Receipt Scanning OCR: Simplify Expense Management Today

Harness receipt scanning OCR to automate expenses, reduce errors, and gain quick financial insights. Discover smarter expense management now!

Tags

If you've ever found yourself staring at a shoebox overflowing with faded paper receipts, you know that sinking feeling. The sheer dread of manual expense tracking is real. But what if you could skip that whole mess?

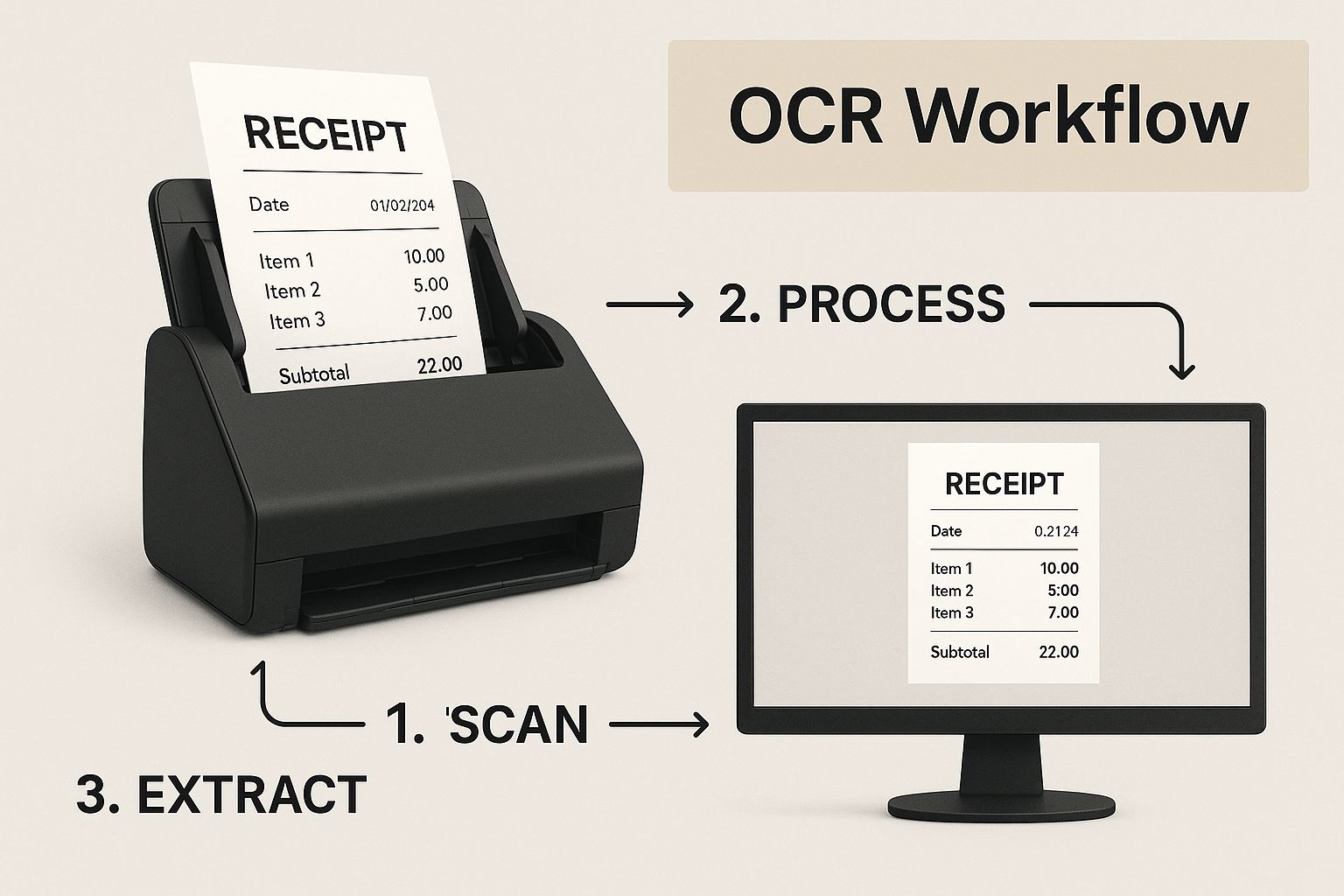

That's exactly what receipt scanning OCR does. It uses a clever technology called Optical Character Recognition (OCR) to look at a picture of a receipt, instantly read all the important details, and turn them into digital data. No more typing, no more squinting at crumpled paper.

Tired of Drowning in Paper Receipts?

We've all seen it - or lived it. The frantic finance manager or small business owner, hunched over a desk, manually punching numbers from a mountain of receipts. Each one of those little paper slips represents precious time wasted on a task that’s, frankly, mind-numbing. It’s like being asked to copy a book by hand when there's a high-speed scanner sitting right next to you.

This old-school approach isn't just slow; it's practically an invitation for costly mistakes. A single misplaced decimal or a "fat-finger" typo can completely throw off your budget, make tax time a nightmare, and lead to inaccurate financial reports. The risk of human error is always lurking, creating a constant hum of stress for anyone who needs accurate expense data.

The Shift to Automated Efficiency

Thankfully, the days of manual receipt entry are numbered. Businesses are wising up to a simple truth: your team's time is your most valuable resource. Why would you spend it on something a machine can do flawlessly in seconds? This is where receipt scanning OCR changes everything. It’s not just about doing the same old job faster; it’s about transforming how you handle financial information from the ground up.

Let's look at the difference side-by-side.

Manual Entry vs Automated OCR Scanning

See the stark contrast between traditional expense reporting and the efficiency of modern receipt scanning OCR.

| Metric | Manual Processing | Receipt Scanning OCR |

|---|---|---|

| Speed | Slow, tedious, and time-consuming | Instant data capture in seconds |

| Accuracy | High risk of human error (typos, etc.) | 98%+ accuracy with modern tools |

| Team Focus | Low-value data entry | High-value analysis and strategy |

| Data Visibility | Delayed, often weeks or months late | Real-time, up-to-the-minute insights |

| Audit Trail | Messy paper trails, easy to lose receipts | Clean, digital, and instantly searchable |

| Employee Experience | Frustrating and often a burden | Simple, fast, and user-friendly |

The table really says it all. You move from a reactive, error-prone system to a proactive and incredibly accurate one.

This is a big reason why the global Expense Receipt OCR App market was valued at over $1.41 billion, with experts predicting even more growth as companies flock to better data solutions. You can dive deeper into these trends in the Expense Receipt OCR App Market report from DataIntelo.

By automating receipt capture, you’re not just digitizing paper; you’re unlocking real-time visibility into your company's spending, empowering your team to make smarter, data-driven decisions on the fly.

This move is part of a much larger push toward digital efficiency. If you’re thinking about the wider benefits of ditching paper for good, there are some fantastic strategies for going paperless that can help your whole organization run more smoothly.

The bottom line is simple: receipt scanning OCR frees your team from the soul-crushing drudgery of data entry. It lets them focus on what they were actually hired to do - analyze numbers, build strategy, and drive growth. It turns an administrative nightmare into a seamless, reliable workflow that gives you a crystal-clear picture of your company's financial health.

How Receipt Scanning OCR Works Its Magic

Ever wondered how your phone can look at a crumpled receipt from your pocket and instantly pull out all the key details? It’s not magic, but it’s a pretty clever process that blends a few different technologies.

Think of it like a digital detective working a case. It all starts the moment you snap a photo. That picture is the raw evidence, but just like a crime scene photo, it often needs to be cleaned up. Folds, weird shadows, a shaky hand, or bad lighting can make the text tough to read, even for a smart piece of software.

This is where the first crucial step, image preprocessing, comes in.

Step 1: Image Preprocessing and Cleanup

Before the software can even think about reading the text, it has to tidy up the image. This is a make-or-break step; getting this right is essential for accurate results. It's a lot like a photo editor automatically fixing a dark or blurry picture to make everything sharp and clear.

The software runs through a few automated tweaks:

- •Deskewing: It digitally straightens out the receipt, correcting any crooked angles from how you held the camera.

- •Noise Reduction: It gets rid of all the visual "clutter" - random specks, dark spots, or shadows - that could confuse the system.

- •Binarization: The image is converted to a simple black and white. This makes the text pop, creating a stark contrast that's much easier for the software to analyze.

- •Contrast Enhancement: Faded ink from a cheap printer? The software boosts the contrast to make those faint characters bold and legible again.

Once the image is clean and prepped, it's ready for the main event.

This whole workflow, from a physical piece of paper to structured digital data, is what makes the technology so effective.

As you can see, it’s a logical flow that turns a physical document into a digital record you can actually use.

Step 2: Character Recognition and Data Extraction

With a pristine image to work with, the Optical Character Recognition (OCR) engine gets down to business. It scans the image, identifying the shapes of each individual letter and number. It's essentially playing a matching game, comparing those shapes to a massive library of known characters to figure out what they are. It knows the difference between the curves of a "5" and a "G."

But modern receipt scanning OCR is much more than a simple letter-reader. This is where Artificial Intelligence (AI) and machine learning come in and add a whole new layer of smarts. The system doesn't just see a random jumble of text and numbers; it understands the context of a receipt.

The AI acts like a brain that knows exactly what it's looking for. It recognizes the typical layout of a receipt to pinpoint the most important stuff, like the vendor's name, the date, each line item, and of course, the grand total.

This intelligent extraction is the real game-changer. It’s how the software can tell the difference between the date and the total amount, even if they're printed right next to each other. It learns from analyzing millions of different receipt formats, constantly getting better at handling everything from a simple coffee shop slip to a complex, multi-page hardware store invoice. If you're curious about the core technology, you can dig deeper into how OCR is used for image to spreadsheet conversions.

Step 3: Structuring and Delivering the Data

The final piece of the puzzle is organizing all that extracted information into something useful. The software takes the raw data it just identified - the vendor, date, items, tax, and total - and plugs it into neat, labeled digital fields.

From there, this perfectly structured data can be sent straight to your accounting software, expense management platform, or even just a simple spreadsheet. This is the step that officially frees you from manual data entry. For any business ready to automate this, choosing the right receipt scanning software is what connects this powerful tech directly into your financial workflow.

What This Really Means for Your Finance Team

Bringing receipt scanning OCR into your business does more than just get rid of a few paper piles. It fundamentally changes how your finance department works, day in and day out. Think of it like swapping an old paper map for a live GPS - you're not just digitizing a process; you're injecting speed, accuracy, and genuine intelligence right into the heart of your financial operations.

Imagine your finance team right now, maybe swamped with expense reports and mind-numbing data entry. Now, picture them with hours - even dozens of hours - handed back to them every single month. That's not an exaggeration. By automating the grunt work, receipt scanning OCR frees your skilled professionals to do what you hired them for: high-level financial analysis, cash flow forecasting, and strategic planning. They stop being data entry clerks and become the strategic advisors you need.

Nail Your Financial Accuracy, Every Time

Let’s be honest, manual data entry is a minefield. A single misplaced decimal or a typo in a vendor name can cause a ripple effect, leading to incorrect payments and flawed financial statements. Hunting down and fixing these mistakes isn't just annoying; it costs real time and money.

Receipt scanning OCR all but eliminates this risk. The best systems today hit accuracy rates well over 98%, which means the data flowing into your accounting software is clean and reliable from the get-go.

This precision builds a rock-solid foundation for all your financial reporting. You can close the books each month with confidence, knowing the numbers are sound and free from the classic human errors that throw things off.

Ultimately, this gives you a dependable dataset you can trust to make critical business decisions.

Build an Effortless, Unbreakable Audit Trail

We’ve all felt that pre-audit panic, scrambling to find a shoebox full of faded receipts. A single lost receipt can mean a disallowed expense, costing you money and creating a compliance nightmare. With digital receipt capture, that stress is gone for good.

Every scanned receipt instantly creates a secure digital copy linked to its transaction. This process automatically builds a perfect, searchable audit trail. Forget digging through filing cabinets; you can pull up any receipt and its data in seconds. This makes audits smoother and far less painful. For businesses that manage a lot of client work, dedicated https://tailride.so/blog/invoice-ocr-software can make this even easier, ensuring every single billable expense is captured and categorized correctly.

Make Decisions with Live Spending Data

This might be the biggest win of all: shifting from reactive to proactive financial management. Manual expense reporting always has a delay. By the time expenses are finally submitted, approved, and entered, you're looking at data that’s weeks or even months old.

Receipt scanning OCR flips the script, giving you a real-time window into company spending as it happens.

- •Tighter Budget Control: Managers can keep an eye on their budgets in real time and stop overspending before it spirals.

- •Confident Forecasting: With up-to-the-minute data, your finance team can create forecasts that are much more accurate and reliable.

- •Smarter Strategic Insights: Seeing spending patterns as they emerge helps you make better purchasing decisions and negotiate better deals.

This isn't just a niche trend. The broader Optical Character Recognition market was valued at USD 13.95 billion and is expected to explode to USD 46.09 billion by 2033, fueled by a massive demand for automated data tools across every industry. When you combine this technology with modern Cloud Accounting Solutions, you don't just upgrade a process - you transform your finance department from a cost center into a strategic engine for your business.

Choosing the Right Receipt OCR Software

With so many options out there, picking the right receipt scanning OCR tool can feel a little overwhelming. They all promise to make life easier, but the reality is, only one will fit your business just right. It’s not about finding the software with the longest list of features; it's about finding the one that actually solves your problems without creating new ones.

Think of it this way: you wouldn't use a sledgehammer to hang a picture frame. A small business doesn't need a massive, complex enterprise system, and a global corporation will quickly outgrow a basic mobile app. The goal is to match the software's horsepower to your team's real-world needs. You want a tool that feels less like a piece of software and more like a natural part of your finance workflow.

The Foundation: Must-Have Features

Before you get lost in the bells and whistles, there are a few non-negotiable features every solid receipt OCR platform needs. These are the absolute basics. Without them, you’re just swapping one set of manual headaches for a different, digital one.

Start your evaluation with these three core elements:

- •High Accuracy Rate: The whole point of this is to stop manual data entry and its inevitable mistakes. Look for tools that are upfront about their accuracy rates. The best solutions consistently hit over 95-98% precision. Anything less, and your team will spend all their time double-checking and fixing the software's work - which defeats the purpose.

- •Line-Item Extraction: Just grabbing the total and the store name is a start, but the real magic is in pulling out individual line items. This detailed data is what you need for proper bookkeeping, job costing, and truly understanding where your money is going. Knowing you spent $300 at a hardware store is one thing; knowing you bought specific supplies for a specific client project is what really matters.

- •Seamless Accounting Integrations: Your new tool has to talk to your existing accounting software, period. A great receipt scanning ocr tool should offer direct, native integrations with platforms like QuickBooks, Xero, and Business Central. This is what lets the data flow automatically from a scanned receipt right into your general ledger, no more messing with manual CSV uploads.

What to Look For as Your Team Grows

As your business scales - or if you're already managing a complex team - your needs get more specific. What works for a solo freelancer is completely different from what a company with employees all over the world requires.

Here are the features that separate a good tool from a great one for growing companies:

An App People Actually Want to Use If your team is out in the field, the mobile app experience is everything. If it’s clunky, slow, or confusing, they just won't use it. You'll be right back where you started, chasing down a shoebox full of crumpled receipts at the end of the month. The app should make it possible to snap a photo and submit an expense in under 30 seconds.

Multi-Currency Support This one’s a deal-breaker if you have international employees or do business across borders. The software needs to automatically recognize different currencies, use the correct exchange rate for the transaction date, and post everything correctly in your books.

Rock-Solid Security and Compliance You’re trusting this platform with sensitive financial data, so security can't be an afterthought. Make sure your provider offers enterprise-grade security, like end-to-end encryption, and is fully compliant with data privacy laws like GDPR.

A great receipt scanning tool is more than just a gadget; it's a core part of your financial tech stack. To help you weigh your options, here’s a quick checklist of the essential features you should be looking for.

Essential Features in a Modern Receipt OCR Tool

| Feature | Why It Matters | What to Look For |

|---|---|---|

| High Accuracy | Reduces manual corrections and builds trust in the data. Low accuracy just creates more work. | Look for providers claiming 95% or higher accuracy, backed by AI and human-in-the-loop (HITL) review. |

| Line-Item Data | Provides granular spending details needed for accurate accounting, job costing, and budget analysis. | The ability to extract individual items, quantities, and prices, not just the total amount. |

| Native Integrations | Ensures data flows automatically into your accounting system without manual exports/imports. | Direct, pre-built connections to your specific accounting software (e.g., QuickBooks, Xero, NetSuite). |

| Intuitive Mobile App | Drives employee adoption. If it's hard to use, people will revert to old habits (like handing in paper). | A clean, fast app for iOS and Android that allows for quick capture and submission on the go. |

| Multi-Currency | Essential for global teams to handle international expenses without manual currency conversion. | Automatic recognition of foreign currencies and conversion to your base currency using daily exchange rates. |

| Security & Compliance | Protects sensitive financial information and ensures you meet legal data privacy requirements. | End-to-end encryption, regular security audits, and clear compliance with regulations like GDPR and SOC 2. |

| Custom Rules | Allows you to automate approvals and categorize expenses based on your company's specific policies. | The ability to set up workflows, approval chains, and rules for flagging out-of-policy expenses. |

| Real-Time Processing | Gives you an up-to-the-minute view of company spending, rather than waiting until the end of the month. | Receipts should be processed and available for review within minutes, not hours or days. |

Having this checklist handy will help you cut through the marketing noise and focus on what will truly make a difference for your finance team.

Choosing the right software is about building a complete, automated workflow. The goal is to capture financial data at its source and let it flow through your systems without human intervention, ensuring both speed and accuracy.

This idea of a hands-off workflow goes beyond just receipts. If you’re looking to automate your entire accounts payable process, our guide on invoice data capture software is a great next step. It shows how matching the right tools to the right documents is the key to building a truly efficient finance operation.

A Simple Guide to Business Implementation

Rolling out new technology in your business doesn't need to be a massive headache. When it comes to receipt scanning OCR, the secret is to start small, show your team the wins, and build momentum from there. The whole point is to make the transition feel like a helpful upgrade, not some top-down mandate that complicates everyone's job.

Think of it like test-driving a car. You’d never commit to an entire fleet without getting behind the wheel of one first, right? The same principle applies here. A phased rollout lets you smooth out any wrinkles with a small group before going company-wide. This approach is your best bet for getting everyone on board and seeing a quick return on your investment.

Phase 1: Start with a Pilot Program

The best first step is always a small, controlled pilot program. Pick a single department or even just a few employees who are generally open to trying new things. This group becomes your invaluable testing ground, giving you honest feedback without disrupting the entire company's workflow.

This phase is all about learning. You'll see how the tool actually works in the real world, not just in a sales demo. It’s your chance to spot potential hiccups and fine-tune your process based on what your team is experiencing day-to-day.

Phase 2: Train and Create Clear Guidelines

Once your pilot team has the hang of it, you can start planning for a wider rollout. Training is key, but it shouldn’t be a boring, hour-long presentation. The most effective training is hands-on and focuses on what your employees care about: how this makes their jobs easier. Show them how receipt scanning OCR means less tedious paperwork, quicker reimbursements, and no more panicking over a lost coffee receipt.

Put together a simple, one-page cheat sheet with a few best practices:

- •Photo Tips: Remind everyone to take photos on a flat surface with good lighting. No crumpled receipts from the bottom of a bag!

- •Submission Cadence: Encourage people to scan receipts as they get them, rather than saving up a huge pile for the end of the month.

- •Categorization Basics: Give a few simple examples for tagging common expenses, like "Client Meals" or "Office Supplies."

A successful rollout is less about the tech itself and more about changing habits. If you can make the new process dead simple and show people the personal benefits, you'll get your whole team on board in no time.

Phase 3: Integrate and Automate

Now for the fun part. This is where you get to see the real magic happen by connecting your new OCR tool directly with your accounting software. This final integration is what closes the loop, creating a hands-off workflow that moves data from a paper receipt straight into your financial system.

This connection gets rid of the soul-crushing task of exporting and importing spreadsheets - a process just begging for human error. Once integrated, your finance team will see approved expenses pop up in the general ledger almost instantly. This step takes your expense management from a clunky, manual chore and turns it into one smooth, efficient process.

How Different Industries Use Receipt OCR

The true magic of receipt scanning OCR isn't just what it does, but how it adapts to solve real-world problems for all kinds of businesses. While the underlying technology is the same, its application can look completely different from one industry to the next. Let's look at a few stories from the trenches.

Think about a busy logistics company with hundreds of drivers on the road. Every single day, they rack up thousands of small receipts for fuel, tolls, and maintenance. Before OCR, drivers would end up with a glove box stuffed full of paper, creating a massive administrative headache at the end of the month. It was a chaotic mess of collecting, sorting, and manually keying in every single expense.

With receipt scanning OCR, that whole process changes. A driver can just snap a photo of a fuel receipt right at the pump. In seconds, the data is pulled, categorized, and sent back to the main office. The finance team gets a live look at fleet expenses, and drivers can focus on driving, not paperwork.

Solving Problems for Sales and Service Teams

Now, let's picture a sales team that’s constantly out entertaining clients. Building relationships is key to their success, but tracking all those dinner and travel receipts has always been a nightmare. Expense reports were often a dreaded chore, thrown together weeks later based on fuzzy memories and whatever crumpled receipts they could dig out of their bags.

This is where OCR completely flips the script. A salesperson can capture a client dinner receipt before they even walk out of the restaurant.

- •The expense gets logged right away, so it’s never forgotten.

- •It can be immediately tagged to a specific client or project in their CRM.

- •Reimbursements get processed way faster, which keeps the team happy.

This simple change gets rid of that frantic month-end reporting rush and gives managers an accurate, real-time picture of their cost of sales.

By capturing expense data at the point of transaction, businesses transform a messy, delayed process into a clean, immediate, and strategic one. It's about turning operational friction into a competitive advantage.

Empowering Freelancers and Small Businesses

It's not just the big players who get a boost. For freelancers, consultants, and small business owners, just staying organized for tax season can be a huge source of anxiety. The old "shoebox method" isn't just clunky; it's risky. A single lost receipt could mean missing out on a valuable tax deduction.

A freelance graphic designer, for instance, can use a receipt scanner app to capture every software subscription, stock photo purchase, and coffee meeting expense as it happens. When tax time rolls around, they have a perfect, digital, and organized record of all their business expenses ready for their accountant. This simple habit can save dozens of hours of work and ensure they claim every single deduction they're entitled to.

This growing reliance on automated document processing is a significant economic force. The closely related Invoice OCR API market, for example, was recently valued at USD 1.45 billion and is expected to climb to USD 1.75 billion in the next year alone. You can dig into more of the data in this market report from Business Research Insights. From trucking fleets to sales teams to solo entrepreneurs, OCR is quickly becoming a must-have tool for running a modern business.

Common Questions About Receipt OCR

Jumping into any new tech can feel like a big move, and it's smart to ask questions first. When businesses think about switching to receipt scanning OCR, a few key concerns almost always come up. Let's tackle them head-on.

How Accurate Is This Stuff, Really?

This is usually the first question out of the gate, and for good reason - if the data isn't right, what's the point? You'll be happy to hear that top-tier OCR tools, the ones powered by modern AI, consistently hit accuracy rates above 95%. The best of the best even push past 98%.

That's not just a number on a sales page. It’s the result of some seriously sophisticated machine learning. These systems have been trained on millions of real-world receipts, learning to handle all the messy situations that used to trip up older software.

- •Faded Ink: They can digitally "turn up the contrast" on faint text.

- •Crinkled Paper: The software can flatten out wrinkles and distortions before reading the data.

- •Weird Layouts: No matter how cluttered or unconventional a receipt is, the AI is trained to find the important stuff like the vendor, date, and total.

What this means for you is that the data entering your accounting system is trustworthy from the get-go. This drastically cuts down on the time your team has to spend double-checking and fixing things.

Is My Financial Data Actually Safe in an App?

When you're talking about financial data, security isn't just a feature; it's a requirement. Any reputable receipt scanning provider treats data protection as their most important job. Frankly, your digital records are often far safer with them than in a locked filing cabinet.

When you're vetting a solution, dig into their security specs. You're looking for enterprise-grade protection: things like end-to-end encryption, full compliance with privacy laws like GDPR, and hosting on trusted cloud platforms like Amazon Web Services or Microsoft Azure. Don't settle for less.

Will This Even Work with Our Accounting Software?

The short answer? Almost definitely. Modern receipt scanning OCR tools are built from the ground up to play nice with other software. They’re designed to plug right into your existing financial workflow, not become another data silo.

The best platforms offer pre-built, one-click integrations with all the major accounting systems you'd expect:

- •QuickBooks (Online and Desktop)

- •Xero

- •NetSuite

- •Business Central

- •Sage

This direct connection is the key to real automation. As soon as an expense gets the green light, all the data and the receipt image post directly to your general ledger. No more messing with CSV exports and imports - it just works.

Ready to stop chasing paper and start automating your finances? Tailride captures receipts and invoices directly from your email, portals, and mobile bots, flowing clean data directly into your accounting software. Find out how much time you can save with Tailride.