7 Best Expense Management Software for Small Business (2025)

Discover the 7 best expense management software for small business in 2025. Compare features, pricing, and pros/cons to automate your finances.

For any small business owner, tracking expenses feels like a never-ending chore. Between crumpled receipts, overlooked email invoices, and confusing spreadsheets, you're losing valuable hours that could be spent growing your business. The right software doesn't just digitize this mess; it automates it, giving you a crystal-clear view of your spending in real time. This automation is a game-changer, and exploring the broader general business process automation benefits can reveal how much time you can save across your entire operation.

But with so many options, how do you choose? This guide cuts through the noise. We'll break down the 7 best expense management software for small business, complete with screenshots, direct links, and actionable insights. We’re diving deep into each platform, comparing their unique strengths, from all-in-one accounting suites like QuickBooks to smart corporate card platforms like Ramp.

Our goal is simple: to help you find the perfect fit to reclaim your time and master your finances. Whether you're an accountant managing multiple clients, a fast-growing startup, or an e-commerce agency with high invoice volumes, this playbook has a solution for you. Let's find the tool that puts your expense workflow on autopilot.

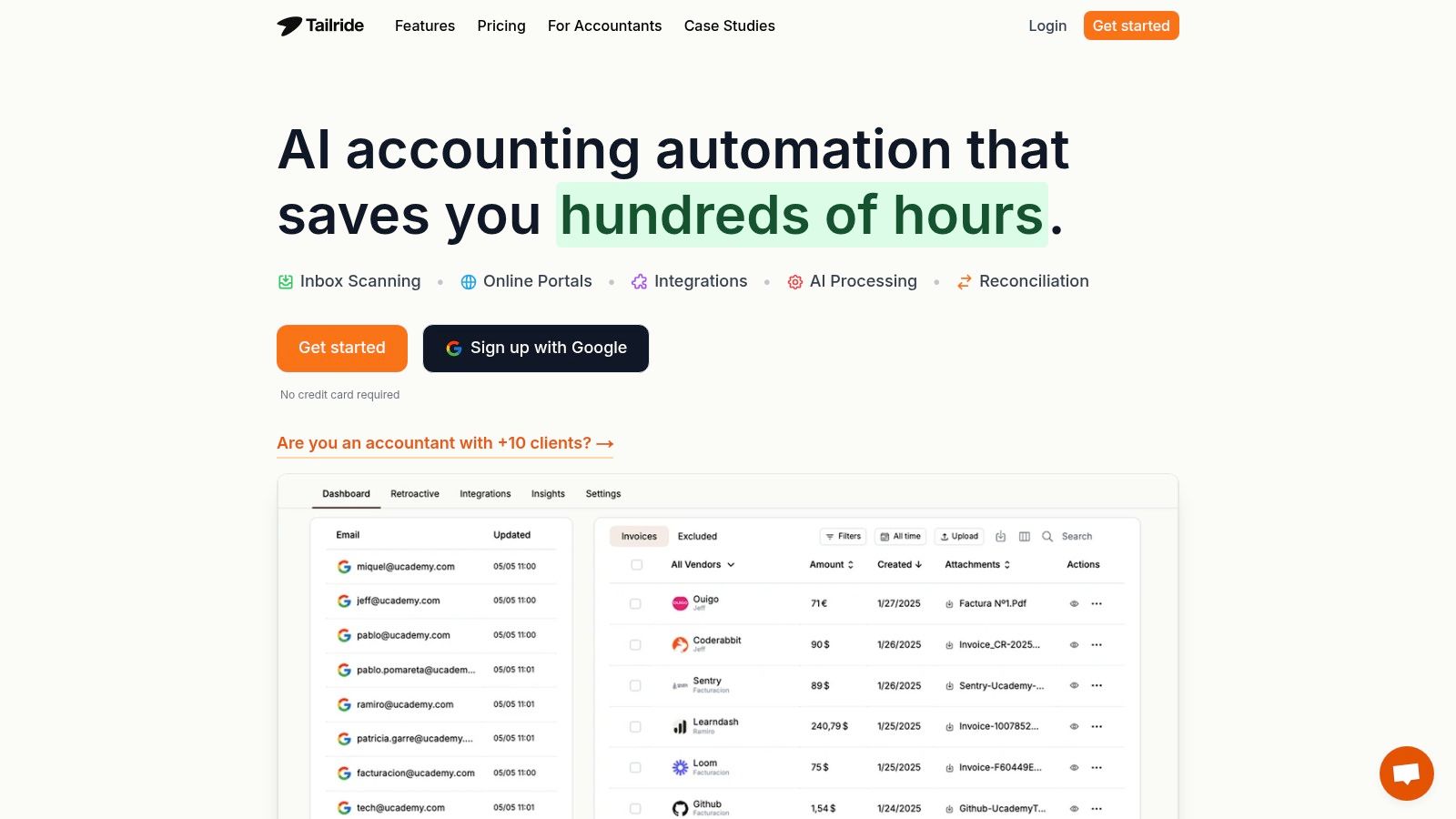

1. Tailride

Tailride stands out as a powerful, AI-driven platform designed to make one of the most tedious parts of expense management, invoice and receipt processing, completely effortless. Instead of just tracking expenses after you’ve entered them, Tailride’s core mission is to eliminate manual data entry from the very beginning. It positions itself as an indispensable tool for any small business serious about automating its financial workflows and achieving real-time accuracy.

For businesses overwhelmed by a constant influx of invoices from various sources, Tailride provides a unified and automated capture system. It connects directly to your email inboxes (Gmail, Outlook, or any IMAP) and monitors them in real-time for new bills. This means invoices are captured and processed the moment they arrive, without anyone needing to lift a finger.

Key Features & How They Help Your Business

Tailride’s feature set is built for comprehensive, hands-off automation, making it a top contender for the best expense management software for small business.

- •Omni-Channel Document Capture: Tailride doesn't just stop at emails. It ingests documents from virtually anywhere an invoice might live. You can forward PDFs, upload images, or even snap pictures of paper receipts using its clever Telegram and WhatsApp bots. The secure Chrome extension can also pull invoices directly from supplier portals, using your active browser session so you never have to share sensitive portal credentials.

- •AI-Powered Data Extraction: At its heart is an intelligent AI that reads and understands your documents. It automatically extracts key information like vendor name, invoice date, amount, and line items, then classifies and categorizes the expense according to your custom rules. This drastically reduces the time spent on manual keying and minimizes human error.

- •Automated Bank Reconciliation: This is a standout feature. Tailride connects to your bank accounts to automatically reconcile captured invoices against bank statements. It works across multiple currencies and instantly flags any discrepancies or missing invoices, ensuring your books are always accurate and audit-ready.

- •Seamless Accounting Integrations: Captured and verified data flows directly into the tools you already use. With native integrations for QuickBooks, Xero, and Microsoft Business Central, plus export options for Google Drive/Sheets and DATEV, Tailride complements your existing accounting system rather than trying to replace it.

Practical Tip: Use the retroactive inbox scan feature immediately after setup. Tailride can go back and process months or even years of historical invoices, helping you clean up your books and establish a complete financial record in minutes.

Who Is It Best For?

Tailride is an excellent fit for small businesses, accountants, and bookkeeping firms that process a significant volume of invoices and want to reclaim hours lost to manual data entry. Fast-growing e-commerce businesses and digital agencies will find its ability to handle diverse invoice sources particularly valuable.

Pricing

Tailride offers a transparent and scalable pricing model:

- •Free Plan: Up to 10 invoices/month.

- •Starter Plan: $19/month for 50 invoices.

- •Credit Packs: You can purchase additional invoice credits as needed, and they never expire.

This structure allows businesses to start for free and scale their usage as they grow without being locked into an expensive, oversized plan.

Website: https://tailride.so

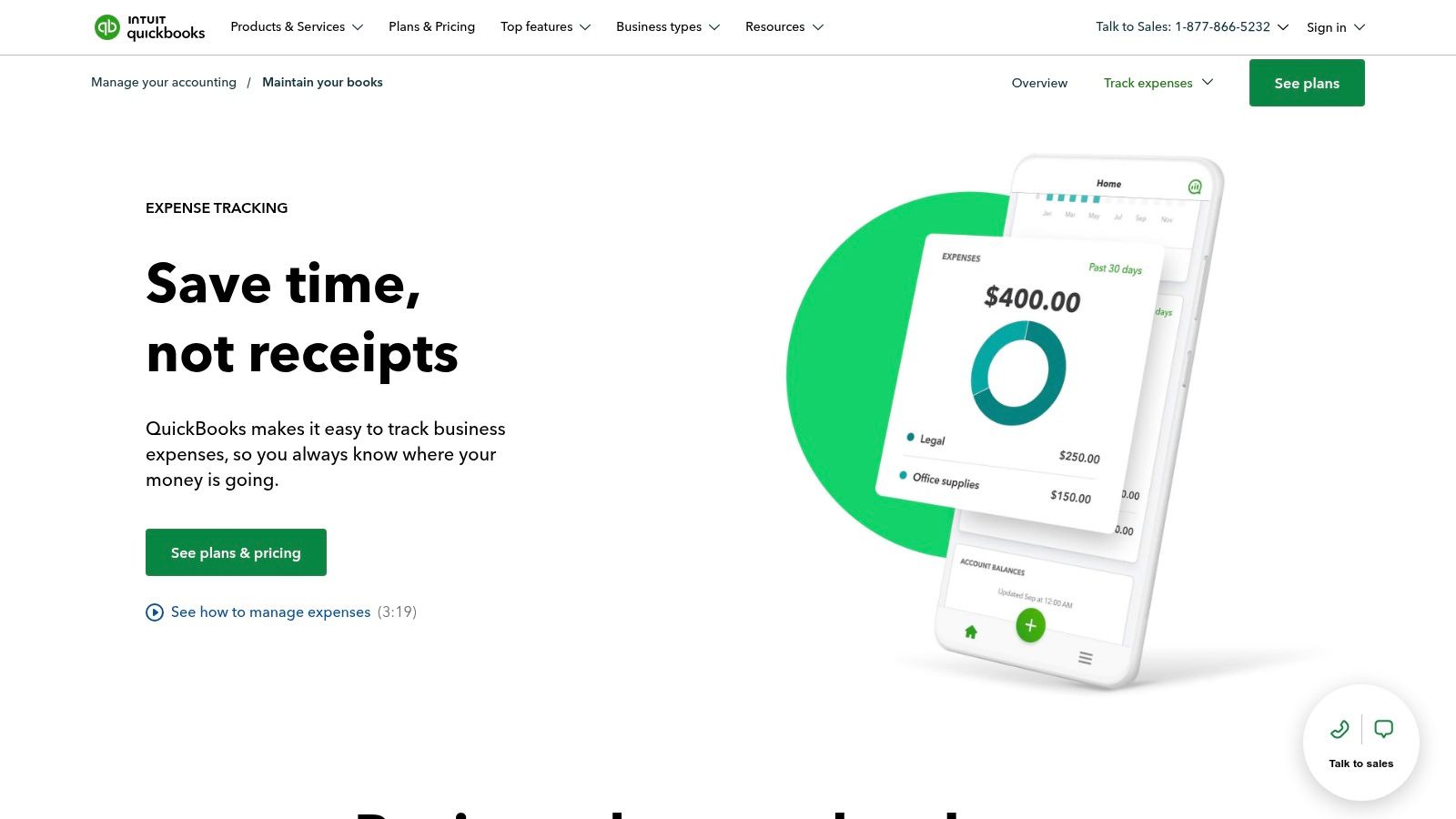

2. Intuit QuickBooks Online (QBO)

For small businesses seeking a single source of truth for their finances, Intuit QuickBooks Online (QBO) is often the go-to solution. It's more than just an expense tracker; it’s a full-fledged accounting platform that integrates expense management directly into your general ledger, providing a holistic view of your company's financial health. This makes it one of the best expense management software for small business owners who want to avoid juggling multiple disconnected tools.

The platform shines with its mobile app, allowing you and your team to snap photos of receipts on the go. QBO’s OCR technology automatically extracts key data like the vendor, date, and amount, and then its powerful bank feed integration tries to match the receipt to an existing transaction. This dramatically cuts down on manual data entry and reduces the risk of human error.

Key Features and Pricing

QBO's strength lies in its ecosystem. Because expenses are tracked within your accounting software, you can immediately categorize them, mark them as billable to a client, and see their real-time impact on your financial statements.

- •Mobile Receipt Capture: Snap a photo, and QBO's app pulls the data and auto-matches it to bank transactions.

- •Automatic Categorization: Set up bank rules to automatically categorize recurring expenses, saving hours of manual work.

- •Comprehensive Reporting: Instantly generate Profit & Loss, cash flow, and other crucial financial reports that include all your tracked expenses.

- •Vast Accountant Network: Finding a bookkeeper or accountant who knows QBO is incredibly easy, especially in the US.

Pricing starts with the Simple Start plan and scales up to the Advanced tier. Keep in mind that Intuit announced price increases in summer 2025, so it's wise to factor that into your budget.

Pros & Cons

| Pros | Cons |

|---|---|

| All-in-one system for accounting, invoicing, and expenses. | Expense approval workflows are less robust than dedicated tools. |

| Mature mobile app and reliable bank connections. | Higher price point compared to standalone expense trackers. |

| Widely used, making it easy to find professional support. | Can feel overly complex if you only need simple expense tracking. |

Who It's Best For

QBO is ideal for businesses that want a unified financial system. If you already use it for invoicing and bookkeeping, leveraging its built-in expense tools is a natural and efficient choice. For those looking to integrate their existing tools, you can discover more about the Tailride integration with QuickBooks Online.

Visit Intuit QuickBooks Online

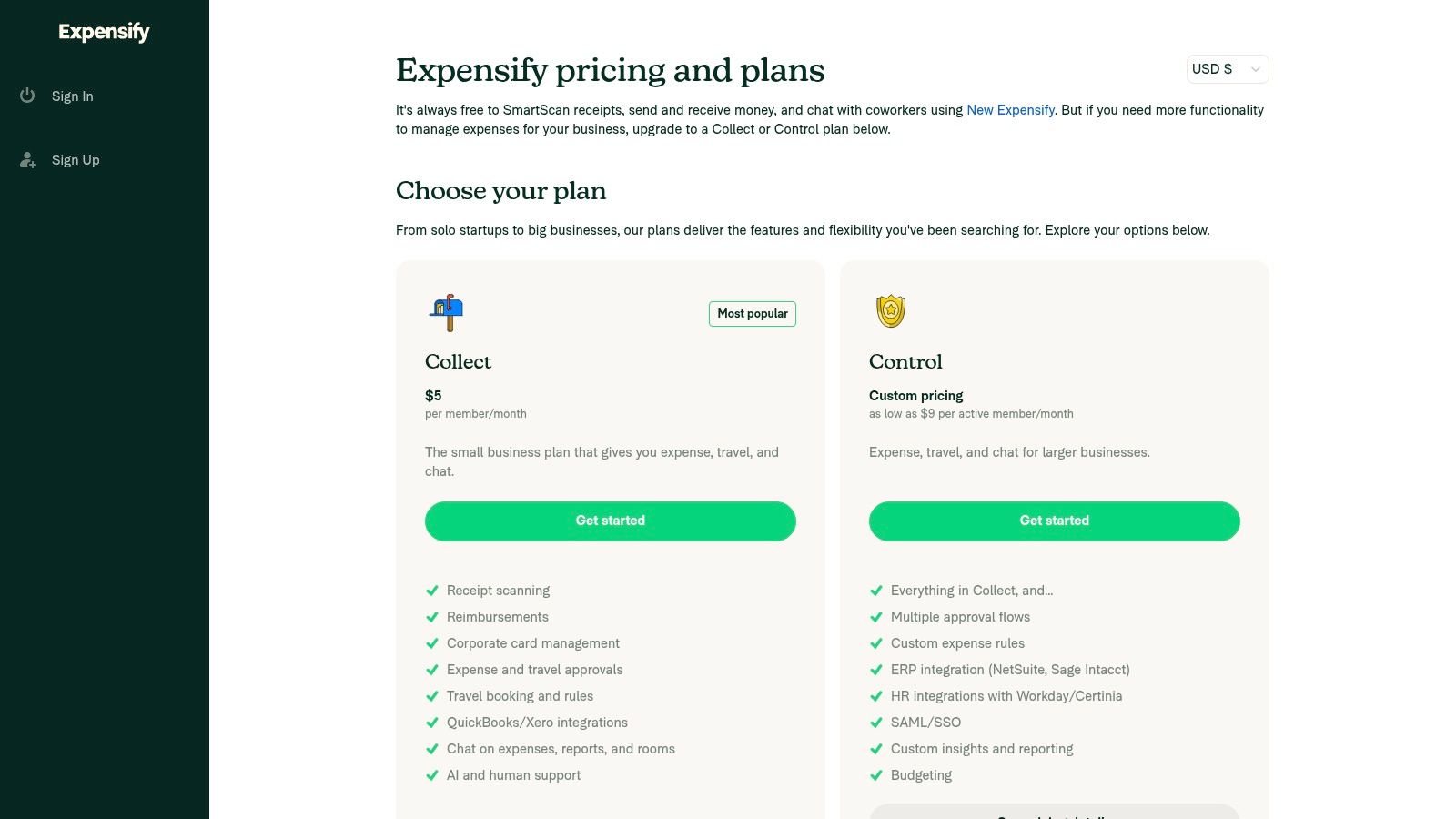

3. Expensify

For small businesses that need a dedicated, mobile-first solution for tracking employee expenses and streamlining reimbursements, Expensify is a top contender. It focuses on doing one thing exceptionally well: making expense reporting as painless as possible. This specialization makes it one of the best expense management software for small business teams that are frequently on the go and need to submit expenses quickly and efficiently.

Expensify’s claim to fame is its patented SmartScan technology. Employees just snap a photo of a receipt, and the app automatically transcribes the details, creates the expense entry, and even submits it for approval. This level of automation empowers employees to manage their own reporting with minimal effort, freeing up administrators from chasing down paperwork and manually entering data. The platform's entire workflow is built around speed and convenience.

Key Features and Pricing

Expensify's power comes from its singular focus on the expense reporting lifecycle, from receipt capture to reimbursement. It also integrates seamlessly with major accounting platforms like QuickBooks, Xero, and NetSuite, ensuring your financial data stays in sync without manual reconciliation.

- •Unlimited SmartScan: Paid plans include unlimited receipt scanning, making it a highly scalable solution for growing teams.

- •Automated Reimbursements: Once a report is approved, the platform can automatically reimburse employees via next-day direct deposit.

- •Corporate Card Integration: Offers the optional Expensify Visa Commercial Card, which provides real-time transaction feeds and auto-reconciliation.

- •Mileage Tracking: The mobile app uses GPS to easily track and submit mileage expenses for reimbursement.

Expensify simplified its pricing in April 2025 with a straightforward Collect plan at $5 per active member per month, making it accessible for small businesses.

Pros & Cons

| Pros | Cons |

|---|---|

| Extremely fast receipt capture and report creation. | Admin workflows can feel different than all-in-one accounting suites. |

| Straightforward SMB pricing with the Collect plan. | The best savings on higher tiers are often tied to using the Expensify Card. |

| Works with or without the Expensify corporate card. | Can be an extra expense if your accounting software has basic tools. |

Who It's Best For

Expensify is ideal for businesses with employees who need to submit expenses regularly, especially for travel, mileage, and client entertainment. Its user-friendly mobile app and powerful automation make it a favorite for teams that value speed and efficiency. For a deeper dive into the fundamentals, you can get more details on how to track business expenses.

4. Zoho Expense

For businesses that need a powerful, dedicated travel and expense (T&E) solution without the enterprise-level price tag, Zoho Expense is a formidable contender. It offers a comprehensive suite of tools designed to automate expense reporting from start to finish, making it one of the best expense management software for small business teams that travel frequently or have complex reimbursement needs. Its strength lies in combining robust features with an accessible, user-friendly interface.

Zoho Expense streamlines the entire process, from receipt scanning to reimbursement. Employees can easily upload receipts via the mobile app, where OCR technology captures the details. Managers can then approve reports based on custom-configured company policies, ensuring compliance and preventing out-of-policy spending before it happens. The platform also offers direct corporate card feeds to simplify reconciliation.

Key Features and Pricing

Zoho Expense stands out by offering end-to-end management that covers everything from travel booking to final reimbursement. It integrates seamlessly with Zoho Books but also works well as a standalone product connecting to other accounting systems.

- •End-to-End Expense Reporting: Automate every step with customizable policies, multi-level approvals, and direct deposit reimbursements.

- •Corporate Card Reconciliation: Connect company card feeds to auto-match expenses, reducing manual reconciliation work for your finance team.

- •Mileage and Per-Diem Support: Easily track mileage using the mobile app’s GPS and manage complex per-diem rates for traveling employees.

- •Zoho Ecosystem Integration: Works flawlessly with other Zoho products like Books and CRM, but flexible enough to connect with external software.

Zoho Expense offers a 14-day free trial and a free plan for up to 3 users. Paid plans are competitively priced per user, though it's wise to verify US pricing at checkout as regional pages can sometimes vary.

Pros & Cons

| Pros | Cons |

|---|---|

| Competitive per-user pricing aimed directly at SMBs. | Pricing pages can vary by region; always confirm US price at checkout. |

| Easy to deploy with a strong, intuitive mobile experience. | Fewer third-party travel partnerships than some enterprise vendors. |

| Flexible integrations beyond the native Zoho product suite. | The sheer number of features might be overwhelming for very simple needs. |

Who It's Best For

Zoho Expense is ideal for small to medium-sized businesses looking for a dedicated and affordable T&E management tool. It's perfect for companies with employees who travel, need to track mileage, or require a formal approval and reimbursement workflow that’s more robust than what a general accounting platform offers.

5. BILL Spend & Expense (formerly Divvy)

For businesses that want to control spending before it even happens, BILL Spend & Expense (formerly Divvy) offers a unique and powerful approach. It combines a corporate card program with free expense management software, shifting the focus from tracking expenses after the fact to setting proactive limits. This innovative model makes it one of the best expense management software for small business leaders who prioritize budget adherence and real-time financial oversight.

The platform’s core strength is its system of budgets and smart cards. You can create specific budgets for departments, projects, or events and then issue physical or virtual corporate cards tied directly to those funds. Employees can only spend what's allocated, eliminating the possibility of out-of-policy purchases and giving managers complete visibility into spending as it occurs.

Key Features and Pricing

The BILL Spend & Expense platform is typically offered with no software subscription fees; access is bundled with its corporate card program. This makes its feature set incredibly compelling, as you get robust expense tools without an added monthly cost.

- •Proactive Spend Controls: Issue virtual cards with specific limits, expiration dates, and vendor locks to enforce budget policies automatically.

- •Real-Time Tracking: See transactions appear in the dashboard the moment a card is swiped, providing an up-to-the-minute view of cash flow.

- •Automated Expense Reports: Employees are prompted to submit receipts via the mobile app right after a purchase, which automates categorization and reconciliation.

- •Accounting Integrations: Seamlessly syncs data with major accounting platforms like QuickBooks, Xero, NetSuite, and Sage Intacct.

Access to the platform is contingent on being approved for the BILL Divvy corporate card, and your credit limit will influence your team's total spending capacity.

Pros & Cons

| Pros | Cons |

|---|---|

| No software subscription fee for the platform. | Access is tied to approval for the BILL Divvy corporate card. |

| Strong upfront spend controls prevent overspending. | Reliance on card program rules can impact cash flow planning. |

| Highly-rated mobile app for on-the-go receipt management. | Not a standalone software; requires using their card product. |

Who It's Best For

BILL Spend & Expense is ideal for businesses that want to enforce budgets and empower their teams with controlled spending autonomy. It’s perfect for fast-growing startups and established small businesses that need to eliminate expense report surprises and gain real-time control over their finances.

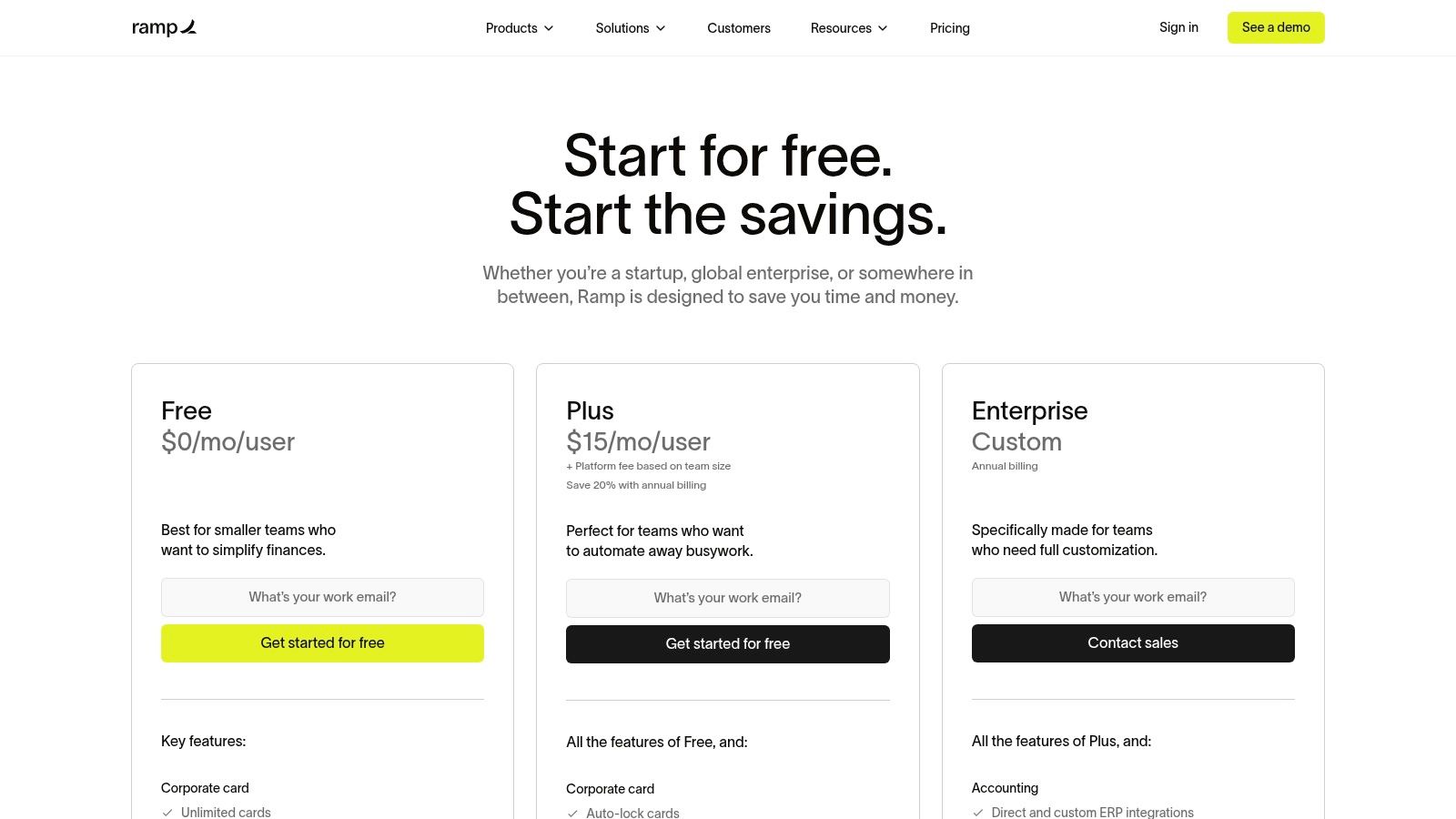

6. Ramp

For businesses looking to combine corporate cards with a powerful spend and expense management platform, Ramp offers a compelling, modern solution. It moves beyond simple expense tracking by integrating corporate cards, bill payments, reimbursements, and accounting automation into a single, unified system. This all-in-one approach provides deep visibility into company spending, making it one of the best expense management software for small business owners who want to proactively control costs, not just track them after the fact.

Ramp's core strength is its tight integration between its corporate cards and its software. Employees use Ramp cards for purchases, and the platform automatically collects receipts via text or email forwarding. Its AI-powered system then codes the transaction and pushes it through predefined approval workflows, virtually eliminating the need for manual expense reports. This level of automation frees up significant time for both employees and finance teams.

Key Features and Pricing

Ramp’s platform is built around automation and intelligent insights designed to help businesses spend less. From enforcing spending policies at the point of sale to providing insights on vendor pricing, it helps you manage expenses proactively.

- •Automated Receipt Matching: The platform automatically collects and matches receipts to card transactions, drastically reducing manual reconciliation.

- •Advanced Policy Controls: Set granular spending rules and approval workflows that are enforced before a purchase can be made.

- •Vendor Insights: Ramp analyzes your spending to identify potential savings, such as duplicate subscriptions or better pricing from other vendors.

- •Direct Accounting Sync: It offers deep integrations with QuickBooks, Xero, NetSuite, and Sage Intacct, ensuring your books are always up-to-date.

Ramp offers a surprisingly robust free tier, with paid plans like Plus and Enterprise unlocking more advanced features like procurement controls and sophisticated integrations.

Pros & Cons

| Pros | Cons |

|---|---|

| Functional free plan suitable for many small teams. | Best experience assumes using Ramp cards; some features are limited without them. |

| Unified cards, reimbursements, and AP in one interface. | Advanced features require upgrading to Plus or Enterprise tiers. |

| Deep controls and strong automation as you scale. | May not be the right fit if you only need simple receipt tracking. |

Who It's Best For

Ramp is ideal for fast-growing startups and tech-savvy small businesses that want an integrated card and spend management system. If your goal is to automate financial operations and gain real-time control over company-wide spending, Ramp's smart, proactive approach is a powerful choice.

7. G2 (Expense Management Category)

Instead of a single software, sometimes the best first step is a trusted marketplace. G2 is a peer-to-peer review site that allows you to compare dozens of expense management tools side-by-side, making it an invaluable research hub. For small businesses overwhelmed by options, G2 provides the data needed to create a shortlist of vendors that genuinely fit your specific needs, from features to company size.

The platform’s real power comes from its verified user reviews and powerful filtering system. You can sort solutions by user satisfaction, market presence, and specific features like receipt scanning or reimbursement management. This lets you see what real users are saying about the tools you're considering, offering a transparent look at both the highlights and the potential drawbacks before you commit to a demo.

Key Features and Pricing

G2 is not a software vendor but a comparison platform. It’s free to use for research, as it makes money from vendors who pay for enhanced profiles and other marketing services.

- •Comparison Grids: Place tools like Expensify, Ramp, and Airbase in a head-to-head grid to compare features, ratings, and pricing information.

- •Verified Peer Reviews: Read in-depth reviews from verified users, often broken down by what they liked, disliked, and the problems they solved.

- •Advanced Filtering: Narrow your search by company size (select "Small Business"), required features (e.g., OCR, card reconciliation), and integration capabilities.

- •Direct Vendor Links: Once you’ve identified top contenders, G2 provides direct links to schedule a demo or start a free trial on the vendor’s website.

Pricing is not applicable as G2 is a free research resource. You will find pricing details for individual software solutions on their respective G2 profiles or vendor sites.

Pros & Cons

| Pros | Cons |

|---|---|

| Neutral marketplace with extensive, verified user feedback. | Some vendor placements are sponsored, so always verify claims. |

| Powerful filters to quickly shortlist relevant options. | Doesn't handle purchases; it redirects you to vendor websites. |

| Free to use for research and comparison. | The sheer number of options can still feel overwhelming initially. |

Who It's Best For

G2 is the perfect starting point for any small business owner or finance manager at the beginning of their search for the best expense management software. It’s ideal for those who want to conduct thorough due diligence, compare the market landscape, and build a confident shortlist based on unbiased peer experiences before engaging with sales teams.

Visit G2's Expense Management Category

Top 7 Expense Management Tools Comparison

| Product | Implementation Complexity 🔄 | Resource Requirements 💡 | Expected Outcomes ⭐📊 | Ideal Use Cases | Key Advantages ⚡ |

|---|---|---|---|---|---|

| Tailride | 🔄 Medium - inbox + Chrome extension setup, rule tuning | 💡 Low - IMAP/Gmail/Outlook access, optional bots; pay-per-invoice credits | ⭐⭐⭐⭐ - high extraction accuracy, automated multi-currency reconciliation; 📊 fewer missing transactions | Accountants, bookkeeping firms, SMB finance teams, e‑commerce, enterprise finance | ⚡ Fast setup & retroactive scanning; seamless accounting integrations; strong security |

| Intuit QuickBooks Online (QBO) | 🔄 Low - single-platform onboarding | 💡 Moderate - subscription cost, bank feeds and apps | ⭐⭐⭐ - unified accounting + expense tracking; 📊 robust financial reporting | Small businesses wanting books and expenses in one system | ⚡ Consolidated workflows; large US accountant ecosystem |

| Expensify | 🔄 Low - mobile-first, simple rollout | 💡 Low–Moderate - per-user fees; optional card program | ⭐⭐⭐⭐ - very fast receipt capture and reimbursements; 📊 quicker expense turnaround | SMBs focused on rapid receipt capture, reimbursements and travel | ⚡ Unlimited SmartScan (paid), fast report creation, card reconciliation |

| Zoho Expense | 🔄 Low - straightforward T&E deployment | 💡 Low - competitive per-user pricing; integrates with Zoho or external systems | ⭐⭐⭐ - complete T&E workflows with approvals and mileage; 📊 controlled travel spend | SMBs seeking robust T&E without enterprise complexity | ⚡ Easy deployment, flexible integrations, strong mobile OCR |

| BILL Spend & Expense (formerly Divvy) | 🔄 Medium - card program + platform onboarding | 💡 Card-dependent - access tied to corporate card; no software subscription fee | ⭐⭐⭐⭐ - strong pre-spend control and real-time visibility; 📊 improved budget compliance | Organizations prioritizing card controls and upfront budget enforcement | ⚡ Virtual cards & pre-spend controls prevent out-of-policy purchases |

| Ramp | 🔄 Medium - card issuance + automation setup | 💡 Moderate - card adoption recommended; Free/Plus/Enterprise tiers | ⭐⭐⭐⭐ - automation and vendor savings insights; 📊 measurable cost reductions | Scaling teams wanting unified cards, AP automation and savings | ⚡ Deep automation, policy enforcement, vendor price intelligence |

| G2 (Expense Management category) | 🔄 Low - use as a research/comparison tool | 💡 Minimal - time to filter and read reviews | ⭐⭐⭐ - better-informed shortlist decisions; 📊 faster vendor selection | Shortlisting vendors and validating peer feedback before purchase | ⚡ Neutral reviews and comparison grids to accelerate vendor selection |

Choosing the Right Tool to Make Your Expenses Disappear

We’ve explored a powerful lineup of platforms, from all-in-one accounting giants to dedicated spend management innovators. The sheer number of options can feel overwhelming, but the journey to finding the best expense management software for small business starts with a simple question: what is your single biggest financial headache right now?

Your answer is your compass. It will guide you toward the solution best equipped to solve your most pressing challenges and deliver the highest return on your investment. Don't chase every feature; focus on the one that will give you back the most time.

How to Pinpoint Your Perfect Match

Making the right choice is less about finding a universally "best" tool and more about identifying the best fit for your unique workflow and business goals. Let’s break down the decision-making process based on common pain points.

- •If you’re buried in manual data entry: Your primary need is automation. Tools like Tailride are designed specifically to eliminate this bottleneck, automatically capturing and processing invoice data from emails and portals before you even see it. This is ideal for businesses with high invoice volumes or those still wrestling with paper receipts.

- •If you need a single source of truth for all finances: An integrated accounting suite is your best bet. QuickBooks Online offers robust expense tracking within a comprehensive system that also manages invoicing, payroll, and financial reporting. This is perfect for small businesses that want everything under one roof.

- •If uncontrolled employee spending is your main concern: Look for a card-first platform. Solutions like Ramp and BILL Spend & Expense provide corporate cards with built-in, customizable controls. This approach proactively manages spending, making it a great choice for fast-growing teams that need to delegate purchasing power without losing oversight.

- •If simplifying expense reports is the goal: A user-friendly, mobile-first app is key. Expensify and Zoho Expense excel at making it incredibly easy for employees to snap photos of receipts, submit reports, and get reimbursed quickly, which is essential for teams that travel frequently.

Your Actionable Next Steps

Once you've identified your primary need, it's time to take action. Don't get stuck in analysis paralysis.

- •Shortlist Two or Three Contenders: Based on your biggest pain point, select the top candidates from our list.

- •Sign Up for Free Trials: Nearly every platform offers a free trial or a demo. Use this opportunity to test the core functionality that matters most to you. Can you easily connect your bank account? Is the receipt scanning accurate? How intuitive is the dashboard?

- •Run a Real-World Test: Process a handful of actual expenses through each system. This hands-on experience is far more valuable than just watching a demo video. Involve a team member to get their feedback on usability.

- •Consider the Bigger Picture: Think about how your chosen software will integrate with your existing systems. When choosing the right software, consider how expense management fits into the broader landscape of essential small business tools. A seamless connection to your accounting software or project management app can save countless hours.

Ultimately, the right expense management software should feel like a weight has been lifted. It should free you from tedious administrative tasks, provide clear visibility into your company’s financial health, and empower you to focus on what you do best: growing your business.

Ready to eliminate manual data entry for good? See how Tailride uses AI to automatically fetch and process your invoices directly from emails and supplier portals, putting your expense management on autopilot. Start your free trial today and reclaim your time.