What is Electronic Invoicing? A Complete Guide to Get Started

Discover what is electronic invoicing, how it works, and its benefits. Learn everything you need to know about electronic invoicing today!

Forget everything you think you know about sending invoices. We're not just talking about emailing a PDF. Imagine sending an invoice that doesn't just sit in an inbox waiting for someone to open it, but instead zips directly into your customer’s accounting system, ready to be processed instantly.

That, in a nutshell, is the magic of electronic invoicing. It’s a direct, system-to-system conversation that cuts out the tedious manual work for good.

Moving Beyond Paper (and PDFs)

Think about the old way of doing things. Sending a PDF invoice is like mailing a box of IKEA furniture parts with the instructions missing. Your customer gets the box, but then they have to figure out what each piece is and manually assemble it all inside their accounting software. It’s slow, clunky, and leaves a lot of room for someone to put a screw in the wrong place.

Electronic invoicing, or e-invoicing, is a completely different ballgame. It's like getting that same piece of furniture delivered fully assembled and ready to use. It arrives as perfectly structured data that the receiving system immediately understands, verifies, and processes - no human intervention required.

It's All About the Data, Not Just the Document

This is the key distinction to grasp. An e-invoice isn’t just a digital file like a PDF or a Word doc you attach to an email. It’s a special file created in a machine-readable format, like XML, that’s built for one purpose: automated processing.

This leap forward completely eliminates the need for a person to squint at a screen and punch numbers into a system. This kind of automation is a cornerstone of modern electronic document management systems, which are designed to manage the entire lifecycle of digital business files.

The push for e-invoicing isn't just about efficiency, either. Governments around the world have been driving its adoption to tighten up tax compliance. Brazil, for example, was a trailblazer, mandating a "clearance" model way back in 2008 where tax authorities had to approve invoices before they were even sent. This set the stage for real-time financial tracking that many other countries have since adopted.

To really see the difference, let’s put the two methods side-by-side.

Traditional Invoicing vs Electronic Invoicing At a Glance

The table below breaks down the fundamental differences between the old way of sending paper or PDF invoices and the modern, structured approach of e-invoicing.

| Feature | Traditional Invoicing (Paper/PDF) | Electronic Invoicing (E-invoicing) |

|---|---|---|

| Data Format | Unstructured (requires manual reading) | Structured (machine-readable) |

| Processing | Manual data entry by a human | Automated, system-to-system |

| Speed | Slow, dependent on manual workflow | Instantaneous transmission and entry |

| Accuracy | High risk of human error | Extremely low error rate |

| Cost | Higher (printing, postage, labor) | Significantly lower operational costs |

As you can see, the shift isn't just a minor upgrade. It fundamentally changes how quickly, accurately, and cost-effectively businesses can handle their financial transactions.

How E-Invoicing Works From Start to Finish

https://www.youtube.com/embed/jAuPffGbauo

To really get a feel for electronic invoicing, it helps to walk through the process. It’s a world away from just attaching a PDF to an email. Think of true e-invoicing as a direct, digital conversation between the seller's and buyer's financial systems. It’s a dedicated pipeline for financial data, making sure every invoice arrives instantly and accurately.

It all starts the moment a seller creates an invoice in their accounting or ERP system. Instead of hitting "print" or "save as PDF," their system generates the invoice as a structured data file, usually in a format like XML. This isn't just a digital picture of an invoice; it's a neat package of organized data - invoice number, amounts, line items, tax details - all ready for a machine to read and understand.

This file is then sent through an e-invoicing service provider or directly onto a secure network.

The Secure Digital Journey

This is where the process really shines. The invoice data travels across a secure digital network, much like how banks handle ATM transactions. A great example of this is the Peppol network, which essentially acts as a universal translator. It allows different accounting systems to communicate perfectly, even if the seller uses one brand of software and the buyer uses another.

Once the data hits the network, it’s instantly validated to make sure it's in the correct format and meets all the necessary standards. Then, it's securely passed along to the buyer's system. This validation step is absolutely critical for compliance, as many governments now require invoices to pass through specific, certified networks.

Key Takeaway: Using a secure, interoperable network is what makes this true e-invoicing. It’s not just about sending a file; it's about guaranteeing the data is delivered instantly, authenticated, and ready for the recipient's system to process without any human intervention.

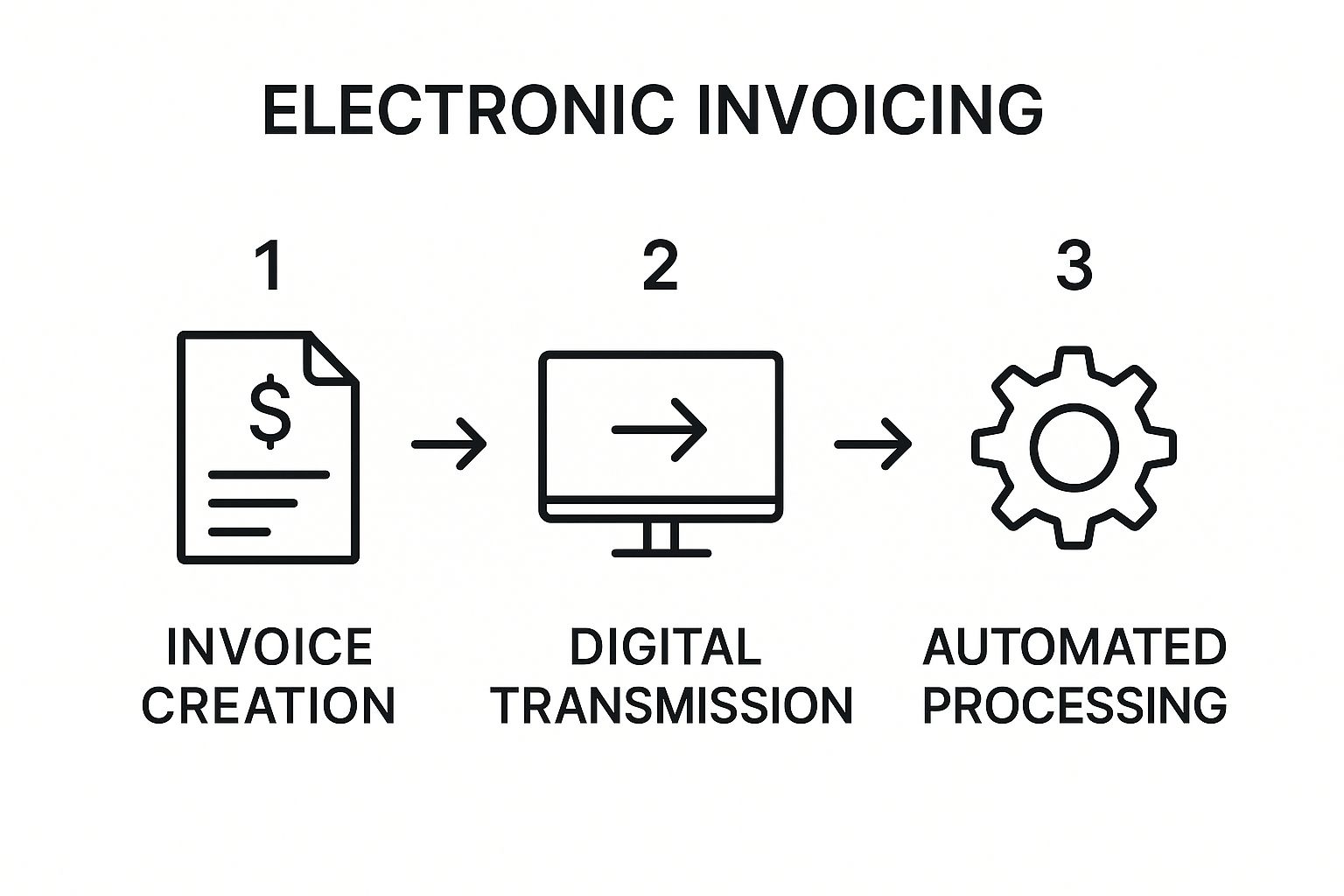

This simple infographic breaks down the core three stages of the electronic invoicing journey.

This flow shows how the process moves from creating structured data to sending it securely, and finally, to hands-free processing on the other end. Manual steps are completely designed out of the system.

Automated Receipt and Payment

The moment the e-invoice arrives in the buyer’s system, automation takes the wheel. The structured data is pulled directly into their accounts payable (AP) software. No one has to key in a single number.

From there, a whole chain of events can happen automatically:

- •Three-Way Matching: The system instantly compares the invoice against the original purchase order and the goods receipt note to confirm everything lines up.

- •Approval Workflows: If it’s a perfect match, the invoice is automatically sent for internal approval based on rules you’ve already set.

- •Payment Scheduling: Once approved, the payment is scheduled, and the whole transaction is logged in the general ledger.

This end-to-end automation transforms the entire workflow. What used to take weeks of manual effort can now be done in hours, or even minutes. It virtually eliminates the risk of human error, slashes the costs tied to manual work, and gives you a crystal-clear, real-time view of your company’s finances. It's simply faster, cheaper, and more accurate than doing things the old-fashioned way.

The Real-World Benefits of Going Digital

It’s one thing to get your head around the concept of electronic invoicing, but it’s another to see what it actually does for a business. Making the leap from manual processing isn't just a tech upgrade; it's a move that brings real, measurable wins in efficiency, cost, and accuracy that can completely reshape how your finance department runs.

The first thing you’ll notice is the impact on your wallet. Just think about all the little costs that come with a single paper invoice - the paper itself, the printer ink, the envelope, and the stamp. Then add the much bigger cost: the time your team spends keying in data, chasing approvals, and fixing the inevitable typos.

When you automate that whole process, those operational costs just melt away. No more buying paper or stamps, and way fewer hours are wasted on mind-numbing data entry. That saving goes straight to your bottom line.

Supercharging Your Cash Flow

Beyond the direct savings, e-invoicing puts the entire invoice-to-pay cycle on fast-forward. The old way of doing things is painfully slow, often taking weeks for an invoice to make its journey from creation to payment. Mail delays, lost documents, and long approval chains can seriously choke a company's cash flow.

Electronic invoicing completely flattens that timeline. An e-invoice gets delivered and processed in moments, not days. This means:

- •Instant Delivery: No more waiting for the mail truck or for someone to finally open an email.

- •Faster Approvals: Smart workflows get the invoice to the right approver immediately.

- •Quicker Payments: A shorter processing cycle means you get paid sooner, freeing up your working capital.

And this speed isn't just a win for sellers. Buyers can finally take advantage of those early payment discounts, turning their accounts payable department from a cost center into a place that actually generates value. The benefits of automated invoice processing ripple through the entire financial relationship, making things better for everyone involved.

Achieving Flawless Accuracy

Let's be honest, manual data entry is a recipe for mistakes. One tiny typo - a misplaced decimal point or a wrong invoice number - can set off a chain reaction of problems, leading to payment disputes, reconciliation nightmares, and strained supplier relationships.

E-invoicing pretty much erases that risk. Because the data moves directly from one system to another in a structured format, the chance for human error disappears. The information is right, right from the start.

This shift is more than a simple operational tweak; it's a strategic move. Businesses embracing e-invoicing report measurable improvements in financial health, attributing it to real-time validation and shortened payment cycles. They see it as a key to becoming more competitive. Discover more insights from the Vertex e-invoicing research report.

This built-in accuracy means fewer rejected invoices, faster resolutions when issues do come up, and far more reliable financial forecasting. When you know your data is clean, you can actually trust the numbers - and that empowers you to make smarter business decisions across the board.

Navigating Global E-Invoicing Mandates

For a growing number of businesses, moving to electronic invoicing isn't just a smart upgrade - it's the law. Governments all over the world are making e-invoicing mandatory, and it's not just to get rid of paper. It's a massive strategic shift for tax authorities.

Why the big push? Tax agencies want real-time visibility into what’s happening in the economy. They’re trying to clamp down on tax fraud and close the ever-present VAT gap. Think about it: trying to track tax revenue by digging through millions of disconnected PDF or paper invoices is a nightmare. It’s an open invitation for errors and evasion.

By requiring structured e-invoices to flow through a central government system, authorities can see and validate transactions as they happen. This gives them a crystal-clear picture of economic activity and helps make sure everyone is paying their fair share.

Keeping Up with a Fast-Moving Trend

This isn't some far-off future concept; it's happening right now and picking up speed. By 2025, e-invoicing has become a non-negotiable part of doing business in major economies.

Take India, for example. Any business with an annual turnover of more than 5 crore INR (that's about $600,000 USD) has to issue e-invoices for every single B2B transaction. Over in Europe, the ‘VAT in the Digital Age’ (ViDA) initiative is rolling out real-time e-invoicing requirements across the EU, with France set to have all B2B invoices compliant by 2026. If you want to dive deeper into these trends, this detailed 2025 e-invoicing overview is a great resource.

Understanding Different Compliance Models

Here’s where it gets a little tricky: not all government mandates are created equal. The end goal is always tax transparency, but the "how" can look very different from one country to the next. If you operate internationally, getting a handle on these models is essential for staying out of trouble.

Generally, you'll run into one of two main approaches:

- •The Clearance Model: Think of this as getting a permission slip. Before you can send an invoice to your customer, you have to submit it to a government tax platform for approval. Only after it gets a digital stamp does it become a legal document. This model is big in Latin America and Italy, giving tax authorities direct control.

- •The Interoperability Model: This approach is more about creating a shared playground. Networks like Peppol in Europe set a standard that everyone follows. You can use any certified software to send and receive invoices, as long as it plugs into the network. The government can then pull the data it needs for audits directly from this network.

To stay on top of the various global e-invoicing mandates and their complexities, many companies turn to a dedicated compliance automation platform to handle the heavy lifting.

Why This Matters for Your Business

Let's be blunt: ignoring these rules is not an option. Getting it wrong can mean hefty fines, customers rejecting your invoices, and serious delays in getting paid. As more countries jump on board, a solid e-invoicing system stops being a "nice-to-have" and becomes a basic requirement for global trade.

The core takeaway is that e-invoicing is becoming the standard language for B2B transactions worldwide. Businesses that adapt now will not only ensure compliance but also gain a significant competitive edge through faster, more accurate financial operations.

Being prepared means knowing the specific rules for every country you do business in. You need to understand everything from the data formats they require (like specific types of XML) to the transmission networks they've approved. Taking a proactive approach here will keep your business running smoothly, without any nasty compliance surprises.

Choosing the Right E-Invoicing Solution

Alright, you've seen the benefits and know that compliance is just around the corner. The next step is the big one: finding the right tool for your business. The market is packed with options, from simple plugins for your current accounting software to full-blown platforms that handle everything for you.

Think of it like buying a car. If you're just running errands around town, a small, reliable sedan is perfect. But if you're hauling cargo cross-country, you'll need a semi-truck. Your business size, how many invoices you send, and where you operate will all point you toward the right solution.

Key Factors for Your Decision

Before you jump into a dozen software demos, it's smart to sit down and figure out what you actually need. A little prep work now can save you from a major headache later. Think of this as your must-have list.

Here are the big things to consider:

- •Integration Capabilities: How well does it play with the software you already use, like your accounting or ERP system? If you have to manually move data back and forth, you’re missing the whole point of automation.

- •Ease of Use: Can your team pick it up and run with it without needing a week of training? A clean, intuitive interface is non-negotiable for getting everyone on board quickly.

- •Scalability: You need a solution that can grow with you. What works for 100 invoices a month might crumble under the weight of 1,000. Make sure it can handle your future success.

- •Compliance Support: This is huge. Does the provider understand and support the e-invoicing rules in all the countries where you do business? This is absolutely critical if you have international customers or suppliers.

You’re not just buying a piece of software. You're bringing on a partner to help streamline your financial workflow. The right tool should feel like a natural extension of your team, taking the e-invoicing complexity off your plate so you can get back to business.

From Basic Tools to Full-Service Platforms

With your checklist in hand, you can start exploring what's out there. Most solutions fall into a few different buckets, each suited for different kinds of businesses.

Some tools are specialists, designed to do one thing really well. Others are all-in-one platforms that manage the entire invoicing lifecycle from start to finish. To get a better sense of the landscape, our guide on automated invoice processing software is a fantastic place to start. A little research goes a long way in making sure you pick a system that delivers real value from the get-go.

Your Guide to a Smooth Rollout

Let's be honest, bringing in any new technology can feel like a huge undertaking. But switching to electronic invoicing doesn’t have to be a nightmare. If you approach it thoughtfully, the transition can be a surprisingly positive change that starts paying for itself almost immediately. The trick is to think of it less as a software install and more as an upgrade to your entire financial workflow.

A successful launch begins way before you flip the switch. First things first: map out a clear plan. What are you trying to achieve? What's a realistic timeline? Most importantly, get your finance team in on the ground floor. They’re the ones who will be using this day-in and day-out, so their buy-in is everything.

Explaining the "why" is just as critical as the "how." Don't just announce a new system is coming. Talk about the benefits it brings to everyone - from getting paid faster to waving goodbye to frustrating data entry errors. This simple step can turn skepticism into genuine excitement.

Start Small, Then Scale Up

Instead of trying to move everyone over at once (a recipe for chaos), start with a pilot program. This is your secret weapon. It lets you test the system in a real but controlled setting, allowing you to smooth out any kinks before they become company-wide headaches.

Here’s a simple way to get started:

- •Pick a Small Test Group: Choose a few trusted partners - a mix of customers and suppliers - who are open to trying something new with you.

- •Run Real Invoices: Process a small, manageable batch of actual invoices through the new system, from creation all the way to payment.

- •Ask for Honest Feedback: Check in with your internal team and your pilot partners. What felt great? What was clunky or confusing? Use their insights to make adjustments.

This trial run is also a fantastic way for your team to get comfortable and build confidence with the new tools.

Think of a pilot program as a dress rehearsal. It’s your chance to make sure that when the curtain goes up for real, everyone knows their lines and the show runs perfectly.

Finally, don't skimp on training. You can have the best system in the world, but it’s useless if your team doesn't know how to use it properly. Provide easy-to-understand guides and hands-on training sessions to get everyone up to speed. A little preparation upfront makes the difference between a bumpy transition and a smooth, successful launch.

Got Questions? We’ve Got Answers.

Even after getting the basics down, a few common questions always seem to surface when people start digging into e-invoicing. Let's walk through them to clear up any confusion and make sure you’re set up for success.

Isn't a PDF Invoice an E-Invoice?

This is probably the most common mix-up, but it's a crucial distinction. Sending a PDF via email is definitely a step up from paper, but it’s not true e-invoicing. A PDF is what we call unstructured data. Think of it as a digital picture of a document. A computer can't "read" it; a person has to open it, interpret the details, and manually type everything into an accounting system.

Real e-invoicing, on the other hand, uses structured data (often in formats like XML). This data is neatly organized so that machines can instantly read, understand, and process it from start to finish without a human touching it. That’s why governments and major networks specifically mandate structured e-invoices, not just email attachments.

Is E-Invoicing the Same Thing as EDI?

You'll often hear EDI (Electronic Data Interchange) mentioned in the same conversation, but they're not interchangeable. EDI is a much broader, older technology for swapping all kinds of business documents electronically - purchase orders, shipping notices, you name it. E-invoicing is a newer, more focused application that deals only with invoices.

Here's an analogy: EDI is like an old-school, private courier service. It’s reliable but requires a complex, custom-built connection between two specific companies. Modern e-invoicing networks are more like the open internet - standardized, accessible, and designed for anyone to connect and communicate with ease.

Do My Customers and Suppliers Need the Same Software as Me?

This is where the beauty of modern e-invoicing really shines. The answer is almost always no. Networks like Peppol are built on a principle called interoperability, which is just a fancy way of saying different systems can talk to each other.

As long as your business and your trading partners are connected to the same network (like Peppol), you can exchange invoices perfectly, no matter what software or service provider you each use. It’s just like email. You can be on Gmail and send a message to someone using Outlook without a second thought because they both speak the same underlying language. E-invoicing networks do the same thing for financial documents.

Ready to stop chasing invoices and automate your entire accounts payable process? Tailride connects directly to your inboxes and online portals, using AI to extract and process invoice data automatically. See how much time you can save by visiting our site today.