Master Invoice Process Automation for Smarter Payments

Discover how invoice process automation can streamline your billing, save time, and boost accuracy. Learn the key benefits today!

Tags

Let’s talk about invoice processing. For a lot of businesses, it’s a necessary evil. Stacks of paper, endless data entry, and the constant back-and-forth of chasing approvals. It's a grind. But what if there was a better way? That’s where invoice process automation comes in.

Think of it as giving your finance team a super-smart digital assistant. This software handles the tedious, repetitive tasks of capturing, processing, and paying invoices, all with minimal human touch. This frees up your team to focus on work that actually moves the needle.

What Is Invoice Process Automation Anyway?

We’ve all seen it: the accounts payable team buried under a mountain of paperwork, manually keying in every single line item from an invoice. It’s a scene straight out of the last century, but it’s still the reality for many companies. This old-school approach is slow, expensive, and a breeding ground for human error. It’s like a massive traffic jam clogging up your financial highway.

Now, imagine a sleek, automated assembly line for your invoices instead. That's the essence of invoice process automation. It’s technology that intelligently grabs invoices from wherever they arrive - a scanned paper document, a PDF in an email, or a vendor portal - and smoothly guides them through every step of the process. Verification, approval, payment… it all happens without someone needing to manually push it along.

The Shift From Manual To Automated Workflows

Moving to automation isn't just some passing trend; it’s a fundamental change in how smart businesses handle their money. The global invoice processing software market has exploded, driven by a universal need for better efficiency. The market was recently valued at approximately USD 33.59 billion and is expected to jump to USD 40.82 billion the following year. You can read more about the invoice software market growth and see just how fast this is catching on.

This rapid growth tells a clear story: for any business looking to stay competitive, sticking with manual invoicing just doesn't cut it anymore. It creates bottlenecks that slow everything down, straining vendor relationships and piling on the risk of late fees.

The real power of invoice process automation is that it transforms accounts payable from a reactive, cost-centric department into a proactive, strategic part of the business.

By taking the repetitive, low-value work off your team's plate, you give them the time and data they need to focus on what truly matters. They can start analyzing spending, negotiating better terms with suppliers, and finding ways to optimize cash flow. It’s all about working smarter, not harder.

Manual Vs. Automated Invoice Processing At a Glance

To really bring the difference to life, let's look at a quick side-by-side comparison. This table makes it crystal clear where automation leaves the old-school manual methods in the dust.

| Task | Manual Process: The Old Way | Automated Process: The New Way |

|---|---|---|

| Data Entry | A person painstakingly types every piece of data from each invoice into the accounting system. | Software using Optical Character Recognition (OCR) reads and extracts all the data in seconds. |

| Approval Routing | An employee physically walks an invoice over to a manager's desk or sends a flurry of follow-up emails. | The system automatically routes the invoice to the right person based on preset rules and dollar amounts. |

| Error Handling | Mistakes like duplicate payments or incorrect amounts often slip through the cracks and are only caught later. | The system instantly flags potential duplicates, mismatches, and other errors for review before any payment goes out. |

| Record Keeping | Invoices are buried in filing cabinets, making them a nightmare to find for an audit or a simple query. | All invoices are stored in a secure, searchable digital archive. Instant access, happy auditors. |

As you can see, the switch is a no-brainer. Invoice process automation directly tackles the biggest headaches of traditional AP. It paves the way for a more efficient, accurate, and organized financial operation, finally freeing your team from the paper chase.

How Automated Invoicing Systems Actually Work

Diving into automated invoicing can feel a bit like popping the hood on a car for the first time - it looks complicated. But once you understand the core parts and how they work together, it all starts to make sense. Think of it less like a complex machine and more like a super-efficient digital assembly line, where each station has a specific, vital job to do.

The whole process kicks off the moment an invoice lands in your world, whether it's a PDF in an email, a scanned paper copy, or even a photo snapped on a phone. The first stop is a technology called Optical Character Recognition (OCR), which basically acts as the system's eyes. It scans the document, intelligently spots the key details, and pulls them out as usable data.

So, instead of someone manually typing in the vendor's name, invoice number, due date, and all those line items, OCR handles it in seconds. It reads the document just like a person would, only much faster and without needing a coffee break.

The Brains Behind The Operation

Once all that data is captured, the system's "brain" takes over. This is where Artificial Intelligence (AI) and Machine Learning (ML) really shine. These aren't just simple programs; they're advanced algorithms that don't just see the data - they understand it. Better yet, they learn from every single invoice you process, getting smarter and more accurate over time.

This intelligence is what allows the system to handle some of the most critical, and often tedious, parts of the job automatically:

- •Duplicate Detection: The AI can instantly cross-reference a new invoice with every other one you've ever received to flag potential duplicates. This simple check can save you from accidentally paying the same bill twice.

- •Fraud Prevention: By analyzing patterns and comparing invoice details against your vendor history, the system can spot anomalies and red flags that might point to fraud.

- •Automatic Coding: After seeing how your team codes invoices from certain vendors, the machine learning models start to recognize patterns. Soon enough, they can suggest the right general ledger (GL) codes for you, saving a ton of time and guesswork.

This layer of intelligence is what truly elevates invoice automation from a simple data-entry tool to a "touchless" process. It's a big reason why over 60% of finance professionals expect their accounts payable process to be fully automated. In fact, just integrating AI can slash human processing errors by up to 40%. You can learn more about AI’s role in finance automation and see how quickly it's being adopted.

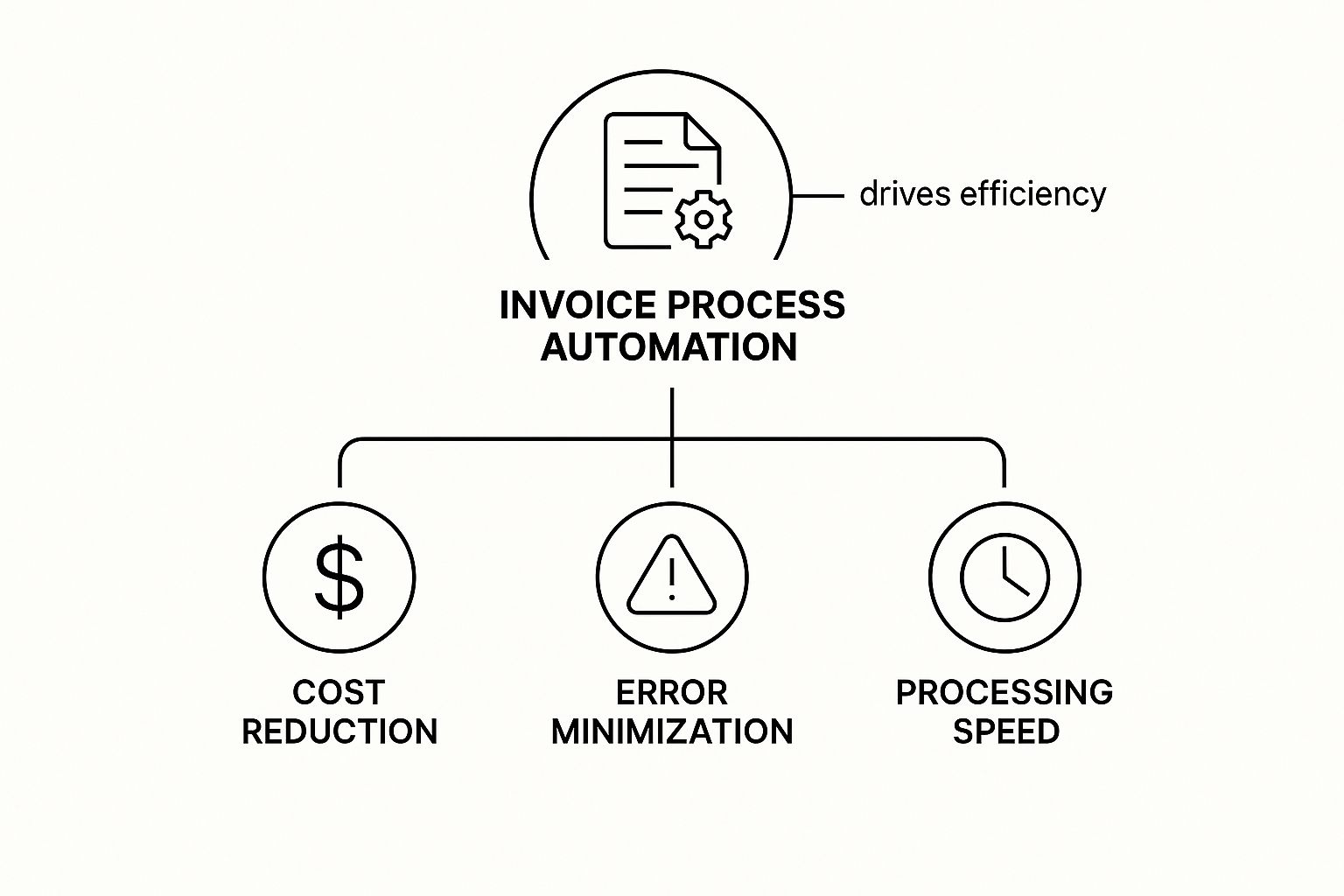

This infographic does a great job of showing how all these benefits work together to make the whole operation more efficient.

As you can see, when you reduce costs and errors, you naturally speed up processing times. It creates a positive feedback loop that benefits your entire finance team.

Connecting The Dots For A Seamless Flow

Okay, so the invoice has been scanned and validated. Now what? It needs to get to the right person for approval. This is where the workflow engine - the system's central nervous system - kicks in. It automatically routes the invoice based on a set of rules that you define.

For example, you could set a rule that sends all invoices under $500 from the marketing department straight to the marketing manager. But any invoice over $10,000? That one might need approval from both the department head and the CFO.

This completely eliminates the frustrating and time-wasting game of chasing people down for signatures.

Once the invoice is fully approved, there's one last step: getting the information into your main financial records. This is handled by ERP integration, which acts as the final, crucial bridge. The system seamlessly syncs all the approved invoice data with your accounting software, whether that's QuickBooks, Xero, or NetSuite. This means your books are always accurate and up-to-date, with zero final data entry required.

If you're curious about which tools might fit your needs, our comprehensive invoice software comparison guide is a great place to start. From OCR all the way to integration, each of these components works in perfect harmony to turn a once-chaotic manual task into a smooth, reliable, and intelligent automated process.

The Real-World Benefits of Automating Invoices

It’s one thing to understand the tech behind invoice process automation, but it's another thing entirely to see what it can actually do for a business. Let's be honest, you're not just buying software; you're investing in a better way of operating. The payoff isn't just felt in the finance department - it creates positive ripples that reach your suppliers and strengthen your entire operation.

So, let's step away from the technical jargon and talk about the real "why" behind it all. This is about making measurable improvements that show up on your bottom line and give you a serious strategic advantage.

Slash Costs and Seize Opportunities

One of the first things you'll notice is a significant drop in what it costs to simply process an invoice. Just think about all the time your team sinks into mind-numbing manual data entry, matching invoices to purchase orders, and chasing people down for approvals. Automation takes that heavy lifting off their plate, freeing up your experts to focus on work that actually requires their brains.

But the savings go deeper than just labor costs. A smart automation system helps you find and capture hidden money you might be leaving on the table.

- •Capture Early Payment Discounts: Lots of vendors offer a nice little discount (like 2/10 net 30) for paying early. When your manual process is slow and clunky, those opportunities fly right by. Automation can shrink your payment cycle from weeks down to just days, making it easy to grab those savings every time.

- •Eliminate Late Fees: We've all been there. Manual bottlenecks are the number one reason for late payments and those frustrating penalty fees. An automated workflow gets invoices approved and paid on schedule, turning that wasted expense back into profit.

This potential for huge savings is exactly why the invoice automation market is exploding. Valued at approximately USD 3.37 billion recently, it's projected to climb to USD 8.91 billion by 2032. Companies are catching on. For a closer look, you can explore the full market forecast on Verified Market Research.

Boost Accuracy and Build Better Vendor Relationships

Let's face it, people make mistakes. A typo here, a duplicate payment there - these little human errors are inevitable in any manual system, and they add up to real financial losses over time. Automation all but wipes out these problems by double-checking data and cross-referencing every invoice automatically.

This new level of accuracy delivers another powerful, if less obvious, benefit: stronger relationships with your vendors. When you pay your bills correctly and on time, every time, you become the kind of customer people want to work with.

An accurate, predictable payment process transforms your vendor relationships from purely transactional to truly strategic. Suppliers are more willing to offer better terms, prioritize your orders, and collaborate on long-term goals when they know they can count on you.

This isn't just about being a good partner; it's about building a healthier, more resilient supply chain that can give you a real competitive edge. Our guide on the top accounts payable automation benefits for 2025 explores how these improvements build on each other.

Gain Unprecedented Visibility and Control

Ever feel like you're flying blind when it comes to your company's financial commitments? With manual processing, getting a clear, up-to-the-minute picture of your cash flow is a nightmare until the books are closed at the end of the month.

Invoice process automation completely flips the script. It gives you a live dashboard view of your entire accounts payable world. You can track every single invoice from the moment it arrives until the moment it's paid. Suddenly, you have instant answers to critical questions:

- •What are our current cash flow commitments?

- •Which payment deadlines are coming up?

- •Where is that one specific invoice in the approval process?

This real-time visibility is a game-changer for financial planning. Better yet, every single action is recorded in a digital audit trail. So when the auditors show up, you can pull any invoice and its entire history in seconds. Compliance stops being a frantic scramble and becomes just another built-in feature of your system.

Your Step-By-Step Implementation Playbook

Making the leap to invoice process automation can feel like a huge undertaking, but it doesn't have to be a headache. The secret is to break the journey down into clear, manageable steps. If you approach it methodically, you can ensure a smooth transition and start seeing the benefits almost immediately.

Think of this as your practical playbook. We'll walk through the essential stages that will take you from initial planning to a fully humming, efficient system that gives your team back their time.

Phase 1: Map Your Current Workflow

Before you can improve a process, you have to truly understand it. The very first thing to do is map out your current invoice workflow, from the moment an invoice hits your inbox to the final payment confirmation. This isn't just about listing steps; it's about playing detective to find the hidden bottlenecks.

Where do things get stuck? Does an invoice sit in an inbox waiting for someone to manually type it in? Does it get lost on a manager's desk awaiting approval? Pinpointing these friction points is gold because it tells you exactly where automation will make the biggest difference.

For example, you might find that a staggering 30% of your team's time is eaten up just by keying in data from PDF invoices. That single discovery gives you a powerful, specific problem to solve.

Phase 2: Set Clear and Measurable Goals

With a clear picture of your current challenges, you can now set some concrete goals. Vague ambitions like "be more efficient" just won't cut it. You need real, measurable targets that define what success actually looks like for your team.

Your goals should be quantifiable and tied directly to the bottlenecks you just uncovered. This turns the project from a simple software purchase into a strategic move for the business.

Here are a few examples of strong, measurable goals:

- •Reduce invoice processing cycle time from an average of 20 days down to 5 days within the first three months.

- •Decrease manual data entry errors by 95% over the next six months.

- •Capture 90% of available early payment discounts by automating the approval process.

- •Lower the cost-per-invoice from $15 to under $5 by the end of the year.

These kinds of goals give your team a clear finish line and provide the hard numbers you'll need later to show a real return on your investment.

Phase 3: Choose the Right Automation Partner

Now for one of the most critical decisions: picking the right software vendor. Let's be honest, not all invoice process automation tools are the same. You need a partner whose platform fits your company's specific needs, size, and existing technology.

When you're looking at different options, go beyond the flashy feature list. Think about how they handle the entire lifecycle of an invoice. For example, some platforms like Tailride are brilliant because they connect directly to your email inboxes and pull in invoices automatically, eliminating a huge manual step right from the start.

Make a checklist to compare your top contenders. You'll want to see how well they handle data extraction, approval routing, and - this is a big one - how smoothly they integrate with your accounting software, whether it's QuickBooks, Xero, or something else.

Phase 4: Plan and Launch a Pilot Program

Once you've picked your partner, fight the temptation to roll it out to everyone at once. The smartest move is to start with a pilot program. This means you'll launch the new system with a small, controlled group first - maybe one department or even just a handful of your most trusted vendors.

A pilot program is your real-world testing ground. It’s your chance to iron out any wrinkles in a low-risk environment, make sure the integration is seamless, and gather honest feedback from the people who will use it every day.

This trial run is also the perfect opportunity for initial team training. When you get a small group of users comfortable and excited about the new system, they become your internal champions who can help get everyone else on board.

Getting ready to roll out your new system? A structured plan is your best friend. This checklist breaks down the implementation into clear phases, helping you stay organized and focused on what matters at each step.

Implementation Phase Checklist

| Phase | Key Action | Success Metric |

|---|---|---|

| 1. Discovery & Mapping | Document the current end-to-end invoice process. | A complete process map with all bottlenecks identified. |

| 2. Goal Setting | Define specific, measurable KPIs for the project. | A list of approved goals (e.g., "Reduce cycle time by 75%"). |

| 3. Vendor Selection | Research, demo, and select an automation platform. | Signed contract with a vendor that meets all key requirements. |

| 4. Pilot Program | Configure the system and launch with a small user group. | Successful processing of 50-100 invoices with positive user feedback. |

| 5. Training & Go-Live | Train all users and deploy the system company-wide. | All AP staff are trained and using the new platform. |

| 6. Monitoring | Track performance against the goals set in Phase 2. | A monthly report showing progress toward KPIs. |

Using a checklist like this ensures no critical step gets missed. It transforms a complex project into a series of achievable milestones, paving the way for a successful launch.

Phase 5: Go Live and Monitor Performance

After a successful pilot, it's go-time! With your process refined and your team ready, you can confidently switch the entire company over to the new automated system. But the job isn't done just because you've flipped the switch.

The final - and ongoing - step is to constantly monitor how you're doing against the goals you set way back in Phase 2. Use the dashboards and reporting tools in your new platform to keep an eye on your key metrics. Are you hitting your targets for processing speed, accuracy, and cost savings? This continuous feedback loop is what ensures you're not just using the software, but truly getting maximum value from your invoice process automation investment.

Best Practices for Long-Term Automation Success

Flipping the switch on your new invoice process automation software feels great, but it’s just the beginning. Real, lasting success comes from treating automation as an ongoing strategy, not a "set it and forget it" project. It’s all about continuously tweaking the system to squeeze every bit of value out of your investment.

Think of it like owning a high-performance car. You don’t just buy it and drive it into the ground. You get regular tune-ups, adjust the settings for different road conditions, and learn the advanced features to get the best ride possible. The same logic applies here. Consistent attention is what keeps your automation engine humming and adapting right alongside your business.

Standardize Your Inputs for Cleaner Data

You’ve probably heard the old saying, "garbage in, garbage out." Well, it’s practically the golden rule of automation. The quality of your automated output is only as good as the data you feed it. The single best way to ensure you're working with clean data is to get your vendors on the same page about how they send you invoices.

Putting together a simple, clear set of guidelines for your suppliers is a small upfront effort that pays off big time. It dramatically cuts down on the exceptions your team has to fix by hand.

- •Create a Single Mailbox: Ask every single vendor to send invoices to one dedicated email address, like

invoices@yourcompany.com. No more invoices getting lost in someone's personal inbox. - •Define "Must-Haves": Clearly tell them what information is non-negotiable. Every invoice should have basics like a unique invoice number, a purchase order (PO) number, and a clear description of what was sold.

- •Push for Digital: Gently nudge your vendors to send machine-readable PDFs instead of scanned images or paper. This is a game-changer for helping the AI capture data with near-perfect accuracy.

When you standardize your inputs, you're not just making your own life easier - you're setting up your software to perform at its absolute best.

Design Clear and Logical Approval Hierarchies

One of the most common traps people fall into is building approval workflows that are just as messy as the manual process they left behind. An invoice stuck waiting for approval is still a bottleneck, whether it’s digital or paper. The trick is to design simple, logical approval chains from the start.

Take some time to map out who needs to approve what, and why. For instance, a department head might need to sign off on any invoice over $1,000, but anything over $20,000 might need an extra look from the CFO.

Your goal is to build an approval matrix that is both efficient and compliant. It should ensure proper oversight without creating unnecessary delays, keeping invoices moving smoothly through the system.

This kind of clarity prevents confusion and keeps everyone accountable. When each person knows exactly what they’re responsible for, the whole process gets faster. That means you can snag early payment discounts and keep your vendors happy. If you want to take this thinking even further, our guide on accounting process automation has some great insights.

Regularly Review and Optimize Your Automation Rules

Your business doesn’t stand still, so your processes shouldn't either. The perfect rule you set up six months ago might be causing headaches today. This is why it’s so important to periodically check in on your automation rules and give them a refresh.

Put a recurring reminder on your calendar - maybe once a quarter - to sit down with your team and look at the system’s performance. Are you seeing patterns in the exceptions? Maybe invoices from one specific vendor keep getting flagged. That’s a sign to either tweak a rule or have a quick chat with that supplier.

Use the analytics tools built into your platform. They are a goldmine of information for spotting spending trends, identifying top vendors, and keeping an eye on cash flow. By treating your automation system as a living, breathing part of your finance department, you’ll make sure it keeps delivering a great return for years to come.

Got Questions About Invoice Automation? Let's Clear Things Up.

Thinking about making the switch to automated invoicing? It's a big move, and it's totally normal to have a few questions swirling around. You want to be sure you're making the right call for your business.

Let’s walk through some of the most common questions and concerns we hear from teams just like yours. My goal here is to give you straight-up, honest answers so you can feel confident about your next steps.

How Much Does Invoice Automation Software Actually Cost?

This is usually the first question out of the gate, and the most truthful answer is: it really depends. There's no single price tag for invoice automation because the best platforms are built to grow with you. Instead of a flat fee, you'll typically run into a few common pricing models.

Figuring out which model fits your business is the key to getting a handle on the real cost.

- •Pay-as-you-go: Some platforms charge you a small fee for each invoice they process. This is fantastic for businesses with unpredictable or seasonal invoice volumes because your costs scale directly with your workload.

- •Tiered Subscriptions: This is probably the most common setup. You pay a set monthly or annual fee for a package that includes a certain number of invoices, users, and features. It's great because you can start with a plan that fits your current needs and easily bump up to the next tier when you grow.

- •User-Based Pricing: Here, the cost is tied to how many people on your team need to use the software. This can be a really cost-effective option for smaller teams, but the price can creep up if you have a lot of people involved in the approval process.

The final cost comes down to a few key things. The volume of invoices you process every month is a huge factor, as is the complexity of the features you need. A system that can handle sophisticated three-way matching will naturally have a higher price point than one that just pulls basic data. Your integration needs also play a big part. Connecting to a popular tool like QuickBooks is usually standard, but if you need a custom hookup to a unique ERP system, that might add to the cost.

Here's the most important takeaway: look past the sticker price and think about the return on your investment (ROI). When you add up all the money you'll save by wiping out late fees, snagging early payment discounts, and freeing up your team from hours of manual data entry, the right platform often pays for itself in no time.

Is My Financial Data Really Secure in The Cloud?

I get it. Handing over sensitive financial data to another company can feel like a leap of faith. It's a valid concern, and one that any worthwhile provider takes extremely seriously. The truth is, a top-tier cloud platform often provides far better security than most businesses could ever build or maintain in-house.

Think of it this way: you could hide cash under your mattress, where you have total control but are vulnerable to all sorts of risks. Or, you could put it in a bank vault, protected by professional security, 24/7 monitoring, and insurance. A high-quality cloud vendor is the bank vault for your data.

Leading invoice process automation platforms are built with layers upon layers of defense to keep your information locked down.

- •End-to-End Encryption: Your data is essentially scrambled into an unreadable code from the moment it leaves your system until it's safely stored, and even while it's at rest in their database.

- •Strict Access Controls: You decide exactly who can see or do what. This principle of "least privilege" ensures that employees only have access to the specific information they need to do their jobs, and nothing more.

- •Regular Security Audits: Reputable companies don't just say they're secure; they prove it. They undergo intense, independent audits to earn certifications like SOC 2, which confirms they have enterprise-grade security controls in place.

With these protections, you can rest easy knowing your financial data is shielded from prying eyes and potential threats.

Will This System Work with My Existing Accounting Software?

The short answer? Almost certainly, yes. Smooth integration isn't just a bonus feature anymore; it's a fundamental requirement for modern automation tools. What’s the point of an automation platform if it can’t communicate with your accounting system? That would just create more work, not less.

Providers know that every business has its own unique tech setup, so they design their software to be as flexible as possible. They usually tackle this in one of two ways.

- •Pre-Built Connectors: Most platforms come with ready-to-go integrations for all the big names in accounting - think QuickBooks, Xero, and NetSuite. These are typically "plug-and-play," letting you sync up your accounts with just a few clicks.

- •Custom Integration Options: What if you’re using a highly customized or industry-specific Enterprise Resource Planning (ERP) system? You're not out of luck. Good vendors offer APIs or professional services to build a custom bridge between their platform and your software.

When you're shopping around, make this one of your top questions. Don't just ask if they integrate; ask them to show you how the integration with your specific software works. A seamless, reliable connection is what turns invoice process automation from a helpful tool into a true, end-to-end solution for your finance team.

Ready to stop the paper chase and see what true automation feels like? Tailride connects directly to your inboxes to capture, process, and pay invoices automatically, getting your first invoices extracted in just seconds. Experience effortless invoice management with Tailride today.