Parse Invoices from Outlook Emails Automatically

Tired of manual data entry? Learn how to parse invoices from Outlook emails, connect your tools, and build a hands-free accounts payable workflow.

If you've ever found yourself stuck in the endless loop of copying and pasting details from PDF invoices in your Outlook inbox, you know exactly how tedious it is. This isn't just a boring task; it's a quiet resource drain that slowly chips away at your team's productivity.

The fix? Automatically parse invoices from Outlook emails. This process is all about setting up a system that intelligently extracts the important data - like invoice numbers, amounts, and due dates - and zaps it straight into your accounting software. It’s a simple change that shifts your team from mind-numbing data entry to high-value financial work.

The Sneaky Costs of Manual Invoice Entry

Let’s be real. Spending an afternoon manually keying in vendor names and line items is frustrating. But it's more than just a time-suck. It's the inevitable human errors that really hurt. A single typo in an invoice number can hold up a payment, and a misplaced decimal can throw your books into chaos for weeks.

For a business that’s trying to grow, these "small" mistakes add up fast. They can lead to strained relationships with vendors, missed early-payment discounts, and a general sense of financial disorganization. All that time your team spends on repetitive keyboard-bashing is time they could be spending on strategic planning, chasing down late payments, or actually managing cash flow.

How Bad Data Creates Bigger Problems

When you let manual errors slip into your accounting system, they don't just sit there quietly. They create a ripple effect. Suddenly, reconciling accounts becomes a headache, your financial reports are off, and your audit trails are a mess.

It's tough to get a clear picture of your company's financial health when you can't trust the numbers. If you want to dive deeper into this, we cover the nuts and bolts in our guide to automated email invoice extraction.

The biggest issue with manual processing isn't just that it's slow. It's that it injects unreliability directly into your financial data. Every time a human has to touch the data, there's a chance for something to go wrong.

This is a more common problem than you might think. Surprisingly, around 68% of companies are still manually typing in their invoice data. According to insights from sources like Docuclipper.com, this manual process can cost anywhere from $15 to over $22 per invoice. Worse, errors can creep into nearly 40% of those manually handled documents, which does nothing to build trust with your suppliers.

To get a clearer picture, let's look at a quick side-by-side comparison.

Manual vs Automated Invoice Processing at a Glance

| Metric | Manual Processing | Automated Processing |

|---|---|---|

| Time per Invoice | 10-20 minutes | < 1 minute |

| Cost per Invoice | $15 - $22.75 | $2 - $5 |

| Error Rate | Up to 40% | < 1% |

| Team Focus | Data Entry & Correction | Analysis & Strategy |

| Vendor Relations | Risk of late payments | Prompt, accurate payments |

Seeing it laid out like this really highlights the difference. Moving to an automated system to parse invoices from Outlook emails isn't just about convenience anymore. It’s a fundamental step toward running a smarter, more efficient business.

How to Choose the Right Invoice Parsing Tool

Alright, so you’re ready to stop manually entering invoice data from Outlook. Smart move. But now you’re staring at a sea of options, and they all claim to be the best. How do you pick the right one?

The secret is to ignore the flashy marketing and dig into the tech that powers these tools. This is where you’ll find the biggest difference between a solution that saves you a few minutes and one that completely overhauls your workflow.

Old School vs. New School: Why AI Matters

Many older tools still use what's called template-based OCR (Optical Character Recognition). Think of it like a stencil. You have to manually show the software exactly where the invoice number, date, and total amount are for each of your vendors. It works… until a vendor moves their logo or adds a new column to their invoice. Then, the whole thing breaks, and you're back to fixing templates.

Modern invoice parsers have gotten much smarter. They use AI to actually read and understand the document, just like a person would.

This AI-driven approach means the tool can find the "Invoice Number" whether it's at the top right or bottom left. It doesn't get thrown off by new layouts and can handle pretty much any format you throw at it - PDFs, Word docs, even a picture of a paper receipt snapped on a phone.

Choosing an AI-powered parser isn't just about cool tech. It's about future-proofing your process. As your business grows and you add more suppliers, an AI system adapts on the fly, saving you from a mountain of manual fixes down the road.

Let’s say you run a small construction company. You start out with a simple template tool for your main 10 suppliers. But then you start a big project and suddenly have 20 new subcontractors, each with their own unique invoice style. Your "automated" system quickly becomes a full-time job of building and maintaining templates. An AI tool, on the other hand, would handle those new invoices with little to no setup.

When you're doing your research, it's a good idea to check out reviews and lists of the top invoice management apps to get a feel for what’s out there and how different platforms handle parsing.

Your Quick-Hit Evaluation Checklist

Before you sign up for any service, make sure you can get a clear "yes" to these questions.

- •Is the Outlook integration seamless? You want a direct, native connection, not some clunky workaround involving email forwarding rules.

- •Can it pull line-item details? A tool that only grabs the total amount is only doing half the job. It needs to be able to extract individual product names, quantities, and prices from a table.

- •How does it connect to your accounting software? Look for pre-built, one-click integrations with systems like QuickBooks, Xero, or whatever you use. This is crucial for a truly automated process.

Connecting Outlook to Your Invoice Parser

Alright, let's get our hands dirty. The first real step is getting your invoices out of Outlook and into your new parsing tool. It sounds technical, but it’s actually pretty straightforward. Once you’re signed into your invoice parser account, you’ve got a couple of ways to get the ball rolling. The whole point is to build a bridge so you can parse invoices from Outlook emails without even thinking about it.

The easiest way is to use the unique email address your parsing tool gives you. Think of it like a dedicated mailbox just for invoices. You'll usually find this address right on your dashboard. Just copy it.

Another solid approach is to set up an auto-forwarding rule inside Outlook itself. This is where you tell Outlook, "Hey, anytime an email comes in from this specific vendor or has the word 'invoice' in the subject, automatically send it over to this special address."

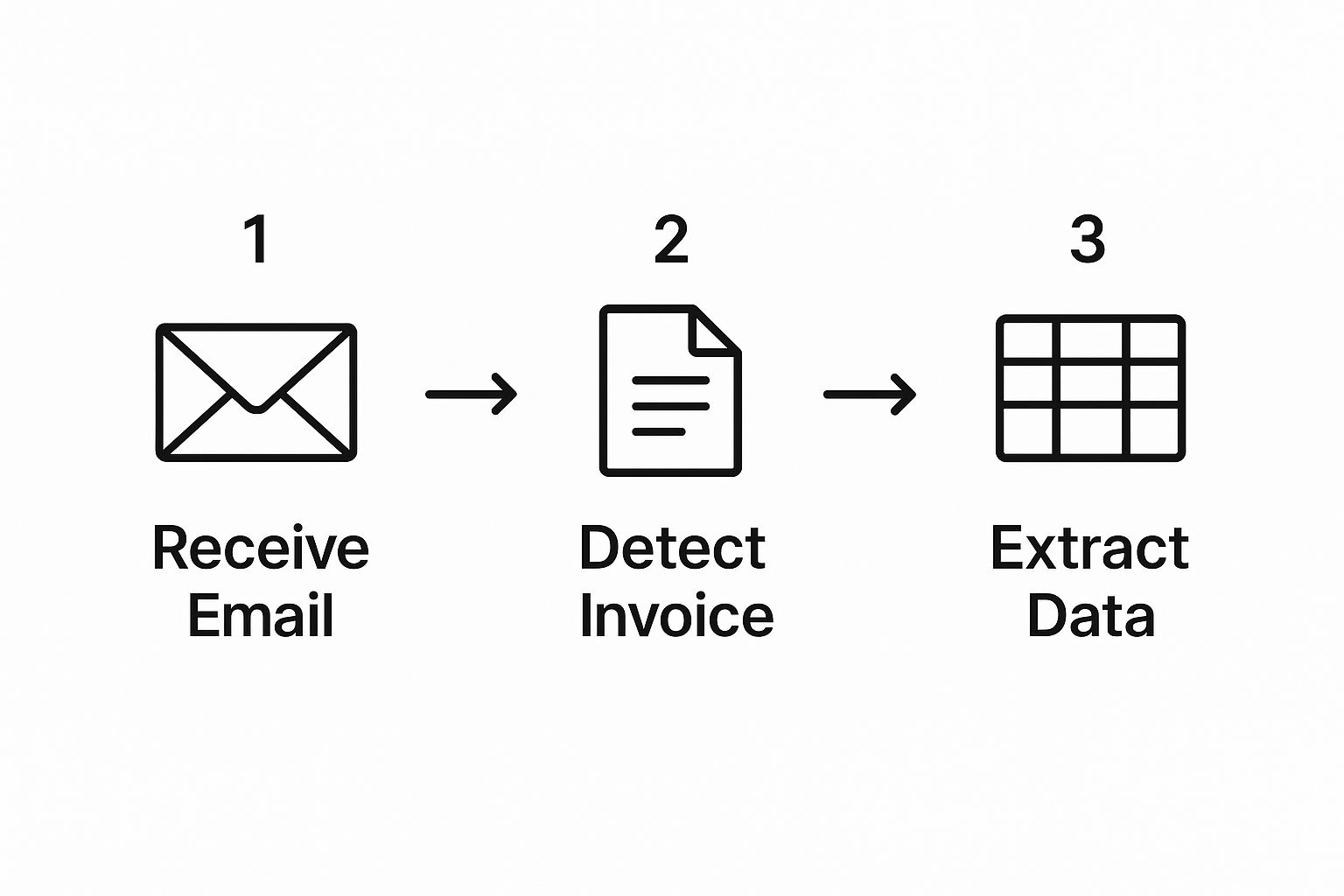

Here’s a quick visual of how that automated flow works once you’ve got it connected.

As you can see, once the email is forwarded, the system takes over, pulling out all the important data. What used to be a manual chore becomes a simple background process.

Setting Up Your Outlook Forwarding Rule

Ready to create your rule? Head over to your Outlook settings and find the "Rules" menu. This is where you'll lay out the instructions for what to forward and where.

It’s a simple two-part command:

- •The "If": You need to tell Outlook what to look for. This could be emails from a specific sender (like

invoices@supplier.com) or any email that has "invoice" or "receipt" in the subject line. Be as specific or as broad as you need. - •The "Then": Next, you choose the action. In this case, you want to "forward the message to" and then paste in that unique email address you grabbed from your parser's dashboard.

By setting up really clear rules, you ensure only the right documents get sent for processing. This keeps your entire workflow tidy and efficient.

My Two Cents: I always recommend starting small. Pick one vendor that sends you a lot of invoices and create a hyper-specific rule just for them. This lets you test the entire connection and make sure the data is being captured perfectly before you roll it out for every other supplier. It’s a great way to catch any hiccups early on.

Teaching the AI to Read Your Invoices

This is where the real fun begins. You don't need to build complex templates or loop in the IT department to get this working. Modern tools that parse invoices from Outlook emails use an intuitive, AI-powered training process you can handle yourself in just a few minutes.

It’s surprisingly straightforward. You just upload one sample invoice from a particular vendor, and the software will display it on your screen. From there, it's a simple point-and-click exercise.

For example, you’d click on the text "INV-2024-001" and tell the system, "This is the Invoice Number." Then, you'd highlight "$549.50" and tag it as the "Total Amount." After labeling just a handful of fields on that one document, the AI has already learned the typical layout for that vendor.

From One Invoice to Full Automation

That one training session is all it takes. Seriously. From now on, every single time an invoice from that vendor lands in your inbox, the AI will remember what you taught it and pull the right information automatically. It's a much more resilient system than old-school templates, which would often fail the moment a vendor made a small change to their invoice design.

If you want a deeper look into the nuts and bolts of this process, our guide on how to extract data from invoices is a great place to start.

This kind of smart automation is driven by a powerful mix of AI, machine learning, and advanced Optical Character Recognition (OCR) that can hit accuracy rates in the high 90% range. Today's systems also use Natural Language Processing (NLP) to understand different formats and even flag when important details are missing. An insightful article from Softco.com digs into some of the other hidden features behind this technology.

Pro Tip: When you're training the AI with a multi-page invoice, make sure you process the entire document. This teaches the system to find summary pages or final totals that might be lurking on the last page, so you never miss a thing.

Sending Parsed Data to Your Accounting Software

https://www.youtube.com/embed/JSA2oezQWOU

Pulling the data off your invoices is a great start, but let's be honest, the real win is getting that information into your financial system without you having to lift a finger. This is where the magic really happens - turning a faster data entry task into a genuinely automated workflow. We're essentially building a pipeline that sends everything you parse from Outlook emails straight into your accounting books.

Thankfully, most modern parsing tools give you a couple of solid options to get this done. The easiest by far is a native integration. Think of it as a pre-built, plug-and-play connection to popular platforms like QuickBooks or Xero. Getting set up is usually as simple as clicking a few buttons and authorizing the connection.

What If There's No Direct Integration?

So, what do you do if your accounting software isn't on the list? No problem. This is where tools like Zapier or Make become your best friend. They act like a universal translator between your parser and just about any other app you can think of.

You can create a simple but incredibly powerful automated rule, often called a "Zap" or a "Scenario," that looks something like this:

- •When this happens (Trigger): A new invoice is successfully parsed in the tool.

- •Do this (Action): Automatically create a new bill in your accounting software using that extracted data.

This setup takes care of mapping everything - the vendor's name, the invoice total, the due date - from the parsed document right into the correct fields in your accounting platform.

Once your invoices are parsed and the data is clean, getting that info into your financial ecosystem is the final piece of the puzzle. Picking the right platform to send it to is key, and it’s worth exploring the top accounting software for small businesses to find a system that fits your workflow perfectly.

Pro Tip: Always Have a Plan B. Even with the slickest automation, it's smart to have a fallback. Nearly all parsing tools will let you export your data into a good old-fashioned CSV or Excel file. This is a lifesaver for doing bulk uploads or working with older software that doesn’t have an integration option, ensuring no invoice gets left behind.

What's Next for Automated Invoice Processing?

If you think tools that parse invoices from Outlook emails are just about data entry, it's time to look again. We're seeing a major shift away from simple data extraction and toward genuinely intelligent financial command centers. This isn't some far-off concept; it’s already started.

The numbers don't lie. The market for AI-powered invoice processing is expected to skyrocket from USD 2.8 billion in 2024 to a staggering USD 47.1 billion by 2034. That's a 32.6% compound annual growth rate, which tells you one thing loud and clear: automation is quickly becoming a non-negotiable for staying competitive. You can get the full scoop on these global trends in AI invoice processing to see just how fast things are moving.

It’s About More Than Just Speed

So what does this really mean for your day-to-day operations? It means using the data you’re already collecting to make smarter, faster decisions. Tomorrow's systems won't just file invoices; they'll provide genuine business intelligence.

Here’s a taste of what’s coming:

- •Predictive Cash Flow: Imagine your system analyzing payment histories to give you an accurate picture of your cash position weeks or even months out. No more guesswork.

- •Smarter Fraud Detection: AI algorithms will be able to spot suspicious invoice amounts or duplicate payment requests far more effectively than the human eye.

- •Strategic Supplier Insights: By digging into your spending habits, the system can point out real opportunities to negotiate better deals with your vendors.

The real endgame here is to turn your accounts payable team from a back-office cost center into a strategic part of the business. When your team isn't bogged down by manual entry, they can focus on what really matters: financial analysis, strategic planning, and fueling growth.

Bringing this technology into your workflow isn't just about being more efficient anymore. It's a strategic move to build a smarter, more resilient business that’s ready for whatever the future holds.

Got Questions About Invoice Parsing? We've Got Answers.

When you start looking into automatically pulling invoice data from Outlook, a few questions always pop up. It's only natural. Let's walk through some of the most common ones we hear from people just like you.

"Is It Actually Secure?"

This is usually the first thing people ask, and for good reason - we're talking about sensitive financial data. The short answer is yes, but you have to choose the right service.

Any trustworthy parsing tool will use robust encryption, both for data flying back and forth over the internet and for the information sitting on their servers. Think of it like a digital armored car. Look for providers who are upfront about their security practices and mention compliance with standards like GDPR. It’s a huge red flag if they aren't.

"What About All My Different Invoice Formats?"

Your vendors don't use a standard template, so why would your parser expect one? One company sends a clean PDF, another a messy Word doc, and a third just types the details right into the email body. It's a common headache.

This is where modern AI-powered tools really shine. They don't just look for data in a specific spot on the page. Instead, they're trained to understand the context - they learn to recognize what an "Invoice Number" or "Total Due" looks like, no matter where it appears. This flexibility means they can handle a wide variety of layouts and file types without you having to manually configure rules for every single vendor.

At the heart of this is a technology called Optical Character Recognition (OCR). It’s built to "read" text from images, which is perfect for those scanned paper invoices that get attached to emails. As long as the scan is decent, the parser can handle it.

Ready to stop wasting time on manual data entry? See how Tailride can automatically parse invoices from your Outlook emails in seconds. Get started today and smooth out your entire accounts payable process.