Integrate with QuickBooks Online A Friendly Guide

Learn how to integrate with QuickBooks Online. This friendly guide covers connecting apps, mapping data, and troubleshooting for a seamless accounting workflow.

If you want to connect your business apps to QuickBooks Online, you'll need a tool that can act as a bridge, automating how financial data flows between them. Think of it as creating a single source of truth for your company's finances. This isn't just about convenience; it's about ditching manual data entry for good and getting a live, accurate view of your business's health.

The Strategic Advantage of a Connected Workflow

Connecting your tools to QuickBooks Online is a game-changer for how you handle your finances. Instead of your team spending hours typing in invoice details or painstakingly reconciling transactions, a proper integration builds an automated pipeline for your data. It just flows where it needs to go - seamlessly and accurately.

This simple shift frees up your people to focus on what actually matters, like analyzing the numbers instead of just inputting them.

For instance, when an app like Tailride grabs an invoice from your email and sends it straight to QuickBooks, you've just eliminated a tedious task and dramatically cut the risk of human error. That immediate sync means you have a crystal-clear, up-to-the-minute picture of where your money is. You're not waiting for a month-end report to understand your cash flow; you see it as it happens.

Moving Beyond Manual Entry

Once you have a connected system, you'll start seeing the benefits pop up everywhere.

- •Spot-On Accuracy: Automation means no more pesky typos or missed entries that can throw your entire reconciliation process into chaos.

- •A More Efficient Team: Imagine all the hours your team gets back when they aren't bogged down by repetitive administrative work.

- •Real-Time Financial Visibility: You can make smarter, faster decisions because you’re working with current, reliable financial data.

Let's look at what this really means for your day-to-day operations.

A Quick Look Before and After Integration

See the practical difference connecting your apps to QuickBooks makes in your daily tasks.

| Manual Process (Before) | Automated Workflow (After Integration) |

|---|---|

| Manually download and save invoices. | Invoices are automatically captured and sent to QuickBooks. |

| Key in transaction details by hand. | Data syncs instantly, populating fields automatically. |

| Spend hours finding and fixing data entry errors. | Accuracy is built-in, drastically reducing mistakes. |

| Financial reports are only accurate at month-end. | Get a real-time view of your financial health, anytime. |

The "after" column isn't just a wish list; it's what a well-integrated system actually delivers.

It's no surprise that cloud-based accounting has become the standard for modern businesses. QuickBooks holds a massive share of the U.S. small business accounting software market, and a big reason for that is its powerful ability to connect with the other tools millions of businesses depend on every day.

For companies that do business internationally, these connections are even more vital. When you’re dealing with different currencies, a solid integration with a good multi-currency accounting software is non-negotiable for keeping your financials precise.

Getting a handle on what’s possible is the first step. To get a better feel for the bigger picture, check out our guide on https://tailride.so/blog/accounting-software-integration. The end goal here is simple: create a financial workflow that’s less stressful and way more efficient.

Preparing Your Accounts for a Smooth Connection

Before you even think about hitting that "connect" button, let's talk prep work. I've seen it time and time again: jumping the gun is a surefire way to create a digital mess. Getting a clean, error-free sync between Tailride and QuickBooks Online really comes down to making sure both systems are speaking the same language from the get-go.

Think of it like this: you wouldn't just dump a new box of files into your filing cabinet without sorting them first, right? The same logic applies here. A little tidying now will save you a massive headache later.

Align Your Key Data Points

The most common snag people hit is mismatched information. It sounds simple, but if a customer is "John Smith Trucking" in Tailride and just "JS Trucking" in QuickBooks, the integration might see them as two different companies and create a duplicate. A few minutes of cleanup now prevents hours of untangling records down the road.

Here’s a quick checklist of what to eyeball before connecting:

- •Chart of Accounts: Are your income and expense accounts in QuickBooks clearly defined? You'll need to tell Tailride exactly where to put different types of transactions, like fuel expenses versus repair costs.

- •Customer and Vendor Lists: Do a quick scan of your lists in both Tailride and QuickBooks. Look for duplicate entries or slight naming differences and standardize them.

- •Product and Service Items: Make sure the services you bill for (like "Freight Hauling" or "Detention Fee") are named consistently in both systems. This is key for invoices to sync properly.

Making sure your foundation is solid is non-negotiable. If you're new to the accounting side of things, a good guide on setting up QuickBooks correctly can be a real lifesaver here. A clean setup makes any integration run smoother.

My Two Cents: Always, and I mean always, back up your QuickBooks Online company file before you connect a new app. Modern integrations are incredibly safe, but having a restore point is the ultimate peace of mind. You just never know.

Finally, a quick but critical check on user permissions. The person who authorizes the connection absolutely must have admin-level access in QuickBooks. A standard user won't have the authority to grant an external app access to your financial data, which will stop the connection cold.

Your Guide to the Connection Process

Alright, you've done the prep work and your accounts are ready. Now for the exciting part: actually making the connection between Tailride and QuickBooks. This is where the automation magic begins, and trust me, it's simpler than you might think. We'll skip the jargon and walk through it together.

First, you'll start inside your Tailride account. Look for the 'Integrations' or 'Connected Apps' section in your settings - this is your command center for linking with other tools. Once you find the option to integrate with QuickBooks Online, clicking it will kick off the authorization process.

Authorizing the Connection

This next step is crucial for security, but it’s very straightforward. You'll be redirected to a secure Intuit login page. This is simply QuickBooks asking for your permission to let Tailride access specific data. It's important to understand that you're not giving away your password; you are just granting permission for the two apps to talk to each other.

This process, often called OAuth, is the industry standard for secure connections. The permissions you grant are typically very specific:

- •Viewing and creating customers: This lets Tailride add new clients to QuickBooks for you.

- •Managing invoices and bills: This is the heart of the integration, allowing Tailride to send invoice data directly into your books.

- •Accessing your Chart of Accounts: This is necessary so the integration can correctly categorize your income and expenses.

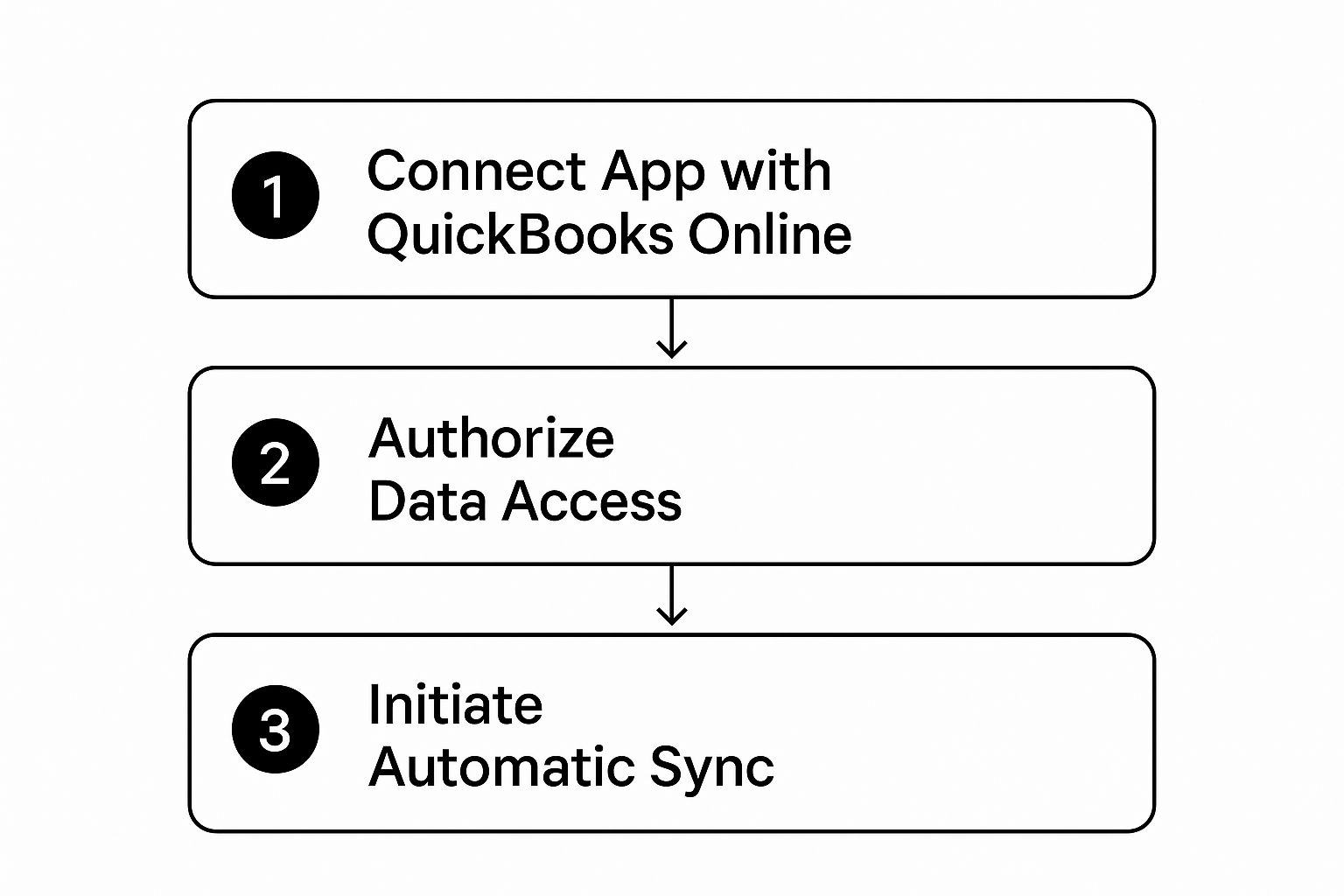

The whole flow is a simple, three-stage process, as you can see here.

This visual just highlights how initiating the connection, authorizing access, and starting the sync are distinct but sequential actions.

Finalizing the Integration

Once you grant permission, you'll be sent right back to Tailride, usually with a satisfying "Successfully Connected!" message. From that point on, you can manage - and even revoke - this access at any time from within the QuickBooks App Store.

Inside QuickBooks, you’ll find a 'My Apps' section that gives you a clear overview of all your connections. This puts you in complete control, so you always know what tools are communicating with your financial data.

Modern integrations enable live data reporting and bi-directional syncing, which automates invoice generation and helps attribute revenue accurately. You can even see a comparison of other top integrations on Coefficient’s blog to get a feel for what’s possible.

The whole point is to establish a secure, reliable link between your operations and your finances. Once connected, tasks that took hours can happen in seconds.

The evolution of these integrations has been a game-changer for so many businesses. For a deeper dive into what this kind of automation can do, check out our article on how to email invoices to QuickBooks automatically. Getting this connection right is the foundation for a truly efficient workflow.

How to Map Your Data for a Perfect Sync

Alright, so you’ve connected Tailride to QuickBooks. That’s the handshake. Now comes the real conversation: data mapping. This is where you tell both systems how to talk to each other so a sale in one place doesn't turn into a jumbled mess in the other.

Trust me, skipping this step is a recipe for headaches and a ton of manual clean-up down the road.

Think of it like giving your software a specific playbook. When a transaction flies over from Tailride, what should it become in QuickBooks? An invoice? A sales receipt? A bill? Without proper mapping, the system is left guessing, and that’s a gamble you don’t want to take with your financials. Getting this right from the get-go is the key when you integrate with QuickBooks Online.

Defining Your Transaction Rules

The first big decision is how you want to handle your sales. You need to give the integration clear instructions on what type of document to create in QuickBooks for every transaction.

- •Sales as Invoices: This is the go-to for most businesses. When a job is marked complete in Tailride, an open invoice pops up in QuickBooks automatically. Simple and clean.

- •Sales as Sales Receipts: If you get paid on the spot, this is your best friend. It records the sale and the payment in one swift move, completely bypassing the whole accounts receivable dance.

Don't forget about payment types, either. You have to tell the system where to put the money. Link your credit card, ACH, or check payments to the correct bank accounts in your Chart of Accounts. If you don't, you risk every single deposit getting dumped into one generic account, which turns bank reconciliation into an absolute nightmare.

Data mapping isn't just a technical task - it's about making your operational workflow and your accounting practices see eye to eye. It guarantees the data hitting QuickBooks is accurate and organized exactly how you (and your accountant) need it.

Mapping Customers and Items

For your data to be reliable, you need consistent customer and item records. Any solid integration tool will let you match up the fields directly. For example, you’ll want to map the "Company Name" field in Tailride straight to the "Customer Name" field in QuickBooks. This one little step is what stops the system from creating duplicate contacts every time a repeat customer books a job.

You’ll do the same thing for your services. Map a service like “Line Haul” from a Tailride invoice directly to the corresponding “Line Haul” service item in QuickBooks. This ensures every line item gets categorized correctly, which makes your income reports infinitely more useful.

If you want to see how these connections work in practice, our QuickBooks sync tool offers a clear view of how to set up these rules.

Ultimately, spending a few extra minutes to map your data thoughtfully is what turns your integration from a simple data-dumping tool into a powerful automation engine that actually saves you time.

Time for a Test Run: Making Sure Your New Integration is Ready

You’ve done the hard part - connecting Tailride and mapping out how your data should flow. Great job! But hold off on flipping the "on" switch for your live books just yet. Taking a few minutes to run a controlled test is one of the smartest things you can do.

Think of it as a dress rehearsal. It’s your chance to catch any little hiccups before they become big headaches. A quick test now will build your confidence in the automation and save you from the painful task of untangling incorrect entries later.

Kicking the Tires with a Safe Sync

The goal here is simple: see if the data lands exactly where you expect it to in QuickBooks Online. To do this, you'll want to create a few dummy transactions in Tailride. Just be sure to use fake data - create a test customer or use an internal account so you don't mess with your real records.

Here are a few classic test scenarios I always recommend running:

- •A standard invoice: Create an invoice for "Test Customer Inc." with a couple of different line items. Make sure to assign a tax rate you use often.

- •A payment record: Record a payment against that same invoice. Choose a specific payment method you mapped earlier, like "Credit Card" or "ACH."

- •A vendor bill: Enter a sample bill from a supplier to make sure your accounts payable side is syncing up correctly.

Once you have those dummy transactions in Tailride, you can either manually trigger a sync or just wait for the next scheduled one. After it runs, pop over to QuickBooks Online to play detective.

This is your final checkpoint. Did the sample invoice show up? Is "Test Customer Inc." now in your customer list? Did the payment get applied correctly? Check the dates, amounts, and accounts to make sure everything is perfect. A few minutes of verification now pays for itself tenfold down the road.

This kind of smart automation is exactly why so many professionals are leaning on new tech. In fact, a whopping 81% of accountants find that AI-powered tools help them get more done by handling these routine tasks, which is the whole point when you integrate with QuickBooks Online. You can actually learn more about AI-driven accounting features on Minding My Books if you're curious.

Once everything looks good, just delete your test data from both platforms. Now, you’re ready to go live with confidence

Got Questions About the QuickBooks Integration? We've Got Answers

Even with a perfect roadmap, plugging a new app into your financial system can feel a bit like a leap of faith. It's totally normal to have a few "what if" moments before you hand over the keys to a new automated workflow. I've been there.

Let's walk through some of the most common questions I hear from business owners hooking up their tools to QuickBooks Online. The goal here is to get you feeling confident and in control.

What Happens If Data Syncs Incorrectly?

This is probably the number one fear I see, but don't panic. If you ever spot wonky data making its way into QuickBooks, your first move is always the same: go into your app's settings and hit pause on the sync.

This immediately stops the flow of bad data, giving you breathing room to figure out what went wrong without making the problem bigger. Once it's paused, you can start cleaning up any incorrect entries in QuickBooks. This exact scenario is why I always preach about doing a small test run first and, most importantly, backing up your company file before going live with any new integration. Think of it as your financial safety net.

Can I Connect More Than One App to QuickBooks?

Absolutely! In fact, that's one of the biggest wins of using QuickBooks Online as your home base. You can connect a whole suite of apps for everything from your CRM and payment gateways to inventory management. It’s built to be the central hub for your entire business tech stack.

The trick is to be thoughtful about how each app talks to QuickBooks so they don't step on each other's toes. For instance, if your e-commerce platform and your CRM are both set up to create new customers, you'll want a clear process to prevent a mountain of duplicate entries. A little planning goes a long way.

Here's a quick note on security: The connection process uses a super secure authentication method called OAuth. This means you never actually share your QuickBooks password with the other app. You're just granting specific, limited permissions that you can check - and revoke - at any time.

Will an Integration Mess Up My Existing Data?

A well-built integration is designed to play nice. It should only add new information, not randomly overwrite or delete your historical data without you telling it to. When you set it up carefully, your existing books are safe.

That said, the risk is never zero, which is why a little prep work is so important. By cleaning up your data beforehand, creating that backup, and running a small test, you're building a defense for your financial history. These simple precautions ensure the integration works for you, not against you.

Ready to stop chasing down invoices and put your bookkeeping on autopilot? Tailride plugs right into your email and online portals, using AI to pull invoice data and sync it straight to QuickBooks. See how much time you can get back at https://tailride.so.