How to Export Invoices in DATEV Format Easily

Learn how to export invoices in DATEV format with this friendly guide. We cover system prep, export steps, and troubleshooting for a seamless process.

If you're doing business in Germany, you’ve almost certainly come across the name DATEV. It's the gold standard for exchanging financial data with your tax advisor, and for good reason. Exporting your invoices in the proper DATEV format is the key to a smooth, error-free accounting workflow.

Think of it as the secret handshake between your invoicing software and your accountant’s system. It’s designed to eliminate manual data entry, which helps slash errors and keeps your books perfectly aligned with German tax law.

Why Should You Care About DATEV Invoice Exports?

The DATEV format is essentially a universal language that your business software and your tax advisor's system both understand fluently. Instead of emailing over a jumble of PDFs or a messy spreadsheet, you send a single, clean file that their software can import in seconds. It’s a simple step that completely transforms your financial process.

The biggest win here is efficiency. We've all been there - spending hours trying to hunt down a single typo in a spreadsheet. Manual data entry isn't just slow; it's a breeding ground for costly mistakes. A misplaced decimal or a wrong account number can spiral into a major headache. Exporting directly to DATEV format protects your data's integrity from your system to theirs.

The Bedrock of German Accounting

This isn't just about making things easier; it's fundamental to modern German accounting. The DATEV format is a specific type of CSV file, meticulously structured to import financial data into DATEV's own accounting software. Developed by DATEV eG, a cooperative of tax pros founded way back in 1966, it ensures every little detail - from gross amounts to tax codes - lands in the right place.

Taking this structured approach pays off in several ways:

- •Speedy Monthly Closings: Your tax advisor gets data they can use immediately, which really speeds things up.

- •Fewer Mistakes: Automation cuts out the risk of human error when transferring data.

- •Better Collaboration: It just makes for a smoother workflow and less back-and-forth with your accountant.

- •Audit-Proof Records: Standardized exports give you a clean, traceable history of every transaction, which is a lifesaver during an audit.

By using the DATEV standard, you’re doing more than just sending a file. You're plugging into a highly accurate and efficient financial system that keeps your business compliant and your advisor smiling.

Even if you're working with other accounting platforms, the core idea of clean data extraction is the same. For instance, our guide on how to handle QuickBooks invoice extraction digs into similar principles. At the end of the day, a clean export is the first step toward a much less stressful tax season.

Preparing Your System for a Perfect DATEV Export

Before you even think about hitting that export button, a little prep work can save you a mountain of headaches later on. Think of it as the mise en place for your accounting - getting all your ingredients in order ensures the final dish (your DATEV file) comes out perfectly.

Your first port of call should always be the Chart of Accounts. It doesn't matter if you're using SKR03 or SKR04; what matters is that every single account is set up correctly. Trust me, a single mismatched account code is the number one reason I've seen DATEV files get kicked back. Precision here is everything.

Fine-Tuning Customer and Tax Data

Next up, let's talk about your customer data. Every client needs a unique debtor account number. This isn't just some optional field for your internal records; it's the primary way the DATEV system connects an invoice to the right person or company. No number, no connection.

Just as critical are your tax rates. You need to be certain that your standard VAT rates, like 19% and 7%, are configured properly in your system. A surprisingly common slip-up is invoicing with an outdated or incorrect tax rate, which instantly throws off the books and gets flagged by your tax advisor’s software.

Expert Tip: Before you run your first export, take five minutes to spot-check a few of your biggest customers and most-used revenue accounts. Are the debtor numbers present? Are the tax settings still correct? This simple audit catches the vast majority of common import errors before they even happen.

To get your data ready for a seamless export of invoices in DATEV format, you really just need to focus on three key areas:

- •Complete Debtor Accounts: Make sure every single customer you've invoiced has their own debtor number assigned in their master file. No exceptions.

- •Accurate Chart of Accounts: Give your accounts a quick once-over to confirm they line up with the SKR03 or SKR04 framework your tax advisor is expecting.

- •Correct Tax Configuration: Verify that your VAT rates are up-to-date and applied correctly to the products or services on your invoices.

Nailing these fundamentals from the start means your export file will be clean and compliant, ready for your advisor to process without any back-and-forth. A little diligence here turns what could be a messy chore into a smooth, simple step in your monthly closing routine.

Alright, with all the prep work done, it’s time to actually generate your first DATEV export file. This part might seem a little intimidating at first, but once you’ve done it a couple of times, you'll see how much it simplifies your monthly closing process.

Let's walk through it together.

First, you'll head over to the export function within your accounting software. The most critical choice you’ll make here is locking in the correct date range. For most businesses in Germany, this means running a monthly export to keep everything aligned with standard financial reporting.

For instance, if you're closing out your October books, you’d set the filter to capture all invoices from ‘01.10’ to ‘31.10’. Getting this right is crucial - it ensures your tax advisor gets a clean, auditable record for that specific month. You can learn more about standard German accounting practices on docs.frappe.io.

Nailing the Export Settings

Beyond the date range, a few other settings will pop up. Pay close attention to these, as they make a big difference.

- •Grouping Data: You’ll often see an option to group the data by ‘accounts’ or by ‘items.’ My advice? Stick with grouping by accounts. This is the standard for most DATEV exports because it lines up perfectly with the Chart of Accounts structure your advisor works with.

- •Preventing Duplicates: Look for a checkbox that says something like "Exclude previously exported documents." Always check this box. It's a simple click, but it's a lifesaver. It stops you from accidentally sending the same invoice twice, which can create a real reconciliation nightmare for your accountant.

The goal here is simple: produce a clean, one-time export for a specific accounting period. Selecting the right date range and excluding past transactions are the two most important things you can do to give your tax advisor a file they can use immediately, no cleanup required.

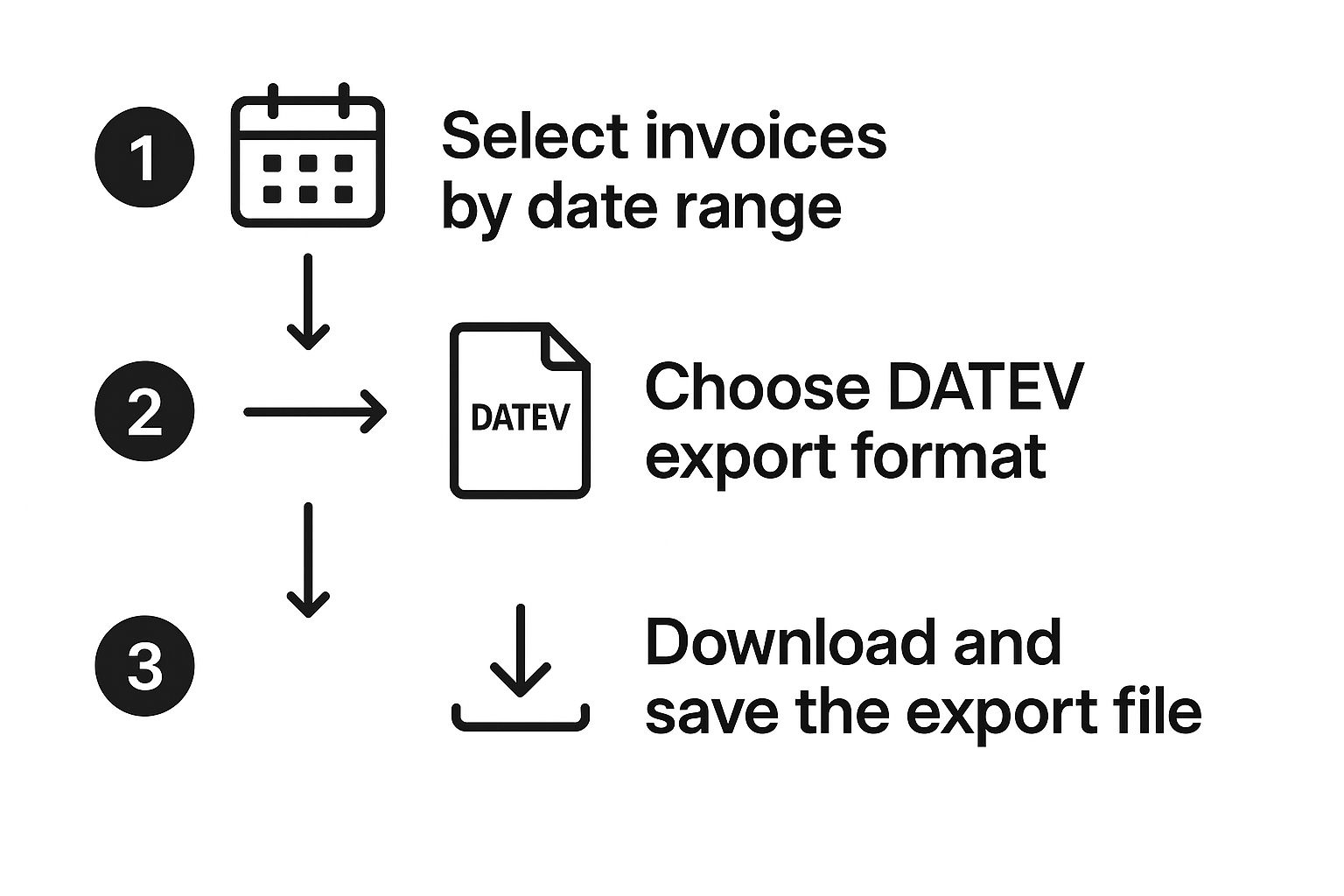

This little graphic breaks down the basic workflow for exporting your invoices.

As you can see, it really boils down to defining your scope, choosing the right format, and then grabbing the file to either save or send off.

Once you’ve confirmed all your settings, go ahead and generate the file. It will usually download as a ZIP archive that holds one or more CSV files. Now you're just one final check away from sending it off. And just like that, you’ve created your first clean, structured DATEV export - ready to go

What's Inside Your DATEV Export File?

Alright, you've got your hands on the exported CSV file. You open it up, and... it looks like a wall of code. Don't sweat it. That seemingly cryptic spreadsheet is actually a perfectly structured record of your transactions, and once you know what to look for, it’s easy to read.

The whole thing is built on the principles of double-entry bookkeeping. This is a core concept for any clean export of invoices in DATEV format. It just means a single invoice won't show up as a single line. Instead, it gets broken down into a few separate entries that have to balance each other out perfectly.

Following One Invoice Through the File

Let's walk through a real-world example. Imagine you sent an invoice for €119. That total breaks down into €100 net revenue and €19 in VAT.

In your export file, this single transaction will appear as (at least) three distinct lines:

- •The Debtor Line: You'll see a debit of €119 posted to your customer's debtor account. This line simply says, "This person owes us money."

- •The Revenue Line: Next, you'll find a credit of €100 posted to the appropriate revenue account (something like "Sales Revenue 19%"). This is the actual income you've earned.

- •The VAT Line: Finally, there's a credit of €19 posted to the VAT account. This represents the tax you've collected that you'll eventually owe to the tax authorities.

See how the debits (€119) exactly match the credits (€100 + €19)? That balance is the golden rule. If they don't match, the import into DATEV will fail.

This structured format is precisely why DATEV-compatible reports are so critical for businesses in Germany, streamlining how you work with your tax advisor. Many modern tools have built this functionality right in, as explained in articles like this one on how platforms support DATEV reports on support.holvi.com.

A quick pro-tip: Before you send the file over, open it in Excel or Google Sheets and just scan the debit/credit columns, booking texts, and account numbers. You can quickly spot glaring errors, like a missing debtor account or an incorrect tax posting. A quick check like this saves everyone a headache later.

Navigating Common DATEV Export Glitches

Even with a perfectly configured setup, you'll probably hit a bump in the road when you export invoices in DATEV format. Seeing a cryptic error message or getting a file rejected by your tax advisor is frustrating, but don't worry - the fix is usually pretty simple once you know what to look for.

A "missing debtor account" error is one of the most common culprits. This one is refreshingly literal. It simply means an invoice in your export batch is tied to a customer who hasn't been assigned their unique debtor number yet. The fix? Just find that customer in your system, pop in the correct number, and run the export again.

Dealing with Formatting and Balance Errors

Another classic headache is the "unbalanced entry" flag from your accountant. This pops up when the total debits and credits for a transaction don't match. More often than not, this points to an incorrect tax rate on a single line item or a mix-up in how a credit note was handled.

Here are a few practical fixes for the most common export problems I've seen:

- •File Rejected for Bad Formatting: First things first, check your export settings. Are you using the right DATEV format version, like v7.0? Sometimes a software update can quietly switch these defaults back.

- •Export Freezes Mid-Process: If you’re exporting a huge batch of invoices (like at year-end), the system can time out. The easiest way around this is to break it down. Try exporting one month at a time to reduce the load and help you pinpoint any problematic entries.

- •Credit Notes Causing Chaos: Make sure your credit notes are correctly mapped to their reversal accounts. A single misconfigured credit note can throw off the balance of the entire export batch.

Don't let a failed export throw a wrench in your day. The problem is almost always a small data mismatch. The trick is to find the specific invoice causing the trouble and fix the data at the source.

Sorting these issues out by hand can really eat up your time. That's a big reason why many businesses are now exploring ways to streamline the entire data capture process from the get-go. Learning how to automate invoice processing can make sure your data is clean and properly formatted long before you even hit the export button, sidestepping many of these problems entirely.

Got Questions About DATEV Exports? We’ve Got Answers.

Even with the best instructions, you're bound to run into a few specific questions when you first start to export invoices in DATEV format. It’s completely normal. Let’s walk through some of the most common things people ask so you can get ahead of any potential hiccups.

One of the first things I'm often asked is, "Can I just export one single invoice?" The simple answer is almost always no. Most systems, and the accountants who use them, are set up to work with batches of transactions for a set period, like an entire month. This is actually a good thing - it ensures your tax advisor gets a complete, balanced dataset to work with for your monthly books.

Another area that trips people up is handling international invoices. Dealing with different currencies or reverse-charge VAT can feel like a headache waiting to happen, but it doesn't have to be.

How to Handle Special Invoice Types

When you export your invoices, the system should automatically convert foreign currencies using the exchange rate from the invoice date. That said, it’s always a smart move to double-check that your foreign currency accounts are mapped correctly in your Chart of Accounts beforehand. A little check now saves a lot of back-and-forth later.

For those international and special cases, here are a few pointers from experience:

- •Foreign Currencies: Make sure your software is configured to pull the right daily exchange rate. The converted amount needs to land in the correct accounts.

- •Reverse-Charge VAT: These invoices have to be flagged correctly from the start. A misconfigured reverse-charge invoice is one of the most common reasons for booking errors.

- •Credit Notes: Always, always export credit notes in the same batch as the invoices for that period. This gives your accountant the complete story and avoids painful reconciliation problems down the line.

The big takeaway here is that your accounting software is meant to do the heavy lifting. Your main job is to ensure the initial data - customer details, tax settings, account mappings - is spot-on from day one. A clean setup is the secret to avoiding nearly every common export issue.

Automating Data Entry for Cleaner Exports

"What about all my old invoices? Do I seriously have to enter them all by hand?" This is a huge, and valid, concern for anyone switching systems. Manually keying in a year's worth of invoices is not only a monumental chore but also a recipe for typos and errors.

This is exactly where automation makes all the difference. Instead of spending hours typing, you can use tools to pull the data right from the source document. For a closer look at how this works, check out our guide on how email invoice extraction can help. When you automate the data capture from the beginning, your records are pristine long before you even think about exporting.

Ready to stop wrestling with manual data entry and start creating perfect exports every time? Tailride connects to your email, scans your invoices, and captures all the data automatically, so your books are always accurate and ready for a seamless DATEV export. Get started with Tailride today and see your first invoices extracted in seconds.