A Guide to the Invoice Matching Process

Unlock efficiency with our guide to the invoice matching process. Learn how to prevent errors, reduce costs, and streamline your accounts payable workflow.

Tags

Think about the last time you were at a restaurant. When the bill arrived, you probably gave it a quick once-over to make sure it matched what you actually ordered. You wouldn't just hand over your credit card without checking, right? In the business world, the invoice matching process is that exact same sanity check - it's how your company confirms it only pays for what it ordered and received.

What Is the Invoice Matching Process?

At its heart, invoice matching is a crucial internal control. It's the standard procedure your accounts payable (AP) team follows to compare a supplier's invoice against your company's own records, like the purchase order (PO) and the delivery receipt. It’s the first, and most important, step before any money leaves your bank account.

This isn't just about administrative box-ticking. This verification is a critical shield for your company's cash flow. By lining up what was requested, what arrived, and what you're being billed for, invoice matching acts as a powerful first line of defense.

This systematic check is what protects your business from common and costly problems, like overpayments due to incorrect pricing, accidentally paying the same invoice twice, or even falling victim to vendor fraud.

Why This Process Is So Important

Operating without a solid invoice matching system is like paying your bills with a blindfold on. A well-defined process introduces much-needed clarity and control, which has a direct and positive impact on your bottom line and overall efficiency.

There are a few different levels of verification, usually referred to as 2-way, 3-way, and 4-way matching. Each one adds another layer of scrutiny to the process. You can dig deeper into these different verification methods on Appvizer, but the core idea is the same.

Quick Guide to Invoice Matching Types

To get a clearer picture, it helps to see how the different matching types stack up. Each level offers more verification and is suited for different kinds of purchases.

| Matching Type | Documents Checked | Best For |

|---|---|---|

| 2-Way Matching | Invoice + Purchase Order | Services, subscriptions, or recurring charges where physical goods aren't delivered. |

| 3-Way Matching | Invoice + PO + Goods Receipt | The most common type, ideal for any purchase involving physical products. |

| 4-Way Matching | Invoice + PO + Goods Receipt + Inspection Report | High-value or complex orders where quality assurance is absolutely critical. |

Ultimately, choosing the right level of matching and implementing a strong workflow gives you some serious advantages.

Here’s what a great invoice matching process delivers:

- •Financial Accuracy: It guarantees you're paying the right price for the goods and services you actually got. No more budget leaks from simple mistakes.

- •Fraud Prevention: Any oddities or discrepancies get flagged right away, which slams the door on most fraudulent or duplicate invoices.

- •Stronger Supplier Relationships: When vendors know they'll be paid accurately and on time, it builds trust. That trust can lead to better payment terms and a healthier partnership.

- •Operational Integrity: It creates a clear, documented audit trail that makes financial compliance easier and gives everyone visibility into the entire payment cycle.

Breaking Down the Different Types of Invoice Matching

Not all purchases are created equal, so why would we verify them all the same way? The invoice matching process isn't a one-size-fits-all solution. It’s more like a toolbox, with different methods for different kinds of transactions. Picking the right one means you’re working smart, not just hard.

Think about it like this: you wouldn't use a simple password to protect your company's bank account, but it's probably fine for a free trial of a new app. The same logic applies here. A simple software subscription doesn't carry the same risk as a massive shipment of raw materials, so the level of verification should match the risk.

Two-Way Matching: The Quick Check

The most basic method is 2-way matching. It’s a straightforward comparison between just two documents: the supplier's invoice and your original purchase order (PO).

This simple check answers two fundamental questions:

- •Did we actually order this?

- •Are they charging us the right price?

It's the perfect approach for things you can't physically touch, like services or digital goods. A recurring software license, a monthly retainer for a marketing agency, or a digital subscription are all great candidates. You just confirm the invoice matches what you agreed to in the PO, and you're good to go. It’s fast, clean, and ideal for your low-risk, predictable expenses.

Three-Way Matching: The Industry Standard

Now we get to the most common method in the business world: 3-way matching. This approach introduces a third, critical piece of evidence into the mix - the goods receipt note (or packing slip). This document is your proof that the goods have physically arrived at your doorstep.

The process confirms three things are in alignment:

- •What you ordered (Purchase Order)

- •What you received (Goods Receipt)

- •What you were billed for (Invoice)

Let’s say you ordered 50 new laptops for the team. With 3-way matching, you don’t just check that the invoice price is correct. You also pull out the delivery paperwork to confirm that all 50 laptops actually showed up. This simple step is a powerful defense against paying for items that are missing or were never shipped in the first place - a surprisingly common and costly problem. For any company that handles physical products, this is the gold standard.

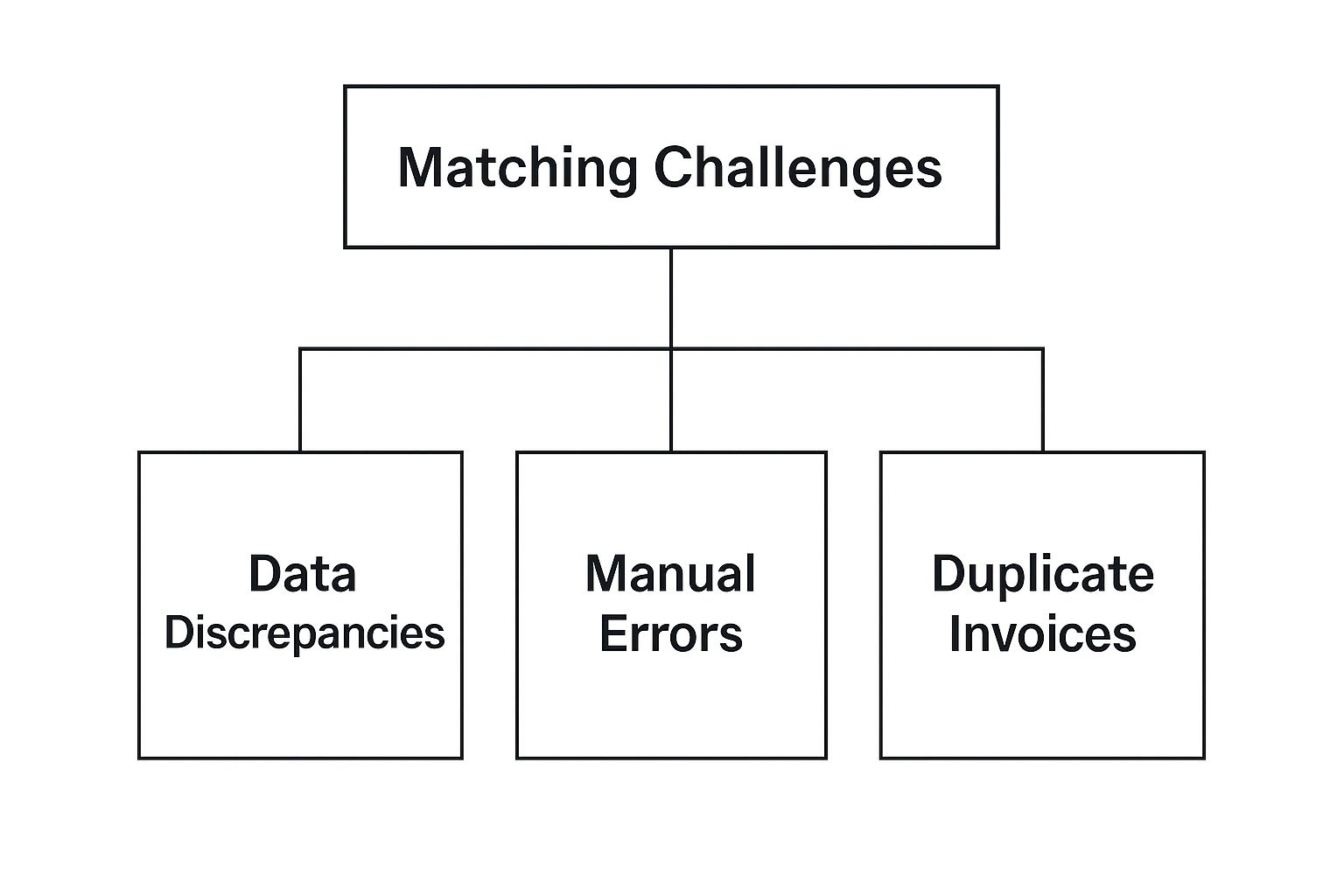

This visual really drives home the common headaches that a solid matching process helps you avoid.

As you can see, a structured process directly tackles the biggest sources of accounts payable errors.

Four-Way Matching: For Maximum Security

For your most critical, high-stakes purchases, there’s 4-way matching. This adds a final, fourth layer of verification: an inspection or quality acceptance report. You’d pull this out for purchases where quality is absolutely non-negotiable - think custom-machined parts, sensitive medical equipment, or a specific grade of raw materials.

This ultimate check confirms not only that the goods arrived, but that they meet your exact specifications and quality standards before you release the payment. Is it more time-consuming? Absolutely. But for those crucial purchases that could make or break a project, it provides the highest level of financial security.

If you're curious about the software that makes these different workflows possible, our invoice software comparison guide is a great place to start.

The True Cost of Manual Invoice Matching

Let's be honest, we've all seen it: an accounts payable team drowning in paperwork. Imagine your own team manually sifting through stacks of invoices, purchase orders, and delivery slips, then chasing down approvals. This old-school approach isn't just slow; it's a massive drain on your business.

The most obvious cost is the sheer amount of time your team wastes on repetitive tasks. But the real price of sticking with a manual invoice matching process runs much deeper. It creates frustrating bottlenecks that can halt your entire payment cycle, leading to late payments and damaging relationships with valuable suppliers.

A manual invoice matching process is more than an inefficiency; it's a liability. Every hour spent on manual data entry is an hour not spent on strategic financial analysis that could actually grow the business.

Uncovering the Hidden Financial Drains

When people are responsible for every single step, mistakes are bound to happen. Simple typos, mismatched line items, or duplicate entries can easily slip through, leading to overpayments that hit your bottom line directly. These small leaks add up to a significant financial drain over time.

This manual grind is also painfully slow. In fact, research shows the average time to process a single invoice by hand is around 14.6 days, and a staggering 39% of all invoices contain some kind of error. This sluggish pace often means missing out on early payment discounts, which is essentially leaving free money on the table. You can dive deeper into these common accounts payable challenges and statistics.

Ultimately, these hidden costs paint a very clear picture:

- •High Error Rates: Manual data entry and verification are prone to human error, leading to costly overpayments and rework.

- •Lost Productivity: Your skilled finance team spends valuable hours on low-value administrative work instead of strategic financial tasks.

- •Missed Discounts: Slow processing times mean you often fail to pay within the discount window offered by suppliers.

- •Strained Vendor Relationships: Late payments caused by internal bottlenecks can damage trust and lead to less favorable terms in the future.

Sticking with the old way of doing things isn't just inefficient - it’s actively holding your business back from reaching its full potential.

How Automation Can Revolutionize Your Invoice Workflow

After wrestling with the bottlenecks of manual work, moving to automation starts to feel less like a luxury and more like a lifeline. Think of modern accounts payable software as a super-efficient assistant for your finance team, one that happily takes on the most mind-numbing parts of the invoice matching process.

Instead of your team getting bogged down printing, scanning, and flipping between documents, automation platforms use smart tech like Optical Character Recognition (OCR) and Artificial Intelligence (AI) to do the heavy lifting. These tools can read an incoming invoice, pull out the important details, and instantly check them against the right purchase orders and delivery receipts.

It really boils down to this: automation turns a slow, mistake-ridden task into a fast, accurate, and seamless workflow. This frees up your team to focus on strategic financial oversight instead of tedious data entry.

Supercharge Your Speed and Precision

Automation software doesn’t just make the process faster; it makes it far more accurate. The system can run a 2-way or 3-way match in a matter of seconds - a job that could easily take a person several minutes.

If it finds any discrepancies, like a price mismatch or an wrong quantity, it immediately flags the issue for a human to review. This acts as a digital safety net, ensuring no bad data gets through and preventing costly human errors that so often creep into manual systems.

For a closer look at how this all fits together, you can explore how to automate accounts payable from start to finish.

The growth in this space speaks volumes. It's part of a huge shift toward smarter digital finance. The global market for invoice processing software is expected to jump from $33.59 billion in 2024 to $40.82 billion in 2025, all because businesses are demanding this kind of efficiency.

Get a Clear View of Your Finances Like Never Before

One of the biggest game-changers with automation is real-time visibility. Forget about invoices getting lost in email inboxes or sitting in a pile on someone's desk. With an automated system, every document lives in a central dashboard.

This gives you an instant, up-to-the-minute picture of your financial commitments and cash flow. You always know where you stand.

This kind of integration means data flows effortlessly from your invoices straight into your accounting software. No more manual keying, no more duplicate entries - just one reliable source of truth.

When it comes to handling the sheer volume of paperwork, tools like Intelligent Document Processing (IDP) solutions have become incredibly effective. By automating invoice matching, you aren’t just improving a single task. You’re making your entire AP department faster, smarter, and more secure.

Actionable Best Practices for a Seamless AP Process

Getting your invoice matching process running smoothly doesn't mean you have to tear everything down and start from scratch. A few smart habits and clear protocols can make a world of difference, cutting down on errors, speeding up payments, and saving your accounts payable team a lot of headaches. Think of these best practices as building a stronger, more efficient foundation.

First things first: centralize every single invoice. Whether it comes in through email, snail mail, or a vendor portal, make sure it all funnels into one designated spot. This simple move stops invoices from getting lost in random inboxes or piled up on someone's desk. It gives every transaction an organized, predictable starting point. We've got more tips on this in our guide on how to keep track of invoices.

Establish Clear Rules and Maintain Clean Data

Once you have a central hub, it's time to set some ground rules. Keeping your vendor master file clean is absolutely critical. A database with accurate names, contacts, and payment terms is your best friend - it helps prevent payments from going to the wrong place and avoids unnecessary delays, whether you're matching manually or with software.

Setting clear tolerance levels is another powerful move. Decide on a threshold for small, acceptable differences in price or quantity - say, a 2% variance or a $10 limit - that can be approved automatically. This lets your AP team push through minor discrepancies without getting bogged down in a full investigation.

Finally, have a firm, documented process for handling exceptions that fall outside those tolerances. This ensures everyone on the team knows exactly what to do when a real problem pops up.

Here are a few essential tips to put into practice:

- •Standardize Your Exception Protocol: Clearly map out who investigates mismatches, what steps they need to follow, and how long they have to resolve it. Consistency is everything here.

- •Prioritize System Integration: If you bring in new AP software, make sure it plays nicely with your current accounting system or ERP. This avoids creating data silos and the dreaded task of entering the same information twice.

- •Encourage Digital Invoicing: Gently nudge your suppliers toward sending digital invoices, like PDFs, instead of paper ones. It makes capturing the data on your end much faster and far more accurate.

Putting these straightforward practices into place will help you build a more predictable, accurate, and stress-free workflow for matching invoices.

Common Questions About the Invoice Matching Process

As you start to get the hang of invoice matching, a few questions always seem to pop up. It's totally normal. While the process can feel a little complicated at first, the core ideas are actually quite simple once you break them down.

This section is your go-to cheat sheet. We'll clear up any lingering confusion and give you the confidence to put what you've learned into practice. Let's tackle these common questions head-on.

What Is the Main Difference Between 2-Way and 3-Way Matching?

The biggest difference boils down to one simple thing: proof of delivery. A 2-way match is a basic check comparing the invoice against the purchase order. It just confirms that the prices and quantities line up with what you originally agreed to buy. Quick and easy.

But 3-way matching adds a crucial third document to the mix: the goods receipt note. This extra step confirms that the items weren't just ordered, but that they were actually received by your team before you cut a check. This adds a powerful layer of security, protecting you from paying for goods that never arrived. It's why 3-way matching is the gold standard for any business dealing with physical products.

How Should My Team Handle an Invoice Matching Exception?

When a mismatch pops up - say, a price is wrong or the quantity is off - the first rule is simple: don't pay the invoice. The payment process needs to be paused immediately while your accounts payable team figures out what went wrong.

Usually, this means a quick call to the purchasing department to double-check the PO or reaching out directly to the vendor for an explanation or a corrected invoice.

The key to handling this smoothly is having a standardized exceptions protocol. This process should clearly define who is responsible for resolving different types of issues and outline the exact steps needed to get the correct documentation or a revised invoice from the supplier.

A clear protocol turns a potential fire drill into just another routine task.

What Is the First Step to Automating Our Invoice Matching Process?

Getting started with automation isn't about buying software right away. The very first step is to map out your current process from start to finish. You need to know exactly how things work right now. Document every touchpoint, pinpoint your biggest bottlenecks, and try to calculate your current cost-per-invoice.

This initial deep dive gives you a rock-solid business case for making a change. Once you have that, you can start looking for AP automation software, like Tailride, that plays nicely with your existing accounting system or ERP.

As you get going, think about taking these steps:

- •Start small with a pilot program. Don’t try to boil the ocean. Test the new system with just one department or a handful of trusted vendors.

- •Demonstrate the value. Use the data from your pilot to show a clear return on investment. This will help you get buy-in from everyone else for a full rollout.

Taking it one step at a time makes the transition much smoother and sets your team up for a big win.

Ready to stop chasing down paperwork and start automating your invoice matching process? Tailride connects directly to your inboxes and vendor portals to capture, extract, and match invoices for you. See how much time you can save by visiting https://tailride.so.