Your Guide to an AI Agent for Accounting

Discover how an AI agent for accounting transforms your finances. Learn how they work, their benefits, and how to choose the right one for your business.

An AI agent for accounting is essentially a smart, automated assistant that’s been built specifically to handle those repetitive financial chores. Think of it as a digital team member working tirelessly around the clock to process invoices, organize receipts, and get your books in order with incredible accuracy. This frees you and your team up for the kind of strategic work that actually grows your business.

What Is an AI Agent for Accounting?

Imagine having the most diligent, detail-obsessed assistant you could possibly hire. This person never needs a coffee break, never makes a typo, and instantly knows what to do with every single invoice, receipt, or financial statement that comes their way. In a nutshell, that's an AI agent for accounting. It’s more than just a piece of software; it’s an active, intelligent system designed to take over the manual, time-draining parts of financial management.

This technology is a huge leap past simple automation. Instead of just following a strict set of pre-programmed rules, an AI agent uses artificial intelligence to actually understand the context of your financial documents. When a PDF invoice lands in your inbox, it doesn't just see a file. It identifies the vendor, reads the due date, pulls out the line items, and knows exactly where to file that information in your accounting system.

The Core Functions of an AI Agent

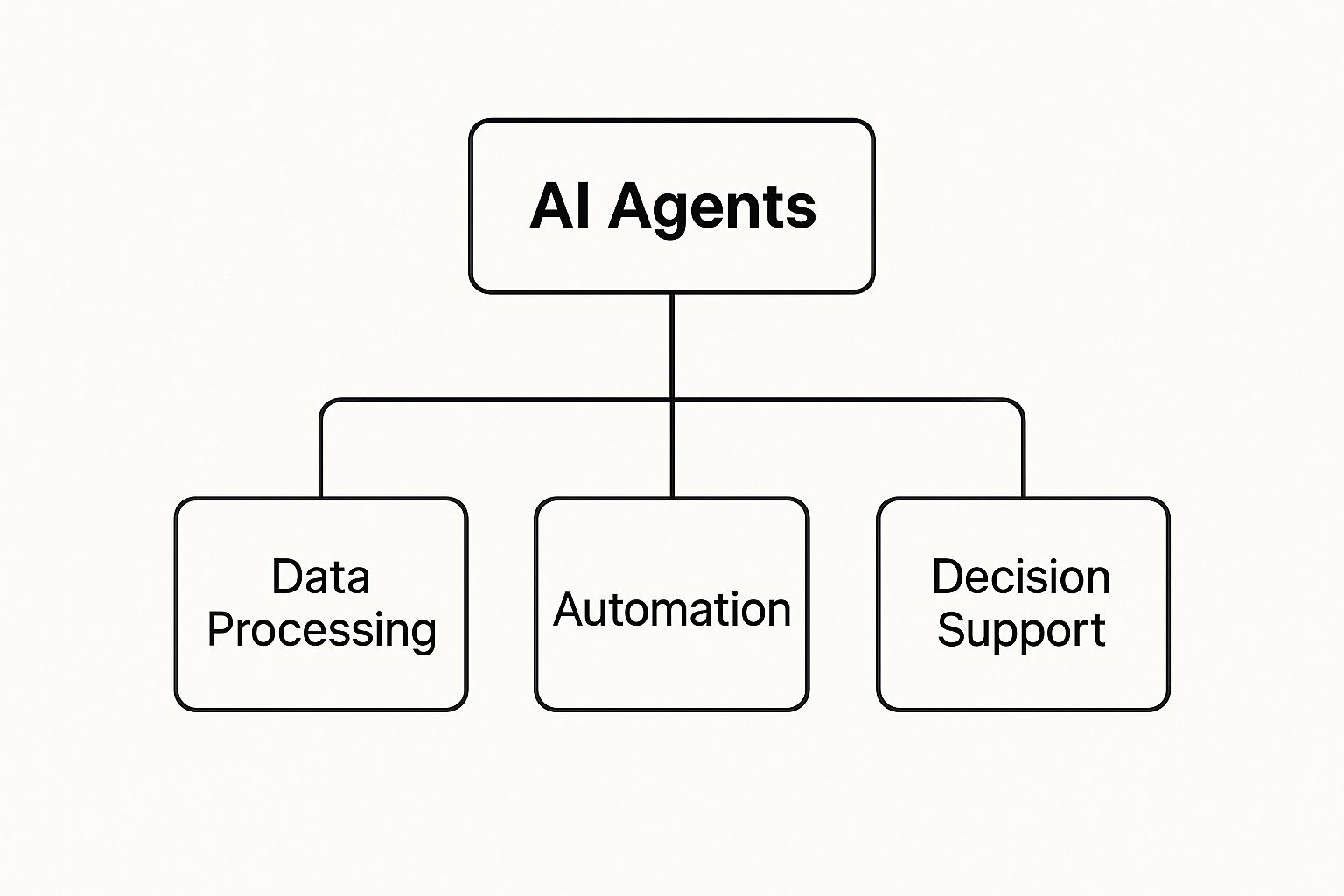

The real magic of an AI agent is its ability to juggle three key functions at once. The diagram below breaks down how these pieces fit together to create a seamless workflow.

As the visual shows, it all starts with processing data. This foundation makes intelligent automation possible, which in turn gives you the insights needed for better decision-making. It’s no surprise that these agents are becoming a cornerstone of modern finance.

The market for AI in accounting is absolutely booming. It's currently valued at USD 4.87 billion and is expected to rocket to an incredible USD 96.69 billion by 2033. That’s a massive 39.6% compound annual growth rate, driven by businesses of all sizes rushing to adopt these tools for everything from basic bookkeeping to complex financial forecasting.

How an AI Agent Transforms Your Workflow

You can really see the impact of an AI agent when you put the old way of doing things side-by-side with the new. Those tedious tasks that used to eat up hours of your week? They're now done in seconds. This shift doesn’t just speed things up; it completely changes how you manage your financial operations. For a closer look at the technology behind this, check out our complete guide to accounting AI.

The goal isn’t to replace accountants but to elevate them. By automating the monotonous prep work, an AI agent turns financial professionals from data entry clerks into strategic reviewers and advisors.

To see just how different the workflows are, let's compare some common tasks. The table below shows the stark contrast between traditional accounting and what's possible with an AI agent.

Table: Traditional Accounting vs AI Agent Capabilities

| Task | Traditional Method (Manual) | AI Agent Method (Automated) |

|---|---|---|

| Invoice Processing | Manually typing invoice details from a PDF into accounting software. | Automatically extracts all data from invoices received via email or portals. |

| Expense Categorization | Sorting through a pile of receipts and guessing the correct expense category. | Learns your spending habits and intelligently assigns categories to each expense. |

| Data Reconciliation | Spending hours matching bank statements against your general ledger line by line. | Instantly matches transactions and flags discrepancies for review. |

The difference is clear. One path is filled with manual effort and potential errors, while the other is fast, accurate, and frees up your most valuable resource: time.

How Do AI Accounting Agents Actually Work?

Thinking about how an AI agent for accounting works can feel a bit like trying to understand magic. But it's not a mysterious "black box" at all. It's more like a super-efficient digital assembly line, where each step logically builds on the last to turn a messy pile of documents into clean, organized financial data.

The whole process kicks off the moment a document lands in its court, whether that's a PDF invoice in your inbox or a quick photo you snapped of a lunch receipt. The first job for the AI is to "see" and "read" it, just like a person would.

Step 1: Seeing and Reading the Document

This first part of the process relies on a cool piece of tech called Optical Character Recognition (OCR). The easiest way to think about OCR is as a pair of digital eyes that can read. It scans documents like PDFs or phone pictures and turns the visible text into digital characters a computer can work with.

But here's the catch: standard OCR is a bit like a toddler who can sound out letters but doesn't know what the words mean. It can spot the letters "T-O-T-A-L," but it has no idea that this word represents the final bill. That’s where the real intelligence kicks in.

Step 2: Understanding the Context

Once OCR has done its job, the AI agent uses a combination of Natural Language Processing (NLP) and Machine Learning (ML) to actually make sense of everything. NLP helps it grasp the meaning and structure of the words, while ML allows it to get smarter over time.

Think about it this way: if you hand a new assistant a stack of invoices, they use their experience to find the important stuff:

- •Vendor Name: Who sent this?

- •Invoice Number: What’s the unique ID for this bill?

- •Due Date: When is it due?

- •Total Amount: How much do I owe?

An AI agent does the exact same thing, but it’s been trained on millions of financial documents. This massive experience helps it instantly recognize the patterns and context for these fields, even when the invoice layouts look completely different.

An AI agent doesn't just read words; it understands their financial meaning. It learns that "Amount Due," "Balance," and "Total" are often the same thing and correctly grabs the number next to them. This ensures your data is accurate right from the start.

And the best part? It's always learning. Every single document it processes makes it a little bit sharper and more accurate.

Step 3: Classifying and Filing the Data

Okay, so the agent has pulled out all the key information and understands what it means. Now for the final, and most satisfying, step: putting that data where it belongs. This is where you really see the automation pay off. The agent takes the extracted data and gets to work based on rules you’ve set or what it's learned to do.

A platform like Tailride, for instance, uses this intelligence to connect all the dots in your workflow.

The dashboard you see here is the result of all that background work - the AI agent has already read, understood, and filed every document. It’s your command center where everything is neatly organized and ready for you.

From this point, the agent can do things like:

- •Categorize Expenses: It sees a bill from "AWS" and instantly knows to tag it under a "Cloud Services" expense category.

- •Sync with Accounting Software: It pushes the vendor, date, amount, and category straight into your QuickBooks or Xero account. No more manual data entry.

- •Flag for Review: If an invoice amount looks way off or it spots a duplicate bill, it’ll flag it so a human can take a quick look.

This simple three-step flow - seeing, understanding, and acting - is what makes an AI accounting agent so powerful. It follows the same thought process as a human bookkeeper but does it with a speed and accuracy that turns chaotic paperwork into perfect, audit-ready financial records.

The Real-World Payoff for Your Business

Okay, so the technology is impressive, but let's get down to brass tacks. What's the actual, tangible benefit for your business? When you move past the theory, using an AI agent for accounting really boils down to three huge wins: a massive efficiency boost, near-perfect accuracy, and much deeper financial insights. It's about turning your accounting from a necessary chore into a genuine strategic advantage.

Think about getting your weekends back, free from the dread of manual data entry. Imagine your finance team shifting from tedious reconciliations to high-level planning. This isn't just a nice idea; it's what's happening right now for businesses that have embraced this tech. Having real-time financial data at your fingertips lets you make smarter, faster decisions that fuel real growth.

Unlocking a New Level of Efficiency

The first thing you'll notice is the incredible jump in efficiency. Those repetitive tasks that eat up hours of your team's day? An AI agent can knock them out in seconds. This isn't just about saving time; it's about reallocating your team's most valuable resource - their brainpower - to work that truly matters.

Let's just look at the old way of handling accounts payable. It’s a grind:

- •Digging through emails to find invoices.

- •Printing or downloading the attachments.

- •Manually typing vendor names, dates, and amounts into your accounting software.

- •Carefully filing the document in the right digital folder.

An AI agent collapses that entire mess into a single, automated action. When an invoice hits your inbox, the agent reads it, pulls out the key data, and puts it right into your accounting system. No human hands needed. This is a profound shift, freeing your team to focus on things like vendor relationships, analyzing cash flow, and finding ways to save money. The accounts payable automation benefits go way beyond just speed - they ripple through your entire financial operation.

Hitting a New Standard of Accuracy

We all make mistakes. But in accounting, even a tiny error can cause big headaches. One misplaced decimal point or a typo in an invoice number can lead to paying the wrong amount, creating compliance issues, or forcing hours of frustrating detective work to figure out what went wrong.

An AI agent for accounting all but eliminates the risk of human error. By automating how data is extracted and entered, it guarantees the information in your books is an exact match to the source document. No more fat-fingering numbers or misreading a blurry receipt.

By eliminating manual data entry, you’re not just speeding up a process - you’re building a more reliable and trustworthy financial record from the ground up. This accuracy is the foundation for confident decision-making.

This level of precision is a lifesaver, especially during month-end closes and audits. With an AI agent, you have a clean, consistent, and easily traceable data trail. Every single entry is linked directly back to its source document, which makes audits infinitely smoother and less stressful. Instead of digging through filing cabinets, you can give auditors clear, digital proof in a matter of moments.

From Data Entry to Strategic Insight

This might be the biggest long-term win of all. You can finally turn your accounting function from a reactive cost center into a proactive, strategic powerhouse. When your financial data is captured accurately and in real-time, you suddenly have the ability to see what's happening in your business right now, not what happened last month.

This change is fundamentally reshaping the accounting profession. In major markets like the UK, AI's contribution to the economy is already valued at over £2 billion. A telling 61% of accountants see AI as their ticket to moving beyond manual grunt work, improving accuracy, and delivering sharper financial insights.

With an AI agent handling the data grind, your team can finally focus on answering the big questions:

- •Which spending categories are creeping up the fastest?

- •Are we paying our vendors on time to snag early payment discounts?

- •How does our cash flow today stack up against our forecast for the month?

This is the kind of strategic focus that separates businesses that thrive from those that just get by. By automating the "what," you empower your team to explore the "why" and the "what's next," driving your company forward with data-backed confidence.

Common Use Cases for an AI Accounting Agent

Alright, so we know what these AI agents are and the perks they bring to the table. But where do you actually see them in action? Where does the rubber meet the road?

The real magic happens when you apply this technology to the day-to-day grind - the tasks that secretly eat up hours and drain your team's energy. Think of it less as a complete overhaul and more as a smart upgrade for your existing workflows, from taming a mountain of invoices to sniffing out weird-looking transactions.

Automated Invoice and Receipt Processing

This is the big one. Honestly, if an AI agent did nothing else, this alone would be worth it for most businesses. Every company is constantly swimming in a sea of invoices and receipts, and manually processing them one by one is a huge time-waster.

You know the drill. An invoice lands in your inbox. Someone has to download it, squint at the details, and then painstakingly type the vendor name, invoice number, due date, and every single line item into the accounting software. It’s not just slow and mind-numbing; it’s a perfect recipe for typos that can cost you real money.

Enter the AI agent. It keeps an eye on your inbox, spots new invoices as they arrive, and instantly pulls out all the key information with impressive accuracy. That data is then teed up for your approval or sent straight into your books. The whole point is to automate data entry, freeing up your team from the copy-paste cycle.

Intelligent Expense Categorization

Getting your expense categories right is crucial for clean books and a stress-free tax season. But let’s be real, it’s often a messy guessing game, especially with those vague descriptions you see on receipts and bank statements.

The old-school way? An employee sees a charge for "The Corner Cafe" and has to manually tag it as "Meals & Entertainment." This depends entirely on someone’s memory and judgment, which leads to inconsistent records that are a headache to clean up later.

An AI agent, on the other hand, actually learns from you. The first time you categorize a transaction from "The Corner Cafe," it takes note. The next time a charge from that same spot pops up, it automatically suggests or applies the right category. This simple bit of learning keeps your books consistent and your financial data trustworthy.

An AI agent for accounting doesn't just automate; it learns. It builds a custom rulebook based on your specific business activities, ensuring that every transaction is categorized correctly and consistently over time.

This adaptive learning is a game-changer for keeping your financial records spotless with almost no effort.

Seamless Bank and Credit Card Reconciliation

Ah, reconciliation. That dreaded month-end task of matching every transaction in your accounting software with what’s on your bank statement. For many, it means hours spent with two screens, ticking off entries one by one.

An AI agent turns this whole process on its head. It securely connects to your bank feeds and does the matching for you in the background. Instead of hunting for every single transaction, you just need to glance over a short list of exceptions that the AI couldn't figure out on its own. What used to be a multi-hour chore becomes a quick ten-minute review.

The demand for this kind of efficiency is skyrocketing. The AI in accounting market is expected to leap from USD 6.68 billion to a massive USD 37.60 billion by 2030. With software making up 85% of that market, it’s clear businesses are hungry for tools that solve these exact problems.

Proactive Anomaly and Fraud Detection

Finally, a great AI agent acts like a 24/7 watchdog for your finances, always on the lookout for anything that seems off.

Without this kind of help, fraud detection is usually reactive. You find a duplicate payment or a sketchy charge weeks after the fact, long after the money is gone. It’s a vulnerable position for any business to be in.

An AI agent for accounting gives you a proactive shield. It can instantly flag things like:

- •Duplicate Invoices: If the same invoice number from a vendor shows up twice, you'll get an alert before you pay it a second time.

- •Unusual Spending: A large, out-of-character purchase on a company card at 3 AM? The system will flag it for you to check out.

- •Vendor Detail Changes: If an invoice shows up with a new bank account number for a familiar vendor, the agent flags it as a potential scam.

This constant monitoring is an incredible safety net, helping you catch problems before they turn into major financial headaches.

To give you a clearer picture, here’s a breakdown of how these agents tackle common accounting challenges.

Practical Applications of an AI Accounting Agent

| Use Case | Problem It Solves | How AI Helps |

|---|---|---|

| Invoice & Receipt Processing | Time-consuming manual data entry and human error. | Automatically extracts data from documents, eliminating manual input. |

| Expense Categorization | Inconsistent and inaccurate expense tracking. | Learns from user behavior to categorize transactions consistently. |

| Bank Reconciliation | Tedious, manual matching of transactions at month-end. | Connects to bank feeds and auto-matches entries, highlighting exceptions. |

| Fraud Detection | Reactive discovery of fraud or errors, often too late. | Proactively monitors for anomalies like duplicates or unusual spending. |

As you can see, the applications are direct and practical. It’s all about taking the robotic, repetitive work off your plate so you and your team can focus on what really matters.

How to Choose the Right AI Agent

https://www.youtube.com/embed/_Eebm1Z2uZY

With so many tools popping up, picking the right AI agent for accounting can feel overwhelming. But it doesn't have to be. If you know what to look for, you can easily sift through the hype and find a tool that actually makes your life easier. It’s not about getting the most features; it’s about finding the right fit for your team and how you work.

Think of it like hiring a new person for your finance team. You need to know they have the right skills, can get along with your current systems, and can be trusted with sensitive data. A little bit of homework upfront will help you make a great choice that pays for itself many times over.

Does It Play Well with Your Other Software?

This is the big one. The single most important thing to consider is how well an AI agent connects with the software you already use every day. If it can't talk to your accounting system, it's just creating another data silo and more manual work. That's the opposite of what you want.

Before you even book a demo, jot down your must-have software. Your list should include:

- •Accounting Software: Does it connect seamlessly with your system, whether it’s QuickBooks, Xero, or Business Central? A native, deep integration is what you’re looking for.

- •Communication Tools: Can it automatically grab invoices from your team's inboxes, like Gmail and Outlook?

- •Cloud Storage: Does it file the processed documents neatly into Google Drive or another storage service for easy archiving?

A good AI agent should feel like a natural extension of your existing setup, not something you have to build your entire workflow around.

Is It Actually Easy to Use?

Next up: usability. Even the most powerful tool is worthless if your team hates using it because it's too complicated. The whole point is to save time and reduce headaches, so the software should feel intuitive right out of the box. Look for a clean design and a simple setup process.

A great AI agent should deliver value almost immediately. If getting started feels like a massive IT project that takes weeks, it’s probably too complex for what you need. Simplicity is a feature, not a bug.

As you evaluate different options, ask yourself a few practical questions:

- •How fast can we go from signing up to processing our first real invoice?

- •Is the interface clear enough for someone who isn't a tech expert?

- •What kind of help and training do they offer to get us up and running?

A smooth start means your team will adopt it faster, and you'll see the benefits much sooner. Some systems, like Tailride, are built so you can extract your first invoice just seconds after signing up.

How Seriously Do They Take Security and Compliance?

You're about to hand over some of your most critical financial data to this tool, so security isn't just a feature - it's everything. Don't just take a company's word for it. You need to dig into their security practices to make sure your information is locked down tight.

Look for concrete proof of their security measures:

- •Data Encryption: Is your data protected while it's being sent and while it's being stored? It should be.

- •Compliance Standards: Does the company follow well-known data privacy rules like GDPR?

- •Access Controls: Can you control which team members can see or do what within the platform?

These aren't just buzzwords; they're your guarantee that your financial data is being handled with care. It can be helpful to see how other industries approach this. For example, when experts select the top sustainability software with AI, they perform similar deep dives into data security and reliability.

Finally, remember that the right AI agent can completely change how you handle your finances, especially when it comes to paying bills. To see just how this works in practice, check out our guide on how to automate accounts payable for a step-by-step plan.

Frequently Asked Questions About AI in Accounting

Diving into new technology always brings up a few questions. That's completely normal. When it comes to something as important as your finances, bringing an AI agent for accounting into the mix deserves a healthy dose of curiosity.

We get it. That’s why we’ve put together this section to tackle the most common questions and concerns we hear from business owners and accountants just like you. Our goal is simple: to give you clear, straight-up answers so you can feel great about making the switch.

Let's get into the nitty-gritty and clear up the big questions around security, jobs, and just how hard this stuff really is to use.

Is My Financial Data Secure with an AI Agent?

This is usually the first thing people ask, and for a very good reason. Your financial data is incredibly sensitive, and you need to have complete trust in any tool that handles it. The short answer? Yes, with a quality provider, your data is incredibly secure. In fact, it’s often much safer than many of the old-school manual methods.

Think about it for a second. Right now, you might have invoices floating around in email inboxes, printed out on someone's desk, or saved to a local computer with minimal security. An AI accounting platform is built from the ground up with security as its absolute core.

Reputable companies pour resources into security measures that most small businesses simply couldn't justify on their own. This usually includes:

- •End-to-End Encryption: Your data is essentially scrambled into a secret code the moment it leaves you, while it's in transit, and while it's stored.

- •Strict Access Controls: You're the boss. You decide exactly who on your team can see or do what, preventing any unauthorized peeking.

- •Compliance with Global Standards: The best platforms play by the rules, adhering to strict data privacy laws like GDPR to ensure your information is handled with care.

- •Regular Security Audits: These platforms hire professional "ethical hackers" to constantly test their defenses, find any potential weak spots, and fix them before they become a problem.

Think of a top-tier AI accounting platform as a digital Fort Knox. It’s designed with multiple layers of security, offering a level of protection that’s light-years ahead of just emailing unencrypted PDFs back and forth.

Will an AI Agent Replace My Accountant?

This is a huge myth, and the answer is a firm no. An AI agent isn't here to replace the strategic brilliance of a human accountant. It’s designed to be their new best friend - their most powerful tool. The whole point is to elevate what an accountant does, not make them obsolete.

It's like giving a master chef a state-of-the-art kitchen. The new tools don't replace the chef's expertise; they free them up to create more amazing dishes, faster. An AI agent takes on all the repetitive, soul-crushing tasks that drain an accountant's time, like:

- •Manually typing in data from invoices and receipts.

- •The mind-numbing process of matching transactions.

- •Chasing down people for missing paperwork.

By automating all that grunt work, the AI frees up your accountant to focus on what humans do best: thinking strategically. They can now spend their time on financial planning, spotting trends in the data, advising you on business growth, and navigating the complexities of tax law.

Ultimately, an AI agent helps an accountant evolve from a data preparer to a data reviewer and trusted advisor. The accountant is still in the driver's seat, using the AI's perfectly organized data to give you much deeper, more valuable insights.

How Difficult Is the Setup Process?

When people hear "AI," their minds often jump to a massive, months-long project that needs a whole IT department to get off the ground. With a modern AI agent for accounting, the reality is the complete opposite. The best tools are built for speed and simplicity, getting you up and running in minutes, not months.

For a tool like Tailride, we made the setup process ridiculously simple on purpose:

- •Sign Up: A few clicks and you have an account. No hoops to jump through.

- •Connect Your Accounts: You securely link your email (like Gmail or Outlook) and your accounting software (like QuickBooks or Xero). It’s as easy as logging in.

- •Start Processing: That’s literally it. The AI agent starts watching for new invoices and receipts right away, ready to go to work on the very first document it finds.

You don't need to be a tech genius. The whole experience is designed to feel natural and intuitive. The goal is to show you the magic almost instantly. You should be able to process your first invoice within seconds of signing up and see exactly how it works, without needing to read a thick manual. We focus on immediate impact, not a long, drawn-out setup.

Ready to see how an AI agent can give your accounting workflow a serious upgrade? Tailride offers a seamless, secure, and incredibly easy way to put your invoice and receipt management on autopilot. Get started in seconds and reclaim your time with Tailride today.