Extract PDF Invoices from Email The Easy Way

Tired of manual data entry? Learn how to extract PDF invoices from email automatically. A practical guide to saving time and streamlining your AP process.

Let's be real - manually pulling PDF invoices from your email, then punching all that data into another system is a soul-crushing time suck. This old-school approach isn't just annoying; it's a silent killer of productivity, paving the way for expensive mistakes and infuriating delays. The good news? You can put this entire workflow on autopilot and get those hours back.

Why Sticking to Manual Invoice Processing Is Costing You Big

Manually wrangling invoices is way more than a minor hassle. It’s a major operational bottleneck that comes with a real price tag. Every single time someone on your team has to open an email, download a PDF, and painstakingly type invoice details into your accounting software, your business is leaking time and money. It's a surprisingly expensive habit once you add up the labor and the inevitable "oops" moments.

Picture this all-too-common scene: a vendor invoice lands in a cluttered inbox and disappears into the digital abyss. Days - or even weeks - later, someone finally unearths it, prints it out, and drops it in a physical tray for approval. That single delay can mean missing out on an early payment discount or, even worse, getting hit with late fees and damaging a great vendor relationship.

The Shocking Numbers Behind the Scenes

The scale of this issue is far bigger than most people think. Believe it or not, the global average cost to process a single invoice by hand can climb as high as $22.75. That eye-watering number is driven by the sheer amount of hands-on work required and a sluggish average processing time of 14.6 days per invoice.

To make matters worse, a staggering 39% of invoices have errors, which throws a wrench in the works and adds even more cost and complexity. You can discover more insights about these global invoicing trends and see just how your own process stacks up.

The real cost of manual data entry isn't just what you pay your staff per hour. It's the snowball effect of payment errors, forfeited discounts, and all the high-value strategic work your team could have been doing instead.

The Damage Goes Beyond Dollars and Cents

The fallout doesn't stop with the direct financial hit. Manual processing is a breeding ground for human error. One tiny typo when entering an invoice total or due date can spiral into overpayments, underpayments, or duplicate payments. And guess what? Each of those mistakes requires even more time and effort to untangle.

This whole mess creates a slow, clunky accounts payable cycle that holds you back. When your finance team is buried under a mountain of data entry, they have zero time for the work that actually moves the needle - things like financial analysis, cash flow forecasting, and big-picture strategic planning. By clinging to the old way of manually extracting PDF invoices from email, businesses are essentially throttling their own growth.

Let's break down the differences a bit more clearly.

Manual vs Automated Invoice Processing at a Glance

Here’s a quick comparison highlighting the key differences between the old-school manual methods and a modern, automated approach to handling email invoices.

| Metric | Manual Processing | Automated Extraction |

|---|---|---|

| Average Cost Per Invoice | Can exceed $20 | As low as a few dollars |

| Processing Time | 1-2 weeks on average | Minutes |

| Error Rate | High, prone to human error | Near-zero, thanks to AI validation |

| Team Focus | Tedious data entry & correction | Strategic analysis & exception handling |

| Scalability | Poor; more invoices = more staff | Excellent; handles volume effortlessly |

| Visibility | Limited; hard to track status | Full; real-time dashboards |

As you can see, the contrast is stark. One path is slow, expensive, and risky, while the other is fast, cost-effective, and reliable. This guide is all about showing you how to get on the right path.

Finding the Right Invoice Extraction Tool

Once you’ve had enough of manual data entry, the next step is finding the right tool to take over. The market is absolutely flooded with options, which is both a blessing and a curse. You'll find everything from simple email parsers to sophisticated platforms that use AI to read and interpret invoices with human-like accuracy.

There's a good reason this software market is booming. Businesses are finally catching on to just how much time and money they can save. The market was valued at a hefty USD 36.1 billion back in 2025 and is on track to hit an incredible USD 189.2 billion by 2035. Picking the right tool isn’t just about fixing today’s headache; it’s about setting up a workflow that can grow with you.

Core Features to Look For

When you start digging into different tools, there are a few features that are simply non-negotiable. These are the things that separate a genuinely useful automation tool from a glorified data entry shortcut.

Here’s what I always tell people to look for:

- •AI-Powered OCR: Basic Optical Character Recognition (OCR) is old news. It can pull text from a PDF, sure, but AI-driven OCR is the real game-changer. It actually understands the document, meaning it knows an invoice number from a due date, even if your suppliers format their invoices completely differently.

- •Seamless Integrations: This is a big one. Your new tool has to talk to your existing accounting software. If it doesn't have a solid, direct connection to platforms like QuickBooks, Xero, or Business Central, you’re just creating another manual step for yourself. The whole point is to have data flow automatically.

- •Customizable Rules: Every business has its quirks. A great tool lets you create your own rules to match your process. Think about automatically tagging invoices from certain vendors for a specific project or flagging any invoice over a set dollar amount for review. That's where the real power lies.

Beyond the Basics: What Really Matters

While the core features are your starting point, it’s the user experience and the tool's ability to grow with you that make all the difference in the long run. A powerful piece of software is worthless if your team can't figure out how to use it.

A great invoice extraction tool shouldn't just be powerful; it should be accessible. The goal is to reduce your team's workload, not add "learning complex software" to their to-do list. The best platforms feel like they're built for you, not for an engineer.

Scalability is the other piece of the puzzle. Will the tool you choose today still work for you when your invoice volume doubles or triples? Take a close look at the pricing. Does it scale fairly as your usage increases? A solution that's perfect for 100 invoices a month needs to be just as viable when you're pushing 1,000.

It often helps to look at the best business process automation tools to see how invoice processing fits into your company's bigger automation strategy. You're not just buying software; you're investing in a partner for your growth. We actually designed our own https://tailride.so/tool/pdf-invoice-extractor with this very balance of power and simplicity in mind.

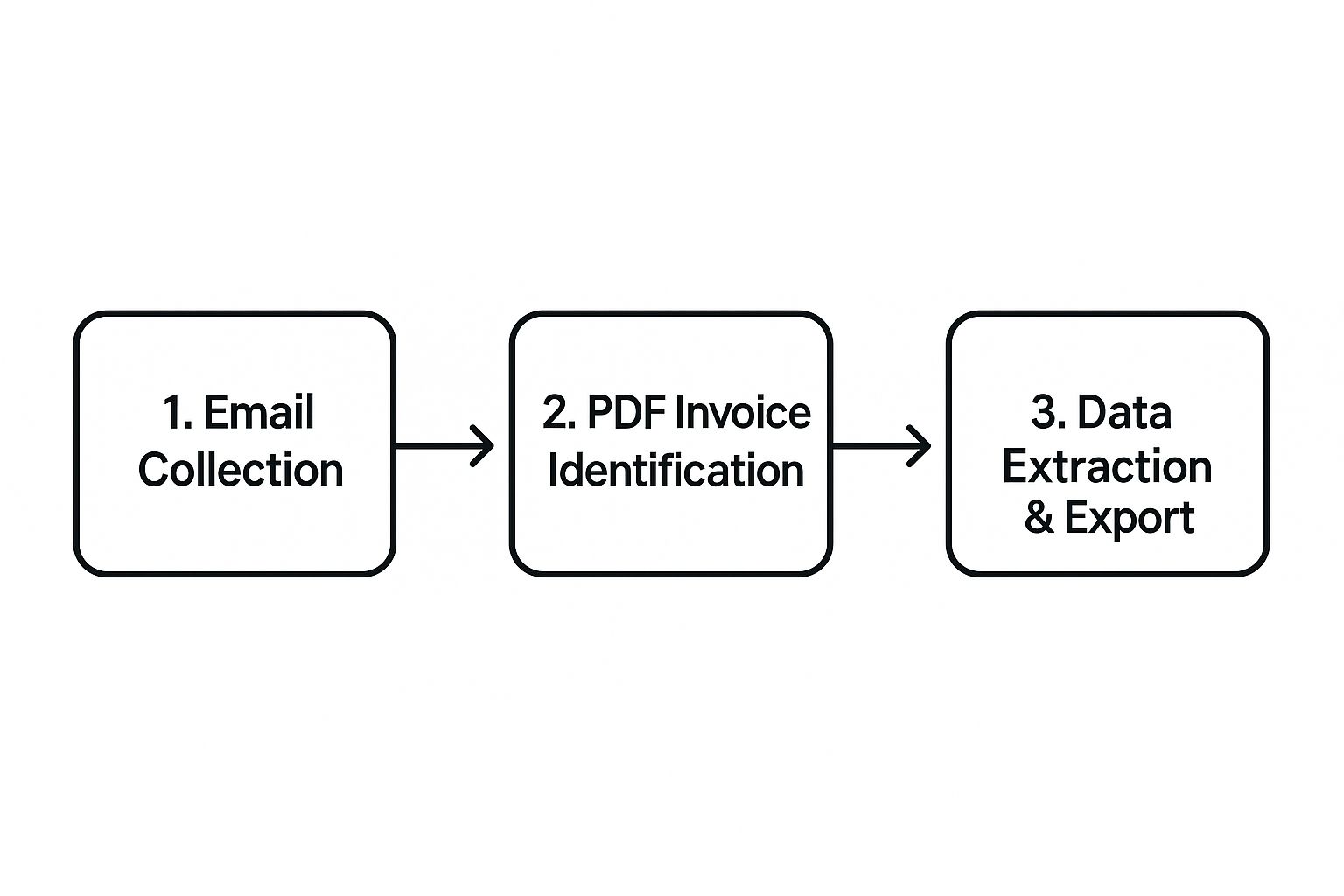

Connecting Your Email for Automated Capture

Getting your invoice extraction tool to actually do its job starts with one simple but critical step: feeding it the invoices. To automatically extract PDF invoices from email, you need to build a solid bridge between your inbox and your new software. Don't worry, this isn't some complex technical hurdle. It's about setting up a simple, reliable pipeline that just works in the background.

The smartest strategy I've seen, and one I always recommend, is to create a dedicated email address just for invoices. Think invoices@yourcompany.com or ap@yourcompany.com. This little organizational trick is a game-changer. It keeps your main inbox from getting cluttered and guarantees that every single email landing there is a bill that needs processing. It’s a simple move that pays off big time in accuracy and efficiency later on.

With that dedicated address in hand, the next step is to automatically funnel all those invoices into it.

Setting Up Auto-Forwarding Rules

Thankfully, modern email clients like Gmail and Outlook make this incredibly easy. You can set up a rule that automatically forwards messages based on specific criteria. For instance, you could create a filter that looks for emails from known vendors or, even more broadly, one that catches any email with a PDF attachment.

Here's a quick peek at what the forwarding setup looks like in Gmail. It's pretty straightforward.

As you can see, you just add your new dedicated forwarding address, verify it, and you're good to go. Your invoice automation tool will now get a copy of every relevant email without you lifting a finger.

For those who need something a bit more direct and real-time, some tools can plug right into your email server. You might want to explore an IMAP email monitor to see how this kind of direct integration can shave off even more processing time.

My Go-To Tip: When you're building that forwarding rule, add one more condition: apply a label like "Forwarded for Processing." This gives you a clear visual tag right in your inbox, showing you exactly which invoices have been sent over. It’s a lifesaver for avoiding duplicate entries.

The whole point is to make this process completely hands-off once it's set up. It's a simple yet powerful flow that takes a manual chore and turns it into a silent, automated workflow. By getting this initial connection right, you’re laying the groundwork for a much more efficient, error-free accounts payable system.

Showing the AI How to Read Your Invoices

Alright, now that you've got your email connection sorted, we're heading into the most critical part of the whole setup. This is where the magic really happens - where you take a general-purpose tool and turn it into a sharp, custom-trained assistant that understands your business inside and out. You're not just crossing your fingers and hoping the AI figures it out; you're actively showing it what matters.

And don't worry, this isn't nearly as technical as it sounds. Most modern platforms have made this incredibly simple with a point-and-click interface. You’ll just grab a sample invoice from one of your vendors, upload it, and it'll pop up on your screen. From there, your job is to simply point out the important bits of information.

Point, Click, and Build a Smart Template

Let's say you have an invoice from your web hosting provider. You’ll literally use your mouse to draw a box around the invoice number. A little pop-up will ask what this is, and you’ll just label it “Invoice Number.” Easy.

You just repeat that simple action for all the other key fields you care about:

- •Due Date

- •Total Amount

- •Supplier Name

- •Purchase Order Number

What you're really doing here is building a smart template. Once you save it, the AI now has a perfect map for what an invoice from that specific supplier looks like. The next time one of their emails lands in your inbox, the system instantly recognizes it, applies this template, and pulls the right data with incredible precision.

This is why the template approach is so important - no two suppliers lay out their invoices the same way. One might say "Invoice #," while another uses "Reference No." By showing the AI how to navigate these little differences, you’re setting yourself up for truly reliable, hands-off automation.

The real power of AI here isn't just that it can read text - it's that it can learn context. By building these templates, you’re creating a library of business knowledge that makes the system smarter and more dependable with every supplier you add.

Tackling Line Items and Tricky Layouts

But what about the nitty-gritty details, like individual line items? The process is basically the same. You can teach the AI to spot the entire table of products or services on an invoice. You'll highlight the area and define the columns - things like Description, Quantity, Unit Price, and Line Total - and the AI learns to grab every single row automatically.

For any business that needs to track expenses on a granular level, this is a massive win. Think about it: manually punching in a dozen line items from a single invoice is not only a drag but also a recipe for typos. With a trained model, it’s all done in a flash. If you want to see this in action, our complete guide on how to extract data from invoices breaks it down with more examples.

The impact here is huge. Good PDF invoice data extraction software has completely changed the game for accounts payable departments by nearly eliminating manual entry mistakes and dramatically speeding things up. The best AI tools are now hitting about 99% accuracy, processing invoices in seconds, not hours. It’s common for businesses to see a 60%–80% drop in processing costs and a 90% boost in speed within the first few months. You can learn more about the power of PDF invoice data extraction software on fluxity.ai.

Putting Your Extracted Invoice Data to Work

Getting the data out of a PDF is a fantastic first step, but let's be honest, that's not the end of the road. The real game-changer is what you do next - getting that information to automatically populate all the other systems that keep your business running. This is where we close the loop and turn a mind-numbing task into a genuinely automated workflow.

The whole point is to finally ditch the copy-and-paste grind. All that valuable invoice data you just pulled - supplier name, total amount, due date - shouldn't just die in a spreadsheet. It needs to land right where it belongs: in your accounting software, ERP, or even your project management tool, all set for your accounts payable process.

Connecting to Your Financial Hub

Most invoice extraction tools I've worked with are built for this exact purpose. They come ready with direct, native integrations for the big players in the accounting world. Linking your tool to platforms like QuickBooks, Xero, or Business Central is usually as simple as signing in and giving it the green light.

Once they're talking to each other, you can map the fields. It's a pretty intuitive process. You’re just telling the system where to put the data:

- •The Supplier Name from the invoice? That goes into the Vendor field in QuickBooks.

- •Total Amount gets mapped straight to the Bill Total.

- •Invoice Number lines up perfectly with the Ref No. field.

This kind of direct link is hands-down the best way to keep your data clean and build a rock-solid, seamless process.

Expanding Your Reach with Integration Platforms

But what happens when there's no direct connection for a niche app you rely on? That’s where tools like Zapier or Make become your best friend. Think of them as universal translators, letting thousands of different apps chat with each other.

The real value of automation isn't just speed; it's consistency. By creating a digital pipeline for your invoice data, you ensure that every bill is entered the same way, every single time, drastically reducing the "human error" variable.

For instance, you could set up a simple workflow (a "Zap" in Zapier lingo or a "Scenario" in Make) that kicks off the moment a new invoice is processed. From there, it can grab that data and create a new entry in pretty much any cloud-based tool you can think of.

The possibilities are almost endless. This is how you finally extract PDF invoices from email and make that data start pulling its weight, automatically.

Common Questions About Invoice Extraction

Diving into any new automation tool can feel a bit overwhelming at first. It's totally normal to have questions as you start figuring out how to extract PDF invoices from email. I've pulled together some of the most common questions we get to give you clear, straightforward answers and help you get started on the right foot.

Think of this as your go-to FAQ for building a smarter, faster accounts payable workflow. These are the real-world questions that pop up once you actually start connecting the pieces.

How Does the Tool Handle Scanned Invoices?

This is a fantastic and very common question. A lot of tools can only read text-based PDFs that were created digitally. But what happens when you get a scanned invoice - basically just a picture of a paper document? For that, you need a tool with Optical Character Recognition (OCR) technology.

OCR is the magic that lets software "read" the text from an image and turn it into data you can actually use. So, when you're looking at different options, always check if they have solid OCR capabilities. If not, you'll be stuck doing manual data entry every time a vendor sends a scanned file, which kind of defeats the whole purpose.

What About Invoices in Different Languages or Currencies?

Business is global these days, and your invoices probably reflect that. Good news is, high-quality extraction tools are built to handle this. They can typically recognize and process invoices in multiple languages and accurately capture different currencies without breaking a sweat.

You can usually set a default currency, but the AI is smart enough to spot symbols like €, £, or ¥ right on the document. This is a bigger deal than it sounds - it prevents a $500 USD invoice from being logged as $500 AUD, a tiny mistake that can cause major accounting headaches down the road.

One of the most overlooked benefits of an automated system is how it standardizes global data. It takes messy invoices from all over the world and organizes them into a single, consistent format that your accounting software can easily understand.

Can I Extract Data from the Email Body Too?

Absolutely. While this guide focuses on PDF attachments, let's be real - sometimes the "invoice" is just text in the body of an email. Modern parsing tools don't just look for attachments; you can set them up to read the email content itself.

You can create rules to find and grab key info right from the message. This is perfect for things like:

- •Payment links: Capturing a Stripe or PayPal link for quick payment.

- •Subscription renewal dates: Pulling dates mentioned in the text.

- •Total amounts: Finding the total even if it’s just plain text.

This flexibility means no invoice slips through the cracks, no matter how a vendor decides to send it.

For a deeper dive into the entire invoice automation process, from different tools to full implementation strategies, this How to Automate Invoice Processing: A Complete Guide is a great resource. It really lays out the end-to-end workflow.

Ready to stop the manual data entry grind for good? Tailride connects directly to your inbox to automatically capture and process every invoice, so you can get back to what really matters. Start your free trial today.