What Is Invoice Reconciliation Explained

Struggling with payments? Understand what is invoice reconciliation, why it matters, and how to master the process for complete financial accuracy.

Think of invoice reconciliation as a bit of financial detective work. It's the process of taking the invoices your suppliers send you and matching them against your own records - things like purchase orders and delivery receipts. The goal is to make sure you're only paying for what you actually ordered and received.

This simple check is a fundamental part of keeping your company's finances healthy and preventing you from paying for someone else's mistake.

Your Guide to Understanding Invoice Reconciliation

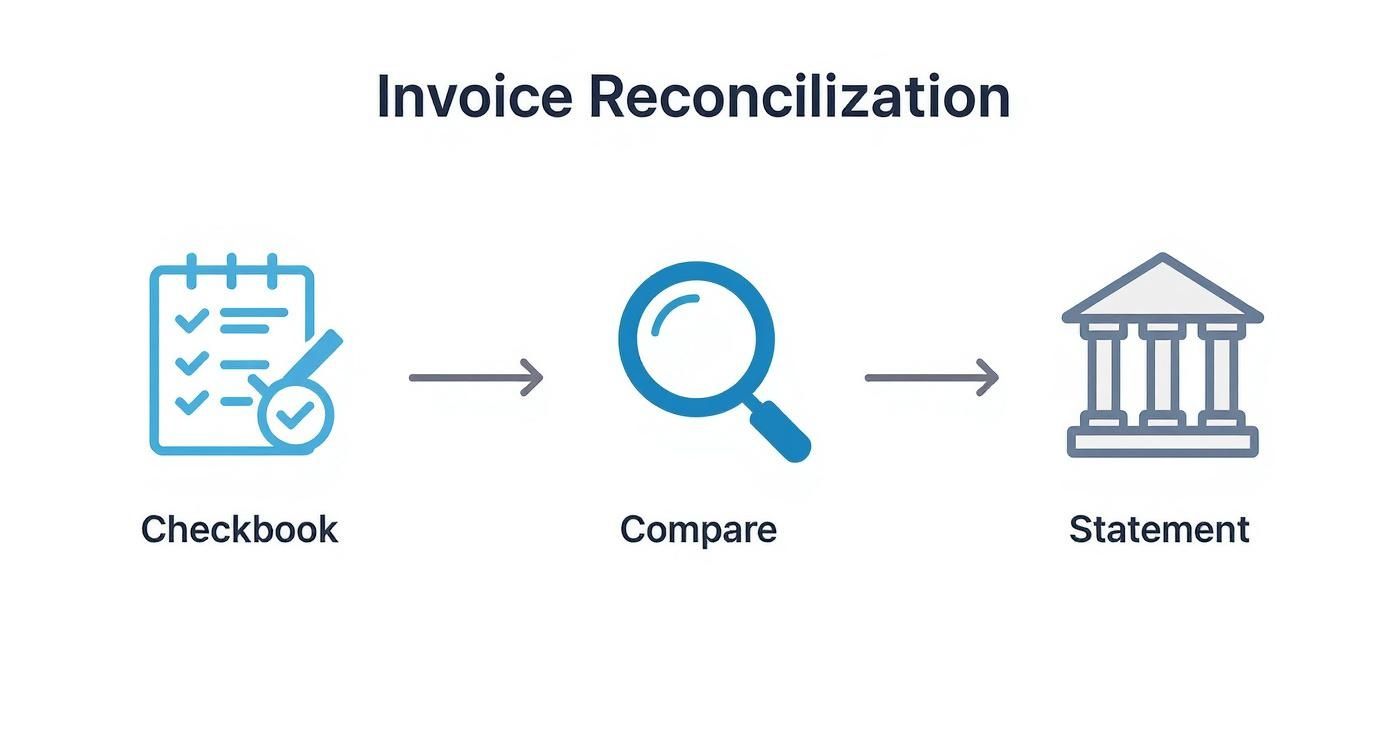

At its heart, invoice reconciliation is a lot like balancing your personal checkbook. You sit down with your bank statement and compare every line item to your own records, checking off each transaction one by one. You're looking for anything that doesn't add up, whether it's a fee you didn't expect or a coffee you forgot to write down.

Businesses do the exact same thing, just on a much bigger scale. Instead of a bank statement, they have a supplier's invoice. Instead of a checkbook register, they have their purchase order (what they agreed to buy) and a receiving report (proof of what was delivered).

This is often called a "three-way match," and it’s the bedrock of any solid accounts payable process.

Why It's More Than Just Paperwork

Without a proper reconciliation system in place, a business is essentially flying blind. You could easily end up paying for items you never got, getting billed the wrong amount because of a simple typo, or even paying the same invoice twice.

These aren't just small bookkeeping hiccups. They are real cash leaks that, over time, can turn into a serious financial drain.

Invoice reconciliation is your financial safeguard. It turns accounts payable from a simple bill-paying task into a strategic checkpoint for accuracy, cost control, and even fraud prevention.

The Challenge of Manual Processes

The problem is, many companies are still trying to do this all by hand. When you're dealing with stacks of paper and endless spreadsheets, things get messy - fast.

Research shows that a shocking 39% of invoices have errors on them. When your team is spending more than five days a month buried in paperwork, it's easy for those mistakes to slip through. Not only is the manual approach slow and prone to errors, but it's also surprisingly expensive. The average cost to process just one invoice can be around $15.

This is where a smarter approach comes in. Modern finance teams often lean on robust ERP systems, like Dynamics 365 solutions, to handle these complex financial workflows. By stepping away from the manual grind, companies can protect their cash flow and free up their people to focus on work that really matters.

The Invoice Reconciliation Process Step by Step

To really get a feel for invoice reconciliation, let's walk through the manual process from start to finish. Picture this: you run a busy coffee shop, "The Daily Grind," and you've just received a big shipment of premium coffee beans from your go-to supplier. The beans arrive with an invoice, and now your real work begins.

It might sound complicated, but the whole thing boils down to a few logical steps. Think of it as detective work - every step is about making sure the numbers on the paper match what you actually ordered and got, which is your best defense against expensive mistakes.

This visual breaks down the basic flow of checking your internal records, lining them up with the invoice, and finally matching everything to your bank statements.

As you can see, the heart of reconciliation is just a systematic comparison of documents. You’re making sure everything is perfectly aligned before a single dollar leaves your account.

Step 1: Gather Your Documents

First things first, you need to gather your evidence. This isn't just about grabbing the invoice. You need all the related paperwork to see the full story of the transaction from beginning to end.

For "The Daily Grind," that means tracking down three crucial pieces of paper:

- •The Purchase Order (PO): This is the document you sent to the supplier, spelling out exactly what you wanted to buy - 50 bags of Sumatra coffee beans at $100 per bag.

- •The Receiving Report: This is your internal proof, filled out when the shipment landed. Your team counted everything and confirmed all 50 bags showed up in good shape.

- •The Supplier's Invoice: This is the bill from your supplier asking you to pay up for the order.

Step 2: Perform the Three-Way Match

With all three documents in front of you, it’s time for the most important part: the three-way match. You're carefully comparing the details across all three to make sure they tell the exact same story.

You check the item descriptions (Sumatra coffee beans), the quantities (50 bags), and the price per item ($100). If the purchase order, receiving report, and invoice all agree, you've got a perfect match. To dive deeper into this specific check, you can explore our guide on the invoice matching process.

Step 3: Identify and Investigate Discrepancies

Now, you get to put on your detective hat. What happens if the invoice says you owe for 55 bags, but your team only counted 50? Or maybe the price is listed as $105 per bag instead of the $100 you agreed on?

A discrepancy isn't an accusation; it's just a question. It’s your chance to clear things up with your supplier before a simple typo leads to an overpayment.

You have to dig in and find the root cause. Was it a simple typo from the supplier? Were some items on back-order? You'll probably need to give your vendor a call, share your records, and work together to figure out where things went wrong. Good communication here is essential for keeping your business relationships strong.

Once the issue is sorted out - let's say the supplier sends a corrected invoice for the proper $5,000 total - you can proceed. Only when every detail is confirmed and all the numbers align can you officially approve the invoice for payment, keeping The Daily Grind's finances accurate and healthy.

Why Accurate Invoice Reconciliation Is a Game-Changer

More than just a box-ticking exercise to keep your books neat, invoice reconciliation is one of the most vital health checks for your business. Think of it as your company's financial immune system. A sloppy process can leave you wide open to costly mistakes and cash flow problems, while a solid one protects your money and lays the groundwork for real growth.

The stakes are surprisingly high. A misplaced decimal point or a single accidental duplicate payment might seem like a small blip on the radar, but these little errors have a nasty habit of adding up. Over time, these tiny leaks can quietly drain your bank account and put your entire business in a tough spot.

It’s Your Best Defense Against Lost Money

One of the most immediate wins from getting this right is preventing fraud and errors. When you meticulously check every invoice against its corresponding purchase order and delivery receipt, you build a powerful shield against overpayments, phantom charges, and duplicate bills. This isn't just a "what if" scenario - it's a common and expensive reality for many businesses.

Here’s a real-world example: a small marketing agency was paying a recurring monthly bill for a software tool. A glitch in the vendor's system meant they were charged twice a month for three straight months. Because their reconciliation process was basically non-existent, they didn't spot the error for a whole quarter. They lost thousands of dollars that a simple, routine check would have saved instantly.

This process is your first and best line of defense, making sure you only pay for exactly what you ordered and actually received.

It Powers Smarter Business Decisions

Clean, accurate financials are the bedrock of every good business decision. When your invoice reconciliation is spot on, the financial reports you rely on - like your P&L and balance sheet - paint a true picture of your company's health. This goes way beyond basic accounting; it's about steering the ship.

When you can trust your financial data, you can make confident calls on everything from setting next year's budget to adjusting your pricing or even planning a major expansion. It transforms your financial records from a backward-looking chore into a forward-looking roadmap.

This whole process is a crucial piece of the puzzle. To see how it fits into the broader accounting world, you can learn more about what general ledger reconciliation is in our other guide.

It Helps You Build Stronger Vendor Relationships

Don't underestimate the power of a smooth payment process. Getting your invoice reconciliation right is a surprisingly effective way to build and maintain great relationships with your suppliers. When vendors know they can count on you to pay accurately and on time, it builds a massive amount of trust. That trust can translate into better payment terms, priority service, and a much stronger partnership down the road.

Think about what this means for your vendor relationships:

- •Prompt Payments: An efficient system gets invoices approved faster, so you can easily pay within terms and kiss late fees goodbye.

- •Clearer Communication: If a discrepancy pops up, a good reconciliation workflow gives you all the documents you need to sort it out quickly and professionally.

- •A-List Reputation: Companies that run a tight ship with their accounts payable are seen as reliable, trustworthy partners that people want to do business with.

At the end of the day, invoice reconciliation isn't just another tedious administrative task. It's a core business function that protects your cash, sharpens your strategy, and strengthens the commercial relationships that matter most.

The Headaches of Manual Reconciliation

If you’ve ever felt like your desk is drowning in a sea of paperwork or you’ve lost an afternoon hunting down a single missing purchase order, you already know the pains of manual invoice reconciliation. On paper, it sounds simple. In reality, it’s often a major bottleneck, packed with frustrating and time-consuming hurdles.

The truth is, relying on human effort alone leaves the door wide open for simple mistakes. A single typo in a dollar amount, a transposed digit in an invoice number, or a misread line item can throw the whole system off. These aren't just minor annoyances; they're costly errors that lead to overpayments, strained vendor relationships, and messy financial reports.

Drowning in Volume and Variety

For a lot of businesses, the sheer volume of incoming invoices is just overwhelming. Each one needs to be carefully checked, matched against other documents, and punched into the system. This mountain of work gets even bigger because there's no standard format - every supplier has its own unique invoice layout and terminology.

Your team ends up playing detective with every document, trying to find the key information in a different spot each time. This manual effort isn't just slow; it’s a recipe for burnout and mistakes. All that time spent deciphering various formats is time that could be spent on work that actually moves the needle.

The real cost of manual reconciliation isn’t just the hours your team puts in. It’s the opportunity cost - the high-value analysis and strategic planning that gets pushed aside for tedious, repetitive tasks.

When you look at the bigger picture of payment processing, you can see just how clunky these manual systems are. While digital payments are zipping around in real-time, traditional claims processing - which reconciliation is a part of - still takes an average of 23.9 days from start to finish. That lag is a massive cost burden, especially compared to what’s possible today. You can get more context on how fintech is shaking things up in this claims statistics overview.

The Endless Hunt for Documents and Discrepancies

One of the biggest time-sucks in manual reconciliation is the constant hunt for missing information. A supplier sends an invoice, but where’s the matching purchase order? Did the warehouse team actually log the delivery receipt? These gaps in the paper trail bring the whole process to a screeching halt.

Even when all the documents are in hand, discrepancies are a common frustration. Maybe the invoice lists a different price than what was agreed upon in the purchase order, or the quantities don't match up. Fixing these issues means a long back-and-forth of emails and phone calls, which only delays payment and puts a strain on your relationship with the vendor.

This constant friction makes it impossible to see what's really going on in your accounts payable process. Without a clean, organized system, getting an accurate, real-time view of your company’s financial commitments and cash flow is a nearly impossible task.

How Automation Creates Smarter Reconciliation

If you've ever been stuck in the frustrating maze of manual reconciliation, the automated alternative feels like a breath of fresh air. Invoice reconciliation platforms are changing the game by taking over the tedious, repetitive work that bogs your team down.

Think of it like hiring a super-smart assistant who works 24/7. This assistant can instantly read any invoice that lands in your inbox, regardless of its format. It then digs through your system to find the matching purchase order and delivery receipt, compares every single line item in a matter of seconds, and flags anything that doesn't add up for you to review. That’s precisely what modern automation does.

This jump from manual drudgery to intelligent systems isn't just a minor tweak; it completely reworks your accounts payable process. The future of smarter invoice handling is closely tied to new developments in AI document processing solutions, which bring huge gains in speed and precision.

Manual vs Automated Invoice Reconciliation

The difference between the old way and the new way is night and day. Let's look at how this plays out in the real world for your team.

The table below breaks down the key differences between sticking with manual processes and making the switch to an automated system.

| Feature | Manual Reconciliation | Automated Reconciliation |

|---|---|---|

| Speed | Slow, taking hours or even days per batch of invoices. | Fast, processing hundreds of invoices in minutes. |

| Accuracy | Prone to human error like typos and missed details. | Highly accurate, with AI flagging discrepancies automatically. |

| Cost | High operational costs due to labor-intensive tasks. | Lower cost per invoice by reducing manual intervention. |

| Visibility | Limited real-time insight into financial liabilities. | Full, real-time visibility into invoice status and cash flow. |

| Scalability | Difficult to scale as invoice volume grows. | Easily scales to handle increasing transaction volumes. |

By automating, you're not just saving time - you're building a more resilient, accurate, and scalable financial operation. If you're wondering how to pick the right platform, we break it down in our guide to the best invoice reconciliation software.

The Technology Behind the Magic

This isn’t just basic software; it’s powered by some seriously smart technology. Here are the key ingredients:

- •Optical Character Recognition (OCR): This tech acts like a digital set of eyes. It reads and pulls key data - like invoice numbers, amounts, and dates - from any document, turning pictures of text into usable information.

- •Artificial Intelligence (AI): AI is the brain of the operation. It learns your company's coding rules and vendor quirks to intelligently categorize expenses and perform that critical three-way match.

- •Machine Learning (ML): With every invoice it processes, the system gets smarter. Over time, it learns to handle new layouts and gets even better at spotting potential issues before they become problems.

This powerful combination has fueled massive growth in the financial tech space. In fact, the global reconciliation software market is projected to hit as high as $3.32 billion by 2025, all driven by the need for better accuracy and efficiency. This rapid expansion shows just how essential these tools have become.

By embracing automation, you empower your finance team to shift their focus from mind-numbing data entry to high-value strategic analysis. They can spend their time investigating anomalies, optimizing cash flow, and providing insights that help grow the business.

This transition lets your skilled professionals do what they do best - think critically and strategically - instead of getting buried in paperwork.

Invoice Reconciliation FAQs

As you start to wrap your head around invoice reconciliation, you'll probably have a few practical questions. I get these all the time. Let's tackle some of the most common ones with simple, straight-to-the-point answers.

What Is a Three-Way Match?

Think of a three-way match as the gold standard for verifying an invoice before you pay it. It’s a simple but powerful cross-check to make sure everything adds up. You’re essentially lining up three key documents to ensure they all tell the same story.

Here are the three pieces of the puzzle:

- •The Purchase Order (PO): This is the order you sent out. It clearly states what you asked for, how much of it, and the price you agreed to pay.

- •The Receiving Report: This is your internal proof of what actually showed up at your door. It confirms the goods or services you received from the supplier.

- •The Supplier's Invoice: This is the bill the supplier sent you, asking for payment.

When the item descriptions, quantities, and prices on all three documents are a perfect match, you’ve got a green light. You can approve that payment with confidence, knowing you’re not overpaying or paying for something you didn't receive.

How Often Should You Reconcile Invoices?

This really depends on how many invoices you're handling, but my advice is simple: don't wait until the end of the month. Pushing it off just creates a stressful pile-up and leaves you guessing about your cash flow.

For most businesses, a weekly reconciliation schedule is the sweet spot. It’s frequent enough to catch problems early but not so often that it takes over your entire week.

When you reconcile regularly, you get a much clearer, almost real-time snapshot of your company's financial obligations. This helps you manage your cash more effectively, keep suppliers happy with on-time payments, and completely avoid that frantic end-of-month crunch.

When Is It Time to Consider Automation?

Doing this by hand is perfectly fine when you're small. But as your business grows, the manual process starts to crack. If any of these sound familiar, it’s probably time to look into an automated solution.

You should seriously consider automation when:

- •The invoice pile is getting overwhelming. Is your team always behind, struggling to keep up with the sheer volume of invoices coming in? That’s a major red flag.

- •Mistakes are becoming more common. Are you catching more and more typos, duplicate payments, or other little errors that can add up to big money?

- •Your team is stuck doing data entry. You hired smart finance people to analyze and strategize, not to spend their days keying in invoice details.

- •You can’t see what you owe. If someone asks for an up-to-the-minute report on your company's outstanding liabilities and you can't provide it quickly, you have a visibility problem.

Moving to an automated system isn't just a time-saver. It's about making your financial operations more accurate, scalable, and strategic - a system that can actually support your business as it grows.

Ready to stop chasing paperwork and start automating your accounts payable? Tailride captures invoices from any source, extracts the data with AI, and syncs it directly with your accounting software. See how it works.