Automate Gmail Invoice Extraction with AI

Tired of manual data entry? Discover how to automate Gmail invoice extraction with AI to save time, reduce errors, and streamline your entire workflow.

Tags

Let's be real - digging through Gmail for invoices is a soul-crushing task. It's a slow, manual grind of searching for PDFs, squinting at line items, and hoping you don't mistype a number. This old-school approach doesn't just eat up your team's precious time; it's a breeding ground for human error and a direct cause of reporting delays.

Moving to an automated gmail invoice extraction system isn't just a nice-to-have anymore. For any business that wants to operate efficiently, it's a must.

The Hidden Costs of Manual Invoice Processing

If your team's "process" for finding invoices involves hitting "Ctrl+F" in a chaotic inbox, you've got a problem. Every minute someone spends hunting for an attachment or manually keying data into a spreadsheet is a minute they could have spent on work that actually grows the business. This isn't just a minor annoyance; it’s a direct hit to your bottom line.

This manual mess is often where you find what I call "Mystery Steps and Email Misfires." It’s that hidden workflow chaos that eats growth. An invoice gets lost in a thread, a number is entered wrong, or a payment goes out late. These little hiccups seem small on their own, but they add up, creating a serious financial and operational drag on the company.

The Real-World Frustrations

Anyone in finance or small business knows this pain all too well. It starts with just trying to find the right email. Then you have to download the correct PDF, assuming it wasn't buried ten replies deep in a conversation. And that's before the real work even starts.

The day-to-day headaches of this broken system usually boil down to a few key things:

- •Time-Consuming Searches: Your team literally wastes hours sifting through countless emails just to find a single vendor invoice. This stalls the entire accounts payable cycle right from the start.

- •Data Entry Errors: Let's face it, humans make mistakes. Manually typing invoice numbers, dates, and amounts is a recipe for errors that can throw off your financial records and cause payment headaches.

- •Delayed Payments and Damaged Relationships: When invoices get stuck in limbo, you risk missing payment deadlines. This can lead to nasty late fees and, even worse, damage the relationships you have with good vendors.

The true cost of manual invoice processing isn't just the salary of the person doing it. It's the lost opportunities, the costly errors, and the lack of real-time financial visibility that holds your business back.

Quantifying the Impact of Inefficiency

When you look at what AI-driven tools can do, it really puts the inefficiency of manual methods into perspective. Modern solutions can slash manual data entry costs by up to 80%. Think about that. They can also speed up the entire invoice processing cycle by 300% or more.

These platforms use smart systems that learn and adapt to different invoice layouts on their own, so you don't have to waste time setting up rigid templates for every vendor. If you're still doing things by hand, you're leaving massive efficiency gains on the table.

How AI Gets Your Invoices Out of Gmail

So, what's really happening behind the scenes when you automate your invoice processing? It’s not some smoke-and-mirrors trick. It’s a smart combination of AI models and Optical Character Recognition (OCR) that turns a messy inbox into a perfectly organized data source.

Think of it less like setting up rigid, old-school email rules and more like hiring an incredibly fast and accurate assistant.

The process kicks off the moment a tool like Tailride gets secure access to your Gmail. It’s not reading your personal emails; it’s specifically on the lookout for attachments - like PDFs and images - that have the tell-tale signs of an invoice. The AI is trained to recognize the patterns and structure of financial documents, so it can spot them without needing a specific template for every vendor.

Turning Pictures into Usable Data

Once a potential invoice is flagged, OCR jumps in. In the past, OCR was pretty basic - it just turned the words on a page into text. But modern AI takes it to a whole new level. It doesn't just read the words; it understands what they mean in context.

The AI model intelligently scans the document, searching for the critical data points you actually need, regardless of the invoice's layout. This is where the real power lies.

- •It spots key fields: The AI looks for common labels like “Invoice Number,” “Due Date,” and “Total Amount.”

- •It figures out the context: If a label is missing, the AI is smart enough to use surrounding information as clues. For instance, it knows a date listed near the bottom is likely the due date, and a number near the vendor's logo is probably the invoice ID.

- •It adapts to anything: Different layouts, languages, or currencies? No problem. The system processes them all without you needing to lift a finger.

This is what makes the whole system so effective. By 2025, invoice automation has become incredibly sophisticated. Deep learning models can now pull data from just about any invoice format with an accuracy rate that often tops 90%. This drastically reduces the kind of human errors that creep in during manual data entry.

Why This is a Smarter Way to Work

The real beauty of using AI is that it handles the chaos. You can’t control the format your vendors use for their invoices, and with this approach, you don't have to. Big players are seeing huge wins here - just look at examples like JPMorgan's platform for automating invoices and payments, which shows just how much of an impact this can have on financial workflows.

It’s not just about pulling text from a PDF. It’s about getting the right information, every single time, without you having to babysit the process. The AI takes over the tedious work, giving you back clean, structured data.

Before you dive in, it’s helpful to see a direct comparison of the old way versus the new.

Manual vs Automated Gmail Invoice Extraction

This table breaks down the core differences between slogging through your inbox by hand and letting an AI-powered tool do the work for you. The contrast in time, cost, and accuracy is pretty stark.

| Metric | Manual Processing | Automated Extraction |

|---|---|---|

| Time Spent | 3-10 minutes per invoice | Seconds per invoice |

| Cost | High (labor hours) | Low (fixed subscription) |

| Accuracy | Prone to human error (typos, missed data) | Highly accurate (over 90%) |

| Scalability | Poor; more invoices mean more staff | Excellent; handles volume effortlessly |

As you can see, automation isn't just a minor improvement - it fundamentally changes the game.

This whole process turns a frustrating manual task into something that just happens in the background. If you want a step-by-step walkthrough, our guide on how to extract invoices from Gmail covers setting up these workflows in detail.

Ultimately, this lets your team stop being data entry clerks and start being financial strategists.

Setting Up Your First Automated Workflow

Alright, let's roll up our sleeves and actually build your first automated invoice processing machine. We're not just talking theory here; we’re going to walk through a real-world setup so you can see exactly how to connect the dots and get your Gmail invoice extraction working. We'll stick to a common scenario: using an automation platform to pull invoices from Gmail and send the data straight into Google Sheets.

This is way more straightforward than it sounds. You don't need to be a developer to pull this off. Modern tools are built with visual, drag-and-drop interfaces, letting you create a powerful workflow that can literally save you hours of manual data entry every single week.

The Three Key Pieces of Your Workflow

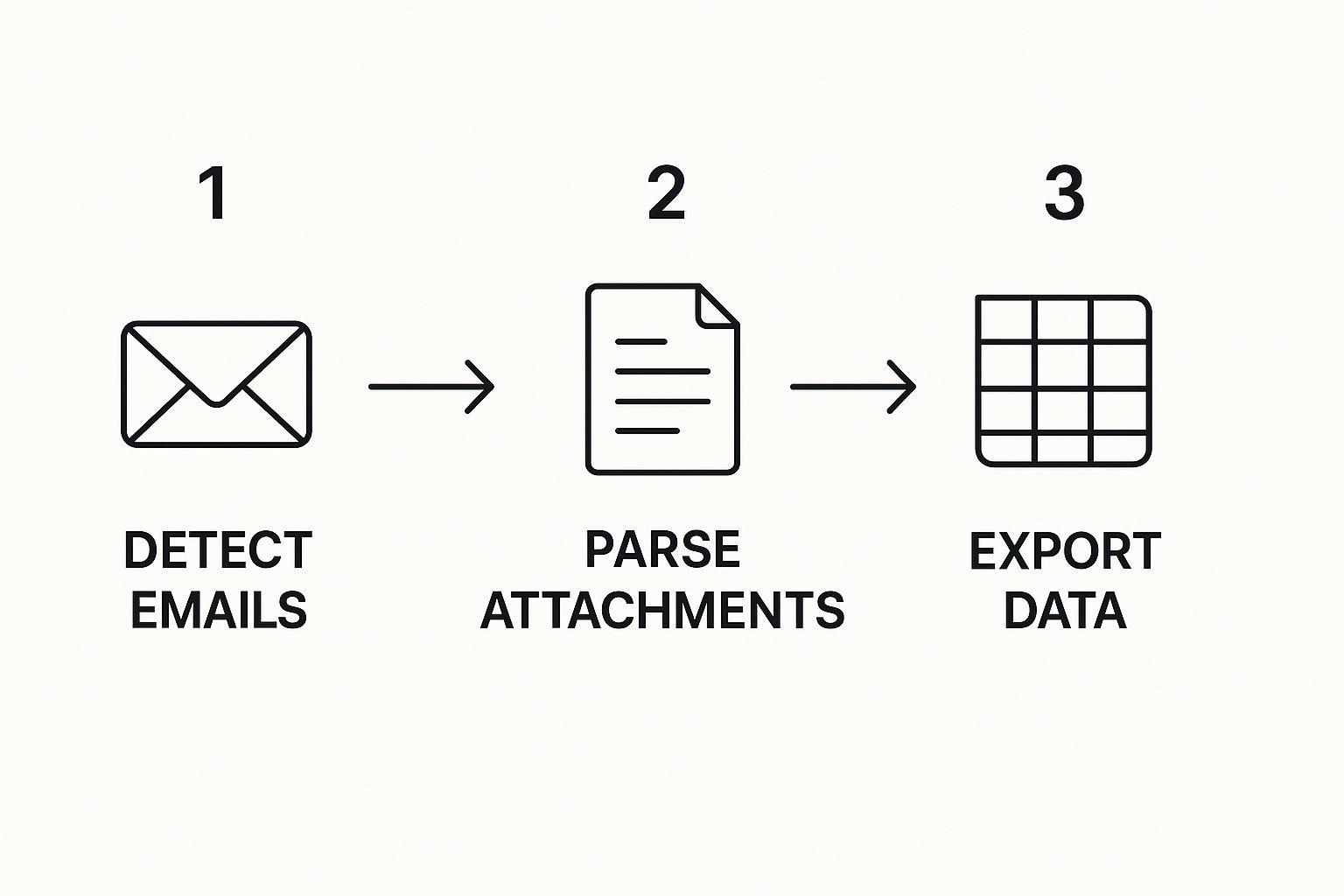

Before you start clicking around, it helps to understand the three main building blocks of any invoice automation. Just think of it like a mini assembly line for your financial data.

- •The Trigger: This is what kicks everything off. For us, the trigger is a new email landing in your Gmail inbox that meets certain criteria - maybe it's from a specific supplier or has the word "Invoice" in the subject line.

- •The Action: Here's where the real magic happens. Once an email is flagged, the system’s AI and OCR tech get to work. They scan the attached invoice (usually a PDF), "read" it, and pull out all the important bits of information you need, like the invoice number, total amount due, and the payment deadline.

- •The Destination: This is the final stop for your neatly organized data. All the extracted details are automatically sent to another app, whether that’s a new row in a Google Sheet, a bill created in QuickBooks, or even a task in your project management software.

This flow is the heart of the whole operation, from spotting the email to exporting the data.

It’s this simple three-part structure that forms the backbone of a system that can run entirely on its own.

Getting Connected and Filtering the Noise

First thing's first: you need to give your automation tool secure permission to access your Gmail account. This is usually handled with something called OAuth, which is just a fancy, secure way of granting access without ever handing over your password. Your tool never sees your login info, so your account stays safe.

Once you’re connected, it’s time to set up filters. This is where you tell the system exactly what to look for, so you aren't trying to process your weekly newsletters.

You can get pretty specific here:

- •Filter by Sender: A great place to start is to only watch for emails from specific vendor addresses, like

billing@supplier.com. - •Filter by Subject: You can also tell the system to only grab emails with keywords like "invoice," "receipt," or a specific PO number format.

- •Filter by Attachment: Some tools even let you set the trigger to only fire if the email has a PDF attached, which adds another layer of precision.

My Advice: Start small. Pick one or two of your highest-volume vendors and build the filter just for them. This lets you test and perfect the workflow on a manageable scale before you roll it out for everyone.

Getting this right is a core principle of good digital workflow automation.

Mapping Your Invoice Data

With your filter in place, the next step is mapping. This is where you play matchmaker, telling the system where to put the data it pulls from the invoice. The AI will identify fields like "Invoice Number," "Total Amount," and "Vendor Name," and you just need to connect them to the right columns in your Google Sheet or fields in your accounting software.

This is the crucial step that ensures consistency. Every single invoice from that vendor will now have its data land in the exact same format, every time. That consistency is what kills manual errors and makes your financial data something you can actually trust.

Once you test it out and flip the switch, this workflow will run silently in the background, grabbing and organizing your invoices the moment they arrive.

Getting your first automated workflow up and running is a fantastic start. But the real magic of gmail invoice extraction happens when you dial in the accuracy. Let's be honest, an automation is only useful if you can trust it. This is where we go from a basic setup to a truly smart system that can handle all the weird formats and curveballs your suppliers love to send.

Sometimes you'll get an invoice with a bizarre layout. Or maybe a key piece of information, like the "Invoice Number," is missing a clear label. This is your chance to teach the AI how to be even smarter.

https://www.youtube.com/embed/8Gqo5ZIEJAY

Creating Smarter Extraction Rules

Think of the AI like a new junior employee. It knows the basics of reading an invoice, but it needs you to point out the specific quirks of each vendor. When you see it struggling with a certain supplier's format, you don't throw your hands up - you just give it better instructions.

For example, what if a vendor never labels the "PO Number" field? Instead of just accepting a blank field every time, you can create a custom rule. You could tell the system to find any number that always starts with "PO-" or to grab the number located directly underneath the main billing address. This kind of contextual guidance is what takes the AI's performance from pretty good to incredibly reliable.

You can also set up rules to handle common variations you see all the time:

- •Keyword Anchors: If an invoice is missing a "Total" label, tell the AI to look for phrases like "Amount Due" or "Please Pay" and extract the dollar amount closest to it.

- •Date Format Handling: Some suppliers use

MM/DD/YYYY, while others preferDD-MON-YY. You can train the system to spot these different formats and automatically standardize them into a single format for your records.

Using Validation to Catch Errors Early

Validation checks are your safety net. These are simple but powerful rules you can set up to automatically flag potential mistakes before they ever get into your accounting software. It’s all about catching issues upfront instead of cleaning up a mess later.

I see this all the time: people expect the AI to be perfect right out of the box. The real power comes from guiding its learning. By correcting its first few attempts and setting up smart validation rules, you’re training it to become a precise, reliable part of your team.

For instance, you could set a validation rule to flag any invoice where the total is over $10,000, sending it to you for a quick manual review. Or, if you know a particular vendor's invoices are always between $500 and $1,500, you can create a rule that alerts you if an extracted total falls outside that range. Simple, but so effective.

Training the AI with Your Feedback

Modern systems like Tailride are built to learn from your input. When you review an extracted invoice and fix a mistake - maybe it grabbed the shipping date instead of the due date - you’re doing more than just correcting one document. You're giving the AI direct feedback that it uses to refine its model for every future invoice from that same vendor.

This feedback loop is what makes the system so powerful. After you make just a handful of corrections for a specific supplier, you'll see the accuracy for that vendor improve dramatically. It's a tiny investment of your time that pays off big, making your gmail invoice extraction process stronger and more dependable with every invoice that comes in.

Where Does Your Invoice Data Go Next? Connecting It All Up

Getting data out of Gmail is a massive first step, but honestly, that’s only half the battle. The real magic happens when that clean, organized data automatically flows into the business tools you rely on every day. This is how you close the automation loop and turn your Gmail invoice setup into a truly hands-off system.

The whole point here is to finally kill that last bit of manual drudgery: the copy-paste. Forget exporting a CSV and then uploading it somewhere else. We're talking about a seamless connection where the moment an invoice is processed, its data instantly shows up right where you need it to be.

Create a Live Financial Dashboard in a Spreadsheet

One of the most powerful and immediate things you can do is pipe your extracted data straight into a spreadsheet. Imagine a Google Sheet that acts as a real-time expense tracker for your entire company, updating itself automatically.

Every time a new invoice is captured, the system can add a new row to your sheet, filling in the columns you've set up.

- •Vendor Name: The supplier’s name drops right into Column A.

- •Invoice Date: Column B gets populated with the date it was issued.

- •Total Amount: The total due lands in Column C, ready for your formulas.

- •Due Date: Column D tracks payment deadlines so you never miss one.

This gives you a constantly updated view of your accounts payable without ever needing to dig through your inbox. As of mid-2025, this workflow - scanning Gmail, grabbing attachments, and pushing data to a spreadsheet - has become insanely efficient, all thanks to integrated AI.

By connecting your tools directly, you’re not just shuffling data around. You’re building a single source of truth for your finances that updates itself. This breaks down data silos and ensures your entire team is working with the same accurate numbers.

Push Data Directly Into Your Accounting Software

For a lot of businesses, the final destination for invoice data is the accounting software. A good automation platform can go beyond simple spreadsheets and connect directly with systems like QuickBooks, Xero, or Business Central.

This is what a true end-to-end workflow looks like. An invoice lands in Gmail, the AI pulls out the key info, and a new bill is instantly created in your accounting platform, waiting for approval. This completely eliminates manual data entry, which is where a staggering 73% of finance professionals say most errors happen.

Trigger Actions in Your Other Business Apps

And why stop with just finance tools? You can use this extracted invoice data to kick off all sorts of helpful actions across your entire tech stack.

For example, you could set up a rule that sends a notification to a specific Slack channel for any invoice over $5,000, tagging the finance manager for immediate review. Or maybe you want it to create a task in your project management tool to make sure the payment gets scheduled on time. This kind of integration turns your invoice processing workflow from a simple data capture exercise into a smart, proactive system that keeps everyone on the same page.

Still Have Questions About Invoice Automation?

It's completely normal to have a few questions before plugging a new tool into your financial workflow. When it comes to something as important as Gmail invoice extraction, I've found most people have similar concerns about security, accuracy, and just how tricky the setup really is.

Let's tackle those head-on.

Is It Really Secure to Connect an AI to My Gmail?

I get it - connecting anything to your inbox feels a little nerve-wracking. But yes, it’s secure. Reputable platforms use battle-tested authentication methods like OAuth 2.0.

This is the key part: you aren't handing over your password. Instead, you're granting specific, limited permissions. The tool can only read emails you direct it to (like those with a specific "Invoices" label), and it can't touch anything else. It's a secure handshake, not a free-for-all.

What if the AI Messes Up and Grabs the Wrong Info?

Let's be real: no AI is flawless right out of the box. But modern systems are built for this. They almost always include a quick review step where you can glance over the extracted data and make any needed corrections.

Here’s the best part, though. Every time you fix something, the AI learns. Correcting an invoice total from one vendor teaches it how to read that vendor's invoices better next time. You can even set up your own rules, like flagging any invoice total that seems way too high for a final check.

The point isn't just to pull data; it's to build a system you can trust. A few minutes spent making corrections at the start trains the AI to become a genuinely reliable part of your process.

If you want to see how different platforms handle this, checking out various types of invoice automation software can give you a better feel for the features that matter most to you.

How Technical Do I Need to Be?

You definitely don't need to be a developer. These tools are specifically designed for business owners, accountants, and operations folks - not programmers.

Think of it this way: if you're comfortable using Gmail and maybe a spreadsheet, you have all the skills you need. The setup is all visual, with drag-and-drop interfaces for connecting your apps and telling the AI which data fields to look for. It’s built to be intuitive.

Ready to finally stop chasing down invoices and get your workflow running on autopilot? You can get your first invoices extracted in just a few minutes with Tailride. Get started for free at https://tailride.so.