

- •Spot-On Budgeting: Knowing what you actually spend means you can build realistic budgets and forecast future costs with confidence, not just guesswork.

- •Healthier Cash Flow: When you understand your outflows, you can manage your cash much more effectively. No more surprise shortfalls or operational hiccups.

- •Slash Unnecessary Costs: You can instantly spot where you're overspending, uncover hidden fees, and find opportunities for real savings. For example, costs for operational needs like business storage solutions become a clear line item you can actually analyze, rather than just another bill you have to pay.

Sloppy tracking is a fast track to missed opportunities and a ton of financial stress. On the flip side, a clean, organized system gives you the insights you need to steer your company toward real profitability and long-term success.

Make Tax Time (and Audits) a Breeze

One of the best perks of tracking your expenses diligently is a much, much calmer tax season. Having organized records means you can claim every single deduction you're entitled to, which can seriously lower your taxable income. For more on that, our guide on small business bookkeeping tips is packed with helpful advice.

And what if the tax authorities come knocking for an audit? Well-documented expenses make that whole process smoother and way less disruptive. It proves you're financially responsible and gives you the backup you need for your filings, protecting your business from nasty penalties. This isn't just about saving a few bucks; it's a direct investment in your company's resilience.

Laying the Groundwork for Smart Expense Tracking

Before you even think about downloading an app or setting up a fancy spreadsheet, we need to get the basics right. Think of it like building a house - you wouldn't start putting up walls without a solid foundation. These first few steps are absolutely essential for getting a real grip on your business finances.

The single most important thing you can do right now is to separate your personal and business finances. I can't stress this enough. It’s the golden rule of bookkeeping for a very good reason. When you use a personal card for a business lunch or pay a personal bill from your business account, you're creating a tangled mess that's a nightmare to unravel later. It becomes nearly impossible to see what your business is truly spending and earning.

Getting a dedicated business bank account and a business credit card isn't just a "nice-to-have." It’s a strategic move. It immediately simplifies your financial records, makes tax time a whole lot less painful, and helps protect your personal assets by creating a clear legal line between you and your company. This one move is the bedrock of any good expense tracking system.

Create a Simple Chart of Accounts

Once you’ve separated your accounts, the next piece of the puzzle is to organize your transactions. This is where a Chart of Accounts (CoA) comes into play. Don't let the formal name spook you. A CoA is really just a list of categories you'll use to sort every dollar that moves in and out of your business.

It’s like creating digital folders for your money. Instead of throwing everything into one giant "expenses" bucket, you create specific categories that actually mean something to your business. This is how you get a crystal-clear picture of where your money is going.

For instance, your expense categories might look something like this:

- •Software & Subscriptions: For all those monthly SaaS tools and apps.

- •Marketing & Advertising: Covers everything from your Google Ads to printed flyers.

- •Office Supplies: Printer paper, pens, coffee for the team - it all goes here.

- •Travel & Entertainment: For client dinners, flights, and hotel stays.

- •Utilities: Your internet, electricity, and other essential services.

As you map out your system, it’s smart to think through all potential business costs, even the less frequent ones. For example, you might need a category for business storage services if you handle physical inventory. Having a home for every type of expense ensures nothing slips through the cracks.

Develop a Clear Expense Policy

If you have a team - even just one or two people - an expense policy is non-negotiable. This document lays out the rules of the road: what employees can spend company money on and how they need to report it. A solid policy cuts down on confusion, prevents questionable spending, and keeps things fair for everyone.

An expense policy isn’t about micromanaging. It's about empowering your team with clear guidelines so they can make smart spending decisions confidently. This is a huge part of building an efficient accounts payable process.

Your policy doesn't have to be a 50-page legal epic. In fact, a simple and direct guide works best. Just be sure it covers the essentials:

- •Spending Limits: Set clear caps for common categories like meals, hotels, or airfare.

- •Receipt Submission Rules: Be specific. Require a receipt for everything and set a firm deadline for submission, like within 5 business days.

- •What’s Covered (and What’s Not): Clearly list what’s reimbursable (a client lunch) versus what’s not (a personal coffee run).

This policy becomes your go-to rulebook, making approvals and reimbursements a breeze. And if you're looking for more ways to tighten up this part of your operation, our detailed guide on how to https://tailride.so/blog/improve-accounts-payable-process is packed with actionable advice.

Nailing these fundamentals - a separate account, a clear chart of accounts, and a documented policy - sets you up perfectly for choosing the right tools and finally mastering how to track business expenses.

Picking Your Toolkit: The Classic Spreadsheet vs. Modern Automation

When it comes to the nitty-gritty of tracking your business expenses, you're essentially at a crossroads. One path is the old-school manual route - think spreadsheets. The other is paved with the sleek efficiency of automated software. The choice you make here isn't a small one; it will directly shape how much time you spend on admin, how accurate your books are, and how easily your business can grow.

Let's be real about the manual path. For a brand-new solopreneur just starting, a simple spreadsheet can feel like the right move. It’s free (assuming you have the software), and it seems simple enough to get started. You just set up some columns for dates, vendors, categories, and amounts, and then you diligently punch in every single transaction. Easy, right?

Well, the initial appeal of that spreadsheet fades. Fast. This method is an absolute time-drain and, frankly, a minefield for human error. One little typo or a copy-paste slip-up can derail your entire financial picture, leading to poor business decisions and a massive headache come tax season. As your business picks up steam and transactions multiply, that "simple" sheet quickly morphs into a convoluted, clunky monster that's nearly impossible to manage.

The Ceiling of Manual Tracking

Relying on spreadsheets for your expenses is like trying to build a house with only a hand saw when a power saw is sitting right there. Sure, you might get the job done eventually, but it’s going to be slow, exhausting, and far from perfect.

The biggest headaches with manual tracking boil down to a few key things:

- •It’s a Time Sink: Every hour you spend hunched over a keyboard doing data entry is an hour you're not spending on what actually matters - growing your business.

- •High Risk of Mistakes: From tiny typos to busted formulas, the opportunities to mess up are everywhere. These aren't just small oopsies; they can have serious financial blowback.

- •No Real-Time Picture: Your spreadsheet is only as good as the last time you updated it. You’re always looking in the rearview mirror, which makes it impossible to get a true, up-to-the-minute feel for your cash flow.

- •Scaling is a Nightmare: Just imagine trying to manage expense reports from a team of five people using one shared spreadsheet. It’s a guaranteed recipe for chaos, version-control nightmares, and lost receipts.

My Takeaway: For any business with real growth ambitions, manual tracking is a dead end. It quietly puts a ceiling on your efficiency, bogging you down with administrative grunt work.

The Game-Changer: Automation

This is where automated expense tracking software, like GetInvoice, completely flips the script. These tools are built from the ground up to eliminate the pain points of doing things by hand. They do the heavy lifting so you get your time back and gain a crystal-clear view of your finances.

This move toward automation isn’t just a passing trend; it's a fundamental shift in how smart businesses run. The global expense management software market is exploding, jumping from $6.62 billion to $7.49 billion with a compound annual growth rate of 13.1%. And it’s not slowing down - experts predict it will hit $12.22 billion by 2029, all driven by the demand for tools that give us real-time data and AI-powered help. You can read more about the growth of expense management technology to see where the industry is headed.

Instead of you pushing data into a system, an automated platform pulls it in for you. This magic happens through a few key features:

- •Receipt Scanning: Just snap a photo of a receipt with your phone. The software's AI uses optical character recognition (OCR) to instantly pull the vendor, date, and amount. No typing needed.

- •Live Bank Feeds: Securely connect your business bank accounts and credit cards, and the software automatically imports every transaction right after it happens.

- •Smart Categorization: The system actually learns your spending patterns and starts suggesting - or even automatically assigning - categories to your expenses, saving you from endless clicking.

Spreadsheets vs. Automated Software: A Head-to-Head Comparison

To make the choice crystal clear, let's put these two methods in the ring together and see how they stack up.

| Feature | Manual Spreadsheets | Automated Software (e.g., GetInvoice) |

|---|---|---|

| Data Entry | 100% manual, slow, and riddled with potential errors. | Automated via bank feeds and receipt scanning; fast and accurate. |

| Receipt Management | Requires a shoebox or a separate, clunky digital filing system. | Integrated digital receipt capture and storage, linked to each transaction. |

| Reporting | Manual report creation; static, tedious, and time-consuming. | Instant, real-time reports and dashboards with just a few clicks. |

| Scalability | Poor. Becomes a chaotic mess as your team and transactions grow. | Excellent. Easily handles high volumes, multiple users, and company growth. |

| Cost | "Free" upfront, but has high hidden costs in lost time and errors. | Subscription-based, delivering a huge ROI in time savings and accuracy. |

At the end of the day, your choice comes down to this: how much do you value your time and the integrity of your financial data? While a spreadsheet might feel adequate on day one, automated software is the professional-grade solution that doesn't just manage your business - it helps you build it.

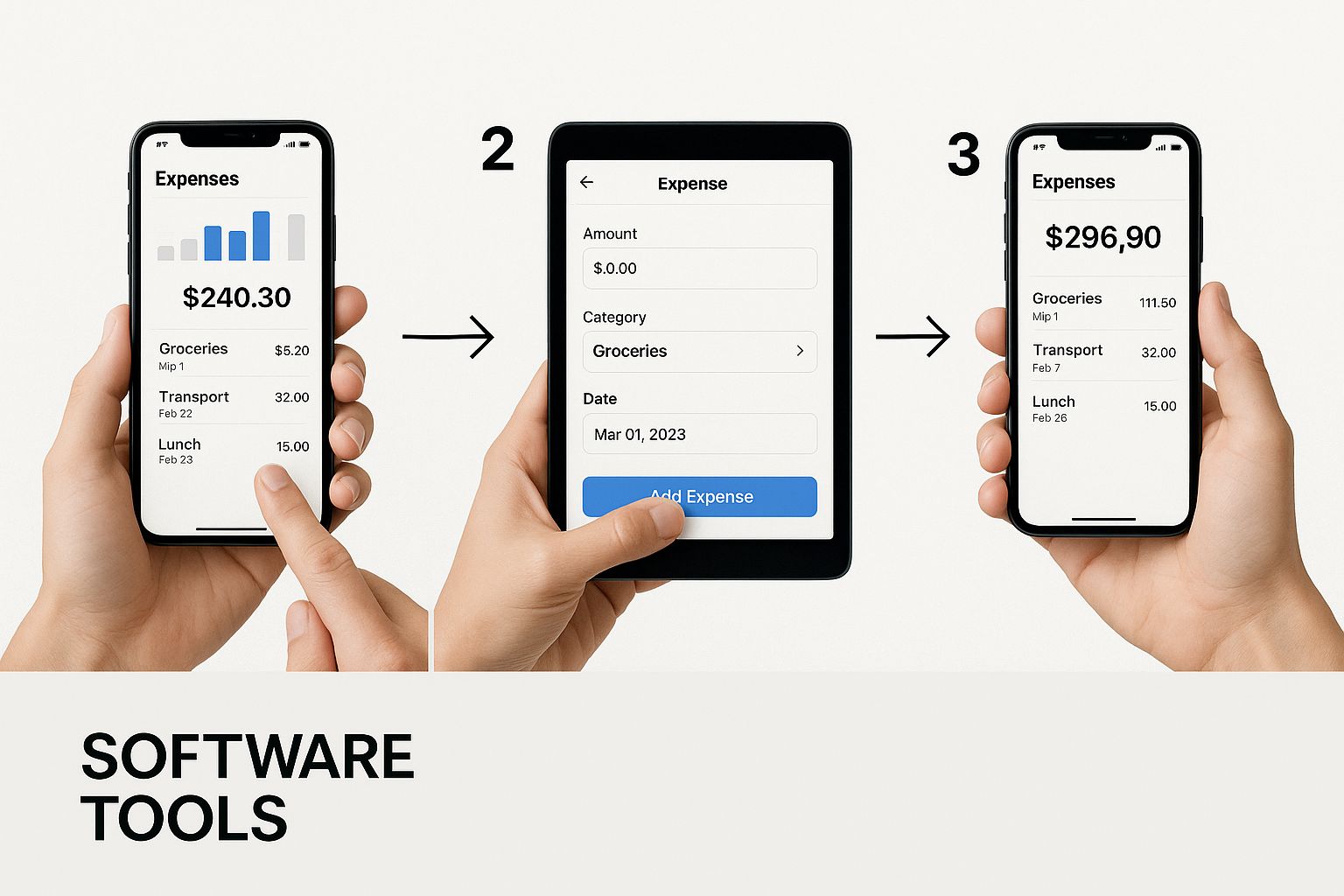

Let's See Your Modern Expense Tracking Workflow in Action

Theory is one thing, but seeing a modern, automated system in action is where the magic really happens. Let's walk through a common scenario to show you just how powerful tools like GetInvoice can be. This isn't just about small improvements; it's about completely transforming a process that used to be a major headache.

Imagine Sarah, one of your sales reps, is out for a client lunch. In the old days, this was the beginning of a tedious paper trail. She'd have to pocket the paper receipt, hope it didn't turn into a crumpled mess, and then remember to fill out an expense report later - taping that little slip of paper to a form and praying it didn't get lost.

With an automated workflow, that whole song and dance is a thing of the past.

The Capture: A Quick Snap and You're Done

The moment lunch is over, Sarah pulls out her phone. Instead of jamming the receipt into her wallet, she just opens the company’s expense tracking app.

It’s as simple as taking a picture.

But the app is doing so much more than just snapping a photo. It’s using advanced optical character recognition (OCR) to instantly read and digitize all the important information.

That single, simple action sets off a whole chain of automated events. The paper receipt is now completely irrelevant. You have a secure, compliant digital copy ready for processing. This shift to mobile-first expense management isn't just a niche trend; it's how business gets done now. A recent survey found that 54% of expense reports are submitted via mobile apps. This shows just how much employees rely on their phones to handle expenses on the go. You can dig deeper into these insights on mobile-first expense trends to see where things are headed.

The Brains: AI-Powered Data Extraction and Sorting

Once Sarah hits "send," the system's AI immediately gets to work behind the scenes. In seconds, it has pulled all the key details from her receipt:

- •Vendor Name: The Corner Bistro

- •Date: Today’s date

- •Total Amount: $87.50

But here’s where it gets really smart. The system knows your company’s financial rules, so it doesn't just stop at pulling data. Based on the vendor's name and past transactions, the AI automatically categorizes the expense as "Meals & Entertainment." Sarah didn't have to scroll through a dropdown menu or try to guess the right category. It was done for her, ensuring every expense is categorized consistently and accurately.

This isn't just about saving a few seconds. It’s about stamping out the human error and sloppy categorization that make manual spreadsheets so unreliable. When the system handles it, your financial reports become infinitely more trustworthy.

The Rules: Automated Approvals and Policy Guardrails

Now for the best part: applying your company's policies automatically. Let's say your policy is that any "Meals & Entertainment" expense under $100 is automatically approved. Since Sarah's $87.50 lunch falls under that threshold, it's instantly marked as approved. No waiting, no follow-up needed.

But what if her lunch had been $150? The system would see it's over the limit and automatically route it to her manager, Alex, for a quick review. Alex would get a notification on his phone, see the receipt and all the details, and could approve or deny it with a single tap. This is how you enforce your expense policy without ever having to be the bad guy.

You can set up all kinds of custom rules like this:

- •Catching Duplicates: The system will automatically flag it if Sarah accidentally tries to submit the same receipt twice.

- •Enforcing Travel Budgets: If an employee books a flight that goes over the pre-approved budget, it can be flagged for review before it's even paid for.

- •Blocking Certain Vendors: You can even create rules to automatically reject expenses from vendors that aren't on your company's approved list.

Closing the Loop: Seamless Accounting Integration

The final piece of the puzzle is getting this information into your accounting software. In a manual system, this is where your finance team would have to sit down and painstakingly re-enter all of Sarah's approved expenses into QuickBooks or Xero. It's a recipe for typos and wasted hours.

With an integrated, automated workflow, that entire step simply vanishes.

Because your expense tool is connected directly to your accounting software, the approved expense - along with its digital receipt, category, and approval history - is synced automatically. The $87.50 transaction shows up in the right account in QuickBooks, perfectly reconciled and ready for your reports.

The loop is closed. What started as a photo on a phone is now a perfectly recorded entry in your general ledger. The entire process was fast, accurate, and required almost zero manual effort. That’s how you truly master tracking business expenses.

Keeping Your Expense Records Flawless

Alright, so you’ve got a great expense tracking system in place. That's a huge win! But let's be real - the best software in the world won't help if it's not used consistently. The secret to clean, reliable financial data comes down to the daily habits you build around it.

This is all about creating routines that keep your records in pristine condition. The goal? An “audit-proof” system. And that doesn't just mean being ready for the tax man. It means having financial records so clear that an investor, a lender, or your new CFO can look at your numbers and immediately understand the story they tell. It’s about building unshakable trust in your financial data.

The Power of Regular Reconciliation

One of the most valuable habits you can adopt is regular reconciliation. This is just a fancy way of saying you need to sit down and compare your expense records to your bank and credit card statements to make sure everything lines up. I like to think of it as a weekly or monthly health check for the business's finances.

Whatever you do, don't put this off until the end of the quarter. A small mistake is easy to fix when it’s a week old, but it can become a nightmare to untangle after three months.

Doing these regular check-ins helps you:

- •Catch errors early: Instantly spot a duplicate charge or an expense you accidentally put in the wrong category before it messes up your reports.

- •Find what's missing: See if a transaction from your bank feed somehow never made it into your expense software.

- •Stop fraud in its tracks: Quickly identify any weird, unauthorized charges that don’t match what you've spent.

This simple, consistent review is your best defense against financial chaos. It turns expense tracking from a frantic, year-end scramble into a proactive and totally manageable routine.

Create an Audit-Proof Record-Keeping System

A truly bulletproof system has to account for everything - digital and physical. While a tool like GetInvoice is fantastic for snapping and organizing digital receipts, you still need a game plan for all the other paperwork that comes with running a business.

For truly flawless records, you have to think about organizing both your digital files and any physical documents, which might even include looking into secure document storage solutions for critical papers like contracts or loan agreements.

The key is to create a clear, logical structure. For your digital files, this could be a simple folder system like "Expenses > 2024 > Q3 > Travel." For the physical papers you absolutely must keep, labeled file folders or binders work wonders. Consistency is everything.

A huge piece of this puzzle is knowing what to do with physical receipts. Even if you're scanning everything, you need a process. We've got you covered - check out our deep-dive guide on how to organize receipts effectively to build a system that can withstand anything.

Train Your Team to Be Your Allies

Your expense system is only as good as the people using it. If your team isn't on board or doesn't know the rules, things can get messy fast.

Clear training isn't about micromanaging; it's about empowering your team. When people understand why they need to categorize a receipt a certain way or add a note, they're much more likely to do it right.

Set aside some time for a quick training session. Walk everyone through your expense policy and show them exactly how to use the tools. Cover the common slip-ups, like mixing personal and business expenses or forgetting to explain what a purchase was for.

Getting this right is more critical than ever. With so many people working remotely, the complexity of tracking expenses has shot up. In fact, a recent report found that 71% of finance leaders are struggling with compliance and fraud, mostly because they're still stuck with manual processes. By training your team and leaning on automation, you can turn what feels like a major risk into a smooth, efficient part of your business.

Got Questions About Tracking Business Expenses? We’ve Got Answers.

As you start getting serious about tracking your business expenses, you're bound to run into a few questions. It happens to everyone. Getting straight answers to these common sticking points can help you build a system that actually supports your business instead of just creating more work. Let’s clear up a few of the most frequent ones I hear.

What’s Genuinely the Easiest Way to Track Expenses?

Honestly, for most businesses I've worked with, the easiest and most reliable way is to use good expense management software from day one. I know it’s tempting to start with a simple spreadsheet - it seems easy at first. But that manual approach quickly becomes a huge time-suck and is packed with opportunities for human error.

Modern software handles the tedious stuff for you. Think receipt scanning with your phone, automatic expense categories, and direct feeds from your bank account. It's not just about saving a few hours here and there; it’s about having accurate, up-to-the-minute data on where your money is really going.

How Long Do I Really Need to Keep Business Receipts?

This one is critical for staying on the right side of the tax authorities. The general rule is to keep all your business records for at least three to seven years. For expense receipts specifically, a safe bet is to hang onto them for three years from the date you file the tax return they're associated with.

My best advice? Go digital. Storing clear digital copies of your receipts is a lifesaver. Tax agencies accept them, and you’ll never have to worry about ink fading on thermal paper or losing that tiny slip from the coffee shop.

What are the Biggest Tracking Mistakes People Make?

Knowing what not to do is just as important as knowing what to do. From what I’ve seen, a few mistakes pop up over and over again.

- •Mixing personal and business funds. This is the number one bookkeeping sin. It creates a complete mess, making it nearly impossible to see how your business is actually performing. Do yourself a massive favor: open a dedicated business bank account and use it for everything business-related.

- •Losing or forgetting receipts. No receipt means no proof of an expense. That means you miss out on a legitimate tax deduction and your financial records are incomplete. Make a habit of snapping a picture of every receipt the moment you get it.

- •Inconsistent categorizing. If one month you categorize your software subscription as "Office Supplies" and the next as "Software & Tools," your financial reports become meaningless. This makes budgeting and strategic planning a guessing game. Using software with automated rules is the best fix for this.

Ready to stop wrestling with these questions and just get it done? GetInvoice plugs into your inboxes and online portals to fetch every invoice and receipt automatically. Say goodbye to manual data entry for good. Find out how you can get started in seconds.