Your Guide to Email Invoice Extraction

Tired of manual data entry? Our guide to email invoice extraction shows you how to automate your invoice process, reduce errors, and save valuable time.

So, what exactly is email invoice extraction? Think of it as a smart assistant living inside your inbox. Its sole job is to spot invoices - whether they're attached as PDFs or just part of the email text - and instantly pull out all the important details. Using tech like AI and Optical Character Recognition (OCR), it grabs the invoice number, due date, and total amount, so you don't have to.

It’s all about eliminating manual data entry for good, making the whole payment process faster and way more accurate.

End Manual Invoice Entry for Good

Let's be real: your inbox is probably overflowing with invoices. Each one is a mini-project. You have to stop what you're doing, open it, find the key information, and painstakingly type it all into your accounting system. It’s slow, mind-numbing work, and a single typo can cause major headaches down the line.

Trying to manage this manually is like being a librarian who has to copy every single book by hand before putting it on the shelf. It’s an old-school approach that just doesn't make sense anymore.

The Modern Alternative to Manual Work

Email invoice extraction is the digital printing press to that manual scribe work. It’s a solution that automatically scans your emails, finds the invoices, and extracts the data you need in seconds. No more copy-pasting. The technology handles the heavy lifting, which is precisely why the invoice processing software market is exploding.

In just one year, the global market jumped from USD 33.59 billion to USD 40.82 billion. That’s a huge shift. And it's expected to hit nearly USD 87.95 billion soon, all because businesses are tired of the old way of doing things. You can dig into more of this trend over on Research and Markets.

By automating the extraction process, you're not just saving time; you're creating a reliable, error-free foundation for your entire financial workflow.

Why Automation Is a Game Changer

This isn't just about making life a little easier. It’s a fundamental upgrade to your financial operations. When you automate email invoice extraction, you start to see real, tangible benefits.

Businesses that make the switch can:

- •Eliminate costly human errors that lead to overpayments or late fees.

- •Slash invoice processing times from days or weeks down to just minutes.

- •Free up their finance team to focus on analysis and strategy, not just data entry.

In the end, it turns a constant, frustrating chore into a smooth, automated process. This lets you focus on what really matters: growing your business, not getting buried in paperwork.

How Email Invoice Extraction Actually Works

So, how does an invoice get from a supplier's email into your accounting software without anyone lifting a finger? It's not magic, but it's a pretty smart, automated workflow. Think of it as having a digital assistant who's incredibly fast, never makes a typo, and works around the clock to read, understand, and file every single invoice.

The whole thing kicks off the second an invoice lands in a specific inbox you've set up. The system keeps a constant eye on this inbox, like a bouncer at a club, waiting for the right guests to arrive. As soon as it spots an email with an invoice - whether it's a PDF, a JPG, or just plain text in the email body - it gets to work.

This first step is all about isolation. The system intelligently separates the invoice attachment from everything else in the email. It isn’t distracted by email signatures, chit-chat, or promotional fluff. It has one job: find the invoice.

Capturing the Data with OCR and AI

With the invoice file in hand, the real brainy part begins. The system uses Optical Character Recognition (OCR), a cool piece of tech that turns pictures of text into actual text data your computer can understand. It basically “reads” the document, converting the entire invoice into raw information.

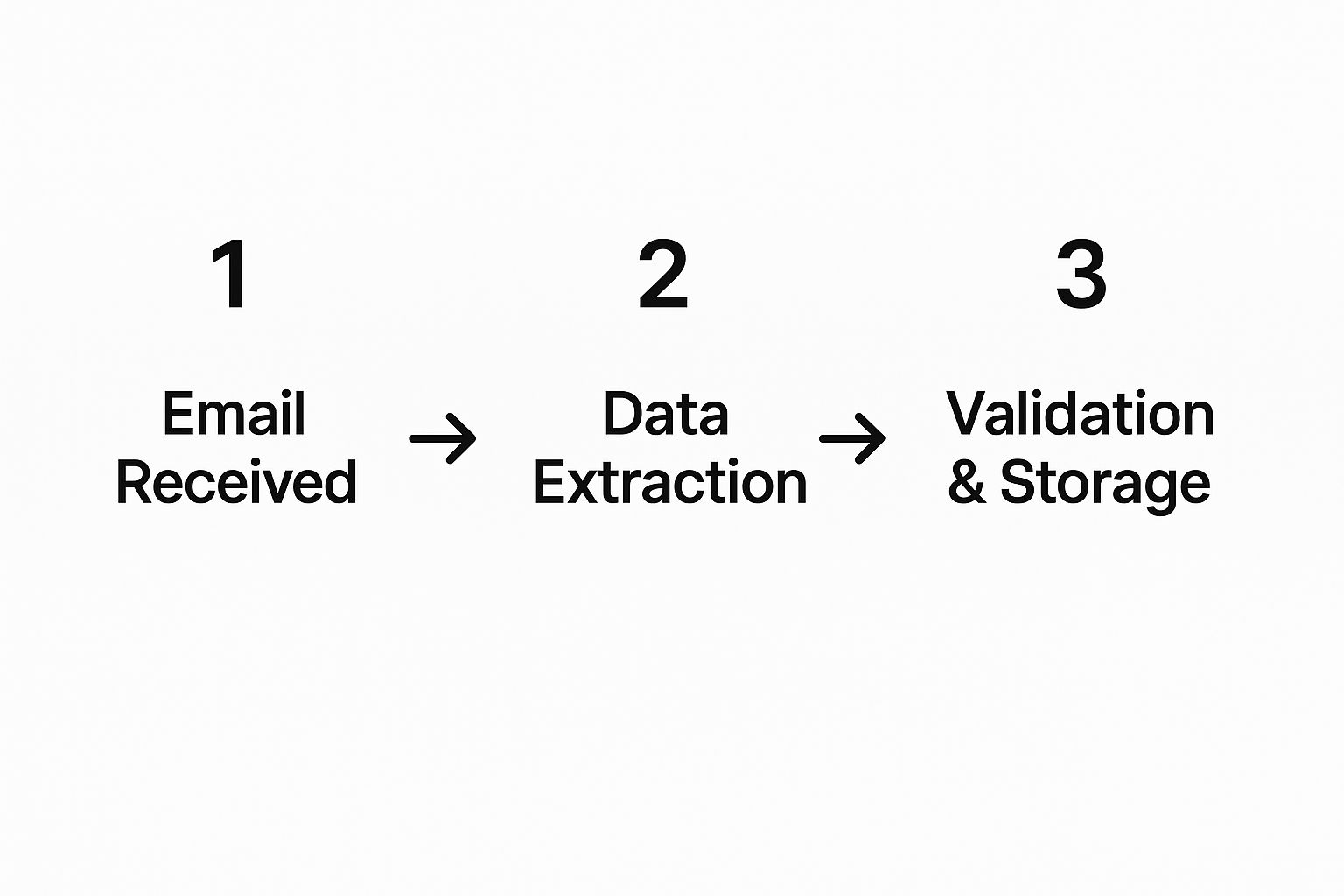

Here’s a quick look at how the data flows from a messy inbox to clean, usable information.

As you can see, it’s a simple journey in three stages: from raw email data to structured information that’s ready for your financial software.

But just reading the words isn't enough; the system has to understand what they mean. This is where Artificial Intelligence (AI) comes into play. The AI model sifts through all that raw text from the OCR to find and label the important bits. It instinctively knows that "Invoice #" is the invoice number and "Total Due" is the final amount, no matter how the document is formatted.

While we're talking about invoices, the technology behind this is fascinating. You can get a better sense of the core principles by looking into the fundamental methods for text extraction.

Validation and Seamless Integration

Okay, so the AI has grabbed all the key fields - vendor name, line items, payment terms, you name it. But it doesn't just pass them along blindly. The final, critical steps are all about making sure the data is correct before it goes anywhere.

The system runs a series of quick checks. For example, it will add up the line items to make sure they match the total amount, or it might double-check the vendor name against your list of approved suppliers. This catches the kinds of tiny errors that a human might easily overlook after a long day.

The whole point of this automated validation is to deliver data with over 99% accuracy. It turns a notoriously error-prone task into something you can actually rely on.

Finally, once the data is checked and double-checked, the system sends it straight into whatever software you're using, like QuickBooks, Xero, or your company's ERP. The invoice details just show up, ready for you to approve and pay. The entire trip - from email to accounting entry - takes just a few seconds and completely changes the game for your accounts payable process.

The Technology Powering Automated Extraction

To really get why modern email invoice extraction is such a game-changer, it helps to pop the hood and see what's running the show. The whole process is built on a foundational technology called Optical Character Recognition, or OCR.

Think of OCR as the eyes of the system. Its entire job is to look at an image or a PDF of an invoice and turn all the pictures of letters and numbers into actual text a computer can read. It’s a huge leap from having someone type everything out by hand.

But here’s the catch: by itself, OCR is just a reader. It can see the words "Total Due" next to the number "$1,250.75," but it has no clue that one describes the other. This is exactly where older, template-based systems used to stumble. The moment a vendor tweaked their invoice layout, the whole rigid system would break.

From Just Reading to Actually Understanding

The real magic happens when you add a brain to those eyes. This is where Artificial Intelligence (AI) and Machine Learning (ML) come into play. Instead of just reading the text, an AI-powered system understands the context behind it, a lot like a person would.

For example, it learns that "Amount Due," "Grand Total," and "Please Pay" all mean the same thing. It doesn't care where that total appears on the page - top, bottom, or middle. This is what makes modern tools so incredibly reliable.

The market stats tell the same story. The AI for Invoice Management space was valued at around USD 2.8 billion and is expected to explode to USD 47.1 billion in the next ten years. Data extraction alone accounts for over 28.6% of that market. This kind of growth is all thanks to AI's ability to deal with the messy, unpredictable nature of real-world invoices. If you want to dive deeper into the numbers, you can find more details in this comprehensive market report.

The Old Way vs. The New Way

Let's break down the difference between the old template-based approach and modern AI. It’s night and day.

Traditional OCR systems forced you to manually draw boxes around every piece of data on an invoice for every single vendor. If a vendor changed their invoice design? You had to start all over again. It was a brittle, high-maintenance nightmare.

AI, on the other hand, is a completely different beast.

AI-powered extraction uses models that have already been trained on millions of different invoices. This means it can intelligently spot and pull data from a new invoice format it has never seen before, right out of the box.

This intelligent approach is simply better. It offers:

- •More Flexibility: It can handle invoices from all your vendors without needing any special setup for each one.

- •Better Accuracy: Because it understands context, it doesn't get tripped up by minor layout changes.

- •Less Upkeep: Your team is freed from the thankless job of building and fixing templates.

Comparing Old vs. New Invoice Extraction Methods

This table paints a clear picture of how far the technology has come. The shift from rigid, template-based systems to intelligent, AI-driven ones is what makes modern automation so powerful.

| Feature | Template-Based OCR | AI-Powered Extraction |

|---|---|---|

| Setup Process | Manual; requires creating a new template for each vendor. | Automatic; pre-trained models work out of the box. |

| Adaptability | Low; breaks when invoice layouts change. | High; adapts to new and varied formats on the fly. |

| Accuracy | Prone to errors if text shifts even slightly. | Much higher, as it understands context, not just location. |

| Maintenance | High; constant need to update and fix broken templates. | Minimal; the system learns and improves on its own. |

| Scalability | Poor; adding new vendors is a time-consuming manual task. | Excellent; easily handles growing vendor lists. |

Ultimately, AI transforms email invoice extraction from a frustrating, rule-based chore into a smart, dynamic workflow that just works.

Key Business Benefits of Invoice Automation

https://www.youtube.com/embed/KSOxkhWs2Ic

Let's move past the tech talk. What does automating your invoice process actually do for your business in the real world? Adopting email invoice extraction is so much more than just saving a few hours on data entry. It's a smart business decision with some serious financial and operational upsides.

One of the first things you'll notice is how it slashes costly human errors. Let's be honest, manual data entry is a recipe for mistakes - transposed numbers, wrong vendor details, you name it. These little slip-ups can snowball into overpayments, missed payments, and a reconciliation nightmare. Automation virtually eliminates this risk by capturing data with over 99% accuracy, keeping your financial records clean from the get-go.

Accelerate Payments and Boost Your Bottom Line

Speed is another game-changer. An invoice can easily get buried in an inbox for days before anyone even looks at it. With automation, that same invoice is processed in a matter of seconds, which dramatically shortens the entire payment cycle.

This newfound speed isn't just about efficiency; it opens the door to real savings. Think about all the early-payment discounts you could be capturing. Consistently paying within 10 days to snag a 2% discount from vendors can add up to a huge chunk of change over the year. Instead of a five-day delay just to get an invoice into the system, it’s ready for approval in hours, making those discounts an easy win.

It's no surprise the e-invoicing market is booming. Valued at USD 15.9 billion, it's on track to hit USD 68.7 billion in the next nine years. You can read more about this growth at IMARC Group.

Gain Real-Time Financial Clarity and Control

When invoices are processed the moment they arrive, you get an up-to-the-minute, accurate picture of your company's financial liabilities. This kind of visibility is gold for managing cash flow and planning for the future.

Instead of waiting until the end of the month to understand your outstanding payables, you have a live dashboard of your financial commitments. This empowers you to make smarter, data-driven decisions about spending and budgeting.

On top of that, automation creates a perfect digital audit trail. Every single step, from extraction to approval, is automatically logged. This gives you a clear, traceable history for every invoice, which strengthens security, makes compliance a breeze, and turns audits from a headache into a simple review.

By turning chaotic inboxes into structured, reliable data, you’re not just cleaning up a messy process - you're building a more resilient and efficient financial foundation. For a closer look at how to structure these operations, check out our guide on creating an effective invoice processing workflow.

Choosing the Right Invoice Extraction Tool

With so many options out there, picking the right tool for email invoice extraction can feel like a real chore. Not all platforms are built the same, and the last thing you want is to sink time and money into a system that falls short of its promises. A great tool should feel like a dependable member of your team, not another piece of software you have to wrestle with.

To cut through all the marketing fluff, you need to zero in on features that solve the real problems of invoice management. Look for a solution that simplifies things from start to finish, beginning with being able to handle any file type your vendors throw at you. Whether they send a PDF, a JPG, or just type the details in an email, your tool has to manage it all without a hiccup.

Must-Have Features in an Extraction Tool

Beyond just reading files, the best tools nail the trifecta of accuracy, integration, and user-friendliness. A clunky, confusing interface can tank productivity just as fast as old-school manual data entry. You need a system your team can actually use without weeks of training.

Here are the non-negotiables to look for:

- •High Accuracy Rates: The provider should be confident enough to guarantee accuracy above 99%. This is what gives you the peace of mind to trust the data and stop double-checking everything.

- •Seamless Integrations: The tool absolutely must plug directly into the accounting software you already use, whether that's QuickBooks, Xero, or Business Central. That direct connection is the key to truly automate your accounts payable process.

- •Intuitive User Interface: A clean, simple dashboard makes all the difference. It should be easy to glance at extracted data, handle approvals, and see where every invoice is in the pipeline.

- •Intelligent AI: The AI needs to be smart enough to figure out new invoice layouts on its own. You shouldn't have to manually build a template every time a new vendor sends you a bill.

Key Questions to Ask Vendors

When you're talking to potential providers, asking sharp questions can tell you a lot about what's really under the hood. Don't be shy - dig into the details of how their tech works and what kind of support you can expect if things go wrong.

You're looking for a partner, not just a product. The way a vendor answers your questions reveals whether they've built a solution for real-world AP headaches or just a tool with a long list of features.

Before you sign on the dotted line, make sure you ask:

- •How does your AI handle an invoice format it has never seen before?

- •What's the process for a human to review an invoice if the AI gets stuck?

- •Can you show me exactly how this would integrate with my accounting software?

- •What security measures do you have in place to protect our sensitive financial data?

Getting clear, confident answers here will help you pick a tool that will actually make your life easier and give you a solid return on your investment.

Common Questions About Email Invoice Extraction

Stepping into the world of automation can feel like a big leap. It's totally normal to have questions. After all, you’re thinking about handing over a key part of your financial workflow to a new system, so it’s smart to get the lay of the land first.

Let's walk through some of the most common questions we hear from businesses looking into email invoice extraction. Getting clear on things like security, setup, and what happens when things get tricky will help you feel confident about making the move.

How Secure Is My Financial Data?

This is almost always the first question out of the gate, and for good reason. Your financial data is sensitive stuff. Reputable platforms understand this and are built with serious, enterprise-grade security from day one.

Think of it like a digital Fort Knox. These systems use bank-level encryption to protect your data, both while it’s on the move and while it’s being stored. They also follow strict data privacy standards like GDPR, which means they’re legally bound to handle your information responsibly.

Here’s what you should expect from a secure platform:

- •End-to-End Encryption: From your inbox to your accounting software, your data is completely scrambled and unreadable to anyone who isn't authorized to see it.

- •Secure Authentication: Strong login measures and user permissions mean only the right people on your team can get in.

- •Regular Audits: The best platforms are constantly running security checks and updates to stay ahead of new threats.

A truly secure system doesn't just automate a task. It actually creates a far more controlled and traceable environment for your financial data than a messy, unsecured inbox ever could.

What Does the Setup Process Look Like?

The thought of a painful, weeks-long implementation is enough to make anyone hesitate. The good news? Modern email invoice extraction tools are built to be incredibly simple to get started with. The days of needing a dedicated IT team and a long setup manual are long gone.

Typically, you can be up and running in just a few minutes. It’s usually a simple three-step process: you create an account, connect your email inbox (like Gmail or Outlook) through a secure authorization, and then link up your accounting software, such as QuickBooks or Xero. And... that's it.

The system gets to work right away, and you'll often see your first invoices processed in seconds. There are no complicated rules to write or manual templates to build. The AI comes pre-trained to recognize invoices right out of the box, making the whole setup feel practically instant.

What Happens If the AI Cannot Read an Invoice?

This is a great question, because let's be realistic - no technology is perfect 100% of the time. Invoices can show up in weird formats, as blurry scans, or with key information missing. A well-designed system has a simple, built-in plan for these edge cases.

When the AI stumbles on an invoice it can't read with high confidence, it doesn't just give up or, worse, push garbage data into your books. Instead, it flags the document for a quick human check. You’ll get a notification, and the invoice will pop up in an easy-to-use interface where the system points out exactly what it was unsure about. For a closer look at this process, our guide to invoice automation software explains how different tools handle these exceptions.

This "human-in-the-loop" approach offers the perfect balance. You get the incredible speed of automation for the vast majority of your invoices, with the peace of mind that a real person can step in to handle the odd one out. It ensures you never lose control or accuracy, all while letting the system do the heavy lifting.

Ready to stop worrying and start automating? Tailride connects to your inbox in seconds, securely extracts invoice data with over 99% accuracy, and syncs it directly to your accounting software. Try Tailride for free and see your first invoice processed in under a minute.