7 Accounts Payable Best Practices for 2025

Streamline your finance operations with our guide to accounts payable best practices. Learn automation, fraud prevention, and vendor management tips today.

Welcome to the future of accounts payable, where manual data entry and late payment penalties are relics of the past. A well-oiled AP department is more than just a back-office function; it's a strategic hub for cash flow management, fraud prevention, and building rock-solid vendor relationships. But achieving this level of efficiency doesn't happen by accident. It requires a deliberate shift towards modern processes and smart technology.

This guide is designed to transform your operations for 2025 and beyond by providing a clear roadmap of actionable accounts payable best practices. We're skipping the generic advice to give you practical strategies you can implement right away. You will learn how to:

- •Secure your process with robust internal controls like three-way matching and proper segregation of duties.

- •Boost efficiency by automating invoice processing and implementing vendor self-service portals.

- •Improve cash flow through optimized payment timing and early payment discount programs.

We will cover seven critical areas, detailing the "how" and "why" behind each one. From establishing a clean vendor master file to optimizing payment methods, these insights provide a comprehensive blueprint for success. Whether you're a finance manager at a growing startup or an accountant managing multiple clients, mastering these practices will help you reduce costs, improve accuracy, and turn your AP team into a powerhouse of financial intelligence. Let's get started.

1. Implement Three-Way Matching

Think of three-way matching as your AP department’s own internal security check. It’s a fundamental control process that significantly reduces the risk of overpayment, fraud, and duplicate payments. Before any money leaves your bank account, this practice ensures that every vendor invoice is legitimate and accurate.

The process involves comparing three critical documents:

- •Purchase Order (PO): The document you send to a vendor detailing what you want to buy, the quantity, and the agreed-upon price.

- •Receiving Report (or Goods Receipt Note): The internal document created when the ordered goods or services are received, confirming what actually arrived.

- •Vendor Invoice: The bill sent by the vendor requesting payment for the goods or services delivered.

If the details on all three documents align - price, quantity, item description, and terms - the invoice is approved for payment. If there's a discrepancy, the payment is put on hold until the issue is investigated and resolved. This simple yet powerful step is a cornerstone of effective accounts payable best practices.

Why Three-Way Matching is a Game-Changer

Implementing a three-way match isn't just about adding another step; it’s about building a fortress around your company's cash flow. It provides a clear, auditable trail for every transaction, making your financial records more reliable and transparent.

For example, global giants like Walmart and Johnson & Johnson rely on this process to manage millions of invoices and maintain regulatory compliance across their vast supply chains. Similarly, General Electric successfully automated its three-way matching system, cutting invoice processing times by an impressive 40%. These examples show that the process scales from small businesses to multinational corporations, delivering value at every level.

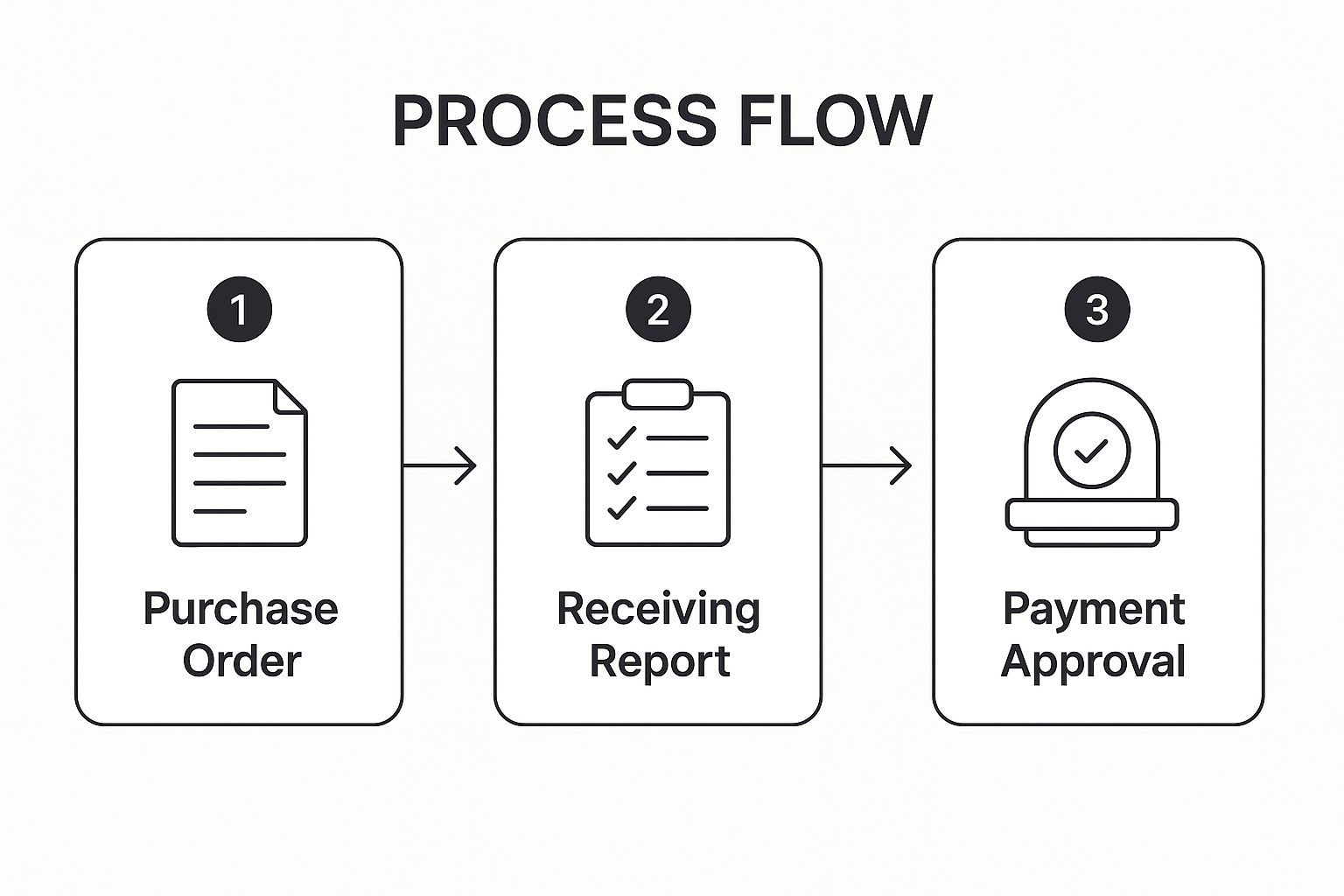

The following infographic illustrates the straightforward flow of the three-way matching process, from the initial order to the final payment approval.

This visual highlights how each document serves as a check and balance for the others, creating a verified path before payment is authorized.

Actionable Tips for Implementation

Getting started with three-way matching is easier than you think. Here are a few practical tips to integrate it smoothly into your AP workflow:

- •Set Tolerance Levels: Small discrepancies are inevitable. Establish acceptable tolerance levels (e.g., a 1% price variance or a 2-unit quantity difference) to automatically approve minor mismatches and focus manual review on significant issues.

- •Automate the Process: Manually matching documents is time-consuming. Use AP automation software to automatically compare line items across documents, flagging only the exceptions for human review.

- •Establish Clear Escalation Paths: When a mismatch occurs, who handles it? Define a clear procedure for investigating discrepancies and an escalation path for unresolved issues to prevent payment delays.

- •Train Your Team: Ensure everyone involved understands the process, their role in it, and how to handle exceptions. Proper training minimizes errors and keeps the workflow moving efficiently.

2. Automate Invoice Processing

Moving away from manual data entry is one of the most impactful upgrades you can make to your AP department. Invoice processing automation uses technology like optical character recognition (OCR) and artificial intelligence (AI) to capture, validate, and route invoices through approval workflows with minimal human intervention. This shift frees your team from tedious, repetitive tasks and allows them to focus on more strategic activities.

The process begins when an invoice arrives, whether by email or physical mail. The automation software scans the document, uses OCR to extract key data like the vendor name, invoice number, amount, and line items, and then validates this information against your existing records, such as purchase orders. To streamline your operations, consider automating invoice processing, which can be facilitated by using efficient invoice submission form templates. Once validated, the system automatically routes the invoice to the correct approver based on predefined rules, creating a seamless flow from receipt to payment readiness.

Why Automation is a Game-Changer

Adopting automation is about more than just speed; it's about introducing precision, visibility, and scalability into your financial operations. It drastically reduces the risk of human error, eliminates lost or misplaced invoices, and provides a real-time overview of your company's liabilities.

For instance, global beverage leader Coca-Cola transformed its AP department by implementing Basware's automation solution, cutting its average invoice processing time from seven days down to just two. Similarly, industrial manufacturing giant Siemens leverages SAP Ariba to process over four million invoices annually with an incredible 95% automation rate. These examples highlight how automation is a cornerstone of modern accounts payable best practices, driving efficiency at an enterprise scale.

The following video provides a deeper look into how invoice processing automation works and the benefits it can bring to your organization.

This visual explanation shows how technology handles the heavy lifting, making the entire process faster and more reliable. For a more detailed guide, you can learn more about the specifics of invoice approval automation.

Actionable Tips for Implementation

Ready to bring automation into your workflow? Here are some practical steps to get started:

- •Start with High-Volume Vendors: Begin your automation journey by targeting your most frequent, standardized invoices. This approach allows you to work out any kinks in the process and see a quick return on investment before rolling it out company-wide.

- •Prioritize Strong OCR Capability: Not all OCR technology is created equal. Choose a solution that can accurately capture data from various invoice formats and layouts to minimize the need for manual corrections.

- •Define Robust Exception Workflows: Automation is great, but exceptions will happen. Establish clear, automated workflows for handling mismatched or incomplete invoices, ensuring they are routed to the right person for quick resolution.

- •Monitor Key Performance Indicators (KPIs): Track metrics like invoice processing time, cost per invoice, and exception rates. Regularly monitoring these KPIs will help you measure success and identify areas for further optimization.

3. Establish Vendor Master Data Management

Think of your vendor master file as the central nervous system of your accounts payable process. It’s the single source of truth for all supplier information, and if it's messy, inaccurate, or outdated, the consequences can ripple across your entire financial operations. Establishing strong Vendor Master Data Management is a critical practice for ensuring data consistency, preventing fraud, and streamlining payments.

This process involves creating and meticulously maintaining a centralized, accurate, and complete database of all your vendor information. This isn't just a simple contact list; it's a comprehensive record that includes:

- •Contact and Legal Information: Vendor name, address, and contact details.

- •Financial Data: Banking details for electronic payments, payment terms, and credit limits.

- •Tax and Compliance Information: Tax ID numbers (like W-9 forms in the U.S.), business registration details, and compliance certifications.

- •Contractual Details: Copies of active contracts, service level agreements (SLAs), and pricing agreements.

When this data is clean and controlled, you dramatically reduce the risk of paying duplicate vendors, sending payments to incorrect bank accounts, or falling victim to fraudulent invoices. It’s a foundational element of robust accounts payable best practices.

Why Vendor Master Data Management is a Game-Changer

A well-managed vendor master file is more than just good housekeeping; it’s a strategic asset that protects your business and enhances operational efficiency. It provides a clear, controlled, and auditable foundation for every vendor relationship, making your procurement and payment cycles more reliable.

For instance, IBM implemented a strict vendor master data governance program and successfully reduced its number of duplicate vendors by an impressive 85%. Similarly, Procter & Gamble's centralized vendor master system effectively manages over 75,000 active suppliers globally, ensuring consistency and compliance across a massive scale. These examples demonstrate that disciplined vendor data management is essential for businesses of any size aiming for financial control and operational excellence. For a deeper dive into this topic, you can learn more about vendor management best practices on tailride.so.

Actionable Tips for Implementation

Building a pristine vendor master file is an ongoing commitment, not a one-time project. Here are a few practical tips to get started and maintain data integrity:

- •Implement a Strict Vendor Onboarding Process: Create a standardized, multi-step approval workflow for adding any new vendor. Require documentation and verification of all key data points (like tax IDs and bank details) before the vendor is activated in your system.

- •Conduct Regular Data Audits: Schedule periodic reviews of your vendor master file to identify and purge duplicate entries, update outdated information, and deactivate dormant vendors who haven't been used in a set period (e.g., 18-24 months).

- •Use Automated Duplicate Detection: leverage tools within your accounting or AP automation software to automatically flag potential duplicates during the vendor setup process based on similarities in name, tax ID, or address.

- •Establish Clear Governance Policies: Define who has the authority to create or modify vendor records. Limiting access and creating an audit trail for all changes is a key control for preventing internal fraud and maintaining data accuracy.

4. Implement Early Payment Discount Programs

Think of early payment discounts as turning your accounts payable department from a cost center into a profit center. This strategic approach involves paying your vendors ahead of the standard payment due date in exchange for a discount on the invoice total. It’s a win-win scenario that can generate significant savings while strengthening your supply chain relationships.

The most common discount term you'll see is "2/10, net 30," which means you can take a 2% discount if you pay the invoice within 10 days, otherwise the full amount is due in 30 days. On an annualized basis, capturing that 2% discount is equivalent to earning a 36% return on your cash. This practice is a cornerstone of savvy cash management and one of the most impactful accounts payable best practices you can adopt.

Why Early Payment Discounts are a Game-Changer

Implementing an early payment program isn't just about saving a few dollars; it's about optimizing working capital for both you and your suppliers. By providing your vendors with faster access to cash, you become a preferred customer and help stabilize your supply chain. This proactive approach builds goodwill and can give you leverage in future negotiations.

Tech giant Apple, for instance, has a sophisticated early payment program that saves the company hundreds of millions annually while providing its suppliers with crucial liquidity. Similarly, platforms like C2FO have enabled companies such as Coca-Cola and Bacardi to implement dynamic discounting, where the discount rate changes based on how early the payment is made. These examples prove that a well-executed program can deliver substantial financial benefits and strategic advantages.

Actionable Tips for Implementation

Ready to start capturing those discounts? Integrating an early payment program is a straightforward process with the right approach. Here are a few practical tips to get you started:

- •Analyze Your Cash Flow: Before committing, ensure you have sufficient cash reserves to pay invoices early without straining your own operational needs. A healthy cash position is essential.

- •Start with High-Spend Vendors: Prioritize your efforts by focusing on vendors with the highest invoice volume and value. Capturing discounts on these accounts will deliver the most significant initial return on investment.

- •Automate Discount Capture: Manually tracking due dates and discount opportunities is a recipe for missed savings. Use AP automation software to flag discount-eligible invoices and prioritize them for payment.

- •Negotiate Favorable Terms: Don't be afraid to negotiate terms with your key suppliers. Propose a discount structure that benefits both parties and formalize it in your vendor agreements.

- •Monitor Program ROI: Regularly track the total discounts captured versus the cost of capital. This helps you demonstrate the program's value and identify opportunities for improvement.

5. Establish Proper Segregation of Duties

Think of segregation of duties (SoD) as building a system of checks and balances directly into your financial processes. It’s a foundational internal control principle designed to prevent fraud and errors by ensuring that no single individual has control over all phases of a financial transaction. In the world of accounts payable, this is a non-negotiable best practice.

The core idea is to divide critical tasks among different people to prevent one person from having the power to both commit and conceal fraudulent activities. The key responsibilities in the AP cycle that should be separated are:

- •Vendor Management: Adding or modifying vendor information in your system.

- •Purchase Authorization: Creating and approving purchase orders.

- •Invoice Processing: Receiving and entering vendor invoices for payment.

- •Payment Execution: Authorizing and issuing the actual payment to the vendor.

When these duties are handled by separate individuals or teams, it creates an environment of mutual accountability. An employee processing an invoice cannot create a fake vendor and then pay them, as another employee is responsible for vendor setup and a third for executing payments.

Why Segregation of Duties is a Game-Changer

Implementing SoD is more than just a fraud-prevention tactic; it’s about creating a robust, transparent, and error-resistant financial ecosystem. It forces a review process at multiple stages, significantly increasing the likelihood that mistakes or intentional deceptions are caught before a payment is made. This is a critical component of effective accounts payable best practices.

This principle is essential for regulatory compliance. For instance, public companies must implement stringent SoD controls to comply with the Sarbanes-Oxley Act (SOX), which mandates strong internal controls over financial reporting. Similarly, financial institutions like major banks use strict segregation for all payment processing to prevent unauthorized fund transfers and protect customer assets. These examples demonstrate that SoD is a universally recognized standard for financial integrity.

Actionable Tips for Implementation

Putting segregation of duties into practice requires careful planning, especially for smaller teams where roles may overlap. Here are a few practical tips to get started:

- •Document Roles and Responsibilities: Create a clear matrix or chart that explicitly defines who is responsible for each step of the procure-to-pay cycle. This document should be reviewed and updated regularly.

- •Leverage System-Based Controls: Modern accounting software allows you to configure user roles and permissions. Use these features to enforce SoD by restricting access so that, for example, a user who can enter invoices cannot also approve payments.

- •Conduct Regular Access Reviews: Periodically review user access rights to ensure they are still appropriate for each employee's role. This is especially important when employees change positions or leave the company.

- •Cross-Train for Continuity: While roles should be separate, cross-train employees on different functions. This ensures that you have backup coverage for absences without compromising your SoD controls, as the primary responsibilities remain segregated during normal operations.

6. Implement Vendor Portal Self-Service

Think of a vendor self-service portal as a dedicated, 24/7 communication hub for your suppliers. Instead of fielding constant emails and phone calls about invoice status or payment details, you empower vendors to find the answers themselves. This digital platform is a cornerstone of modern accounts payable best practices, transforming a traditionally manual relationship into an efficient, transparent partnership.

The portal provides suppliers with secure online access to manage their accounts. Key functionalities typically include:

- •Invoice Submission: Vendors can directly upload invoices, eliminating mail delays and data entry errors.

- •Status Tracking: Suppliers can view the real-time status of their invoices, from receipt and approval to scheduled payment.

- •Information Management: Vendors can update their own contact details, banking information, and tax forms, ensuring your records are always accurate.

- •Communication: A centralized place to ask questions and resolve disputes, creating a clear and auditable communication trail.

When vendors can self-serve, your AP team is freed from time-consuming administrative tasks. This shift allows them to focus on more strategic activities like cash flow analysis, discount capture, and process improvement.

Why a Vendor Portal is a Game-Changer

Implementing a vendor portal isn't just about convenience; it's about building stronger, more collaborative supplier relationships while boosting internal efficiency. It provides a single source of truth for all vendor-related information, reducing misunderstandings and accelerating the entire procure-to-pay cycle.

For example, Cisco successfully funnels 95% of its invoices through its vendor portal, achieving high supplier adoption and dramatically reducing manual processing. Similarly, global platforms like the SAP Ariba Network connect millions of suppliers, demonstrating the immense scalability and value of this approach. These examples prove that a well-designed portal can revolutionize how businesses of any size interact with their supply chain.

By empowering suppliers with direct access and visibility, you reduce friction, improve their satisfaction, and create a more resilient and efficient AP ecosystem.

Actionable Tips for Implementation

Rolling out a successful vendor portal requires more than just launching the technology. Here are a few practical tips to drive adoption and maximize its value:

- •Provide Comprehensive Vendor Training: Don't assume vendors will figure it out on their own. Offer webinars, video tutorials, and clear documentation to guide them through the onboarding process and key features.

- •Offer Multiple Support Channels: While the goal is self-service, be prepared to help. Provide clear support channels, such as a dedicated email address or a helpdesk, to assist vendors as they transition to the new system.

- •Incentivize Portal Adoption: Encourage vendors to use the portal by highlighting the benefits, such as faster invoice processing and quicker payment visibility. You might even make portal submission a requirement in your vendor agreements.

- •Ensure a Mobile-Friendly Design: Your vendors are on the go. A responsive, mobile-friendly portal ensures they can submit invoices and check statuses from any device, improving convenience and adoption rates.

7. Optimize Payment Methods and Timing

Think of payment optimization as the final, strategic move in the accounts payable chess game. It’s not just about paying bills on time; it’s about choosing the right way and the right moment to pay them. This practice involves strategically selecting payment methods and scheduling payments to maximize cash flow, minimize transaction costs, and strengthen vendor relationships.

The process involves evaluating various payment options and their associated benefits and costs:

- •Virtual Cards: Offer cash-back rebates and enhanced security.

- •ACH (Automated Clearing House): A low-cost electronic option for reliable, scheduled payments.

- •Wire Transfers: Fast and secure for large or international payments, though often more expensive.

- •Checks: Traditional but slow and costly to process, often reserved for specific vendors.

By aligning the payment method with the invoice amount, vendor preference, and your own financial goals, you can turn your AP department from a cost center into a value-generating powerhouse. This strategic approach is a key component of modern accounts payable best practices.

Why Payment Optimization is a Game-Changer

Strategic payment management directly impacts your company’s bottom line and operational efficiency. It provides flexibility, allowing you to hold onto cash longer, capture early payment discounts, or earn rebates, all while ensuring vendors are paid according to their terms. For a deeper dive into financial control, explore these cash flow management strategies.

For instance, General Motors strategically uses virtual cards for approximately 40% of its supplier payments, earning millions of dollars in annual rebates. Similarly, a tech giant like Microsoft reportedly optimized its payment timing and methods to improve its cash flow by over $50 million in a single year. These examples demonstrate that even small adjustments to how and when you pay can yield significant financial benefits.

Actionable Tips for Implementation

Integrating a payment optimization strategy is a practical step toward financial excellence. Here are a few tips to get you started:

- •Analyze Total Payment Costs: Look beyond the transaction fee. Consider the costs of labor, materials (like checks and envelopes), and potential fraud risk associated with each method to understand the true cost.

- •Negotiate Terms Based on Method: When onboarding a new vendor, discuss payment methods. You might negotiate a small discount for paying via a low-cost method like ACH or offer to pay faster in exchange for them accepting a virtual card.

- •Segment Your Vendors: Not all vendors are the same. Group them by payment preference, invoice volume, or strategic importance. Pay high-volume, critical suppliers with efficient, secure methods, while using other options for smaller, one-off vendors.

- •Implement Payment Analytics: Use your accounting or AP automation software to track payment data. Analyze metrics like cost-per-payment, rebate capture rates, and on-time payment percentages to identify areas for improvement and refine your strategy.

Accounts Payable Best Practices Comparison

| Item | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Implement Three-Way Matching | Medium-High: Setup can be complex; staff training needed | Moderate: Requires ERP integration and trained staff | Accurate payments; reduces fraud/duplicates; strong audit trail | Companies needing compliance and payment accuracy | Prevents duplicates, reduces fraud, improves vendor trust |

| Automate Invoice Processing | High: Initial setup costly; needs change management | High: Technology investment and user training required | Drastically faster processing; error reduction; scalable | High-volume invoice processing environments | Up to 90% process time reduction; eliminates data errors |

| Establish Vendor Master Data Management | Medium: Ongoing maintenance and governance needed | Moderate: Requires collaboration across departments | Consistent vendor data; fewer duplicates; improved compliance | Organizations managing large supplier bases | Eliminates duplicates, improves onboarding, enhances reporting |

| Implement Early Payment Discount Programs | Medium: Negotiation and cash flow analysis needed | Low-Moderate: Mainly financial resource allocation | Cost savings; better cash flow; improved vendor relations | Businesses with flexible cash flow looking to save | Direct cost savings 1-5%; better working capital efficiency |

| Establish Proper Segregation of Duties | Medium: Role definition and monitoring essential | Moderate-High: More staff, ongoing reviews | Fraud risk reduction; compliance; accountability | Organizations with regulatory compliance needs | Reduces fraud risk up to 75%; ensures compliance |

| Implement Vendor Portal Self-Service | Medium: Vendor training and tech setup involved | Moderate: Initial costs and ongoing support | Faster invoice processing; improved vendor satisfaction | Companies focused on vendor collaboration | Reduces manual entry, enhances visibility, boosts satisfaction |

| Optimize Payment Methods and Timing | Medium: Managing multiple methods and compliance challenges | Moderate: Technology tools and negotiation required | Reduced costs; improved cash flow; stronger vendor relations | Firms seeking to optimize cash flow and reduce costs | Cuts transaction costs 30-50%; improves payment security |

Putting Your AP Modernization Plan into Action

We've journeyed through a comprehensive roadmap of accounts payable best practices, covering everything from the foundational necessity of three-way matching to the strategic optimization of your payment timing. Each practice we discussed, whether it's automating invoice processing, centralizing vendor data, or implementing a secure segregation of duties, is a powerful lever you can pull to transform your AP function from a cost center into a strategic business asset.

But let's be realistic. Implementing all seven of these at once would be overwhelming. The key takeaway isn't to boil the ocean; it's to start a ripple that will grow into a wave of efficiency across your organization. True AP modernization is an iterative process, a journey of continuous improvement rather than a one-time destination. The most successful finance teams approach this by prioritizing, planning, and building momentum one strategic step at a time.

From Theory to Tangible Results: Your Action Plan

So, where do you begin? The most effective approach is to identify your biggest pain point and tackle it first. This creates an immediate, visible win that builds support and energy for the next phase of your transformation.

Consider these starting points based on common challenges:

- •If you're drowning in manual data entry: Your first and most impactful move is invoice processing automation. This single change directly addresses the most time-consuming part of the AP cycle, freeing up your team's bandwidth almost overnight and providing a solid foundation for all other improvements.

- •If you're battling payment errors and overpayments: Focus on implementing three-way matching and establishing a rock-solid vendor master data management policy. These practices create the internal controls needed to ensure you only pay what you legitimately owe, protecting your bottom line from costly mistakes.

- •If you're missing out on savings: The clear winner is to explore an early payment discount program. This initiative turns your accounts payable department into a profit-generating function, directly improving your company's profitability with every invoice paid.

- •If fraud risk keeps you up at night: Your priority should be establishing a formal segregation of duties. This is a non-negotiable best practice for internal control that significantly reduces the risk of both internal and external payment fraud.

Key Insight: The common thread weaving through nearly all modern accounts payable best practices is technology. Automation is no longer a luxury for large enterprises; it's the essential engine that makes these strategies accessible, scalable, and effective for businesses of all sizes.

By embracing these best practices, you're not just speeding up invoice payments. You are fundamentally elevating the role of your finance team. You are shifting their focus from tedious, repetitive tasks to high-value strategic activities like cash flow analysis, vendor relationship management, and risk mitigation. This transformation strengthens your company’s financial health, improves supplier relationships, and builds a more resilient, scalable, and profitable business. The future of accounts payable is intelligent and automated, and your journey to get there starts with that first, decisive step.

Ready to eliminate manual data entry and supercharge your AP workflow? Tailride automates invoice capture directly from your inbox, making it the perfect first step in implementing these accounts payable best practices. See how you can transform your AP department by visiting Tailride today.