Automated Invoice Processing That Frees Your Team

Tired of manual data entry? Learn how automated invoice processing transforms your accounts payable with less cost, fewer errors, and more control.

Picture this: your accounts payable team is no longer drowning in paperwork, chasing down approvals, or fixing tiny data entry errors. It sounds like a dream, but it's the reality of automated invoice processing. This is simply a smart system that takes over the entire invoice lifecycle, from arrival to payment, with very little hands-on effort required from your team.

It's Time to Ditch Manual Invoice Processing for Good

Think about your current manual invoice process. It's probably a lot like a city-wide traffic jam. Every invoice is a car, stuck in gridlock, inching along. This creates frustrating delays for everyone and a high risk of collisions - or in this case, costly errors. It's a system that eats up valuable time, drains your resources, and slows your entire financial engine to a crawl.

This old-school approach isn't just slow; it's expensive and full of pitfalls. Manual processing is still a huge hurdle for many businesses. In fact, recent data shows that a staggering 68% of organizations still key in invoice data by hand. This can drive the average cost to process a single invoice up to $15. Now, multiply that by the hundreds or thousands of invoices you handle each month. The numbers add up fast.

Let's take a quick look at how these two methods really stack up against each other.

Manual vs Automated Invoice Processing at a Glance

This table breaks down the core differences, showing just how much you stand to gain by making the switch.

| Metric | Manual Processing | Automated Processing |

|---|---|---|

| Average Cost per Invoice | $15 or more | As low as $3-$5 |

| Processing Time | Days or weeks | Minutes or hours |

| Error Rate | High (human error) | Extremely low (system-validated) |

| Approval Process | Slow, manual follow-ups | Instant, digital notifications |

| Visibility & Tracking | Limited, paper-based | Real-time, full audit trail |

The contrast is stark. Automation doesn't just offer marginal improvements; it fundamentally changes the efficiency and reliability of your AP department.

The Real Pain of Sticking With Old Methods

The problems with handling invoices by hand go way beyond just typing in numbers. The whole workflow is a minefield of bottlenecks that can hurt your bottom line and even damage your relationships with suppliers.

Here are a few of the most common headaches:

- •Chasing Approvals: How much time does your team waste hunting down managers for a simple signature? These delays can lead to late payments and frustrated vendors.

- •Costly Data Errors: A single misplaced decimal or the wrong vendor code can cause you to overpay or pay an invoice twice. Fixing these mistakes is a time-consuming nightmare.

- •Lost in the Shuffle: Paper invoices get lost. It’s a fact of life. They get buried on a desk, misplaced between departments, or lost in the mail, causing you to miss payment deadlines and lose out on early payment discounts.

Sticking with these outdated methods means you’re essentially accepting these problems as a normal cost of doing business. But it doesn’t have to be this way. Automation creates a clear path forward, turning a chaotic process into a smooth, predictable, and reliable operation.

Welcome to the High-Speed Express Lane

If manual processing is a traffic jam, then automated invoice processing is the dedicated, high-speed express lane that lets you bypass it all. It acts like a digital air traffic controller, intelligently routing every single invoice from the moment it arrives until it's paid, all without needing someone to manually steer it. This shift doesn’t just make things faster; it gives you a level of precision and control you never had before.

Even today, with all the technology available, some industries are still stuck using antiquated fax-based processes in trade finance. By bringing in automation, you’re making a decisive move into the modern age, leaving those clunky, expensive habits in the past. It’s all about empowering your team to stop being data-entry clerks and start being the strategic financial experts you hired them to be.

How Automation Turns a Stack of Invoices Into Smart Business Decisions

So, what really happens when you ditch the manual process and let automation take over? It’s not magic. It's a logical, step-by-step journey that transforms a tedious administrative chore into a predictable, data-rich part of your operations.

Think of it like hiring a digital assistant who works around the clock. This assistant instantly catches every invoice, reads it perfectly, and knows exactly who needs to see it next. It takes a simple document and turns it into genuinely useful business information.

The 5 Core Steps of Invoice Automation

The whole process kicks off the second an invoice lands in your inbox and doesn't stop until it's safely filed away in your accounting system, ready for payment. Each stage is designed to cut out manual work, slash errors, and speed everything up. This structured flow means nothing falls through the cracks.

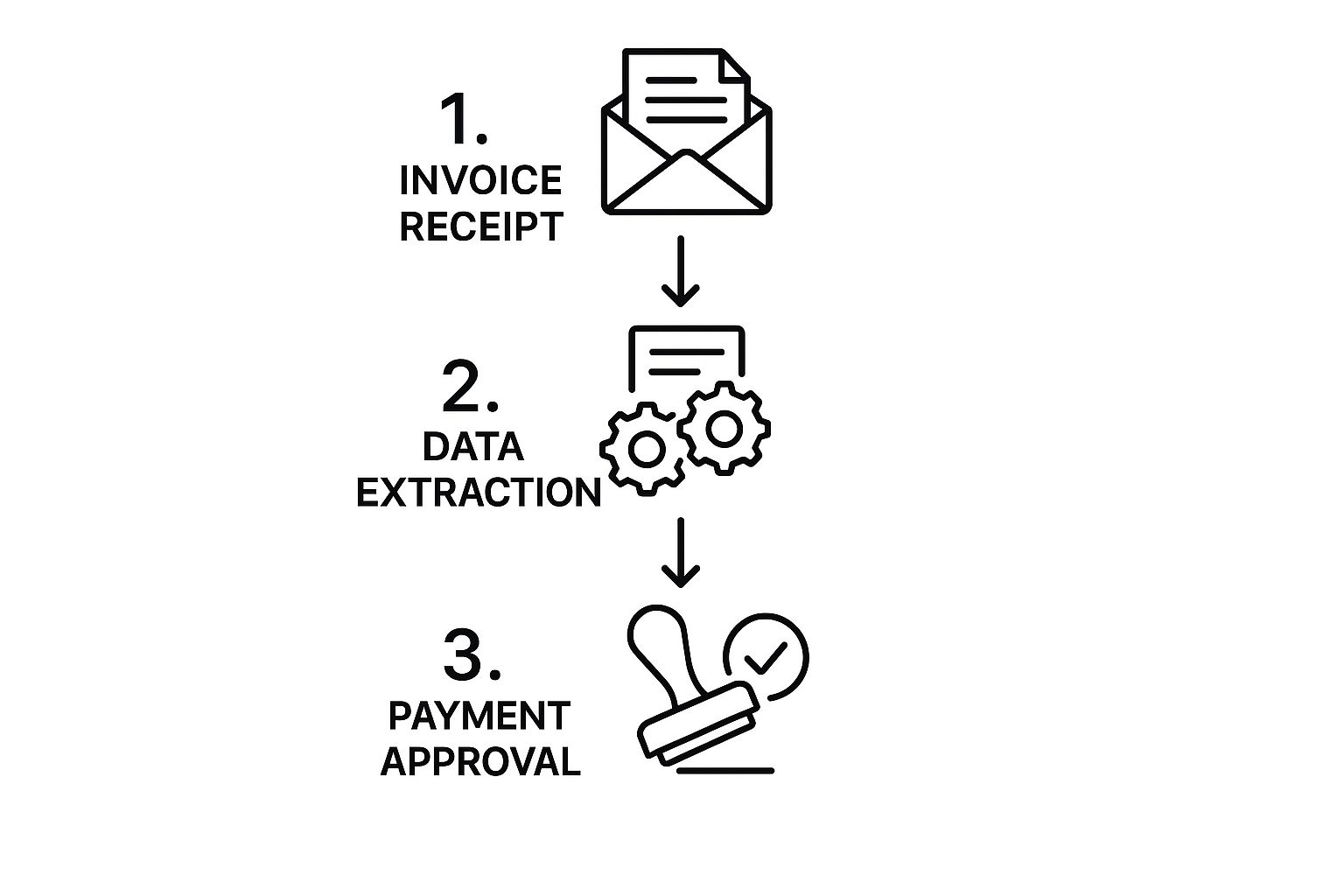

This image lays out the basic journey an invoice takes, from arrival to approval.

As you can see, the technology handles the heavy lifting - receiving, reading, and routing invoices - so your team doesn't have to.

Let's break down what's happening at each stage.

1. Invoice Capture First things first, the system has to get its hands on the invoice. Modern automated invoice processing tools are designed to grab documents from anywhere. Whether they’re email attachments, scanned paper copies, or uploaded PDFs, the system ingests them all. This flexibility means your suppliers can send invoices their way, and your system will be ready.

2. Data Extraction Once the invoice is in, that "digital assistant" I mentioned starts reading. Using smart technology, it pinpoints and pulls out all the key information: the vendor’s name, invoice number, due date, individual line items, and the total amount. This one step eliminates what is arguably the most mind-numbing and mistake-prone part of the manual process.

It's not just basic text recognition. The software is smart enough to understand context - telling the difference between an invoice number and a PO number. This leads to far greater accuracy than a human quickly copy-pasting data.

3. Data Validation With the data pulled, the system plays detective. It cross-checks the information against your existing records. It can perform a two-way match (checking the invoice against the purchase order) or even a three-way match (adding the goods receipt note to the comparison). This validation step instantly flags problems, like a price mismatch or wrong quantity, long before the invoice gets to a human for approval.

4. Approval Workflow After the invoice passes validation, it’s automatically sent to the right person for a sign-off. No more hunting down managers for signatures. The system pings the approver with a notification, and they can approve the invoice with a click - from their desk or their phone. If an invoice needs a few sets of eyes on it, it moves seamlessly down the chain based on the rules you set up.

5. Payment and Archiving Once it's fully approved, the invoice data flows directly into your accounting software, whether that's QuickBooks, Xero, or something else. The payment gets scheduled, and a complete digital record - the invoice, the approval history, everything - is securely archived. This creates a crystal-clear, searchable audit trail that makes month-end closing and financial reporting a breeze.

You can learn more about how this fundamentally changes a finance department in our complete guide to invoice process automation.

The Smart Tech Powering Your AP Team

So, what’s the secret sauce that gives these automated systems their superpowers? It's not just one thing, but a powerful team-up of two key technologies: Optical Character Recognition (OCR) and Artificial Intelligence (AI). When they work together, they transform a static invoice document into a stream of reliable, actionable data.

Think of OCR as the system’s eyes. When an invoice lands in your inbox as a PDF or you scan a paper copy, OCR gets to work. Its entire job is to look at that image, identify the letters and numbers, and turn it all into digital text your computer can understand. It’s the first, absolutely essential step in getting the data off the page.

But OCR by itself is just a reader. It can tell you what characters are on the document, but it has no clue what they actually mean. That's where the real magic of automated invoice processing kicks in.

The Brains of the Operation: Artificial Intelligence

If OCR provides the raw text, AI provides the understanding. It’s the smarts of the system, taking the data OCR has pulled and figuring out its context. It’s the difference between just reading words and actually understanding the message.

This AI layer is what turns a basic data entry tool into a genuine financial assistant. It doesn't just see a string of numbers; it recognizes it as an "invoice number," a "PO number," or a "due date." This is what allows the platform to start doing the heavy lifting for your accounts payable team.

AI isn't just about reading and sorting. It's about learning, interpreting, and protecting your business. It adds a critical layer of analytical power that can spot issues a human might easily miss during a busy day.

It's no surprise that the market for this kind of intelligent tech is booming. Driven by huge leaps in AI capabilities, the global market for AI in Invoice Management is expected to jump from $2.8 billion to a staggering $47.1 billion over the next decade. That kind of growth tells you just how much value businesses are getting out of these smart systems. You can read more about the future of AI in invoice processing on Veryfi.com.

What AI-Powered Automation Really Does

With AI in the driver's seat, an automated system can do things that go way beyond simple data entry. It’s actively working to make your entire AP process safer, more accurate, and a whole lot faster.

Here’s a quick look at what that intelligence really does for you:

- •Fraud and Anomaly Detection: The AI learns your patterns. If a vendor who usually invoices for $500 suddenly sends one for $5,000, the system can flag it for a human to double-check.

- •Duplicate Invoice Prevention: It catches duplicates instantly. If an invoice with the same number and amount has already been paid, it stops it in its tracks, preventing you from paying twice.

- •Continuous Learning: This is one of the coolest parts. Every time your team corrects a field the system might have misread, the AI learns from it. Over time, it gets smarter and more accurate, becoming perfectly tuned to the specific invoices your business handles.

This powerful duo - OCR and AI - is the heart of modern automated invoice processing. OCR handles the "what" by turning images into text, while AI handles the "so what" by understanding that data, checking it for problems, and putting it to work.

So, What's the Real-World Payoff?

Let's get down to brass tacks. Moving to automated invoice processing isn't just about speeding things up a bit. It’s a fundamental shift in how your business runs, creating real, tangible benefits that you'll feel across the entire company. We're talking about more than just efficiency; this is about building a more robust and resilient financial foundation.

https://www.youtube.com/embed/5QdSCjAYI10

Think about it: you're essentially transforming your accounts payable department from a necessary cost center into a genuine strategic advantage. By getting rid of the soul-crushing manual work, you free up your team to focus on what humans do best - analyzing financial trends, building strong vendor relationships, and spotting opportunities for growth.

Slash Your Operational Costs - Seriously

One of the first things you'll notice is a major drop in your operating costs. Manual processing is a quiet budget killer. When you add up the hours your team spends on data entry, plus the cost of paper, ink, postage, storage, and fixing inevitable human mistakes, it gets expensive fast.

Research has shown that automation can cut the cost of processing a single invoice by a whopping 67%. What could your business do with that extra cash? You could pour it into product development, hire top talent, or expand your marketing efforts. Automation takes the money you were spending on tedious tasks and puts it right back on your bottom line.

It's a simple equation, really: every dollar you don't spend on someone manually typing in numbers or chasing down approvals is a dollar you can invest in what actually moves the needle for your business. This isn't just about saving; it's about smart reinvestment.

Boost Your Data Accuracy and Trust

Let’s be honest, manual data entry is a minefield of potential errors. A simple typo, a moment of distraction, or a smudged document can lead to a misplaced decimal or the wrong vendor code. These tiny mistakes can snowball into huge headaches, like overpaying a supplier or running into compliance issues.

Automated systems, on the other hand, use smart technology like OCR and AI to pull information with incredible precision. In fact, many systems boast a data capture accuracy of up to 99%. This level of reliability means your financial records are always clean and trustworthy, giving you a solid footing for every business decision you make. Better data always leads to better business.

For a deeper look at making your AP department a well-oiled machine, check out these strategies to improve your accounts payable efficiency.

Speed Up Payments and Pocket Early Payment Discounts

Take a second and think: how long does it take for an invoice to travel from the mailroom to a final "paid" status in your company? For most businesses sticking to manual methods, it's a long journey. The American Productivity & Quality Center (APQC) found that the average manual process takes 8.3 days for just one invoice.

Automation can shrink that timeline down to a matter of hours. This speed brings two massive perks. First, you can finally take advantage of those early payment discounts that vendors offer. Getting that 2% discount for paying within 10 days might not sound like much, but it adds up to significant annual savings.

Second, paying faster means happier suppliers. And happy suppliers are good for business.

Build Stronger Relationships with Your Vendors

Everyone likes to get paid on time, and your vendors are no exception. When you're the client who always pays promptly and without any drama, you become a favorite. This goodwill builds trust and can lead to better payment terms, preferential treatment, and a rock-solid partnership for the long haul.

Automation gets rid of the classic culprits behind late payments - lost paperwork, approval bottlenecks, and data entry flubs. By ensuring your vendors are paid accurately and on schedule, you’re actively strengthening these crucial relationships without your team having to lift a finger. A smooth AP process is one of the most powerful, yet underrated, tools for building a reliable supply chain.

Quantifiable Business Impact of AP Automation

It's one thing to talk about benefits, but it's another to see the numbers. The table below highlights the specific KPIs that see a dramatic improvement when you bring automation into your accounts payable workflow.

| Business Area | Metric Improved | Typical Improvement Range |

|---|---|---|

| Finance & Operations | Invoice Processing Cost | 60-80% Reduction |

| Accounts Payable | Invoice Processing Time | 70-90% Faster |

| Finance | Early Payment Discount Capture | 50-100% Increase |

| Data Management | Data Entry Error Rate | 90% or Greater Reduction |

| Team Productivity | Manual Tasks & Intervention | 60-85% Less Time Spent |

As you can see, the impact isn't just marginal. These are substantial improvements that directly affect your company's financial health, operational agility, and strategic capabilities. The data clearly shows that automating AP is a powerful lever for growth.

How to Choose the Right Automation Partner

Jumping into automated invoice processing is a fantastic move, but it's important to know that not all solutions are created equal. Picking the right software partner is a lot like choosing a co-pilot for your business's financial journey; the right one makes the flight smooth, while the wrong one can cause some serious turbulence. You need a platform that not only fixes today’s headaches but is also ready to grow with you.

This isn't just about buying software. It's a real investment in your company's operational backbone. The market for these tools is booming, which shows just how many businesses are ditching paper for smarter, automated workflows. Valued at over USD 33 billion, the invoice processing software market is on track to more than double, hitting nearly USD 88 billion in the next few years. This growth is all about businesses wanting to trade old-school methods for intelligent, cloud-based automation.

With so many choices out there, how do you find the one that’s truly right for you? It comes down to focusing on a few key factors that will actually make a difference for your team and your bottom line.

Evaluate Seamless System Integration

The very first question you should ask is, "Will this play nicely with the tools we already use?" A great automation platform shouldn't make you tear down your entire tech setup. It should act more like a bridge, connecting effortlessly with the accounting or Enterprise Resource Planning (ERP) software you already depend on.

Look for a partner that offers ready-made integrations with popular systems like QuickBooks, Xero, or Business Central. This built-in connectivity is a game-changer because it means data flows automatically from the moment an invoice arrives to its final payment, all without someone having to manually shuttle information back and forth. A system that needs clunky, custom-coded integrations can quickly turn into an expensive, time-sucking nightmare.

Prioritize Scalability and Future Growth

The software that fits your business perfectly today might feel cramped next year. A common mistake is picking a system that can only handle your current invoice load. As your company expands, so will the number of invoices you need to process. Your chosen platform has to be able to scale right alongside you without skipping a beat.

Ask yourself these questions about scalability:

- •Pricing: Does the cost scale fairly as you grow, or are you going to get hit with a massive price jump once you cross a certain threshold?

- •Performance: Can the system keep up its speed and accuracy when it's processing hundreds, or even thousands, of invoices every month?

- •Future-Proofing: Is the provider constantly improving the platform and adding new features?

Finding a scalable partner means you won't have to go through the whole painful process of switching systems again in just a few years.

Choosing an automation partner is about finding a tool that adapts to your business, not forcing your business to adapt to the tool. The best solutions are flexible, powerful, and designed to support your journey from a small startup to a thriving enterprise.

Don't Underestimate the User Experience

A system can have all the power in the world, but if your team finds it clunky or confusing, it's basically useless. The user experience (UX) isn't just a "nice-to-have" feature; it's absolutely essential for getting your team on board and seeing a real return on your investment. When a platform is intuitive, your team can get started quickly with very little training.

A great user experience simply means the software was designed with real people in mind. Approving an invoice should take just a few clicks. Finding a specific document from six months ago should be a piece of cake. Before you sign on the dotted line, always ask for a live demo or a free trial. Even better, let your accounts payable team take it for a spin. Their feedback is pure gold. The goal is to find a tool they'll actually enjoy using, not one they have to put up with. After all, the many accounts payable automation benefits only kick in when your team truly embraces the new tech.

Got Questions? We’ve Got Answers

Stepping into the world of automated invoice processing naturally brings up a few questions. It’s a big change, after all. We’ve put together answers to some of the most common things people ask, helping you see how these systems really work day-to-day.

Is This Stuff Actually Secure?

Yes, absolutely. Any reputable platform is built with security as its foundation, not an afterthought. Think of it like a digital vault for your financial data. These systems use powerful data encryption when your information is moving and when it's sitting still. Plus, with role-based access, you control exactly who gets to see or approve sensitive documents.

Honestly, it's a huge step up from manual processes. Paper invoices can get lost, left on a desk for anyone to see, or accidentally thrown away. A digital system locks everything down and creates a crystal-clear audit trail, so you always know who did what and when.

How Long Will It Take to Get This Set Up?

Probably a lot less time than you think. Forget those clunky, months-long software projects of the past. Modern, cloud-based tools are designed to get you up and running in days or weeks, not quarters.

The setup process is pretty straightforward:

- •First, we'll configure the software to match your company's unique approval workflows.

- •Next, we'll connect it to your existing accounting or ERP system.

- •Finally, a quick training session gets your team comfortable and ready to go.

Most providers, like us at GetInvoice, walk you through every step. The goal is a fast, smooth transition so you can start seeing a return on your investment right away.

The whole point of modern automation is getting value quickly. You shouldn't have to wait half a year to see the benefits. A good system should start freeing up your team's time almost immediately.

Is This Just for Big Companies, or Can Small Businesses Use It?

This is for everyone. While giant corporations have been using automation for a while, today’s Software-as-a-Service (SaaS) platforms are built and priced specifically for small and medium-sized businesses (SMBs). The flexible, scalable model means you can start with what you need and only pay for what you use.

For a smaller team, the time savings can be even more dramatic. Think about it: reclaiming just a few hours each week from chasing invoices lets your team pour that energy back into growing the business, not getting buried in paperwork.

What if Our Invoices Come in All Kinds of Crazy Formats?

That's exactly the kind of chaos that modern automated invoice processing is designed to tame. These systems are built to be flexible, handling pretty much anything you can throw at them.

You can forward emails with PDF attachments, upload scanned paper copies, or even snap a picture of a receipt with a mobile app. Behind the scenes, smart OCR and AI technology get to work, reading and pulling the important data no matter the layout. Everything gets standardized into one simple, digital workflow.

Ready to stop chasing paperwork and start saving time? GetInvoice uses AI to automatically capture, read, and organize all your invoices, freeing your team to focus on what matters most. See how it works and get started in seconds.