8 Best Way to Organize Business Receipts in 2025

Discover the best way to organize business receipts for tax season. Explore 8 proven methods, from manual systems to automated tools like Tailride.

Welcome to the age-old challenge for every business owner, freelancer, and finance manager: the never-ending stream of receipts. From coffee meetings to software subscriptions, these small slips of paper and digital notifications are the lifeblood of your financial records. But left unchecked, they can quickly morph into a chaotic mess, making tax season a nightmare and obscuring your true financial health.

The key isn't just about storing them. It's about creating a system that's efficient, accessible, and audit-proof. Finding the best way to organize business receipts is more than a chore; it's a strategic move that saves time, reduces stress, and unlocks valuable insights into your spending. This is crucial for accurate bookkeeping, maximizing tax deductions, and maintaining a clear picture of your company's financial performance.

This guide will cut through the clutter and get straight to the solutions. We'll walk you through eight distinct, actionable methods designed for different business needs and workflows. You’ll explore everything from time-tested physical techniques like the envelope filing system to powerful digital automation with cloud platforms. Get ready to find the perfect system to finally conquer your receipt chaos for good.

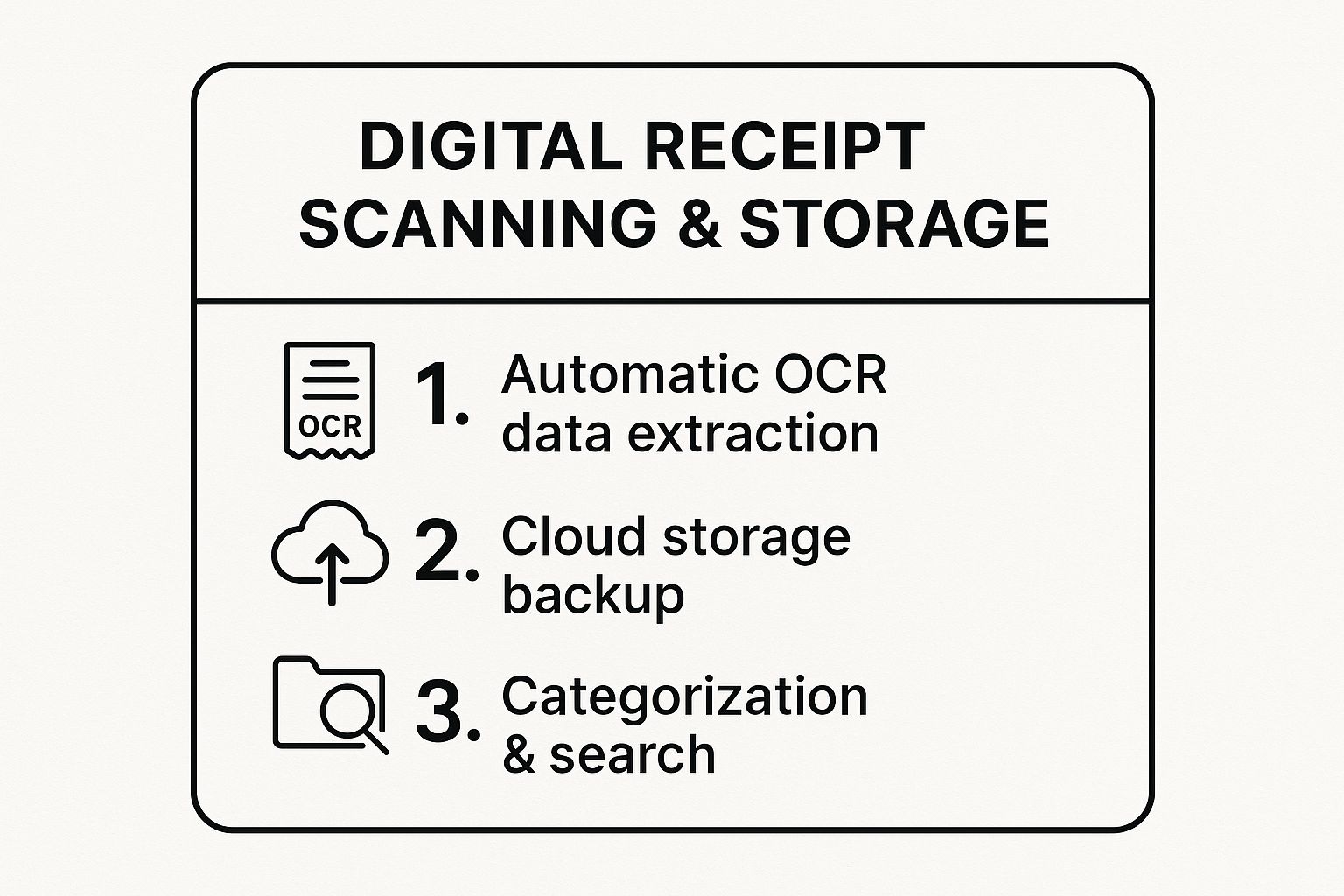

1. Digital Receipt Scanning and Storage

Tired of shoeboxes overflowing with faded thermal paper? Going digital is often the first and most impactful step in mastering your financial records. This method transforms your paper receipts into organized, searchable digital files using just your smartphone or a dedicated scanner. It’s one of the best ways to organize business receipts because it eliminates physical clutter while creating an accessible and secure archive.

The process is simple yet powerful. You snap a photo of a receipt, and an app uses Optical Character Recognition (OCR) technology to automatically read and extract key details like the vendor, date, and amount. From there, you can categorize the expense and store it securely in the cloud.

How It Works in Practice

Imagine a freelance consultant who just finished a client dinner. Instead of stuffing the receipt into a wallet to be forgotten, they can immediately use an app like Dext or Expensify to scan it. The app digitizes the data, which can then be synced directly to their accounting software, making month-end reconciliation a breeze. Similarly, a sales team on the road can use Shoeboxed to capture fuel and meal receipts, ensuring timely reimbursement and accurate expense tracking.

To help you understand the core benefits at a glance, this summary box breaks down the key features of digital receipt management.

These features work together to create a robust system that not only saves time but also provides clear, audit-ready financial records.

Tips for Success

To get the most out of this method, follow a few best practices:

- •Scan Immediately: Capture receipts as soon as you get them to avoid loss or damage.

- •Ensure Clarity: Use good lighting and a flat surface for clear, legible scans.

- •Be Consistent: Use a standard naming convention (e.g.,

YYYY-MM-DD_Vendor_Amount) for easy searching. - •Verify OCR: Always double-check the data extracted by the OCR technology for accuracy.

This approach provides a solid foundation for any modern business looking to streamline its financial workflows. To see how quickly you can digitize your receipts, check out this short tutorial.

Ready to explore the software that makes this possible? Learn more about the top receipt scanning software available today and find the perfect fit for your business needs.

2. Envelope Filing System

Sometimes, the simplest solution is the most effective. The envelope filing system is a time-tested, physical organization method that remains a go-to for many small businesses. This low-tech approach involves sorting paper receipts into labeled envelopes based on expense categories, offering a straightforward way to manage finances without complex software. It stands out as one of the best ways to organize business receipts for those who prefer a tangible, hands-on system.

The system works by assigning an envelope to each expense category, such as "Office Supplies," "Travel," or "Utilities." When you receive a receipt, you simply place it in the corresponding envelope. This method provides an easy-to-understand visual overview of your spending and ensures all your physical records are neatly categorized for tax time or bookkeeping reviews.

How It Works in Practice

Consider a local restaurant that needs to track its daily expenses. The manager can maintain a set of envelopes for categories like "Produce," "Meat & Dairy," and "Cleaning Supplies." At the end of each day, they file supplier invoices and receipts into the appropriate envelope. Similarly, a home-based consultant can use a simple accordion file with labeled sections for "Client Lunches," "Software Subscriptions," and "Marketing," making it easy to tally up deductions at the end of the year.

Tips for Success

To get the most out of this manual method, a little discipline goes a long way:

- •File Immediately: Make it a habit to sort receipts as soon as you get them to prevent a dreaded pile-up.

- •Use Durable Envelopes: Choose sturdy manila envelopes that can withstand frequent handling.

- •Label Clearly: Write categories in large, clear letters with a permanent marker for easy identification.

- •Organize by Year: At the start of a new tax year, begin with a fresh set of envelopes to avoid confusion.

- •Store Securely: Keep your organized envelopes in a dedicated filing cabinet or a fireproof safe to protect them from damage or loss.

This tactile method provides a reliable foundation for businesses with a moderate volume of paper receipts, ensuring everything is in its right place when you need it.

3. Monthly Accordion File Method

For those who prefer a tangible, chronological system, the Monthly Accordion File Method is a classic for a reason. This low-tech approach uses a simple expanding file folder with 12 sections, one for each month. It’s a straightforward way to keep physical receipts organized by date, making it a reliable and easy-to-manage solution for many small business owners. This is one of the best ways to organize business receipts if you value simplicity and chronological order over digital tools.

The system is refreshingly simple. As you collect receipts throughout the month, you simply drop them into the corresponding monthly slot. At the end of the year, you have a single, neatly organized file containing all your business expenses, ready for tax preparation. This method is particularly useful for businesses that need to track expenses by time period, such as those with seasonal spending patterns.

How It Works in Practice

Consider a seasonal landscaping business. The owner can use an accordion file to track monthly expenses, easily seeing how costs for fuel, equipment, and supplies fluctuate between the busy spring season and the slower winter months. Likewise, a consulting firm can organize travel receipts by project timelines that span specific months, keeping everything in one easy-to-access physical location. This method offers a clear, sequential view of spending.

To help you understand the core benefits at a glance, this summary box breaks down the key features of the Monthly Accordion File Method.

These features provide a dependable framework for any business that prefers a hands-on, chronological approach to receipt management.

Tips for Success

To get the most out of this tried-and-true method, follow a few best practices:

- •Label Clearly: Ensure each of the 12 sections is clearly labeled with the month's name.

- •Start Fresh Annually: Begin a new accordion file for each new tax year to prevent confusion and keep records distinct.

- •File Promptly: Get into the habit of filing receipts daily or weekly to avoid a disorganized pile-up at the end of the month.

- •Create a Summary: At the end of each month, attach a summary sheet listing the total expenses for that period.

This approach provides a solid, tangible system for financial organization. To see this method in action, check out this quick guide to setting up your own file system.

Ready to get started? High-quality accordion files are readily available from brands like Pendaflex and can be found at most office supply stores.

4. Spreadsheet-Based Digital Tracking

For those who prefer a hands-on approach without the monthly subscription fees of dedicated software, spreadsheet-based tracking is a time-tested and effective solution. This method uses programs like Google Sheets or Microsoft Excel to create a detailed digital log of all your expenses. It's a fantastic hybrid system where you manually enter receipt data into a spreadsheet for analysis and organization, while keeping the physical copies filed chronologically for compliance.

This approach offers a high degree of customization and control, making it one of the best ways to organize business receipts for those with straightforward needs. You build your own system from the ground up, tailored exactly to how your business operates. It empowers you to see exactly where your money is going without relying on external apps.

How It Works in Practice

Consider a freelance photographer who needs to track equipment purchases, travel costs, and other client-related expenses. They can create a simple spreadsheet with columns for date, vendor, amount, expense category (e.g., "Gear," "Travel," "Software"), and project name. After each purchase, they enter the details into the sheet and file the physical receipt in a monthly folder. This simple log makes it easy to calculate project profitability and prepare for quarterly tax submissions.

Similarly, a small marketing agency can use a shared Google Sheet to manage project-based expenses across its team. This central document gives everyone a real-time view of the budget, ensuring spending stays on track and client billing is accurate.

Tips for Success

To maximize the effectiveness of your spreadsheet system, implement these best practices:

- •Standardize Categories: Create a predefined list of expense categories and use data validation to ensure consistency.

- •Use Formulas: Set up formulas to automatically calculate totals, taxes, and monthly summaries to save time and reduce errors.

- •Be Consistent: Use a uniform date format (e.g.,

YYYY-MM-DD) across all entries to make sorting and filtering simple. - •Back It Up: Regularly save backups of your spreadsheet to a cloud service like Google Drive or Dropbox to prevent data loss.

- •Create Summary Tabs: Build a separate tab that pulls data from your main log to provide a high-level monthly or quarterly overview.

This manual but powerful method gives you full ownership over your financial data. To dive deeper into creating your own system, learn more about how to track business expenses with a spreadsheet and download a free template to get started.

5. Cloud-Based Expense Management Platforms

For businesses looking beyond simple storage, cloud-based expense management platforms offer an end-to-end solution. These systems handle the entire expense lifecycle, from receipt capture and categorization to multi-level approvals and direct integration with accounting software. This comprehensive approach is one of the best ways to organize business receipts for companies with multiple employees, as it automates workflows and enforces spending policies.

These platforms are more than just digital file cabinets; they are powerful engines for financial control. An employee can submit an expense via a mobile app, which is then automatically checked against company policies. The expense report is routed through a predefined approval chain, and once approved, it syncs seamlessly with your accounting system for reimbursement and bookkeeping.

How It Works in Practice

Consider a mid-size consulting firm where consultants incur frequent travel and client-related expenses. Using a platform like SAP Concur, a consultant can snap a photo of a receipt, link it to a specific client project, and submit it for approval in real-time. The finance manager can then view all project-related expenses in a centralized dashboard, ensuring budgets are met and client billing is accurate. Similarly, a growing sales team can use Expensify to automatically create expense reports from corporate card transactions, drastically reducing manual data entry.

These platforms provide a holistic view of company spending, turning scattered receipts into structured, actionable financial data.

Tips for Success

To effectively implement an expense management platform, a structured rollout is key:

- •Configure Policies First: Before inviting users, set up your company’s spending rules and approval workflows within the platform to automate compliance.

- •Provide User Training: Host training sessions to ensure all employees understand how to submit expenses correctly and efficiently.

- •Integrate with Accounting: Connect the platform to your existing accounting software (like QuickBooks or Xero) to create a seamless flow of data.

- •Establish Clear Hierarchies: Define who approves expenses for whom. A clear approval hierarchy prevents bottlenecks and confusion.

- •Review and Update Regularly: Periodically review your spending policies and update them in the system to reflect business changes.

This method transforms receipt organization from a tedious chore into a strategic financial management process, offering unmatched control and visibility.

6. Category-Based Binder System

For those who prefer a tangible, hands-on approach or need to maintain physical records for compliance, the category-based binder system is a classic for a reason. This method organizes your paper receipts into dedicated three-ring binders, sorted by specific expense categories. It’s one of the best ways to organize business receipts physically because it offers both chronological and categorical order, making manual reviews straightforward.

The system involves creating tabbed sections for categories like office supplies, travel, meals, utilities, and professional services. You simply hole-punch each receipt and file it chronologically within its corresponding category. This creates a neat, physical archive that is easy to navigate when it’s time to do the books or face an audit.

How It Works in Practice

Imagine a law firm that needs to meticulously track client-related expenses. They could dedicate a binder to each client, with tabs for categories like court filing fees, travel, and expert witness payments. Similarly, a construction company can use separate binders for different projects, with categories for materials, subcontractor labor, and equipment rentals. This keeps costs organized by job and type, simplifying project-based accounting.

This time-tested method, long championed by traditional accounting practices and small business management courses, provides a clear, physical trail of your financial activities.

Tips for Success

To maximize the effectiveness of your binder system, consider these practical tips:

- •Label Clearly: Use bold, clear labels on the binder spines, including the business name and the year (e.g., "Smith Consulting - 2024 Expenses").

- •Create an Index: Place a master category index at the front of each binder for quick reference.

- •Keep Categories Broad: Avoid over-complicating your system with too many niche categories. Stick to the main expense types relevant to your business.

- •Protect Important Receipts: Use acid-free sheet protectors for significant purchases or receipts printed on flimsy thermal paper to prevent fading and damage.

- •Be Consistent: Hole-punch receipts in the same place every time to keep the pages neat and uniform.

While it requires more manual effort than digital methods, this system offers a reliable and organized physical record that many business owners still trust and value.

7. Hybrid Digital-Physical System

For businesses that want digital convenience without sacrificing physical security, a hybrid system offers the best of both worlds. This approach involves scanning receipts for immediate digital access while also filing the original paper copies. It’s a robust method for organizing business receipts, creating a redundant, compliant, and easily searchable archive that satisfies both modern workflows and traditional record-keeping mandates.

The process bridges the gap between digital efficiency and physical documentation. You capture a receipt with a scanner or app for instant data extraction and cloud storage, then file the physical copy in an organized system. This dual approach ensures you have a readily accessible digital file for day-to-day operations and a hard copy for audits or long-term retention requirements.

How It Works in Practice

Consider a government contractor who must retain physical documents for a set period. They can scan a receipt for a project expense into their accounting software for immediate billing and tracking. The original receipt is then filed in a binder labeled with the project name and date. Similarly, a healthcare practice can digitize patient-related expense records for quick reference while keeping the physical copies secure to maintain HIPAA compliance, ensuring an unbroken audit trail.

This method provides peace of mind by creating two separate but connected systems. The digital files offer speed and accessibility, while the physical ones provide a reliable backup and meet strict regulatory standards.

Tips for Success

To effectively manage a hybrid system, consistency is key. Follow these best practices:

- •Establish a Cross-Reference System: Use a unique ID or code on both the digital file and the physical receipt to easily link them.

- •Scan and File Together: Make it a habit to scan a receipt immediately before or after you file it physically to prevent backlogs.

- •Prioritize What You Keep: Not every receipt may need a physical backup. Identify categories, like major asset purchases or tax-critical expenses, that require dual storage.

- •Organize Your Physical Space: Even with a hybrid system, physical clutter can be an issue. Following essential tips for maximizing business storage space will keep your paper records tidy and accessible.

- •Conduct Regular Audits: Periodically check a sample of receipts to ensure your digital and physical files match, maintaining system integrity.

This balanced approach is the best way to organize business receipts for companies in regulated industries or for anyone who prefers a tangible backup for critical financial documents.

8. Automated Bank Integration Method

Tired of manually entering every single transaction from your bank statements? The automated bank integration method is a game-changer for modern businesses. This approach directly connects your business bank accounts and credit cards to your accounting software, creating a seamless flow of financial data. It's one of the best ways to organize business receipts because it dramatically reduces manual data entry and ensures your records are always up-to-date.

This method works by automatically importing every transaction into your accounting platform. From there, AI-powered tools categorize expenses based on vendor information and past behavior. When you scan a receipt for that purchase, the system can often match the image to the corresponding bank transaction, creating a complete and verifiable record.

How It Works in Practice

Imagine an e-commerce business using QuickBooks Online. By connecting their Chase Business bank account, all sales, supplier payments, and ad spend transactions are automatically pulled into their books. The software learns to categorize recurring charges from vendors like Shopify or Google Ads, saving hours of work. Similarly, a fast-growing startup using a modern platform like Brex benefits from real-time expense tracking as every card swipe is instantly recorded and categorized.

This direct link between your banking and accounting systems provides a comprehensive, real-time overview of your company's financial health, making it an indispensable tool for efficient financial management.

Tips for Success

To maximize the benefits of bank integration, keep these best practices in mind:

- •Dedicate Accounts: Use business bank accounts and credit cards exclusively for business expenses to avoid commingling funds.

- •Train the AI: Initially, review and correct AI-driven categorizations. The system will learn from your changes and become more accurate over time.

- •Set Up Rules: Create rules for recurring vendors to ensure consistent and correct categorization for every transaction.

- •Reconcile Regularly: Periodically reconcile the imported data with your official bank statements to catch any discrepancies early.

This automated approach transforms receipt organization from a tedious chore into a streamlined, background process. The power of this technology lies in its ability to learn and adapt, making your financial management smarter over time.

Ready to see how artificial intelligence is reshaping financial workflows? Learn more about the rise of the AI agent for accounting and discover how it can elevate your business operations.

8 Methods for Organizing Business Receipts Comparison

| Method | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Digital Receipt Scanning and Storage | Medium (app setup, OCR learning curve) | Moderate (smartphone, subscription) | Accurate digitized records, searchable database | Small businesses, freelancers, sales teams needing digital integration | Automatic OCR extraction, cloud backup, easy search |

| Envelope Filing System | Low (simple manual sorting) | Low (paper envelopes, labels) | Basic physical organization, chronological within category | Small volume businesses, low-tech preference, offline use | Low cost, no tech needed, easy to maintain |

| Monthly Accordion File Method | Low to Medium (labeling and filing) | Low (accordion folder purchase) | Date-based chronological filing | Seasonal/periodic businesses, those focusing on month-by-month tracking | Portable, quick monthly filing, inexpensive |

| Spreadsheet-Based Digital Tracking | Medium (manual entry, formula setup) | Low (spreadsheet software) | Detailed tracking with customizable analysis | Businesses comfortable with spreadsheets, tax preparation focus | Customization, powerful reports, low cost |

| Cloud-Based Expense Management Platforms | High (initial setup, training) | High (software subscription, training) | Automated workflows, real-time tracking, compliance | Medium to large businesses with multiple employees and approvals | End-to-end automation, scalability, advanced reporting |

| Category-Based Binder System | Low (manual organization, filing) | Low (binders, dividers) | Physical categorical filing, manual review | Businesses requiring robust physical audit trails | Clear category organization, durable, tech-independent |

| Hybrid Digital-Physical System | High (dual maintenance, consistent filing) | High (digital and physical storage) | Redundancy, compliance with physical/digital requirements | Regulated industries, government contractors, audit-sensitive entities | Dual backup, audit compliance, flexible retrieval |

| Automated Bank Integration Method | Medium to High (integration setup) | Moderate (software, bank accounts) | Automated real-time expense tracking, AI-enhanced accuracy | Businesses using dedicated business accounts and digital accounting | Minimal manual entry, real-time tracking, bank reconciliation |

From Chaos to Clarity: Choosing Your Perfect Receipt System with Tailride

We've explored a wide range of strategies, from the steadfast reliability of manual binders to the dynamic efficiency of automated software. Finding the best way to organize business receipts isn't about chasing a one-size-fits-all solution. Instead, it’s about identifying the system that aligns perfectly with your business’s unique pulse, transaction volume, and growth ambitions.

Whether you're a solopreneur who finds comfort in a physical accordion file or a growing startup leveraging cloud storage, the core principle remains the same: a well-organized system is the bedrock of financial health. It transforms a shoebox of crumpled paper into a powerful resource for strategic decision-making.

Key Takeaways for Your Financial Workflow

Let's distill our journey down to its most crucial insights:

- •Consistency is King: The "best" system is the one you actually use. Whether it's the weekly envelope method or a daily digital scan, consistency prevents backlogs and ensures you're always prepared.

- •Digital Isn't Just for Tech Giants: Even the smallest businesses can benefit from digital tools. Simple scanning apps or organized spreadsheets can dramatically reduce physical clutter and make information retrieval instantaneous.

- •Automation is the Ultimate Upgrade: While manual and digital methods are effective, true automation is the game-changer for businesses focused on scaling. It frees up invaluable time and mental energy previously spent on tedious administrative tasks.

Ultimately, the goal of an organized receipt system is to achieve greater financial clarity, making critical processes like understanding account reconciliation significantly simpler and more accurate. When your data is clean and accessible, you move from reactive bookkeeping to proactive financial management.

Your Next Step: From Managing to Mastering

Your journey from receipt chaos to financial clarity starts with a single, decisive step. Review the methods we’ve covered and ask yourself: "Which system will not only solve today's problems but also support my business tomorrow?"

If your answer involves less manual data entry, fewer lost receipts, and more time dedicated to growth, then it’s time to embrace automation. Platforms like Tailride are designed to be the final destination in your search for the perfect system. They don't just help you organize receipts; they eliminate the task altogether by capturing, categorizing, and syncing them for you. You get all the benefits of a flawless organizational system with none of the manual effort.

Stop letting receipt management be a bottleneck. Choose the path that empowers you, streamlines your operations, and turns your financial data into your most valuable asset.

Ready to put your receipt organization on autopilot? Discover how Tailride uses AI to automatically fetch, process, and sync all your receipts, giving you back hours every week. Explore Tailride today and transform your financial workflow forever.