A Guide to Email Invoice Parsing

Tired of manual data entry? This guide to email invoice parsing explains how to automate your AP workflow, save time, and boost accuracy.

Email invoice parsing is exactly what it sounds like: a smart, automated way to pull key information from invoices that land in your inbox. Instead of you doing the work, think of it as a digital assistant that opens your emails, finds the invoices, and grabs all the important details - like the vendor's name, the amount due, and the invoice number.

No manual effort required.

The End of Manual Invoice Entry

Picture your inbox as a never-ending pile of mail. In the old days (which, for many businesses, was yesterday), you’d have to open every single email, squint at the attached PDF, and painstakingly type all the details into a spreadsheet or your accounting software. It’s slow, it’s boring, and it's a perfect recipe for mistakes.

Every time someone manually keys in data, there's a chance for a typo, a misplaced decimal point, or an overlooked due date. These aren't just small slip-ups; they can spiral into real problems like overpayments, late fees, and frustrated vendors. It’s a tedious grind that eats up precious time that could be spent on much more important things.

Shifting From Tedium To Automation

This is where email invoice parsing completely changes the game. Instead of a person digging through the inbox, intelligent software takes over as your digital mailroom clerk. It automatically scans incoming emails and their attachments, figures out which ones are invoices, and extracts all the critical data.

Suddenly, the soul-crushing task of data entry becomes a smooth, hands-off workflow. Key data points are captured with near-perfect accuracy and instantly fed into your financial systems. It’s a huge leap forward for any business feeling the weight of paperwork.

By automating that first step of data capture, you eliminate the single most time-consuming and error-prone part of the entire accounts payable process. This frees up your team to focus on what really matters - like analyzing spending, managing cash flow, and making strategic financial decisions.

The numbers tell the story. The market for invoice processing software is expected to jump from $33.59 billion in 2024 to $40.82 billion in 2025. You can read more about the invoice software market forecast at openpr.com. That kind of growth shows just how essential this technology is becoming for modern businesses.

Ditching manual processing isn’t just about being more efficient. It’s a strategic decision that leads to better accuracy, a clearer view of your finances, and a business that can scale without getting bogged down.

How Email Invoice Parsing Actually Works

So, how does this whole thing work? It’s not one single piece of magic, but more like a super-efficient digital assembly line for your financial data. The process kicks off the very moment an invoice lands in your inbox, turning a messy email into clean, organized information you can actually use.

First, the system has to be a good bouncer, letting in only the important guests. Your inbox is a chaotic mix of newsletters, client chatter, and who-knows-what-else. A parsing tool is trained to look for tell-tale signs like the words "invoice," "receipt," or "payment due." It quickly learns to recognize your vendors' email addresses, cutting through all the noise to find the invoices.

Once an invoice email is flagged, the real work begins. The software hunts down the attachment, which is usually a PDF but could also be a Word doc or even an image. Sometimes, the invoice details are right there in the body of the email - the parser can handle that, too. If you want a deeper dive into this first step, our guide on how to parse invoice attachments from Gmail breaks it all down.

Turning Pictures into Words

The next critical step relies on a technology called Optical Character Recognition (OCR). Let's say you have a scanned paper invoice saved as a PDF. To a computer, that's just a flat picture of text, not the text itself. OCR is the translator that scans the image, recognizes the shapes of the letters and numbers, and converts them into text the computer can read and understand.

This is the foundational step that makes automation possible. Without OCR, any invoice that isn't already a text-based file would be a complete dead-end for an automated system. It’s the bridge that connects a static image to dynamic, usable data.

The Smart Part: AI and Machine Learning

After OCR does its job and turns the invoice into text, the most impressive part of the process gets started: AI and machine learning. This is where the system shifts from just reading the words to actually understanding their meaning.

Think about training a new accounts payable clerk. You'd have to show them where to find the vendor name, the total amount, and the due date on a bunch of different invoice layouts. An AI model is trained the same way, but on thousands and thousands of examples. It learns to spot the patterns and context for key pieces of information, no matter how weird the invoice format is.

- •Finding the Vendor: The AI looks for clues like logos, company letterheads, and phrases like "Invoice From."

- •Spotting the Total: It scans for keywords like "Total," "Amount Due," or "Balance," and it’s smart enough to know the total is usually the largest number on the page.

- •Locating the Invoice Number: It hunts for terms like "Invoice #," "Inv No.," or patterns of letters and numbers that look like a typical invoice ID.

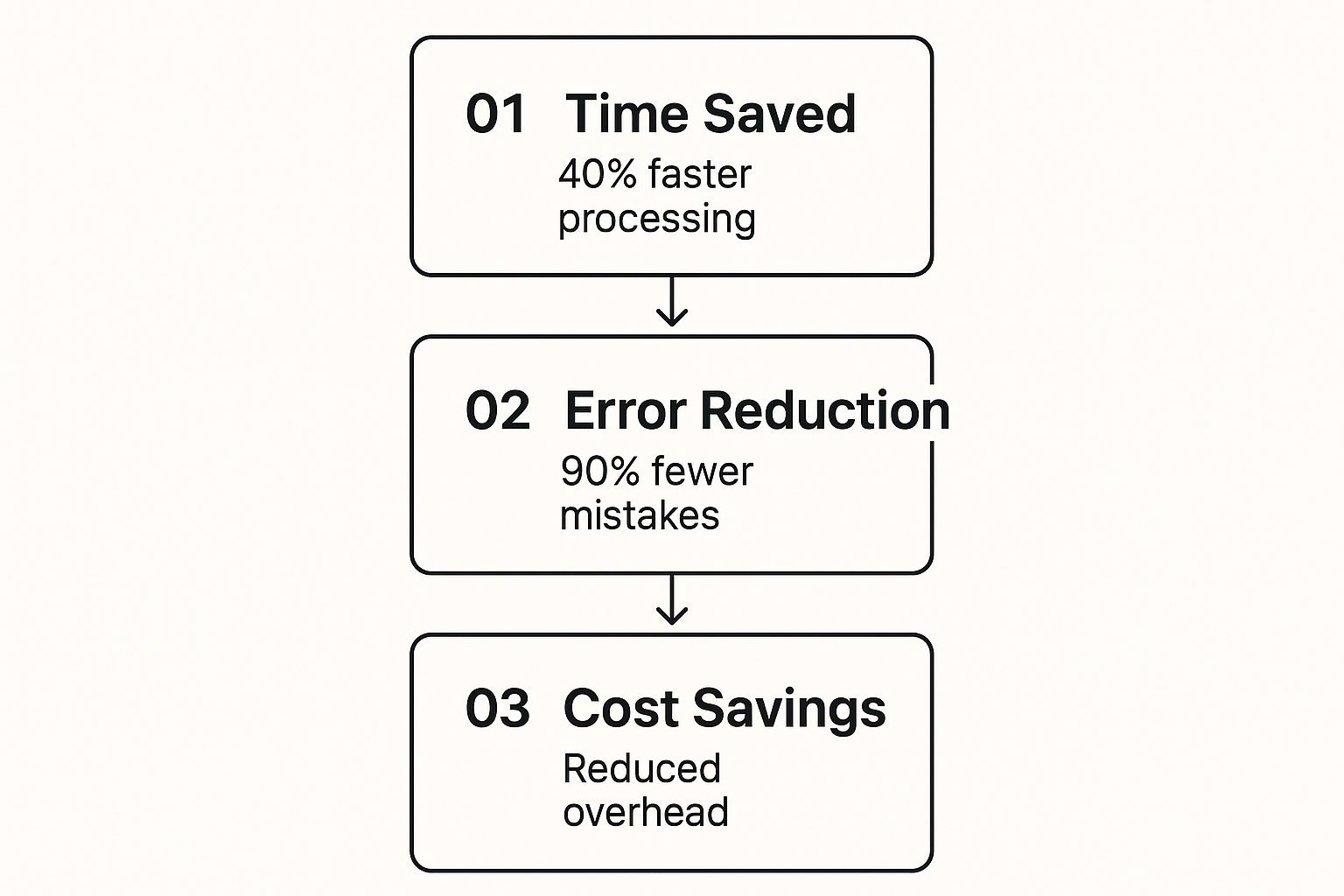

This is where you see the real-world impact of putting a system like this in place.

As the numbers show, this isn't just about moving faster. This intelligent process slashes processing time, nearly eliminates errors, and brings down operational costs. It completely changes the reliability of your entire financial workflow. The final step? Delivering all this perfectly structured data straight into your accounting software, ready for you to approve and pay.

The Real-World Payoff for Your Business

Switching to automated invoice processing is about so much more than just clawing back a few minutes in the day. When you put email invoice parsing to work, you set off a chain reaction of positive changes that touches everything from your cash flow to your vendor relationships. It’s a genuine shift from tedious manual work to a real strategic advantage.

Let’s imagine a growing business called "FreshFare Grocers." Their accounts payable team was drowning in a sea of invoices. Every single day was a grind of manual data entry, which often led to late payments and the occasional, very expensive, typo. Their view of the company's finances was always a few weeks behind reality.

After they brought in an automated system, everything changed for FreshFare. The difference was immediate and obvious across four crucial areas, showing just how powerful this kind of technology can be.

A Huge Boost in Efficiency

The first and most obvious win is the sheer amount of time you get back. Manually keying in invoice details is a slow, soul-crushing task that can eat up several minutes for every single document. With email invoice parsing, that entire process shrinks down to a matter of seconds.

- •Slash Processing Time: A task that used to take an employee 10-15 minutes is now done automatically before they even see the email.

- •Free Up Your People: Your team can finally step away from mind-numbing data entry and focus on work that actually matters, like analyzing budgets, negotiating with suppliers, or planning for the future.

For FreshFare, this meant their small AP team could suddenly handle a much higher invoice volume without needing to hire more people. They were no longer just trying to stay afloat; they were actively optimizing the company's cash flow.

Nailing Near-Perfect Accuracy

Let's be honest, people make mistakes - especially when doing the same boring task over and over. A single misplaced decimal point or a mistyped invoice number can cause overpayments, missed payments, and a massive reconciliation headache later on.

An automated system doesn't get tired or bored. It pulls data with incredible precision every time, slashing the risk of human error and making sure the financial data flowing into your accounting software is clean from the get-go.

Getting a Crystal-Clear Financial Picture

When invoice data is captured and logged the moment it arrives, you get a real-time, up-to-the-minute view of your company's liabilities. This is a game-changer for managing cash flow and making smart decisions. You always know exactly what you owe and when you owe it.

This level of clarity is why these tools are becoming so popular. The demand for email parsing solutions has shot up since 2019, as businesses struggle to keep up with the ever-growing flood of emails. You can dive deeper into the email parser market growth at datainsightsmarket.com.

Building Stronger Relationships with Vendors

At the end of the day, paying your suppliers accurately and on time is the foundation of a great business relationship. Automation gets rid of the manual bottlenecks that cause delays, ensuring invoices are processed quickly and correctly.

When your vendors are happy, they're far more likely to give you better payment terms, put your orders at the front of the line, and act like true partners in your success.

Choosing the Right Email Parsing Solution

https://www.youtube.com/embed/4tIKeC8KIJE

Not all email invoice parsing tools are built the same. It's easy to get lost in marketing fluff, but finding the right fit means looking at the features that will genuinely make your life easier. Go too basic, and you're still stuck doing manual work. Go too complex, and you might need a whole IT department to get it off the ground.

The sweet spot is a tool that feels like it just gets your workflow. It should effortlessly bridge the gap between your inbox and your accounting system without causing any friction.

Hitting the Non-Negotiables

When you start comparing options, there are a few core features that are absolutely non-negotiable. Think of these as the foundation. Without them, any tool will create more headaches than it solves, and you won't get the efficiency boost you're after.

- •

Seamless Integrations: The parser has to talk directly to your accounting software, whether that's QuickBooks, Xero, or Business Central. If a tool can't connect natively, you've just created a new manual data entry step for yourself, which defeats the whole point.

- •

Broad Format Support: Invoices show up in every format imaginable - PDFs, Word docs, images embedded in an email, or even just plain text in the email body. A truly capable parser handles all of them without making you stop to convert files.

- •

Intelligent Data Extraction: The tool's brain - its AI - needs to be smart enough to find the key details on wildly different invoice layouts. This is where the magic really happens, and it's powered by technologies like email invoice OCR that read and understand documents.

The best email parsing solutions don’t just grab data; they understand its context. They know the difference between a shipping address and a billing address and can pick out line items, even when vendors format them completely differently.

A Look at Key Features

To help you compare apples to apples, it's useful to group features into "must-haves" and "nice-to-haves." The essentials form the core of any solid system, while the advanced features are what separate a good tool from a great one that can grow with your business.

Key Features in Email Invoice Parsing Tools

| Feature Category | Essential Features | Advanced (Nice-to-Have) Features |

|---|---|---|

| Data Extraction | Extracts key fields (vendor, date, total) | Line-item extraction, currency conversion |

| Integrations | Native connection to major accounting software | API access for custom integrations, ERP sync |

| Workflow | Basic approval flows, automated data entry | Multi-step approvals, custom validation rules |

| Support | Email/chat support, online documentation | Dedicated account manager, phone support |

Ultimately, your choice depends on your current needs and where you see your business heading. A startup might only need the essentials, while a growing company will quickly find value in the more advanced capabilities.

Key Questions to Ask Vendors

Before you sign on the dotted line, you need to ask some tough questions. A vendor's answers will tell you everything you need to know about their product, their reliability, and the support you'll get when you're in a pinch. Remember, invoice parsing is just one of the many top business process automation tools out there, so getting clarity is crucial.

- •How do you handle data security? Dig into their encryption practices, access controls, and how they comply with regulations like GDPR.

- •What does the setup process actually involve? Is it a simple, self-serve onboarding you can knock out in an afternoon, or does it require scheduling time with their technical team?

- •What level of customer support is included? You need to know their average response times and, most importantly, if you can talk to a real human when something goes wrong.

Setting Up Your Automated Workflow for Success

Picking the right email invoice parsing tool is a great start, but how you set it up is what really makes the difference. This isn't just about flipping a switch; it's about thoughtfully building an automated workflow that your business can truly rely on. The end game is a smooth, hands-off process that just works.

A smart setup begins with good organization. The best first move is to create a dedicated email address just for invoices - something simple like invoices@yourcompany.com. This one small step funnels all your bills into a single, clean channel, making sure nothing gets lost in the daily shuffle of a crowded inbox.

Building Your Foundation for Automation

Once your dedicated inbox is humming along, the next piece of the puzzle is setting up clear validation rules. Think of these as your system's built-in quality control. They double-check the data your parser pulls before it gets anywhere near your accounting software, catching little errors before they become big headaches.

Here are a few common-sense rules you can put in place:

- •Matching Vendor Names: Does the vendor name on the invoice actually match a supplier in your system? This rule ensures you’re paying the right people.

- •Checking for Duplicates: The system can automatically flag any invoice number it’s seen before, stopping you from accidentally paying the same bill twice.

- •Verifying Totals: A quick sanity check to confirm that the sum of all the line items adds up to the invoice's grand total.

These checks are your safety net, giving you real confidence in the data flowing through your new automated system. For a more detailed walkthrough, our guide on how to parse invoices from Outlook emails breaks it down even further.

My best advice? Don't try to go big on day one. A phased rollout is your ticket to a stress-free transition. Start small with a pilot program, maybe just a handful of your most consistent vendors.

This approach gives you a safe space to test everything out. You can tweak your parsing rules, iron out any wrinkles, and get your team comfortable with the new process without disrupting your entire accounts payable department.

Once you’ve nailed the workflow with this small group, you can start rolling it out to everyone else with confidence. Taking it one step at a time ensures your automated system is solid, accurate, and ready to handle whatever you throw at it.

The Future of Invoice Automation

Email invoice parsing is a huge leap forward, no doubt. But honestly, it's just the first chapter in a much bigger book about automation. The tech is already moving past just pulling data from a PDF. We're stepping into an era of hyperautomation, where entire financial workflows start to think for themselves.

Think about a system that doesn't just read an invoice. It also checks it against preset rules, lines up the payment, and matches it to your bank statement - all without anyone lifting a finger. This isn't some far-off dream; it's where we're heading. The focus is shifting from automating single, annoying tasks to building a truly hands-off financial nervous system for a business.

From Data Entry to Data Intelligence

The real magic isn't just capturing the data anymore; it's what you can do with it. As the AI behind these tools gets smarter, it can start to analyze years of spending history pulled straight from your invoices. Suddenly, your AP system becomes a strategic advisor, digging up insights you never would have had the time to find.

And there's serious money pouring into making this happen. The global email parsing software market is on track to hit around $2 billion by 2025, growing at a compound annual rate of about 15%. You can dig into more of the numbers on the growth of the email parsing market at archivemarketresearch.com. All that investment is fueling new features that turn old invoice data into a crystal ball for your business finances.

The goal is no longer just to get invoices paid faster. It’s about using that historical data to predict future costs, find real savings opportunities with vendors, and even flag weird spending patterns that might point to fraud.

The New Role for Finance Teams

This completely changes the game for finance professionals. Instead of spending their days buried in data entry and chasing down approvals, they're free to do the work that actually matters. They can finally spend their time analyzing the trends the AI uncovers, negotiating better deals with suppliers, and building a solid financial strategy for the future.

When you look at it that way, the future of email invoice parsing is less about the "parsing" and more about the intelligent action that comes next. We're moving toward a reality where finance teams aren't just keeping score - they're helping to win the game.

Got Questions About Email Invoice Parsing? We've Got Answers.

Jumping into any new tech can feel like a leap of faith, and email invoice parsing is no different. When businesses think about ditching manual data entry for good, a few common questions always pop up. Getting clear answers is the first step toward feeling great about the change.

The first thing people usually ask is, "Can I really trust it to be accurate?" It's a fair question. You're handing over critical financial data to a machine, after all. The good news is that modern AI-powered parsers, backed by smart validation rules, can hit over 99% accuracy. The system isn't just guessing; it learns from millions of invoices and can even be trained on your specific vendor layouts.

What About Global Invoices and Security?

Okay, so it's accurate. But can it handle the messy reality of a global business? What about invoices from Germany in Euros or from Japan in Yen? Absolutely. Today's parsing tools are built for a connected world. They're designed to recognize different languages and convert currencies automatically, which takes a huge headache out of international accounts payable.

That brings us to the biggest question of all: is it secure? Letting an outside system handle your financial information requires a massive amount of trust.

You're right to be cautious, but top-tier email invoice parsing platforms are often more secure than manual processes. Think about it: no more invoices sitting on desks, saved to random folders, or passed around in unsecured emails. Everything is locked down.

Here’s a quick look at the security measures you should always look for:

- •Data Encryption: Your invoice data is scrambled and unreadable from the moment it enters the system until you access it.

- •Secure Access Controls: You decide exactly who on your team can see or handle financial information, minimizing the risk of internal errors or misuse.

- •Compliance with Standards: Reputable providers meet strict data protection laws like GDPR, so you know your data is being handled correctly and ethically.

Once you see how these systems tackle accuracy, global complexity, and security, it's easy to understand why so many finance teams are making the switch. It's a solid, safe, and reliable way to build a modern AP department.

Ready to stop chasing invoices and start automating your accounts payable? See how Tailride can capture and process every invoice from your inbox in seconds. Get started for free at tailride.so.