Email Invoice OCR: Automate Your Accounts Payable Today

Learn how email invoice OCR streamlines accounts payable. Discover benefits and find the right solution for your business efficiency.

So, what's all the buzz about email invoice OCR? Think of it as your own personal accounts payable assistant, one that works 24/7 right inside your inbox. It automatically "reads" invoices that land in your email, pulls out all the important stuff like who to pay and when, and then zaps that data directly into your accounting software. No more mind-numbing data entry.

What Exactly Is Email Invoice OCR?

Welcome to the future of accounts payable, where the soul-crushing task of typing in invoice details is finally behind us. Instead of spending hours slogging through emails, downloading attachments, and painstakingly copying numbers, email invoice OCR takes over the entire chore.

Picture your AP inbox as a chaotic digital mailroom. Invoices flood in daily in every format imaginable - slick PDFs, blurry JPGs, and sometimes just a few lines of text in the email body. The old-school way? Someone has to open every single one, decipher the layout, and manually type all that information into a spreadsheet or accounting system. It's slow, tedious, and a recipe for human error. One wrong number can cause a world of financial headaches.

How It Redefines Your AP Workflow

This is where the magic happens. Email invoice OCR automates that whole messy process from start to finish. It keeps an eye on your inbox, spots new invoices as they arrive, and uses Optical Character Recognition (OCR) to read them.

But this isn't just basic OCR that spits out a wall of jumbled text. Modern systems are much smarter. They understand the context behind the words, telling the difference between an invoice number and a PO number, or an issue date and a due date, even if every vendor uses a completely different template.

If you're curious about the nuts and bolts, our guide on email invoice extraction breaks down the technology from start to finish.

The goal is simple: turn a cluttered inbox full of random documents into a clean, organized, and automated financial workflow. This frees your team to stop being data-entry clerks and start being financial strategists.

Instead of hunting for paperwork, they can finally focus on what matters:

- •Handling exceptions: They only need to step in when the system flags a potential issue.

- •Analyzing spend: With accurate, real-time data, they can spot trends and find savings.

- •Building vendor relationships: Paying people on time, every time, keeps your partners happy.

At the end of the day, email invoice OCR is more than just another piece of software - it’s a completely new way to manage your company's financial documents.

So, How Does This Technology Actually Work?

Alright, let's pop the hood and see what makes email invoice OCR really work. It's not some kind of digital magic - it's actually a clever team-up of three key technologies that transform a tedious manual task into a smooth, automated process. The whole thing kicks off with the system’s "eyes": Optical Character Recognition.

Optical Character Recognition (OCR) is the first and most crucial step. It takes an invoice document - whether it’s a crisp PDF or a slightly blurry photo snapped on a phone - and turns the visual text into digital text a computer can read. Think of it like a transcriptionist: they type out the words they see, but they don't necessarily grasp the context behind them just yet.

This ability to digitize documents is a huge deal for businesses everywhere. The global OCR market was valued at around USD 13.95 billion in 2024 and is expected to soar to USD 46.09 billion by 2033. That tells you just how essential this technology has become in fields like finance, healthcare, and logistics. You can read more about the growth of the OCR software market on Data Horizzon Research.

The Brains of the Operation: AI and Machine Learning

Now, just having a bunch of digitized text isn't very helpful. An invoice isn’t just a random jumble of words; it’s a structured document where every piece of information has a specific job. This is where Artificial Intelligence (AI) and Machine Learning (ML) come in to play the role of the "brain."

AI gives the system the contextual smarts that basic OCR is missing. It doesn't just see the characters "123 Main Street"; it understands that this is a vendor's address. It can tell the difference between an Invoice # and the Total Amount Due, even if they're right next to each other.

Machine Learning then takes this intelligence to a whole new level. Think about training a new accounts payable team member. The first time they see an invoice from a new supplier, they might need a little help figuring out the layout. But after a few times, they know exactly where to look for the key details. ML models do the same thing, just on a much bigger scale.

With every single invoice it processes, the system gets a little bit smarter and a little more accurate. It learns all the different layouts and quirks from your vendors, constantly improving how it pulls data without you ever needing to build a specific template for each one.

This ability to learn and adapt on its own is what makes modern email invoice OCR so incredibly powerful. It can handle new invoice formats as they come in, maintaining high accuracy even as your list of suppliers grows. Want to see this in action? Give our free OCR text recognition tool a try.

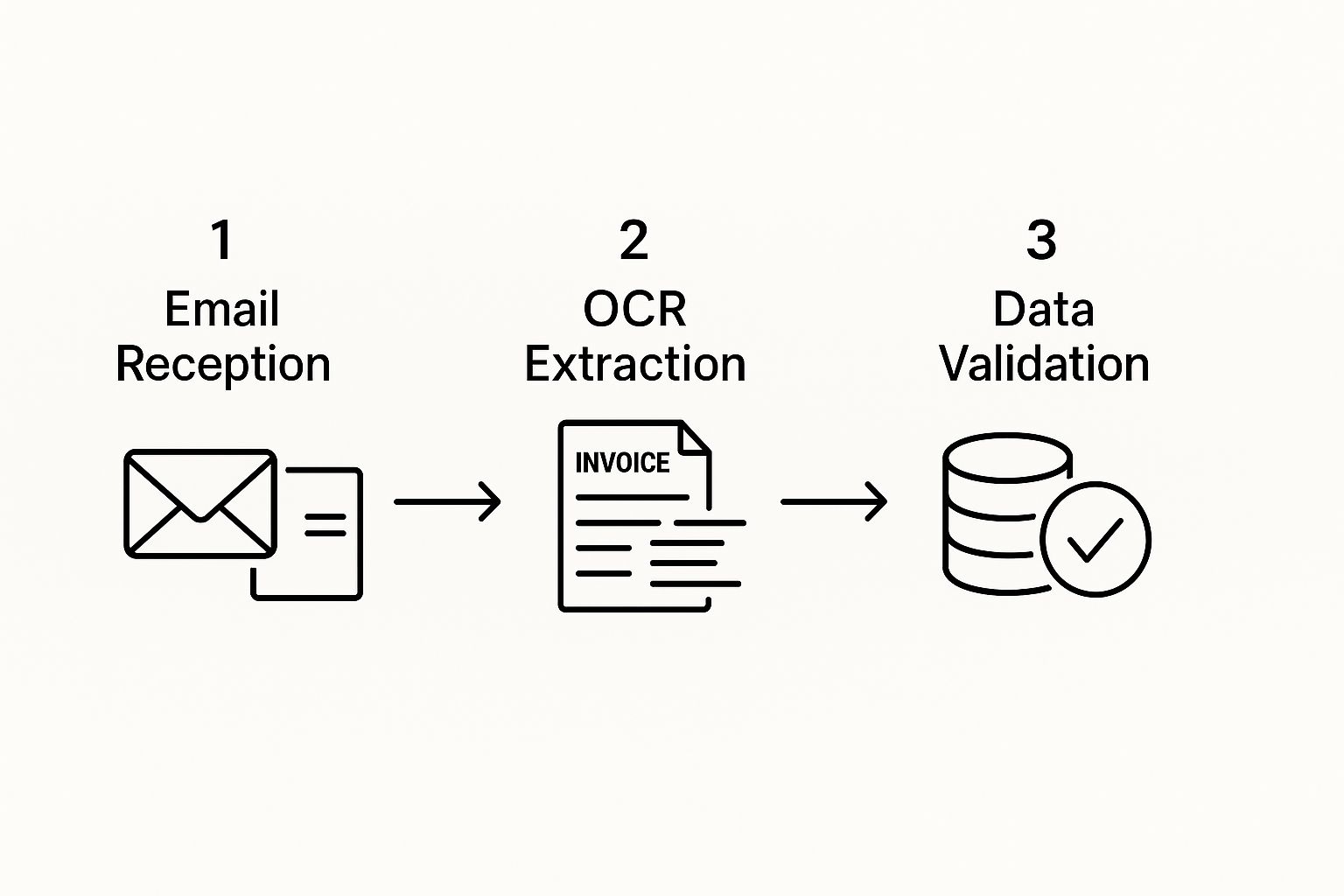

When you put it all together, you get a seamless, three-part flow:

- •See: OCR scans the invoice and converts the image into raw text.

- •Understand: AI analyzes that text to figure out what each part means (e.g., "this is the due date").

- •Learn: ML continuously refines the system's understanding, getting more accurate with every invoice.

This powerful trio works together to create a truly automated solution, turning your inbox from a mountain of digital paperwork into a smart, efficient data-processing machine.

Your Invoice Processing Workflow on Autopilot

So, what does this actually look like day-to-day? Imagine swapping that frantic scramble of digging through emails and punching numbers into a spreadsheet for a calm, predictable, and hands-off system. Let's walk through the journey of a single invoice, from the moment it hits your inbox to when it’s a paid entry in your accounting books.

It all kicks off the second a vendor emails an invoice to your dedicated accounts payable address. The email invoice OCR system is like a digital gatekeeper, watching that inbox 24/7. The instant a new message lands, it spots and grabs the invoice attachment, whether it's a PDF, a JPG, or another standard image file.

From Document to Data in Seconds

This is where the magic - and the heavy lifting - happens without you lifting a finger. The AI-powered OCR engine immediately gets to work, scanning the document and pulling out every critical piece of information with remarkable precision.

It instantly identifies and captures key fields like:

- •Vendor name and contact details

- •Invoice number and issue date

- •Due date and payment terms

- •Individual line items, quantities, and prices

- •Subtotals, taxes, and the final total amount due

This infographic really helps visualize how the data is captured and checked in this automated flow.

As you can see, it’s a logical path from receiving the email to pulling the data and confirming it's right - all before a human even sees it. The principles of smarter automation powered by AI are what make this kind of efficiency possible in the first place.

Intelligent Validation and Seamless Integration

Once the data is pulled, the system’s real intelligence kicks in. It runs a series of validation checks, cross-referencing the invoice details with the data you already have. For example, it can match the invoice against a purchase order (PO) or confirm the vendor's details are correct, making sure everything lines up perfectly. This step alone is a game-changer; studies show it reduces invoicing errors for 63% of businesses that switch to an automated AP process.

After the system has done its work, the data is presented in a clean, organized way, ready for the next step. No more manual keying.

With a green light from the validation checks, the structured data is pushed directly into your accounting software, whether that's QuickBooks, Xero, or a big-gun ERP like SAP. The invoice is automatically coded, sent for approval, and queued for payment, creating a perfect digital audit trail along the way.

But what about tricky invoices? The best systems are built with a "human-in-the-loop" failsafe. If the software encounters a major discrepancy or a completely new invoice format it doesn't recognize, it doesn't just guess. It flags the exception and sends it to a team member for a quick review. This ensures 100% accuracy while still letting the automation handle the vast majority of the work.

It's this blend of smart automation and human oversight that gives you the best of both worlds: incredible speed and total confidence in your numbers.

The Real-World Payoff of Automating Invoices

Let's be real. Bringing in email invoice OCR isn't just about getting a cool new tool. It’s a genuine shift in how your business operates, delivering concrete results you can actually measure. Sure, you'll save time, but the benefits go so much deeper, hitting your bottom line, making you more nimble, and even improving your relationships with vendors.

Think of it as transforming your finance team from data entry operators into strategic thinkers who can actually guard your company’s financial health.

The first thing you'll notice is a huge drop in what it costs to just run the office. How many hours are currently spent typing invoice details, tracking down managers for approvals, or fixing simple typos? An automated system handles all of that in a flash. This frees up your team to focus on things that really matter, like analyzing budgets and forecasting for the future.

And this isn't just a hypothetical benefit - it's driving colossal growth in the industry. The AI for Invoice Management market was valued at USD 2.8 billion in 2024 and is expected to skyrocket to USD 47.1 billion by 2034. That kind of explosion shows just how vital these tools have become for companies trying to cut costs and get rid of manual mistakes. You can get a glimpse into what’s next by checking out the future trends in AI-powered invoice processing on Veryfi.com.

Gain Pinpoint Financial Accuracy and Tighter Control

Beyond just saving money, automation brings a whole new level of accuracy to your accounts payable process. We're all human, and manual data entry is bound to have mistakes - a misplaced decimal point can easily lead to an expensive overpayment or a frustrated vendor.

An email invoice OCR system pretty much wipes out those kinds of errors. By capturing and double-checking every detail, it ensures your financial records are spotless. This accuracy unlocks a few key advantages:

- •Lightning-Fast Processing: Invoices get processed in minutes, not days. This speed means you can always take advantage of early payment discounts, which can save you a surprising amount of money over the year.

- •Stronger Vendor Relationships: Paying people correctly and on time builds trust. When your vendors are happy, they're more likely to give you better terms and treat you like a priority partner.

- •Better Fraud Detection: The system can immediately spot red flags like duplicate invoices or strange payment requests that a person buried in paperwork might miss. It’s an extra layer of security that’s hard to put a price on.

By putting routine checks and balances on autopilot, you build a more secure and predictable financial foundation. This gives you a live look at your cash flow, which is exactly what you need to make smarter business decisions.

Nail Compliance and Scale Without the Headaches

Finally, let’s talk about the long game. Every single automated transaction leaves a perfect, searchable digital footprint. Come tax time or an audit, you won’t be scrambling through filing cabinets or digging through old email chains. Everything is organized and right there at your fingertips.

This solid setup also means your AP process can grow right alongside your business. It doesn't matter if you're handling a hundred invoices a month or ten thousand. The system takes on the extra load without you needing to hire more people, keeping your operations lean and efficient as you expand.

Integrating OCR with Your Existing Software

Bringing new tech into your business shouldn't feel like a massive headache. The good news is that modern email invoice OCR solutions are built to slot right into your current financial setup without causing a major disruption.

The whole point is to build a smooth bridge between the invoice data your OCR pulls from emails and the systems you live in every day - whether that’s your accounting software or a bigger Enterprise Resource Planning (ERP) platform. This connection is what turns a bunch of isolated numbers into useful, actionable information for your business.

Connecting Through APIs

The most flexible and powerful way to connect these systems is through an Application Programming Interface (API). The easiest way to think of an API is as a universal translator that lets different software programs talk to each other safely and directly.

When your OCR tool uses an API, it can push extracted invoice details - like the vendor's name, the total amount, and the payment due date - straight into your accounting software. This real-time data sync completely gets rid of manual data entry, which means your financial records are always accurate and up-to-the-minute. The demand for this kind of automation is exploding; Verified Market Reports notes that the Invoice OCR API market was valued at USD 1.5 billion in 2024 and is expected to climb to USD 5.8 billion by 2033.

Using Pre-Built Connectors

If the idea of working with an API sounds a bit too techy, don't worry. Many OCR platforms offer pre-built connectors for the most popular accounting software out there. Think of these as simple, ready-to-go integration templates that you can set up in just a few clicks.

These connectors make it incredibly easy to link up with common platforms like:

- •QuickBooks: Send data over to instantly create new bills and sync vendor info.

- •Xero: Automatically create draft invoices that are ready for a quick review and approval.

- •NetSuite: Push invoice details directly into your ERP to keep your larger company workflows moving.

An integration shouldn't force you to change how you work. The right tool meets you where you are, fitting into your established processes to make them better, not tear them down.

Picking a tool that offers the right integration options is key to a painless rollout. For a deeper dive, our guide on what to consider for accounting software integration has some great tips to help you get ready.

At the end of the day, the best email invoice OCR tools are designed with this kind of connectivity at their core. They give you the flexibility you need to make sure automation strengthens your existing tech stack instead of just creating another isolated pocket of data.

Choosing the Right Invoice OCR Solution

Diving into the world of email invoice OCR can feel a bit overwhelming at first. There are so many options out there, all promising to make your life easier. So, how do you cut through the marketing noise and find a tool that actually works for your business?

The trick is to focus on what will genuinely impact your day-to-day workflow. It's a bit like buying a car. You wouldn't just pick one because you like the color, right? You'd dig into the engine's performance, the safety features, and how it handles on the road. Your OCR solution needs that same level of scrutiny - it has to perform where it counts.

Must-Have Features on Your Checklist

When you're comparing tools, a few features are completely non-negotiable. These are the make-or-break elements that separate a truly helpful tool from one that just creates more headaches.

- •High Extraction Accuracy: The entire point is to read invoices correctly. Look for AI-powered systems that learn from your corrections. This is a game-changer because it means the tool gets smarter over time, even when dealing with weird layouts or blurry scans. A goal of an 85% reduction in manual entry is totally achievable, but only with top-notch accuracy.

- •Broad Format Support: Your vendors aren't all going to send you a perfect, standardized PDF. You'll get JPGs, PNGs, and sometimes the invoice details are just typed right into the email body. Your solution needs to handle all of it seamlessly.

- •Solid Security Protocols: We're talking about sensitive financial data here. Make sure any provider you consider is GDPR compliant and has robust security measures in place to keep your information safe.

The best solution isn't just about pulling data off a page. It's about delivering clean, validated, and secure information you can trust without double-checking everything. That confidence is where the real value lies.

Comparing Solution Types and Key Factors

Beyond the core features, you'll need to think about the type of tool that fits your company's size and budget. The market has everything from simple, standalone OCR readers to comprehensive accounts payable platforms that handle everything from receiving the invoice to sending the payment.

As you narrow down your choices, weigh these factors carefully:

- •Pricing Model: Does the company charge a flat monthly fee, a per-invoice rate, or have tiered plans? Find a model that makes sense for your current invoice volume but won't become a burden as you grow.

- •Scalability: Will this tool keep up as your business expands? A system that’s great for 100 invoices a month needs to be just as efficient when you’re suddenly processing 1,000.

- •Customer Support: Let's be real - at some point, you'll run into a snag or have a question. When that happens, you need fast, helpful support. Check out reviews and ask about their support channels before you sign on the dotted line.

Got Questions About Email Invoice OCR?

It's completely normal to have questions before bringing any new technology into your finance department. In fact, it's smart. You need to know how it all works and what to expect.

Let's walk through some of the most common questions we hear from people thinking about switching to automated invoice processing.

"How Secure Is My Financial Data?"

This is always the first question, and for good reason - it’s the most important one. Any reputable email invoice OCR provider puts security front and center.

Your data should be encrypted every step of the way, both when it's being sent and when it's sitting on a server. Always look for providers that are GDPR compliant and have clear, strict data privacy policies. This is how you know your sensitive financial information is getting the enterprise-grade protection it deserves.

"What Kind of Accuracy Can I Really Expect?"

Modern AI-powered systems are remarkably accurate. If you’ve been burned by older OCR tools that stumbled over tricky layouts, you'll be pleasantly surprised. Today’s technology uses machine learning, which means it gets smarter over time.

Most businesses find they hit 98% accuracy (or even higher) on data capture after just a short initial training period.

The real magic is that the system learns from every single invoice you process. It adapts to different vendor formats on its own, so you don't have to build and maintain manual templates. For those rare edge cases, a "human-in-the-loop" feature will flag anything uncertain for a quick review, ensuring your final data is always 100% correct.

"Can It Handle All My Different Vendor Invoice Formats?"

Absolutely. This is where modern email invoice OCR really shines.

Think about all the ways you receive invoices: pristine PDFs, blurry photos snapped on a phone, even details just typed directly into the body of an email. A good system is built for this real-world messiness.

The AI doesn’t just look for data in a specific spot. It actually understands the context, identifying fields like "invoice number," "due date," and "total amount" no matter where they are on the page. That kind of flexibility is what makes it so powerful.

Ready to stop the manual data entry grind and put your invoice processing on autopilot? Tailride plugs right into your inbox to capture, pull out, and organize all your invoice data for you. Start automating your AP process in seconds.