How to Integrate with QuickBooks Easily & Successfully

Learn how to integrate with QuickBooks effortlessly. Follow our simple steps for a smooth setup and start automating today!

If you’re using QuickBooks, you're already on the right track. But to really unlock its power, you need to connect it to the other software you use every day - your CRM, e-commerce store, or even your invoicing tools. When data flows automatically between these systems, it’s a total game-changer.

This isn't just about saving time on manual data entry (though that’s a huge plus). It's about creating a single source of truth for your finances, giving you a crystal-clear, real-time view of your company's health. Think of it as turning your accounting software into the central command center for your entire business.

Why Integrating with QuickBooks Is a Business Superpower

Connecting your apps to QuickBooks is one of those moves that fundamentally changes how you operate. Suddenly, your financial data isn't siloed away; it's weaving through every department, empowering your team with information that's always accurate and up-to-the-minute.

Imagine this: your sales team pulls up a customer in their CRM and can instantly see their payment history without ever leaving the screen. Or, when an online order is placed, the inventory, sales receipt, and customer record all update automatically. That kind of seamless automation isn't just a nice-to-have; it's a serious competitive edge.

The Real-World Impact of a Connected System

We've all seen what happens when systems don't talk to each other. Someone has to manually copy-paste information, and it's not just tedious - it's a recipe for disaster. Human error creeps in, leading to things like incorrect invoices, botched tax filings, or skewed inventory counts. These small mistakes can quickly snowball, hurting customer trust and messing with your bottom line.

By automating that data flow, you build a much more resilient and error-proof workflow.

More importantly, this connectivity gives you a live look at your financial health. You’re no longer waiting for someone to compile a report at the end of the month. Instead, you can make sharp, informed decisions based on what's happening right now. This is absolutely vital for managing cash flow, forecasting revenue, and spotting opportunities before they pass you by.

More Than Just a Tech Project

It's easy to get bogged down in the technical details, but try to see this integration as a strategic business move. The real goal here is to free up your team. When you get rid of the mind-numbing, repetitive tasks, your people can finally focus on work that actually grows the business - like talking to customers or developing new products. That shift alone can do wonders for morale and productivity.

There's a reason QuickBooks is the go-to for over 7 million users worldwide. Its powerful integration ecosystem is a huge part of its appeal. It dominates the small business accounting software market in the U.S. with a massive 62.23% market share, a number that speaks volumes about its central role in business operations. You can find more stats on QuickBooks' market presence over on electroiq.com.

By connecting your essential tools, you're not just moving data around; you're building an intelligent, automated ecosystem where information works for you, not the other way around. This is the foundation for scalable, efficient operations.

In the end, a solid QuickBooks integration pays you back in time, money, and sanity. It’s an investment that helps build a more streamlined, data-driven, and resilient business.

Laying the Groundwork for a Smooth QuickBooks Integration

I’ve seen it happen a hundred times: a business gets excited about the idea of connecting their apps to QuickBooks, dives in headfirst, and ends up with a complete data nightmare. The secret to a successful integration isn't the tool you use; it’s the prep work you do before you even click "connect."

Think of it as your pre-flight checklist. Skipping these steps is a surefire way to cause confusion, create duplicate records, and spend hours fixing mistakes that could have been avoided. A little planning now saves you a massive headache later.

The first, and honestly most important, job is getting your data in order. Messy, inconsistent data is the number one killer of any software integration. Before you even think about syncing anything, you need to roll up your sleeves and clean house in both systems.

This is about the little things that cause big problems. For instance, is a customer called "John Smith Co." in your CRM but "John Smith Company" in QuickBooks? That tiny difference can easily create two separate customer profiles, throwing your reporting completely off.

Get Your Data Cleaned Up

Your best bet is to create a simple, repeatable process for cleaning your data. This isn't a one-time thing; it's about building good habits. Focus on these key areas to make sure your data is ready to move.

- •Standardize Names: Decide on a single format for all customer and vendor names. Are you going to use "Inc." or spell out "Incorporated"? Pick one and stick with it. Consistency is king.

- •Audit Products and Services: Go through your item lists. Get rid of old, discontinued products. Make sure every single active item has a unique SKU or name that matches exactly in both systems.

- •Check Your Chart of Accounts: Take a look at your chart of accounts in QuickBooks. Does it still make sense for how your business runs today? Make sure the accounts you need for the integration are set up and ready to go.

Doing this cleanup is like prepping a wall before you paint. It’s tedious, but without it, the final result will be a mess.

Here's my rule of thumb: If you wouldn't be comfortable handing your data over for a tax audit, it's not ready for an integration. Clean data is the foundation of a reliable connection.

Figure Out Your Workflows

Once your data is sparkling clean, it's time to map out what you actually want this integration to do. Don't just flip all the switches and see what happens. You need a game plan. What specific problem are you trying to solve?

Get your team together and ask some practical questions to create your integration blueprint:

- •What's the must-have data? Pinpoint the absolute non-negotiables. For most businesses, this is new sales orders from an e-commerce site or payment updates from an invoicing platform.

- •How often do we need to sync? The answer varies. Inventory levels might need to update every 15 minutes to prevent overselling. Customer address changes, on the other hand, could probably be synced just once a day.

- •Who actually needs this info? Think about who on your team relies on this data. Does your fulfillment team need real-time order info? Does your sales team need updated payment statuses?

Answering these questions helps you build an integration that serves a real purpose. You'll create a focused, valuable connection instead of just adding more digital noise. This thoughtful approach is the key to successfully integrating with QuickBooks.

Getting Your App Connected to QuickBooks

Alright, let's get down to the fun part: actually connecting your app to QuickBooks. This is where you build the bridge that lets your data flow seamlessly between the two systems. I'll walk you through it without all the heavy technical jargon, so you can get it done right.

At the heart of this whole process is something called authentication. It's just a secure way for your app to prove to QuickBooks that it has your permission to access financial data. The industry standard for this is OAuth 2.0, which keeps everything locked down and safe.

Your first stop is the QuickBooks Developer portal. Think of this as your mission control for the entire integration.

First, Grab Your API Keys

Before you can do anything else, you need to "create an app" inside the developer portal. Don't worry, you're not actually building software from scratch. It's more like setting up a unique profile for your specific connection.

Once that's done, QuickBooks will give you two critical pieces of information: a Client ID and a Client Secret.

Treat these like the keys to your financial kingdom - because they are. Keep them safe and never share them publicly.

- •Client ID: This is basically the public name for your app.

- •Client Secret: This is the private password. It's confidential.

This is what the QuickBooks Developer portal looks like. It's where you'll find those all-important credentials.

You'll be managing your connections and grabbing the necessary keys from this dashboard to ensure a secure link.

The Authentication Handshake

Got your keys? Great. Now it's time for the OAuth 2.0 "handshake." When you kick off the connection from your app or a tool like Tailride, you'll be sent to a familiar QuickBooks login screen. This is where you officially grant permission for the two systems to talk to each other.

This authorization step is incredibly important. It puts you in the driver's seat, letting you decide exactly what data gets shared. Nothing happens without your explicit approval.

After you approve the connection, QuickBooks sends back a temporary authorization code. Your app takes that code, pairs it with your Client ID and Secret, and swaps them for an access token. This token is what finally allows your app to securely request or send data.

If you want to dive deeper into the technical side, our complete guide on the integration with QuickBooks Online breaks it down even further.

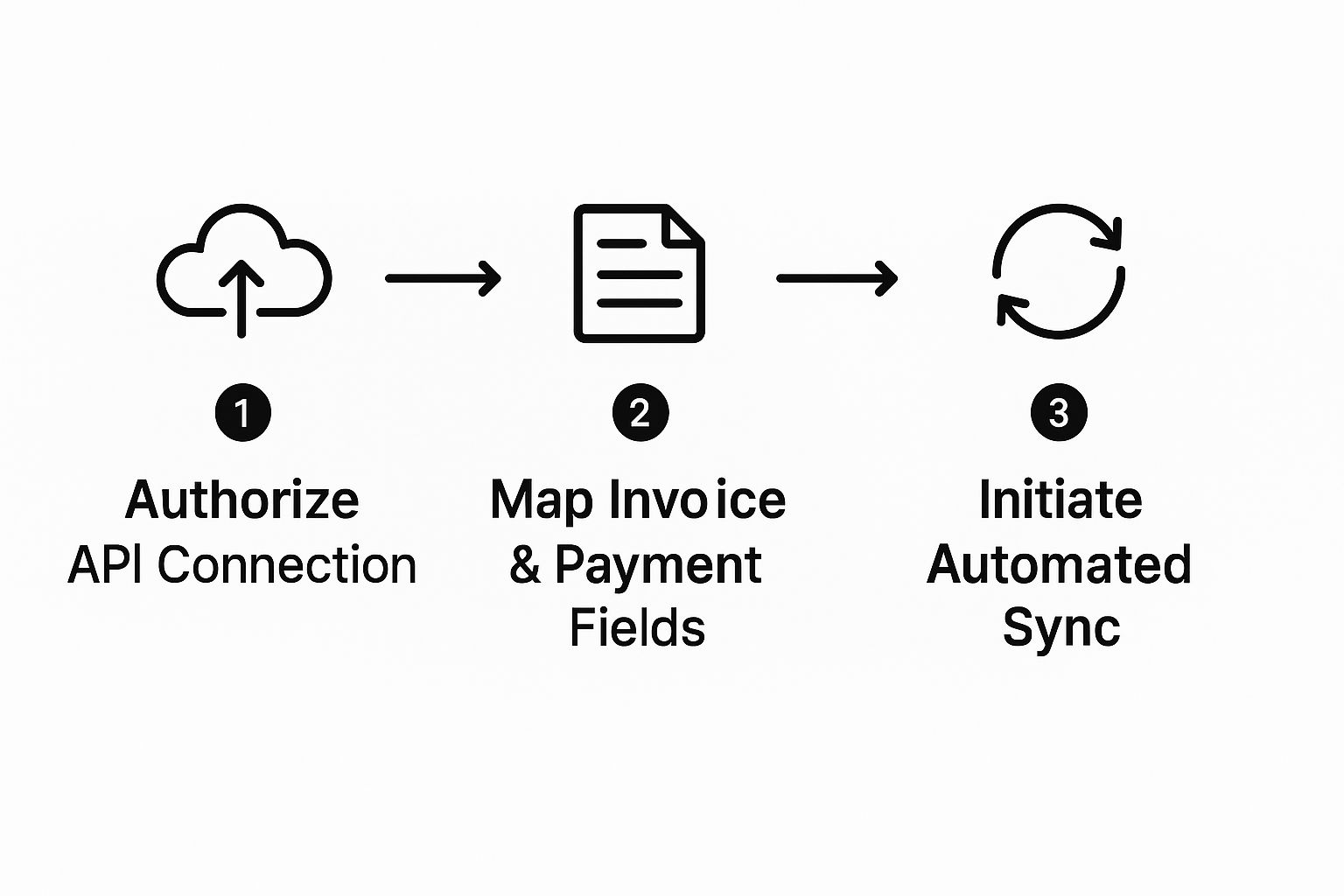

The key thing to remember is that a solid connection is built on authorizing access, figuring out how your data should be mapped, and then letting the automation take over. As you get started, following good API design best practices will make the whole process much smoother.

By following these steps, you’re creating a reliable and secure bridge between your systems, ready to save you a ton of time.

Mastering the Art of Data Mapping

Getting your apps connected is a fantastic first step, but the real work - and the real payoff - comes from data mapping. This is where you roll up your sleeves and teach the two systems how to speak the same language.

If you don't give them clear instructions, your integration won't know that a "Client" in your CRM is the same thing as a "Customer" in QuickBooks. Skipping this step is a recipe for messy data and a lot of headaches down the road.

Think of yourself as a translator. You’re carefully telling the integration exactly how to interpret every piece of information it pulls, making sure each field lands in precisely the right spot. This process is absolutely crucial for keeping your data clean, reliable, and accurate.

A classic and powerful example is syncing a CRM like Salesforce with QuickBooks. It’s a game-changer for automating your entire sales-to-finance workflow, connecting customer details with invoices and payments. Done right, it completely gets rid of manual data entry, slashes errors, and gives you a real-time pulse on your company’s financial health.

To show you how this looks in the real world, here’s a common mapping scenario between a CRM and QuickBooks Online.

Example Field Mapping for CRM to QuickBooks Integration

| Data Object | Field in CRM System | Corresponding Field in QuickBooks | Mapping Note |

|---|---|---|---|

| Customer | Account Name | Customer Name | A direct 1-to-1 match for consistency. |

| Customer | Billing Street Address | Billing Address | Ensure all address lines are mapped. |

| Invoice | Deal Name | Invoice Memo | Helps provide context for the finance team. |

| Invoice | Product Line Item | Product/Service | Links the sale to your inventory or service list. |

| Invoice | Sale Amount | Total Amount | The most critical field for financial accuracy. |

This table is just a starting point, but it shows how defining these relationships creates that reliable bridge for your data to cross. A dedicated QuickBooks sync tool can make this whole process much more visual and intuitive.

What About Unique Data and Conflicts?

So, what happens when you have a field in your CRM that doesn't have an obvious home in QuickBooks? This is where custom fields come in handy. Most solid integration tools let you map data to custom fields you've created in either system. This gives you the flexibility to sync those unique data points that are specific to how you do business.

You also need to think about data conflicts. For example, what if a customer’s phone number gets updated in both systems around the same time? A well-configured integration lets you set a "source of truth." This rule tells the system which app wins in a conflict, preventing messy data overwrites and keeping everything consistent.

Think of your data map as the brain of your entire integration. If you invest the time to be thorough and precise here, you'll prevent countless future problems and ensure your financial records are always spot-on.

Solving Common QuickBooks Integration Headaches

Even with a perfect setup, integrations can sometimes hit a snag. It's frustrating when you see data stop flowing or records that just don't look right. But don't worry - most issues that pop up when you integrate with QuickBooks are pretty common and usually have a simple fix.

Let's walk through some of the usual suspects. Think of this as your field guide for troubleshooting and getting everything running smoothly again in no time.

The Data Sync Suddenly Stops Working

This is probably the most common alert you'll ever see. One minute, everything is humming along perfectly, and the next, your connection is down.

Nine times out of ten, the culprit is an expired authentication token. For security, your link to QuickBooks isn't permanent and has to be re-authorized every so often. Thankfully, it's an easy fix.

- •Symptom: You get an error message that says something like "Sync Failed" or "Authentication Error."

- •Likely Cause: Your app's permission to talk to QuickBooks has expired.

- •Solution: Just log back into your integration platform (like Tailride) and follow the on-screen prompts to reconnect your QuickBooks account. This re-establishes the secure connection, and your data should start flowing again right away.

Duplicate Invoices or Customers Keep Popping Up

Seeing double? Duplicate records are a classic sign that something’s off in your field mapping. This usually happens when the unique identifier - the piece of data used to match records between systems - isn't perfectly aligned.

For instance, if an invoice number in your e-commerce platform doesn't exactly match the corresponding field in QuickBooks, the system might think it's a completely new invoice and create a copy. Even a tiny difference, like "INV-123" versus just "123," is enough to throw things off.

Pro Tip: Establish a "source of truth." Decide which system - your CRM, online store, or QuickBooks itself - is the master record for certain types of data. This simple rule prevents a ton of headaches from conflicting updates and keeps your data clean.

Transactions Are Missing Important Details

Here’s another common one: a transaction syncs over to QuickBooks, but it's missing key information like sales tax, shipping costs, or payment processing fees from a gateway like Stripe. This almost always points back to how you set up your data mapping in the first place.

If you didn't explicitly tell those specific fields where to go during setup, the integration simply doesn't know what to do with them, so it leaves them behind. This can lead to some seriously inaccurate financial reports and a nightmare during reconciliation.

The fix is to dive back into your mapping settings. Go through and make sure every single line item from your original system - taxes, fees, discounts, you name it - has a designated home in a QuickBooks field. Taking a few extra minutes to be thorough here is a small investment that pays off big, especially when you consider the larger wins described in our article on accounts payable automation benefits. Getting your mapping right from the start ensures your financial records are always complete and audit-ready.

Your Top Integration Questions, Answered

When you're first mapping out a QuickBooks integration, a few big questions always pop up. Let's walk through the common ones I hear from businesses and get you some clear answers to help you avoid headaches down the road.

Should I Use a Third-Party Tool or Build a Custom Connection?

This is the classic "buy versus build" debate, and it really comes down to your resources and specific needs.

Using an off-the-shelf tool is almost always faster and way more cost-effective, especially if you don't have a development team on payroll. These platforms are designed to get you connected and syncing data in a matter of hours, not weeks or months.

On the flip side, a custom API connection gives you ultimate flexibility. If your business runs on truly unique workflows that a pre-built tool just can't accommodate, building your own integration lets you dictate every last detail. Just be prepared - this route is a major investment in both time and money, not to mention the ongoing maintenance required to keep it running.

For most small and medium-sized businesses, I always recommend starting with a third-party tool. You'll get 80% of the benefit for maybe 20% of the cost and effort. It’s the quickest way to get a win and see the value of automation firsthand.

How Often Should My Data Sync?

The right sync schedule completely depends on what kind of information you're moving. There's no one-size-fits-all answer here, so think about how quickly you need certain data to be updated.

Here’s how I break it down for clients:

- •Near Real-Time (every 5-15 minutes): This is non-negotiable for critical data. Think new orders from your Shopify store or inventory updates. You need this information flowing constantly to avoid overselling a product or delaying fulfillment.

- •Daily Syncs: For less urgent updates, like syncing a customer's new address from your CRM into QuickBooks, once or twice a day is usually plenty.

Take a look at your different data streams and decide which ones are mission-critical. Those are the ones you'll want to sync more frequently.

Can I Integrate with QuickBooks Desktop, or Just Online?

Good news - you can integrate with both! But it's crucial to understand they are very different beasts.

QuickBooks Online (QBO) is a modern, cloud-based platform. Its API is built for easy connections, which is why most new integration tools are designed to work seamlessly with it.

QuickBooks Desktop, on the other hand, can be a bit more finicky. Integrations usually have to go through a piece of software called the QuickBooks Web Connector. This program has to be installed and running on the same computer where your company file is stored, making the whole setup less flexible and often trickier to manage.

Ready to stop manually entering invoice data and let automation take over? Tailride plugs right into your inbox and vendor portals to pull, read, and sync your invoices directly into QuickBooks. See how it works and process your first few invoices in seconds over at https://tailride.so.