Email Invoices to QuickBooks Automatically | Save Time

Learn how to email invoices to QuickBooks automatically and streamline your accounting. Save hours each week with simple automation tips!

Let's be honest - manually punching invoice details from your email into QuickBooks is a soul-crushing task. It’s not just tedious; it’s a recipe for costly mistakes and a major drag on your whole operation. But what if you could email invoices to QuickBooks automatically? With tools like Tailride, you can connect your inbox directly to your accounting software and finally ditch manual data entry for good. It's a small change that makes a huge difference.

Stop Drowning in Manual Invoice Entry

Does this sound familiar? An invoice lands in your inbox, you download the PDF, and then you painstakingly type every line item, due date, and amount into QuickBooks. If so, you're fighting an uphill battle you can't win. Every single invoice is a new opportunity for a typo or a misplaced decimal that throws your entire financial picture out of whack. It’s the kind of repetitive work that drains your team's energy and time.

But the headache doesn't stop with simple data entry. This old-school process creates a ripple effect of problems across the business:

- •Delayed Payments: When invoices sit in an inbox waiting for someone to process them, payments are inevitably late. This can strain vendor relationships and even lead to late fees.

- •Zero Real-Time Visibility: How can you get an accurate, up-to-the-minute look at your cash flow when outstanding liabilities are scattered across a dozen different emails? You can't.

- •Approval Gridlock: Forwarding emails back and forth for approvals is a mess. Invoices get buried, managers forget to reply, and the whole payment cycle grinds to a halt.

The Real Cost of Doing Nothing

Sticking with the manual way of doing things costs more than you might realize. Think about it: traditional invoice handling can take days, with error rates commonly hitting 5-10%. That’s a lot of potential for payment disputes and reconciliation nightmares.

On the other hand, automated systems can slash that processing time by more than 50%. They use smart technology to pull data right from PDFs and emails, which is a massive leap forward in efficiency.

This table really puts the difference into perspective.

Manual vs Automated Invoice Processing at a Glance

| Metric | Manual Invoice Entry | Automated Email to QuickBooks |

|---|---|---|

| Time Per Invoice | 10-20 minutes | 1-2 minutes |

| Error Rate | High (5-10%) | Low (<1%) |

| Payment Speed | Slow, prone to delays | Fast, often within 24-48 hours |

| Data Visibility | Lagging, updated manually | Real-time, always current |

| Scalability | Poor, requires more staff | Excellent, handles growth easily |

| Team Morale | Low (tedious, repetitive work) | High (focus on strategic tasks) |

Seeing it side-by-side makes the choice pretty clear, doesn't it? One path is full of friction, and the other is built for speed and accuracy.

By clinging to manual entry, you're not just wasting time; you're actively choosing a less accurate, less efficient, and more stressful way to manage your company's finances. The 'before' state is one of constant catch-up and preventable mistakes, while the 'after' state offers clarity, speed, and accuracy.

As you think about making this switch, it’s worth looking into the broader benefits of business automation and how it can impact your entire company. This is about so much more than just technology - it's about getting your time back to focus on what really drives your business forward.

Choosing Your QuickBooks Automation Path

Before you can get emails flowing straight into QuickBooks, you have a decision to make. The right path for your business really hinges on your specific needs - how many invoices you're juggling, how complex your approval process is, and how much control you want.

Let's walk through the options so you can pick the right tool for the job.

Your first thought might be to just use what QuickBooks already offers. With new tools like Intuit Assist, the platform is leaning more into AI to take some of the invoicing work off your plate. The goal is to cut down on manual data entry, which is great in theory.

In practice, though, some people find the native AI can be a bit...overzealous. I've heard from users who've had it override their carefully crafted email templates or make suggestions that just don't fit. It highlights a classic trade-off: simplicity versus control.

Sticking with Native QuickBooks Features

QuickBooks does have some handy built-in tools. For example, you can forward an email with an invoice attached to a special QuickBooks email address. It’ll then try its best to scan the PDF, pull out the key details, and draft a bill for you.

If you only handle a handful of invoices each month, this is a perfectly good place to start. It's already included in your subscription, so there's no harm in giving it a shot.

QuickBooks is pushing hard on this front. They're using AI agents via Intuit Assist to manage the entire invoicing lifecycle, aiming to slash manual work by interpreting transaction data on the fly. It's a sign of where the industry is headed.

But let's be realistic - these native tools have their limits. They often get tripped up by non-standard invoice layouts or lack the kind of sophisticated approval workflows a growing business needs. That’s usually the point where people start looking for a more specialized solution.

Upgrading to a Specialized Third-Party Platform

This is where dedicated tools like Tailride really shine. For businesses that need more horsepower and flexibility, these platforms are a game-changer. They are built specifically to do one thing exceptionally well: get financial documents from your inbox into your accounting software without any drama.

So, what’s the real difference?

- •Smarter Data Extraction: They use much more advanced AI that can accurately read almost any invoice format you throw at it - even ones with messy tables or handwritten notes.

- •Custom Workflows: You can build your own rules. Think automatically tagging expenses from certain vendors or setting up multi-step approval chains for big-ticket invoices.

- •Tighter Integration: These tools offer a true two-way sync. Payment statuses, vendor updates, you name it - everything stays perfectly aligned between the platform and QuickBooks. You can learn more about how to integrate these tools with QuickBooks in our detailed guide.

Ultimately, choosing between a native feature and a specialized tool comes down to your current pain points and future plans. And as you think about your workflow, don't forget the first step: dealing with the email itself. Looking into the best email management software can give you ideas for taming that initial inbox chaos.

A simple setup might be fine for now, but picking a scalable platform from the start will save you a world of headaches down the road.

Setting Up Your Automated Invoice Workflow

Alright, let's dive in and get this system built. The goal is pretty straightforward: create a direct pipeline from your email inbox straight into QuickBooks. Once this is done, you can say goodbye to manually typing in invoice details.

We'll use a tool like Tailride as our example, but the core ideas here apply to most invoice automation platforms.

The Foundation: A Dedicated Invoice Email

First things first, and this is a step you definitely don't want to skip: create a dedicated email address just for invoices. Something clean and simple like invoices@yourcompany.com or ap@yourcompany.com works perfectly.

This isn’t just about keeping things tidy; it's a crucial control point. From there, you just set up a simple forwarding rule in your main inbox (like Gmail or Outlook) to send any emails that arrive at that address directly to your automation tool. This keeps your personal inbox from getting cluttered and guarantees that only actual invoices enter your new workflow.

This initial connection is where the magic really starts to happen. You'll link that new invoice email to your platform and then securely connect it to your QuickBooks Online account. Modern tools make this incredibly easy - it's usually just a secure login that takes less than a minute. No wrestling with complex API keys or needing a developer on standby.

Teaching the System to Read Your Invoices

With everything connected, now comes the fun part. You need to "teach" the system how to read invoices from your specific vendors. The AI is smart right out of the box, but a little bit of guidance makes it brilliant. For instance, your top supplier might always put the invoice number in the top-right corner, while another tucks it away at the bottom.

You'll start by uploading a few sample invoices from each of your main vendors. The platform’s AI will scan the document and take its best guess at identifying the key fields:

- •Vendor Name: Who is this bill from?

- •Invoice Number: The unique ID for this specific bill.

- •Due Date: When does it need to be paid?

- •Total Amount: The bottom-line number, including taxes and fees.

Your job is to simply confirm or, if needed, correct the AI's first attempt. By doing this just a couple of times for each vendor, you're training the model. After only a few examples, the system learns that vendor's unique layout and will recognize it with near-perfect accuracy from then on.

My Takeaway: Think of this initial setup not as doing the work yourself, but as supervising an AI apprentice. You're showing it the ropes and teaching it the specific patterns of your business. That small time investment upfront pays for itself over and over again with every invoice it processes flawlessly on its own.

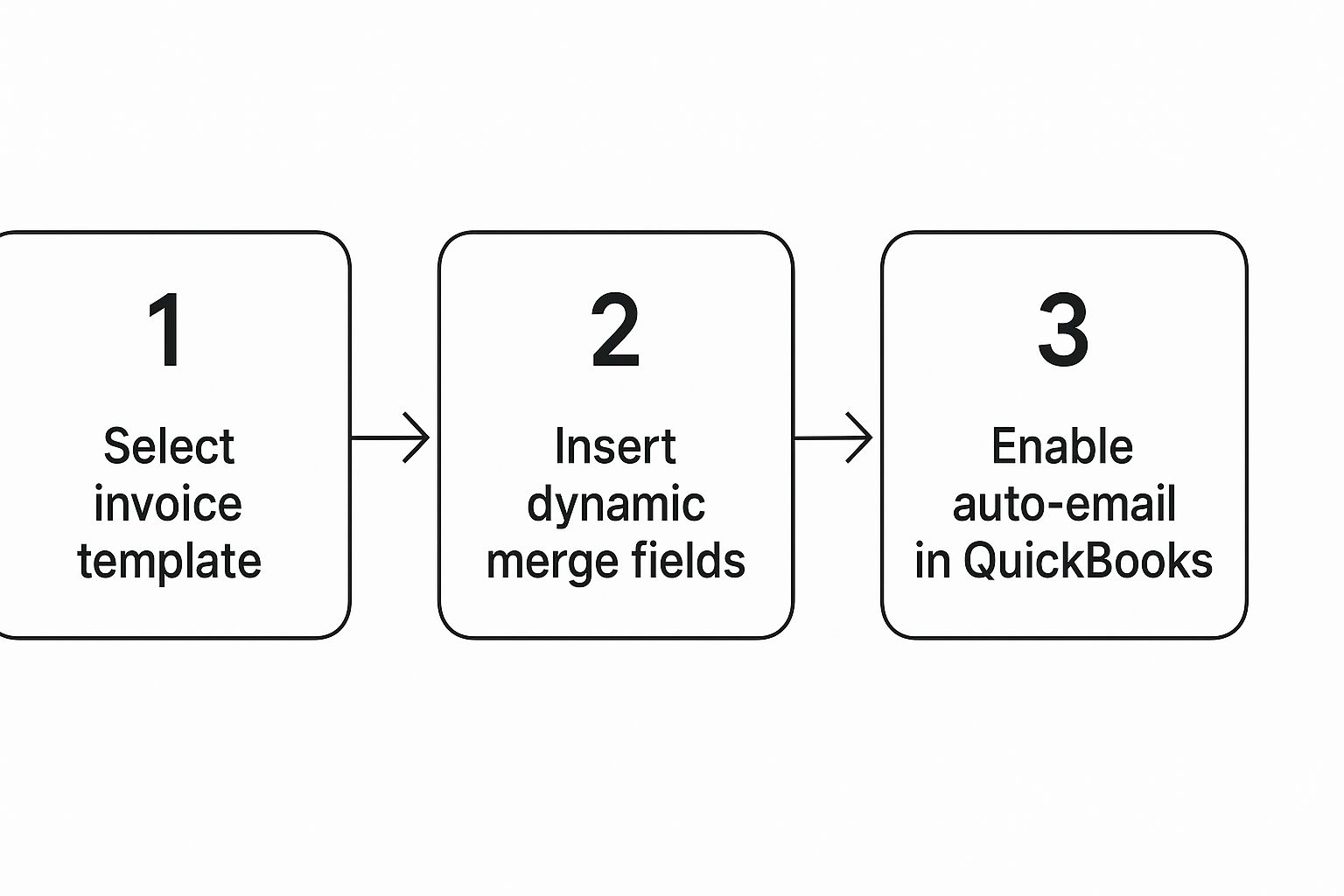

The whole process follows a clear, logical flow.

As you can see, once your templates are set and your fields are configured, switching on the auto-email feature is the final step to a truly hands-off system.

Mapping Data to the Right QuickBooks Fields

The last piece of the puzzle is telling the system exactly where to put the data it pulls from the invoice. This is what we call field mapping.

You'll simply match the fields from your invoice (like "Total Amount") to the corresponding fields in QuickBooks (like "Bill Amount"). It’s very intuitive. To get deeper into this, you can learn more about how to perfect your automated invoice processing with some of these advanced mapping techniques.

To take your setup a step further, understanding the broader principles of document workflow automation can give you some great ideas. After all, this isn't just about invoices; it's about building smarter, more efficient systems for all of your business documents.

This thoughtful mapping is what ensures every piece of data lands in the right account, gets coded correctly, and shows up in QuickBooks ready for your review without you having to lift a finger.

Fine-Tuning Your New Invoicing System

Getting your automated system up and running is a huge win, but the real magic happens when you dial it in to match exactly how your business operates. A stock setup is a great starting point, but a finely-tuned one is a game-changer. This is where you graduate from simple data entry to creating an intelligent accounts payable machine.

The first place to look is your approval process. Who really needs to sign off on what? A one-size-fits-all workflow just doesn't work in the real world. For instance, you could set a rule that any marketing invoice over $1,000 gets routed directly to the CMO for a thumbs-up, while smaller IT expenses head straight to the tech lead.

This kind of specific routing prevents bottlenecks and makes sure the right people have oversight, all without anyone having to manually forward emails. It's all about building a digital process that mirrors your company's actual chain of command.

Creating Smart Rules for Tricky Situations

So, what happens when an invoice lands in your inbox that doesn't fit the perfect template? This is where smart rules become your secret weapon. A well-configured system can handle these exceptions with ease instead of just flagging them for you to deal with manually.

Think about these common headaches:

- •New Vendors: You can create a rule that automatically flags any invoice from a vendor you've never worked with before. The system can then send it straight to your AP manager to verify their details and get them set up properly before the bill even gets processed.

- •Missing PO Numbers: If your company lives and breathes by purchase orders, an invoice without one is a big red flag. A simple rule can hold these invoices in a separate queue and ping the right project manager to hunt down the PO.

The goal isn't just to email invoices to QuickBooks automatically; it's to do it intelligently. When you set up rules for the exceptions, you’re building a system that can think for itself. That saves you from constantly putting out small fires.

These rules are what give you control and keep your data accurate. If you're curious about how the tech pulls this off, our guide on QuickBooks invoice extraction breaks down how the AI makes these smart decisions.

Testing and Building Confidence

Before you flip the switch and go all-in, you have to be sure everything works just as you expect. Don't skip this part - it’s your chance to iron out any kinks in a safe, controlled way.

Start by sending a handful of test invoices through the system. Make sure to pick a good variety: one from a major supplier you pay all the time, one with a ton of line items, and maybe even a poorly scanned one to see how well the AI handles it.

Track each test invoice from start to finish. Watch it pop up in your automation tool, see the data get pulled, and confirm the approval workflow fires off correctly. The last check is the most critical: log into your QuickBooks account and make sure the bill was created perfectly, with every piece of data in the right field. This simple validation process will give you the peace of mind you need to let the system take over.

A Few Pro Tips for Keeping Things Running Smoothly

Even the best-automated systems can hit a bump in the road. Let’s be real, technology isn't magic. The secret isn't just setting up the workflow; it’s knowing how to keep it humming along for the long haul. Think of this as my personal playbook for keeping your invoice automation machine well-oiled.

Getting this right gives you a serious advantage. I've seen it time and time again. Companies that plug AP automation into their QuickBooks can slash their AP workload by up to 80% and close their books 25% faster. Stick with these tips, and you’ll make sure you're getting those results consistently. You can dive deeper into these powerful AP automation findings if you're curious.

Dealing with the Inevitable Automation Hiccups

Sooner or later, the AI is going to misread an invoice. It happens. Often, it’s because a vendor decided to completely redesign their invoice template out of the blue.

When you spot a mistake, your first instinct might be to just fix the entry in QuickBooks. Don't. Instead, pop back into your automation tool (like Tailride), find the original invoice, and correct the data right there. Then, re-process it. This is crucial because you're actually training the AI, teaching it how to read that vendor's new layout for next time.

Duplicate entries are another classic headache. A vendor sends the bill, then a week later sends a "friendly reminder" that’s just a copy of the same invoice. An easy way to stop this is to create a simple rule in your system: flag any invoice that has the same number from the same vendor within a 30-day window. It's a surprisingly effective safety net.

My Takeaway: Don't just fix problems - use them as training opportunities for your system. Every correction you make inside the automation platform is an investment in future accuracy. You're not just fixing one bill; you're making the whole process smarter.

Fine-Tuning for Peak Performance

Once you've got the basics down, a couple of simple habits can take your workflow from good to great and make the process to email invoices to QuickBooks automatically even more of a breeze.

- •

Set Up Vendor-Specific Email Rules: Got a few suppliers who send you a ton of invoices? Go into Gmail or Outlook and create a rule that automatically forwards anything from them straight to your dedicated

invoices@address. This keeps your main inbox clean and gets those bills into the system faster. - •

Schedule a Quarterly Check-Up: I know, nobody wants another meeting. But trust me on this. Block out 30 minutes on your calendar once a quarter to review your automation settings. Are there new vendors you need to create rules for? Are your approval chains still correct? A little preventative maintenance goes a long way and ensures your setup grows with your business.

- •

Fix Broken Connections Immediately: If your tool ever disconnects from QuickBooks - which can happen after a password update or system change - get it reconnected right away. A dead connection is the number one reason I see for data backlogs and painful reconciliation nightmares. Don't let it linger.

Still Have Questions About Invoice Automation?

Jumping into automation can feel like a big leap, so it's only natural to have a few questions. You want to be sure it’s the right move for your business. Let's tackle some of the most common things we hear from people just like you.

"How Much Technical Skill Do I Actually Need?"

This is hands-down the number one question we get, and the answer is surprisingly simple: practically none.

Modern tools like Tailride are built for business owners and bookkeepers, not for coders. Connecting your email to QuickBooks is a guided process that mostly involves clicking a few buttons. It really just takes a few minutes.

You don't need to understand what an API is or worry about complicated integrations. The platform does all the heavy lifting in the background. If you can set up a new email account, you’ve got all the technical know-how you need.

"Is My Financial Data Really Secure?"

Handing over financial documents to another platform is a big deal, and it's something you should take seriously. Any reputable automation provider makes security their absolute top priority. They use bank-level encryption to protect your data, both while it's being sent between systems and while it's being stored.

Look for tools that are open about their security measures, like GDPR compliance or other industry certifications. This is your assurance that your sensitive invoice information is being protected properly. Honestly, it’s far more secure than just emailing unencrypted PDFs around the office.

"What Happens if the AI Gets Something Wrong?"

Let's be realistic - no technology is 100% perfect on day one. But the beauty of a good AI system is that it's designed to learn from its mistakes. The first time the tool encounters a weirdly formatted invoice from a new vendor, it might misread a field.

All you have to do is correct that one entry right inside the platform.

But here’s the cool part: that simple fix does more than just solve one problem. It actively trains the AI. The system remembers that vendor's layout and won't make the same mistake next time.

Think of it like this: A person might make the same typo over and over, but a good AI only needs to be corrected once. It's a self-improving system that actually gets smarter and more accurate with every invoice you process.

"Can I Still Control Who Approves What?"

Absolutely. In fact, automation usually gives you more structured control, not less. The whole point isn't to just blindly email invoices to QuickBooks automatically without anyone looking. It’s about building smart approval workflows that match how your company already operates.

For example, you can easily set up rules like:

- •Approval by Amount: Any invoice over $5,000 automatically goes to the department head for a sign-off.

- •Vendor-Specific Routing: Invoices from your key supplier are always routed directly to the operations manager.

- •Project-Based Workflows: Bills related to the "Alpha Project" get sent straight to that project's lead.

This setup guarantees that the right person reviews every single bill before it gets paid. You get all the speed and efficiency of automation without ever giving up the critical financial oversight your business depends on. It truly is the best of both worlds.

Ready to finally stop the manual data entry grind and get total control over your accounts payable? Tailride plugs right into your email and QuickBooks, pulling invoice data with amazing accuracy in just seconds. Start automating your invoices today and see for yourself.