How to Prepare for an Audit Without the Stress

Learn how to prepare for an audit with our friendly, actionable guide. Discover expert tips on documentation, internal controls, and auditor communication.

Tags

An audit notice can definitely make your stomach drop, but with the right game plan, it's just another business process - not a catastrophe. Getting ready for an audit boils down to a few critical first steps: understanding exactly what the auditors want, getting your internal team on the same page, setting a practical timeline, and opening a clear line of communication with the auditors themselves.

Think of this early stage as building a strong foundation. It's all about having rock-solid documentation, robust system checks, and a well-briefed team ready to go.

Your Friendly Roadmap to a Smooth Audit

The moment that audit notification lands, the clock starts ticking. It's easy to feel a surge of panic, but my advice is to take a breath and reframe it. This isn't a crisis; it's a project. The trick is to shift from a reactive, "oh no" mindset to a proactive, strategic one. This isn’t about preparing for a fight. It’s about setting the stage for a smooth, collaborative review that showcases just how competent and transparent your organization is right from the get-go.

I've seen it time and again: a successful audit always starts with a clear plan. Your very first move should be to carefully dissect the audit engagement letter. This document is your treasure map - it tells you exactly what the auditors will be looking at, the specific time period they're interested in, and the standards they'll be using. You absolutely have to understand this scope, as it will drive every single action you take from this point forward.

Assembling Your Internal Dream Team

Trust me, an audit is not a solo sport. Your next move is to put together your internal "dream team." This group needs to include key players from finance, operations, and any other department that falls under the audit's scope. Critically, you need to designate a single, primary point of contact to handle all communication with the auditors. This one step saves so much confusion and prevents conflicting information from muddying the waters.

This team's first job is to get organized. Here’s what they should focus on immediately:

- •Create a Master Checklist: Start a detailed list of every document you anticipate the auditors will ask for. Assign a specific person to be responsible for gathering each item. To get a head start and make sure you don't miss anything, a comprehensive internal audit checklist can be an invaluable resource.

- •Set a Timeline: Look at the audit start date and work backward. Set realistic internal deadlines for collecting documents, reviewing financials, and checking your systems.

- •Brief Stakeholders: Make sure everyone involved knows their role, understands the audit's goals, and appreciates why their timely cooperation is so important.

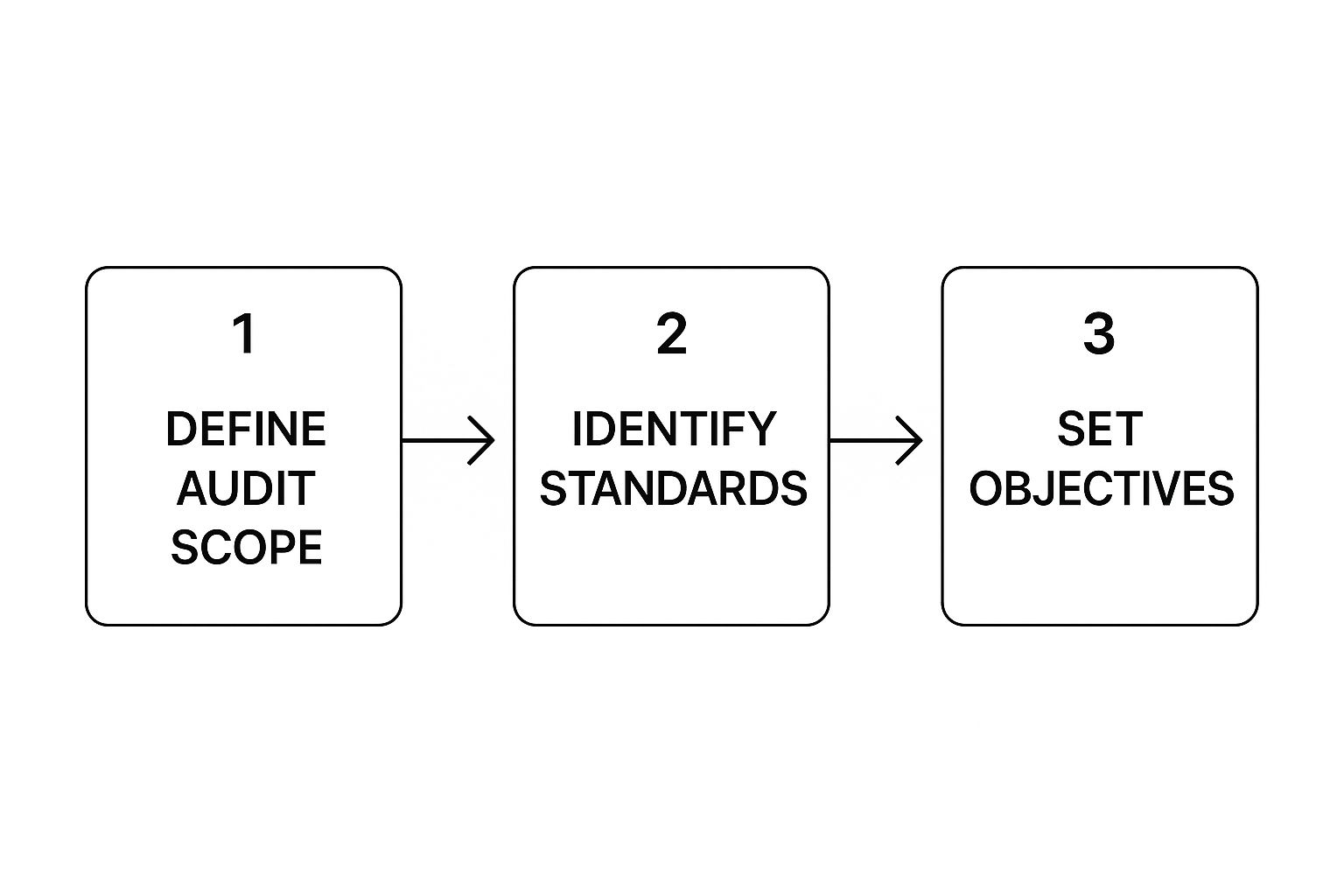

This initial planning phase is absolutely crucial. As this process flow shows, it all begins with defining the scope and objectives.

This visual really drives home the point: a successful audit is built on a solid plan before you even start pulling documents.

Once you have your internal ducks in a row, it’s a good idea to create a simple checklist to ensure you’ve covered the basics.

Your Initial Audit Prep Checklist

Here’s a quick-glance checklist for the essential first steps after receiving an audit notification. Nailing these will ensure you're starting off on the right foot.

| Action Item | Key Focus | Why It Matters |

|---|---|---|

| Analyze the Audit Letter | Scope, period, and standards | Defines the boundaries of the audit and prevents wasted effort. |

| Form an Internal Team | Cross-departmental representation | Ensures all relevant expertise is available and work is distributed. |

| Appoint a Single Contact | Centralize auditor communication | Prevents mixed messages and creates a clear, efficient channel. |

| Hold an Internal Kick-off | Align team on roles & timeline | Gets everyone on the same page and establishes shared goals. |

| Make Initial Auditor Contact | Set a collaborative tone | Establishes goodwill and clarifies any immediate logistical questions. |

Ticking these boxes early on transforms the entire experience from a frantic scramble into a managed, controlled process.

Opening a Positive Line of Communication

Finally, reach out to the audit firm. A quick, friendly introductory call can work wonders to set a collaborative tone and clear up any initial questions about logistics. Let them know you’ve got a dedicated team ready to help them.

A proactive and organized approach during this initial phase does more than just prepare you for the audit; it sends a powerful message to the auditors that you are in control, transparent, and serious about compliance.

By giving this preliminary stage the attention it deserves, you completely change the dynamic. It’s no longer a stressful chore but a well-managed business process. You aren't just getting ready for an audit; you're building a framework for confidence and control that will see you through the entire engagement.

Getting Your Documentation and Data in Order

Let's be honest: an audit lives and dies by its paper trail. This is the stage where being meticulous isn't just a good idea - it's everything. True preparation goes way beyond just stacking up invoices; it’s about gathering, organizing, and critically reviewing every single piece of evidence that tells your financial story.

Your goal here is to project competence and control. When an auditor can easily find what they're looking for, it builds instant trust and makes the entire process smoother. This is your first and best chance to show that your financial operations are as buttoned-up in reality as they look on paper.

Build Your Digital Command Center

The first thing you should do is create a centralized, logical digital filing system. Think of it as building a library where the auditor can quickly grab any "book" they request. A messy, confusing folder structure is an immediate red flag, signaling that your day-to-day processes might be just as chaotic.

I’ve found the best approach is to create a master folder for the audit period. Inside that, create subfolders that mirror common audit requests.

- •Financial Statements: Your monthly, quarterly, and annual reports.

- •Bank Records: All bank statements and, crucially, the reconciliation reports for the period.

- •Revenue & Invoicing: Every single sales invoice, customer contract, and payment record.

- •Expenses & Payables: All vendor invoices, expense reports, and proof of payment.

- •Payroll Records: Payroll registers, tax filings (like 941s), and employee compensation details.

- •Contracts & Agreements: Key contracts with clients, vendors, and partners.

This structure does more than just keep you tidy. It forces you to think like an auditor and anticipate their requests, which is a huge advantage. This is also where automation can be your best friend. To make gathering information less of a manual slog, look into tools like document automation software that can help pull your files together.

Ensure Data Integrity and Review

Once your documents are gathered, the real work begins. It’s not enough to just have the files; you need to be certain they are complete, accurate, and tell a consistent story. This is your opportunity to find and fix issues before they ever become formal audit queries.

A fantastic technique I always recommend is the "four-eyes principle." This simply means that at least two people should review critical documents, especially things like major financial reports or bank reconciliations. A second pair of eyes is invaluable for catching small errors or inconsistencies the primary preparer might have missed.

The worst thing you can do is hand over documents you haven't reviewed yourself. Finding and flagging a minor discrepancy internally shows diligence; letting the auditor find it suggests a lack of control.

Think of this review process as your own internal pre-audit. Be on the lookout for anything that seems odd - a sudden spike in expenses, a missing invoice in a sequence, or a transaction that lacks clear backup. Document these findings and have a clear, concise explanation ready for each one.

Create a Master Document Checklist

To keep this whole process from going off the rails, a master document checklist is non-negotiable. This isn't just a to-do list; it's a dynamic project management tool. A solid checklist ensures nothing falls through the cracks, especially when multiple people are pulling information. For a head start, our complete audit readiness checklist is a great framework to build from: https://tailride.so/blog/audit-readiness-checklist

Your checklist should track several key pieces of information for each requested item.

| Document Category | Item Description | Assigned To | Status | Notes / Issues |

|---|---|---|---|---|

| Accounts Payable | All invoices from Vendor XYZ | Sarah Jones | Collected | Invoice #789 is missing. |

| Payroll | Q3 Payroll Tax Filings | Mike Chen | Reviewed | All forms match payments. |

| Bank Statements | Main Operating Account - July | Sarah Jones | Reconciled | Two uncleared checks noted. |

This kind of detailed tracking helps your audit point person give quick, accurate status updates to the auditors. It demonstrates that you have a robust internal process, which goes a long way in building confidence and rapport.

Ultimately, getting your documentation in order is about more than just compliance. It's a chance to put your own financial records under a microscope, tighten up your processes, and present your organization as a well-oiled machine. Taking this proactive stance can transform an audit from a stressful interrogation into a professional review you can navigate with total confidence.

How to Shore Up Your Internal Controls

Let's be honest: auditors care just as much about how you got your numbers as they do about the numbers themselves. They're going to dig into the systems and processes behind your financial statements. This is where strong internal controls become your best friend - they prove your data is reliable by design, not by chance.

Getting these controls in shape isn't a last-minute scramble. It’s about taking a hard, honest look at your financial workflows to find and fix the weak spots before they turn into painful audit findings. A solid control environment doesn’t just make for a smoother audit; it protects your business from costly errors and fraud every single day.

Kick Things Off with a Pre-Audit Self-Assessment

The best way to get ready for an auditor's inspection is to inspect yourself first. Think of it as a dress rehearsal, where you put on the auditor's hat and poke around your own systems. The goal here is to be brutally honest and find the vulnerabilities before they do.

Start by mapping out your key financial processes. I don't mean just thinking about them - actually draw them out.

- •Procure-to-Pay: What's the journey of a purchase from request to payment? Who has to sign off at each stage?

- •Order-to-Cash: How do you go from making a sale to seeing the cash in your bank account?

- •Financial Close: Walk through how you reconcile accounts, approve journal entries, and pull together the final statements.

As you map each process, ask the tough questions. Where could a simple mistake slip through? Where could someone intentionally commit fraud? This exercise is incredibly revealing and will quickly shine a light on gaps you've probably been overlooking.

Get Your Control Processes in Writing

Once you've mapped everything out, you need to document it all. This documentation is your proof for the auditor, showing that your controls are deliberate and consistently followed.

Think of this documentation as the official playbook for your financial operations. For instance, your expense policy shouldn't be a vague idea; it needs to spell out approval limits, receipt requirements, and submission deadlines. Unwritten rules are a huge red flag for auditors because if it’s not written down, they can't verify that it's being followed consistently.

A well-documented control process is an auditor's dream. It shows you're proactive about risk and take financial governance seriously. Honestly, this alone can dramatically cut down the time they spend testing these areas.

Nail Down Segregation of Duties and Access Rights

One of the most foundational principles in internal control is the segregation of duties. Put simply, no single person should ever control a financial transaction from beginning to end. It's one of the most effective ways to prevent fraud.

For example, the person who approves purchase orders shouldn't also be the one cutting the checks to vendors. The employee who sends out customer invoices shouldn't be the same person collecting the payments or reconciling the bank account.

Hand-in-hand with this is a regular review of who can access your systems. Who has the keys to your accounting software, and what are they allowed to do? An employee who only needs to run reports should never have permission to create or approve journal entries. Make it a habit to review user permissions every quarter to ensure they still match people's job roles, and always remove access for former employees immediately.

Keep Up with Evolving Audit Standards

The world of accounting and auditing doesn't stand still. Showing an auditor you're aware of and adapting to these changes proves your organization is on the ball and committed to doing things right.

For instance, the Institute of Internal Auditors (IIA) rolled out new Global Internal Audit Standards that took effect in early 2025. This was a major update that raised the bar for internal audit teams, forcing many to overhaul their methods and reporting. The companies that got ahead by doing self-assessments against the new standards were far better prepared. You can dive into a detailed analysis of these evolving audit hot topics to get a better sense of the shifting landscape.

Close the Most Common Control Gaps

Your self-assessment will probably uncover a few common weaknesses. The good news? They're often surprisingly easy to fix.

Here are a few frequent offenders I see all the time:

- •Missing Approvals: If invoices are getting paid without a clear, documented sign-off, set up a formal workflow immediately. Even a simple email chain is better than nothing.

- •Stale Bank Reconciliations: Bank accounts need to be reconciled every single month. No exceptions. This is a critical check that catches errors and potential fraud before they spiral.

- •Lax Physical Security: Where are your blank checks, company credit cards, and sensitive files? If they aren't under lock and key, they need to be.

Tightening up your internal controls turns the audit from a stressful, reactive event into a chance to proactively validate the strength of your financial management. It’s an investment that pays off with a smoother audit and a much more secure business.

Knowing What Modern Auditors Really Look For

The days of auditors just ticking boxes against financial statements are long gone. While your books are still the main event, today's audits dig much deeper into a whole new set of risks that can make or break a company's reputation and stability. If you want to breeze through your next audit, you need to get inside the modern auditor’s head.

They're not just confirming financial accuracy anymore. They’re sizing up your company's resilience, transparency, and overall health in a world that’s more complex than ever. Nailing your prep in these key areas is the secret to a smooth, successful review.

Your Cybersecurity Defenses

Cybersecurity isn't just an IT headache; it's a core business risk, and you can bet your auditors see it that way. They’ll want to see hard evidence that you have a solid framework in place to protect sensitive data - not just your own, but your customers' and employees' information too.

Be ready to hand over documentation on things like:

- •Access Controls: Who has the keys to your critical systems and data? How do you manage and review those permissions?

- •Data Protection Policies: What are you actively doing to prevent data breaches? Think encryption, network security, and firewalls.

- •Incident Response Plan: If the worst happens and you get breached, what's your step-by-step plan to contain the damage, notify everyone, and get back on your feet?

Having these policies clearly written down - and proof you actually follow them - is absolutely essential.

Governance and How You Report It

Auditors are obsessed with transparency and accountability, and that all starts at the top with strong corporate governance. They need to be convinced that your organization operates ethically and that your leadership team is providing real, effective oversight.

For example, they'll likely comb through your board meeting minutes. They want to see that major decisions and risks were actually discussed and properly documented. They'll also put your financial reporting process under a microscope to ensure it's not just accurate, but also transparent and easy for an outsider to follow.

An auditor's logic is simple: strong governance means a lower risk of major mistakes, whether they come from honest error or outright fraud. When you can prove your structure is solid, it gives them instant confidence in your entire operation.

This isn't just a hunch; it's a huge industry trend. Recent data shows that cybersecurity now takes up a massive chunk of audit planning, with 69% of organizations globally spending significant time on it. Governance and corporate reporting are right behind, demanding attention from 56% of audit teams, while business continuity is a top concern for 55%. You can explore more about these global audit priorities to see how your own prep measures up.

Business Continuity and Other Hot Spots

What if a real disaster strikes? Auditors need to feel confident that your business can weather a major storm, whether it’s a hurricane, a supply chain meltdown, or another pandemic. A business continuity plan (BCP) isn't just a "nice-to-have" document; it's something they will definitely ask to see.

Your BCP should spell out exactly how your business will keep essential operations running during and after a crisis. This covers everything from data backups and recovery procedures to having a plan for an alternative worksite if your office is out of commission.

Beyond these big three, auditors are also zeroing in on:

- •Regulatory Compliance: How do you keep track of and stick to all the laws and regulations in your specific industry?

- •Fraud Prevention: What proactive steps are you taking to sniff out and stop fraudulent activity before it starts?

- •Financial Liquidity: How are you managing your cash flow to ensure the business stays solvent and can pay its bills?

By getting a handle on these modern priorities, you can anticipate what your auditors will ask for and have the documentation ready to go. To make sure nothing falls through the cracks, grab our detailed audit preparation checklist. It’ll help you systematically cover all these critical risk areas. This kind of proactive approach shows auditors you're not just trying to be compliant - you're strategically managing the risks that truly matter today.

Using Technology for a Pain-Free Audit

Let’s be honest: nobody enjoys the late nights spent hunched over spreadsheets and digging through filing cabinets. But preparing for an audit today doesn't have to be a nightmare. Modern technology is the key to working smarter, not harder.

Think of it this way: the right tools can transform your financial management from a reactive scramble into a proactive, well-oiled machine. It’s not just about surviving an audit; it's about building a transparent system that gives you a crystal-clear view of your finances year-round. This approach not only makes the audit process smoother but also makes your entire business more resilient.

Automation Is Your New Best Friend

The single biggest time-waster during audit prep? Manual work. Hunting for that one missing invoice, matching endless lines of transactions, and painstakingly keying in data are all tasks ripe for human error and frustration. This is where automation platforms truly shine.

Imagine a system that automatically pulls every invoice from your email, categorizes it, and extracts all the critical data without anyone lifting a finger. This isn't science fiction - it's what smart tools do every day. They create a clean, consistent, and easily verifiable data trail right from the start. You can get a feel for what’s possible by looking at various business process automation examples and seeing what might fit your operations.

For a deeper dive, our guide on https://tailride.so/blog/invoice-process-automation shows exactly how this technology can slash manual data entry and keep your records perfectly organized from day one.

The Power of Real-Time Monitoring

Why wait for your annual audit to uncover problems? With modern financial tools, you can continuously monitor your transactions. This means you can spot anomalies, flag unusual spending, or identify missing paperwork as it happens - not months down the line when it’s a much bigger headache.

This real-time visibility is a game-changer. For example, a system can automatically flag an invoice that was approved but never made it to your payables list. Or it could catch a duplicate payment before it ever leaves your bank account.

By the time an auditor walks in, you’ve already found and fixed the small discrepancies that would have otherwise turned into time-consuming questions. This proactive stance demonstrates an exceptional level of internal control and competence.

Using AI for Deeper Insights

Artificial intelligence (AI) is quickly moving from a buzzword to a practical tool in audit preparation. AI-powered software goes beyond simple automation to analyze patterns, predict risks, and surface insights that would be nearly impossible for a human to find manually.

This technology is no longer a futuristic idea; it’s here now, helping businesses strengthen their financial integrity. Consider what AI can do for you:

- •Anomaly Detection: AI algorithms learn your company's normal spending patterns and can instantly flag transactions that seem out of place, like an unusually large payment to a vendor or an invoice from an unrecognized source.

- •Automated Reconciliation: Forget manual ticking and tying. Advanced platforms can match thousands of transactions between invoices, purchase orders, and bank statements in minutes, pinpointing every discrepancy with laser precision.

- •Predictive Analytics: By analyzing your historical data, some tools can even forecast potential compliance risks or cash flow issues, giving you a chance to get ahead of them.

By bringing these tools into your workflow, you aren't just preparing for this year's audit. You're building a smarter, more transparent financial foundation that will benefit your organization for years to come.

Common Audit Preparation Questions Answered

Even with a rock-solid game plan, you're bound to have some nagging questions. It’s completely normal. Getting clear on these common worries beforehand can make a world of difference, helping you walk into the audit feeling confident instead of anxious. Let's dig into some of the questions I hear all the time from businesses getting ready for an audit.

How Far Back Do Auditors Usually Look?

This is easily one of the most frequent questions, and the answer really hinges on your audit history. If you go through audits regularly, the team will almost always focus on the most recent fiscal year. They already have the previous year's files to use as a benchmark, so their main job is to check that this year’s numbers are sound.

But what if this is your company's first-ever audit? In that case, you should expect them to dig a bit deeper. It’s pretty standard for an initial audit to cover the last two to three years. This gives them the context they need to see how your finances have evolved, spot any trends, and make sure your accounting methods have been consistent over time.

Want the definitive answer? It’s always in the audit engagement letter. This document is your official roadmap for the audit and will spell out the exact scope and period being reviewed. When in doubt, check the letter.

What Is the Single Biggest Mistake to Avoid?

I’ve seen it all, and the number one mistake, hands down, is disorganization. Handing auditors a jumbled mess of papers or a confusing set of digital files is a huge red flag. It immediately suggests your internal controls are weak, which almost guarantees they’ll dig deeper, ask more questions, and extend the audit timeline. It’s a self-inflicted wound.

The best way to avoid this is to have everything neatly organized before they even arrive. Imagine an auditor asks for a specific contract from last March, and you pull it up on your screen in less than a minute. That simple act builds a mountain of trust and shows them you’re a competent, well-run organization. It makes their job easier, and trust me, you want their job to be easy.

Should I Tell the Auditor About a Mistake I Found?

Yes. One hundred percent, yes. It feels wrong, I know, but being upfront about an error you’ve already discovered is always the best move. Trying to hide a mistake is a gamble that almost never works. If (and when) they find it on their own, your credibility takes a massive hit.

Instead, get ahead of it. Here’s the playbook:

- •Get to the bottom of it: Pinpoint the error and understand its full impact.

- •Document everything: Make a note of how you found it and when.

- •Show your solution: Detail the steps you took to fix the error and, just as importantly, the measures you put in place to ensure it won’t happen again.

When you present this to the auditor, you're not just admitting a mistake. You're proving that your internal controls actually work - that your system is strong enough to catch and correct its own problems. This can turn a negative into a major positive.

How Can I Make the Process Go Faster?

A quick, smooth audit comes down to two things: great preparation and clear communication. Your goal is to eliminate any friction that could slow the auditors down.

The most effective way to speed things up is to be incredibly responsive and think one step ahead.

- •Have a Designated Point Person: Funneling all auditor questions through a single, dedicated contact prevents crossed wires and keeps things moving.

- •Be Quick on the Draw: When they ask for a document, try to get it to them the same day. The longer you take, the longer they'll be there.

- •Give Them Exactly What They Ask For: If they request a single invoice, don't send them the entire month's folder. Precision shows you respect their time and are on top of your game.

By looking at their initial request list and having those documents ready to go, you can slash the time spent on back-and-forth emails and help everyone get to the finish line faster.

Stop wasting hours on manual data entry and get your business audit-ready automatically. Tailride connects to your inboxes and portals to fetch, categorize, and reconcile every invoice and receipt, creating a perfect, searchable financial archive. Sign up for Tailride today and see your first invoices extracted in seconds.