A Guide to Vendor Invoice Management Software

Discover how vendor invoice management software can streamline AP, eliminate errors, and cut costs. Learn to choose and implement the right solution.

Vendor invoice management software is, at its core, a system built to take the manual chaos out of handling supplier invoices. It automates the whole journey - from the moment an invoice lands in your inbox to the final click that sends the payment. Think of it as replacing endless paper trails and manual data entry with a smart, efficient, and crystal-clear digital workflow that seriously cuts down on costs and mistakes.

Why Manual Invoice Processing Is Holding You Back

If your accounts payable team is buried under stacks of paper, manually punching in line items, and constantly chasing down approvals, you know the feeling. It’s like a kitchen during a frantic dinner rush - orders get lost, mistakes are made, and everything slows to a crawl. This high-stress, error-prone scene is the daily reality for way too many businesses still stuck on manual invoice processing.

This old-school approach isn't just inefficient; it's a massive drain on your resources. Every minute your team spends trying to read a blurry invoice, fixing a typo, or hunting down a missing purchase order is a minute they aren't spending on actual financial strategy. It’s a system that creates friction at every single step. You can dive deeper into these challenges in our guide on the accounts payable process.

The Hidden Costs of Manual Workflows

You might be surprised how common this manual grind still is. Even with all the tech available, a whopping 68% of organizations are still manually keying in invoice data. This isn't just slow; it's expensive. The average cost to process a single invoice by hand is around $15, which is a world away from the cents-on-the-dollar cost of an automated system.

A manual process is just plain fragile. One misplaced decimal point, a misread vendor name, or a single delayed approval can easily snowball into much bigger problems, like:

- •Late Payment Penalties: These not only hit your budget but can also sour your relationships with key suppliers.

- •Duplicate Payments: It’s surprisingly easy for a simple human error to cause you to pay the same bill twice, which directly eats into your cash flow.

- •Zero Visibility: Without a central hub, getting a real-time snapshot of your company's financial liabilities is next to impossible.

- •Higher Fraud Risk: Paper-based systems are a playground for fraud, lacking the digital audit trails and security checks needed to spot and stop suspicious activity.

And since we're talking about the pitfalls of paper, it's worth checking out all the advantages of going paperless for your business.

A Glimpse into an Automated Future

Now, let's paint a different picture. An invoice arrives via email. A system instantly captures it, pulls out all the key data with near-perfect accuracy, matches it to the right purchase order, and sends it to the correct person for approval. The whole thing takes minutes, not days.

This is the calm, controlled efficiency that vendor invoice management software brings to the table.

This technology completely changes the game. It turns a reactive, messy process into a proactive, controlled, and strategic part of your business. It's not just about paying bills faster - it's about finally getting a firm grip on your financial operations.

Manual vs Automated Invoice Processing at a Glance

When you put the two methods side-by-side, the differences become incredibly stark. The old way of doing things comes with hidden costs that go far beyond just staff time.

| Metric | Manual Processing | Automated Software |

|---|---|---|

| Average Cost per Invoice | $15+ | Under $3 |

| Processing Time | Days or Weeks | Minutes or Hours |

| Data Entry Errors | High Probability | Virtually Eliminated |

| Supplier Relations | Strained by late payments | Strengthened by on-time payments |

| Financial Visibility | Limited and Delayed | Real-time and On-demand |

Ultimately, the choice is between a system that's slow, expensive, and risky, and one that's fast, cost-effective, and secure. Automation doesn't just make the process better; it fundamentally transforms its value to the business.

How Invoice Management Software Actually Works

So, what’s really going on under the hood of this software? It might seem like a complex black box, but the process is actually pretty straightforward once you break it down.

Think of it as having the world's most efficient mailroom clerk - one who works 24/7, never makes a typo, and knows exactly who needs to see what and when. This digital clerk has a clear, step-by-step process for handling every single invoice that comes your way.

Stage 1: Invoice Capture

It all starts the moment an invoice arrives. Instead of piling up in a physical inbox or getting lost in an email chain, the software is constantly watching and ready to grab new documents from all the places they might show up.

This automated capture process works around the clock, so nothing ever falls through the cracks. It can pull invoices from a few key sources:

- •Dedicated Email Inboxes: You can set up an address like

invoices@yourcompany.comthat the software monitors. As soon as a vendor emails a PDF, it’s automatically pulled into the system. - •Direct Scans: For those rare paper invoices, you just scan the document. The software picks up the digital file and gets to work.

- •Vendor Portals: Some systems can even log into your suppliers’ portals to download invoices directly, meaning your vendors don't have to do anything at all.

This first step alone solves the age-old "I never got that invoice" headache by creating one central, digital home for every bill.

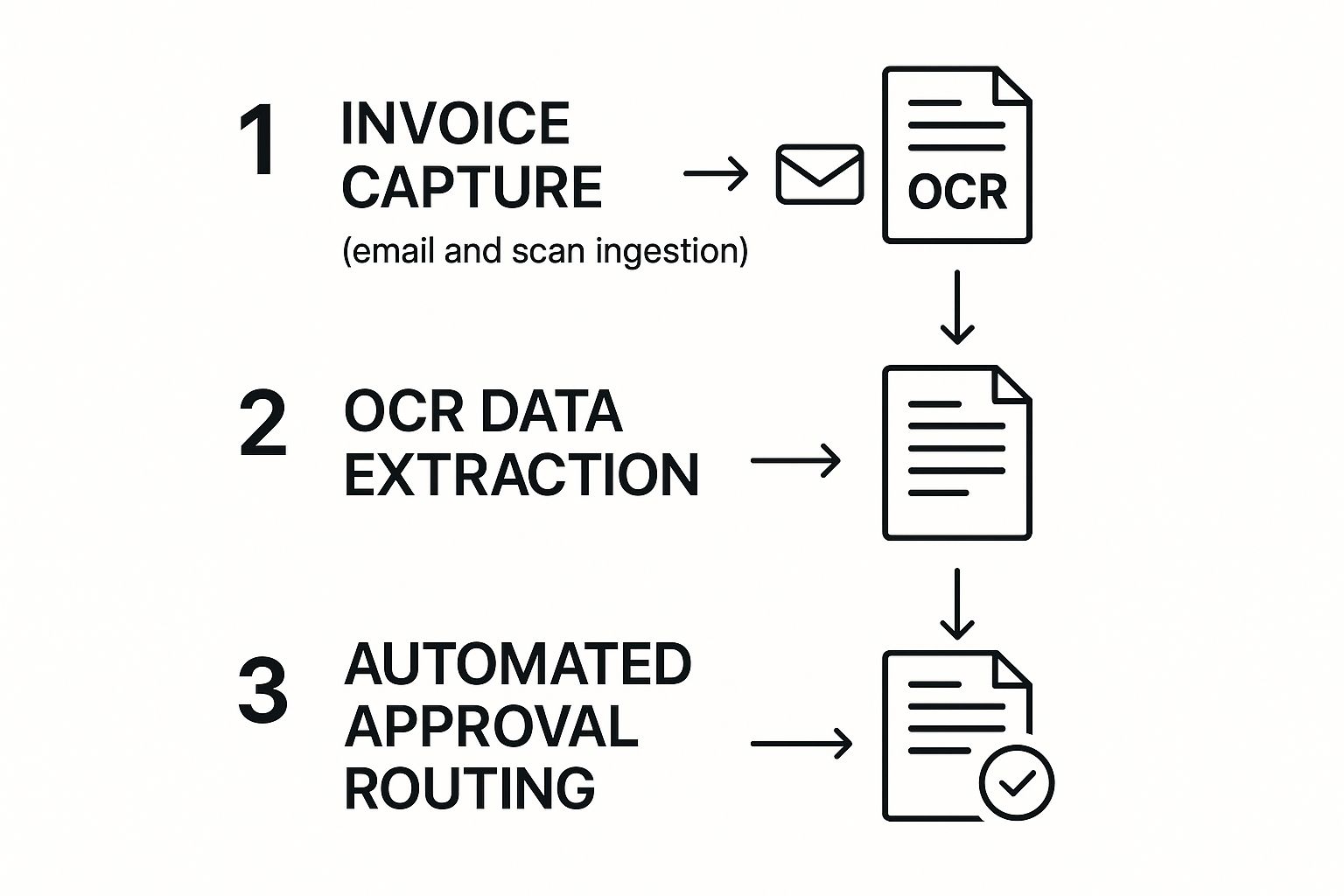

Stage 2: Data Extraction with OCR

Once an invoice is in the system, the real magic happens. The software uses a technology called Optical Character Recognition (OCR) to read the document, just like a person would. It scans the invoice to find and pull out all the important info, completely getting rid of manual data entry.

But modern tools don't stop there. They layer AI and machine learning on top of OCR, which allows the system not just to read the text, but to understand its context. This is what truly sets modern AP departments apart. According to insights from Verified Market Research on the invoice automation market, these sophisticated systems can achieve accuracy rates in the high 90% range.

A smart system actually learns. After seeing a few invoices from a vendor, it knows exactly where to find the invoice number, due date, and line-item details - even if the vendor's layout is a little weird.

The infographic below gives you a simple, visual look at this three-step flow.

This shows how the technology moves an invoice from one stage to the next without anyone having to lift a finger. For a deeper dive into the tech itself, check out our guide on how invoice OCR software works.

Stage 3: Validation and Approval Routing

After pulling the data, the software puts on its security hat. It runs a critical check called the three-way match, comparing the invoice against two other key documents to make sure everything lines up.

- •The Purchase Order (PO): Does the price and quantity on the invoice match what you originally ordered?

- •The Receiving Report: Did you actually get the goods or services you're being billed for?

If all three documents are a perfect match, the invoice is often green-lit for payment automatically. No human touch needed.

But what if there's a problem? If the numbers don't match, the system instantly flags the discrepancy and routes the invoice to the right person for a closer look. This routing is all based on rules you set up. A marketing bill can go straight to the CMO, while an IT expense goes to the IT director. This finally ends the frustrating game of chasing down signatures.

The Real-World Wins of AP Automation

So, we've talked about how the software works. But let's get to the important part: what does it actually do for your business? Bringing in vendor invoice management software is more than just a tech upgrade; it's a complete overhaul of how your finance team operates.

The results aren't just confined to the accounting department. You'll see the positive effects ripple across the entire company, from day-to-day operations all the way up to high-level strategic planning. This is where automation stops being a buzzword and starts delivering real, tangible results.

Slash Invoice Processing Time and Costs

The first thing you'll notice is the speed. Manual invoice processing is a notorious time-sink, often taking weeks of shuffling paper and chasing down approvals. With automation, that entire cycle - from an invoice landing in your inbox to the payment going out - can be squeezed down to just a few hours.

This speed directly translates into serious cost savings. Think about it: instead of your team spending hours on mind-numbing data entry, they're suddenly free to focus on work that actually adds value. It's no surprise that businesses often see an 80% reduction in their invoice processing costs after making the switch.

Imagine a marketing agency that gets hundreds of freelancer invoices every month. What used to be a full week of admin headaches becomes a few hours of simple oversight. That's a huge win.

By automating the repetitive, low-value tasks, you’re not just saving money on the process itself. You are redirecting your most valuable asset - your team’s brainpower - toward activities that actually grow the business.

This is a key principle behind so many business process automation benefits, and it's especially powerful in accounts payable.

Eliminate Costly Errors and Boost Accuracy

Let's be honest, humans make mistakes. It happens. When you're staring at numbers all day, a misplaced decimal or a misread invoice number is bound to slip through eventually. These small errors can lead to big problems, like overpayments or paying the same bill twice.

Vendor invoice management software all but erases this risk. Using smart technology like OCR and AI to pull the data, the system hits a level of accuracy that's nearly impossible for a human to match. You can finally be confident that you're paying the right amount to the right person, every single time.

It’s not just about dodging overpayments, either. It’s about building a solid foundation of financial data you can actually trust for budgeting and forecasting.

Gain Real-Time Financial Visibility

One of the biggest headaches of a manual AP process is the "black hole" effect. Where is that invoice? Has it been approved? When is it due? It’s tough to get a clear picture of your company's financial obligations when invoices are scattered across desks and inboxes.

An automated system changes all that. It gives you a central dashboard where you can see the status of every single invoice at a glance. This kind of real-time insight is a game-changer for managing your cash flow with precision.

- •Smarter Cash Flow: You know exactly what you owe and when it's due, which means you can time payments perfectly and even grab early payment discounts.

- •Better Forecasting: When your data is clean and current, your financial projections become far more reliable.

- •Painless Audits: The next time an auditor asks for paperwork, you won't have to spend days digging through filing cabinets. Everything is neatly organized in a digital, searchable archive.

Strengthen Vendor Relationships

Your vendors are your partners, and nothing keeps a partnership healthy like paying them on time. When your internal processes are slow and clunky, payments get delayed, and that can strain even the best relationships.

By speeding up your payment cycle, you instantly become a favorite client - the one they can always count on. Happy suppliers are more likely to give you better terms, and you'll be in a prime position to negotiate for early payment discounts. It's a simple change that adds even more value back to your bottom line. We dig deeper into these advantages in our article on the benefits of automated invoice processing.

How to Choose the Right Invoice Management Software

With so many options on the market, finding the perfect vendor invoice management software can feel like a real chore. It’s easy to get lost in a sea of feature lists and confusing pricing tiers. But getting this decision right is a big deal - the best tool will feel like a natural extension of your team, while the wrong one can create even more headaches than it solves.

Think of this section as your practical buyer's guide. We'll walk you through a simple framework for sizing up your options and picking a solution that truly fits your business, not just for today but for where you're headed.

Define Your Core Needs First

Before you even think about scheduling a product demo, the most important first step is to look inward. What are the specific, nagging problems you're trying to fix? Getting crystal clear on your pain points will act as your North Star, guiding you to the features that will actually make a difference.

Start by grabbing your accounts payable team and asking a few straightforward questions:

- •Where do things get stuck? What’s the single biggest bottleneck in our current process? Is it the mind-numbing manual data entry, the endless chase for approvals, or the nightmare of matching invoices to purchase orders?

- •What’s our volume? Roughly how many invoices do we handle each month? This number is key for figuring out the kind of horsepower and scalability you’ll need.

- •What are we already using? What’s our current accounting software or ERP? Rock-solid integration with your existing system is completely non-negotiable.

- •Who signs off on things? Who needs to approve invoices, and are they always at their desk? If you have approvers on the road, mobile access just went from a "nice-to-have" to a "must-have."

Nailing down these answers first keeps you from getting distracted by flashy features you'll never actually use. You're not just buying software; you're buying a solution to your company's unique operational headaches.

Must-Have Features to Look For

Okay, once you’ve got your list of needs, you can start comparing software with a clear checklist. While every business has its quirks, there are a few foundational features that any top-tier vendor invoice management software should bring to the table. These are the basics.

A great way to get a bird's-eye view of the market is by checking out software comparison sites. They do a lot of the initial legwork for you.

For instance, this is a screenshot from the Accounts Payable (AP) Automation category on G2, a popular spot for real-world user reviews.

Grids like this are incredibly helpful. You can quickly see how different tools stack up based on what actual users think about things like ease of use and customer support. It’s a fantastic starting point for building your shortlist.

Here’s a breakdown of what to keep an eye on:

- •Seamless ERP and Accounting Integration: Your new software has to play nicely with your existing financial system, whether that's QuickBooks, Xero, NetSuite, or an industry-specific platform. A clunky integration just means you're trading one manual task for another.

- •Intelligent Data Capture (OCR and AI): Don’t just settle for basic OCR. Look for a system that layers AI on top of it. This combination delivers much higher accuracy when pulling data from different invoice formats, which means less time spent on tedious manual corrections.

- •Automated Approval Workflows: The ability to build custom, multi-step approval chains is a game-changer. The system should be smart enough to automatically send invoices to the right people based on rules you create, like the department, invoice amount, or vendor name.

- •Mobile Accessibility: Let’s be real - work happens everywhere now. Managers and executives need to be able to review and approve invoices straight from their phones. If they can’t, you’re just creating a new bottleneck.

The bottom line is this: you’re looking for a system that molds to your workflow, not one that forces you to change how you work. A rigid platform is a major red flag.

Essential Software Feature Checklist

To help you stay organized during your evaluation, we've put together a checklist of key features and the right questions to ask vendors. This table will help you cut through the marketing noise and compare your options on an even playing field.

| Feature/Consideration | Why It Matters | Questions to Ask Vendors |

|---|---|---|

| ERP/Accounting Integration | Prevents manual data re-entry and ensures your financial records are always accurate and in sync. | Do you offer a pre-built, native integration with [Our ERP/Accounting Software]? How deep is the integration (e.g., does it sync vendors, payment status)? |

| Data Capture Accuracy (OCR+AI) | The more accurate the data extraction, the less time your team spends manually verifying and correcting invoices. | What is your guaranteed accuracy rate? Can the system learn from corrections over time to improve? Can it handle line-item detail? |

| Customizable Workflows | Every business has unique approval processes. The software must adapt to your rules, not the other way around. | Can we build multi-step, conditional approval rules (e.g., based on amount, department, GL code)? Is there a limit to the number of rules or steps? |

| Purchase Order (PO) Matching | Automating 2-way and 3-way matching saves countless hours and reduces the risk of paying incorrect or fraudulent invoices. | How does your system handle PO matching? Can it manage partial matches or discrepancies automatically? |

| Vendor Portal | A self-service portal reduces the number of calls and emails your AP team gets from vendors checking on payment status. | Do you offer a secure portal for vendors? What information can they access and update themselves? Is there an additional cost for this? |

| Mobile App/Accessibility | Delays often happen when approvers are away from their desks. A solid mobile experience keeps things moving. | Is there a dedicated mobile app for iOS and Android? What specific actions can be taken from the app (e.g., approve, reject, comment)? |

| Reporting & Analytics | Good data helps you spot bottlenecks, manage cash flow better, and negotiate better terms with vendors. | What kind of standard reports are available? Can we build custom reports to track the KPIs that matter to us? |

This checklist is your secret weapon. Use it during every demo and sales call to make sure you're getting clear, comparable answers from every potential partner.

Beyond the Features: What Else Matters?

A slick product is only half the battle. The company behind the software is just as important as the feature list. Once you've narrowed it down to your top two or three contenders, it's time to dig a little deeper into these crucial, non-technical factors.

- •Pricing Model: How do they charge? Is it a flat monthly fee, a cost-per-invoice, or a per-user license? Look for a pricing structure that is transparent and makes sense for your growth plans. Always ask about hidden fees for things like implementation or premium support.

- •Customer Support: When an urgent payment gets stuck in the system, you need a helpful human, and you need them fast. Scour those user reviews for any mentions of customer support. Do they offer phone, email, and live chat? What are their hours and typical response times?

- •Scalability: The software that’s a perfect fit today needs to keep up as you grow over the next three to five years. Ask potential vendors how their system handles a 10x increase in invoice volume. Can it grow with you, or will you outgrow it?

- •User Experience (UX): The most powerful software on earth is useless if your team hates using it. During a demo or free trial, pay close attention to the interface. Does it feel intuitive? Is it easy to find what you're looking for? A clean, simple UX is absolutely essential for getting your team on board.

Your Roadmap for a Successful Implementation

Choosing the right vendor invoice management software is a great start, but it's only half the battle. The real magic happens when your team actually uses it - when it becomes a natural part of your daily rhythm instead of just another piece of software. A thoughtful, well-planned rollout is what separates a frustrating flop from a game-changing success.

Think of it like getting a brand-new kitchen. You can have the fanciest oven and the sharpest knives, but if no one knows how to use them, you'll still be ordering takeout. A successful implementation isn't just a technical project; it's a people project. Getting your team excited and on board is just as critical as getting the software configured correctly.

Let's walk through the steps to make your transition smooth and effective.

Phase 1: The Blueprint - Planning and Getting Buy-In

Before a single line of code is touched, you need a plan. And that plan starts with getting everyone pulling in the same direction. Your first task is to define what a "win" actually looks like. Are you trying to slash invoice processing time by 75%? Or is the big prize eliminating late payment fees for good? Get specific.

With your goals crystal clear, it’s time to assemble your A-team. This isn't a solo mission. You'll want:

- •An Executive Sponsor: A leader who can champion the project, secure resources, and remove any roadblocks that pop up.

- •An AP Team Pro: Someone from the trenches who knows the current process inside and out - the good, the bad, and the ugly.

- •An IT Whiz: The person who will connect the new software to your existing accounting system or ERP, making sure everything talks to each other nicely.

Once your team is in place, start communicating the "why" to the wider company. Don't just announce a new tool is coming. Explain the headaches of the old system and paint a picture of how much easier life will be. This early communication is your best defense against resistance to change.

Phase 2: The Test Drive - Data Migration and a Pilot Program

Alright, now it’s time to roll up your sleeves. The first big technical step is moving your essential data - vendor lists, payment terms, and past invoices - into the new system. Work hand-in-hand with your software provider on this one; clean data is the foundation of a smooth-running process.

Once the data is in, fight the temptation to flip the switch for everyone. Instead, launch a pilot program with a small, focused group.

Pro Tip: Pick a few of your friendliest, most reliable vendors and a couple of tech-savvy team members for your test run. This creates a safe space to find and fix any glitches, fine-tune approval workflows, and gather honest feedback without disrupting your entire accounts payable operation.

This trial run is your secret weapon. It lets you iron out all the wrinkles before the big premiere.

Phase 3: The Launch - Full Rollout and Team Training

With a successful pilot under your belt, you're ready for showtime. A full, company-wide rollout shouldn't be a surprise; it should be a well-communicated event. Give everyone plenty of advance notice about the official go-live date so they can prepare.

During this phase, your most important job is training. Seriously, don't just email a PDF guide and call it a day. People need hands-on, role-specific guidance to feel confident.

- •For the AP Team: Dive deep. Hold comprehensive sessions covering everything from capturing an invoice to scheduling the final payment.

- •For Managers and Approvers: Keep it focused. Show them exactly how to review and approve invoices on their computer or phone. Make it fast and easy.

Offer training in a few different flavors - live workshops for the hands-on learners, recorded videos for those who want to watch on their own time, and quick-reference cheat sheets for a reminder. When your team feels truly comfortable from day one, you'll start seeing a real return on your investment almost immediately.

What's Next for Invoice Management?

The world of accounts payable is on the cusp of a major shift, moving far beyond just digitizing today's tasks. The future is all about being predictive, fully connected, and deeply analytical. When you bring in a modern vendor invoice management software solution, you’re not just solving today's problems - you're laying the groundwork for what's coming next.

And what's coming is happening fast. The global market for this kind of tech is set to absolutely explode, jumping from USD 36.1 billion in 2025 to an incredible USD 189.2 billion by 2035. This isn't just gradual growth; it's a clear signal that businesses are scrambling to ditch their old manual ways for something smarter. If you're curious about the numbers, you can dive deeper into the full invoice processing software market report.

AI That Does More Than Just Read

Sure, today's AI is a rockstar at pulling data off an invoice. But tomorrow's AI? Think of it as a strategic financial advisor living inside your software. Generative AI is getting ready to leap from simple data capture to truly sophisticated predictive analytics.

Picture this: a system that doesn't just process your bills but actually analyzes spending trends to predict your future cash flow with stunning accuracy. It could flag potential budget blowouts weeks before they happen, suggest the best times to pay certain vendors to free up cash, or even spot new ways to save money based on your past spending.

This is where accounts payable stops being a cost center and starts becoming an intelligence hub. The software will be the source of forward-looking insights that leadership can use to make smarter, proactive financial decisions, guiding the business with real data.

This ability to look ahead is the next big thing in financial operations.

A Single, Unified Payment World

An invoice’s journey isn't over once it gets the green light. The final, critical step is paying it, and the future is all about platforms that connect approval and payment seamlessly. That gap between getting an invoice approved and actually sending the money is a classic source of headaches and delays.

The trend is moving toward fully integrated payment platforms built right into vendor invoice management software. This means you'll handle the entire process - from the moment an invoice arrives to the final payment via ACH, virtual card, or international wire - all from one screen.

Pulling it all together like this gives you a few major wins:

- •Total Transparency: You can see exactly where an invoice is, from receipt to payment, all in one spot.

- •Tighter Security: With no need to shuffle payment details between different systems, you seriously cut down on fraud risk.

- •Effortless Reconciliation: Payments are automatically matched to their invoices, which makes closing the books at the end of the month way faster.

Turning Spending Data into Strategy

Finally, all that data your invoice system gathers is about to become one of your most powerful strategic tools. Every single invoice is a piece of a larger puzzle. When you put them all together, they tell a compelling story about your company’s spending habits and how efficiently you operate.

The platforms of the future will come with powerful, easy-to-use analytics dashboards. These tools will let you slice and dice your spending by vendor, category, or department with just a click or two. This isn't just about keeping track of where the money went; it's about managing it strategically. You’ll be able to spot opportunities to negotiate better deals, clamp down on maverick spending, and make sure everyone is sticking to the procurement rules - all thanks to the data you're already collecting.

Frequently Asked Questions

Jumping into any new kind of software always brings up a few questions. We get it. To help you get comfortable, I've put together some of the most common things people ask about vendor invoice management software, along with some straightforward, real-world answers.

Is Cloud-Based Invoice Software Secure?

Absolutely. In fact, it's often more secure than keeping files on your own server. The top providers in this space live and breathe security - it's their entire business model. They invest in enterprise-level protections that are way beyond what most individual companies can afford or manage.

Think of it this way: it’s like keeping your money in a bank vault versus a cash box under your desk. These platforms use layers of defense to keep your financial data locked down tight:

- •Data Encryption: All your information is scrambled into an unreadable code, making it useless to anyone who doesn’t have the key.

- •Regular Audits: Keep an eye out for certifications like SOC 2 compliance. This is a big deal - it means an independent third party has kicked the tires and confirmed their security is up to snuff.

- •Role-Based Access: You get to be the gatekeeper. You decide exactly who can see or do what in the system, so your team members only have access to what they truly need for their role.

Can This Software Handle Different Invoice Formats?

Yes, and this is where the magic really happens. A core strength of any good invoice automation tool is its ability to handle pretty much anything your vendors throw at it. It doesn't care if it's a slick PDF, a scanned piece of paper saved as a JPEG, or a blurry photo of a receipt. This flexibility is what finally kills off all that mind-numbing manual data entry.

Modern systems use a combination of Optical Character Recognition (OCR) and AI to intelligently read and pull the important details from any document. The best ones can even handle multiple languages and currencies, which is a lifesaver if you work with suppliers from around the globe.

A great system should bend to your vendors' processes, not the other way around. It needs to seamlessly catch and process whatever they send, so your team doesn't have to.

How Long Does Implementation Usually Take?

This really depends on the size and complexity of your business. If you're a smaller company and you're just connecting the software to something standard like QuickBooks, you could be up and running in just a couple of days. It's often surprisingly quick.

On the other hand, a large enterprise with a custom-built ERP, complex approval chains, and a mountain of old invoices to import is a different story. That kind of project could take a few weeks. Any vendor worth their salt will give you a clear, step-by-step project plan so you know exactly what to expect and when.

Will It Integrate With My Current Accounting System?

This is probably the most important question you can ask, and for most quality platforms, the answer is a resounding "yes." These tools are built from the ground up to play nicely with popular accounting and ERP software like Xero, NetSuite, and Sage. A solid integration is non-negotiable for a smooth, two-way data sync.

Before you commit, always double-check that the vendor has a pre-built, proven integration for your specific accounting software. This is what saves you from the nightmare of manually keying in data from one system to another and ensures your books are always accurate and up-to-date.

Ready to eliminate manual data entry and get hours back every week? Tailride connects directly to your inboxes and vendor portals, using AI to capture and process invoices automatically. Start automating in seconds.