8 Essential Small Business Accounting Tips for 2025

Discover 8 actionable small business accounting tips to streamline your finances, manage cash flow, and master tax prep. Perfect for owners and entrepreneurs.

Juggling sales, marketing, and operations is the daily reality for a small business owner. Amidst this controlled chaos, accounting can often feel like a daunting chore, pushed aside until tax season looms. But what if you could transform it from a source of stress into a strategic advantage? Effective financial management is the bedrock of a sustainable business, providing the clarity needed for smart growth. This guide offers more than just a list; it's a blueprint built on powerful small business accounting tips designed to streamline your processes and boost your bottom line.

We will move beyond generic advice to provide a practical, actionable framework. You will learn specific, implementable strategies for everything from separating your finances and mastering software to proactive cash flow management and tax readiness. Consider this your go-to resource for turning financial data into a powerful tool for confident decision-making. These insights will help you establish robust systems, leverage technology effectively, and build a financially resilient business poised for long-term success. Let's dive into the tips that will fortify your company's financial foundation.

1. Implement Separation of Business and Personal Finances

The most foundational of all small business accounting tips is creating a clear, impenetrable wall between your business and personal finances. This isn't just a suggestion; it's a critical practice for accurate bookkeeping, simplified tax preparation, and protecting your personal assets. Blurring these lines can lead to a messy, complicated financial picture that's nearly impossible to untangle.

At its core, this means all business income goes into a dedicated business bank account, and all business expenses are paid from that account or a business credit card. This separation is your first line of defense against financial chaos and provides a clean, auditable trail of your company's performance. It’s the bedrock upon which all other sound financial practices are built.

Why This Separation Is Non-Negotiable

Separating finances is crucial from day one, especially for sole proprietors or LLCs. It maintains the legal "corporate veil" that shields your personal assets, like your home or car, from business debts and lawsuits. Without this distinction, you risk creditors coming after your personal property if the business faces financial trouble.

Beyond legal protection, it makes tracking profitability a breeze. You can see precisely how much money the business is making and spending, allowing for smarter, data-driven decisions.

Actionable Steps for Implementation

Getting started is straightforward. Here’s how to create that essential financial boundary:

- •Open Dedicated Accounts: Immediately open a business checking account and a business savings account. Even if you're a freelancer, a separate account is a must. An e-commerce store, for instance, should have separate PayPal and Stripe accounts used exclusively for business sales.

- •Get a Business Credit Card: Use a business credit card for all company purchases, from software subscriptions to office supplies. This not only simplifies expense tracking but also helps build your business's credit history.

- •Establish a Payment System: Pay yourself a regular salary or owner's draw by transferring a set amount from your business account to your personal account. Avoid dipping into business funds for personal expenses.

- •Review Statements Monthly: Make it a habit to review both business and personal statements each month. This helps you catch any accidental crossover transactions and correct them promptly before they become a bigger problem.

2. Establish Consistent Bookkeeping Routines

Procrastination is the enemy of accurate financial records. One of the most impactful small business accounting tips is to establish a consistent, non-negotiable bookkeeping routine. This means systematically recording all financial transactions on a daily, weekly, or monthly schedule, rather than letting everything pile up for a stressful, last-minute scramble at tax time.

A regular routine prevents the accumulation of overwhelming paperwork, which often leads to errors, missed deductions, and a foggy view of your company's financial health. Embracing digital bookkeeping is a cornerstone of this modern approach, helping to streamline operations and ensure your data is always current and accessible. This habit transforms accounting from a dreaded chore into a powerful tool for strategic decision-making.

Why This Routine Is Non-Negotiable

Waiting until the end of the quarter or year to manage your books is a recipe for disaster. Small discrepancies can balloon into major problems, and you lose the ability to make timely, informed business pivots. A consultant who reconciles their books weekly can immediately see if a project is becoming less profitable, while a retailer who waits might not notice a cash flow issue for months.

Consistent bookkeeping gives you an accurate, real-time snapshot of your business's performance. It allows you to monitor cash flow, track expenses against your budget, and generate reliable financial statements whenever you need them, whether for a loan application or a strategy meeting. For an even deeper dive, you can learn more about these small business bookkeeping tips to build a robust system.

Actionable Steps for Implementation

Creating a sustainable routine is about making it a manageable, recurring task. Here’s how to put it into practice:

- •Schedule Bookkeeping Time: Block out a specific time on your calendar for accounting tasks and treat it like an important client meeting. For example, dedicate every Friday afternoon to categorizing expenses and sending invoices.

- •Leverage Automation: Use accounting software like QuickBooks or Xero that connects directly to your business bank accounts. Automatic transaction feeds drastically reduce manual data entry and potential errors.

- •Start with a Weekly Cadence: A weekly routine is a great starting point for most small businesses. An e-commerce store, for instance, could reconcile bank and payment processor accounts every Monday morning to review the previous week's sales and fees.

- •Create Checklists: Develop a simple checklist for your routine. It might include: categorizing new transactions, reviewing accounts payable and receivable, and checking your bank balance against your books. This ensures nothing falls through the cracks.

3. Choose and Master Appropriate Accounting Software

Once your finances are separated, the next crucial step is moving beyond manual spreadsheets. Selecting and mastering the right accounting software is one of the most impactful small business accounting tips because it automates tedious tasks, provides real-time financial insights, and scales with your company. The right platform acts as your financial command center, transforming complex data into clear, actionable information.

Modern cloud-based solutions like QuickBooks, Xero, or FreshBooks are designed to streamline everything from invoicing and expense tracking to bank reconciliation and financial reporting. Investing the time to choose and properly set up this software is an investment in your business's efficiency, accuracy, and long-term financial health.

Why This Software Is a Game-Changer

Relying on spreadsheets is prone to human error, time-consuming, and offers limited visibility into your financial position. Accounting software minimizes these risks by automating data entry, categorizing transactions, and generating professional financial statements with a few clicks. It gives you a live, accurate view of your cash flow, profitability, and overall financial stability.

For example, an e-commerce business can integrate its accounting software with Shopify to automatically record sales and fees, saving hours of manual reconciliation. Similarly, a construction company can use a platform like FreshBooks for project-specific expense tracking and client invoicing, ensuring every cost is billed correctly.

Actionable Steps for Implementation

Choosing the right software requires thoughtful evaluation. Here’s how to find and implement the perfect fit:

- •Evaluate Your Specific Needs: List your essential requirements. Do you need project-based billing, inventory management, or multi-currency support? A small law firm, for instance, needs software that can handle trust accounting.

- •Utilize Free Trials: Test-drive two or three top contenders. Use their free trials to process a few real transactions and see which interface feels most intuitive for your workflow.

- •Prioritize Integration Capabilities: Your accounting software should connect seamlessly with your other business tools, like your bank, CRM, and payment processor. Strong integration, such as the ability to integrate with Xero, automates data flow and creates a single source of truth.

- •Invest in Proper Setup: Don't rush the initial setup. Take the time to correctly configure your chart of accounts and connect your bank feeds. A clean setup from day one prevents major headaches later on.

4. Maintain Comprehensive Expense Tracking

Diligent expense tracking is more than just collecting receipts; it's a systematic process of recording, categorizing, and documenting every dollar your business spends. This practice is fundamental to understanding your financial health, maximizing tax deductions, and making informed decisions. Failing to track expenses accurately can lead to overpaying taxes and a distorted view of your company's profitability.

At its heart, this tip is about creating a detailed and organized record of all business expenditures, from a cup of coffee with a client to major equipment purchases. A robust expense tracking system ensures every legitimate cost is accounted for, providing a clear and defensible financial history. It’s a crucial habit for any business aiming for financial clarity and operational efficiency.

Why This Practice Is Essential

Comprehensive expense tracking is a cornerstone of sound financial management. It directly impacts your tax liability, as every documented business expense can be a potential deduction, lowering your taxable income. For instance, a freelance writer who meticulously records home office expenses can significantly reduce their tax bill.

Beyond taxes, it provides invaluable insights into your spending patterns. By categorizing expenses, you can see exactly where your money is going. A retail shop tracking inventory costs, rent, and utilities separately can identify areas for potential savings and better manage its budget.

Actionable Steps for Implementation

Implementing a strong expense tracking system is easier than ever with modern tools. Here’s how to get started:

- •Digitize Receipts Immediately: Use a mobile app like Expensify or your accounting software’s mobile app to photograph receipts the moment you get them. This prevents lost receipts and automates data entry.

- •Automate Recurring Expenses: Set up rules in your accounting software to automatically categorize regular payments like rent, software subscriptions, and utility bills. This saves time and reduces manual errors.

- •Create Detailed Categories: Go beyond generic labels. Instead of just "Marketing," create subcategories like "Social Media Ads," "Content Creation," and "Email Marketing Software" for deeper analysis.

- •Use a Mileage Tracking App: If you use a vehicle for business, use a GPS-based app like MileIQ to automatically log trips. This ensures you capture every deductible mile accurately for tax purposes.

- •Perform Monthly Reconciliations: Schedule time each month to review your expense reports against your bank and credit card statements. This helps you catch discrepancies, miscategorized items, or potential fraud early.

5. Implement Proactive Cash Flow Management

While profitability is important, cash is the lifeblood that keeps your business running day-to-day. Proactive cash flow management is the practice of systematically monitoring, forecasting, and optimizing the movement of money into and out of your business. This foresight ensures you always have the liquidity needed to pay bills, cover payroll, and seize opportunities without stress.

This discipline involves more than just checking your bank balance; it's about understanding the timing of your financial obligations and income streams. It allows you to anticipate shortfalls and surpluses, transforming your financial management from a reactive scramble to a strategic advantage. This is one of the most critical small business accounting tips for ensuring long-term operational stability.

Why This Foresight Is Non-Negotiable

A profitable business can fail if it runs out of cash. This happens when there's a significant delay between earning revenue and collecting the actual cash, such as when clients pay invoices late but your own bills are due immediately. Proactive management helps you spot these potential gaps long before they become a crisis.

For instance, a seasonal business like a landscaping company can use cash flow forecasting to save during peak months to cover equipment maintenance and other costs during the slow winter season. This prevents the need for high-interest loans or frantic cost-cutting when revenue dips. For an in-depth guide, you can learn more about how to improve your cash flow on tailride.so.

Actionable Steps for Implementation

Putting a cash flow system in place gives you control over your company's financial pulse. Here’s how to get started:

- •Create a Rolling Forecast: Develop a 13-week rolling cash flow forecast. This document projects your weekly cash inflows and outflows, giving you a clear, near-term view of your financial position and helping you make timely adjustments.

- •Accelerate Receivables: Don't let your invoices languish. Offer a small discount (e.g., 2%) for early payment to encourage clients to pay faster. Consistently follow up on overdue payments to shorten your collection cycle.

- •Manage Payables Strategically: When cash is tight, talk to your suppliers. You can often negotiate extended payment terms, giving you more breathing room to align your outflows with your inflows.

- •Maintain a Cash Reserve: Build and protect a cash buffer equivalent to 3-6 months of essential operating expenses. This reserve acts as a safety net, protecting your business from unexpected downturns or emergencies.

6. Perform Regular Bank Reconciliation

One of the most powerful yet often overlooked small business accounting tips is performing regular bank reconciliation. This is the process of comparing the financial transactions recorded in your business's books against the statements provided by your bank. It’s an essential internal control that confirms your records are accurate, complete, and free from errors or potential fraud.

Think of it as a financial health checkup. By regularly matching these two sets of records, you create a system of checks and balances that ensures every dollar is accounted for. This simple habit transforms your accounting records from a "best guess" to a reliable source of truth, providing a solid foundation for financial decisions and tax reporting.

Why This Reconciliation Is Non-Negotiable

Failing to reconcile your accounts is like navigating a ship without a compass; you might be moving, but you don't know if you're on course. Regular reconciliation helps you catch costly errors, such as duplicate vendor charges, unrecorded bank fees, or even missed client payments. A consulting firm, for example, might realize a major client invoice was never paid only after reconciling their accounts and noticing a missing deposit.

Furthermore, it’s a critical step in fraud detection. Unexplained withdrawals or unauthorized transactions become immediately apparent during this process, allowing you to act quickly. It provides the confidence that your cash balance is what you think it is, which is fundamental for managing cash flow effectively.

Actionable Steps for Implementation

Making bank reconciliation a routine part of your accounting workflow is easier than it sounds, especially with modern tools. Here’s how to get it done:

- •Set a Monthly Schedule: Make it a non-negotiable monthly task. As soon as your bank statement for the previous month is available, perform the reconciliation. This prevents small discrepancies from snowballing into massive problems.

- •Leverage Accounting Software: Use accounting software like QuickBooks, Xero, or Wave that offers automatic bank feeds. These tools import your bank transactions directly, making it easy to match them with the entries in your books, dramatically speeding up the process.

- •Investigate Discrepancies Immediately: Never ignore a difference, no matter how small. A minor unexplained transaction could be a sign of a larger issue. Investigate and document the reason for any adjusting entries you have to make.

- •Keep Clear Records: Maintain a record of each completed reconciliation report. This documentation is invaluable for internal review, financial audits, and proves your commitment to maintaining accurate financial records.

7. Understand and Track Key Financial Metrics

Going beyond basic bookkeeping, one of the most powerful small business accounting tips involves actively tracking key financial metrics. These Key Performance Indicators (KPIs) act as your business's vital signs, offering deep insights into its health, profitability, and operational efficiency. By monitoring these numbers, you can move from reactive problem-solving to proactive, strategic decision-making based on solid data.

At its heart, this practice is about identifying and measuring the specific data points that truly drive your business's success. This allows you to spot positive or negative trends early, benchmark your performance against goals, and understand the real-world impact of your strategies. It transforms your accounting from a simple record of past events into a forward-looking tool for growth.

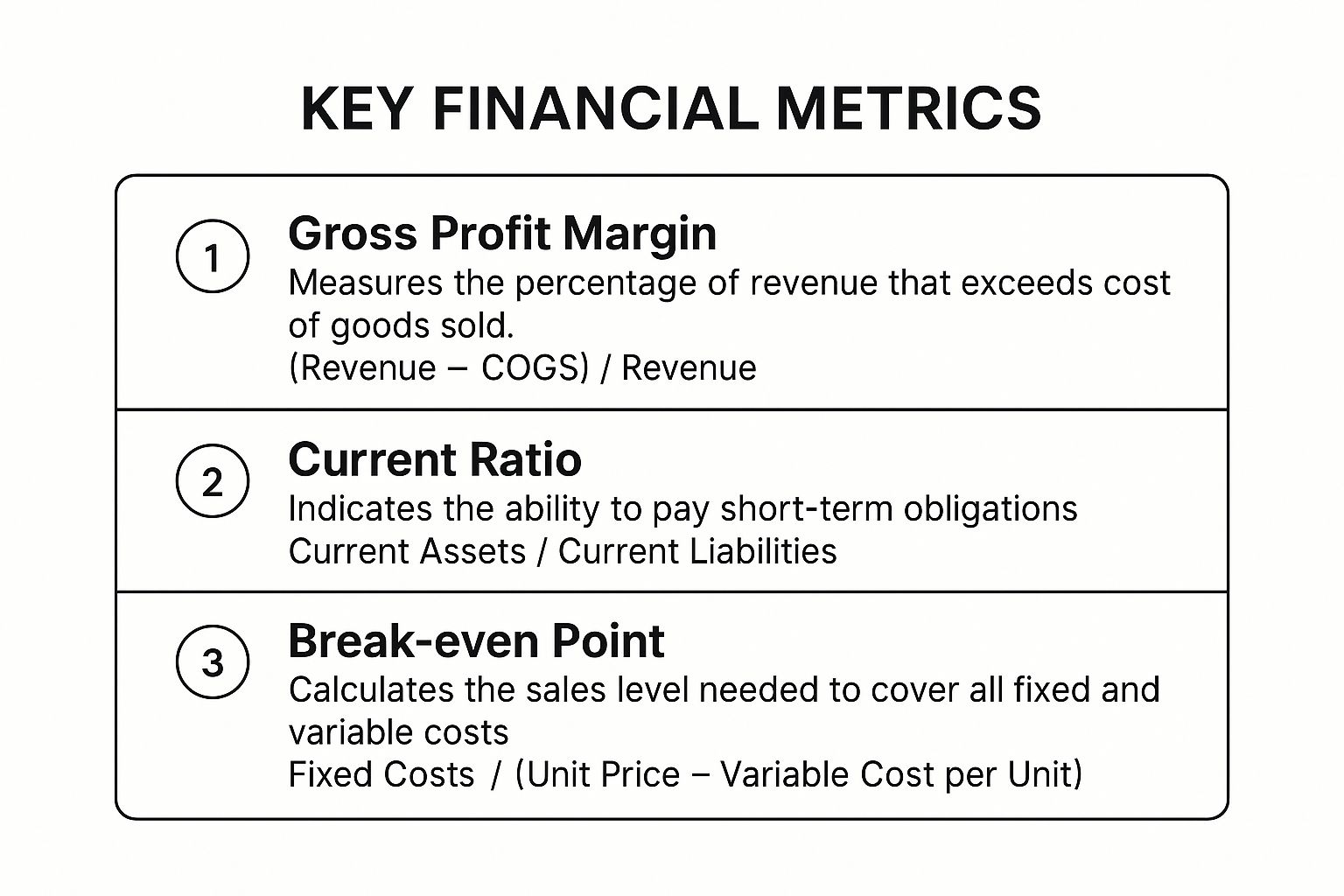

The infographic below highlights three fundamental financial metrics that provide a snapshot of your business's health.

Monitoring these core KPIs gives you a balanced view of your company’s profitability, liquidity, and operational baseline.

Why This Is Essential for Growth

Relying on your bank balance alone gives you a dangerously incomplete picture. Tracking specific metrics helps you answer critical questions: Are your prices high enough? Do you have enough cash to cover short-term debts? How many sales do you need to cover your costs? For instance, a subscription service tracking Monthly Recurring Revenue (MRR) can forecast future cash flow, while a manufacturer monitoring inventory turnover can prevent cash from being tied up in unsold goods.

This data-driven approach is what separates thriving businesses from those that stagnate. It empowers you to make smarter, faster decisions, whether it's adjusting your pricing, cutting unnecessary costs, or investing in a new marketing channel.

Actionable Steps for Implementation

You don't need a finance degree to start tracking metrics effectively. Here’s how to get started:

- •Identify 3-5 Core Metrics: Don't overwhelm yourself. Start with a few KPIs most relevant to your business model, like gross profit margin, customer acquisition cost, or break-even point.

- •Create a Monthly Dashboard: Use your accounting software's reporting features or a simple spreadsheet to build a dashboard. This provides a clear, at-a-glance view of your performance each month.

- •Set Targets and Benchmarks: For each metric, establish a target or goal. Compare your current numbers to past periods (e.g., month-over-month) and, if possible, industry benchmarks to see how you stack up.

- •Analyze and Act: The goal isn't just to collect data but to use it. If a metric is off-target, investigate why and develop a clear action plan to address it.

8. Maintain Proper Tax Records and Planning

One of the most impactful small business accounting tips is to shift your mindset from reactive tax filing to proactive tax planning. This means systematically organizing all financial documents, meticulously tracking deductible expenses, and implementing strategies throughout the year to minimize your tax liability, not just scrambling when deadlines loom. This proactive stance ensures compliance and prevents costly surprises.

At its core, proper tax planning involves treating tax preparation as a year-round activity. It’s about creating a system where every financial move is considered through a tax lens, allowing you to legally reduce what you owe. This approach transforms tax season from a stressful event into a predictable, manageable process that can save your business thousands.

Why This Proactive Approach is Essential

Effective tax planning is a cornerstone of smart financial management for small businesses. It goes beyond simply filing on time; it's about strategically structuring your finances to leverage every available deduction and credit. For a growing business, this foresight can mean the difference between having capital for expansion or facing an unexpected tax bill that drains resources.

Furthermore, organized records are your best defense in the event of an IRS audit. A clean, well-documented trail of income and expenses demonstrates diligence and can resolve inquiries quickly and painlessly. This preparation provides peace of mind and solidifies your financial integrity. One strategy that can yield significant savings is understanding how to put your children on payroll to save taxes.

Actionable Steps for Implementation

Turning tax planning into an ongoing habit is easier than it sounds. Here’s how to get started:

- •Schedule Quarterly Tax Reviews: Meet with your accountant or tax advisor every quarter. Use these meetings to review year-to-date performance, project your annual tax liability, and adjust your strategy accordingly.

- •Use Cloud Storage for Records: Digitize and organize all important documents, such as receipts, bank statements, and legal forms, in a secure cloud storage system. This creates a searchable, backed-up archive that's accessible from anywhere.

- •Track Estimated Tax Payments Diligently: If you're required to pay estimated taxes, use your accounting software or a simple spreadsheet to track payment dates and amounts. This helps you stay on schedule and avoid underpayment penalties.

- •Keep Records for the Right Amount of Time: The IRS generally recommends keeping tax records for three to seven years, depending on the circumstances. When in doubt, holding onto them for at least seven years is a safe bet.

8 Key Small Business Accounting Tips Comparison

| Item | Implementation Complexity 🔄 | Resource Requirements ⚡ | Expected Outcomes 📊 | Ideal Use Cases 💡 | Key Advantages ⭐ |

|---|---|---|---|---|---|

| Implement Separation of Business and Personal Finances | Low to Medium: Needs discipline | Low: Separate bank accounts, time to track | Clear financial records, legal protection, tax compliance | Small to medium businesses separating personal vs business funds | Protects personal assets, simplifies tax prep, reduces IRS risk |

| Establish Consistent Bookkeeping Routines | Medium to High: Requires routine setup | Medium: Time investment, software or help | Accurate financial data, timely decisions, less year-end stress | Businesses needing real-time financial visibility and control | Reduces accounting stress, improves cash flow management |

| Choose and Master Appropriate Accounting Software | Medium: Learning curve and setup | Medium to High: Subscription fees, training | Automated data entry, real-time insights, scalable | Businesses scaling or needing integrated financial tools | Reduces errors, integrates with tools, supports growth |

| Maintain Comprehensive Expense Tracking | Medium: Requires detail and consistency | Medium: Time, apps or software | Maximized tax deductions, cost control, expense clarity | Businesses with diverse or frequent expenses | Improves budgeting, tax savings, detailed expense insights |

| Implement Proactive Cash Flow Management | High: Requires forecasting and analysis | Medium to High: Tools, time, forecasting skills | Avoid cash shortages, optimized liquidity and growth planning | Seasonal or cash-sensitive businesses | Prevents shortages, supports decision-making, reduces stress |

| Perform Regular Bank Reconciliation | Medium: Recurring, attention to detail | Low to Medium: Time, software automation | Accurate records, fraud detection, error identification | Businesses with multiple bank accounts or complex finances | Ensures accuracy, detects fraud, satisfies internal controls |

| Understand and Track Key Financial Metrics | Medium: Requires data collection and analysis | Medium: Time, software reporting tools | Data-driven decisions, trend identification, benchmarking | Businesses aiming to monitor performance and optimize results | Supports pricing strategies, improves communications |

| Maintain Proper Tax Records and Planning | Medium to High: Ongoing and detailed | Medium to High: Professional help, software | Minimized tax liability, audit readiness, financial planning | Businesses aiming for tax compliance and proactive tax strategy | Reduces tax risk, ensures compliance, supports budgeting |

Putting Your Accounting Plan into Action

Navigating the world of small business finance can often feel like steering a ship through a dense fog. The journey from financial uncertainty to clarity is built on a foundation of solid, consistent practices. By now, you've explored eight crucial small business accounting tips, each one a beacon designed to guide you toward greater stability, control, and strategic insight. From the foundational step of separating business and personal finances to the strategic discipline of proactive cash flow management, these aren't just items on a checklist. They are the core components of a robust financial engine for your company.

The power of these tips lies not in simply knowing them, but in their deliberate and consistent application. Mastering your books isn't about a single heroic effort; it's about building sustainable habits. Think of it as a flywheel: the initial push requires effort, but each subsequent action builds momentum, making the process smoother and more powerful over time.

From Knowledge to Action: Your Next Steps

The key is to avoid feeling overwhelmed. You don't need to implement everything overnight. Instead, choose one or two areas that represent your biggest pain points and start there.

- •If you're just starting out: Your immediate priority should be Tip #1: Implement Separation of Business and Personal Finances. This single action prevents countless headaches down the line. Follow this by choosing and setting up the right accounting software (Tip #3) to create a central hub for all financial activity.

- •If you feel disorganized: Focus on Tip #2: Establish Consistent Bookkeeping Routines. Block out time on your calendar each week, whether it's 30 minutes or two hours, to categorize transactions and review your accounts. This simple habit is the cornerstone of effective financial management.

- •If you're worried about profitability: Dive into Tip #7: Understand and Track Key Financial Metrics. Move beyond just your bank balance. Start tracking your gross profit margin and net profit margin to truly understand your business's financial health and make smarter decisions.

The True Value of Financial Mastery

Ultimately, embracing these small business accounting tips does more than just prepare you for tax season. It transforms accounting from a dreaded administrative chore into a strategic asset. When you have a clear, real-time view of your financial landscape, you can spot opportunities, mitigate risks, and confidently invest in growth. You're no longer just reacting to financial events; you're proactively shaping your company's future. The peace of mind that comes from knowing your numbers are accurate, organized, and audit-ready is invaluable, freeing you to focus on what you do best: running and growing your business.

Ready to eliminate one of your most time-consuming accounting tasks? See how Tailride can automatically capture, read, and process invoices and receipts directly from your email, saving you hours of manual data entry every week. Visit Tailride to learn how you can put your expense management on autopilot and focus on the bigger picture.