What Are Credit Card Statements? Your Simple Guide

Discover what are credit card statements, understand each section, and learn how to read them with confidence in our easy-to-follow guide.

Think of your credit card statement as more than just a bill - it's your monthly financial story. It's a detailed breakdown of everywhere your card went over the last month, logging every purchase, payment, fee, and interest charge that occurred during the billing cycle.

Your Credit Card Statement Explained in 60 Seconds

Financial documents can seem a little intimidating, but your credit card statement is actually pretty straightforward once you know what you're looking at. It's essentially a monthly report from your bank, giving you a complete snapshot of how you used your card over the last 30 days or so.

This single document is a cornerstone of your financial health. In the United States alone, there are over 631 million active credit card accounts, and with 82% of U.S. adults holding at least one card, it’s a vital skill to understand what these statements are telling you. You can dive deeper into these numbers with credit card usage statistics on ClearlyPayments.com.

Here’s a simple way to think about it: If your credit card is a car you drive all month, the statement is your trip summary. It shows you how far you’ve gone (your purchases), how much gas you’ve put in the tank (your payments), and what the trip cost you (interest and fees).

Regularly checking your statement is one of the smartest money habits you can build. It helps you:

- •Spot any fishy charges or mistakes right away.

- •Get a real, honest look at your spending habits.

- •Make sure your payments were posted correctly.

- •Keep an eye on important dates, especially your payment due date.

At the end of the day, getting comfortable with your statement turns a boring piece of mail (or a PDF) into a powerful tool. It’s the first step to using credit wisely and steering clear of any expensive surprises.

A Guided Tour of Your Statement's Key Sections

Getting your credit card statement can feel a little intimidating, but think of it less like a single, dense document and more like a dashboard for your spending. Each part tells a specific piece of your financial story for the month. Once you get the hang of where everything is, you'll be able to scan it and find what you need in seconds.

The first thing you’ll probably notice is the Summary of Account Activity. This is the 30,000-foot view, giving you all the big numbers at a glance. It’ll show what you owed last month, what you've spent since then, any payments you made, and what your new balance is. It's the perfect starting point.

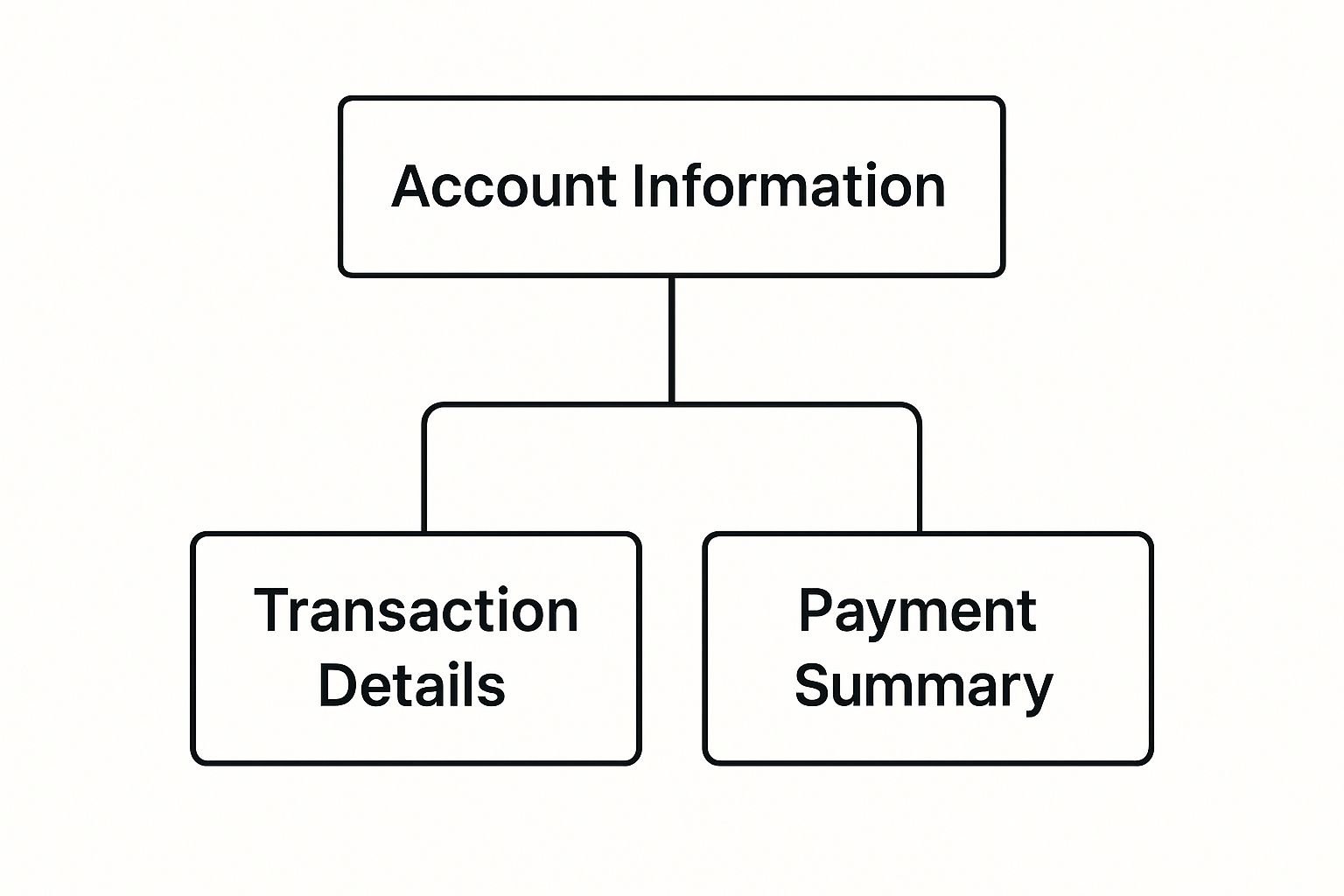

This infographic breaks down the basic layout, showing how all the different pieces fit together.

Think of it like a roadmap. The summary gives you the destination, and the other sections provide the turn-by-turn directions to help you understand how you got there.

To help you get your bearings, here's a quick breakdown of the most common sections you'll find on your statement.

Key Sections of Your Credit Card Statement

| Section Name | What It Tells You | Why It's Important |

|---|---|---|

| Account Summary | A high-level overview of your balance, payments, and new charges. | Gives you a quick snapshot of your financial activity for the month. |

| Payment Information | Your total new balance, the minimum payment required, and the due date. | This is the most urgent section - it tells you how much to pay and when. |

| Transaction Details | An itemized list of every purchase, credit, or return made during the cycle. | Perfect for tracking your spending and spotting any fraudulent charges. |

| Fees & Interest | A breakdown of any charges from late fees or interest accrued on your balance. | Shows you the real cost of carrying a balance and helps you avoid future fees. |

Now that you have a map, let's zoom in on a few of these sections to see what they're all about.

Payment Information and Deadlines

Okay, if you only look at one part of your statement, make it this one. This little box contains the three most important numbers you need to know:

- •New Balance: The total amount you owe as of the statement closing date.

- •Minimum Payment: The smallest amount you’re required to pay to keep your account in good standing.

- •Payment Due Date: The hard deadline for when your payment needs to arrive.

Missing that due date is a big deal - it can lead to late fees and put a dent in your credit score. While you only have to pay the minimum, keep in mind that doing so means interest will pile up on the rest of your balance, making things more expensive in the long run.

Given that the average credit card debt for U.S. consumers who carry a balance is around $7,321, paying close attention to these details is a huge part of managing your finances well. If you're curious, you can dig into more consumer credit card debt trends on LendingTree.com.

Transaction and Charge Breakdowns

This is where you'll find the nitty-gritty details - a line-by-line list of every single thing that happened on your account during the billing period. It shows all your purchases, refunds, and any other credits. Each entry will typically have the date, the merchant's name, and the exact amount.

Pro Tip: Make a habit of scanning this list every single month. It's your first line of defense against fraud. If you see a charge you don't recognize, you can report it immediately, which makes it much easier to get your money back.

Finally, you’ll see a section for Fees and Interest Charges. This part is all about transparency. It shows exactly how much you were charged in interest for carrying a balance and spells out any other costs, like late payment fees or an annual fee. It’s a clear look at the cost of borrowing when you don't pay your bill in full.

Decoding the Numbers and Financial Jargon

Let's be honest, staring at the financial terms on your credit card statement can feel like trying to read another language. But you don't need to be a financial whiz to figure it out. Think of this as your personal translator for the terms that have a real impact on your money.

First up is the big one: APR, or Annual Percentage Rate. Simply put, this is the price you pay for borrowing money, shown as a yearly percentage. If you carry a balance over from one month to the next, this is the interest rate slapped onto what you owe.

Getting a handle on your APR is so important because it reveals the true cost of carrying debt. A high APR means your balance balloons much faster if you don't pay it off, costing you a lot more in the long run.

For instance, the average APR for credit cards that are charging interest hovers around a hefty 22.25%, and some new card offers are even higher. Numbers like these really drive home why paying attention to how unpaid balances turn into interest charges is a must. If you're curious, you can dig into more current credit card debt statistics on LendingTree.com.

Key Terms You Should Know

Beyond the APR, a few other terms on your statement dictate how your account really works. Knowing what they mean is the key to staying in the driver's seat of your finances.

- •

Billing Cycle: This isn't just a calendar month. It’s the specific timeframe - usually around 30 days - that your statement covers. Any purchase, payment, or credit you make between the start and end dates shows up on this bill.

- •

Credit Limit: This is the absolute maximum amount your credit card company will let you borrow. It’s your spending ceiling. Pushing past it can trigger fees and even ding your credit score.

- •

Minimum Payment: This is the smallest amount you have to pay by the due date to avoid late fees and keep your account in good standing. But be warned: only paying the minimum is an expensive habit. The rest of your balance will keep racking up interest at your APR, which is a surefire way to stay in debt for a very, very long time.

These terms all work together to give you a complete snapshot of your account's health. While your statement is a great summary, you might also find it helpful to understand the difference between an invoice and a receipt for more granular record-keeping.

Why You Should Read Your Statement Every Month

With auto-pay and digital banking making life so easy, it's tempting to let that credit card statement just sit in your inbox, unopened. But skipping this quick monthly review is a bit like driving with your eyes closed - you might be okay for a little while, but you’re ignoring crucial information that keeps you safe and heading in the right direction.

When you don't look at your statement, you can easily miss small, sneaky charges. Fraudsters often test the waters with tiny purchases on stolen card numbers, hoping they fly under the radar. Catching an odd $1.50 charge right away can stop a much bigger financial nightmare before it even starts.

Beyond just security, your statement is one of the best tools you have for getting a real handle on your finances. It’s an honest, no-fluff breakdown of where your money is actually going, helping you see spending habits you might not even realize you have.

Find Hidden Savings and Costly Errors

Think of your statement as a financial treasure map. A quick scan can uncover that streaming service you signed up for a year ago and forgot about, or show you that your daily coffee habit is adding up to more than you thought. This is the kind of insight that helps you build a smarter budget and actually hit your savings goals. For business owners, this habit is an absolute must, and you can find more tips for how to track business expenses in our guide.

Your credit card statement is your first line of defense against both fraud and unintentional overspending. A five-minute check can save you hundreds of dollars and significant stress.

Finally, mistakes happen all the time. It's not uncommon for a restaurant to accidentally charge you twice or for a refund on that shirt you returned to never show up. If you're not checking your transaction list, you'd never know you're out that money. Making a habit of scanning each line item ensures you’re only paying for what you actually bought, protecting your hard-earned cash from simple but costly errors.

How to Spot and Fix Errors on Your Statement

That sinking feeling when you see a charge you don’t recognize? We’ve all been there. It’s definitely stressful, but the good news is that fixing it is usually pretty simple, as long as you act fast. The trick is to report the error to your credit card company the moment you find it.

Thankfully, you've got some serious backup here. A federal law called the Fair Credit Billing Act (FCBA) protects you from having to pay for billing mistakes. This means you’re not on the hook for fraudulent charges, but there's a catch: you have to report them, typically within 60 days of when the statement was sent.

Your best defense is a good offense. Get into the habit of scanning your transactions every month. It’s the single best way to catch mistakes early and keep your money safe.

Taking Action on Statement Errors

Found something that looks off? Don’t panic. Just follow these steps to get it sorted out.

- •

Contact Your Issuer ASAP: The customer service number is right on the back of your card. Even better, most banks now let you dispute a charge right from their mobile app or website, which is often the quickest way to get the ball rolling.

- •

Give Them the Details: Be prepared to point out exactly which charge is wrong and why. Have the date, merchant name, and dollar amount handy. The more info you can give them upfront, the smoother the investigation will go.

- •

Follow Up in Writing: After you call or click, it’s a smart move to send a quick letter or email summarizing the dispute. This gives you a paper trail and officially documents everything under the FCBA guidelines.

Here's the best part: while the credit card company looks into it, you don't have to pay for that specific disputed amount. The whole process is a bit like reconciling your books - matching up records to make sure everything is accurate. For anyone running a business, getting good at this is key, and these bank reconciliation tips offer a great look into keeping your financial records airtight.

Got Questions? We've Got Answers

Even with a full breakdown, a few common questions always seem to pop up about credit card statements. Let's run through a quick FAQ to tackle the things that might still feel a little fuzzy. Think of this as the final piece of the puzzle to help you manage your finances like a pro.

One of the top questions we get is, "How long should I keep old statements?" For the most part, you're safe to shred them after about a year. But here’s a pro-tip: hang on to any statements connected to a big purchase - like a new fridge or laptop - at least until the warranty is up. You'll also want to keep any statements you might need for tax season for at least three years, especially those that show business expenses or charitable donations.

Statement Balance vs. Current Balance: What’s the Difference?

This one trips a lot of people up, but the distinction is actually pretty simple.

- •

Statement Balance: This is the total amount you owed on the exact day your billing cycle ended. It's a snapshot in time. This is the magic number you need to pay off by the due date to avoid interest.

- •

Current Balance: This is your account's balance right now. It includes your statement balance, plus any new purchases you've made since that statement was printed, minus any payments you’ve sent in.

Here's an easy way to think about it: Your statement balance is like a photo taken last week. Your current balance is a live video stream of your account.

To keep your account in good shape and dodge those interest fees, always aim to pay the statement balance in full before the due date.

Paper or Digital? Which Statement Is Better?

So, should you stick with old-school paper statements in the mail or go fully digital? Honestly, there’s no right or wrong answer here - it’s all about what works for you.

Going paperless is fantastic for cutting down on clutter, and you can access your statements from anywhere. It's also a bit kinder to the planet. On the flip side, some people find it easier to sit down and focus on a physical copy, making sure they don't miss anything. A paper statement won't get buried in a crowded inbox, either.

The most important thing is to pick the format that you'll actually look at every single month without fail.

Ready to stop manually chasing down receipts and invoices? Tailride automates the entire process, from capturing documents in your email to organizing them for reconciliation. Discover how Tailride can save you hours of work.