Top 12 Invoice Scanning Software Solutions for 2025

Discover the 12 best invoice scanning software options for 2025. Compare features, pricing, and use cases to automate your accounts payable workflow.

Tags

Buried in a mountain of invoices? You're not alone. Manual data entry is slow, error-prone, and a major bottleneck for any growing business, from small e-commerce shops to enterprise finance departments. But what if you could reclaim those lost hours and streamline your entire accounts payable process? The answer lies in powerful invoice scanning software.

These tools use AI and OCR (Optical Character Recognition) to automatically read, understand, and process invoices from any source, whether it's a PDF in your email, a paper receipt, or a supplier portal. This isn't just about going paperless; it's about transforming your financial operations from a reactive chore into a proactive, data-driven engine for growth. The initial step in this transformation often involves moving away from physical documents, as highlighted by articles discussing the transition from paper to a management tool. This shift is fundamental to achieving modern operational efficiency.

This guide gets straight to the point. We've done the heavy lifting to provide a detailed comparison of the best invoice scanning software available. We will explore platforms like Tailride, Tipalti, and Nanonets, diving deep into what makes each one unique. For every solution, you will find:

- •A breakdown of key features and ideal use cases.

- •Honest insights into limitations and implementation needs.

- •Detailed pricing information to match your budget.

- •Screenshots and direct links to help your evaluation.

Our goal is to help you find the perfect platform to eliminate manual work, reduce errors, and unlock new levels of efficiency for your business. Let's find the right tool for you.

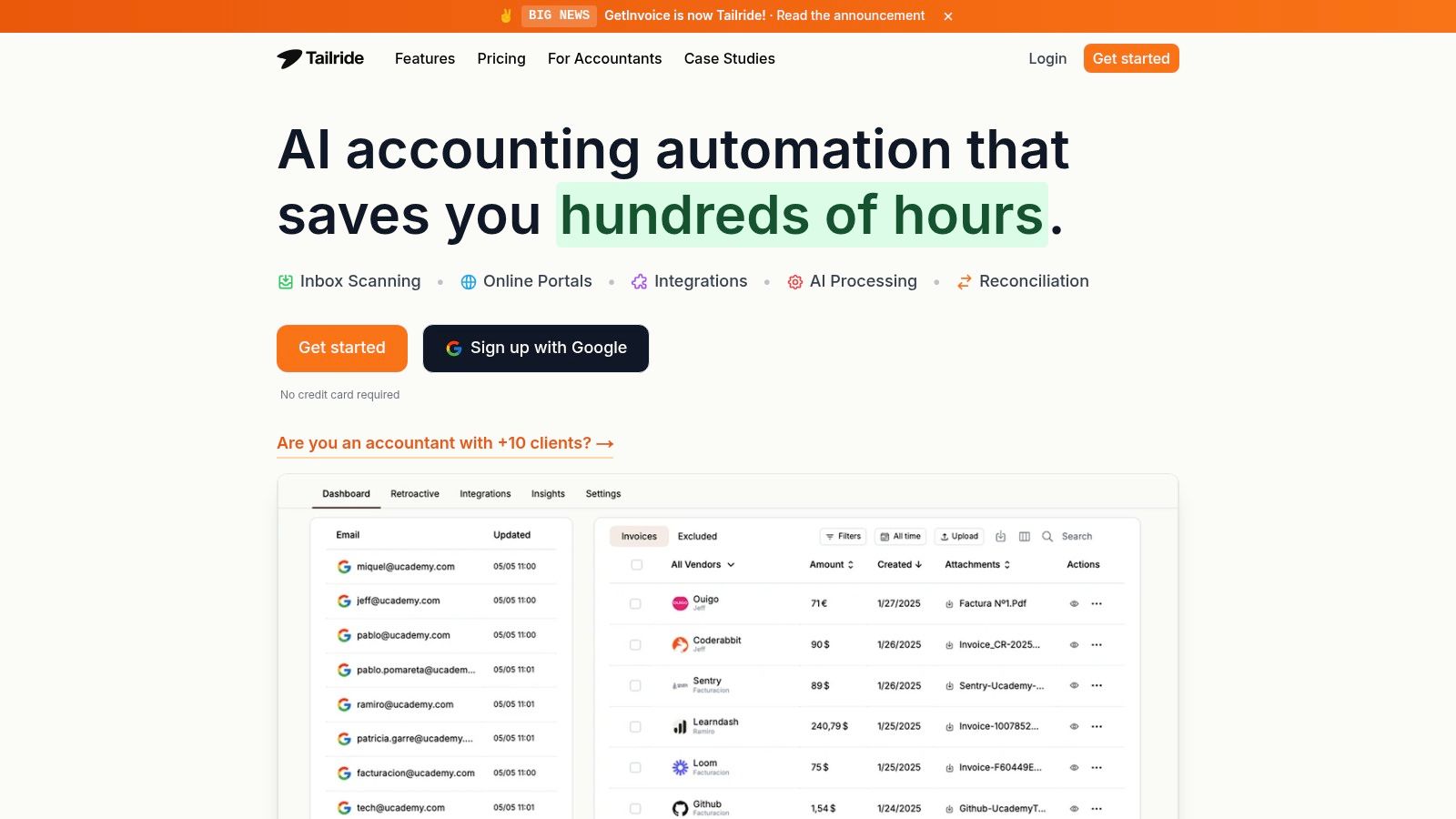

1. Tailride

Tailride positions itself as a premier, all-encompassing solution for automated invoice and receipt management, making it an exceptional choice for businesses aiming to eliminate manual data entry. It excels by directly connecting to your email inboxes (like Gmail and Outlook) and supplier portals, creating a truly hands-off workflow. This platform is far more than a simple document scanner; it's a comprehensive data extraction and processing engine designed for accuracy and efficiency.

The platform's core strength lies in its powerful AI, which intelligently captures and digitizes invoice data from virtually any source. Whether you receive invoices as PDFs, email attachments, embedded images, or even just plain text in an email body, Tailride’s system automatically identifies, extracts, and categorizes key information with remarkable precision. This makes it a standout piece of invoice scanning software for teams handling diverse and high-volume vendor communications.

Key Features and Practical Use Cases

What truly sets Tailride apart are its advanced, real-world features that address common accounts payable pain points.

- •Automated Multi-Source Capture: Tailride continuously monitors designated inboxes, including those of your colleagues, to automatically fetch new invoices the moment they arrive. Its unique Chrome extension can also securely log into supplier portals like Amazon or Meta Ads to download invoices directly, a feature that saves significant time while maintaining credential security.

- •Intelligent Data Processing: Beyond simple OCR, the AI classifies documents, extracts line items, applies custom tags based on your predefined rules, and reconciles data across multiple currencies. This is ideal for businesses with complex international supply chains or diverse spending categories.

- •Seamless Accounting Integration: The platform offers deep, two-way sync with major accounting systems. For example, its integration with Xero not only pushes extracted data but also ensures records are perfectly aligned. You can explore a detailed guide on how to integrate Tailride with Xero.

Pricing & Implementation

Tailride offers a very accessible entry point with a free plan for up to 10 invoices per month, perfect for freelancers or micro-businesses wanting to test the waters. Paid plans are competitively priced, starting at $19 per month, with tiers designed to scale as your invoice volume grows.

Implementation is refreshingly simple. You can connect your email and process your first invoice within seconds of signing up. For larger organizations, enterprise plans with custom pricing are available by contacting their sales team directly.

| Pros | Cons |

|---|---|

| Comprehensive Capture: Processes invoices from emails, portals, PDFs, and images automatically. | Plan Limits: Higher volume businesses will need to upgrade from the lower-tier plans. |

| Advanced AI: Offers precise data extraction, custom rule creation, and multi-currency reconciliation. | Enterprise Pricing: Custom enterprise solutions require a direct sales consultation for a quote. |

| Robust Security: Features GDPR compliance, AWS EU data residency, and Tier-2 CASA validation for data safety. | |

| Excellent Integrations: Deeply connects with QuickBooks, Xero, Business Central, and Google Workspace. |

2. Scan2Invoice

Scan2Invoice is a streamlined, desktop-based application designed for a single, crucial purpose: getting paper invoices into your cloud accounting software as quickly and painlessly as possible. It acts as a direct bridge between your physical scanner and platforms like Xero and QuickBooks Online. This focused approach makes it an excellent piece of invoice scanning software for small businesses, bookkeepers, or accountants who still handle a significant volume of paper documents and need to digitize them efficiently.

Unlike more complex, all-in-one accounts payable platforms, Scan2Invoice doesn’t try to do everything. Its primary strength is its simplicity and direct integration with TWAIN and WIA-compatible desktop scanners. You simply scan your invoice, the software extracts key data like the supplier, date, and amounts, and then sends it directly to your accounting system as a draft bill with the scanned document attached.

Who is Scan2Invoice Best For?

This tool is tailor-made for users who prioritize speed and simplicity for paper-to-digital workflows. It's ideal for small business owners who manage their own books or accounting professionals who want to rapidly process piles of client invoices without the overhead of a larger system. If your main bottleneck is manual data entry from physical invoices, this is a targeted solution.

Our Take: Scan2Invoice excels in its niche. It's not a comprehensive AP automation suite, but it's one of the best tools for the specific task of scanning invoices directly into cloud accounting software.

Pricing & Key Details

Scan2Invoice offers straightforward, one-time pricing, which is a refreshing change from monthly subscriptions.

- •Pricing: A one-time purchase of $49 for a single-user license.

- •Key Integrations: QuickBooks Online and Xero.

- •Requirement: A desktop scanner is necessary for the software to function as intended.

- •Limitation: Its integration list is limited, so it won't be a fit if you use other accounting platforms like Sage or MYOB.

Website: https://www.scan2invoice.com/

3. Tipalti

Tipalti is a comprehensive, end-to-end accounts payable automation platform designed for businesses looking to streamline their entire financial workflow, not just one piece of it. While it features advanced, AI-powered invoice scanning software, its true strength lies in integrating this capability into a larger system that handles supplier onboarding, payment processing, and compliance. This makes it a powerful solution for mid-market to enterprise-level companies aiming for significant operational efficiency.

The platform uses sophisticated OCR and machine learning to extract invoice data with high accuracy, automatically routing documents for approval based on custom rules. It goes further by offering features like two-way and three-way purchase order matching, which helps prevent overpayment and fraud. This holistic approach means invoices aren't just scanned; they are validated, approved, and paid within a single, controlled environment.

Who is Tipalti Best For?

Tipalti is ideal for fast-growing and established businesses that have outgrown basic accounting tools. Finance departments that are bogged down by manual invoice processing, complex approval workflows, and multi-currency global payments will see the most significant benefit. If your goal is to automate the entire accounts payable lifecycle and gain real-time visibility into spending, Tipalti is a top-tier choice.

Our Take: Tipalti is more than just an invoice scanner; it's a full-scale AP transformation tool. Its comprehensive feature set and robust controls justify the investment for businesses where manual processing has become a major operational bottleneck.

Pricing & Key Details

Tipalti’s pricing is customized based on the modules and transaction volume a business needs.

- •Pricing: Custom quote-based pricing. It is generally positioned for mid-market and enterprise clients, so it may be a significant investment for smaller businesses.

- •Key Integrations: Offers robust integrations with major ERP systems like NetSuite, QuickBooks, Sage Intacct, and more.

- •Key Feature: Its self-service supplier portal simplifies onboarding and reduces administrative work for the AP team.

- •Limitation: The platform's complexity and cost can make it overkill for small businesses or startups with low invoice volume.

Website: https://tipalti.com/

4. Kofax

Kofax is a powerhouse in the enterprise content and process automation space, offering an advanced platform built for high-volume, complex invoice processing. It leverages powerful AI and machine learning for "document intelligence," enabling it to capture, classify, and extract data from virtually any invoice format with remarkable accuracy. This makes it a formidable piece of invoice scanning software for large organizations dealing with diverse and data-intensive workflows.

Unlike simpler tools, Kofax focuses on end-to-end intelligent automation. It's not just about scanning; it's about seamlessly orchestrating the entire accounts payable process, from invoice arrival to final approval and archival. The platform can integrate with legacy systems and enterprise applications, ensuring that the automated workflow fits into your existing tech stack while maintaining strict compliance and reporting standards.

Who is Kofax Best For?

Kofax is designed for medium to large enterprises that require a scalable, robust, and highly accurate solution for managing significant invoice volumes. It's ideal for finance departments aiming to transform their AP operations, reduce manual errors, and achieve digital workflow orchestration. Companies with complex approval chains and a need for deep integration with ERPs like SAP or Oracle will find Kofax particularly suitable.

Our Take: Kofax is enterprise-grade automation at its best. Its AI-powered data extraction is top-tier, but the complexity and cost mean it's best suited for large organizations with the resources to implement it fully.

Pricing & Key Details

Kofax provides custom quotes based on business size, volume, and specific feature requirements.

- •Pricing: Available upon request. It is a premium-priced solution reflecting its enterprise focus.

- •Key Integrations: Extensive integration capabilities with major ERPs, CRMs, and other enterprise systems.

- •Requirement: While it works with various inputs, a full implementation often requires technical expertise for setup and customization.

- •Limitation: The cost and complexity can be prohibitive for small businesses or startups looking for a simple, out-of-the-box solution.

Website: https://www.kofax.com/

5. ABBYY

ABBYY is a global leader in intelligent document processing, and its technology is the engine behind many other applications on this list. For businesses that need enterprise-grade, highly accurate invoice scanning software, ABBYY’s solutions like Vantage and FineReader offer unparalleled power. It leverages sophisticated AI-powered Optical Character Recognition (OCR) to extract data from virtually any document, no matter how complex the layout. This makes it a foundational technology for large-scale digital transformation projects.

Unlike point-and-click tools, ABBYY is a platform for building robust, automated workflows. It excels at high-volume document conversion, maintaining original formatting, and integrating with enterprise systems like digital archives and content management platforms. With support for over 200 languages and advanced capabilities like PDF compression and format support, it's built to handle the complexities of global business operations and intricate audit trails.

Who is ABBYY Best For?

ABBYY is best suited for large enterprises or organizations with significant document processing needs that go beyond simple invoice scanning. If your company handles thousands of invoices monthly alongside other documents like contracts and forms, or requires top-tier accuracy for regulatory compliance, ABBYY provides the necessary horsepower. It's also ideal for developers looking to embed powerful OCR into their own applications. Learn more about the intricacies of invoice data capture software here.

Our Take: ABBYY is less of a ready-made tool and more of a powerful engine for building custom document automation solutions. Its accuracy and scalability are industry benchmarks, but it requires technical expertise to implement effectively.

Pricing & Key Details

ABBYY’s pricing is customized based on the specific product, usage volume, and feature set required.

- •Pricing: Quote-based. Pricing can be high, reflecting its enterprise-grade capabilities.

- •Key Features: AI-powered OCR, support for over 200 languages, high-volume document conversion, and advanced workflow automation.

- •Limitation: The initial setup and configuration can be complex and may require dedicated IT resources or professional services.

- •Best For: High-volume, complex document environments where accuracy and scalability are non-negotiable.

Website: https://www.abbyy.com/

6. DocParser

DocParser is a powerful, web-based tool that excels at turning unstructured documents like PDF invoices into structured, usable data. Unlike some platforms that are hardwired for specific accounting software, DocParser’s strength lies in its flexibility. It allows you to create custom parsing rules to extract exactly the information you need, from standard fields like invoice number and total amount to complex line-item details from any invoice layout. This makes it a fantastic piece of invoice scanning software for businesses that deal with a wide variety of vendor formats.

The platform is designed for users who want granular control over their data extraction process without needing to code. You upload your document, highlight the data you want to capture, and train the tool to recognize that layout in the future. Once processed, you can download the data in various formats (Excel, JSON, XML) or send it directly to other applications via webhooks or native integrations.

Who is DocParser Best For?

DocParser is ideal for businesses and developers who need to automate data extraction from non-standardized invoices or documents. If you find that other OCR tools fail to capture specific data points or line items correctly, DocParser’s customizable rules offer a robust solution. It's also perfect for workflows that require feeding structured data into proprietary systems or multiple different apps.

Our Take: DocParser is less of an end-to-end AP solution and more of a powerful data extraction engine. Its customization is its killer feature, allowing you to build the perfect invoice processing workflow for unique or challenging document types.

Pricing & Key Details

DocParser uses a tiered subscription model based on the number of documents processed per month.

- •Pricing: Plans start at $39/month for 100 documents and scale up based on volume. A free plan is available for low-volume testing.

- •Key Integrations: Zapier, Microsoft Power Automate, and other platforms via webhooks and API access. Connects to cloud storage like Google Drive, Dropbox, and Box.

- •Pros: Highly customizable parsing rules, handles complex line-item extraction well, and offers flexible export and integration options.

- •Limitation: It requires an initial time investment to set up and train the parsing rules for each new document layout, and it's not an offline tool.

Website: https://docparser.com/

7. Docsumo

Docsumo positions itself as an intelligent document processing platform, using powerful AI to go beyond simple OCR. It's designed to understand and extract data from unstructured documents like invoices, receipts, and purchase orders, regardless of their layout. This makes it a formidable piece of invoice scanning software for businesses that receive invoices in a wide variety of formats and need a system smart enough to handle the chaos without constant manual intervention.

Where Docsumo stands out is its use of pre-trained APIs for specific document types, including invoices. This allows for rapid deployment and high accuracy right out of the box. The platform captures key fields, categorizes documents, and flags exceptions for human review, creating a streamlined workflow that significantly reduces the time spent on manual data entry and validation before pushing the data into connected ERP or accounting systems.

Who is Docsumo Best For?

Docsumo is an excellent fit for medium-to-large businesses or fast-growing companies with high document volumes and diverse invoice formats. It’s also ideal for enterprises that need to automate data extraction across various document types, not just invoices. If your primary challenge is dealing with unstructured data from many different suppliers, Docsumo’s AI-powered flexibility is a major advantage.

Our Take: Docsumo is a powerful step up from basic OCR tools. Its ability to intelligently handle complex and varied invoice layouts makes it a top contender for businesses scaling their accounts payable automation efforts.

Pricing & Key Details

Docsumo's pricing is usage-based, catering to businesses with fluctuating document volumes.

- •Pricing: Custom pricing based on the number of documents processed and features required. A free trial is available to test the platform's capabilities.

- •Key Integrations: Offers API access and pre-built integrations for systems like QuickBooks, Xero, and other ERPs.

- •Key Feature: Advanced AI models that require minimal setup and can process highly unstructured invoices with high accuracy.

- •Limitation: The custom pricing model and initial setup might be more involved than simpler tools, making it less suitable for very small businesses with basic needs.

Website: https://www.docsumo.com/

8. DocuClipper

DocuClipper is a powerful and accessible OCR tool designed to convert unstructured documents like invoices and bank statements into clean, structured data. It shines in its ability to handle large volumes of documents through batch processing, making it a go-to solution for businesses and accounting firms looking to automate their data entry workflows without a heavy investment. This platform is a strong piece of invoice scanning software for those who need to quickly extract information and move it into formats like Excel, Google Sheets, or their accounting systems.

Unlike some enterprise-level systems that require extensive setup, DocuClipper works right out of the box. You can upload a batch of invoices in various formats, and the software quickly gets to work extracting key fields. It's particularly effective for users who need the raw data for analysis, reconciliation, or import into systems that may not have direct integrations with other AP tools.

Who is DocuClipper Best For?

DocuClipper is ideal for small to medium-sized businesses, bookkeepers, and accountants who process a high volume of invoices or bank statements and need an efficient way to convert them into usable data. If your primary goal is data extraction for use in spreadsheets or direct import into accounting software like QuickBooks, DocuClipper offers a streamlined and cost-effective path.

Our Take: DocuClipper's strength is its simplicity and speed for batch data extraction. It's not a full accounts payable suite, but it's an excellent, no-fuss tool for converting document piles into organized, actionable data.

Pricing & Key Details

DocuClipper offers flexible, credit-based pricing that scales with your usage, making it affordable for businesses of all sizes.

- •Pricing: Plans start from around $29/month for 200 pages, with larger plans available. A free trial is also offered.

- •Key Integrations: QuickBooks Online, Xero, and can export to Excel, CSV, and Google Sheets.

- •Key Feature: Strong batch processing capabilities allow for uploading and converting hundreds of documents at once.

- •Limitation: It focuses primarily on data extraction rather than full AP workflow automation, and its language support may not cover all global needs.

Website: https://www.docuclipper.com/

9. Nanonets

Nanonets is an advanced, AI-powered platform that specializes in extracting data from unstructured documents, making it a powerful piece of invoice scanning software for businesses dealing with diverse and complex invoice formats. Unlike tools that rely on rigid templates, Nanonets uses artificial intelligence to read and understand invoices from images, PDFs, or scanned files, regardless of their layout. This adaptability makes it a great fit for companies that receive invoices from a wide variety of vendors and need a solution that can learn and improve over time.

The platform is built for more than just data extraction; it supports the creation of customizable approval workflows, allowing teams to route invoices for verification and payment automatically. This focus on both data capture and process automation helps businesses streamline their entire accounts payable cycle. Its ability to handle complex layouts where other OCR tools might fail is its key differentiator, significantly reducing the need for manual corrections and data entry. Further explore how such tools fit into a broader strategy by reading about invoice processing automation.

Who is Nanonets Best For?

Nanonets is ideal for medium to large businesses or fast-growing companies with high invoice volumes and a wide array of vendor formats. If your primary challenge is dealing with unstructured invoice data that consistently breaks template-based systems, Nanonets' AI-driven approach offers a more robust and scalable solution.

Our Take: Nanonets stands out for its intelligent OCR capabilities. It’s a smart choice for organizations that have outgrown simpler tools and need a system that can handle real-world invoice complexity with minimal human intervention.

Pricing & Key Details

Nanonets offers usage-based pricing that scales with your volume, making it accessible for different business sizes.

- •Pricing: Starts with a "Starter" plan at $499/month for processing up to 5,000 pages per year. Custom "Pro" and "Enterprise" plans are available for higher volumes.

- •Key Integrations: QuickBooks, Salesforce, Zapier, and various ERP systems via API.

- •Limitation: The initial setup can be more involved and may require some technical know-how to configure the AI models and workflows optimally. Its pricing might be a barrier for very small businesses.

Website: https://nanonets.com/

10. Dext Prepare

Dext Prepare, formerly known as Receipt Bank, is a premier tool designed to eliminate manual data entry for accountants, bookkeepers, and small businesses. It excels at capturing, processing, and publishing financial documents like invoices and receipts with remarkable accuracy. By leveraging powerful OCR and machine learning, it pulls key data from submitted documents and categorizes it, drastically reducing the time spent on bookkeeping. This makes it an essential piece of invoice scanning software for professionals managing multiple clients or businesses seeking operational efficiency.

The platform is renowned for its user-friendly web and mobile applications, which allow users to submit documents easily via email, direct upload, or a simple photo snap. Dext Prepare's real strength lies in its ability to learn and apply predefined supplier rules, which automates the coding of recurring expenses. This smart automation ensures that data flows seamlessly into integrated accounting software, ready for reconciliation.

Who is Dext Prepare Best For?

Dext Prepare is ideal for accounting and bookkeeping firms that need a standardized, efficient way to collect client documents. It's also perfect for small to medium-sized businesses that want to empower their team members to submit expenses on the go without needing deep accounting knowledge. If your goal is to create a near-real-time flow of financial data into your accounting system, Dext is a top-tier choice.

Our Take: Dext Prepare is a market leader for a reason. Its focus on making data collection effortless for the end-user while providing powerful automation for the finance professional is a winning combination.

Pricing & Key Details

Dext offers tiered pricing plans for businesses and tailored plans for accountants and bookkeepers.

- •Pricing: Business plans typically start around $30/month. Custom pricing is available for accounting partners.

- •Key Integrations: Extensive integrations including Xero, QuickBooks Online, Sage, MYOB, and many more.

- •Unique Feature: Excellent multi-user support, allowing different team members to submit documents to a central account.

- •Limitation: While excellent for data capture, it lacks advanced multi-level approval workflows found in more comprehensive AP automation platforms.

Website: https://dext.com/prepare

11. DocuPhase

DocuPhase is a comprehensive automation platform that goes beyond simple invoice scanning to offer a full suite of accounts payable and receivable tools. It is designed for businesses aiming to overhaul their entire financial document workflow, not just digitize paper. The platform's core strength lies in its ability to automate complex processes like purchase order matching, approval routing, and ERP integration, making it a powerful piece of invoice scanning software for growing companies.

Unlike single-purpose tools, DocuPhase handles the entire lifecycle of an invoice. Once scanned or received digitally, invoices are automatically processed, with data extracted and validated. It then intelligently matches invoices to purchase orders and routes them for approval, all while maintaining a complete, searchable audit trail. This makes it an excellent choice for businesses needing to enhance productivity and ensure compliance.

Who is DocuPhase Best For?

DocuPhase is ideal for medium to large businesses that require robust, end-to-end AP automation rather than just a basic scanning solution. Companies with complex approval workflows, high invoice volumes, or the need for tight integration with ERP systems like NetSuite will find significant value here. It's particularly well-suited for finance departments focused on minimizing manual tasks and improving operational visibility.

Our Take: DocuPhase is a serious process automation tool. It's less about a quick scan and more about building a resilient, automated, and audit-proof financial workflow from the ground up.

Pricing & Key Details

DocuPhase provides custom pricing based on the specific needs and scale of your organization, requiring a direct consultation.

- •Pricing: Custom-quoted. You must contact their sales team for a demo and pricing details.

- •Key Integrations: Deep integration capabilities with major ERPs including NetSuite, QuickBooks, Microsoft Dynamics, and others.

- •Key Feature: Its two-way and three-way purchase order matching is a standout feature for businesses managing complex procurement processes.

- •Limitation: The extensive feature set may introduce a steeper learning curve compared to simpler tools, and the lack of transparent pricing can be a hurdle for smaller businesses.

Website: https://www.docuphase.com/

12. Egnyte

Egnyte is a powerful, enterprise-grade content and data governance platform that extends its capabilities into the realm of document management, making it a strong contender for businesses that need more than just basic invoice processing. While not a dedicated AP automation tool, its robust features for secure storage, collaboration, and optical character recognition (OCR) provide a solid foundation for building a centralized invoice scanning software workflow. It allows teams to upload invoices from any source, converting them into fully searchable PDFs.

Unlike specialized invoice tools, Egnyte’s strength lies in its holistic approach to document management. It’s designed for organizations that need to manage all types of sensitive files, not just invoices. The platform provides customizable dashboards and workflow tools that can be configured to track invoice approvals, enhance collaboration between departments, and ensure all financial documents are securely stored and easily retrievable for audits.

Who is Egnyte Best For?

Egnyte is ideal for medium to large businesses that require a comprehensive and secure document management system where invoice processing is one component of a larger content strategy. It's particularly well-suited for companies in regulated industries that need strong governance, version control, and collaboration features for remote or distributed teams.

Our Take: Egnyte is a content management powerhouse first and an invoice tool second. It's an excellent choice if your primary need is secure, scalable, and collaborative file storage, with invoice scanning as a key part of that ecosystem.

Pricing & Key Details

Egnyte’s pricing is geared towards business and enterprise teams, with plans that scale based on user count and storage needs.

- •Pricing: Plans start with the "Business" tier at $20 per user/month (for teams of 10-100). Custom pricing is available for enterprise needs.

- •Key Features: Secure cloud storage, OCR for searchable PDFs, real-time collaboration, and customizable workflow dashboards.

- •Advantage: Unifies all company documents, not just financial ones, into a single, secure platform.

- •Limitation: It lacks specific AP automation features like direct data extraction for accounting software or automated 3-way matching.

Website: https://www.egnyte.com/

Invoice Scanning Software Comparison Overview

| Solution | Core Features ★✨ | User Experience ★👥 | Value Proposition 💰 | Unique Selling Points ✨🏆 | Price Points 💰 |

|---|---|---|---|---|---|

| Tailride 🏆 | Multi-format capture, AI extraction, real-time inbox monitor | Intuitive UI, instant setup, scalable for SMBs & enterprises | Time saved, workflow integrations, secure & compliant | Chrome extension, multi-currency reconciliation, custom AI rules | Free up to 10 invoices/mo, paid from $19/mo |

| Scan2Invoice | Desktop scanner integration, rapid scanning | User-friendly, efficient for small teams | Affordable for small teams | Simple setup, desktop scanner support | Affordable, suitable for small teams |

| Tipalti | AI OCR, supplier onboarding, PO matching | Comprehensive AP focus, real-time tracking | Reduces payment errors | Two/three-way PO matching, tax compliance | Higher pricing, enterprise targeted |

| Kofax | AI document intelligence, workflow orchestration | Enhances productivity, scalable | Automation of data-heavy workflows | Legacy system integration, compliance monitoring | Higher pricing, complex setup |

| ABBYY | AI OCR supporting 200+ languages | Scalable for large volumes | Maintains document quality | Multi-language support, audit workflows | Higher pricing for advanced features |

| DocParser | Custom parsing, multi-format support | No coding required, flexible | Efficient line-item data extraction | Extensive export options, API access | Moderate, depends on usage |

| Docsumo | AI extraction, automated categorization | Scalable for businesses, reduces errors | Pre-trained models + human review | Automated categorization, ERP integrations | Higher pricing for smaller users |

| DocuClipper | OCR batch processing, supports various formats | Fast, no training needed | Cost-effective for SMBs | Out-of-the-box accuracy, affordable pricing | Affordable, SMB focused |

| Nanonets | AI OCR for unstructured invoices, custom workflows | Flexible, reduces manual entry | Scalable, tailored workflow automation | Custom approval workflows, QuickBooks integration | Higher pricing, technical setup needed |

| Dext Prepare | Accurate extraction, supplier rules | Intuitive web & mobile apps | Improves expense processing | Predefined rules for bulk processing | Pricing info not public |

| DocuPhase | Invoice processing, PO matching | Enhances productivity, mobile access | Comprehensive automation | Advanced search & audit trails | Pricing requires contact |

| Egnyte | Document mgmt, OCR PDFs, secure cloud | Supports collaboration & workflow visibility | Scalable document organization | Real-time collaboration, dashboards | Higher pricing, limited invoice automation |

The Final Scan: Automating Your Way to Financial Clarity

Navigating the world of invoice scanning software can feel overwhelming, but as we've explored, the right tool is out there waiting to transform your financial workflows. We’ve journeyed through a dozen powerful solutions, from the enterprise-grade AI of Tipalti and Kofax to the nimble, developer-friendly APIs of DocParser and Nanonets. We've seen how tools like Dext Prepare cater specifically to accountants and bookkeepers, while platforms like Egnyte and DocuPhase integrate document management into a broader content governance strategy.

The core takeaway is this: moving away from manual invoice processing is no longer a luxury, it's a fundamental competitive advantage. The best invoice scanning software doesn't just digitize paper; it automates data extraction, eliminates human error, and accelerates your entire accounts payable cycle. This shift from tedious data entry to strategic financial oversight is where the real value lies.

How to Choose the Right Tool for Your Business

Your "perfect" solution depends entirely on your unique circumstances. To make the best choice, don't get distracted by the longest feature list. Instead, focus on a few key areas that will drive the most significant impact for your team.

Start by mapping your current process.

- •Invoice Volume and Variety: How many invoices do you process monthly? Are they standardized digital PDFs, messy paper receipts, or complex multi-page documents? A high-volume e-commerce business will have different needs than a consultancy with a few dozen large invoices.

- •Integration Needs: Your invoice scanning software must communicate seamlessly with your existing ecosystem. Does it need to connect directly with QuickBooks, Xero, NetSuite, or a custom-built ERP? A tool with a robust, native integration will save you countless headaches compared to one requiring manual exports or a complex API setup.

- •Automation Depth: Are you just looking for simple OCR to pull invoice numbers and totals? Or do you need advanced AI that can handle line-item extraction, three-way matching against purchase orders, and complex approval workflows? Be honest about how much automation you truly need right now versus what you might need in the future.

Beyond the Scan: Implementation and Strategy

Choosing your software is just the first step. Successful implementation is what guarantees a return on your investment. Remember to plan for a transition period. Designate a champion within your team to lead the adoption process, provide training, and gather feedback.

By automating these manual tasks, you empower your finance team to evolve. They can shift their focus from chasing down paperwork to analyzing spending trends, optimizing cash flow, and contributing to strategic business decisions. This elevation of the finance function is critical for building more efficient accounts payable operations and achieving true financial clarity. Your team becomes a hub of insight, not just a processing center.

Ultimately, the goal of adopting invoice scanning software is to buy back your most valuable resource: time. It’s about creating a system that is accurate, auditable, and effortlessly efficient. Whether you're a solo entrepreneur tired of shoeboxes full of receipts or a finance manager overseeing a global team, the right automation platform will provide the clarity and control you need to scale with confidence.

Ready to eliminate manual data entry and get a crystal-clear view of your business expenses? Tailride is designed to provide the most accurate and effortless invoice and receipt scanning available. See how our AI-powered platform can streamline your bookkeeping and give you back hours every week by visiting Tailride to start your free trial.