How to Use a Gmail Invoice Parser and Save Time

Tired of manual data entry? Learn how a Gmail invoice parser automates your workflow. This guide shows you how to set up and optimize your system.

If you're still painstakingly typing invoice details from your Gmail into a spreadsheet, you're giving away hours of your time every single week. A Gmail invoice parser is designed to stop that bleed. It works by automatically pulling key details - think invoice numbers, due dates, and totals - right from your emails and their attachments. This one change can give you back a shocking amount of time and put an end to those frustrating (and costly) data entry mistakes.

Why Manual Invoice Entry Is Holding You Back

Let's be real: no one gets excited about copying and pasting information from a PDF into accounting software. It’s one of those mind-numbing, repetitive tasks that feels like a necessary evil, whether you're a freelancer, a small business owner, or part of a larger finance team. But the true cost of doing this by hand is much higher than just a little boredom.

Every minute you or your team spends on manual data entry is a minute you're not spending on growing the business, talking to clients, or figuring out your next financial move. It's a classic bottleneck that quietly saps your productivity. For a solopreneur, that's time you could have spent on sales. For a growing team, it means paying good money for low-value work that a tool could do in a blink.

The Hidden Costs of Doing It by Hand

The trouble with manual invoice processing runs deeper than you might think. It creates a domino effect that can mess with everything from your cash flow to the accuracy of your financial reports.

Here are the big culprits:

- •Human Error: It just happens. A single mistyped number can lead to paying too much, paying too little, or generating completely wrong financial statements. Fixing these mistakes isn't just expensive; it can also strain your relationships with vendors.

- •Delayed Payments: When invoices sit in an inbox waiting for someone to get to them, payments get pushed back. This can directly choke your company's cash flow and put you in a tough spot with suppliers.

- •Wasted Talent: Your team has skills that are far more valuable than mind-numbing data entry. If you actually calculate the cost of those hours, you'll likely be shocked at how much you're spending on a process that can be fully automated.

Thinking about the bigger picture of business efficiency really drives this point home. For example, many procurement cost reduction strategies point directly to getting administrative tasks like this off your team's plate.

The real problem isn't the time it takes to enter just one invoice. It's the cumulative effect of hundreds of them over a year, where each one is a potential landmine for errors, delays, and wasted resources.

The Gmail Tidal Wave

The sheer amount of information pouring into our Gmail inboxes is exactly why this is a problem begging for an automated solution.

We all know this view well - it's where countless invoices land every single day.

This familiar interface is ground zero for a massive flow of data that needs a much smarter approach than manual entry.

This familiar interface is ground zero for a massive flow of data that needs a much smarter approach than manual entry.

With over 1.8 billion active users, Gmail is a firehose of daily emails, and a huge chunk of that is invoices and receipts. This makes a Gmail invoice parser less of a "nice-to-have" and more of an essential tool for any business that wants to handle its finances efficiently. When you make the switch from manual entry to an automated parser, you're not just saving time - you're turning a tedious chore into a smooth, accurate, and scalable part of your workflow.

Choosing the Right Invoice Parsing Tool

Picking the right Gmail invoice parser is a huge decision, and honestly, it can make or break your entire workflow. Get it right, and you’ve got a seamless, automated system that saves you hours. Get it wrong, and you're stuck with a clunky, semi-manual process that just adds frustration. Think of this as your inside guide to finding a solution that actually fits what you need to do.

This space is exploding right now, and for good reason. The global email parsing software market is on track to hit $2.5 billion by 2025. That growth is being pushed by the mind-boggling 376.4 billion emails expected to fly around daily by 2025, with a massive chunk of those being invoices ripe for automation. You can dig into the numbers yourself in this detailed report on the email parsing software market.

All this growth means you've got a ton of options, from simple browser add-ons to seriously powerful, dedicated platforms.

Core Features You Absolutely Need

When you start looking at different Gmail invoice parsers, it's easy to get sidetracked by flashy features. But for real, hands-off automation, you have to focus on what's going on under the hood.

Here’s a no-fluff list of what to demand:

- •AI-Powered Data Extraction: The tool has to use AI - specifically Optical Character Recognition (OCR) - to read text from PDFs and even images. If a parser can only handle plain text in an email body, it's going to fall flat the second a vendor sends a standard PDF invoice.

- •Seamless Accounting Integrations: This is a big one. Look for native, direct connections to software like QuickBooks, Xero, or Business Central. A tool that just spits out a CSV file isn't a complete solution; you’re still stuck with the manual import process, which defeats half the purpose.

- •Customizable Parsing Rules: Let's be real - no two supplier invoices look the same. A great parser lets you teach it where to find specific details, like an 'Invoice Number' or 'PO Number', on different vendor templates. This is how you achieve high accuracy over time.

My Take: A top-tier tool doesn't just grab data; it understands and structures it. The end goal is to get information from an email straight into your accounting system with zero manual steps. If you still have to open a spreadsheet, the tool isn’t doing its job.

Comparing Different Types of Parsers

The right tool for you really depends on the size and complexity of your business. A freelancer’s needs are a world away from a growing e-commerce store that’s drowning in hundreds of supplier invoices every week.

To help you navigate your options, I've put together a quick comparison of the different solutions out there.

Feature Comparison of Leading Gmail Invoice Parsers

This table compares key features across different types of Gmail invoice parsing solutions to help you make an informed decision based on your business needs.

| Feature | Simple Parsers (e.g., Browser Extensions) | Mid-Tier Automation Platforms | Enterprise-Level Solutions |

|---|---|---|---|

| PDF & OCR Support | Very limited or non-existent. | Robust OCR for various formats. | Advanced, highly accurate OCR. |

| Accuracy | Low to moderate; struggles with complex layouts. | High, with machine learning improvements. | Extremely high, with human-in-the-loop verification. |

| Accounting Integrations | Usually none; limited to CSV/Excel export. | Direct API integrations (QuickBooks, Xero, etc.). | Deep, custom ERP/accounting integrations. |

| Custom Rules | Basic keyword-based rules. | Advanced, template-based custom fields. | Fully customizable workflows and validation rules. |

| Ideal User | Freelancers, solopreneurs with low volume. | Small to medium-sized businesses. | Large corporations with high volume and complexity. |

| Price Point | Free to very low cost. | Moderate monthly subscription. | High, often with implementation fees. |

For most small and medium-sized businesses, I've found that a dedicated mid-tier platform like Tailride hits that sweet spot. It gives you the powerful AI extraction and crucial accounting integrations needed for a truly automated workflow, but without the enterprise-level price tag or complexity. Making the right choice here is what sets you up for scalable, hands-off financial management down the road.

Getting Your Parser Connected and Configured

Alright, this is where the magic really starts. Getting your Gmail invoice parser hooked up is the first step toward true automation. Don't worry, this isn't some super technical process; it's more like giving a new app permission to help you out.

The whole connection process is built around security. Most tools worth their salt, including Tailride, use a secure standard called OAuth. This is great because you never have to share your actual Gmail password. Instead, you just approve the connection through a familiar Google sign-in window. This gives the parser read-only access, and crucially, you can limit it to specific folders or labels.

Your First Moves in Configuration

Once you're connected, the immediate goal is to tell the parser where to look for invoices. You definitely don’t want it sifting through every single email you get. That’s just a recipe for chaos and inefficiency.

A really smart first move is to point it toward a specific label you use for organizing invoices. I've found it helps to create a Gmail filter that automatically slaps a label like "Invoices-To-Process" on any email that has words like "invoice" or "receipt" in the subject or body. Then, inside your parser’s settings, you just tell it to watch that one label. It keeps the whole process tidy from the very beginning.

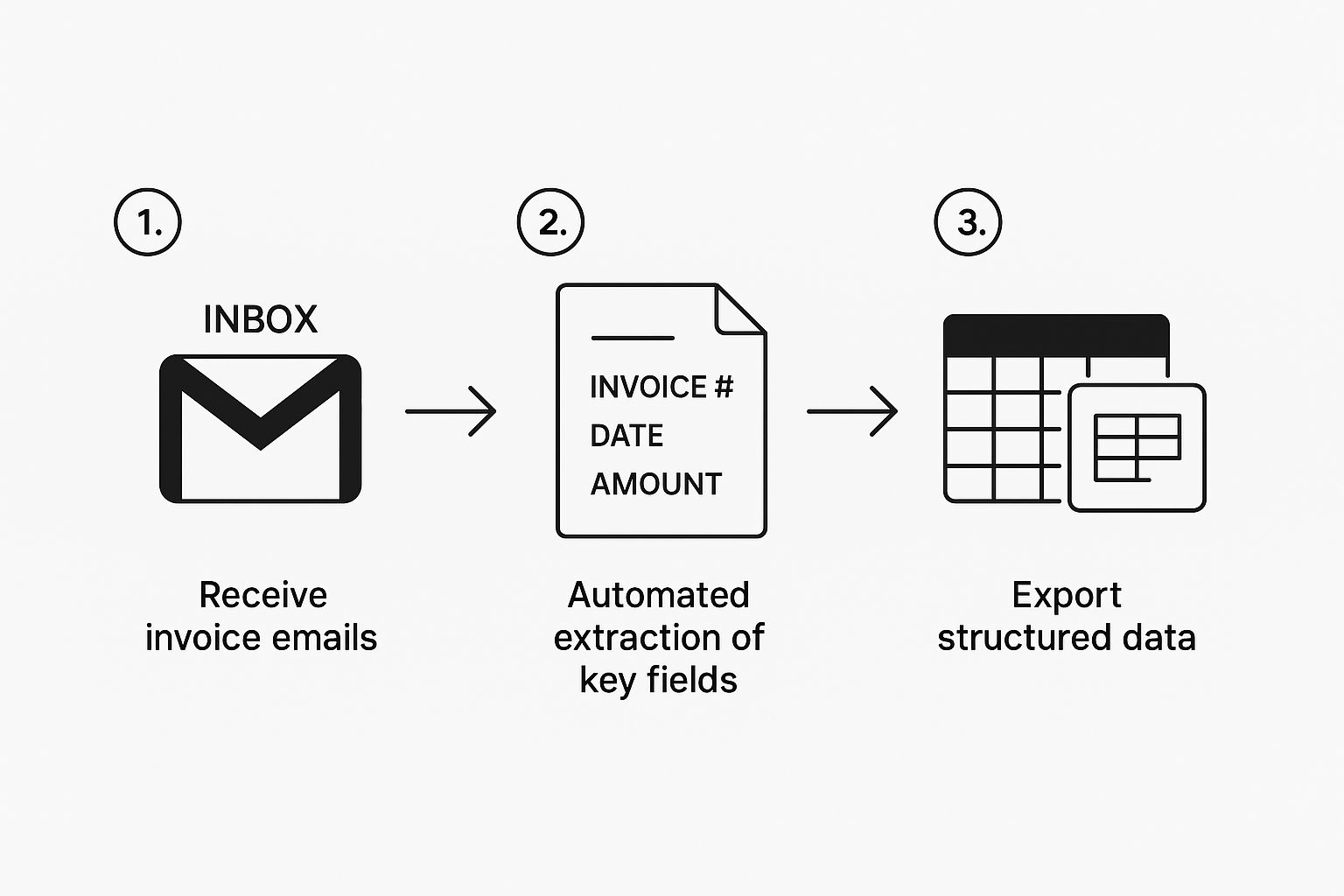

This flow chart gives you a bird's-eye view of how it all works, from the email landing in your inbox to the data being exported.

As you can see, it's a beautifully simple, straight line: an invoice arrives, the tool pulls out all the key data points, and then it zips that clean, structured info right over to your accounting software.

Navigating Common Setup Hurdles

Connecting an app to your Gmail is usually a breeze, but sometimes you hit a snag with permissions. If the connection fails, it's almost always something to do with your Google Workspace security settings.

Some companies lock down third-party app access by default. If you run into trouble, here are the usual culprits:

- •Admin Console Permissions: If you're on a business account, your IT admin might need to whitelist the tool. It's a quick fix for them in the Google Workspace Admin console.

- •Existing App Connections: Take a peek at your Google account's "Security" settings and see what apps already have access. Sometimes, an old or unused connection can cause a conflict, and just revoking it does the trick.

- •Two-Factor Authentication (2FA): Make sure your 2FA is set up and working properly. Any secure parser will fully support 2FA and might ask you to re-authenticate as part of the setup.

The whole point of this initial setup is precision. By pointing the parser to one specific label and making sure the permissions are squared away, you’re building a rock-solid, automated pipeline. It ensures only the right documents get processed, saving you from digging through digital clutter later. Getting this foundation right is what makes the entire workflow so powerful.

Teaching Your Parser to Read Invoices

Alright, you’ve connected your Gmail account, and the data pipeline is officially built. Now for the fun part: teaching your new parser how to think. An out-of-the-box parser is a fantastic starting point, but its real magic shines when you fine-tune it to understand the specific invoices your business deals with every day.

Let's face it, every vendor has their own idea of what an invoice should look like. One might stick the invoice number in the top right corner, while another buries it at the bottom left. This is where creating custom rules becomes your superpower, turning a good tool into a ridiculously accurate one.

From Generalist to Specialist

Think of a brand-new parser as a smart intern. It has a general idea of what an "invoice number" or "due date" is, but it needs a little guidance. Your job is to train it to become a specialist that recognizes documents from your top suppliers instantly and without a single mistake.

The process is surprisingly intuitive. You essentially show the parser a sample invoice from a specific vendor - let's say it's from your cloud hosting provider - and then you draw a virtual box around the key bits of information you need it to grab every single time.

- •Invoice Number: Just highlight the text, like

INV-2024-001, and tell the parser, "This is theinvoice_number." - •Total Amount: Point it to the final figure, often labeled "Grand Total" or "Amount Due," and tag it as

total_amount. - •Due Date: Find the date payment is required and assign it the

due_datefield.

This isn't something you have to do every time. This one-time training session creates a permanent template for that vendor. The next time an invoice from them lands in your inbox, the parser knows exactly where to look, delivering near-perfect accuracy for that source.

The goal here isn't just to pull data. It's to pull it with such high confidence that you never have to second-guess it. Spending a few minutes setting up a rule for a frequent supplier will save you countless hours of manual checks down the road.

Handling Tricky Invoice Formats with Smart Rules

Of course, not all invoices are so straightforward. Some are a mess, lacking clear labels or embedding crucial data inside long strings of text. This is where pattern matching, often using something called regular expressions (or regex), really comes in handy.

For instance, a purchase order number might be buried in a sentence like, "Reference your PO #45033-B for this order." Instead of telling the parser to look in a specific spot, you can create a rule that looks for a pattern: the letters "PO #" followed by a mix of numbers and letters. This gives your gmail invoice parser some serious flexibility.

Thankfully, recent tech advancements have made this whole process much easier. Modern parsers from companies like Klippa now use AI and machine learning to understand context and spot key details in emails and PDF attachments. They even learn from any corrections you make. This combination of optical character recognition (OCR) and natural language processing (NLP) is a game-changer.

This intelligent approach means you'll spend less and less time creating manual rules. The parser simply gets smarter with every invoice it sees. For a deeper look into the nitty-gritty, check out our guide on how to extract invoices from Gmail for more hands-on tips. By blending your specific instructions with the parser's built-in smarts, you build a powerful system that all but eliminates manual data entry and the headaches that come with it.

Automating Your Bookkeeping Workflow

Pulling data is really just the first part of the puzzle. The real magic happens when you push that neatly structured information exactly where it needs to go. This is how you build a bookkeeping workflow that practically runs itself, turning your Gmail invoice parser into the powerhouse of your financial ops.

The end game? An invoice lands in your inbox, and moments later, it appears as a draft bill in your accounting software. No clicks, no manual entry, no hassle.

This final connection is what elevates a simple data extraction tool into a genuine automation platform. It's the difference between exporting a CSV you still have to wrangle and having a bill pop up, categorized and ready for your approval.

Connecting to Your Accounting Software

Most modern parsers, including Tailride, offer direct, native integrations with the big players like QuickBooks and Xero. Honestly, these are your best bet. They’re built specifically for this job, which means they're reliable and packed with the features you actually need.

If you have a more custom setup or your accounting software isn't on the list, a tool like Zapier can be your best friend. It acts as a universal adapter, letting you build connections (they call them "Zaps") between your parser and thousands of other apps. This gives you some serious flexibility.

For a deeper dive into these integration methods, check out our guide right here: https://tailride.so/blog/gmail-invoice-extraction.

A Practical Data Mapping Example

Let’s get practical. Say your parser just successfully snagged the following details from a PDF invoice:

- •Vendor Name:

Cloud Services Inc. - •Invoice Date:

2024-10-26 - •Total Amount:

149.99 - •Due Date:

2024-11-15

Now, you'll go through a quick, one-time "mapping" process when setting up the integration. All you're doing is telling the two systems how to talk to each other - translating one field to another.

Your mapping might look something like this:

- •The parser's

Vendor Name→ becomes theSupplierin QuickBooks.- •The parser's

Invoice Date→ becomes theBill Datein QuickBooks.- •The parser's

Total Amount→ becomes theBill Amountin QuickBooks.- •The parser's

Due Date→ becomes thePayment Duein QuickBooks.

Once you’ve set that up, it’s done. Every single invoice the parser processes will now automatically and correctly populate those fields in your accounting software. It's a true "set it and forget it" solution that brings amazing consistency to your books.

Putting a Gmail invoice parser to work is a huge leap forward for your business's efficiency. If you're looking for more ways to fine-tune your operations, these strategies for increasing operational efficiency offer some great ideas.

By automating this critical link in your financial chain, you're not just saving a few hours on data entry. You're building a reliable, scalable workflow that can grow right alongside your business.

Still Have Questions About Gmail Invoice Parsers?

It's totally normal to have a few questions before you let a new tool loose in your inbox. You're talking about automating a critical part of your business, so let's tackle some of the most common things people ask when they're getting started.

First up is security. I get it - giving an app access to your email can feel a bit nerve-wracking. The good news is that modern parsers don't ask for your password. Instead, they use a secure standard called OAuth, which means you authorize access directly through Google's own sign-in screen. You're always in the driver's seat and can cut off access anytime you want.

But How Accurate Is This Thing, Really?

This is the big one. Can you actually trust software to grab the right numbers every single time? Out of the box, a good AI-powered parser is surprisingly accurate. But the real magic happens as you use it.

By setting up a few simple rules for your key vendors, you’re basically telling the system, "Hey, for invoices from this supplier, the total is always right here." With that little bit of guidance, accuracy rates quickly climb above 99%. That's a whole lot better than manual data entry, where a slip of the keyboard can easily throw things off. If you want to dive deeper into how this works, we've got a great post on email invoice extraction that breaks it all down.

Here's what you really need to know: A smart invoice parser isn't a blunt instrument. It's a tool that learns and adapts specifically to your business, getting better and more reliable with every invoice it sees.

What Happens with Weird File Types or Different Languages?

Real-world invoices are messy. Sometimes they're PDFs, but other times you get a blurry JPG snapped on a phone. And what if you work with international suppliers? This is where a solid parsing tool proves its worth.

A few things a good parser should handle without breaking a sweat:

- •File Flexibility: It should use Optical Character Recognition (OCR) to read text from pretty much anything, including PDFs, JPGs, and PNGs. No more manual typing from an image.

- •Speaking Your Language: Many of the best tools can process invoices in different languages, figuring out what's what without you needing to translate.

- •Crazy Layouts: Even if a vendor sends an invoice that looks like it was designed in the '90s, the AI is smart enough to find the important stuff by looking for context and key terms.

This kind of flexibility is what keeps your automated workflow running smoothly, no matter what your suppliers throw at you. It takes the chaos of your inbox and turns it into clean, organized data ready for your accounting system.

Tired of the copy-paste grind? It might be time to see how an automated workflow can change your business. Tailride connects directly to your Gmail, pulls invoice data with pinpoint accuracy, and sends it right where it needs to go.