A Guide to Invoice Data Capture Software

Discover how invoice data capture software streamlines your accounts payable. Learn to automate invoicing, reduce errors, and improve business efficiency.

Tags

Picture this: your finance team, finally freed from the endless stacks of paper invoices. No more squinting at tiny print, no more mind-numbing manual typing of vendor names, line items, and due dates. This isn't a fantasy; it's what invoice data capture software makes possible. Think of it as a smart assistant that automatically reads, understands, and organizes all that crucial invoice information for you.

Leave Manual Data Entry in the Dust

Manually processing invoices is a lot like trying to copy a book by hand, page by painful page. It’s painstakingly slow, incredibly tedious, and a recipe for mistakes. A single typo can snowball into a delayed payment, throw off your financial reports, or even damage a relationship with a key supplier.

Invoice data capture software is the modern solution - a high-speed scanner and an intelligent word processor all in one. It doesn’t just digitize the text; it actually understands what it’s looking at. This is the heart of modern accounts payable (AP) automation. It tackles the most time-consuming and error-prone part of the entire process: getting the data off the invoice and into your accounting system where it belongs. Instead of your team burning hours on data entry, the software does the heavy lifting in seconds.

The Core Problem It Solves

Here’s the hard truth about manual processing: it just doesn't scale. As your business grows, the mountain of invoices grows right along with it. This inevitably leads to a few very predictable, and very frustrating, problems:

- •Skyrocketing Labor Costs: More invoices mean you either need more people or your current team has to spend more hours on basic data entry.

- •The Human Error Factor: The more invoices you handle, the higher the risk of typos, accidental duplicate payments, and missed details. It’s only natural.

- •Painfully Slow Approval Cycles: Manual entry is a classic bottleneck. It gums up the works, delaying payment approvals and putting you at risk for late fees and unhappy vendors.

- •Zero Real-Time Visibility: When your financial data is trapped on paper or locked in email attachments, getting a clear, up-to-the-minute view of your cash flow and liabilities is practically impossible.

Invoice data capture software was built from the ground up to solve these exact issues. This is a key part of the broader trend to automate data entry and give businesses a serious efficiency boost. This shift away from manual work is what’s fueling some pretty explosive market growth.

The global market for invoice processing software was valued at around USD 3.9 billion in 2024. It’s projected to more than double, reaching USD 8.4 billion by 2033. This surge shows just how many companies are waking up to the huge operational wins that come from automation. For a deeper dive, you can explore the market trends in this comprehensive research on invoice processing software.

Manual vs. Automated Invoice Processing at a Glance

When you put the old way and the new way side-by-side, the difference is night and day. Automation brings clear, measurable advantages that can turn your AP department from a cost center into a strategic part of the business.

Here’s a quick breakdown:

| Metric | Manual Processing | Automated Data Capture |

|---|---|---|

| Time per Invoice | Days or even weeks | Minutes or seconds |

| Processing Cost | High (it’s all labor) | Low (minimal human touch) |

| Accuracy Rate | Lower (human error is a given) | High (data is validated) |

| Data Visibility | Poor (insights are always delayed) | Excellent (real-time view) |

Ultimately, by embracing automation, you’re not just speeding up a process. You’re empowering your team to focus on work that actually moves the needle - things like financial analysis, strategic cash flow management, and big-picture planning. That’s the work that truly drives a business forward.

How the Technology Actually Works

So, how does this all work? It might seem like a bit of black magic, but invoice data capture software is really just a clever combination of smart, step-by-step technologies. Think of it as a highly trained digital clerk who can read, understand, and file information faster and more accurately than any human could.

Let's start at the beginning. When an invoice lands in your inbox as a PDF or you scan a paper copy, the software first needs to see the text. This is where Optical Character Recognition (OCR) comes in. OCR is essentially the eyes of the system. It scans the document, converting the images of letters and numbers into digital, machine-readable text. It’s the critical first step that turns a static picture of an invoice into raw data the computer can actually work with.

But having a jumble of text isn't enough. The software needs to make sense of it all. What does "Vendor ABC," "Invoice #12345," or "$500.00" actually mean in context? That's where the brain of the operation - artificial intelligence - takes over.

From Raw Text to Structured Data

The AI component in modern invoice capture tools is trained on millions of different invoices. It uses this vast experience to identify and classify each piece of information. It learns to recognize layouts and patterns, figuring out that the number after "Invoice #" is the invoice ID, the address block at the top belongs to the vendor, and the table in the middle lists out all the line items.

This is way more advanced than simple keyword searching. The AI understands nuance and variation. For example, it knows that "Inv #," "Invoice No.," and "Invoice Number" all mean the same thing. This ability to adapt on the fly, without needing a rigid template for every single vendor, is what makes the technology so powerful.

Before this kind of automation, manual invoice processing could cost a business anywhere from USD 4 to USD 25 per invoice. With automated systems, that cost plummets, and error rates can drop to as low as 0.5% - a huge leap from manual error rates that often top 20%. You can dive deeper into how technology has changed the game with these invoice management software insights.

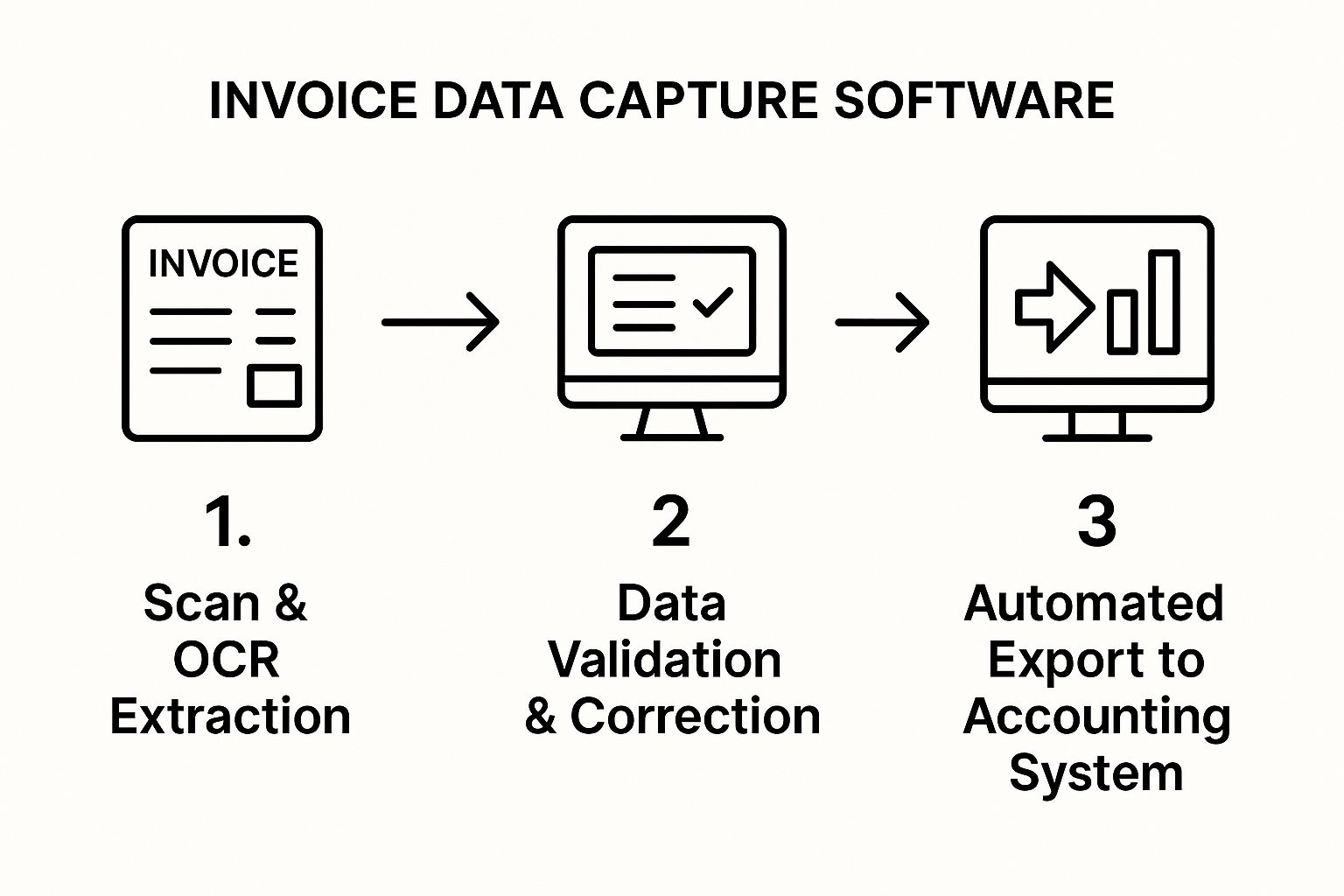

This infographic gives a great visual overview of an invoice's journey through a data capture system, from the initial scan to the final, clean export.

As you can see, it's a logical flow designed to make sure data isn't just pulled out, but is also checked and verified before it ever hits your accounting system.

The Validation and Learning Loop

Once the AI has a go at extracting the data, it doesn't just blindly pass it on. The best systems have a crucial validation stage where the software cross-references the information with your existing company records.

Here’s what that looks like in practice:

- •Vendor Matching: It checks if the vendor name on the invoice is a known supplier in your accounting software.

- •PO Matching: The system can automatically compare the invoice details against an open purchase order, flagging any mismatches in price or quantity.

- •Duplicate Detection: It scans for repeat invoice numbers from the same vendor to stop you from accidentally paying the same bill twice.

This is also where the "learning" in machine learning really proves its worth. If the software isn't 100% sure about a particular field, it will flag it for a quick human review. When you confirm or correct the data, the AI learns from that feedback. The next time it sees a similar invoice, it will remember what to do, getting smarter and more accurate with every invoice it processes. This continuous improvement loop is what makes the system so incredibly reliable over time.

What to Look For: 6 Must-Have Features in Invoice Capture Software

Not all invoice data capture tools are built the same. While a basic one might grab a vendor's name and the total due, the really great platforms offer a whole suite of features designed for the messy reality of a busy accounts payable department. Knowing what these core functions are is the secret to picking a solution that doesn't just digitize your old process, but genuinely makes it better.

Think of it like buying a car. The base model gets you from A to B, sure. But the premium version comes with GPS, adaptive cruise control, and all the safety features that make the drive faster, safer, and way less stressful. The same idea applies here. Let's break down the "must-have" features that separate the good from the great.

1. Intelligent Data Extraction

At its core, any invoice capture software has one primary job: pull data accurately. The best solutions go way beyond basic OCR, using intelligent technology that understands the context of an invoice, no matter how a vendor formats their bill.

This means you need:

- •Multi-Format Support: Your suppliers send invoices every way you can imagine - PDFs, JPEGs, Word docs, and sometimes just pasted into an email. A solid tool has to handle all of them without a hiccup.

- •Automatic Line-Item Capture: Just grabbing the invoice total is rookie stuff. Real efficiency comes from capturing every single line item - the description, quantity, unit price, and SKU. This is non-negotiable for accurate job costing and inventory management.

- •Purchase Order (PO) Matching: This is a huge one. This feature automatically checks incoming invoices against the purchase orders you've already issued. It instantly flags any mismatches in price or quantity, stopping overpayments and potential fraud in their tracks.

Without these foundational features, your team will just trade one manual task for another - endlessly correcting a machine's mistakes.

The real power of invoice data capture software isn't just about moving faster; it's about trusting your data. When you can automatically validate invoices against POs, you catch expensive errors that could have cost you thousands.

2. Seamless System Integration

A data capture tool that doesn't talk to your other software isn't a solution; it's just another information silo. The data it pulls needs to flow right into the other business systems you depend on. This is where seamless integration becomes absolutely critical.

A top-tier platform should connect directly with your accounting or ERP software. This completely eliminates the soul-crushing, error-prone task of manually exporting and re-uploading spreadsheets. The goal is a connected workflow where an invoice gets captured, processed, and synced to your general ledger without anyone having to touch it.

For a better sense of how different tools handle this, our guide to invoice software comparison is a great place to start.

3. Rock-Solid Security and Compliance

When you're dealing with financial data, security can't just be a bullet point on a feature list - it has to be baked into the platform's DNA. The best invoice capture tools are built with enterprise-grade security to protect your information and keep you compliant with privacy laws.

Look for tools that offer data encryption (both for data on the move and data at rest) and strict access controls so you can decide exactly who can view or approve invoices.

As more business goes global, sticking to international standards is also key. When checking out different options, it’s smart to understand their approach to data privacy. For example, these GDPR compliance insights can be useful in your evaluation. Choosing a vendor who takes security seriously gives you the freedom to focus on your business, knowing your financial data is safe and sound.

What's the Real Payoff for Your Business?

Let's move past the technical features and talk about what this software actually does for your business. We're not just talking about entering data faster; we're talking about a real shift in how your company handles its finances, opening up new ways to grow. The return you get is about so much more than just saving a few hours here and there.

Think about a growing retail company for a moment. As their sales climb, they're suddenly buried in invoices from suppliers, shipping companies, and all sorts of vendors. Their finance team, which should be focused on the big picture, is now stuck in the weeds - typing in data, chasing down approvals, and fixing typos. This is where the benefits of automation really click into place.

Drastically Cut Costs and Save Time

The first thing you’ll notice is the impact on your bank account. Manually processing invoices is a hidden money pit when you add up staff hours, the cost of fixing mistakes, and late payment fees. By automating how you capture that data, you slash the hands-on effort needed for every single invoice.

This leads directly to:

- •Lower Labor Costs: Your team can step away from mind-numbing, repetitive work and focus on tasks that actually move the needle.

- •No More Late Fees: Quicker processing means bills get paid on time, helping you avoid those frustrating (and expensive) penalties.

- •Fewer Costly Errors: Automated checks for duplicates and purchase order mismatches stop you from paying the same bill twice or for the wrong amount.

Businesses that automate their accounts payable process can cut their invoice processing costs by as much as 80%. That’s not a small tweak - it’s a massive drop in your day-to-day operational expenses.

By putting invoice data capture software to work, our retail business could finally get its finance team out of the data entry grind. Instead of hiring more people just to keep up with the paperwork, they can now have their experts focus on financial forecasting, cash flow analysis, and finding new ways to save money.

Supercharge Your Team’s Productivity

When your team isn't drowning in tedious manual tasks, their productivity skyrockets. Automation gets rid of the bottlenecks that gum up the works, leading to a workflow that’s smooth, fast, and efficient. If you want to dive deeper, our guide on accounts payable automation benefits really unpacks these productivity gains.

This boost in efficiency means:

- •Lightning-Fast Approvals: With data captured and checked in a flash, invoices can be ready for approval in minutes, not days.

- •Stronger Supplier Relationships: Paying your suppliers on time, every time, builds a ton of goodwill. This can even lead to better payment terms and discounts down the road.

- •Happier Employees: Let's be honest, nobody enjoys monotonous work. Taking that off their plate leads to better job satisfaction, and you get to keep your talented finance pros focused on the expert-level work they were hired to do.

Nail Your Accuracy and Stay Compliant

We're all human, and mistakes happen - it’s just a fact of life in any manual process. But a single misplaced decimal point or the wrong vendor ID on an invoice can create a huge mess. Invoice data capture software all but erases these risks, making sure the information flowing into your accounting system is accurate and reliable from the start.

This commitment to accuracy also creates a perfect, audit-ready trail for every single payment. Because every step is logged digitally - from the moment an invoice arrives to the final payment - you have a clean, searchable record at your fingertips. This makes audit season far less painful and helps you stay compliant with financial rules and regulations.

How to Choose the Right Software for You

Picking the right invoice data capture software can feel a bit like wading through a sea of options. Every vendor promises the world, and it’s easy to get lost in the noise. The trick is to step back and create a clear game plan for evaluating what your business actually needs based on its size, budget, and how you operate day-to-day.

One of the first big decisions you'll face is where the software will "live": on-premise or in the cloud. An on-premise solution means you install and run the software on your own company servers. This gives you a ton of control, but it usually comes with a hefty upfront cost and the ongoing headache of maintenance. On the flip side, a cloud-based (SaaS) solution is hosted by the vendor and you just access it online. This approach is generally more flexible, scales easily, and is much quicker to get up and running.

This shift to the cloud is a huge reason the market is growing so fast. The global invoice management software market was already worth USD 3.4 billion in 2023 and is projected to more than double by 2032. This isn't just a trend; it's a massive move by businesses of all sizes toward digital tools, with cloud options leading the way because they’re affordable and accessible from anywhere. You can dig into more of the numbers in this invoice software market analysis.

Comparing Solution Types

Let's be honest: not all tools are built the same. The software that's a perfect match for a solo freelancer would be a disaster for a multinational corporation, and vice versa. By understanding the main categories of tools out there, you can quickly filter out the noise and focus on what’s relevant for you.

Here’s a quick breakdown of how these different solutions typically compare.

Comparing Invoice Data Capture Solutions

The table below gives you a bird's-eye view of the landscape, comparing the common types of invoice data capture software. Think of it as a guide to help you figure out which category best aligns with your company's current reality and future ambitions.

| Feature | Small Business Tool | Mid-Market Platform | Enterprise Solution |

|---|---|---|---|

| Typical User | Startups, freelancers, small businesses with low invoice volume. | Growing businesses, companies with a dedicated finance team. | Large corporations, multinational companies with complex needs. |

| Pricing Model | Often free or low-cost monthly subscription based on usage. | tiered monthly subscriptions based on features and volume. | Custom annual contracts, often with implementation fees. |

| Core Features | Basic OCR, simple data extraction, some accounting integrations. | Advanced data capture, PO matching, approval workflows. | Fully customizable workflows, multi-entity support, advanced analytics. |

| Ease of Use | Very simple and intuitive, designed for non-accountants. | User-friendly but requires some configuration and training. | Can be complex, requiring dedicated administrators and user training. |

| Integrations | Primarily with common accounting software like QuickBooks or Xero. | Connects to a wider range of accounting systems and business apps. | Deep integration with major ERP systems and custom-built software. |

As you can see, there’s a natural progression. As your business grows in size and complexity, so does your need for more powerful features and sophisticated integrations. It's really all about finding that "just right" fit. The technology that powers all of this, especially Optical Character Recognition, is pretty fascinating. If you're curious, you can learn more about how invoice OCR software works in our detailed guide.

Your Vendor Evaluation Checklist

Okay, so you've narrowed down the type of tool you need. Now it’s time to look at specific vendors. To make sure you choose with confidence, you need to ask the right questions.

Key Insight: Finding the right software is about more than just a list of features. It’s about finding a true partner who gets your business and can support you as you grow. Don’t be shy - ask the tough questions about their service and security.

Keep this checklist handy for your research and demo calls:

- •Implementation and Onboarding: How long does it really take to get set up? What does your training process look like for my team?

- •Scalability: Can your platform handle our growth? How will our costs change as our invoice volume doubles or triples?

- •Data Security and Compliance: How are you protecting our sensitive financial data? Are you compliant with regulations that matter to us, like GDPR?

- •Customer Support: What happens when we run into a problem? What kind of support can we expect (phone, chat, email), and how fast do you respond?

- •Product Roadmap: What cool new features or improvements are you working on for the next 12 months?

With this framework in hand, you’re ready to cut through the sales pitches and focus on what really matters: finding the perfect software to make your invoice process a whole lot smoother.

Your Step-by-Step Implementation Plan

Bringing new software into your business is a lot like a road trip - you need a good map to get where you're going without getting lost. A solid implementation plan is that map. It's what separates a tool that revolutionizes your workflow from one that just sits on a digital shelf collecting dust. This guide will walk you through a smooth, successful rollout of your chosen invoice data capture software.

The idea is to get your team comfortable and your new system humming along with as little fuss as possible. When you’ve got a solution like Tailride, the process is designed to be pretty painless, helping you capture your first invoices in just a few minutes.

Phase 1: Initial Planning and Buy-In

Before you start clicking any buttons, you need to build a strong foundation. This means getting everyone who will use or be impacted by the new tool on the same page from the very beginning.

First, figure out what a "win" looks like for your company. Is it slashing invoice processing time by 50%? Or maybe your main goal is to completely wipe out those pesky late payment fees. Once you have clear, measurable goals, you can get the right people on board. This isn't just about getting the budget signed off; it's about helping your finance team, department heads, and IT folks see the why behind the change. Show them how invoice data capture software is going to make their lives easier, not more complicated.

Phase 2: Configuration and Pilot Testing

Alright, now for the fun part - getting your hands dirty. Modern tools like Tailride are designed for a quick setup. It's usually as simple as connecting your email or linking up your existing accounting software. This is where you'll tweak the system to fit your company's unique process, like setting up specific approval chains or creating custom rules for categorizing expenses.

A Word of Advice: Don't try to flip the switch for the whole company at once. That's a recipe for chaos. Instead, run a small pilot program. Pick a single, tech-savvy department to go first. This trial run lets you smooth out any wrinkles, perfect your workflow, and create a group of internal experts who can champion the tool when you roll it out to everyone else.

Phase 3: Team Training and Full Launch

Once your pilot program is a proven success, you’re ready for the main event. Your focus now pivots to getting everyone to actually use the new system. The secret here is to make the training dead simple and incredibly practical.

Here are a few tips to make training stick:

- •Create Simple Guides: Think short, visual "how-to" documents or quick videos that walk through the most common daily tasks.

- •Define an "Oops" Plan: Clearly map out what to do when the system flags an invoice for manual review. Who handles it? What are the steps?

- •Offer Real Support: Make sure every team member knows exactly who to go to with questions or when they get stuck.

Taking these steps from the get-go helps head off frustration and encourages your team to embrace the change. It's the best way to make sure your new software starts delivering real value right from day one.

Common Questions About Invoice Data Capture

Making the leap to new software always brings up a few questions. It's smart to dig into the details, especially around security, global use, and what kind of return you can realistically expect. Let’s walk through some of the most common questions we hear.

How Secure Is My Financial Data?

Handing over financial data is a big deal, so security should be at the top of your list. You can rest assured that any reputable invoice data capture software is built like a digital Fort Knox, with layers of protection to keep your information locked down.

Top-tier platforms use end-to-end encryption, which essentially scrambles your data from the moment it leaves an invoice until it's safely in your accounting system. They also feature strict access controls, giving you the power to decide precisely who on your team can see, change, or approve financial documents. This creates a secure trail, ensuring only the right people touch sensitive info.

Can It Handle Invoices in Different Languages and Currencies?

Absolutely. We live in a global economy, and modern businesses work with suppliers from all over the world. Invoice capture tools were built for this. The underlying technology has been trained on a massive and diverse set of documents, so it can accurately read and understand invoices in many different languages.

It works the same way for money. These systems are smart enough to recognize various currency symbols and formats, whether it’s Euros, Pounds, or Yen. This means you can create one smooth, standardized process for all your payables, no matter where your vendors are based.

What Is the Typical ROI I Can Expect?

While the exact return on investment will depend on your company's size and how many invoices you process, the payback is both clear and significant. The ROI from invoice data capture software really boils down to three key areas.

Think about it: manual processing is just asking for mistakes and delays. An automated system slams that door shut by moving data directly from the invoice to your books with incredible accuracy. That alone is a huge cost saver.

- •Cost Savings: You'll spend far less on labor for manual data entry and all but eliminate expensive mistakes like paying an invoice twice or getting hit with late fees.

- •Efficiency Gains: Your entire accounts payable cycle can shrink from days down to just a few hours. This frees up your finance team to focus on high-value work instead of tedious administrative tasks.

- •Error Reduction: Automated checks and purchase order matching slash error rates. This not only improves the accuracy of your financial records but also helps you build stronger, more reliable relationships with your suppliers.

When you add it all up, these benefits deliver a powerful ROI. Your AP department transforms from a simple cost center into a streamlined, strategic part of your business.

Ready to stop wasting time on manual data entry and see these benefits firsthand? Tailride connects directly to your inboxes and accounting software to automate the entire process. Start capturing your invoices in seconds.