Expense Reimbursement Invoice: What Is It & Why It’s Important

Learn what an expense reimbursement invoice is, why it’s important, and how it helps streamline your business expense processes. Get expert tips now!

Ever paid for a business lunch or a flight to a conference out of your own pocket? An expense reimbursement invoice is simply the formal document you give your employer to get that money back.

Think of it as a detailed, professional "you owe me" note. It’s absolutely essential because it creates an official paper trail for accounting and tax purposes, making sure everything is above board and that you get paid back promptly.

What an Expense Reimbursement Invoice Really Is

Let’s put it in simpler terms. Imagine you ask a friend to grab a specific tool for a project you're working on together. When they get back, you wouldn't just hand them a random amount of cash. You'd want to see the receipt to know the exact cost, right? That little exchange is the basic idea behind an expense reimbursement invoice.

In the business world, this document just makes that process official. It's more than a simple request for cash; it’s a vital tool for financial management. It proves that the spending was legitimate, helps the company track its budget, and ensures everything lines up with company policy.

While they might sound similar to receipts, they actually do very different jobs. If you're curious about the specifics, we break down the difference between an invoice and a receipt in another guide.

To get a handle on what you can and can't claim, a business expense calculator can be a lifesaver. It helps you see what qualifies as a legitimate expense before you even start filling out a form.

And this whole process is getting a major digital upgrade. The global market for expense processing is expected to more than double, rocketing from USD 1.78 billion in 2025 to USD 3.62 billion by 2035. This shift highlights just how important accurate, efficient expense tracking has become for modern businesses. You can learn more about these financial trends from industry reports on expense processing.

Key Functions of an Expense Reimbursement Invoice

So, what does this document actually do for everyone involved? This table breaks down its main jobs from both the employee and company perspectives.

| Function | What It Means for the Employee | What It Means for the Company |

|---|---|---|

| Formal Request | This is your official way of asking for your money back. | It's a formal trigger for the accounts payable process. |

| Proof of Expense | It provides clear evidence of the money you spent on behalf of the business. | This document verifies that the expense was real and business-related. |

| Financial Record | It serves as your personal record of the claim for your own financial tracking. | It creates an official entry for the company's accounting and tax records. |

| Policy Compliance | It demonstrates that your spending followed the company's rules. | It helps enforce spending policies and maintain budget control. |

At the end of the day, this invoice is the bridge that ensures fairness and transparency, making sure employees aren't left out of pocket and companies have a clear, accurate picture of their spending.

Why Getting Expense Reimbursement Right Is a Big Deal

Okay, so we know what an expense reimbursement invoice is, but why should you actually care? It’s easy to dismiss this as just another piece of administrative busywork, but in reality, a solid reimbursement process is a vital sign of your company's health. It touches everything from employee trust to the financial stability of your entire operation.

Think of it as a financial handshake between your company and your team. When an employee pays for a business dinner or a flight on their personal card, they're essentially giving the company a short-term, interest-free loan. Paying them back quickly and accurately isn't just good manners - it’s a powerful way to show you respect them and value their contribution.

Fostering Trust and Financial Integrity

Let's be real: a slow or clunky reimbursement system sends a terrible message. It tells your people that their financial well-being isn't a priority, which can crush morale and lead to disengagement. Who wants to front money for a company that takes forever to pay them back? On the flip side, a smooth, fast process makes employees feel secure and appreciated.

Beyond keeping your team happy, a proper reimbursement process creates the paper trail that acts as your company's financial shield. When tax season rolls around or - heaven forbid - you get audited, having a clean, organized record of every single business expense is absolutely non-negotiable.

This clear record-keeping is the backbone of compliance. It proves that your expense claims are legitimate business costs, not disguised compensation, which is a critical distinction for tax authorities.

Adapting to a Changing Economic Landscape

The need for a great system goes even deeper, right into corporate strategy. Those reimbursement invoices are goldmines of data for accurate budgeting, financial forecasting, and getting a handle on costs.

As the economy shifts, fixed reimbursement rates can quickly become outdated and unfair. For instance, with inflation, many companies have had to increase meal allowances in major cities to keep pace with rising costs. You can dig deeper into these financial management industry trends on Netsuite.com. Keeping your policies current ensures you’re not just fair, but also competitive.

Ultimately, understanding the "why" behind an expense reimbursement invoice transforms it from a boring form into a strategic tool. It helps you build a business that is trustworthy, compliant, and financially sound - protecting both your employees and your bottom line.

The Anatomy of a Perfect Reimbursement Invoice

So, what does a bulletproof expense reimbursement invoice actually look like? It's not just a form; think of it as the clear, simple story of a business expense. Every section provides a critical piece of the puzzle that your finance team needs to approve payments without a hitch. Get it right, and you ensure the company’s records are solid and audit-proof.

A perfect invoice leaves no room for confusion. It needs to spell out exactly who is asking for the money, what they bought, when and why they bought it, and - most importantly - include undeniable proof of the purchase. If any of these pieces are missing, you’re looking at delays, rejections, and a headache for everyone involved.

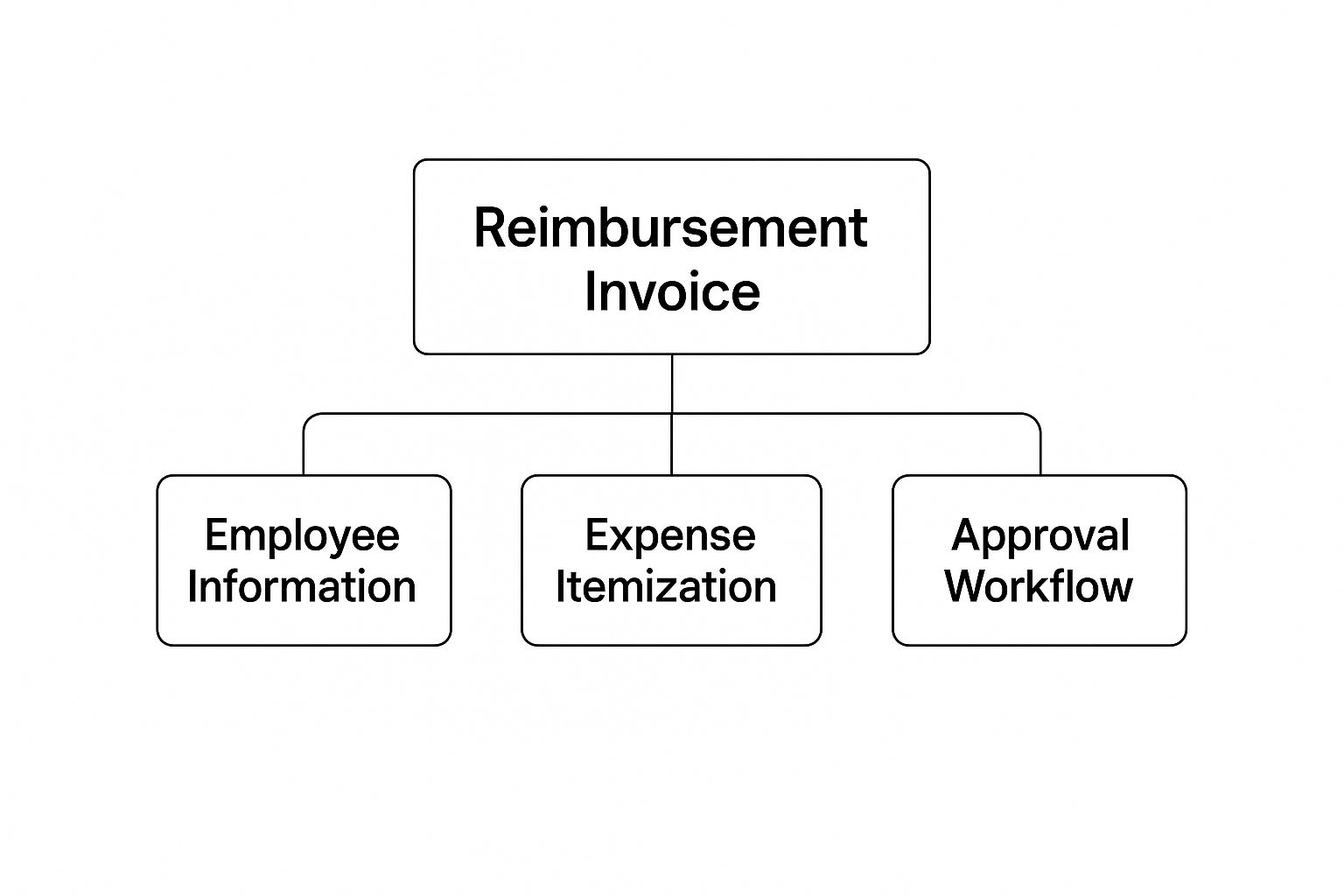

This infographic breaks down the core structure into three main pillars.

As you can see, every solid invoice is built on employee details, itemized expenses, and a clear approval path. Together, they create a transparent financial record that keeps everyone on the same page.

Must-Have Components for Every Invoice

To make sure your reimbursement request sails through the approval process, every single invoice needs a few essential elements. These are the non-negotiables that make a document easy for accounting to process, verify, and file away.

- •

Employee Information: This is the basic "who." It should include the employee's full name, their department, and an employee ID if your company uses them.

- •

Itemized List of Expenses: Don't just lump everything together. Each expense needs its own line item with the date, a clear description (like, "Client Lunch with Acme Corp"), its category (e.g., Meals & Entertainment), and the precise amount. This level of detail is vital for accurate budgeting and tax records.

- •

Attached Proof of Purchase: This is the big one. You absolutely must attach legible copies of receipts, bills, or confirmations for every single expense. Without a receipt, there is no proof of the expense. It's as simple as that.

- •

Business Purpose: A short, specific explanation of why the expense was necessary is key. "Client meeting" is too vague. Something like "Project kickoff meeting with Jane Doe to discuss Q4 goals" is specific, justifiable, and much more likely to get approved quickly.

- •

Totals and Signatures: The invoice has to clearly show the subtotal, any taxes, and the final reimbursement amount. Finally, it needs a spot for the employee's signature and the manager's approval signature.

Invoice Components Must-Haves vs Nice-to-Haves

Not all invoice details are created equal. Some are absolutely mandatory, while others are just helpful additions that make the process smoother for everyone. Here’s a quick breakdown.

| Component | Status | Why It's Important |

|---|---|---|

| Employee Name & ID | Must-Have | Identifies who is requesting the reimbursement, ensuring the right person gets paid. |

| Itemized Expense List | Must-Have | Provides a clear breakdown of costs for accurate accounting, budgeting, and financial tracking. |

| Receipts Attached | Must-Have | Offers concrete, undeniable proof of purchase, which is essential for audits and preventing fraud. |

| Business Purpose | Must-Have | Justifies the expense as a legitimate business need, helping with compliance and tax reporting. |

| Manager Approval | Must-Have | Confirms that the expense was authorized and necessary, adding a layer of internal control. |

| Invoice Number | Nice-to-Have | Helps with unique tracking and referencing, making it easier to find a specific claim later. |

| Project Code | Nice-to-Have | Allows finance to allocate the cost to a specific project or client, leading to more accurate project costing. |

| Payment Method Used | Nice-to-Have | Can provide extra context, especially for tracking expenses made on personal vs. corporate cards. |

Getting these must-haves right is the foundation of a good invoice. The "nice-to-haves" are just the icing on the cake that can really help your finance team keep things organized.

Of course, entering all this data by hand can be a real grind. It's no wonder so many businesses are turning to tools like invoice data capture software to automate the work and cut down on human error.

Moving From Paper Piles to Smart Systems

Remember the days of stuffing crumpled receipts into an envelope? That whole process was a chaotic mess of manual data entry, hunting down a manager for a signature, and then waiting weeks - sometimes months - to get your money back. The "old way" was a frustrating cycle of lost receipts and soul-crushing admin work for everyone involved.

This manual approach wasn't just slow; it was an open invitation for errors and compliance headaches. In fact, a recent survey found that 71% of finance leaders still struggle with expense compliance and fraud, mostly thanks to these outdated tracking methods. It’s no wonder projections show 75% of businesses will be using mobile expense apps by 2025 to handle their reimbursement invoices. Learn more about these business expense management trends on expenseout.com.

The Shift to Smarter Workflows

Today's tools have completely changed the game. Instead of paper piles, we now have smart systems that handle the entire expense reimbursement invoice process smoothly from start to finish. Ditching manual processes for automated invoice processing solutions is a game-changer for efficiency and saving time.

These new platforms are packed with features that make the old frustrations disappear:

- •Mobile Receipt Scanning: An employee can just snap a photo of a receipt the moment they get it. Optical Character Recognition (OCR) technology instantly reads the vendor, date, and amount, so no one has to type it all in by hand.

- •Instant Submissions: Claims can be submitted right from a smartphone in seconds. No more waiting until the end of the month to file a mountain of paperwork.

- •Automated Policy Checks: Smart systems can instantly flag expenses that are out of policy - like an unapproved first-class flight - preventing compliance issues before they ever hit the finance team's desk.

This evolution from manual chaos to automation is about more than just technology. It’s about giving employees their time back, reducing stress, and making sure they get repaid quickly for the money they spend on the company’s behalf.

At the end of the day, these digital tools are a fundamental part of running a modern business. To see how they fit into the bigger picture, check out our guide on electronic document management systems. The goal is simple: a faster, more accurate, and less stressful process for everyone.

Simple Habits for a Hassle-Free Reimbursement Process

A smooth reimbursement process isn't magic. It's the result of good, simple habits from everyone involved - both the company and its employees. When each side plays its part, the whole system just works better, becoming faster, clearer, and a whole lot less frustrating for everyone.

For the company, it all starts with a crystal-clear expense policy. This shouldn't be a dusty legal document hidden away somewhere; it needs to be easy to find and even easier to read. It should spell out exactly what's covered, any spending limits, and what kind of proof is needed. After all, vague rules are the number one cause of confusion and delays.

Choosing the right tools is just as crucial. Investing in easy-to-use expense management software really encourages people to file things on time and cuts down on mistakes. If the system is a headache to navigate, you can bet people will put it off, and that’s how backlogs start.

Tips for a Smoother Company Process

- •Create a Centralized Hub: Put your expense policy, submission links, and finance team contacts all in one easy-to-find spot, like a page on the company intranet.

- •Set Clear Timelines: Be upfront about the deadlines for submitting expenses and when employees can expect to be paid back. This manages expectations and keeps everyone on the same page.

- •Offer Training: Don't just assume everyone knows how to use the expense software. A quick training session or a simple how-to video can head off a mountain of common errors.

Simple Habits for Employees

On the employee side, a few small habits can make a massive difference. The single best thing you can do is capture receipts immediately. The moment you pay for something, snap a quick photo with your phone. This tiny action prevents the classic "lost receipt" headache or trying to decipher one that's faded to nothing.

Another great habit is to submit your expenses regularly. Instead of letting a giant pile of receipts build up all month, try filing them weekly. This turns a dreaded, time-consuming task into a quick five-minute job and, best of all, gets your money back into your account that much faster.

Submitting expenses in smaller, regular batches not only speeds up your personal reimbursement but also helps the finance team manage their workload more effectively, preventing month-end bottlenecks for the entire company.

Got Reimbursement Questions? We've Got Answers

Even with a smooth system, you're bound to run into questions about expense reimbursements. Here are some of the most common ones we hear, broken down with simple answers to help you navigate them like a pro.

What's the Difference Between an Expense Report and an Invoice?

Think of it like this: an expense report is the story behind your spending. It’s the detailed log of every purchase, explaining what you bought and why it was for business.

The expense reimbursement invoice is the official bill you present based on that story. It’s the formal request for the total amount you're owed. While the report provides the backup and context, the invoice is what actually gets you paid. Modern software often merges these two, but it’s helpful to know the difference.

How Long Should I Have to Wait to Get Reimbursed?

There’s no single federal law on this, but a good rule of thumb is getting paid back within one pay cycle, which is usually 15 to 30 days. Your company’s expense policy should spell this out clearly.

Faster reimbursements make for happier, more trusting employees. It's that simple. Modern automated systems are a game-changer here, often cutting the wait time down to just a few days by eliminating the manual bottlenecks that slow things down.

Remember, when an employee uses their own money for a business expense, they're essentially giving the company a short-term, interest-free loan. Paying them back quickly is a huge sign of respect.

Are Reimbursements Considered Taxable Income?

In most cases, no. As long as your company uses what the IRS calls an "accountable plan," reimbursements for valid business expenses are not taxed as income.

For a plan to be "accountable," it just needs to follow a few straightforward rules:

- •The expense must have a clear business purpose.

- •The employee has to provide proof (like receipts) in a reasonable timeframe.

- •Any excess money advanced to the employee must be returned.

This is exactly why a proper expense reimbursement invoice is so important. It creates the paper trail needed to keep everything compliant and tax-free for both the company and the employee.

Why Would a Reimbursement Invoice Get Rejected?

It usually comes down to simple, preventable mistakes. The most common culprits are missing receipts, claiming something that’s not allowed by company policy (like that first-class upgrade or a round of drinks), or submitting the request past the deadline.

Another classic reason is just incomplete or incorrect info on the form itself. This is where expense software really shines - it can catch a lot of these errors before you even click "submit," saving everyone the frustration of a rejected claim.

Tired of chasing down receipts? Let AI take over your expense reimbursement workflow. Tailride connects to your email and other accounts to automatically pull and process every invoice and receipt, saving you hours of tedious work. Get started with Tailride today and watch your first invoices get extracted in seconds.