Difference Between Invoices and Receipts: Key Comparisons Explained

Learn the difference between invoices and receipts, understand their uses, and discover key differences to manage your finances effectively.

The real difference between an invoice and a receipt boils down to timing and what each document is trying to accomplish. At its core, an invoice is a request for payment. It's sent out before a customer pays you, clearly listing what they owe and why.

On the flip side, a receipt is a confirmation of payment. It’s the proof you give a customer after they’ve paid, showing the deal is done and the account is settled.

Invoice vs. Receipt: The Main Difference at a Glance

Let's use a simple real-world example. Imagine you've just finished a fantastic meal at a local restaurant. The server brings over the check detailing every item you ordered and the total amount due. That's the invoice.

Once you hand over your credit card and they run the payment, they bring back a small slip of paper showing the transaction was successful. That’s your receipt. It's your proof of purchase.

Getting this distinction right is absolutely critical for keeping your business finances in order. Invoices are the lifeblood of your accounts receivable - the money people owe you. Receipts, on the other hand, are your proof of income, wrapping up the transaction and helping you track revenue accurately.

Key Functional Differences

Knowing how each document works in the day-to-day of your business helps you avoid messy accounting mistakes and keeps communication with your customers crystal clear.

- •For Your Business: An invoice is your tool for getting paid and keeping an eye on who still owes you money. A receipt confirms that cash is in the bank and allows you to update your sales records.

- •For Your Customer: An invoice tells them exactly what they need to pay and when it’s due. A receipt is their proof of purchase, which is essential for things like returns, warranties, or filing expense reports.

The simplest way to remember it is this: Invoices ask for money, and receipts confirm you got it. If you mix these two up, you can cause serious cash flow confusion and even frustrate customers. After all, one implies a debt is still open, while the other shows it’s closed.

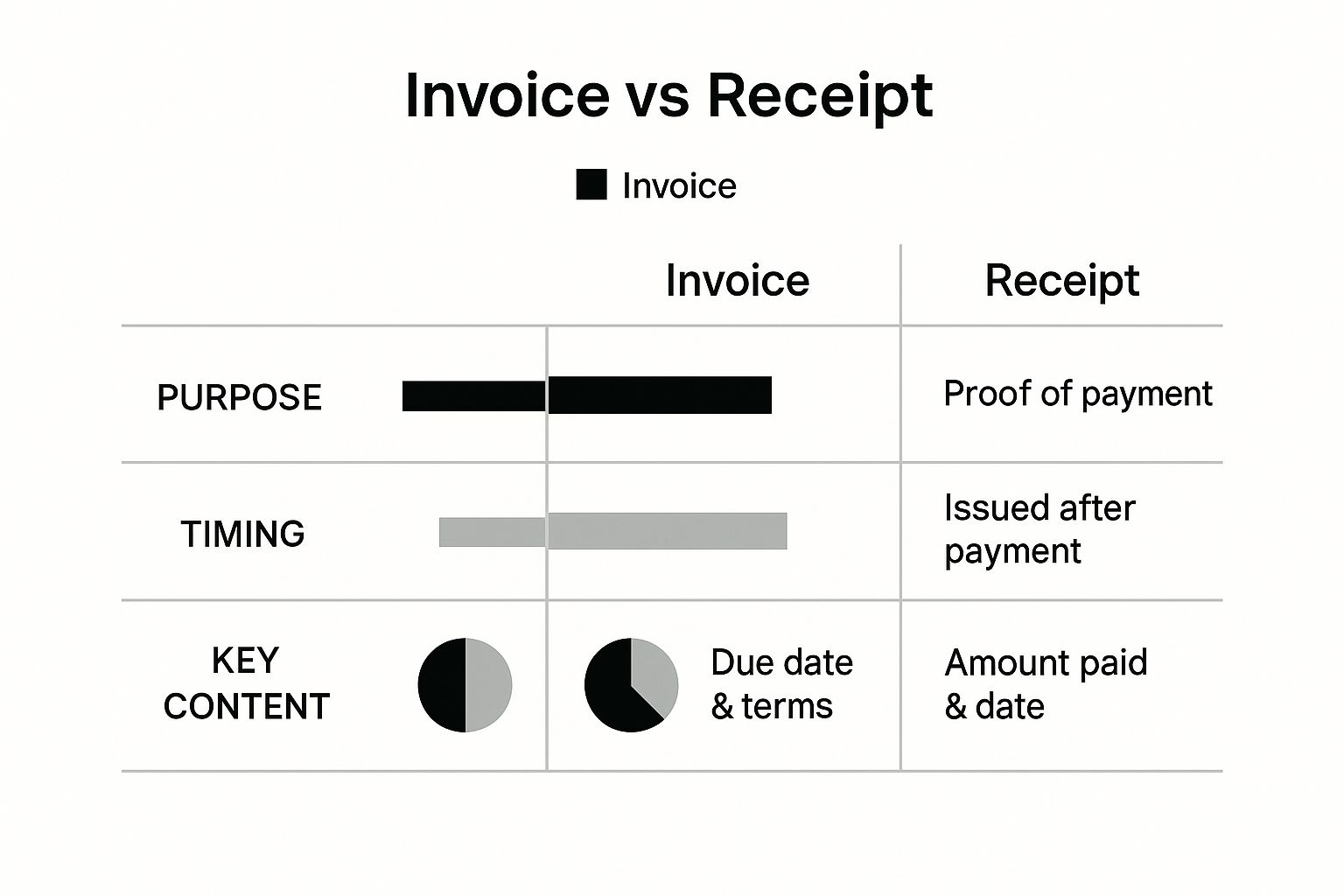

This visual breaks down the three key elements that set an invoice and a receipt apart.

As you can see, their purpose, timing, and the information they contain are completely different. They serve opposite ends of the very same transaction.

For a quick side-by-side look, this table breaks it down even further.

Quick Comparison: Invoices vs. Receipts

| Attribute | Invoice | Receipt |

|---|---|---|

| Primary Purpose | To request payment for goods or services | To confirm payment has been received |

| Timing | Issued before payment is made | Issued after payment is made |

| Financial Role | Creates an account receivable for the seller | Closes an account receivable for the seller |

| Key Information | Itemized costs, payment terms, due date | Amount paid, payment method, transaction date |

In short, while both documents are part of the same transaction lifecycle, they play unique and non-interchangeable roles in financial record-keeping.

Breaking Down the Anatomy of an Invoice

An invoice is much more than a simple bill. It's a formal, legally significant document that officially requests payment, kicking off your accounts receivable process. Think of it as the starting pistol for getting paid. It creates a crystal-clear record of a transaction, showing exactly what you provided, who owes the money, and when it needs to be paid.

If you don't have a solid invoicing process, you're setting yourself up for delayed payments, confused customers, and a messy bookkeeping situation. This is a key difference between an invoice and a receipt: an invoice creates a financial obligation, while a receipt settles one.

Essential Components of a Professional Invoice

To make sure your invoice is clear, professional, and gets you paid faster, it needs a few key ingredients. Missing even one of these can cause unnecessary friction and slow things down.

Every great invoice includes:

- •A Unique Invoice Number for easy tracking and reference.

- •Your Business Information, including your name, address, and contact details.

- •The Client’s Information to ensure it lands on the right desk.

- •An Itemized List of every service or product, complete with descriptions, quantities, and rates.

- •Clear Payment Terms and a Due Date so everyone knows what to expect.

Here’s a look at a standard invoice, with all the essential parts clearly marked.

As you can see, the itemized breakdown and the total amount due leave no room for guesswork. Each section plays a vital role, from tracking sales to staying compliant. For merchants using platforms like Shopify, understanding the specifics of these charges is crucial; you can dig deeper into Shopify fees per sale and understanding your Shopify invoice.

An invoice is the primary document for managing your business’s cash flow. It turns a completed job into trackable revenue and is the foundation of your financial forecasting.

We're also seeing a massive shift toward e-invoicing, which is making the whole process faster and more efficient for everyone. The global invoicing market is in the middle of a huge digital makeover. By 2025, the number of digital invoices is projected to quadruple, hitting an astonishing 220 billion each year. This boom is being fueled by major cost savings and government mandates for better tax compliance.

Ultimately, getting your invoicing right is non-negotiable. It ensures you get paid on time, keeps your cash flow healthy, and helps you maintain professional relationships with your clients. For businesses looking to streamline this first step, it’s worth learning how to automatically extract data from invoices and get that information into your accounting system without lifting a finger.

Understanding the Purpose of a Receipt

Once the payment is handled, the receipt steps in to close the loop on the transaction. If an invoice is the request for payment, the receipt is the official proof of purchase. It confirms that the deal is done and the debt is settled. Its main job is to create a clear, verifiable record that money has officially changed hands.

This little document marks the end of a sale, which is a huge part of the difference between invoices and receipts. An invoice kicks off the financial conversation, but a receipt is what officially ends it. Think of it as the final handshake that gives both the buyer and the seller peace of mind.

Why Receipts Are Vital for Everyone

A receipt is so much more than just a slip of paper. For your customers, it’s an essential tool that gives them power long after they've made a purchase.

- •Returns and Warranties: It's the golden ticket they need to return an item or make a warranty claim. No receipt, no service.

- •Expense Tracking: For individuals and especially for businesses, receipts are non-negotiable for keeping track of spending and sticking to a budget.

- •Proof of Ownership: It's the legal document confirming they now own the product or have paid for the service rendered.

From a business owner's standpoint, receipts are just as critical. They are the bedrock of accurate financial record-keeping. They verify every sale, help you reconcile your cash and bank accounts, and give you the hard data needed to manage inventory. Without a solid receipt system, your bookkeeping quickly turns into a messy guessing game.

A receipt acts as the final, undisputed record of a transaction. It protects the customer by proving payment and protects the business by confirming revenue, making it indispensable for clear and honest accounting.

The format doesn't really matter - it could be the traditional paper slip from a register or a digital version that lands in an email inbox. Either way, the core purpose is the same: to provide concrete evidence that a transaction was successfully completed.

Managing these documents properly is crucial. Using a dedicated receipt organizer for your business can be a lifesaver, preventing your financial records from spiraling into chaos. This simple document is truly a pillar of trust and transparency in every commercial exchange.

Comparing Their Legal and Accounting Roles

While invoices and receipts are both pieces of the financial puzzle, they play completely different roles, especially when it comes to the law and your accounting books. The difference between invoices and receipts really clicks when you see one as a starting gun and the other as the finish line for a transaction. One creates a legal IOU, and the other confirms it's been paid off.

Think of an invoice as a formal, legally recognized request for payment. When you send one out, you're not just asking for money; you're creating a record of debt for services you've delivered or goods you've sold. If a client goes silent and payment is late, that invoice becomes your single most important piece of evidence in the collections process or any legal scuffle that might follow.

A receipt, on the other hand, is the official "all clear." It’s the proof that the debt has been settled and the transaction is done. This little document is a big deal: it protects your customer by showing they’ve paid up, and it protects your business by confirming you’ve received the revenue.

The Accounting Perspective

In the world of accounting, these two documents live on opposite sides of the ledger. Invoices are the heart of your accounts receivable (AR). Every time you issue an invoice, your AR balance goes up, showing you exactly how much money is owed to your company. This is absolutely essential for managing your cash flow and trying to predict what your income will look like next month or next quarter.

Receipts are all about revenue recognition and making sure your bank accounts match your books. When you get paid and issue a receipt, you can finally move that money from the "owed" column (AR) to your cash account. This is the moment you officially recognize the income, which is a must-do for reconciling your bank statements and keeping your financial reporting accurate.

A common but costly mistake is treating these documents interchangeably. An invoice is a promise of future cash, directly impacting your AR. A receipt is the proof of current cash, which is critical for revenue and bank reconciliation.

The rise of global e-invoicing really drives this point home. Back in 2008, Brazil started requiring tax authorities to approve invoices before businesses could even send them to customers. This trend shows just how seriously governments view invoices as fiscal documents needing oversight. Receipts, which are just proof of a transaction, don't get anywhere near that level of scrutiny. You can learn more about the global deployment of e-invoicing to get a sense of how this is changing business worldwide.

To put it all together, let’s look at how invoices and receipts function across different parts of a business.

Functional Roles in Business Operations

| Business Function | Role of an Invoice | Role of a Receipt |

|---|---|---|

| Accounting | Initiates an entry in Accounts Receivable (AR), tracking money owed to the business. | Confirms cash receipt, moves funds from AR to cash, and enables bank reconciliation. |

| Legal | Establishes a legal obligation for the customer to pay. Serves as evidence in collections or disputes. | Serves as legal proof of payment, closing the transaction and dissolving the debt. |

| Customer Relations | Clearly communicates what was sold, the cost, and payment terms, setting expectations. | Provides the customer with a record of their purchase for returns, warranties, or their own records. |

| Tax & Audits | Substantiates reported income. Auditors match invoices to sales records and bank deposits. | Validates business expense deductions. Without a receipt, an expense can be disallowed. |

As you can see, each document has a clear and distinct job to do. Mixing them up isn't just a small bookkeeping error; it can cause real problems with your cash flow, legal standing, and tax reporting.

Tax Compliance and Audits

When it's time for a tax audit, you’ll be glad you kept these records straight. Tax authorities need to see both to get a full picture of your finances, and they look for very different things in each.

- •Invoices are what you'll use to prove your reported income. An auditor will line up your invoices with your sales logs and bank deposits to make sure every dollar you earned is accounted for.

- •Receipts are your golden ticket for business deductions. If you claim an expense, you need a receipt to back it up. No receipt, no deduction - and that could mean a bigger tax bill and even penalties.

The consequences of a mix-up here can be serious. For example, if you try to use an invoice as "proof" you paid for something during an audit, it will get shot down immediately. An invoice only shows you owed the money, not that you actually paid it. Only a receipt or a bank statement can prove payment. Keeping these two document trails separate and organized isn’t just good practice; it's non-negotiable for staying financially healthy and out of trouble.

A Tale of Two Workflows: Seeing Invoices and Receipts in Action

To really get a feel for how invoices and receipts work, let's walk through a couple of real-world scenarios. Seeing them in their natural habitat shows why their distinct roles are so crucial for keeping a business running smoothly, whether you're selling a service or a product. It all comes down to timing.

The Freelancer's Journey

Picture a freelance graphic designer who just wrapped up a big logo project. After weeks of creative work, the job is done. But here's the key: no money has changed hands yet. This is where the invoice comes in.

The designer sends over a document that breaks down the project, lists the agreed-upon price, and specifies the payment terms - maybe "Net 30," giving the client 30 days to pay. This invoice isn't just a piece of paper; it's an official request for payment that starts the clock on the client's financial obligation.

Once the client sends the money and it hits the designer's account, then the designer issues a receipt. This final document is the proof of payment, confirming the transaction is officially closed and the books are balanced.

The E-commerce Checkout

Now, let's switch gears to an online store. You find a product you love, add it to your cart, and hit "buy." Your card is charged right then and there. What's the first thing that pops into your inbox? A receipt.

This email is your immediate confirmation that the payment went through successfully. A few days later, when your package shows up, you might find a packing slip or a document that looks a bit like an invoice inside. But it's not a request for more money - you've already paid. It's just a detailed record of your purchase. The receipt was the all-important first step.

The real difference here boils down to one thing: cash flow. With the online store, payment is instant, so there’s no gap. For the freelancer, that waiting period between sending the invoice and getting paid creates a delay that can seriously strain their finances.

This delay is more than just an inconvenience; it's a massive challenge for many businesses. When invoice payments are held up, it creates an operational black hole. In the UK, a shocking 62% of small businesses deal with late payments, a problem that contributes to the failure of about 50,000 small businesses every single year. You can dig into more of these late invoice statistics on Clockify.me.

These two examples perfectly illustrate the fundamental sequence. An invoice comes before payment to create a financial obligation. A receipt comes after payment to close the loop. Getting this order right isn't just good practice - it's essential for accurate bookkeeping and maintaining healthy cash flow. For service providers, managing that invoice-to-payment gap is a core financial battle, one that most retail businesses with their instant receipts never have to fight.

How Tailride Takes the Headaches Out of Your Paperwork

Knowing the difference between an invoice and a receipt is just the first step. Actually keeping track of them both? That's a whole different ball game. We’ve all been there - shuffling through papers, dealing with misplaced files, chasing down late payments, and facing a mountain of stress come tax time.

This is exactly where a little bit of smart automation can make a world of difference, turning a messy process into a smooth one.

At its core, Tailride is designed to cut through the noise and manual grind of financial paperwork. Instead of you having to piece together invoices and chase down clients for payment, the platform does the heavy lifting. It creates professional invoices for you, keeps an eye on who’s paid and who hasn’t, and even sends out friendly reminders. This one feature directly attacks the cash flow problem that so many businesses face.

And once that payment lands in your account? Bam. Tailride automatically generates and sends a branded receipt, officially closing the loop on the transaction without you having to do a thing.

Putting Your Organization on Autopilot

This hands-off approach has some serious real-world perks. You get a huge chunk of your time back from tedious admin tasks, and your business looks incredibly polished and professional to your clients.

- •Invoice Capture: One of the coolest features is how Tailride syncs with your email to pull invoice data automatically. This alone saves hours of mind-numbing data entry. You can see a full breakdown of how it works in our guide: https://tailride.so/email-invoice-extraction

- •Receipt Management: On the other side of the coin, all your expense receipts get captured and neatly categorized. Suddenly, you have a perfectly organized, audit-ready system for tracking every penny you spend.

By handling both the ask (the invoice) and the proof of payment (the receipt) automatically, your entire financial system just clicks into place. Bookkeeping becomes simpler, and tax season feels a whole lot less like a looming storm cloud.

For any business owner serious about getting their records in order, diving into best practices for small business document management is a great next step. Think of Tailride as the tool that helps you put all those powerful principles into practice, effortlessly.

Frequently Asked Questions

Even after getting the hang of invoices and receipts, some real-world questions always pop up. Here are some quick answers to the common situations you'll likely run into while managing your business.

Can a Receipt Be Used as an Invoice?

Definitely not. Think of it this way: an invoice is a formal request for payment. It's the bill you send to a client telling them what they owe. A receipt, on the other hand, is proof of payment - it’s what you give them after they've paid.

Trying to use a receipt to ask for money would be like sending someone a "thank you for your payment" note before they've even paid. It’s confusing and bad practice. Always issue an invoice to request payment, then follow up with a receipt once the money is in your account.

What Happens If an Invoice Is Lost but I Have the Receipt?

If you've misplaced an invoice from a vendor, your receipt is your golden ticket. It's the essential proof you need to show you paid for the goods or services, which is incredibly important for your own bookkeeping and especially for tax season.

The good news is the business that sent the invoice should have a copy. If you need the itemized details for a warranty claim or your own detailed accounting, just reach out and ask the vendor for a duplicate.

Here's the key difference to remember for tax audits: An invoice shows you owed money. A receipt proves you paid it. The IRS wants to see proof of payment to validate a business expense.

Do I Need to Keep Both Invoices and Receipts?

Yes, without a doubt. Keeping both is non-negotiable for running a tight ship financially.

- •Invoices are the backbone of your accounts receivable. They track who owes you money and what you've sold.

- •Receipts are crucial for your own expense tracking and are the final confirmation that a sale is complete and paid for.

Having both documents on hand ensures your books are accurate, makes tax filing a breeze, and leaves a clear financial trail if you're ever audited.

Stop wasting time on manual data entry and keep your financial documents perfectly organized. Tailride automatically captures, extracts, and categorizes your invoices and receipts directly from your email, giving you back hours of valuable time. Discover how Tailride can automate your finances today.