Optimizing Your Invoice Processing Workflow

Transform your invoice processing workflow from a costly chore to a strategic advantage. Learn the steps, tools, and best practices to boost efficiency.

An invoice processing workflow is simply the A-to-Z system your business uses to handle supplier invoices. It kicks off the second an invoice lands on your desk (or in your inbox) and doesn't end until the payment is sent and everything is logged in your books.

Think of it like your company's financial circulatory system. When it’s running smoothly, cash flow is healthy and predictable. But any clog or bottleneck can cause some serious operational headaches.

The Journey of an Invoice

To really get a feel for it, let's compare an invoice's journey to how a restaurant handles an order. It all begins when a customer places an order - that's just like your company receiving an invoice from a vendor.

The order ticket then zips to the kitchen, where the chefs check the details and get cooking. This is exactly what your accounts payable (AP) team does when they verify invoice details, match them against purchase orders, and confirm you actually got the goods or services you paid for.

Once the meal is served, the customer pays the bill. That's the final step in your workflow: approving the invoice and scheduling the payment. A well-run restaurant makes sure every order is tracked, accurate, and paid on time. An effective invoice processing workflow does the very same thing for your business finances.

Why a Clunky Workflow Hurts Your Business

A messy, manual workflow isn't just a minor annoyance; it's a real financial risk. When invoices get lost in endless email threads or sit on someone's desk waiting for a signature, the consequences are very real.

You'll quickly run into problems like:

- •Late Payment Fees: Vendors will slap on penalties for overdue payments, tacking unnecessary costs onto your expenses.

- •Strained Vendor Relationships: If you're always paying late, your reputation takes a hit, and vendors might not be so willing to offer you good terms down the road.

- •Missed Early Payment Discounts: Many suppliers offer a nice discount for paying early, but you can't grab those savings if your process moves at a snail's pace.

An inefficient invoice workflow doesn’t just waste time; it actively costs your business money. Fixing it is one of the smartest financial moves you can make to protect your bottom line and build stronger partnerships.

The drive to solve these problems is shaking up the market. The invoice processing software market was valued at around $33.59 billion in 2024 and is expected to jump to $40.82 billion by 2025. This explosion is happening because businesses are finally ditching paper-based headaches for smarter digital systems. You can read more about the invoice processing software market to see just how fast things are changing.

It's a clear signal that a smooth, automated workflow isn't a luxury anymore - it's essential for any modern business.

The True Cost of Manual Invoice Processing

When you think about the cost of handling invoices by hand, what comes to mind? Paper, maybe a stamp? The reality is, those are just the tip of the iceberg. The real cost is the one that doesn't show up on a balance sheet - it’s the hours your team loses to tedious data entry, the frustration of chasing approvals, and the constant stress of juggling payment deadlines.

Think of it this way: every minute spent manually keying in numbers, cross-referencing purchase orders, and hunting down a manager for a signature is a minute your skilled finance team isn't spending on strategic work that actually grows the business. It’s not just inefficient; it's a direct drain on your most valuable resource: your people's time and talent.

And let's not forget the human error factor. A single misplaced decimal point or a misread vendor code can lead to overpayments or duplicate payments that can cost your company thousands before anyone even catches on.

The Ripple Effect of Inefficiency

A clunky, manual invoice processing workflow doesn’t just slow down your finance team. Its problems spill over into nearly every corner of your business.

- •Eroding Vendor Relationships: When you consistently pay vendors late because an invoice is buried in someone's inbox, you're damaging that relationship. Good partners might start offering less favorable terms or just get tired of working with you.

- •Stifling Your Team: Your finance pros are not data-entry clerks. Forcing them into that role day after day is a surefire way to kill morale, leading to burnout and costly employee turnover.

- •Flying Blind on Cash Flow: With stacks of paper invoices, getting a clear, up-to-the-minute picture of your company's liabilities is next to impossible. This turns critical financial forecasting into a high-stakes guessing game.

The true cost of manual processing isn’t just about the price of a single invoice. It’s the cumulative weight of lost time, missed opportunities, and strained relationships that holds your entire business back.

This isn't a rare problem. You might be surprised to learn that a staggering 68% of companies are still stuck manually entering invoice data. With the average cost to process a single invoice hovering around $15 and error rates climbing as high as 39%, the potential for payment delays and operational headaches is enormous.

To really see the difference, let’s compare the old way with the new.

Manual vs Automated Invoice Processing: A Quick Comparison

This table breaks down the core differences in cost, time, and accuracy between sticking with manual workflows and switching to a modern, automated system.

| Metric | Manual Workflow | Automated Workflow |

|---|---|---|

| Average Cost per Invoice | $15+ (labor, materials, corrections) | $3.50 or less |

| Processing Time | Days or Weeks | Minutes or Hours |

| Error Rate | Up to 39% (data entry, duplicates) | Less than 1% |

| Team Focus | Data entry, chasing approvals | Strategic analysis, exceptions |

| Financial Visibility | Delayed and often inaccurate | Real-time and precise |

The numbers speak for themselves. Automation doesn't just make the process faster; it makes it fundamentally cheaper, more accurate, and frees up your team to do more valuable work.

When Delayed Payments Become a Crisis

For your vendors, especially smaller businesses, these payment delays are more than just an annoyance - they can be a full-blown crisis. Late payments wreck their cash flow, making it a struggle to pay their own bills and employees. In some cases, exploring options like invoice factoring for small business becomes a necessity just to stay afloat.

Ultimately, fixing your invoice workflow is about more than internal efficiency. It's about being a reliable partner and building a stronger, more resilient business from the inside out.

The 5 Key Stages of a Modern Invoice Workflow

Think of your invoice processing workflow as a financial assembly line. It’s not just one step; it's a series of connected stages that take a raw invoice and turn it into a paid, settled, and archived transaction. When this assembly line runs smoothly, you gain incredible control over your accounts payable, making everything faster and far more accurate.

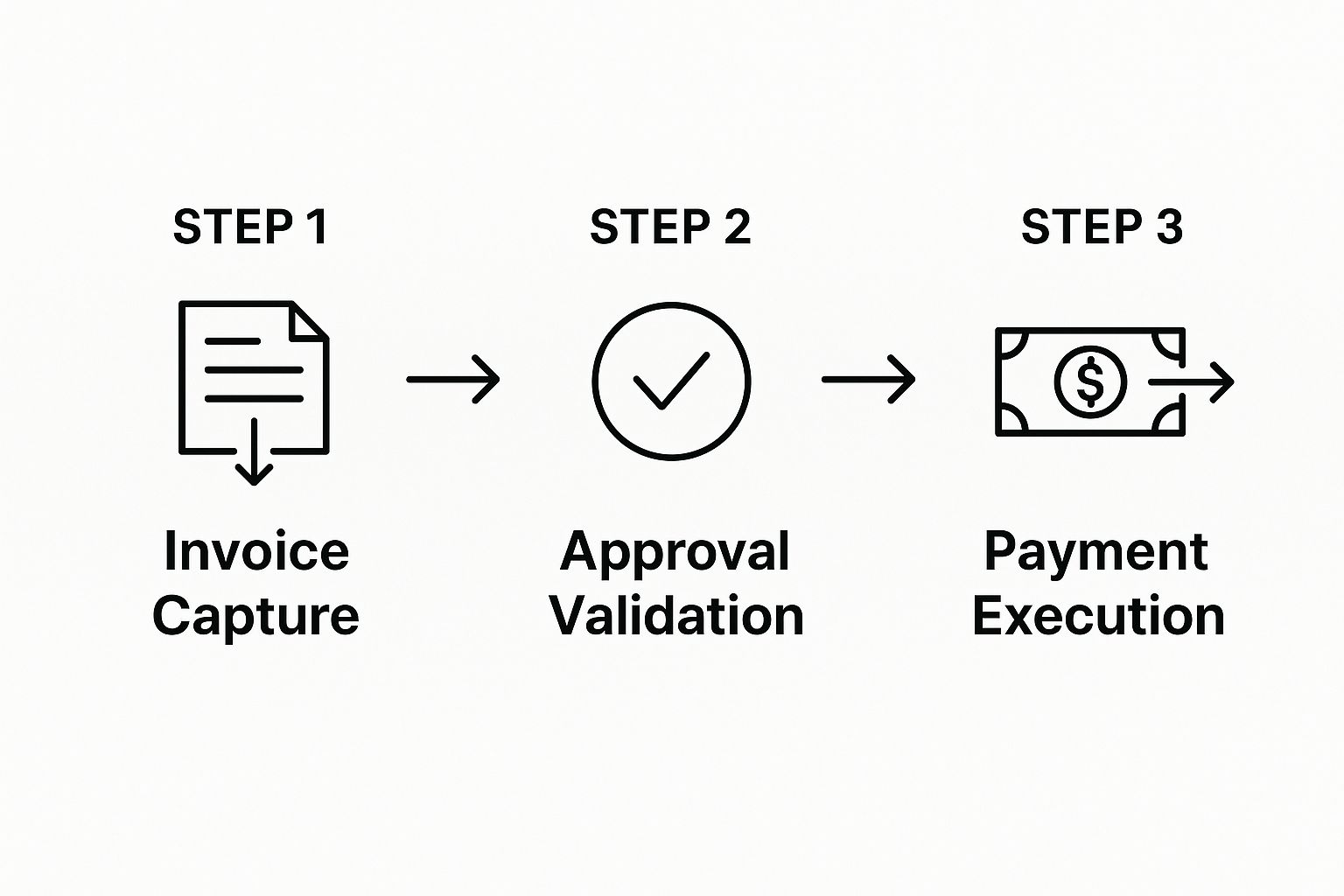

Let's break down the journey an invoice takes into five core steps. Understanding each one is the key to spotting those frustrating bottlenecks and finding easy ways to improve your whole process.

This diagram gives you a bird's-eye view of how an invoice moves from arrival to payment.

As you can see, a logical, step-by-step process is what keeps the chaos at bay and ensures every single invoice is handled the right way.

Stage 1: Invoice Capture

This is the front door. Invoice capture is simply the act of receiving an invoice from a vendor and getting it into your system. In the old manual world, this was a mess of opening mail, scanning paper, and forwarding emails from a dozen different inboxes.

A modern approach cleans this up immediately. Instead of invoices landing all over the place, they’re channeled into one central hub - like a dedicated AP email address or a digital portal. This one simple change dramatically cuts down on lost or forgotten invoices right from the start.

Stage 2: Data Extraction

Okay, the invoice is in the door. Now what? You need to pull out all the critical information: the vendor's name, invoice number, due date, line items, and the total amount. Done by hand, this is easily the most mind-numbing and error-prone part of the entire workflow.

This is where technology like Optical Character Recognition (OCR) becomes your best friend. It essentially "reads" the invoice, whether it's a PDF or a scanned image, and pulls out all that key data automatically. This doesn't just save a ton of time on manual data entry; it also boosts accuracy to over 99% in many automated systems.

A clean data extraction process is the foundation for everything else. If the data entering your system is accurate from the get-go, every step that follows becomes faster and more reliable.

Stage 3: Verification and Matching

With the data pulled, the next job is to make sure it's actually correct. This stage is your main line of defense against paying for things you shouldn't, whether due to a simple mistake or outright fraud. The gold standard here is three-way matching.

This process is a lightning-fast cross-check between three key documents:

- •The Purchase Order (PO): What your company originally agreed to buy.

- •The Goods Receipt: Proof that the items or services were actually delivered.

- •The Vendor Invoice: What the vendor is asking you to pay for.

If everything lines up - prices, quantities, terms - the invoice gets validated instantly. If something’s off, the system flags it for a human to take a quick look. This automated check stops bad payments from ever leaving your bank account.

Stage 4: Approval Routing

Once an invoice is verified, it needs a final sign-off from the right person. In a manual system, this is where things grind to a halt. Invoices get lost on desks or buried in endless email chains.

An automated workflow fixes this completely. The system uses pre-set rules (based on things like department, dollar amount, or vendor) to instantly send the invoice to the correct approver. They get a notification, can see all the documents in one place, and can approve or reject it with a single click. No more guesswork, just a clear, auditable trail of who approved what and when.

Stage 5: Payment and Archiving

We’re at the finish line. Once approved, the invoice is pushed into your accounting system, ready for payment. After the payment goes out, all the related documents - the invoice, PO, receipt, and approval history - are bundled together and stored in a digital archive.

This creates a secure and, more importantly, searchable record for audits, compliance checks, or just looking something up later. Forget digging through dusty filing cabinets; now you can pull up a complete invoice history in seconds. This final step not only keeps your vendors happy with timely payments but also builds a rock-solid financial archive that protects your business.

How Automation Supercharges Your Workflow

Think of an automated invoice processing workflow as the ultimate assistant for your finance team - one that works 24/7, never makes a typo, and zips through the most mind-numbing tasks in seconds. This isn't just about speeding things up; it's about completely changing how your business handles its money, moving from putting out fires to smart, proactive financial management.

Instead of your team spending hours manually typing data from a PDF into a spreadsheet, an automated system captures it all instantly. This frees them up from the soul-crushing routine of data entry to focus on what really matters: analyzing spend, managing cash flow, and building better relationships with your vendors.

The Power of Intelligent Data Extraction

The first big win is waving goodbye to manual data entry for good. Modern automation tools use a powerful combo of technologies to read and understand invoices with startling accuracy. It’s a real one-two punch for efficiency.

- •Optical Character Recognition (OCR): This is the first step. The tech scans the document - whether it’s a crisp PDF or a blurry photo of a receipt - and turns the text into digital data.

- •Artificial Intelligence (AI): Here's where the magic happens. AI doesn't just see the text; it understands the context. It knows an invoice number isn't the same as a PO number, and it can pinpoint the due date and total amount, even if the invoice layout is a complete mess.

This combination completely changes the game for accuracy and speed. Today's AI-driven invoice systems often achieve accuracy rates over 90%. They grab all the key details and can even spot discrepancies or flag missing info before it ever becomes a headache. For more on this, Superagi.com has a great review on AI's role in accounting.

Smart Validation and Approval Routing

Once the data is captured, automation keeps working its magic on the next critical steps: verification and approval. No more digging through filing cabinets or endless email threads to find a matching purchase order. The system does it in a flash.

It automatically performs a three-way match, checking the invoice against the purchase order and the goods receipt note. If everything lines up, the invoice gets a green light. If there’s a mismatch - say, a price difference or a wrong quantity - the system immediately flags it and pings the right person to take a look.

This is what a modern, clean automation interface looks like. It’s all about making the process easy to monitor.

A dashboard like this gives you a clear, at-a-glance view of every invoice's status, so you can spot bottlenecks or follow up on approvals that need a nudge.

By automating validation, you build a powerful safeguard against overpayments and fraudulent invoices. It’s like having a digital auditor meticulously checking every single bill before it gets paid, ensuring you only pay for what you actually ordered and received.

The approval process gets a serious upgrade, too. Forget chasing managers down the hall for a signature or watching approvals get buried in an inbox. The system automatically routes invoices to the right person based on rules you set, like the department or invoice amount. Approvers get a notification, can review the details right on their phone or computer, and approve with a single click. For a deeper dive, check out our guide on how to automate your accounts payable workflow.

This not only shrinks approval times from days to mere minutes but also creates a perfect, auditable trail of who approved what and when. To see how these ideas apply beyond just invoices, you can explore comprehensive workflow automation services to understand the broader potential. At the end of the day, automation turns your invoice workflow from a slow, manual chore into a fast, accurate, and strategic asset for your business.

Best Practices for a Flawless Workflow

Knowing the steps in an invoice processing workflow is a great start, but making that workflow run like a well-oiled machine is a whole different ballgame. The secret? It usually comes down to a few powerful habits. Think of these best practices as your toolkit for turning a clunky, reactive process into a smooth, proactive financial engine.

By putting these strategies into play, you can get ahead of common headaches like lost invoices and late payments before they even start. Each one is a practical, actionable step toward building a more resilient and efficient system today.

Centralize Your Invoice Intake

First things first: you have to stop invoices from slipping through the cracks. When bills show up in a dozen different employee inboxes or get tossed in a random mail pile, they’re bound to get lost, forgotten, or paid late. It’s a recipe for chaos.

The fix is surprisingly simple. Create one single, dedicated entry point for every invoice that comes in. This could be a specific email address (like invoices@yourcompany.com) or a vendor portal. This one change guarantees every invoice is captured right away and follows the same predictable path.

Standardize and Digitize Everything

In the world of accounts payable, consistency is king. When everyone on your team follows the exact same steps for every single invoice, you eliminate confusion, reduce errors, and make training new hires a breeze.

The easiest way to make this happen is to go digital. Ditching the paper copies for digital formats makes invoices easier to track, store, and find. Plus, it paves the way for automation, which is where you’ll see the biggest jumps in efficiency.

Define Clear Approval Hierarchies

We’ve all been there - the dreaded approval chase. Who needs to sign off on this invoice? The department head? The project manager? When nobody knows, the invoice just sits there, collecting dust and racking up late fees.

Set up clear, documented approval rules based on things like department, project, or invoice amount. For example, any invoice over $5,000 automatically goes to the CFO. No more guesswork.

This clarity ensures invoices get to the right person instantly, slashing approval times and keeping the process moving.

Proactively Capture Early Payment Discounts

Are you leaving money on the table? Many vendors offer 1-2% discounts for paying early, and that can add up to serious savings over the year. The problem is, you can't grab those discounts if your process is slow and clunky.

A smart workflow can automatically flag invoices with early payment terms. By prioritizing these bills, you can make sure they’re approved and paid well before the discount window closes. Suddenly, your AP department isn't just a cost center - it's actively saving the company money.

Conduct Regular Audits and Reviews

Finally, remember that your workflow isn't a "set it and forget it" kind of thing. You need to check in on it regularly to find bottlenecks and see where you can improve. Are invoices from one vendor always getting stuck? Is a specific manager a notorious slow-poke when it comes to approvals?

Periodic audits help you spot these patterns and tweak your process. Applying proven strategies to improve workflow efficiency will keep you on the right track for long-term success. By constantly monitoring performance, you ensure your invoice workflow stays sharp and effective as your business grows. You can find even more tips in our guide to https://tailride.so/blog/invoice-processing-best-practices.

Choosing the Right Automation Tools

Alright, you get the stages of an invoice processing workflow and why automation is a game-changer. Now for the fun part: picking the software that will actually do the work. With a ton of options out there, it’s easy to feel like you’re drowning in choices. A simple game plan can help you find the perfect fit.

Think of it like hiring a new person for your finance team. You wouldn’t hire someone who couldn't get along with your current staff, would you? The same idea applies here. The "best" tool isn't always the one with a million bells and whistles; it's the one that slots right into your existing systems and makes everyone's job easier.

You're looking for a platform that feels like a natural part of your business - not another complicated system your team has to battle every day.

Core Features You Cannot Ignore

When you start looking at different tools, zoom in on a few non-negotiable features. These are the absolute essentials that will have the biggest impact on your daily efficiency and financial accuracy.

- •

Seamless Integration: Your new tool has to play nicely with the accounting software you already use, like QuickBooks or Xero. Data needs to flow back and forth automatically, no manual exports or uploads required.

- •

Intuitive User Interface: Let's be honest, if the software is confusing or clunky, your team just won’t use it. Look for a clean, user-friendly design that makes tasks like reviewing and approving invoices feel simple right from the start.

- •

Robust Security: We're talking about sensitive financial data here. Make sure any platform you consider has top-notch security, is GDPR compliant, and follows strict data protection rules to keep your company’s information locked down tight.

Putting Principles into Practice with GetInvoice

Let’s see how these ideas look in the real world with a tool like GetInvoice. It was built from the ground up to solve the common headaches we've been talking about. For example, it hooks directly into your email inboxes to grab invoices the moment they arrive, so you can forget about that manual intake step.

A powerful tool doesn’t just automate tasks; it anticipates your needs. By automatically extracting data, categorizing expenses, and syncing with your accounting software, GetInvoice transforms your workflow from a reactive chore into a proactive, well-managed process.

It also takes on one of the most mind-numbing parts of the job - data entry. Using AI, it accurately reads and fills in all the key details from an invoice. This frees up your team to focus on more important work instead of just typing numbers.

By zeroing in on these core functions, you can find a tool that does more than just automate your invoice processing workflow - it helps your whole business run smoother. To take this a step further, you should also check out these 7 invoice management best practices for 2025 that go hand-in-hand with great software.

Got Questions About Invoice Processing? We've Got Answers.

Thinking about overhauling your invoice workflow? It’s a smart move, but it’s totally normal to have a few questions. Moving away from manual habits and toward a smarter, automated system is a significant change, but it's much easier than you might think. Let's clear up some of the most common questions so you feel confident taking the next step.

Consider this your go-to FAQ. We'll sort out any lingering doubts to help you make a decision that’s right for your business.

How Long Does This Whole Setup Take?

The big fear is always that a new system means months of painful setup and disruption. Thankfully, modern tools are built differently.

For most small and mid-sized businesses, getting a cloud-based platform up and running is surprisingly quick. You can usually get everything done - from syncing with your accounting software like QuickBooks to setting up your approval rules - in just a few days. The trick is to pick a tool that’s designed for a fast, simple start, not a massive, drawn-out IT project.

Can Automation Really Handle All My Different Invoice Formats?

Yes, and honestly, this is where automation truly shines. A good automated system is designed for the messy reality of business, where invoices show up in every format imaginable.

It uses smart tech like Optical Character Recognition (OCR) and AI to read and pull key data from just about anything you throw at it:

- •PDFs that vendors email you.

- •Scans of old-school paper invoices.

- •Even a quick photo of a receipt taken with your phone.

The system is smart enough to find the vendor name, invoice number, and due date no matter how the document is laid out. It takes all that messy, unstructured information and turns it into clean, organized data you can actually use.

What on Earth Is Three-Way Matching?

It sounds technical, but the idea is actually pretty simple - and it’s a huge deal for financial control. Think of it as an automated security check for your payments. The system cross-references three key documents to make sure they all tell the same story:

- •The vendor’s invoice (what they say you owe).

- •Your purchase order (what you agreed to buy).

- •The goods receipt (what you actually received).

If the quantities, prices, and terms match across all three, the invoice is automatically approved for payment.

Three-way matching is your company's automated financial guard. It's a simple but powerful check that prevents overpayments, catches mistakes, and shuts down fraudulent invoices before they can cause any damage.

Ready to stop chasing invoices and start saving time? GetInvoice connects directly to your inboxes and vendor portals to automate your entire invoice processing workflow, from data capture to payment reconciliation. See how GetInvoice can transform your accounts payable process today.