A Guide to Scanning Receipts for Taxes

Tired of the paper mess? This guide covers the best ways of scanning receipts for taxes to help you stay organized and maximize every deduction.

If you've ever found yourself digging through a shoebox overflowing with crumpled paper, you know the special kind of panic that comes with tax season. Scanning receipts for taxes is the modern fix, turning that chaotic pile into IRS-approved digital records you can actually use. This one change can transform tax prep from a frantic hunt for faded scraps into a calm, organized process.

Why Scanning Your Receipts Is a Tax Season Lifesaver

Let's be real - the old shoebox method is a recipe for disaster. It's a jumble of missed deductions and last-minute stress. Every one of those faded thermal paper slips or misplaced coffee receipts is potential money you're leaving on the table. Going digital isn't just about tidying up; it's about building a smarter, more reliable financial system for your business.

When you start scanning your receipts, you solve a few huge problems right off the bat. First, you create permanent, clear copies that the IRS accepts. Most retail receipts are printed on thermal paper, which is infamous for fading into a blank slate within months. That's a big problem if you ever need to prove an expense.

Second, a digital system gives you the peace of mind that comes with secure backups. A lost or damaged shoebox could be a catastrophe. But with cloud-based storage, your records are safe from fires, floods, or even just a clumsy coffee spill.

Streamline Your Workflow and Get Your Time Back

The real game-changer here is the efficiency. Instead of spending hours squinting at receipts and typing numbers into a spreadsheet, a good scanning system can grab all the important details - vendor, date, amount - in just a few seconds.

Shifting to a digital workflow for receipts isn't just an organizational upgrade; it's a strategic business decision. You're trading a low-value administrative task for high-value time that you can reinvest into actually growing your business.

For small businesses and freelancers, this is a massive win. Receipt scanning apps are designed to automate the organizing and sorting of expenses specifically for tax purposes, which is a lifesaver when manual tracking feels like a full-time job. As more businesses move online, having accurate, compliant records is more important than ever. If you're curious, you can find more insights on the best receipt scanning apps on Emburse.com.

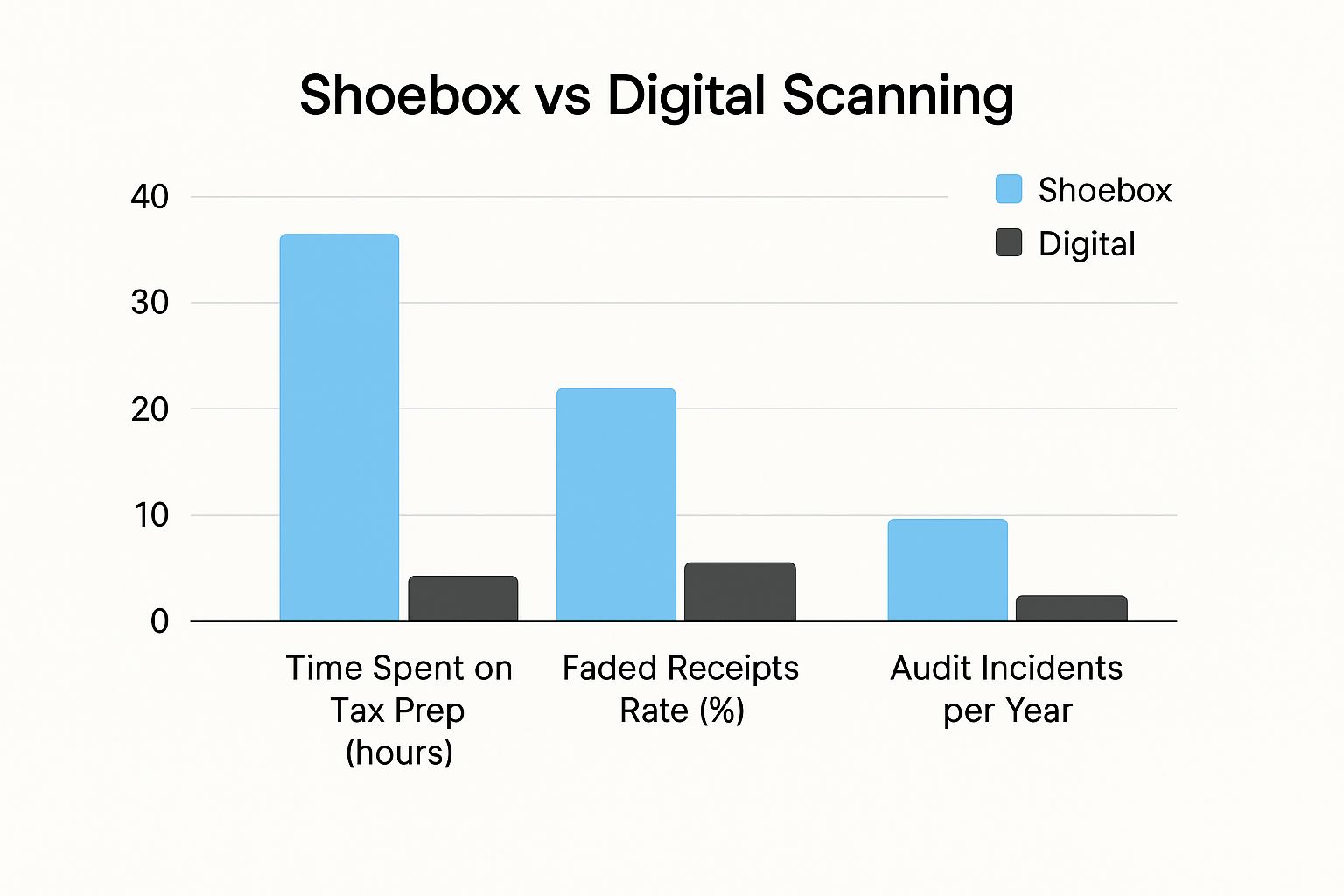

This infographic really puts the shoebox method head-to-head with digital scanning, looking at things like tax prep time and how many receipts become unusable because they fade.

The numbers don't lie. A digital approach slashes the time you spend on administrative work while making sure your financial records stay intact and legible. At the end of the day, scanning your receipts turns tax prep from a dreaded annual chore into a simple year-end review.

So, Which Receipt Scanning Tool Is Right for You?

There’s no magic bullet when it comes to scanning receipts for tax time. The "best" tool is simply the one that fits your workflow, not the other way around.

Think about it: a freelance photographer who’s always on the move has totally different needs than an office manager buried under a mountain of expense reports. The photographer needs something fast and portable, while the manager needs batch processing and serious integration power.

Let's dig into the common options to see what makes the most sense for how you work.

H3: Mobile Receipt Scanning Apps

For freelancers, solopreneurs, or anyone racking up expenses out in the field, a mobile app is usually the way to go. The convenience is just off the charts. Your phone is already in your pocket, so you can snap a picture of a receipt the second it hits your hand.

These apps are way smarter than your phone’s camera app. Most use some pretty sophisticated tech to pull out the important details automatically - the vendor's name, the date, and the total. This technology is often called Intelligent Document Processing (IDP), and it’s what turns a simple photo into clean, organized data you can actually use.

If you're just dipping your toes into digital record-keeping, you don’t have to spend a fortune. You can find some of the https://tailride.so/blog/best-free-receipt-scanner-app options that pack a serious punch without the price tag. They're perfect for capturing those on-the-go expenses like client lunches, gas, and supplies.

H3: Dedicated Desktop Scanners

Okay, if you’re dealing with a high volume of receipts and invoices, trying to scan them one by one with your phone will drive you crazy. This is where a dedicated desktop scanner completely changes the game. These machines are built for one thing: turning stacks of paper into pristine digital files, and fast.

They come with features a mobile app just can't compete with:

- •Batch Scanning: Drop a stack of 50 receipts in the tray and let it run.

- •Automatic Feeders: No more placing each little receipt on a flatbed one at a time.

- •Duplex Scanning: It captures both sides of a document in a single pass. Genius.

The real win with a dedicated scanner is time. If you're spending more than an hour a week scanning receipts, investing in a proper scanner pays for itself by giving you that time back to focus on actual work.

H3: All-in-One Printers

Ah, the trusty all-in-one printer. It’s the Swiss Army knife of the home office - it prints, it copies, and yes, it scans. If you already have one sitting on your desk, you’ve got a zero-cost way to start digitizing your receipts right now.

While it’s incredibly convenient, an all-in-one isn’t really built for heavy-duty receipt scanning. The process can be clunky and slow compared to a dedicated unit, and the software is usually pretty basic. But for a business that only deals with a few paper receipts each month, it’s a perfectly good solution that gets the job done without any extra expense.

Comparing Your Receipt Scanning Options

To help you decide, here’s a quick side-by-side look at the tools we just covered. This should make it easier to see where your needs align.

| Tool Type | Best For | Pros | Cons |

|---|---|---|---|

| Mobile App | Freelancers, solopreneurs, and anyone on the go. | Extremely convenient, captures receipts instantly, often has smart data extraction. | Can be slow for high volume, relies on good lighting and a steady hand. |

| Desktop Scanner | Businesses with high volumes of paper receipts. | Super fast batch processing, high-quality scans, built for efficiency. | Higher upfront cost, takes up desk space, not portable. |

| All-in-One Printer | Small businesses with very low receipt volume. | No extra cost if you already own one, versatile for other office tasks. | Slower and more manual than dedicated scanners, software can be clunky. |

Ultimately, the goal is to pick a tool that feels easy and natural to use. If it’s a hassle, you won’t do it, and that defeats the whole purpose of going digital. Choose the path of least resistance, and you’ll be in great shape come tax season.

How to Get a Perfect Scan Every Time

A blurry, crooked, or incomplete scan is just as useless as a receipt you've lost. The whole point of digitizing receipts for your taxes is to create a crystal-clear digital record. Luckily, getting a perfect scan isn't about buying fancy equipment; it’s about building a few simple habits.

Let's talk about lighting first. Direct overhead light is your worst enemy, especially with that glossy thermal paper most receipts are printed on. It creates a nasty glare that can completely wash out the numbers.

Instead, find some indirect, natural light from a window or even just a desk lamp positioned off to the side. This tiny adjustment eliminates those pesky reflections and makes the text pop. It’s a game-changer.

Next, always flatten the receipt. A crumpled-up receipt casts weird shadows and distorts the text, which is a surefire way to confuse any scanning software. Just take a second to smooth it out on a dark, contrasting background - a clean desk or even a piece of dark paper works great. This gives your app’s edge-detection a helping hand, letting it find the corners in a snap.

Setting Up for Success

Once your little scanning station is ready, it’s time to dial in the technical details. These settings aren't just for tech geeks; they're what create IRS-compliant records you can actually rely on.

- •

Resolution: Always aim for 300 DPI (dots per inch). This is the gold standard - sharp enough for every character to be perfectly legible, but not so massive that the files eat up all your storage.

- •

File Format: Stick with PDF or JPEG. I find PDFs are fantastic for long, skinny receipts since you can keep the whole thing in one file. JPEGs are perfect for standard, single-page receipts and usually create smaller files.

- •

Capture All Four Corners: This sounds obvious, but it's easy to miss. When you're using your phone, make sure the entire receipt is visible in the frame. Cutting off a corner might seem like no big deal, but you could be losing the date or the vendor name.

A perfect scan is your first line of defense in an audit. It’s not just a picture; it’s undeniable proof of an expense. Taking an extra five seconds to get it right saves you from massive headaches down the road.

Let the Software Do the Heavy Lifting

The quality of your scan directly impacts how well the software can read it. Most modern scanning apps use some pretty impressive tech to automatically pull key information right off the image. For a deeper dive into how this magic works, check out our guide on how receipt scanning OCR works.

These apps are getting smarter all the time, thanks to AI and machine learning. You can see just how big this trend is by reading about the growing receipt scanner app market on archivemarketresearch.com. A clean scan feeds the AI good data, ensuring the vendor, date, and amount are extracted flawlessly - which is the whole point of doing this in the first place.

Building a Smart Digital Filing System

Look, just scanning receipts and tossing them into one big folder is the modern-day equivalent of the old shoebox method. Sure, you've saved them, but you haven't actually made your life any easier when tax season rolls around. The real magic happens when you build a smart, searchable filing system that turns a pile of scans into tax-ready records.

A logical structure is your foundation. I always tell people to start by creating a main folder for each tax year, say, "Taxes 2024." Then, inside that folder, create subfolders that match up with common tax-deductible categories. This simple move prevents chaos from day one and makes finding specific expenses a total breeze.

Create a Logical Folder Structure

Your folder setup needs to be intuitive, but also able to grow with your business. Just think about the categories your accountant or bookkeeper is constantly asking for.

- •Taxes 2024

- •Travel Expenses

- •Office Supplies

- •Software & Subscriptions

- •Client Meals & Entertainment

- •Marketing & Advertising

With a setup like this, figuring out your total software spend for the year is just a matter of a few clicks. It’s a non-negotiable step for meeting record-keeping standards and makes any potential tax audit far less painful. And if you're doing business in other countries, this kind of organization is essential for staying compliant with local regulations, like Australia's record-keeping requirements.

Adopt a Consistent Naming Convention

Okay, you've got your folders sorted. Now, let's talk about what you name the files. A generic name like "IMG_2049.jpeg" tells you absolutely nothing. A descriptive name, however, gives you the whole story before you even open the file.

After years of trial and error, my go-to format is YYYY-MM-DD_Vendor_Amount_Item. It's clean, it’s sortable, and it just works.

A receipt for a coffee meeting with a client? That becomes 2024-10-28_TheCoffeeShop_12.50_ClientMeeting-Jones.pdf. A monthly software bill? 2024-11-01_ProjectTool_49.00_MonthlySubscription.pdf. This little trick automatically organizes all your receipts by date within each folder, making it dead simple to see what you spent and when.

A consistent naming convention is the secret weapon of digital organization. It turns a messy folder into a searchable database, allowing you to find any specific receipt in seconds without relying on complicated software.

Use Tags and Metadata for Deeper Insights

Folders and file names give you structure, but tags add a whole new layer of searchable detail. Most receipt scanning apps - and even your computer's operating system - let you add tags to files. Think of them as keywords that let you run powerful searches across all your different categories.

Let's say you want to see every single expense related to a specific project, which we'll call "Project Phoenix." That project probably involves travel, software, and client meals, all filed away in separate folders. If you tag each of those receipts with "ProjectPhoenix," you can pull a complete expense report for that project with one quick search.

Here are a few tags I find incredibly useful:

- •By Project: ProjectPhoenix, WebsiteRedesign, ClientOnboarding

- •By Client: AcmeCorp, GlobalTech, InnovateInc

- •By Payment Method: Amex, BusinessChecking, PayPal

When you combine a smart folder structure, a consistent naming system, and a good tagging strategy, you’re not just building a digital archive. You're creating a powerful, tax-ready resource that puts you in complete control of your business finances.

Connecting Scans to Your Accounting Software

This is where the real magic happens. A folder full of organized scans is a fantastic start, but a receipt that automatically pops up in your accounting software, already linked to the right transaction? That's a total game-changer. This integration is what takes a good habit and turns it into a fully automated system for managing your expenses.

Most modern receipt scanning tools are built to play nicely with accounting platforms like QuickBooks, Xero, or Business Central. Getting them connected is usually pretty simple - it often just involves authorizing the connection and tweaking a few settings. The whole point is to create a smooth path where a scanned receipt becomes a permanent, auditable part of your financial records without you ever having to open a spreadsheet.

Establishing a Flawless Connection

When you first link your scanning app to your accounting software, take a few extra minutes to get the settings just right. This initial setup is the key to making sure data flows accurately from the get-go.

You'll typically need to match up your expense categories between the two systems. For instance, your scanning app might have a category called "Travel," which you’ll want to map directly to the "Travel Expenses" account in your accounting ledger. Doing this ensures that every flight or hotel receipt you scan is automatically coded correctly, saving you or your bookkeeper a ton of time fixing it later. For a deeper dive into this process, our guide on how to integrate with QuickBooks Online is a great resource.

Verifying and Troubleshooting Data Syncs

Once you're all connected, your scanning app will start sending data over to your accounting software. For the first few weeks, it's a smart move to spot-check your work. Just take five minutes at the end of the week to pop open your accounting software and confirm the last few scanned receipts have shown up as expected.

Keep an eye out for these common hiccups:

- •Duplicate Entries: Is a single receipt creating more than one expense entry?

- •Incorrect Amounts: Did the OCR technology read the total correctly, especially on a faded or handwritten receipt?

- •Mismatched Categories: Are your category mapping rules working the way you intended?

The ultimate goal of integration is trust. You need to be confident that the data flowing into your books is 100% accurate. A few quick checks early on will build that confidence and let you truly set it and forget it.

The push toward this kind of automation is massive. The cloud-based receipt management market is on track to hit USD 11.36 billion by 2034, with receipt capture and scanning accounting for almost 40% of that growth. Businesses are clearly tired of manual data entry. You can see more on these automation trends and market growth on market.us.

This kind of automation virtually eliminates the human error that so often creeps into manual data entry, building a clean and reliable financial record you can count on come tax time.

Still Have Questions About Scanning Receipts? Let’s Clear Things Up

Even with a solid plan in place, a few nagging questions always seem to pop up when you're making the switch to a digital receipt system. It’s totally normal. Most of the freelancers and business owners I talk to have the exact same concerns.

Let's walk through some of the most common questions to make sure you're building a system that's not just organized, but truly audit-proof.

How Long Should I Hang On to My Digital Receipts?

This is probably the most-asked question, and thankfully, the answer is pretty straightforward. For most situations, the IRS wants you to keep your tax records for three years from the date you filed your tax return. That’s your baseline.

But, like with all things tax-related, there are a few "what ifs." For instance, if you're claiming a loss from something like a bad business debt, you’ll need to hold onto those specific records for seven years. The great thing about a digital system is that this is no big deal - the files just sit there quietly, taking up virtually no space. No more stacks of dusty boxes in the garage.

Are Scanned Receipts Actually Legit With the IRS?

Yes, one hundred percent. It's a common fear that a digital copy won't hold up in an audit, but the IRS officially gave scanned records their seal of approval a long time ago.

Under a guideline known as IRS Revenue Procedure 97-22, a scanned receipt is considered just as valid as the paper original. The key, however, is that the copy must be clear, complete, and legible. A blurry photo or a scan that cuts off the date or total? That’s not going to fly. This is exactly why getting a good, clean scan every single time is non-negotiable.

A good rule of thumb: your digital receipt system needs to create an exact, unalterable copy of the original. That integrity is what gives it the same legal muscle as the paper version.

What's the Best File Format to Use? PDF or JPEG?

When you’re saving your scans, the most important thing is consistency. The two best and most common formats you'll run into are PDF and JPEG.

Here's how I think about them:

- •PDF: This is my go-to for those long, skinny CVS-style receipts or anything that’s multi-paged. A PDF bundles everything into one neat file, which keeps things incredibly tidy.

- •JPEG: Perfect for snapping a quick photo of a standard-sized receipt with your phone. JPEGs are usually smaller files, which is a nice bonus if you're watching your cloud storage space.

Honestly, either one works just fine. My advice? Just pick one format and make it your standard. It makes finding and managing your files so much easier down the road.

Can I Finally Shred the Paper Receipts After Scanning?

The moment you've been waiting for! Yes, once you have a high-quality digital copy saved and backed up (I always recommend one cloud backup and a second local one), you can generally shred the paper original. The IRS now considers your digital file the official record.

That said, I know plenty of people who get a little peace of mind from holding onto the paper copies for a bit longer, maybe until they've filed the taxes for that year. It's a personal comfort thing. This is a great topic to bring up with your accountant to decide on a disposal policy that you both feel confident about.

Stop wasting hours chasing down faded receipts. Tailride plugs into your email and online accounts to automatically fetch, scan, and organize every single receipt and invoice. The data flows right into your accounting software without you lifting a finger. Start automating your finances in seconds with Tailride.