Will AI Replace Accountants? A Look at the Future

Will AI replace accountants? Discover how AI is transforming accounting, augmenting human roles, and creating new opportunities, not replacing professionals.

Will AI replace accountants? Let's get straight to the point: no. What it is doing is becoming the single most powerful tool an accountant can have, taking over the monotonous tasks and freeing up human experts for the high-level strategic work that truly matters.

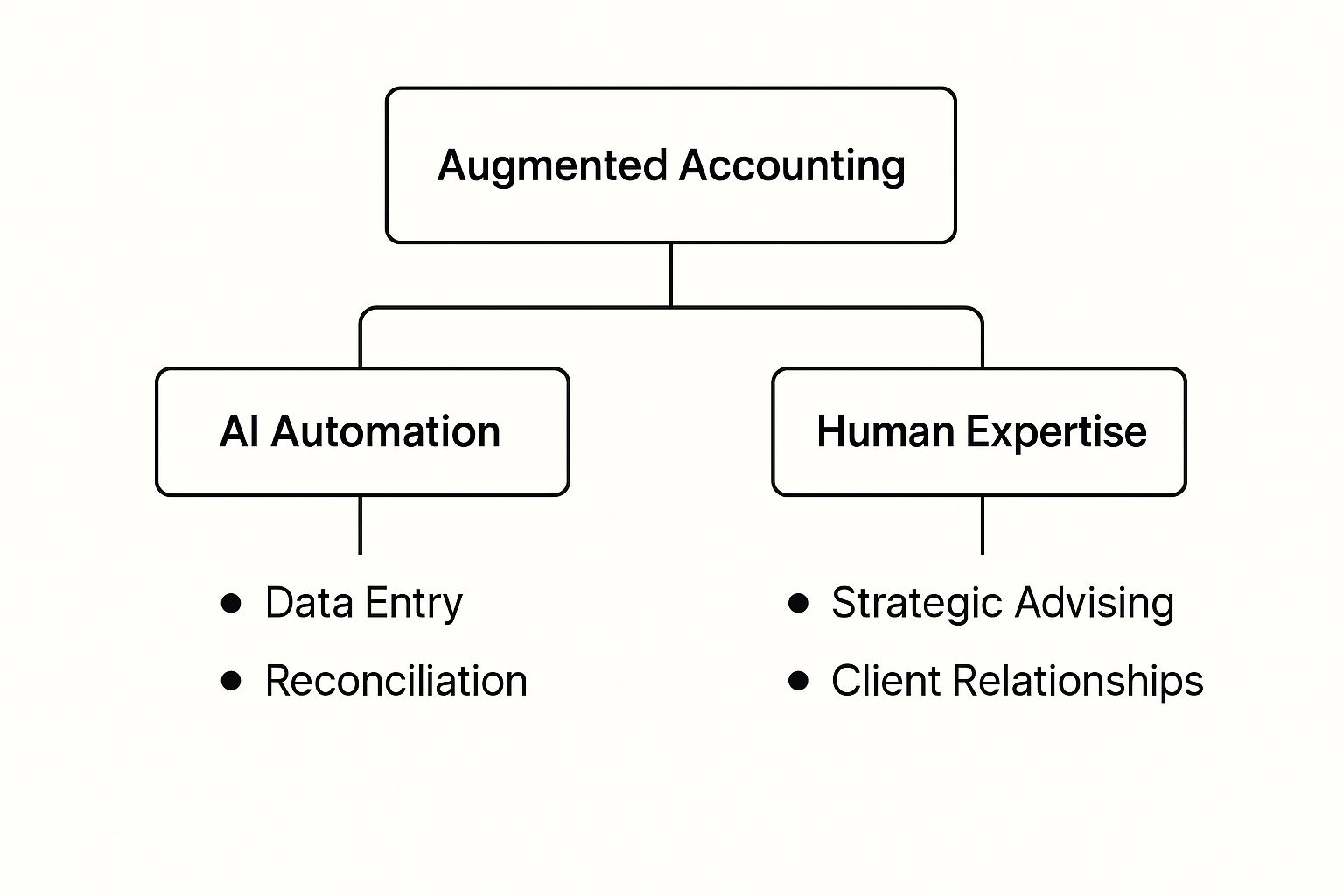

The Real Story: Augmentation, Not Replacement

The whole "human vs. machine" debate misses the point entirely when it comes to accounting. The reality is much more of a partnership. Think of AI as your new, hyper-efficient assistant - the one who happily takes on the tedious, data-heavy jobs that eat up your day, like reconciliation, endless data entry, and routine compliance checks.

This simple shift allows accountants to evolve. You're no longer just processing data; you're becoming a strategic advisor. By letting AI handle the grunt work, you can focus on what humans do best: interpreting complex financial stories, giving clients tailored advice, and building the kind of trust-based relationships that software just can't replicate.

The infographic below really brings this to life, showing a clear division of labor between tasks perfect for AI and those that demand a human touch.

As you can see, it’s all about a partnership. Technology handles the mechanics, which lets people deliver the insights and strategic value that clients are really paying for.

A New Way of Working Together

This collaborative model isn't some far-off future concept; it's happening right now. Recent surveys show that 58% of firms were already using some form of AI by 2024. And it's paying off. Some analysts predict this shift could slash operational costs by as much as 40% by 2025. This isn't just a trend; it's a fundamental change in how the industry operates, driven by the need for greater accuracy and less manual work.

A great way to think about this is through the lens of staff augmentation, where you bring in outside experts to boost your team's existing skills. AI does something very similar for an accountant. It’s not about making you obsolete; it's about adding to your capabilities. The real magic happens in the synergy between AI's efficiency and a human's critical thinking.

To make this crystal clear, let's break down where each side truly shines.

Human Accountant vs AI Capabilities

| Area of Focus | Human Accountant Strengths | AI Strengths |

|---|---|---|

| Data Processing | Oversight and validation | High-speed data entry, sorting, and categorization |

| Strategic Advice | Contextual understanding, ethical judgment, future planning | Data analysis to identify patterns and anomalies |

| Client Relations | Empathy, trust-building, communication | 24/7 availability for basic queries and data retrieval |

| Problem-Solving | Creative solutions for unique, complex scenarios | Rule-based problem detection and flagging issues |

| Compliance | Interpreting gray areas in regulations, adapting to new laws | Automated checks against existing regulatory frameworks |

This table shows it's not a competition. It’s about using the right tool for the right job to get the best possible outcome.

AI is not here to take jobs; it's here to take tasks. This distinction is critical for understanding the future of the accounting profession.

Ultimately, this evolution is creating a more dynamic, valuable, and - frankly - more interesting role for accountants. You can dive deeper into this topic in our guide to the intersection of accounting and AI.

What AI Can and Cannot Do in Accounting

To get a real feel for AI's role, picture it as a brilliant but very literal-minded junior accountant. This assistant can plow through thousands of invoices in the time it takes you to make a cup of coffee, and it never gets tired. But it can’t sit down with a nervous business owner and walk them through the strategic implications of a merger.

This difference is everything. It’s why the whole "will AI replace accountants?" debate misses the point. AI is built to nail repetitive, data-heavy tasks with breathtaking speed and accuracy, changing the very nature of day-to-day accounting work.

Where AI Truly Excels

AI is in its element when dealing with structured data and predictable processes. It was born to automate the stuff that eats up an accountant's day, freeing them up for more valuable work.

Here’s where AI is already a game-changer:

- •Automated Data Entry: It can pull key details from invoices, receipts, and bank statements in a flash. No more mind-numbing manual entry.

- •Transaction Categorization: Smart algorithms learn how to classify your expenses and income correctly every time, leading to cleaner, more reliable books.

- •Reconciliation: That painful process of matching bank statements to your accounting software? AI can do it in seconds, not hours.

- •Compliance Checks: AI can be programmed to flag transactions that look iffy or fall outside certain regulatory rules, giving you an early warning system for compliance issues.

These tasks are critical, but they're only part of the job. By letting technology handle the grunt work, accountants can finally step away from the calculator and into a more strategic role.

By automating the routine, AI elevates the human role. The accountant of the future isn't a data processor but a strategic advisor who interprets the story the data tells.

The Uniquely Human Side of Accounting

While AI is amazing at crunching the numbers and telling you what happened, it takes a person to explain why it happened and figure out what to do next. Some skills are just plain human - they rely on context, empathy, and creative problem-solving. This is where real value lies.

For example, AI just can't handle:

- •Ethical Judgment: Navigating the gray areas of tax law or financial reporting requires a moral compass. Machines don't have one.

- •Strategic Financial Planning: AI can show you past performance, but it takes a human to understand a client's dreams and map out a financial strategy to get them there.

- •Interpreting Nuance: To an AI, a dip in sales is just a data point. A human accountant can connect that dip to a new competitor, a shift in the market, or an internal operational issue.

- •Building Client Trust: The most important part of accounting is the relationship. Providing reassurance, communicating clearly, and giving advice that shows you get it - that’s a human touch.

A good AI agent for accounting is designed to be a partner, not a replacement. It takes the robotic work off your plate, giving you more time and better data to provide the high-value advisory services that clients will always need.

How AI Is Reshaping Accounting Roles

Let's be honest, AI isn't some far-off concept anymore - it's already changing the daily grind for accountants. But the popular story that robots are coming for everyone's jobs? It's just not that simple. What we're actually seeing is a transformation, where the nature of the job is evolving as routine work gets handed over to technology.

Roles that have traditionally been heavy on manual, repetitive tasks are the first to feel this shift. Think about bookkeepers, payroll clerks, and auditors. So much of their day involves data entry, matching transactions, and ticking compliance boxes. These are exactly the kinds of rule-based activities that AI is built for, and it can do them faster and more accurately than any human ever could.

The Shift from Processor to Supervisor

The good news is that AI isn't making these roles disappear. It's just changing the job description. Professionals are moving from being manual data processors to becoming something more like "AI supervisors." Their new focus is on managing the automated systems, making sure the data going in is accurate and the results coming out make sense.

This change really elevates what an accountant does. Instead of spending their days buried in spreadsheets reconciling accounts, they're now free to zero in on the exceptions - those tricky, unusual transactions that AI flags for a human to look at. This is where real expertise shines. It takes critical thinking and deep knowledge to investigate anomalies and make the right call.

Think of it less as a replacement and more as a promotion. Accountants are being promoted from data entry clerks to strategic analysts, using the insights AI uncovers to help guide the business.

The job is shifting from "doing" the work to analyzing what the work means. An auditor, for example, can now use AI to scan 100% of a company's transactions for red flags, instead of just checking a small sample. Their role then becomes about interpreting the patterns and risks the AI has uncovered, not just finding them.

The Evolving Job Market

You can see this playing out in the broader employment numbers. The World Economic Forum’s 2025 Future of Jobs Report predicted that accounting, bookkeeping, and payroll clerk jobs would be some of the fastest-declining roles, mostly due to automation. But that number doesn't tell the full story. The industry is also staring down a massive demographic cliff, with nearly 75% of CPAs expected to retire in the next decade. That's a huge talent gap to fill. You can read more about these accounting AI trends on synder.com.

At the end of the day, the accountant of the future isn't a number-cruncher; they're a strategic partner. They'll use technology to handle the tedious mechanics, freeing them up to provide the high-value advice that truly helps a business succeed. This isn't the end of the accounting profession. It's the beginning of its most strategic and influential chapter yet.

How Accountants Really Feel About AI

So, beyond all the tech-talk and bold predictions, what's the actual vibe on the ground? While the headlines love a good "robots are taking our jobs" story, the conversations happening inside accounting firms are surprisingly optimistic.

The truth is, many accountants aren't just putting up with AI - they're genuinely excited about it.

It's not hard to see why. Accountants are famously overworked, especially when tax season or year-end rolls around. They look at AI and don't see a competitor; they see a lifesaver that can finally take over the soul-crushing, repetitive tasks that cause so much burnout. Think about it: wiping out hours of manual data entry or tedious reconciliations. That's the promise that's getting people's attention.

A Major Shift in Thinking

This isn't just wishful thinking; the numbers back it up. The old question of whether AI will replace accountants is starting to feel a bit dated. The mood is shifting from "uh oh" to "let's go."

A July 2025 survey gives us a pretty clear picture. It found that a whopping 72% of accountants are totally fine with technology handling tasks that humans used to do. Even more telling, 64% said their firms were already using these kinds of tools, and more than half of them reported that AI was making them better at their jobs. You can dig into the full survey on accountants' readiness for AI at AccountingToday.com to see the details.

This shows that firms aren't waiting around to be disrupted. They're getting ahead of the curve because they know that embracing this change is the only way to stay in the game.

Instead of seeing AI as a threat, savvy accountants see it as a career booster - a ticket to move from just crunching the numbers to becoming a trusted strategic advisor. And maybe, just maybe, getting a better work-life balance.

Balancing Excitement with a Bit of Caution

Of course, nobody's wearing rose-colored glasses. The optimism is grounded in a healthy dose of reality. Any big technological shift brings a little anxiety, and worrying about job security is perfectly normal.

But the overwhelming feeling isn't fear; it's opportunity. Accountants are realizing their jobs aren't vanishing. They're evolving into something more meaningful, more strategic, and ultimately, more valuable.

Here’s what’s really driving this change:

- •A Hunger for Efficiency: Everyone is eager to hand off the boring, repetitive work to an automated system.

- •A Push for Higher-Value Work: There's a real desire to spend more time advising clients, building relationships, and solving tricky problems.

- •A Practical Approach: Accountants get it - learning to work alongside AI is no longer optional. It's a fundamental skill for career growth.

This mix of excitement and realism paints a picture of a profession that isn't just surviving the age of AI. It's gearing up to lead the way.

The New Skills You Need in the AI Era

If you want to thrive in an AI-powered world, you can't just stick to the old playbook. It's time to write a new one. The whole "AI will replace accountants" narrative starts to fall apart when you realize the goal isn't to compete with machines, but to direct them. All that foundational accounting knowledge you have? It’s the perfect launchpad for the skills that are in high demand right now.

This shift means moving away from the repetitive, manual tasks and leaning into strategic thinking. It’s less about knowing how to do something and more about understanding why it’s being done and how technology can do it faster and better. Let's break down how you can turn this challenge into a huge career opportunity.

From Data Entry to Data Storytelling

One of the biggest changes is the move from just managing data to actually interpreting it. AI is fantastic at crunching the numbers and telling you what happened, but it needs a human expert - you - to explain the "so what?" Your real value now comes from looking at an AI-generated report and weaving it into a compelling story that helps a business make smarter decisions.

This means you need to get comfortable with data analytics. You should be the one asking tough questions of the data, spotting trends that software might overlook, and translating dense financial reports into clear, actionable advice for your clients or leadership team.

The modern accountant doesn't just present numbers; they explain the story behind the numbers. This is where human insight creates irreplaceable value.

Becoming a Technology Navigator

It used to be enough to master a single piece of accounting software. Not anymore. The new expectation is technology proficiency across a much wider range of tools. Don't worry, this doesn't mean you need to learn to code. It just means you need to understand how different systems connect and work together.

For instance, knowing how to set up and manage automated workflows in a tool that handles bookkeeping with AI is quickly becoming a core skill. Our guide on how to use AI for bookkeeping is a great place to start if you want to see what this looks like in practice. When you become the go-to person who can find, implement, and oversee these tech solutions, you make yourself essential.

The table below breaks down this evolution, showing how traditional skills are being reimagined for the AI era.

Evolving Skillset for the Modern Accountant

| Traditional Skill | Modern AI-Era Skill | Why It Matters |

|---|---|---|

| Manual Data Entry | Data Validation & Oversight | AI handles the input, but a human needs to ensure the data quality and system integrity are top-notch. |

| Report Generation | Data Storytelling & Visualization | Instead of just creating reports, you interpret the data, find the narrative, and present insights visually. |

| Compliance & Rule-Following | Strategic Advisory & Forecasting | With compliance automated, you can focus on helping clients plan for the future and navigate complex financial decisions. |

| Software Proficiency | Tech Stack Integration | Knowing one tool is good; knowing how to make multiple tools (CRM, ERP, AI) work together is invaluable. |

This isn't about throwing out your old skills; it's about building on top of them with new capabilities that complement what technology can do.

The Rise of Advisory and Problem-Solving Skills

With automation taking care of the routine stuff, you can finally double down on the areas where AI still struggles. These are the uniquely human domains that call for nuance, creativity, and a personal touch.

- •Strategic Advisory: Clients don't just want clean books. They're looking for a forward-thinking partner who can help them understand financial complexities and map out a path for growth.

- •Creative Problem-Solving: When a weird financial issue pops up, AI can flag it. But it takes human ingenuity to come up with a custom solution that fits the business's unique goals.

- •Communication and Empathy: Building trust and explaining sensitive financial information in a way that clients actually understand is a skill no machine can replicate.

Ultimately, the future of your career depends on leaning into these human-centric skills. The accountant of tomorrow is a tech-savvy strategist, a data interpreter, and a trusted advisor all rolled into one.

So, How Do You Get Started with AI?

It's one thing to talk about AI's potential, but actually bringing it into your daily work is a whole different ball game. The great news? You don't have to flip a switch and change everything at once. The most successful firms I've seen start with small, smart steps that create real momentum.

Instead of worrying about a future where AI replace accountants, think of this as a golden opportunity. This is your chance to build a practice that’s more efficient, more strategic, and ultimately, more valuable to your clients. It all begins with a simple plan focused on getting quick wins while building for the long haul.

Start Small, Win Big

The easiest way to get comfortable with AI is to aim it at the tasks that drive you and your team crazy - the repetitive, time-sucking stuff. Think about the biggest bottlenecks in your day. That’s your sweet spot. Tackling this low-hanging fruit gives you a fast return on your investment and, just as importantly, builds everyone's confidence.

- •Invoice and Receipt Processing: Imagine a world where you don't have to manually key in data. Tools like Tailride can do the whole nine yards, from snagging documents in an inbox to pulling the data and plugging it right into your accounting software.

- •Expense Reporting: Put expense categorization and approvals on autopilot. This frees up so much administrative time for both your team and your clients.

- •Bank Reconciliations: Why manually match thousands of transactions when an AI can do it in a fraction of the time? This lets your team focus their brainpower where it truly matters: investigating the outliers.

If you want to see what's out there, checking out a list of the 12 best AI tools for small business leverage can be a great way to discover technologies that can boost your team's output.

Remember, the goal is progress, not perfection. One successful automation project will do more to win over skeptics than a dozen meetings ever could.

Build a Team That Loves to Learn

Technology waits for no one, and staying relevant means making learning a part of your firm's DNA. This goes beyond just sending people to a training course. It's about creating an environment where curiosity is celebrated and experimenting with new tools is just part of the job.

When you encourage your team to play with AI and share what they find, something amazing happens. The fear of being replaced morphs into excitement for career growth.

By treating AI as a collaborator, you and your team aren't just reacting to the future - you're actively shaping it. You’re making sure your skills are not just needed but absolutely essential for this new, more strategic era of accounting.

Got Questions? We've Got Answers

It's only natural to have a lot of questions when we talk about something as big as artificial intelligence shaking up the accounting world. Let's clear up some of the common ones.

So, Can AI Completely Replace an Accountant?

Not a chance. Honestly, it's not even close.

Sure, AI is a powerhouse for chewing through repetitive work - think data entry, reconciliations, or spitting out standard reports. But it completely misses the mark on what makes a great accountant. It can't offer strategic advice over a cup of coffee, navigate a tricky ethical dilemma, or build the kind of trust that keeps clients for life.

Think of today's AI as the world's most efficient assistant, not a replacement for the person in charge.

Here's the best way to look at it: AI handles tasks, not entire jobs. It takes care of the "what" - processing endless numbers - so you can focus on the "why" and "what's next."

Which Accounting Tasks Will AI Take Over First?

The first things on the chopping block are always the tasks that are repetitive, follow clear rules, and involve mountains of data. These are the areas where we humans tend to make mistakes or get bogged down.

You'll see it happening most in:

- •Invoice and Receipt Processing: AI can instantly grab the details from a PDF or a photo and plug them right into your accounting system. No more manual typing.

- •Transaction Categorization: Smart algorithms quickly learn how to sort income and expenses, keeping the books clean and consistent.

- •Bank Reconciliation: Instead of you manually ticking and tying, AI can compare thousands of transactions to bank statements in a flash, only flagging the few odd ones that need a human eye.

Do I Need to Become a Coder to Use This Stuff?

Absolutely not. That’s the beauty of it. The best AI accounting tools are built for accountants, not for programmers.

Platforms like Tailride have simple, clear interfaces that let you set things up without touching a single line of code. You’re just telling the system what to do using your accounting knowledge. The skill you need isn't coding; it's knowing your craft and seeing how a tool can make you better at it.

The goal isn't to turn accountants into programmers. It's about becoming a pro who knows how to direct these powerful tools. When you can do that, technology stops being a threat and starts being your most valuable team member.

Ready to stop drowning in manual data entry? The team at Tailride can show you how to automate your invoice and receipt management in seconds. Get started for free at tailride.so.