Automate Invoice Processing A Friendly How-To Guide

Tired of manual data entry? Learn how to automate invoice processing with our friendly guide. Cut costs, reduce errors, and reclaim your team's time.

Tags

Let’s face it, nobody enjoys being buried under a mountain of invoices. For any growing business, it’s a familiar pain. When we talk about automating invoice processing, we're really talking about trading in that soul-crushing manual data entry for smart software that does the heavy lifting - capturing invoice details, checking them for accuracy, and getting them paid. Making this one change can slash errors and give your team back their most valuable resource: time.

Why Manual Invoicing Is Quietly Draining Your Bank Account

If your accounts payable department still runs on paper stacks, messy email threads, and typing out line items by hand, you’re losing a lot more than just your patience. You're losing cold, hard cash. The daily slog of tracking down approvals, matching invoices to purchase orders, and fixing inevitable typos adds up to a slew of hidden costs that are way bigger than you might think.

This isn’t just a minor headache; it's a serious financial leak. The average cost to process a single invoice the old-fashioned way is a whopping $22.75. Think about how quickly that adds up. It turns a basic business function into a major-league expense. If you want to see the bigger picture, the latest research on global AI trends shows how these costs snowball for companies of all sizes.

The Hidden Costs You’re Probably Not Tracking

The most obvious expense is your team's time. Every minute someone spends punching in numbers from a PDF, digging through emails for a missing receipt, or nudging a manager for an approval is a minute they could have spent on high-value work like financial planning or strategic analysis.

But that’s just the tip of the iceberg. The real damage from manual workflows comes from the less obvious costs that chip away at your profit margins.

- •Missing Out on Easy Money: A lot of suppliers offer a 1-2% discount if you pay within 10 days. When an invoice is sitting in someone's inbox for a week waiting for a signature, you're literally throwing that free money away. Over a year, that can easily add up to thousands of dollars.

- •Getting Hit with Late Fees: On the flip side, a disorganized system is a recipe for overdue payments and the penalties that come with them. These fees not only hit your cash flow but can also sour your relationship with the very suppliers you rely on.

- •The High Price of Human Error: Let's be real, people make mistakes. A simple typo can lead to paying too much, too little, or, worst of all, paying the same invoice twice. Finding and fixing those errors just creates more work and more frustration.

The biggest problem with manual invoicing isn't just that it’s slow. It’s that it forces your finance team into a constant state of putting out fires. They never get the chance to be the proactive, strategic partner your business truly needs them to be.

Damaged Vendor Relationships and Stalled Growth

The financial hit is bad enough, but a clunky payment process can also damage your reputation. Suppliers who constantly have to chase you down for payment or deal with incorrect remittances get frustrated. That can lead to them offering you less favorable terms or even prioritizing other customers over you.

At the end of the day, an inefficient AP process is a major roadblock to growth. As your business expands, the number of invoices grows with it, and a manual system will inevitably buckle under the pressure. The process that worked fine for 20 invoices a month will completely fall apart when you hit 200. This is the point where you don’t just automate invoice processing for convenience - you do it to survive.

Laying the Groundwork for Smooth Automation

It’s tempting to jump straight into new software, but trust me, hitting the pause button and doing a little prep work first is the secret to a successful rollout. Think of it like this: you wouldn't build a house on a shaky foundation. The same logic applies here.

Before you even look at a tool like Tailride, the most important thing you can do is get your own house in order. We're not talking about complicated technical stuff. This is about making smart, simple changes to your current process that will pay off massively when it's time to flip the switch on automation.

Map Your Current Invoice Journey

First up, you need a crystal-clear picture of how things work right now. Grab a whiteboard, a fresh notebook, or a digital flowchart tool and trace the life of an invoice from the moment it hits your company to the final payment confirmation.

Be painfully honest. Where do invoices actually come from?

- •A few land in a general

info@inbox. - •Others get sent directly to a project manager's email.

- •And yes, some paper copies still show up in the mail.

Write down every single one of these entry points.

Then, follow the money. Who has to approve what? Does a manager need to sign off on anything over $500? Does the department head look at it after that? Chart every person, every step, and every potential delay. This exercise will shine a big, bright light on your biggest bottlenecks - those black holes where invoices seem to get stuck for days on end.

Standardize How You Receive Invoices

After mapping your process, you’ll probably notice one glaring issue: invoices are coming in from all over the place. Juggling different email inboxes, sorting through mail, and chasing down forwarded attachments is a recipe for chaos.

The single best change you can make immediately is to centralize everything.

Set up one dedicated email address for all incoming invoices. Something simple and clear like invoices@yourcompany.com or ap@yourcompany.com works perfectly. This becomes your single source of truth.

My Favorite Quick Win: Set up an auto-responder on that new inbox. A simple message confirming receipt and explaining your typical processing timeline works wonders. It manages vendor expectations and drastically cuts down on all those "Just checking in..." emails.

This one move makes automation a breeze later on. Nothing gets lost in a cluttered personal inbox or buried on someone's desk. The next step, of course, is to clearly communicate this new process to all of your vendors and give them a firm but friendly deadline to make the switch.

Get Everyone on the Same Page

Here’s a hard truth I’ve learned over the years: the best software in the world will fail if your team isn’t on board. Getting buy-in from key people isn't just a nice-to-have; it's absolutely essential.

Start with the people who will live in this new system every day.

- •Your Finance Team: These are your power users. Sit down with them and ask about their biggest headaches. What's the most repetitive task they do? What kind of errors drive them crazy? When you involve them from the start, they become champions for the change, not roadblocks.

- •The IT Department: Don't spring a new software implementation on your IT team. Loop them in early to discuss security, integrations, and any technical requirements. They'll thank you for it.

- •Department Heads & Managers: The people approving the invoices are a crucial piece of the puzzle. You can win them over by showing them how much easier their life will be. Think one-click approvals from their email or phone instead of hunting down physical copies.

Taking the time to understand the wider world of general automation services can also give you a broader perspective on what's possible. By doing this groundwork, you ensure that when you finally introduce a tool like Tailride, everyone knows exactly why you’re doing it and is ready to embrace a much smarter way of working.

How to Choose the Right Invoice Automation Software

With a sea of options out there, picking the right software to automate invoice processing can feel overwhelming. Every platform promises to solve all your problems, but flashy features on a sales page don't always translate into real-world value for your business.

The secret is to look past the marketing noise. It's not about finding the software with the longest feature list; it's about finding the one that fits your unique workflow like a glove. To do that, we need to break down what truly matters.

Prioritize High-Accuracy Data Extraction

The heart of any great invoice automation tool is its ability to read and understand invoices accurately. This is where Optical Character Recognition (OCR) and AI come in, but not all OCR is created equal.

A basic system might pull the vendor name and total amount. That’s a start, but it still leaves your team filling in the rest. True efficiency comes from a platform that can capture line-item details with precision - every single quantity, unit price, description, and tax amount. That level of detail is non-negotiable for accurate bookkeeping and job costing.

Picture a construction firm trying to track costs for a specific project. Capturing just the invoice total is useless. They need to see that 50 bags of cement from one supplier and 200 feet of copper pipe from another are correctly coded to that job. Without line-item extraction, someone is still stuck doing manual data entry, which completely defeats the purpose.

The goal is to eliminate manual keying, not just reduce it. If you're still typing in line items, you haven't truly automated your process. Look for a solution that boasts over 90% accuracy on data extraction, including the nitty-gritty details.

This technology is reshaping finance across the globe. In fact, the invoice processing market is projected to hit $13.4 billion by 2025, growing at an impressive 18.5% annually. This growth is fueled by AI and machine learning that enable intelligent data extraction with incredible accuracy.

Insist on Seamless Accounting Integrations

An invoice automation tool that doesn't talk to your accounting software is like a car without wheels - it looks nice but won't get you anywhere. The whole point is to create a smooth, end-to-end flow of information.

Your chosen software absolutely must offer deep, native integrations with the platforms you already use, whether it’s QuickBooks, Xero, or NetSuite. This means once an invoice is captured and approved, all the data - vendor info, GL codes, payment details - posts directly to your accounting system without anyone having to lift a finger.

A SaaS company, for example, might process hundreds of recurring monthly invoices for software licenses and cloud services. A seamless integration means their automation tool can capture an invoice from AWS, code it to the correct expense account, and sync it to their accounting platform in minutes. This avoids duplicate work and ensures their financial records are always spot-on.

For a more detailed breakdown, check out our complete guide on how to automate invoice processing for a deeper look at workflow integration.

Look for Flexible and Customizable Workflows

Your business isn't a cookie-cutter operation, so why would your approval process be? The right software gives you the power to build custom approval workflows that actually mirror how your company works.

Rigid, one-size-fits-all approval chains just create more problems than they solve. You need a system that can handle different scenarios with ease.

Here are a few examples of what to look for:

- •Multi-Step Approvals: Can you set up a rule where invoices under $1,000 go to a department manager, but anything over that also requires a sign-off from the CFO?

- •Vendor-Specific Rules: Maybe invoices from your primary office supplier can be auto-approved, while invoices from a new contractor always need a manual review.

- •Role-Based Permissions: The ability to control who can view, edit, and approve invoices is critical for security and maintaining internal controls.

Think about a marketing agency that manages campaigns for multiple clients. They need to route an invoice for a freelance designer to the project manager overseeing that specific client account. A flexible system lets them build these granular, project-based workflows, ensuring the right person approves the right expense, every single time.

Essential Features in Invoice Automation Software

When you're comparing different platforms, it’s easy to get lost in the details. This table breaks down the must-have features so you can evaluate your options with a clear checklist.

| Feature | What It Does | Why It's Important for Your Business |

|---|---|---|

| Line-Item Data Extraction | Uses OCR and AI to capture every detail on an invoice, not just the total amount. | Eliminates manual data entry, improves accuracy for job costing, and provides granular expense tracking. |

| Native Accounting Sync | Directly connects and syncs data with your accounting software (e.g., QuickBooks, Xero). | Prevents duplicate work, reduces errors, and ensures your financial records are always up-to-date. |

| Custom Approval Workflows | Allows you to build multi-step, conditional approval chains based on your rules. | Mirrors your company’s internal controls, speeds up approvals, and gets invoices paid on time. |

| Duplicate Invoice Detection | Automatically flags invoices that have already been entered into the system. | Prevents costly overpayments and protects your business from accidental or fraudulent billing. |

| Centralized Dashboard | Provides a single, real-time view of all invoices and their current status. | Gives you complete visibility into your AP process, helping you manage cash flow and spot bottlenecks. |

| Secure Document Storage | Offers a cloud-based, searchable archive for all processed invoices. | Simplifies audits, ensures compliance, and makes it easy to find any invoice whenever you need it. |

By focusing on these three core pillars - extraction accuracy, seamless integration, and workflow flexibility - and using this checklist, you can confidently choose a tool that will truly transform your accounts payable process.

Your Phased Rollout Plan for a Successful Launch

Jumping headfirst into a full-scale software launch is a recipe for chaos. I’ve seen it happen, and it’s never pretty. A much smarter approach is a phased rollout, which gives you the breathing room to test, learn, and adapt without overwhelming your team or grinding your operations to a halt.

Think of it as a series of controlled, manageable stages that build momentum and confidence for a smooth transition. Instead of a "big bang" launch where everyone switches over at once, we'll break it down into three flexible phases. This method allows you to work out any kinks in a low-risk environment, ensuring that by the time you go live across the company, your new process to automate invoice processing is already running like a well-oiled machine. It’s all about starting small, proving the concept, and scaling up with confidence.

Phase One: Launch a Pilot Program

Your first move should always be to run a pilot program with a small, handpicked group of vendors. This isn't about testing the software itself - that's already been done. This is about testing how the software works within your specific environment, with your unique workflows and your team.

I recommend choosing five to ten vendors you have a great relationship with. These should be suppliers who are communicative, patient, and understanding. Reach out to them personally, explain that you're upgrading your AP system, and ask if they'd be willing to participate. Most vendors will be happy to help, especially since it means they’ll likely get paid faster.

During this phase, your goals are simple but crucial:

- •Confirm Data Capture Accuracy: Does the system pull data from their specific invoice formats correctly?

- •Test Communication Channels: Is the new

invoices@email address working flawlessly? Are they receiving confirmations? - •Identify Early Friction Points: Are there any unexpected snags in the process, no matter how small?

This pilot acts as your safety net. It’s far better to discover that a certain invoice template is causing OCR issues with a friendly vendor than to find out when hundreds of invoices are piling up. Gather feedback, make adjustments, and get your team comfortable with the new flow.

Phase Two: Integrate and Design Workflows

Once your pilot is humming along smoothly, it's time to build the bridges between your new automation tool and your existing systems. This is where you connect Tailride directly to your accounting software, turning a series of separate tasks into one seamless, automated process.

This integration is the magic that eliminates the mind-numbing task of re-keying approved invoice data into your general ledger. A native sync with platforms like QuickBooks or Xero means that once an invoice is approved, it’s instantly and accurately recorded in your books. This one connection saves hours of work and completely removes the risk of manual entry errors during the final posting step.

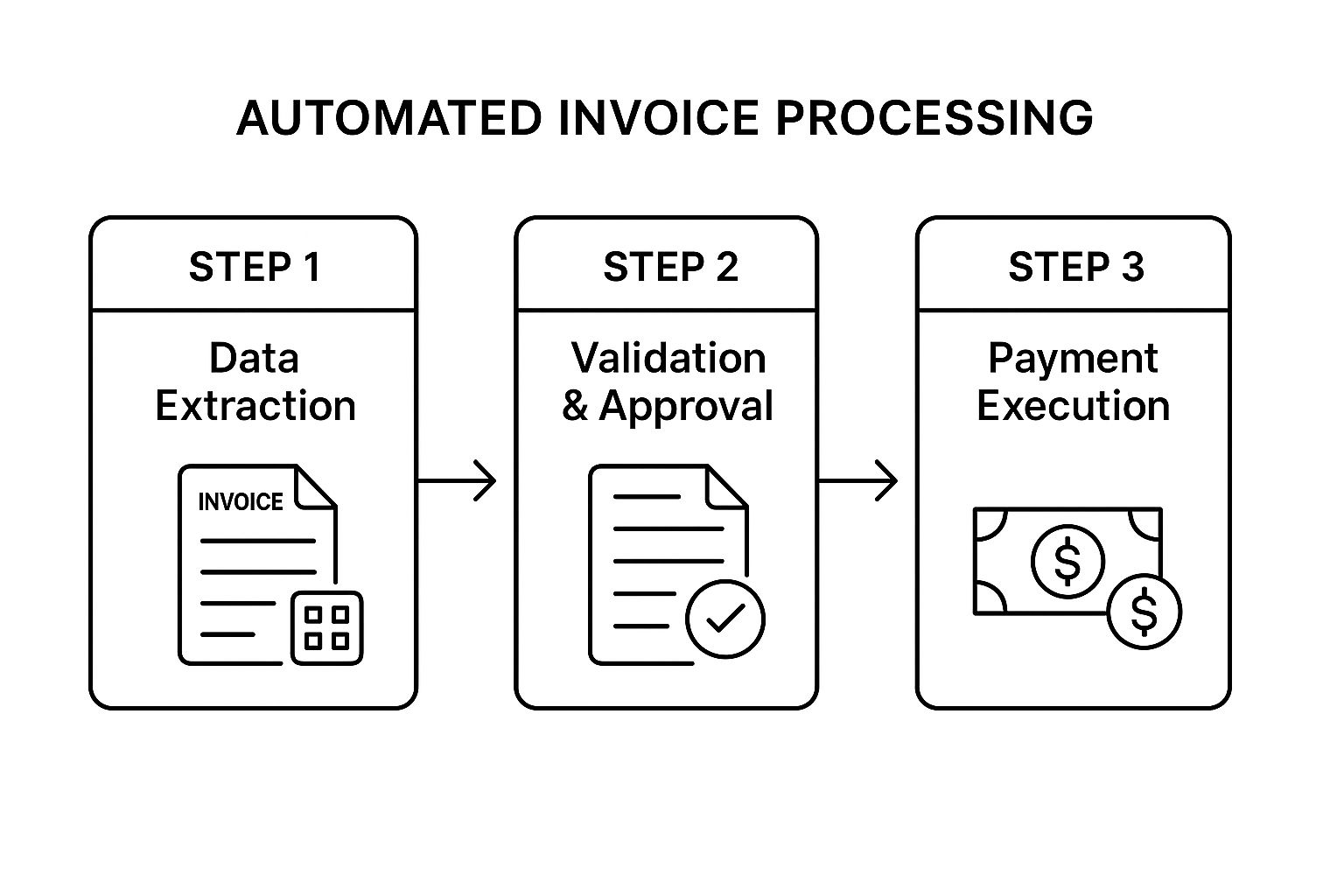

This image gives a great high-level view of how data moves through the core stages of an automated system.

As you can see, the process logically flows from initial data capture to final payment, with validation and approval serving as that critical control point in the middle.

With the integration in place, you can now design your intelligent approval workflows. Honestly, this is the fun part where you get to translate your company’s internal rules into automated logic.

Think about a real-world scenario. A digital marketing agency needs to route invoices based on the client project. Using a tool like Tailride, they can set up a rule that says: "If an invoice contains the project code 'XYZ-Client-A', automatically send it to Jane Smith for approval." Just like that, invoices go to the right project manager every single time, without anyone having to manually forward emails.

Pro Tip: Don't try to perfect your workflows on day one. Start with your most common approval paths. You can always add more granular rules and exceptions later as your team gets more familiar with what the system can do.

Phase Three: Train Your Team and Go Live

With your system tested and your core workflows mapped out, the final phase is all about empowering your team and managing the official changeover. Trust me, successful adoption hinges on clear communication and practical, hands-on training.

Schedule a dedicated training session for everyone involved in the AP process - from the finance clerks who will manage the dashboard to the department heads who will be approving invoices. Be sure to focus on the "what's in it for me" for each group. For the AP team, it's no more data entry. For managers, it's one-click approvals from their phone.

Your training shouldn't just be a demo. Get them into the system with sample invoices so they can experience the workflow firsthand.

- •Practice Makes Perfect: Have each team member process a few test invoices from start to finish.

- •Create Simple Guides: A one-page cheat sheet or a short video tutorial can be an invaluable resource during the first few weeks.

- •Appoint a Champion: Designate one person on the finance team as the go-to expert for any questions. This makes a huge difference.

When it's time for the official go-live, consider running the old and new systems in parallel for a short period - maybe a week. It’s a bit of extra work upfront, but it provides an incredible confidence boost. This allows the team to verify that the new system is producing the exact same results as the old one, proving its reliability before you fully retire the manual process for good. After that, you're ready to make the full switch, confident that your careful plan has paved the way for success.

Moving from Automation to True AP Intelligence

https://www.youtube.com/embed/XKKi3dq9Jvc

Getting your automated system up and running is a huge win, but honestly, it’s just the beginning of the journey. The initial setup solves the most painful part of the problem - that soul-crushing manual data entry. The real magic happens when you shift your mindset from simply processing invoices faster to using that data to make smarter business decisions.

Your new platform isn't just a processing engine; it's a goldmine of financial intelligence. Every single invoice that flows through it tells a story about your company's spending, your vendor relationships, and your overall efficiency. The goal now is to listen to those stories and turn them into action. This is how accounts payable evolves from a reactive cost center into a strategic team that actively contributes to the bottom line.

Uncovering Insights in Your AP Data

With all your invoice data finally digitized and structured in one place, you can see the big picture for the first time. Start by digging into the analytics and reporting features within Tailride. Instead of being buried in paperwork, you can now ask powerful questions and get immediate answers.

So, what should you look for?

- •Spending Trends: Who are your top vendors by volume and value? Is your software spend creeping up month after month? Spotting these trends early is your key to managing budgets before they get out of hand.

- •Vendor Performance: Are certain suppliers always sending invoices with errors or missing PO numbers? This data gives you concrete evidence to have productive conversations with them about cleaning up their process.

- •Payment Cycles: What’s your average time-to-pay? Pinpointing how long each stage of your approval workflow takes will show you exactly where the bottlenecks are hiding.

A common "aha!" moment for businesses we work with is realizing just how much they spend with a single vendor across different departments. Seeing that consolidated view is often the catalyst for renegotiating volume discounts that were completely invisible before.

From Data Points to Strategic Action

Once you've identified these patterns, it's time to act. This is where your finance team can truly shine, moving away from administrative drudgery and into high-impact strategic work. The data you've gathered is the leverage you need to make changes that save the company real money.

Imagine this scenario: your AP dashboard shows that you consistently pay a key supplier in just 15 days, even though their terms are net 30. This is a golden opportunity. You can go to them with the data and say, "Look, we're one of your fastest-paying clients. Let's talk about a 2% early payment discount."

You can also use these insights to refine your internal processes. If you discover that invoices from the marketing department are always getting stuck waiting for approval, it might be time to tweak the workflow rules for that team. Our guide on optimizing the invoice processing workflow has some great tips for fine-tuning these approval chains.

Expanding the Automation Mindset

This data-driven approach doesn't have to stop with accounts payable. The same principles - centralizing data, analyzing trends, and taking action - can be applied across your entire financial operations. Think about areas like employee expense reports, corporate card reconciliation, and purchase order management.

The momentum is undeniable. As of 2024, the portion of invoices requiring manual data entry has dropped to 60% from 85% just a year ago. And while only 20% of AP teams are fully automated today, another 41% are planning to make the switch within the next year. You can check out the full accounts payable automation statistics on Docuclipper.com to see just how fast the industry is moving.

By getting invoice automation in place, you’ve built an incredible foundation. Now, it's time to build on that success and use the intelligence it gives you to drive your business forward.

Got Questions About Invoice Automation? We've Got Answers.

It’s totally normal to have a few questions when you're thinking about moving to an automated system. Getting a handle on the nuts and bolts is just smart business. Let’s walk through some of the most common things we get asked, so you can feel confident about making the switch.

Just How Secure Is Automated Invoice Processing?

This is usually the first thing people ask, and for good reason - we're talking about sensitive financial data. Top-tier automation platforms are built with security at their core, using things like data encryption, secure cloud storage, and role-based access controls.

What this means in practice is that only the right people can see or approve invoices. Frankly, it’s a huge step up in security compared to paper invoices that can get lost, left on a desk, or seen by the wrong eyes. A pro tip? When you're checking out different platforms, ask if they are SOC 2 compliant. That's a good sign they take security seriously.

Can This Software Really Handle Our Complicated Invoices?

You bet. Modern AI-powered systems are built for complexity. They use sophisticated OCR and machine learning that go way beyond just grabbing the vendor's name and the total amount.

These tools are smart enough to pull out and digitize every single line item on an invoice - the quantity, the unit price, SKU numbers, you name it. This is a game-changer for getting your GL coding right and performing three-way matching against purchase orders. It’s absolutely essential if you need to track costs down to the last detail.

The goal should be to get rid of manual work completely. If your team is still typing in line items from a PDF, you haven't truly automated the process. The right tool captures everything, freeing up your people for work that actually matters.

What Kind of ROI Are We Talking About?

The return on your investment shows up in a few different places. The most obvious win is cutting down on manual labor costs - most businesses see a drop in their processing expenses by 60-80%.

But the savings don't stop there. You'll also see ROI from:

- •Catching more early payment discounts. This can easily add up to thousands of dollars over a year.

- •Wiping out late payment fees because the approval process is so much faster.

- •Giving your team back their time. They can focus on financial analysis and planning instead of mind-numbing data entry.

Most companies see a positive ROI within the first 6-12 months. If you want to see how this all comes together, check out our guide on how to automate your accounts payable process.

Will We Have to Ask All Our Vendors to Change How They Do Things?

Not at all. A great automation platform should be flexible enough to work with your vendors, not force them to change for you. It should easily handle invoices in all sorts of formats, whether it's a PDF in an email, a paper copy you've scanned, or a file uploaded to a portal.

The whole point is to make your life easier, not make things difficult for your suppliers. That said, it can be helpful to gently nudge vendors to send invoices to one dedicated email address - it just makes processing even quicker on your end.